0000063296false00000632962025-02-062025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

____________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2025

____________________________________________________________

MATTHEWS INTERNATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

____________________________________________________________

| | | | | | | | |

| Pennsylvania | 0-09115 | 25-0644320 |

| (State or other jurisdiction of | (Commission | (I.R.S. Employer |

| Incorporation or organization) | File Number) | Identification No.) |

Two Northshore Center, Pittsburgh, PA 15212-5851

(Address of principal executive offices) (Zip Code)

(412) 442-8200

(Registrant's telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

_____________________________________________________________________________________________ Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Class A Common Stock, $1.00 par value | | MATW | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 6, 2025, Matthews International Corporation ("Matthews" or the "Company") issued a press release announcing its earnings for the first fiscal quarter of 2025. A copy of the press release is furnished hereto as Exhibit 99.1.

Item 7.01 Regulation FD Disclosure.

On February 6, 2025, Matthews posted to the Company's website (www.matw.com/investors) its earnings teleconference presentation which includes selected financial results for the first fiscal quarter of 2025. The presentation is furnished herewith as Exhibit 99.2. This information, including exhibits attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. This information shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference to this Form 8-K in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit

Number | | Description |

| | | |

| | Press Release, dated February 6, 2025, issued by Matthews International Corporation |

| | Matthews International Corporation earnings teleconference presentation for the first fiscal quarter of 2025 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| MATTHEWS INTERNATIONAL CORPORATION |

| (Registrant) |

| | | |

| By: | /s/ Steven F. Nicola | |

| | | |

| | Steven F. Nicola | |

| | Chief Financial Officer and Secretary | |

Date: February 7, 2025

Matthews International Corporation

Corporate Office

Two NorthShore Center

Pittsburgh, PA 15212-5851

Phone: (412) 442-8200 | | | | | | | | |

| February 6, 2025 | Contact: | Steven F. Nicola |

| | Chief Financial Officer and Secretary |

MATTHEWS INTERNATIONAL REPORTS RESULTS FOR

FISCAL 2025 FIRST QUARTER

| | |

Fiscal 2025 First Quarter Financial Highlights: |

•Company maintains outlook for fiscal 2025 (subject to the completion of the SGK Brand Solutions (SGK) transaction)

•Positive arbitration ruling affirms Company's right to sell its DBE solutions

•Cost reduction program on track

•Regulatory filings for SGK transaction initiated; continue to expect transaction to be completed by mid-2025 with proceeds applied substantially to debt reduction

•Webcast: Friday, February 7, 2025, 9:00 a.m., (201) 689-8471

PITTSBURGH, PA, February 6, 2025 - Matthews International Corporation (NASDAQ GSM: MATW) today announced financial results for its first quarter of fiscal 2025.

In discussing the results for the Company’s fiscal 2025 first quarter, Joseph C. Bartolacci, President and Chief Executive Officer, stated:

“Our results for the fiscal 2025 first quarter were generally in line with our expectations and, as a result, we are maintaining our outlook for the full fiscal year. The Memorialization and SGK Brand Solutions segments continued their solid performance in the quarter. Further, as we also anticipated, results for the Industrial Technologies segment were challenged by the impact of the Tesla litigation, and we look forward to improving in this business.

“As we announced this morning, yesterday's ruling in our case against Tesla affirmed our ownership rights to our groundbreaking Dry Battery Electrode technology. Pursuant to the arbitrator's ruling and consistent with our contractual rights, we intend to immediately begin marketing, selling, and delivering our DBE solutions to other customers and unlock their value for shareholders.

“With respect to the recently announced SGK transaction, we initiated the required regulatory filing process, and remain on track to complete the transaction by mid-2025. Consideration to Matthews upon closing will be $350 million upfront plus a 40% interest in the new entity. The upfront consideration includes cash of $250 million that will be immediately applied, net of a minor amount of taxes, to debt reduction. We currently estimate that the combined entity will generate synergies exceeding $50 million, which will greatly enhance the value of our 40% interest in the new entity.

“Furthermore, the Board’s comprehensive evaluation of strategic alternatives for our entire portfolio remains ongoing.

Matthews International Reports Results for Fiscal 2025 First Quarter

Page 2 of 11

February 6, 2025

“As we announced in November 2024, we have significant cost reduction actions which are now underway and progressing well. Although the upfront costs incurred in connection with these actions have unfavorably affected our current GAAP results, we remain on track to achieve cost reductions of at least $50 million. Additionally, following the transition of SGK, we expect reductions in Matthews’ corporate costs as the organizational structure becomes more simplified.

“Adjusted EBITDA for the Memorialization segment was relatively unchanged compared to the first quarter last year. The segment reported lower sales compared to last year primarily reflecting the impact of lower U.S. deaths and the prior year included sales in connection with a reduction in backlog of granite memorials. However, the impact of these declines on adjusted EBITDA for the current quarter was mitigated by the benefits from ongoing productivity and cost reduction initiatives and improved price realization.

“The SGK Brand Solutions segment reported a modest increase in sales for the current quarter compared to last year. The U.S. brand market continued to demonstrate improving conditions and sales in the Asia-Pacific region increased. In addition, private label and European cylinder sales increased compared to a year ago, while the European brand markets remained soft.

“Sales for the Industrial Technologies segment for the current quarter declined from the first quarter last year. As anticipated, the engineering business reported significantly lower sales, primarily reflecting a slowdown in Tesla project work and the impact of the litigation on work with other customers.

“Litigation costs related to the Tesla matter have also unfavorably impacted our GAAP results. In addition, health care costs were approximately $1.6 million higher for the current quarter compared to a year ago. Beginning January 1, 2025, we have transitioned to a premium based program which is expected to lower and improve the predictability of these costs.

“Outstanding debt increased $32.7 million during the fiscal 2025 first quarter which was also within our expectations. Our fiscal first quarter generally reflects net cash outflows primarily resulting from payments related to our fiscal year-end and is seasonally slower for earnings. Additionally, for the current fiscal year, we had outflows related to the litigation and in connection with the upfront costs (e.g. severance) related to our cost reduction programs.

