0001821586FALSE00018215862024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 or 15(d) of the

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 7, 2024

MOONLAKE IMMUNOTHERAPEUTICS

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Cayman Islands | | 001-39630 | | 98-1711963 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

Dorfstrasse 29

6300 Zug

Switzerland

(Address of Principal Executive Offices and Zip Code)

41 415108022

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A ordinary share, par value $0.0001 per share | | MLTX | | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 7, 2024, MoonLake Immunotherapeutics (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

This Item 2.02 and the Press Release attached hereto as Exhibit 99.1, insofar as they disclose information regarding the Company’s results of operation and financial condition for the quarter ended June 30, 2024, are being furnished to the U.S. Securities and Exchange Commission.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following exhibit is being furnished herewith:

| | | | | |

| Exhibit Number | Exhibit Title or Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | | |

| | MOONLAKE IMMUNOTHERAPEUTICS |

| Date: | August 7, 2024 | By: | /s/ Matthias Bodenstedt |

| | Name: | Matthias Bodenstedt |

| | Title: | Chief Financial Officer |

MoonLake Immunotherapeutics Reports Second Quarter 2024 Financial Results and Announces a Capital Markets Update for September 11

•Initiated Phase 3 VELA program of the Nanobody® sonelokimab in hidradenitis suppurativa (“HS”), with topline results anticipated as of mid-2025

•Secured positive feedback from both U.S. Food and Drug Administration (“FDA”) and the E.U. European Medicines Agency (“EMA”) on the regulatory path for the Phase 3 program of the Nanobody® sonelokimab in psoriatic arthritis (“PsA”) and outlined the clinical plan with topline results anticipated in end-2026

•Ended the quarter with $519.8 million in cash, cash equivalents and short-term marketable debt securities, expected to support a roadmap rich in potential catalysts whilst providing a cash runway to the end of 2026

•Capital Markets Update to be held on Wednesday, September 11 – to provide an update on market opportunity and trial execution

ZUG, Switzerland, August 7, 2024 – MoonLake Immunotherapeutics (NASDAQ:MLTX) (“MoonLake” or the “Company”), a clinical-stage biotechnology company focused on creating next-level therapies for inflammatory diseases, today announced its financial results for the second quarter of 2024. MoonLake continues to make significant progress in advancing its investigational Nanobody® sonelokimab in a number of dermatological and rheumatological inflammatory indications.

Following positive top-line results from its global Phase 2 MIRA trial announced last year, the Company initiated its global Phase 3 VELA program during the quarter to evaluate sonelokimab for a total of 52 weeks in an estimated total of 800 patients with moderate-to-severe HS. Management anticipates topline results of the 16 weeks primary endpoint as of mid-2025. The initiation of an additional Phase 3 study in adolescents with HS, the VELA TEEN trial, is on track for enrollment of the first patients around year-end.

MoonLake also received positive regulatory feedback from both the FDA and the EMA during the quarter which clarifies the path for its Phase 3 IZAR program in PsA. IZAR-1 will focus on bio-naïve patients* and radiographic progression whilst IZAR-2 will focus on TNF-IR patients**. The IZAR program will feature risankizumab as a reference arm and is expected to enroll around 1,500 patients, starting in the fourth quarter of 2024.

Preparations for the initiation of additional Phase 2 trials of sonelokimab in palmo-plantar pustulosis (“PPP”), radiographic and non-radiographic axial spondyloarthritis (“axSpA”) are ongoing and progressing according to plan for an expected enrollment of first patients before the end of the year.

Dr. Jorge Santos da Silva, Chief Executive Officer of MoonLake Immunotherapeutics, said: “This quarter saw us take important steps towards registration as we enrolled the first patients into the HS Phase 3 trials for our Nanobody® sonelokimab. By the end of the of the year we expect to have Phase 3 programs underway in both HS and PsA, two major inflammation & immunology indications. Given that HS most commonly manifests in young adults, we also plan to initiate a Phase 3 trial in adolescent HS which we expect to be the first dedicated clinical trial focused on the adolescent HS population. Our additional trials in PPP, axSpA and PsA are expected to provide further opportunities for MoonLake. Our team continues to grow in a carefully managed way, adding new capabilities to support our maturing status. We look forward to providing further updates on progress at our Capital Markets Update in September.”

