Matthews International Corporation (Nasdaq GSM: MATW)

(“Matthews” or the “Company”) issued the following statement

regarding a February 6, 2025 report by Institutional Shareholder

Services ("ISS"):

We strongly disagree with ISS’ recommendation, which adopts

Barington’s positions while giving no substantive analysis to

Barington’s own plans and nominees. In doing so, ISS does not give

appropriate consideration to the concerning absence of relevant

skills and new ideas among Barington’s nominees and the actions

Matthews is taking to unlock the value of its businesses.

Notably, Barington’s “four-step plan” contains no ideas that

would help shareholders, except those (like a strategic transaction

of SGK) that have already been initiated by the Company. ISS’

report does not address whether Barington’s plans for the Company

would be better for shareholders than the Board’s current

strategy.

Additionally, we do not agree with the position that the “most

important attribute” that Barington’s nominees have is their

“independence.” In fact, they would bring to the Board a total lack

of understanding about our business, no relevant skills, and track

records of poor oversight. As a consultant to the Company, James

Mitarotonda added no value, showed up to most meetings unprepared

and made suggestions that either did not make sense or were already

being executed. Barington’s other two nominees also showed no

understanding of our Company in interviews with directors.

Furthermore, Mr. Mitarotonda and his nominees have no experience

relevant to the businesses in which we operate, and each have been

criticized for questionable M&A oversight that was alleged to

have destroyed shareholder value.

In contrast, under the current Board of Directors, the Company

has taken significant actions to benefit all shareholders:

- The Board has developed our Memorialization segment into a

market-leading, cash-generating business—leading to significant

capital return to shareholders and significant re-investment into

our high-growth Industrial Technologies segment, such as our Dry

Battery Electrode (DBE) technology. Following our recent victory

against Tesla in arbitration, we intend to immediately resume

marketing, selling and delivering our DBE solutions to other

customers in the growing electric vehicle market, where battery and

automobile equipment manufacturers from around the world seek to

adopt our innovative solutions. We expect that this victory will

eliminate an overhang on the stock that we believed was caused by

this dispute.

- The Board announced a strategic disposition of the SGK business

following a process begun in 2019, well before Barington was even a

shareholder. The SGK transaction provides for substantial upfront

consideration of $350 million at closing, while still benefiting

from synergy-driven value creation in the future. The favorable

terms of the SGK transaction reflect the various strategic

investments in technology and cost-savings initiatives executed by

the leadership team over recent years.

- The Board disclosed a comprehensive evaluation of strategic

alternatives for all of the Company’s businesses, engaging J.P.

Morgan’s expertise to facilitate this process. Matthews expects to

announce several initiatives over the course of the 2025 fiscal

year that we believe will help drive shareholder value.

- Since 2020, we have welcomed three new independent directors

and nominated a fourth new independent director for election at the

2025 annual meeting. The Board plans to continue to refresh in the

coming year. As part of this commitment, Mr. Babe will not stand

for re-election at the 2026 annual meeting, which is further

evidence of Board change and refreshment. Matthews' nominees bring

the right set of skills and expertise to help the board drive

long-term shareholder value.

On January 31, 2025, GAMCO Asset Management, one of Matthews’

top 5 shareholders with an approximate 4.38% stake, announced that

it will support Matthews’ director nominees. In its press release,

GAMCO stated: “After a thorough review, GAMCO believes that

Matthews’ proposed slate of nominees is best positioned, at this

time, to focus and execute on the Company’s efforts to surface

underlying value for all shareholders.”

We have been in ongoing discussions with shareholders and value

the feedback we have received. We look forward to continuing these

conversations and are committed to doing what is in the best

interest of all Matthews shareholders.

Your vote is important, and we ask that you vote “FOR”

all three Matthews’ nominees on the WHITE proxy card and “WITHHOLD”

on Barington’s Director Nominees.

J.P. Morgan Securities LLC is serving as financial advisor to

Matthews. Sidley Austin LLP is serving as legal counsel to

Matthews.