“In November 2024, we projected adjusted EBITDA in the range of $205 million to $215 million for fiscal 2025, which contemplated SGK in our consolidated results for the full fiscal year. On the same basis, we are still projecting fiscal 2025 in this range.”

First Quarter Fiscal 2025 Consolidated Results (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions, except per share data) | Q1 FY2025 | | Q1 FY2024 | | Change | | % Change |

| Sales | $ | 401.8 | | | $ | 450.0 | | | $ | (48.2) | | | (10.7) | % |

| Net loss attributable to Matthews | $ | (3.5) | | | $ | (2.3) | | | $ | (1.2) | | | 50.8 | % |

| Diluted loss per share | $ | (0.11) | | | $ | (0.07) | | | $ | (0.04) | | | 57.1 | % |

| Non-GAAP adjusted net income | $ | 4.3 | | | $ | 11.3 | | | $ | (7.0) | | | (61.8) | % |

| Non-GAAP adjusted EPS | $ | 0.14 | | | $ | 0.37 | | | $ | (0.23) | | | (62.2) | % |

| Adjusted EBITDA | $ | 40.0 | | | $ | 45.5 | | | $ | (5.5) | | | (12.0) | % |

| Note: See the attached tables for additional important disclosures regarding Matthews’ use of non-GAAP measures as well as reconciliations of non-GAAP measures to corresponding GAAP measures. |

| | | | | | | |

Matthews International Reports Results for Fiscal 2025 First Quarter

Page 3 of 11

February 6, 2025

Consolidated sales for the quarter ended December 31, 2024 were $401.8 million, compared to $450.0 million for the same quarter a year ago. Net loss attributable to the Company for the quarter ended December 31, 2024 was $3.5 million, or $0.11 per share, compared to $2.3 million, or $0.07 per share in the prior year. On a non-GAAP adjusted basis, earnings for the fiscal 2025 first quarter were $0.14 per share, compared to $0.37 per share a year ago. The decrease was primarily attributable to lower consolidated adjusted EBITDA and higher interest expense for the current quarter compared to a year ago. Adjusted EBITDA for the fiscal 2025 first quarter was $40.0 million, compared to $45.5 million a year ago, primarily reflecting lower adjusted EBITDA in the Industrial Technologies segment and higher healthcare costs, partially offset by lower corporate and non-operating costs.

Webcast

The Company will host a conference call and webcast on Friday, February 7, 2025 at 9:00 a.m. Eastern Time to review its financial and operating results and discuss its corporate strategies and outlook. A question-and-answer session will follow. The conference call can be accessed by dialing (201) 689-8471. The audio webcast can be monitored at www.matw.com. As soon as available after the call, a transcript of the call will be posted on the Investor Relations section of the Company’s website at www.matw.com.

About Matthews International Corporation

Matthews International Corporation is a global provider of memorialization products, industrial technologies, and brand solutions. The Memorialization segment is a leading provider of memorialization products, including memorials, caskets, cremation-related products, and cremation and incineration equipment, primarily to cemetery and funeral home customers that help families move from grief to remembrance. The Industrial Technologies segment includes the design, manufacturing, service and sales of high-tech custom energy storage solutions; product identification and warehouse automation technologies and solutions, including order fulfillment systems for identifying, tracking, picking and conveying consumer and industrial products; and coating and converting lines for the packaging, pharma, foil, décor and tissue industries. The SGK Brand Solutions segment is a leading provider of packaging solutions and brand experiences, helping companies simplify their marketing, amplify their brands and provide value. The Company has over 11,000 employees in more than 30 countries on six continents that are committed to delivering the highest quality products and services.

Matthews International Reports Results for Fiscal 2025 First Quarter

Page 4 of 11

February 6, 2025

Forward-looking Information

Any forward-looking statements contained in this release are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding the expectations, hopes, beliefs, intentions or strategies of the Company regarding the future, including statements regarding the anticipated timing and benefits of the proposed joint venture transaction, and may be identified by the use of words such as “expects,” “believes,” “intends,” “projects,” “anticipates,” “estimates,” “plans,” “seeks,” “forecasts,” “predicts,” “objective,” “targets,” “potential,” “outlook,” “may,” “will,” “could” or the negative of these terms, other comparable terminology and variations thereof. Such forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from management’s expectations, and no assurance can be given that such expectations will prove correct. Factors that could cause the Company's results to differ materially from the results discussed in such forward-looking statements principally include the possibility that the terms of the final award to be issued by the Arbitrator in the Tesla, Inc. ("Tesla") dispute may differ from the terms of the interim award issued by the Arbitrator and may be challenged, our ability to satisfy the conditions precedent to the consummation of the proposed joint venture transaction on the expected timeline or at all, our ability to achieve the anticipated benefits of the proposed joint venture transaction, uncertainties regarding future actions that may be taken by Barington in furtherance of its intention to nominate director candidates for election at the Company’s 2025 Annual Meeting, potential operational disruption caused by Barington’s actions that may make it more difficult to maintain relationships with customers, employees or partners, changes in domestic or international economic conditions, changes in foreign currency exchange rates, changes in interest rates, changes in the cost of materials used in the manufacture of the Company's products, including changes in costs due to adjustments to tariffs, any impairment of goodwill or intangible assets, environmental liability and limitations on the Company’s operations due to environmental laws and regulations, disruptions to certain services, such as telecommunications, network server maintenance, cloud computing or transaction processing services, provided to the Company by third-parties, changes in mortality and cremation rates, changes in product demand or pricing as a result of consolidation in the industries in which the Company operates, or other factors such as supply chain disruptions, labor shortages or labor cost increases, changes in product demand or pricing as a result of domestic or international competitive pressures, ability to achieve cost-reduction objectives, unknown risks in connection with the Company's acquisitions, divestitures and business combinations, cybersecurity concerns and costs arising with management of cybersecurity threats, effectiveness of the Company's internal controls, compliance with domestic and foreign laws and regulations, technological factors beyond the Company's control, impact of pandemics or similar outbreaks, or other disruptions to our industries, customers, or supply chains, the impact of global conflicts, such as the current war between Russia and Ukraine, the Company's plans and expectations with respect to its exploration, and contemplated execution, of various strategies with respect to its portfolio of businesses, the Company's plans and expectations with respect to its Board, and other factors described in the Company’s Annual Report on Form 10-K and other periodic filings with the U.S. Securities and Exchange Commission.