Q2 highlights (including post-period end)

•Initiated Phase 3 VELA program of the Nanobody® sonelokimab in patients with moderate-to-severe HS; VELA is the first Phase 3 program in HS to use the higher clinical response (HiSCR75); topline primary endpoint readout (week 16) expected as of mid-2025

•Received positive feedback from both the FDA and EMA on the regulatory path for IZAR, the second Phase 3 program to be initiated by MoonLake this year, that outlined the development plan for the program to evaluate sonelokimab for a total of 52 weeks in patients with active PsA;

two trials planned – one focusing on bio-naïve patients* and radiographic progression (IZAR-1) and the other on TNF-IR patients** (IZAR-2) with topline results anticipated by end-2026

•Presented Week 12 efficacy and safety outcomes from the Phase 2 ARGO trial in PsA patients at the European Alliance of Associations for Rheumatology Congress (EULAR) congress in Vienna

•Signed a three-year technology partnership with Komodo Health to advance research on inflammatory skin and joint conditions and presented initial data from this partnership, indicating that at least two million Americans have been diagnosed with HS as of 2023, highlighting a significant unmet need and impact on healthcare systems, and a potential market opportunity exceeding $10bn by 2035

* Patients without previous exposure to biologics

** Patients with an inadequate response to TNF inhibitors

First quarter 2024 financial results

As of June 30, 2024, MoonLake held cash, cash equivalents and short-term marketable debt securities of $519.8 million. Research and development expenses for the quarter ended June 30, 2024, were $23.7 million, compared to $13.0 million in the previous quarter. The increase was primarily due to expenses incurred to initiate new clinical trials. General and administrative expenses for the quarter ended June 30, 2024 were $6.9 million, similar to the $6.8 million incurred in the previous quarter.

Matthias Bodenstedt, Chief Financial Officer at MoonLake Immunotherapeutics, said: “MoonLake is in full execution mode and on track for many important data reads in 2025, including the anticipated primary readout of the Phase 3 HS VELA program. With over $500 million in cash, cash equivalents and short-term marketable debt securities on the balance sheet, we remain well capitalized and our runway guidance to the end of 2026 remains unchanged. Recent market feedback confirms the significant unmet need and commercial opportunity in our focus indications, and we believe that Sonelokimab is uniquely positioned to capture this opportunity.”

Capital Markets Update on Wednesday, September 11

MoonLake will be hosting a Capital Markets Update for investors and analysts on Wednesday, September 11. The live webcast will provide updates from MoonLake’s executive team on the ongoing clinical trials and the Company’s view on the market opportunity featuring insights from recent claims data analyses.

Important upcoming anticipated events for MoonLake:

•Q3-2024: Hosting of a Capital Markets Update on September 11

•Q4-2024: Initiation of the Phase 3 IZAR program in PsA

•2H-2024: Initiation of additional Phase 2 trials as announced for dermatology and rheumatology indications

•Around year-end 2024: Initiation of Phase 3 VELA TEEN program in adolescent HS

•As of mid-2025: Topline primary endpoint readout for Phase 3 VELA program in HS

Upcoming banking and medical conferences

•European Society of Dermatological Research Annual Meeting, September 4-7, Lisbon, Portugal

•International Congress on Spondyloarthritides, September 5-7, Gent, Belgium

•Cantor Annual Healthcare Conference, September 17-19, New York, US

•European Academy of Dermatology and Venereology (EADV) Congress, September 25-28, Amsterdam, The Netherlands

•Symposium on Hidradenitis Suppurativa Advances (SHSA), November 1-3, Texas, USA

•American College of Rheumatology (ACR) Conference, November 14-19 Washington DC, USA

•Jefferies London Healthcare Conference, November 19-21, 2024, London, UK

•Citi’s 19th Annual BioPharma Conference, December 3-5, Boston, US

-Ends-

About MoonLake Immunotherapeutics

MoonLake Immunotherapeutics is a clinical-stage biopharmaceutical company unlocking the potential of sonelokimab, a novel investigational Nanobody® for the treatment of inflammatory disease, to revolutionize outcomes for patients. Sonelokimab inhibits IL-17A and IL-17F by inhibiting the IL-17A/A, IL-17A/F, and IL-17F/F dimers that drive inflammation. The company’s focus is on inflammatory diseases with a major unmet need, including hidradenitis suppurativa and psoriatic arthritis – conditions affecting millions of people worldwide with a large need for improved treatment options. MoonLake was founded in 2021 and is headquartered in Zug, Switzerland. Further information is available at www.moonlaketx.com.