About Matthews InternationalMatthews

International Corporation is a global provider of memorialization

products, industrial technologies, and brand solutions. The

Memorialization segment is a leading provider of memorialization

products, including memorials, caskets, cremation-related products,

and cremation and incineration equipment, primarily to cemetery and

funeral home customers that help families move from grief to

remembrance. The Industrial Technologies segment includes the

design, manufacturing, service and sales of high-tech custom energy

storage solutions; product identification and warehouse automation

technologies and solutions, including order fulfillment systems for

identifying, tracking, picking and conveying consumer and

industrial products; and coating and converting lines for the

packaging, pharma, foil, décor and tissue industries. The SGK Brand

Solutions segment is a leading provider of packaging solutions and

brand experiences, helping companies simplify their marketing,

amplify their brands and provide value. The Company has over 11,000

employees in more than 30 countries on six continents that are

committed to delivering the highest quality products and

services.

|

YOUR VOTE IS IMPORTANT!Your vote is important, and

we ask that you please vote “FOR” the election of

our three nominees: Terry L. Dunlap, Alvaro Garcia-Tunon and J.

Michael Nauman using the WHITE proxy card and

“WITHHOLD” on Barington’s nominees.Simply follow

the easy instructions on the

enclosed WHITE proxy card to vote by

internet or by signing, dating and returning the

WHITE proxy card in the postage-paid envelope

provided. If you received this letter by email, you may also vote

by pressing the WHITE “VOTE NOW” button

in the accompanying email. The Board of Directors urges you to

disregard any such materials and does not endorse any of

Barington’s nominees. If you have any questions or

require any assistance with voting your shares, please call the

Company’s proxy solicitor at: (888) 755-7097

or email MATWinfo@Georgeson.com |

Additional InformationIn connection with the

Company’s 2025 Annual Meeting, the Company has filed with the U.S.

Securities and Exchange Commission (“SEC”) and commenced mailing to

the shareholders of record entitled to vote at the 2025 Annual

Meeting a definitive proxy statement and other documents, including

a WHITE proxy card. SHAREHOLDERS ARE ENCOURAGED TO READ THE

DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS

THERETO) FILED BY THE COMPANY AND ALL OTHER RELEVANT DOCUMENTS WHEN

FILED WITH THE SEC AND WHEN THEY BECOME AVAILABLE BECAUSE THOSE

DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION. Investors and other

interested parties will be able to obtain the documents free of

charge at the SEC’s website, www.sec.gov, or from the Company at

its website: http://www.matw.com/investors/sec-filings. You may

also obtain copies of the Company’s definitive proxy statement and

other documents, free of charge, by contacting the Company’s

Investor Relations Department at Matthews International

Corporation, Two NorthShore Center, Pittsburgh, Pennsylvania

15212-5851, Attention: Investor Relations, telephone (412)

442-8200.

Participants in the SolicitationThe

participants in the solicitation of proxies in connection with the

2025 Annual Meeting are the Company, Alvaro Garcia-Tunon, Gregory

S. Babe, Joseph C. Bartolacci, Katherine E. Dietze, Terry L.

Dunlap, Lillian D. Etzkorn, Morgan K. O’Brien, J. Michael Nauman,

Aleta W. Richards, David A. Schawk, Jerry R. Whitaker, Francis S.

Wlodarczyk, Steven F. Nicola and Brian D. Walters.

Certain information about the compensation of the Company’s

named executive officers and non-employee directors and the

participants’ holdings of the Company’s Common Stock is set forth

in the sections entitled “Compensation of Directors” (on page 36

and available here), “Stock Ownership of Certain Beneficial

Owners and Management” (on page 64 and available here),

“Executive Compensation and Retirement Benefits” (on page 66 and

available here), and “Appendix A” (on page A-1 and

available here), respectively, in the Company’s definitive

proxy statement, dated January 7, 2025, for its 2025 Annual Meeting

as filed with the SEC on Schedule 14A, available here.

Additional information regarding the interests of these

participants in the solicitation of proxies in respect of the 2025

Annual Meeting and other relevant materials will be filed with the

SEC when they become available. These documents are or will be

available free of charge at the SEC’s website

at www.sec.gov.