Matthews International Reports Results for Fiscal 2025 First Quarter

Page 5 of 11

February 6, 2025

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

(In thousands, except per share data) | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Three Months Ended

December 31, | | | |

| | | | | | | | 2024 | | 2023 | | % Change | |

| Sales | | | | | | | | $ | 401,842 | | | $ | 449,986 | | | (10.7) | % | |

| Cost of sales | | | | | | | | (276,150) | | | (317,633) | | | (13.1) | % | |

| Gross profit | | | | | | | | 125,692 | | | 132,353 | | | (5.0) | % | |

| Gross margin | | | | | | | | 31.3 | % | | 29.4 | % | | | |

| | | | | | | | | | | | | |

| Selling and administrative expenses | | | | | | | | (111,410) | | | (113,131) | | | (1.5) | % | |

| Amortization of intangible assets | | | | | | | | (8,608) | | | (9,795) | | | (12.1) | % | |

| | | | | | | | | | | | | |

| Operating profit | | | | | | | | 5,674 | | | 9,427 | | | (39.8) | % | |

| Operating margin | | | | | | | | 1.4 | % | | 2.1 | % | | | |

| | | | | | | | | | | | | |

| Interest and other deductions, net | | | | | | | | (11,504) | | | (12,456) | | | (7.6) | % | |

| Loss before income taxes | | | | | | | | (5,830) | | | (3,029) | | | 92.5 | % | |

| Income taxes | | | | | | | | 2,358 | | | 726 | | | NM | |

| Net loss | | | | | | | | (3,472) | | | (2,303) | | | 50.8 | % | |

| Non-controlling interests | | | | | | | | — | | | — | | | — | % | |

| Net loss attributable to Matthews | | | | | | | | $ | (3,472) | | | $ | (2,303) | | | 50.8 | % | |

| | | | | | | | | | | | | |

| Loss per share -- diluted | | | | | | | | $ | (0.11) | | | $ | (0.07) | | | 57.1 | % | |

| | | | | | | | | | | | | |

Earnings per share -- non-GAAP (1) | | | | | | | | $ | 0.14 | | | $ | 0.37 | | | (62.2) | % | |

| | | | | | | | | | | | | |

| Dividends declared per share | | | | | | | | $ | 0.25 | | | $ | 0.24 | | | 4.2 | % | |

| | | | | | | | | | | | | |

| Diluted Shares | | | | | | | | 31,110 | | | 30,915 | | | | |

(1) See reconciliation of non-GAAP financial information provided in tables at the end of this release | |

| NM: Not meaningful | |

SEGMENT INFORMATION (Unaudited)

(In thousands)

| | | | | | | | | | | | | | | |

| | | Three Months Ended

December 31, |

| | | | | | 2024 | | 2023 |

| Sales: | | | | | | | |

| Memorialization | | | | | $ | 190,486 | | | $ | 208,071 | |

| Industrial Technologies | | | | | 80,533 | | | 111,374 | |

| SGK Brand Solutions | | | | | 130,823 | | | 130,541 | |

| | | | | | $ | 401,842 | | | $ | 449,986 | |

| | | | | | | | | | | | | | | |

| Adjusted EBITDA: | | | | | | | |

| Memorialization | | | | | $ | 36,612 | | | $ | 36,700 | |

| Industrial Technologies | | | | | 1,832 | | | 9,622 | |

| SGK Brand Solutions | | | | | 12,292 | | | 12,893 | |

| Corporate and Non-Operating | | | | | (10,713) | | | (13,733) | |

Total Adjusted EBITDA (1) | | | | | $ | 40,023 | | | $ | 45,482 | |

| | | | | | | |

(1) See reconciliation of non-GAAP financial information provided in tables at the end of this release |

Matthews International Reports Results for Fiscal 2025 First Quarter

Page 6 of 11

February 6, 2025

CONDENSED CONSOLIDATED BALANCE SHEET INFORMATION (Unaudited)

(In thousands) | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2024 | September 30, 2024 |

| ASSETS | | | | | | |

| Cash and cash equivalents | | | $ | 33,513 | | | | $ | 40,816 | |

| Accounts receivable, net | | | 199,303 | | | | 205,984 | |

| Inventories, net | | | 241,585 | | | | 237,888 | |

| Other current assets | | | 148,798 | | | | 147,855 | |

| Total current assets | | | 623,199 | | | | 632,543 | |

| Property, plant and equipment, net | | | 264,895 | | | | 279,499 | |

| Goodwill | | | 685,967 | | | | 697,123 | |

| Other intangible assets, net | | | 116,878 | | | | 126,026 | |

| Other long-term assets | | | 100,780 | | | | 99,699 | |

| Total assets | | | $ | 1,791,719 | | | | $ | 1,834,890 | |

| | | | | | |

| LIABILITIES | | | | | | |

| Long-term debt, current maturities | | | $ | 7,260 | | | | $ | 6,853 | |

| Other current liabilities | | | 388,321 | | | | 427,922 | |

| Total current liabilities | | | 395,581 | | | | 434,775 | |

| Long-term debt | | | 801,951 | | | | 769,614 | |

| Other long-term liabilities | | | 180,731 | | | | 193,295 | |

| Total liabilities | | | 1,378,263 | | | | 1,397,684 | |

| | | | | | |

| SHAREHOLDERS' EQUITY | | | | | | |

| Total shareholders' equity | | | 413,456 | | | | 437,206 | |

| Total liabilities and shareholders' equity | | | $ | 1,791,719 | | | | $ | 1,834,890 | |

CONDENSED CONSOLIDATED CASH FLOWS INFORMATION (Unaudited)