About Sonelokimab

Sonelokimab (M1095) is an investigational ~40 kDa humanized Nanobody® consisting of three VHH domains covalently linked by flexible glycine-serine spacers. With two domains, sonelokimab selectively binds with high affinity to IL-17A and IL-17F, thereby inhibiting the IL-17A/A, IL-17A/F, and IL-17F/F dimers. A third central domain binds to human albumin, facilitating further enrichment of sonelokimab at sites of inflammatory edema.

Sonelokimab is being assessed in two lead indications, hidradenitis suppurativa (HS) and psoriatic arthritis (PSA), and the Company is pursuing other indications in dermatology and rheumatology.

For HS, sonelokimab is being assessed in two Phase 3 trials, VELA-1 and VELA-2 following the successful outcome of MoonLake’s end-of-Phase 2 interactions with the FDA and as well as positive feedback from its interactions with the EMA announced in February 2024. In October 2023, the full dataset from the Phase 2 MIRA trial at 24 weeks (NCT05322473) showed that maintenance treatment with sonelokimab led to further improvements in Hidradenitis Suppurativa Clinical Response (HiSCR)75 which is a higher measure of clinical response versus the HiSCR50 measure used in other clinical trials, setting a landmark milestone and other clinically relevant outcomes. Prior to this, in June 2023, topline results of the MIRA trial at 12 weeks showed that the trial met its primary endpoint, HiSCR75.

For PsA, Phase 3 initiation is anticipated in Q4 2024 following the announcement in March 2024 of the full dataset from the global Phase 2 ARGO trial evaluating the efficacy and safety of the Nanobody® sonelokimab over 24 weeks in patients with active PsA. Significant improvements were observed across all key outcomes, including approximately 60% of patients treated with sonelokimab achieving an ACR50 response at week 24. This followed the positive top-line results in November 2023, where the trial met its primary endpoint with a statistically significant greater proportion of patients treated with either sonelokimab 60mg or 120mg (with induction) achieving an American College of Rheumatology (ACR) 50 response compared to those on placebo at week 12. All key secondary endpoints in the trial were met for the 60mg and 120mg doses with induction.

A Phase 2 trial is expected to be initiated in palmo-plantar pustulosis (PPP), a debilitating disease affecting a significant number of patients. In addition, a Phase 3 trial is expected to initiate in adolescent HS, a disease that typically begins at this early stage of a patient’s life, and also the period in which irreversible damage and inflammatory remission is most critical.

Sonelokimab will also be assessed for seronegative spondyloarthritis with a Phase 2 trial in radiographic and non-radiographic axial spondyloarthritis (axSpA) expected to start in 2024. The trials will feature an innovative design complementing traditional clinical outcomes with modern imaging techniques.

Sonelokimab has also been assessed in a randomized, placebo-controlled Phase 2b trial (NCT03384745) in 313 patients with moderate-to-severe plaque-type psoriasis. High threshold clinical responses (Investigator’s Global Assessment Score 0 or 1, and Psoriasis Area and Severity Index 90/100) were observed in patients with moderate-to-severe plaque-type psoriasis. Sonelokimab was generally well tolerated, with a safety profile similar to the active control, secukinumab (Papp KA, et al. Lancet. 2021; 397:1564-1575).

In an earlier Phase 1 trial in patients with moderate-to-severe plaque-type psoriasis, sonelokimab has been shown to decrease (to normal skin levels) the cutaneous gene expression of pro-inflammatory cytokines and chemokines (Svecova D. J Am Acad Dermatol. 2019;81:196–203).

About Nanobodies®

Nanobodies® represent a new generation of antibody-derived targeted therapies. They consist of one or more domains based on the small antigen-binding variable regions of heavy-chain-only antibodies (VHH). Nanobodies® have a number of potential advantages over traditional antibodies, including their small size, enhanced tissue penetration, resistance to temperature changes, ease of manufacturing, and their ability to be designed into multivalent therapeutic molecules with bespoke target combinations.

The terms Nanobody® and Nanobodies® are trademarks of Ablynx, a Sanofi company.

