Form DFAN14A - Additional definitive proxy soliciting materials filed by non-management and Rule 14(a)(12) material

January 08 2025 - 4:11PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

| Matthews International Corporation |

(Name of Registrant as Specified In Its Charter)

|

| |

BARINGTON COMPANIES EQUITY PARTNERS, L.P.

BARINGTON COMPANIES INVESTORS, LLC

BARINGTON CAPITAL GROUP, L.P.

LNA CAPITAL CORP.

JAMES MITAROTONDA

ANA B. AMICARELLA

CHAN W. GALBATO

1 NBL EH, LLC

JOSEPH GROMEK

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Barington Companies Equity

Partners, L.P. (“Barington”), together with the other participants named herein, has filed a definitive proxy statement and

accompanying GOLD universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes

for the election of Barington’s slate of director nominees at the 2025 annual meeting of shareholders (the “Annual Meeting”)

of Matthews International Corporation, a Pennsylvania corporation (the “Company”).

On January 8, 2025, Barington

issued the following press release:

Barington Capital Group Statement on Matthews

International’s Sale of

SGK Brand Solutions

NEW YORK, January 8, 2025 -- Barington

Capital Group, L.P. (“Barington Capital”) and certain of its affiliates (collectively “Barington” or “we”),

a fundamental, value-oriented activist investor that beneficially owns approximately 1.9% of the outstanding common stock of Matthews

International Corporation (NASDAQ: MATW) (“Matthews” or the “Company”), today issued the following statement in

response to Matthews’ planned sale of SGK Brand Solutions (“SGK”):

“Since 2022, Barington has urged Matthews

to simplify its portfolio. Indeed, Barington has repeatedly proposed the sale of the Company’s SGK segment, a poorly performing

business that has resulted in a write down of more than $266.2 million under the Company’s ownership. While we are pleased that

the Company is taking this step today, it is unfortunate that it occurred only after Barington called for changes to Matthews’ management

and Board of Directors.

“We believe the SGK transaction not only

highlights one of the many value-creating opportunities available to Matthews’ shareholders, but also the importance of having Barington’s

nominees on the Matthews Board. We believe our nominees, if elected, will bring the fresh perspectives, as well as the financial, corporate

strategy and turnaround expertise, that Matthews requires to maximize shareholder value.”

For additional information regarding Barington’s

campaign at Matthews, visit: https://barington.com/matthews

ABOUT BARINGTON CAPITAL GROUP, L.P.

Barington Capital Group, L.P. is a fundamental,

value-oriented activist investment firm established by James Mitarotonda in January 2000. Barington invests in undervalued publicly traded

companies that Barington believes can appreciate significantly in value when substantive improvements are made to their operations, corporate

strategy, capital allocation and corporate governance. Barington’s investment team, advisors and network of industry experts draw

upon their extensive strategic, operating and boardroom experience to assist companies in designing and implementing initiatives to improve

long-term shareholder value.

Media Contact:

Jonathan Gasthalter/Amanda Shpiner

Gasthalter & Co.

212-257-4170

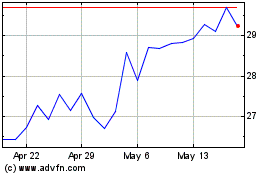

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Dec 2024 to Jan 2025

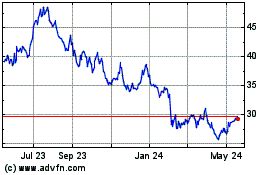

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Jan 2024 to Jan 2025