(In thousands) | | | | | | | | | | | |

| Three Months Ended December 31, |

| | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (3,472) | | | $ | (2,303) | |

| Adjustments to reconcile net loss to net cash flows from operating activities: | | |

| Depreciation and amortization | 22,504 | | | 23,523 | |

| Changes in working capital items | (39,170) | | | (51,640) | |

| Other operating activities | (4,871) | | | 3,154 | |

| Net cash used in operating activities | (25,009) | | | (27,266) | |

| | | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (9,532) | | | (14,073) | |

| Acquisitions, net of cash acquired | (2,218) | | | — | |

| Other investing activities | 13,186 | | | (113) | |

| Net cash provided by (used in) investing activities | 1,436 | | | (14,186) | |

| | | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| Net payments from long-term debt | 31,949 | | | 62,579 | |

| Purchases of treasury stock | (4,275) | | | (17,185) | |

| Dividends | (9,237) | | | (9,280) | |

| Other financing activities | — | | | — | |

| Net cash provided by financing activities | 18,437 | | | 36,114 | |

| | | |

| Effect of exchange rate changes on cash | (2,167) | | | 1,158 | |

| | | |

| Net change in cash and cash equivalents | $ | (7,303) | | | $ | (4,180) | |

Matthews International Reports Results for Fiscal 2025 First Quarter

Page 7 of 11

February 6, 2025

Reconciliations of Non-GAAP Financial Measures

Included in this report are measures of financial performance that are not defined by GAAP, including, without limitation, adjusted EBITDA, adjusted net income and EPS, constant currency sales, constant currency adjusted EBITDA, net debt and net debt leverage ratio. The Company defines net debt leverage ratio as outstanding debt (net of cash) relative to adjusted EBITDA. The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition and divestiture costs, ERP system integration costs, strategic initiative and other charges (which includes non-recurring charges related to certain commercial and operational initiatives and exit activities), stock-based compensation and the non-service portion of pension and postretirement expense. Constant currency sales and constant currency adjusted EBITDA remove the impact of changes due to foreign exchange translation rates. To calculate sales and adjusted EBITDA on a constant currency basis, amounts for periods in the current fiscal year are translated into U.S. dollars using exchange rates applicable to the comparable periods of the prior fiscal year. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that management believes do not directly reflect the Company's core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company's calculations of its non-GAAP financial measures, however, may not be comparable to similarly titled measures reported by other companies. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provide investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures.

Matthews International Reports Results for Fiscal 2025 First Quarter

Page 8 of 11

February 6, 2025

ADJUSTED EBITDA RECONCILIATION (Unaudited)

(In thousands) | | | | | | | | | | | | | | | |

| | | Three Months Ended

December 31, |

| | | | | 2024 | | 2023 |

| Net loss | | | | | $ | (3,472) | | | $ | (2,303) | |

| Income tax benefit | | | | | (2,358) | | | (726) | |

| Loss before income taxes | | | | | $ | (5,830) | | | $ | (3,029) | |

| Net loss attributable to noncontrolling interests | | | | | — | | | — | |

Interest expense, including RPA and factoring financing fees (1) | | | | | 16,854 | | | 12,751 | |

Depreciation and amortization * | | | | | 22,504 | | | 23,523 | |

| | | | | | | |

Acquisition and divestiture related items (2)** | | | | | 577 | | | 1,237 | |

Strategic initiatives and other items (3)**† | | | | | 615 | | | 5,920 | |

| | | | | | | |

Highly inflationary accounting losses (primarily non-cash) (4) | | | | | 191 | | | 320 | |

| | | | | | | |

| | | | | | | |

| Stock-based compensation | | | | | 4,979 | | | 4,651 | |

Non-service pension and postretirement expense (5) | | | | | 133 | | | 109 | |

| Total Adjusted EBITDA | | | | | $ | 40,023 | | | $ | 45,482 | |

| Adjusted EBITDA margin | | | | | 10.0 | % | | 10.1 | % |

| | | | | | | |

| | | | | | | |

(1) Includes fees for receivables sold under the RPA and factoring arrangements totaling $1,172 and $1,175 for the three months ended December 31, 2024 and 2023, respectively. |

(2) Includes certain non-recurring items associated with recent acquisition and divestiture activities. |

(3) Includes certain non-recurring costs associated with commercial, operational and cost-reduction initiatives, and costs associated with global ERP system integration efforts. Also includes legal costs related to an ongoing dispute with Tesla, Inc. ("Tesla"), which totaled $6,867 and $2,370 for the three months ended December 31, 2024 and 2023, respectively. Fiscal 2025 includes $8,702 of net gains on the sales of certain significant property and other assets. Fiscal 2025 also includes loss recoveries totaling $1,170 which were related to a previously disclosed theft of funds by a former employee initially identified in fiscal 2015. |

(4) Represents exchange losses associated with highly inflationary accounting related to the Company's Turkish subsidiaries. |

(5) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. |

* Depreciation and amortization was $7,202 and $6,413 for the Memorialization segment, $5,674 and $6,377 for the Industrial Technologies segment, $8,860 and $9,572 for the SGK Brand Solutions segment, and $768 and $1,161 for Corporate and Non-Operating, for the three months ended December 31, 2024 and December 31, 2023, respectively.

** Acquisition costs, ERP system integration costs, and strategic initiatives and other items were $1,303 and $60 for the Memorialization segment, $4,119 and $5,367 for the Industrial Technologies segment, $714 and $863 for the SGK Brand Solutions segment, and income of $4,944 and charges of $867 for Corporate and Non-Operating, for the three months ended December 31, 2024 and December 31, 2023, respectively.

† Strategic initiatives and other items includes charges for exit and disposal activities (including severance and other employee terminations) totaling $313 and $1,961 for the three months ended December 31, 2024 and 2023, respectively. Fiscal 2025 amounts totaling charges of $601 and income of $288 for the three months ended December 31, 2024 were presented in cost of sales and administrative expense, respectively. Fiscal 2024 amounts totaling charges of $1,902, income of $256 and charges of $315 for the three months ended December 31, 2023 were presented in cost of sales, selling expense, and administrative expense, respectively. Accrued severance and other termination benefits totaled $23,637 and $42,245 as of December 31, 2024 and September 30, 2024, respectively.