About the VELA program

The VELA program is expected to enroll 800 patients across two similarly designed Phase 3 trials (VELA-1 and VELA-2) with the aim to evaluate the efficacy and safety of the Nanobody® sonelokimab, administered subcutaneously, in adult patients with active moderate-to-severe hidradenitis suppurativa. Similar to the design of the landmark Phase 2 MIRA trial, the primary endpoint of the program is the percentage of participants achieving Hidradenitis Suppurativa Clinical Response 75 (HiSCR75), defined as a ≥75% reduction in total abscess and inflammatory nodule (AN) count with no increase in abscess or draining tunnel count relative to baseline. The trial will also evaluate a number of secondary endpoints, including the proportion of patients achieving Hidradenitis Suppurative Clinical Response (HiSCR50), the change from baseline in International Hidradenitis Suppurativa Severity Score System (IHS4), the proportion of patients achieving a Dermatology Life Quality Index (DLQI) total score of ≤5, and the proportion of patients achieving at least 30% reduction from baseline in Numerical Rating Scale (NRS30) in the Patient’s Global Assessment of Skin Pain (PGA Skin Pain). Further details are available under NCT06411379 and NCT06411899 at ClinicalTrials.gov.

About the MIRA trial

The MIRA trial (M1095-HS-201) is a global, randomized, double-blind, placebo-controlled trial to evaluate the efficacy and safety of the Nanobody® sonelokimab, administered subcutaneously, in the treatment of adult patients with active moderate to severe hidradenitis suppurativa. The trial recruited 234 patients, with the aim to evaluate two different doses of sonelokimab, with placebo control and adalimumab as an active control reference arm. The primary endpoint of the trial is the percentage of participants achieving Hidradenitis Suppurativa Clinical Response 75 (HiSCR75), defined as a ≥75% reduction in total abscess and inflammatory nodule (AN) count with no increase in abscess or draining tunnel count relative to baseline. The trial also evaluated a number of secondary endpoints, including the proportion of patients achieving HiSCR50, the change from baseline in International Hidradenitis Suppurativa Severity Score System (IHS4), the proportion of patients achieving a Dermatology Life Quality Index (DLQI) total score of ≤5, and the proportion of patients achieving at least 30% reduction from baseline in Numerical Rating Scale (NRS30) in the Patient’s Global Assessment of Skin Pain (PGA Skin Pain). Further details are available on: https://www.clinicaltrials.gov/ct2/show/NCT05322473

About the ARGO trial

The ARGO trial (M1095-PSA-201) is a global, randomized, double-blind, placebo-controlled trial to evaluate the efficacy and safety of the sonelokimab, administered subcutaneously, in the treatment of adult patients with active PsA. The trial recruited 207 patients, with the aim to evaluate different doses of sonelokimab, with placebo control and adalimumab as an active reference arm. The primary endpoint of the trial is the percentage of participants achieving ≥50% improvement in signs and symptoms of disease from baseline, compared to placebo, as measured by the American College of Rheumatology (ACR) 50 response. The trial also evaluated a number of secondary endpoints, including improvement compared to placebo in ACR70, complete skin clearance as measured by at least a 100% improvement in the Psoriasis Area and Severity Index, physical function as measured by the Health Assessment Questionnaire-Disability Index, enthesitis as measured by the Leeds Enthesitis Index and pain as measured by the Patients Assessment of Arthritis Pain. Further details are available on: https://clinicaltrials.gov/ct2/show/NCT05640245

About Hidradenitis Suppurativa

Hidradenitis suppurativa is a severely debilitating chronic skin condition resulting in irreversible tissue destruction. HS manifests as painful inflammatory skin lesions, typically around the armpits, groin, and buttocks. Over time, uncontrolled and inadequately treated inflammation can result in irreversible tissue destruction and scarring. The disease affects 0.05–4.1% of the global population, with three times more females affected than males. Real-world data indicates that at least 2 million Americans have been diagnosed with HS as of 2023, highlighting a significant unmet need and impact on healthcare systems, and a market opportunity exceeding $10bn by 2035. Onset typically occurs in early adulthood and HS has a profound negative impact on quality of life, with a higher morbidity than other dermatologic conditions. There is increasing scientific evidence to support IL-17A- and IL-17F-mediated inflammation as a key driver of the pathogenesis of HS, with other identified risk factors including genetics, cigarette smoking, and obesity.