Forward-Looking StatementsAny forward-looking

statements contained in this release are included pursuant to the

“safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements include, but

are not limited to, statements regarding the expectations, hopes,

beliefs, intentions or strategies of the Company regarding the

future, including statements regarding the anticipated timing and

benefits of the proposed joint venture transaction, and may be

identified by the use of words such as “expects,” “believes,”

“intends,” “projects,” “anticipates,” “estimates,” “plans,”

“seeks,” “forecasts,” “predicts,” “objective,” “targets,”

“potential,” “outlook,” “may,” “will,” “could” or the negative of

these terms, other comparable terminology and variations thereof.

Such forward-looking statements involve known and unknown risks and

uncertainties that may cause the Company’s actual results in future

periods to be materially different from management’s expectations,

and no assurance can be given that such expectations will prove

correct. Factors that could cause the Company's results to differ

materially from the results discussed in such forward-looking

statements principally include the possibility that the terms of

the final award to be issued by the Arbitrator in the Tesla, Inc.

("Tesla") dispute may differ from the terms of the interim award

issued by the Arbitrator and may be challenged, our ability to

satisfy the conditions precedent to the consummation of the

proposed joint venture transaction on the expected timeline or at

all, our ability to achieve the anticipated benefits of the

proposed joint venture transaction, uncertainties regarding future

actions that may be taken by Barington in furtherance of its

intention to nominate director candidates for election at the

Company’s 2025 Annual Meeting, potential operational disruption

caused by Barington’s actions that may make it more difficult to

maintain relationships with customers, employees or partners,

changes in domestic or international economic conditions, changes

in foreign currency exchange rates, changes in interest rates,

changes in the cost of materials used in the manufacture of the

Company's products, including changes in costs due to adjustments

to tariffs, any impairment of goodwill or intangible assets,

environmental liability and limitations on the Company’s operations

due to environmental laws and regulations, disruptions to certain

services, such as telecommunications, network server maintenance,

cloud computing or transaction processing services, provided to the

Company by third-parties, changes in mortality and cremation rates,

changes in product demand or pricing as a result of consolidation

in the industries in which the Company operates, or other factors

such as supply chain disruptions, labor shortages or labor cost

increases, changes in product demand or pricing as a result of

domestic or international competitive pressures, ability to achieve

cost-reduction objectives, unknown risks in connection with the

Company's acquisitions, divestitures and business combinations,

cybersecurity concerns and costs arising with management of

cybersecurity threats, effectiveness of the Company's internal

controls, compliance with domestic and foreign laws and

regulations, technological factors beyond the Company's control,

impact of pandemics or similar outbreaks, or other disruptions to

our industries, customers, or supply chains, the impact of global

conflicts, such as the current war between Russia and Ukraine, the

Company's plans and expectations with respect to its exploration,

and contemplated execution, of various strategies with respect to

its portfolio of businesses, the Company's plans and expectations

with respect to its Board, and other factors described in the

Company’s Annual Report on Form 10-K and other periodic filings

with the U.S. Securities and Exchange Commission.

Matthews International CorporationCorporate

OfficeTwo NorthShore CenterPittsburgh, PA 15212-5851Phone: (412)

442-8200

ContactsMatthews International

Co.Steven F. Nicola Chief Financial Officer and

Secretary(412) 442-8262

Sodali & Co.Michael Verrechia/Bill

Dooley(800) 662-5200MATW@investor.sodali.com

Georgeson LLCBill Fiske / David

FarkasMATWinfo@Georgeson.com

Collected StrategiesDan Moore / Scott Bisang /

Clayton ErwinMATW-CS@collectedstrategies.com

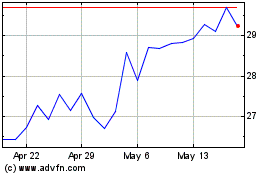

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Jan 2025 to Feb 2025

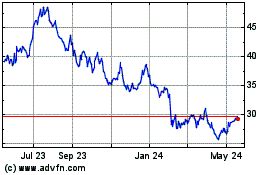

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Feb 2024 to Feb 2025