Matthews International Reports Results for Fiscal 2025 First Quarter

Page 9 of 11

February 6, 2025

ADJUSTED NET INCOME AND EPS RECONCILIATION (Unaudited)

(In thousands, except per share data) | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

December 31, |

| | | | | 2024 | | 2023 |

| | | | | | | | per share | | | per share |

| Net loss attributable to Matthews | | | | | | | $ | (3,472) | | $ | (0.11) | | | $ | (2,303) | | $ | (0.07) | |

Acquisition and divestiture costs (1) | | | | | | | 355 | | 0.01 | | | 899 | | 0.03 | |

Strategic initiatives and other charges (2) | | | | | | | 704 | | 0.02 | | | 5,004 | | 0.16 | |

| | | | | | | | | | | |

Highly inflationary accounting losses (primarily non-cash) (3) | | | | | | | 191 | | 0.01 | | | 320 | | 0.01 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Non-service pension and postretirement expense (4) | | | | | | | 100 | | — | | | 81 | | — | |

| Amortization | | | | | | | 6,456 | | 0.21 | | | 7,346 | | 0.24 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Adjusted net income | | | | | | | $ | 4,334 | | $ | 0.14 | | | $ | 11,347 | | $ | 0.37 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Note: Adjustments to net income for non-GAAP reconciling items were calculated using an income tax rate of 22.9% and 26.4% for the three months ended December 31, 2024 and December 31, 2023, respectively. |

(1) Includes certain non-recurring costs associated with recent acquisition and divestiture activities. |

(2) Includes certain non-recurring costs associated with commercial, operational and cost-reduction initiatives, and costs associated with global ERP system integration efforts. Also includes legal costs related to an ongoing dispute with Tesla, Inc. ("Tesla"), which totaled $6,867 and $2,370 for the three months ended December 31, 2024 and 2023, respectively. Fiscal 2025 includes $8,702 of net gains on the sales of certain significant property and other assets. Fiscal 2025 also includes loss recoveries totaling $1,170 which were related to a previously disclosed theft of funds by a former employee initially identified in fiscal 2015. |

(3) Represents exchange losses associated with highly inflationary accounting related to the Company's Turkish subsidiaries. |

(4) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. |

Matthews International Reports Results for Fiscal 2025 First Quarter

Page 10 of 11

February 6, 2025

CONSTANT CURRENCY SALES AND ADJUSTED EBITDA RECONCILIATION (Unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Memorialization | | Industrial Technologies | | SGK Brand Solutions | | Corporate and Non-Operating | | Consolidated |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Reported sales for the three months ended December 31, 2024 | $ | 190,486 | | | $ | 80,533 | | | $ | 130,823 | | | $ | — | | | $ | 401,842 | |

| Changes in foreign exchange translation rates | 85 | | | 396 | | | 700 | | | — | | | 1,181 | |

Constant currency sales for the three months ended December 31, 2024 | $ | 190,571 | | | $ | 80,929 | | | $ | 131,523 | | | $ | — | | | $ | 403,023 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Reported adjusted EBITDA for the three months ended December 31, 2024 | $ | 36,612 | | | $ | 1,832 | | | $ | 12,292 | | | $ | (10,713) | | | $ | 40,023 | |

| Changes in foreign exchange translation rates | 15 | | | 26 | | | 97 | | | (44) | | | 94 | |

Constant currency adjusted EBITDA for the three months ended December 31, 2024 | $ | 36,627 | | | $ | 1,858 | | | $ | 12,389 | | | $ | (10,757) | | | $ | 40,117 | |

Matthews International Reports Results for Fiscal 2025 First Quarter

Page 11 of 11

February 6, 2025

NET DEBT AND NET DEBT LEVERAGE RATIO RECONCILIATION (Unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | |

| December 31, 2024 | | | | | | September 30, 2024 |

| | | | | | | |

| Long-term debt, current maturities | $ | 7,260 | | | | | | | $ | 6,853 | |

| Long-term debt | 801,951 | | | | | | | 769,614 | |

| Total debt | 809,211 | | | | | | | 776,467 | |

| | | | | | | |

| Less: Cash and cash equivalents | (33,513) | | | | | | | (40,816) | |

| | | | | | | |

| Net Debt | $ | 775,698 | | | | | | | $ | 735,651 | |

| | | | | | | |

| Adjusted EBITDA (trailing 12 months) | $ | 199,698 | | | | | | | $ | 205,157 | |

| | | | | | | |

| Net Debt Leverage Ratio | 3.9 | | | | | | 3.6 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

- ### -

www.matw.com | Nasdaq: MATW First Quarter Fiscal 2025 Earnings Review February 7, 2025 Joseph C. Bartolacci President and Chief Executive Officer Steven F. Nicola Chief Financial Officer