About Psoriatic Arthritis

Psoriatic arthritis (PsA) is a chronic and progressive inflammatory arthritis associated with psoriasis primarily affecting the peripheral joints. The clinical features of PsA are diverse, involving pain, swelling, and stiffness of the joints, which can result in restricted mobility and fatigue. PsA occurs in up to 30% of patients with psoriasis, most commonly those aged between 30 and 60 years. The symptom burden of PsA can have a substantial negative impact on patient quality of life. Although the exact mechanism of disease is not fully understood, evidence suggests that activation of the IL-17 pathway plays an important role in the disease pathophysiology.

Cautionary Statement Regarding Forward Looking Statements

This press release contains certain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements regarding MoonLake’s expectations, hopes, beliefs, intentions or strategies regarding the future including, without limitation, statements regarding: plans for and timing of clinical trials, including initiation of Phase 3 VELA TEEN trial of sonelokimab in adolescents with HS, commencement of clinical trials of sonelokimab in PPP, axSpA and topline results of the Phase 3 VELA program of sonelokimab in HS, the efficacy and safety of sonelokimab for the treatment of HS and PsA, including in comparison to existing standards or care or other competing therapies, clinical trials and research and development programs and the anticipated timing of the results from those studies and trials, potential market opportunities for sonelokimab and our anticipated cash usage and the period of time we anticipate such cash to be available. In addition, any statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward- looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that statement is not forward looking.

Forward-looking statements are based on current expectations and assumptions that, while considered reasonable by MoonLake and its management, as the case may be, are inherently uncertain. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Actual results could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation, risks and uncertainties associated with MoonLake’s business in general and limited operating history, difficulty enrolling patients in clinical trials, state and federal healthcare reform measures that could result in reduced demand for MoonLake’s product candidates and reliance on third parties to conduct and support its preclinical studies and clinical trials and the other risks described in or incorporated by reference into MoonLake’s Annual Report on Form 10-K for the year ended December 31, 2023 and subsequent filings with the Securities and Exchange Commission.

Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements in this press release, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. MoonLake does not undertake or accept any duty to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or in the events, conditions or circumstances on which any such statement is based.

CONTACT

MoonLake Immunotherapeutics Investors

Matthias Bodenstedt, CFO

ir@moonlaketx.com

MoonLake Immunotherapeutics Media

Patricia Sousa, Director Corporate Affairs

media@moonlaketx.com

ICR Consilium

Mary-Jane Elliott, Ashley Tapp, Namrata Taak

Tel: +44 (0) 20 3709 5700

MoonLake@consilium-comms.com

MOONLAKE IMMUNOTHERAPEUTICS

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in USD, except share data)

| | | | | | | | | | | | | | |

| | June 30, 2024 (Unaudited) | | December 31.2023 |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 342,791,142 | | $ | 451,169,337 |

| Short-term marketable debt securities | | 177,008,400 | | 59,838,900 |

| | | | |

| | | | |

| Other receivables | | 1,676,813 | | 1,056,862 |

| Prepaid expenses - current | | 15,405,526 | | 2,102,203 |

| | | | |

| Total current assets | | 536,881,881 | | 514,167,302 |

| | | | |

| Non-current assets | | | | |

| Operating lease right-of-use assets | | 3,384,953 | | 3,628,480 |

| Property and equipment, net | | 481,705 | | 320,865 |

| Prepaid expenses - non-current | | 4,129,151 | | 8,423,468 |

| | | | |

| | | | |

| | | | |

| | | | |

| Total non-current assets | | 7,995,809 | | 12,372,813 |

| Total assets | | $ | 544,877,690 | | | $ | 526,540,115 |

| | | | |

| Current liabilities | | | | |

| Trade and other payables | | $ | 5,142,853 | | | $ | 1,837,684 | |

| Short-term portion of operating lease liabilities | | 1,321,727 | | 1,197,876 |

| Accrued expenses and other current liabilities | | 5,817,384 | | 6,930,120 |

| | | | |

| | | | |

| Total current liabilities | | 12,281,964 | | 9,965,680 |

| | | | |

| Non-current liabilities | | | | |

| Long-term portion of operating lease liabilities | | 2,022,280 | | 2,499,990 |

| Pension liability | | 541,949 | | 583,426 |

| | | | |

| Total non-current liabilities | | 2,564,229 | | 3,083,416 |

| Total liabilities | | 14,846,193 | | 13,049,096 |

| Commitments and contingencies (Note 15) | | | | |

| | | | |

| Equity | | | | |

| | | | |

| | | | |

| | | | |

Class A Ordinary Shares: $0.0001 par value; 500,000,000 shares authorized; 62,874,637 shares issued and outstanding as of June 30, 2024; 60,466,453 shares issued and outstanding as of December 31, 2023 | | 6,287 | | 6,047 |