© 2025 Matthews International Corporation. All Rights Reserved. DISCLAIMER 2 Any forward-looking statements contained in this release are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding the expectations, hopes, beliefs, intentions or strategies of the Company regarding the future, including statements regarding the anticipated timing and benefits of the proposed joint venture transaction, and may be identified by the use of words such as “expects,” “believes,” “intends,” “projects,” “anticipates,” “estimates,” “plans,” “seeks,” “forecasts,” “predicts,” “objective,” “targets,” “potential,” “outlook,” “may,” “will,” “could” or the negative of these terms, other comparable terminology and variations thereof. Such forward- looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from management’s expectations, and no assurance can be given that such expectations will prove correct. Factors that could cause the Company's results to differ materially from the results discussed in such forward-looking statements principally include the possibility that the terms of the final award to be issued by the Arbitrator in the Tesla, Inc. ("Tesla") dispute may differ from the terms of the interim award issued by the Arbitrator and may be challenged, our ability to satisfy the conditions precedent to the consummation of the proposed joint venture transaction on the expected timeline or at all, our ability to achieve the anticipated benefits of the proposed joint venture transaction, uncertainties regarding future actions that may be taken by Barington in furtherance of its intention to nominate director candidates for election at the Company’s 2025 Annual Meeting, potential operational disruption caused by Barington’s actions that may make it more difficult to maintain relationships with customers, employees or partners, changes in domestic or international economic conditions, changes in foreign currency exchange rates, changes in interest rates, changes in the cost of materials used in the manufacture of the Company's products, including changes in costs due to adjustments to tariffs, any impairment of goodwill or intangible assets, environmental liability and limitations on the Company’s operations due to environmental laws and regulations, disruptions to certain services, such as telecommunications, network server maintenance, cloud computing or transaction processing services, provided to the Company by third-parties, changes in mortality and cremation rates, changes in product demand or pricing as a result of consolidation in the industries in which the Company operates, or other factors such as supply chain disruptions, labor shortages or labor cost increases, changes in product demand or pricing as a result of domestic or international competitive pressures, ability to achieve cost-reduction objectives, unknown risks in connection with the Company's acquisitions, divestitures and business combinations, cybersecurity concerns and costs arising with management of cybersecurity threats, effectiveness of the Company's internal controls, compliance with domestic and foreign laws and regulations, technological factors beyond the Company's control, impact of pandemics or similar outbreaks, or other disruptions to our industries, customers, or supply chains, the impact of global conflicts, such as the current war between Russia and Ukraine, the Company's plans and expectations with respect to its exploration, and contemplated execution, of various strategies with respect to its portfolio of businesses, the Company's plans and expectations with respect to its Board, and other factors described in the Company’s Annual Report on Form 10-K and other periodic filings with the U.S. Securities and Exchange Commission. Included in this report are measures of financial performance that are not defined by generally accepted accounting principles in the United States (“GAAP”). The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition and divestiture costs, enterprise resource planning ("ERP") system integration costs, strategic initiative and other charges (which includes non-recurring charges related to certain commercial and operational initiatives and exit activities), stock-based compensation and the non-service portion of pension and postretirement expense. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that management believes do not directly reflect the Company’s core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provides investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. The Company believes that adjusted EBITDA provides relevant and useful information, which is used by the Company’s management in assessing the performance of its business. Adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain non-cash and/or non-recurring items that do not contribute directly to management’s evaluation of its operating results. These items include stock-based compensation, the non-service portion of pension and postretirement expense, acquisition and divestiture costs, ERP system integration costs, and strategic initiatives and other charges. Adjusted EBITDA provides the Company with an understanding of earnings before the impact of investing and financing charges and income taxes, and the effects of certain acquisition and divestiture and ERP system integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in evaluating operating performance. It is also useful as a financial measure for lenders and is used by the Company’s management to measure business performance. Adjusted EBITDA is not a measure of the Company's financial performance under GAAP and should not be considered as an alternative to net income or other performance measures derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of the Company's liquidity. The Company's definition of adjusted EBITDA may not be comparable to similarly titled measures used by other companies. The Company has presented constant currency sales and constant currency adjusted EBITDA and believes these measures provide relevant and useful information, which is used by the Company's management in assessing the performance of its business on a consistent basis by removing the impact of changes due to foreign exchange translation rates. These measures allow management, as well as investors, to assess the Company’s sales and adjusted EBITDA on a constant currency basis. The Company has also presented adjusted net income and adjusted earnings per share and believes each measure provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s management in assessing the performance of its business. Adjusted net income and adjusted earnings per share provides the Company with an understanding of the results from the primary operations of our business by excluding the effects of certain acquisition, divestiture, and system-integration costs, and items that do not reflect the ordinary earnings of our operations. These measures provide management with insight into the earning value for shareholders excluding certain costs, not related to the Company’s primary operations. Likewise, these measures may be useful to an investor in evaluating the underlying operating performance of the Company’s business overall, as well as performance trends, on a consistent basis. Lastly, the Company has presented net debt and a net debt leverage ratio and believes each measure provides relevant and useful information, which is widely used by analysts and investors as well as by our management. These measures provide management with insight on the indebtedness of the Company, net of cash and cash equivalents and relative to adjusted EBITDA. These measures allow management, as well as analysts and investors, to assess the Company’s leverage.

BUSINESS OVERVIEW

© 2025 Matthews International Corporation. All Rights Reserved. 4 SGK BRAND SOLUTIONS MEMORIALIZATION • Benefits from ongoing productivity and cost reduction initiatives and improved price realization • Lower U.S. death rates and impact of granite backlog reduction efforts in the prior year • Improved market conditions and growth in the private label market and European cylinder business • European brand markets remained soft BUSINESS UPDATE INDUSTRIAL TECHNOLOGIES • Engineering business remains challenged by the impact of the Tesla litigation • Positive arbitration ruling affirms Company's right to sell its DBE solutions

© 2025 Matthews International Corporation. All Rights Reserved. Key Drivers • Projected adjusted EBITDA to be in the range of $205 million to $215 million (subject to the completion of the SGK Brand Solutions (SGK) transaction) • Initiated the required regulatory filing process for the SGK transaction, and remain on track to complete the transaction by mid-2025 • Solid performance expected for the Memorialization and SGK Brand Solutions segments • Uncertainty of project timing in the Industrial Technologies segment, specifically related to energy business; cost reduction programs should mitigate some of this impact • Cost reduction program on track • Net leverage and leverage ratio expected to decline by the end of the fiscal year OUTLOOK FOR FISCAL 2025 5

FINANCIAL OVERVIEW

© 2025 Matthews International Corporation. All Rights Reserved. Q1 2025 SUMMARY 7 ($ in millions except per-share amounts) Q1 Q1 2024 Q1 2025 Sales $ 450.0 $ 401.8 Diluted loss per share $ (0.07) $ (0.11) Non-GAAP Adjusted EPS* $ 0.37 $ 0.14 Net loss attributable to Matthews $ (2.3) $ (3.5) Adjusted EBITDA* $ 45.5 $ 40.0 Highlights Sales • SGK Brand Solutions segment reported a modest increase in sales • Lower energy storage sales GAAP EPS • Operating profit for the current quarter offset by interest expense Adjusted EPS • Lower adjusted EBITDA and higher interest expense Adjusted EBITDA • Lower adjusted EBITDA for the Industrial Technologies segment offset partially by lower corporate and non- operating costs * See supplemental slides for Adjusted EPS, Adjusted EBITDA, constant currency sales, constant currency adjusted EBITDA reconciliations and other important disclaimers regarding Matthews’ use of Non-GAAP measures

© 2025 Matthews International Corporation. All Rights Reserved. MEMORIALIZATION 8 23.0% 21.1% $208.1 $190.5 FY2024 FY2025 $36.7 $36.6 FY2024 FY2025 17.6% 19.2% ($ in millions) Q1 Sales Q1 Adjusted EBITDA & Margin* Sales • Lower sales compared to last year primarily reflecting the impact of lower U.S. deaths and reduced sales of granite memorials Adjusted EBITDA • Improved price realization and productivity and cost reduction initiatives * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures

© 2025 Matthews International Corporation. All Rights Reserved. INDUSTRIAL TECHNOLOGIES 9 15.5% 12.4% 15.6%10.3% ($ in millions) $111.4 $80.5 Q1 FY2024 Q1 FY2025 $9.6 $1.8 Q1 FY2024 Q1 FY2025 8.6% 2.3% Q1 Sales Q1 Adjusted EBITDA & Margin* Sales • Energy storage sales impacted by customer delays • Warehouse automation sales unfavorably impacted by market conditions Adjusted EBITDA • Impact of lower sales and lower margins on engineered products • Decreases were partially offset by benefits from cost-reduction initiatives and lower performance-based compensation compared to fiscal 2024 * See supplemental slide for Adjusted EBITDA reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures

© 2025 Matthews International Corporation. All Rights Reserved. SGK BRAND SOLUTIONS ($ in millions) * See supplemental slides for Adjusted EBITDA and other important disclaimers regarding Matthews’ use of Non-GAAP measures 10 15.4% 12.9% $130.5 $130.8 FY2024 FY2025 $12.9 $12.3 FY2024 FY2025 9.9% 9.4% Q1 Sales Q1 Adjusted EBITDA & Margin* Sales • Growth in the private label market and European cylinder business Adjusted EBITDA • Impact of higher labor costs, partially offset by improved price realization to mitigate inflationary cost increases and benefits from cost-reduction initiatives

© 2025 Matthews International Corporation. All Rights Reserved. • First quarter cash flows reflect payments related to fiscal year-end, seasonality of earnings, and outflows related to the litigation and in connection with upfront costs (e.g., severance and other costs) related to our cost reduction programs • Net Debt Leverage Ratio* 3.88 as of December 31, 2024 • Quarterly dividend of $0.25/share, payable 2/24/25 CAPITALIZATION AND CASH FLOWS 11 * See supplemental slide for Net Debt and Net Debt Leverage Ratio reconciliation and other important disclaimers regarding Matthews’ use of Non-GAAP measures Note: Dark gray shades on the left represent Total Debt. Total Debt and Net Debt* $776.5 $809.2 $735.7 $775.7 09/30/24 12/31/24 ($ in millions) Cash $40.8 $33.5 9/30/24 12/31/24 Operating Cash Flow $(27.3) $(25.0) YTD FY2024 YTD FY2025

SUPPLEMENTAL INFORMATION

© 2025 Matthews International Corporation. All Rights Reserved. 13 Included in this report are measures of financial performance that are not defined by GAAP, including, without limitation, adjusted EBITDA, adjusted net income and EPS, constant currency sales, constant currency adjusted EBITDA, and net debt and net debt leverage ratio. The Company defines net debt leverage ratio as outstanding debt (net of cash) relative to adjusted EBITDA. The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect the Company’s core operations including acquisition and divestiture costs, ERP system integration costs, strategic initiative and other charges (which includes non-recurring charges related to certain commercial and operational initiatives and exit activities), stock- based compensation and the non-service portion of pension and postretirement expense. Constant currency sales and constant currency adjusted EBITDA removes the impact of changes due to foreign exchange translation rates. To calculate sales and adjusted EBITDA on a constant currency basis, amounts for periods in the current fiscal year are translated into U.S. dollars using exchange rates applicable to the comparable periods of the prior fiscal year. Management believes that presenting non-GAAP financial measures is useful to investors because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items that management believes do not directly reflect the Company's core operations, (ii) permits investors to view performance using the same tools that management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in evaluating the Company’s results. The Company's calculations of its non-GAAP financial measures, however, may not be comparable to similarly titled measures reported by other companies. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the reconciliations to those measures, provided herein, provide investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these disclosures. RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

© 2025 Matthews International Corporation. All Rights Reserved. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted EBITDA. 14 Three Months Ended December 31, 2024 2023 Net loss $ (3,472) $ (2,303) Income tax benefit (2,358) (726) Loss before income taxes $ (5,830) $ (3,029) Net loss attributable to noncontrolling interests — — Interest expense, including RPA and factoring financing fees (1) 16,854 12,751 Depreciation and amortization * 22,504 23,523 Acquisition and divestiture related items (2)** 577 1,237 Strategic initiatives and other items (3)**† 615 5,920 Highly inflationary accounting losses (primarily non-cash) (4) 191 320 Stock-based compensation 4,979 4,651 Non-service pension and postretirement expense (5) 133 109 Total Adjusted EBITDA $ 40,023 $ 45,482 Adjusted EBITDA margin 10.0 % 10.1 % (1) Includes fees for receivables sold under the RPA and factoring arrangements totaling $1,172 and $1,175 for the three months ended December 31, 2024 and 2023, respectively. (2) Includes certain non-recurring items associated with recent acquisition and divestiture activities. (3) Includes certain non-recurring costs associated with commercial, operational and cost-reduction initiatives, and costs associated with global ERP system integration efforts. Also includes legal costs related to an ongoing dispute with Tesla, which totaled $6,867 and $2,370 for the three months ended December 31, 2024 and 2023, respectively. Fiscal 2025 includes $8,702 of net gains on the sales of certain significant property and other assets. Fiscal 2025 also includes loss recoveries totaling $1,170 which were related to a previously disclosed theft of funds by a former employee initially identified in fiscal 2015. (4) Represents exchange losses associated with highly inflationary accounting related to the Company's Turkish subsidiaries. (5) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service- related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans. * Depreciation and amortization was $7,202 and $6,413 for the Memorialization segment, $5,674 and $6,377 for the Industrial Technologies segment, $8,860 and $9,572 for the SGK Brand Solutions segment, and $768 and $1,161 for Corporate and Non-Operating, for the three months ended December 31, 2024 and 2023, respectively. ** Acquisition costs, ERP system integration costs, and strategic initiatives and other items were $1,303 and $60 for the Memorialization segment, $4,119 and $5,367 for the Industrial Technologies segment, $714 and $863 for the SGK Brand Solutions segment, and income of $4,944 and charges of $867 for Corporate and Non-Operating, for the three months ended December 31, 2024 and 2023, respectively. † Strategic initiatives and other items includes charges for exit and disposal activities (including severance and other employee terminations) totaling $313 and $1,961 for the three months ended December 31, 2024 and 2023, respectively. Fiscal 2025 amounts totaling charges of $601 and income of $288 for the three months ended December 31, 2024 were presented in cost of sales and administrative expense, respectively. Fiscal 2024 amounts totaling charges of $1,902, income of $256 and charges of $315 for the three months ended December 31, 2023 were presented in cost of sales, selling expense, and administrative expense, respectively. Accrued severance and other termination benefits totaled $23,637 and $42,245 as of December 31, 2024 and September 30, 2024, respectively. ADJUSTED EBITDA NON-GAAP RECONCILIATION (Unaudited) (In thousands)