Class C Ordinary Shares: $0.0001 par value; 100,000,000 shares authorized; 995,267 shares issued and outstanding as of June 30, 2024; 2,505,476 shares issued and outstanding as of December 31, 2023 | | 100 | | 251 |

| Additional paid-in capital | | 671,998,583 | | 609,969,236 |

| Accumulated deficit | | (154,598,140) | | (116,657,472) |

| Accumulated other comprehensive income | | 3,256,907 | | 2,357,621 |

| Total shareholders’ equity | | 520,663,737 | | 495,675,683 |

| Noncontrolling interests | | 9,367,760 | | 17,815,336 |

| Total equity | | 530,031,497 | | 513,491,019 |

| Total liabilities and equity |

| $ | 544,877,690 | | $ | 526,540,115 |

| | | | |

| | | | |

MOONLAKE IMMUNOTHERAPEUTICS

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

(Amounts in USD, except share and per share data)

| | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Period Ended | | | | | | |

| | June 30, | | March 31, | | | | | | |

| | 2024 | | 2024 | | | | | | |

| Operating expenses | | | | | | | | | | |

| Research and development | | $ | (23,662,147) | | $ | (13,014,049) | | | | | | |

| General and administrative | | (6,916,054) | | (6,806,440) | | | | | | |

| Total operating expenses | | (30,578,201) | | (19,820,489) | | | | | | |

| Operating loss | | (30,578,201) | | (19,820,489) | | | | | | |

| | | | | | | | | | |

| Other income, net | | 5,898,148 | | 5,915,220 | | | | | | |

| Loss before income tax | | (24,680,053) | | (13,905,269) | | | | | | |

| |

| |

| | | | | | |

| Income tax expense | | (78,701) | | (70,252) | | | | | | |

| Net loss | | $ | (24,758,754) | | $ | (13,975,521) | | | | | | |

| Of which: net loss attributable to controlling interests shareholders | | (24,267,012) | | (13,673,656) | | | | | | |

| Of which: net loss attributable to noncontrolling interests shareholders | | (491,742) | | (301,865) | | | | | | |

| |

| |

| | | | | | |

| Net unrealized gain (loss) on marketable securities and short term investments | | 652,097 | | 182,273 | | | | | | |

| Actuarial gain (loss) on employee benefit plans | | (76,479) | | 81,230 | | | | | | |

| Other comprehensive income (loss) | | 575,618 | | 263,503 | | | | | | |

| Comprehensive loss | | $ | (24,183,136) | | $ | (13,712,018) | | | | | | |

| Comprehensive loss attributable to controlling interests shareholders | | (23,703,201) | | (13,415,707) | | | | | | |

| Comprehensive loss attributable to noncontrolling interests | | (479,935) | | (296,311) | | | | | | |

| |

| |

| | | | | | |

| Weighted-average number of Class A Ordinary Shares, basic and diluted | | 62,874,637 | | 62,637,212 | | | | | | |

| Basic and diluted net loss per share attributable to controlling interests shareholders | | $ | (0.39) | | $ | (0.22) | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

|

| | | | | | | | | | |

| | | | | | | | | | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

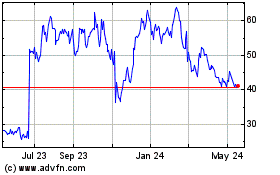

MoonLake Immunotherapeut... (NASDAQ:MLTX)

Historical Stock Chart

From Jan 2025 to Feb 2025

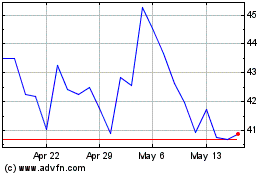

MoonLake Immunotherapeut... (NASDAQ:MLTX)

Historical Stock Chart

From Feb 2024 to Feb 2025