© 2025 Matthews International Corporation. All Rights Reserved. ADJUSTED NET INCOME AND EARNINGS PER SHARE NON-GAAP RECONCILIATION (Unaudited) (In thousands, except per share data) * See Disclaimer (page 2) for Management’s assessment of supplemental information related to adjusted net income and adjusted EPS. 15 Three Months Ended December 31, 2024 2023 per share per share Net loss attributable to Matthews $ (3,472) $ (0.11) $ (2,303) $ (0.07) Acquisition and divestiture costs (1) 355 0.01 899 0.03 Strategic initiatives and other charges (2) 704 0.02 5,004 0.16 Highly inflationary accounting losses (primarily non-cash) (3) 191 0.01 320 0.01 Non-service pension and postretirement expense (4) 100 — 81 — Amortization 6,456 0.21 7,346 0.24 Adjusted net income $ 4,334 $ 0.14 $ 11,347 $ 0.37 Note: Adjustments to net income for non-GAAP reconciling items were calculated using an income tax rate of 22.9% and 26.4% for the three months ended December 31, 2024 and December 31, 2023, respectively. (1) Includes certain non-recurring costs associated with recent acquisition and divestiture activities. (2) Includes certain non-recurring costs associated with commercial, operational and cost-reduction initiatives, and costs associated with global ERP system integration efforts. Also includes legal costs related to an ongoing dispute with Tesla, which totaled $6,867 and $2,370 for the three months ended December 31, 2024 and 2023, respectively. Fiscal 2025 includes $8,702 of net gains on the sales of certain significant property and other assets. Fiscal 2025 also includes loss recoveries totaling $1,170 which were related to a previously disclosed theft of funds by a former employee initially identified in fiscal 2015. (3) Represents exchange losses associated with highly inflationary accounting related to the Company's Turkish subsidiaries. (4) Non-service pension and postretirement expense includes interest cost, expected return on plan assets, amortization of actuarial gains and losses, curtailment gains and losses, and settlement gains and losses. These benefit cost components are excluded from adjusted EBITDA since they are primarily influenced by external market conditions that impact investment returns and interest (discount) rates. Curtailment gains and losses and settlement gains and losses are excluded from adjusted EBITDA since they generally result from certain non-recurring events, such as plan amendments to modify future benefits or settlements of plan obligations. The service cost and prior service cost components of pension and postretirement expense are included in the calculation of adjusted EBITDA, since they are considered to be a better reflection of the ongoing service-related costs of providing these benefits. Please note that GAAP pension and postretirement expense or the adjustment above are not necessarily indicative of the current or future cash flow requirements related to these employee benefit plans.

© 2025 Matthews International Corporation. All Rights Reserved. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to constant currency sales and constant currency adjusted EBITDA. 16 CONSTANT CURRENCY SALES AND ADJUSTED EBITDA NON-GAAP RECONCILIATION (Unaudited) (In thousands) Memorialization Industrial Technologies SGK Brand Solutions Corporate and Non- Operating Consolidated Reported sales for the three months ended December 31, 2024 $ 190,486 $ 80,533 $ 130,823 $ — $ 401,842 Changes in foreign exchange translation rates 85 396 700 — 1,181 Constant currency sales for the three months ended December 31, 2024 $ 190,571 $ 80,929 $ 131,523 $ — $ 403,023 Reported adjusted EBITDA for the three months ended December 31, 2024 $ 36,612 $ 1,832 $ 12,292 $ (10,713) $ 40,023 Changes in foreign exchange translation rates 15 26 97 (44) 94 Constant currency adjusted EBITDA for the three months ended December 31, 2024 $ 36,627 $ 1,858 $ 12,389 $ (10,757) $ 40,117

© 2025 Matthews International Corporation. All Rights Reserved. * See Disclaimer (page 2) for Management’s assessment of supplemental information related to net debt and net debt leverage ratio. 17 December 31, 2024 September 30, 2024 Long-term debt, current maturities $ 7,260 $ 6,853 Long-term debt 801,951 769,614 Total debt 809,211 776,467 Less: Cash and cash equivalents (33,513) (40,816) Net Debt $ 775,698 $ 735,651 Adjusted EBITDA (trailing 12 months) $ 199,698 $ 205,157 Net Debt Leverage Ratio 3.9 3.6 NET DEBT AND NET DEBT LEVERAGE RATIO NON-GAAP RECONCILIATION (Unaudited) (Dollars in thousands)

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

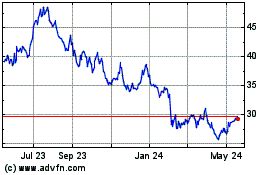

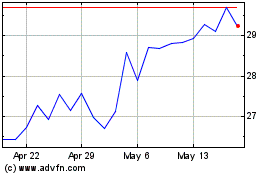

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Jan 2025 to Feb 2025

Matthews (NASDAQ:MATW)

Historical Stock Chart

From Feb 2024 to Feb 2025