0001289419false00012894192024-10-012024-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 1, 2024

MORNINGSTAR, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Illinois (State or other jurisdiction of incorporation) | 000-51280 (Commission File Number)

| 36-3297908 (I.R.S. Employer Identification No.) |

| | 22 West Washington Street Chicago, Illinois (Address of principal executive offices) |

60602 (Zip Code) |

| | (312) 696-6000 (Registrant’s telephone number, including area code) | |

|

N/A | | |

(Former name or former address, if changed since last report) __________________________________

| |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common stock, no par value | MORN | The Nasdaq Stock Market LLC |

Item 7.01. Regulation FD Disclosure

In accordance with Morningstar, Inc.’s (the “Company”) policy regarding public disclosure of corporate information, Investor questions primarily received by the Company through August 2, 2024, and Company responses (the “Investor Q&A”) are attached to this Current Report on Form 8-K (this “Report”) as Exhibit 99.1 and incorporated herein by reference. The Investor Q&A shall be deemed furnished, not filed, for purposes of this Report.

Caution Concerning Forward-Looking Statements

This Report, including the document incorporated by reference herein, contains forward-looking statements as that term is used in the Private Securities Litigation Reform Act of 1995. These statements are based on our current expectations about future events or future financial performance. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and often contain words such as "consider,” “estimate,” “forecast,” “future,” “goal,” “designed to,” “maintain,” “may,” “objective,” “ongoing,” “could,” “expect,” “intend,” “plan,” “possible,” “potential,” “anticipate,” “believe,” “predict,” “continue,” “strategy,” “strive,” “will,” “would,” "determine," "evaluate," or the negative thereof, and similar expressions. These statements involve known and unknown risks and uncertainties that may cause the events we discuss not to occur or to differ significantly from what we expect. For us, these risks and uncertainties include, among others:

• failing to maintain and protect our brand, independence, and reputation;

• failure to prevent and/or mitigate cybersecurity events and the failure to protect confidential information, including personal information about individuals;

• compliance failures, regulatory action, or changes in laws applicable to our credit ratings operations, investment advisory, environmental, social, and governance (ESG), and index businesses;

• failing to innovate our product and service offerings or anticipate our clients’ changing needs;

• the impact of artificial intelligence (AI) and related new technologies on our business, legal, and regulatory exposure profile and reputation;

• failure to detect errors in our products or failure of our products to perform properly due to defects, malfunctions or similar problems;

• failing to recruit, develop, and retain qualified employees;

• prolonged volatility or downturns affecting the financial sector, global financial markets, and the global economy and its effect on our revenue from asset-based fees and credit ratings business;

• failing to scale our operations and increase productivity in order to implement our business plans and strategies;

• liability for any losses that result from errors in our automated advisory tools or errors in the use of the information and data we collect;

• inadequacy of our operational risk management, business continuity programs and insurance coverage in the event of a material disruptive event;

• failing to close, or achieve the anticipated economic or other benefits of, a strategic transaction on a timely basis or at all;

• failing to efficiently integrate and leverage acquisitions and other investments, which may not realize the expected business or financial benefits, to produce the results we anticipate;

• failing to maintain growth across our businesses in today's fragmented geopolitical, regulatory and cultural world;

• liability relating to the information and data we collect, store, use, create, and distribute or the reports that we publish or are produced by our software products;

• the potential adverse effect of our indebtedness on our cash flows and financial and operational flexibility;

• challenges in accounting for tax complexities in the global jurisdictions we operate in could materially affect our tax obligations and tax rates; and

• failing to protect our intellectual property rights or claims of intellectual property infringement against us.

A more complete description of these risks and uncertainties can be found in our filings with the Securities and Exchange Commission (SEC), including our most recent Reports on Form 10-K and 10-Q. If any of these risks and uncertainties materialize, our actual future results and other future events may vary significantly from what we expect. We do not undertake to update our forward-looking statements as a result of new information, future events, or otherwise, except as may be required by law. You are advised to review any further disclosures we make on related subjects, and about new or additional risks, uncertainties, and assumptions in our filings with the SEC on Forms 10-K, 10-Q, and 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | The cover page from this Current Report on Form 8-K formatted in Inline XBRL (included as Exhibit 101). |

_____________________________________________________________________________________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | MORNINGSTAR, INC. |

| Date: October 1, 2024 | | By:/s/ Jason Dubinsky |

| | Name: Jason Dubinsky |

| | Title: Chief Financial Officer |

Investor Questions and Answers: October 1, 2024 We encourage current shareholders, potential shareholders, and other interested parties to send questions to us in writing and we make written responses available on a periodic basis. The following answers respond to selected questions primarily received through August 2, 2024. We retain the discretion to combine answers for duplicate or similar questions into one comprehensive response. If you would like to submit a question, please send an e-mail to investors@morningstar.com or write us at the following address: Morningstar, Inc. Investor Relations 22 W. Washington St. Chicago, IL 60602 Margins and Expense Trends 1. Certain of Morningstar’s products, such as PitchBook, would seem to have a large opportunity to increase margins in future, especially as compared to more mature segments such as Data and Analytics. How does management think about the trade-off between revenue growth and margin expansion in products such as PitchBook, and what signposts would management use to determine when is the right point to more aggressively focus on margin expansion? For example, in PitchBook, would there be a particular revenue or license number, or a percentage of market penetration, that would indicate when to drive more margin expansion? In balancing revenue growth and margin expansion across the business, we focus on maximizing long-term value creation. In the case of PitchBook specifically, we see meaningful opportunity for additional growth and steady margin expansion. Our PitchBook segment had revenues of $583.3 million for the 12 months ended June 30, 2024, with an addressable market that we estimated at $8.8 billion as of February 2024. We also closely monitor SaaS performance metrics, including customer acquisition costs and customer lifetime value. The overall relationship between these metrics continues to be attractive with the segment growing from $301.6 million of revenue with an 18.4% adjusted operating margin in 2021 to $583.3 million of revenue with a 28.8% margin for the 12 months ended June 30, 2024. We remain focused on making the right trade-offs but don’t believe we face a binary choice between revenue and margin growth today. 2. Morningstar’s operating margin has been volatile in recent years with the company investing heavily in headcount growth and significant margin compression followed by a period of declining headcount and margin expansion. Are we likely to see another large investment cycle from MORN in the future or should we expect more consistent operating margins going forward, similar to the consistency that other predominately subscription-based data businesses often exhibit? We acknowledge that much of the recent margin volatility has come from investments within certain areas including Morningstar Wealth and Morningstar Sustainalytics. Additionally, in 2022 and 2023, we also faced market headwinds and softer credit issuance that largely impacted our asset-based and transaction-based areas. These areas inherently have more volatility than the subscription (license-based) products that account for three-quarters of our business. As we look across our segments, we believe that we have good opportunities for organic growth and, as we noted at the annual shareholders meeting, we expect that growth to be largely self-funded. That means we are focused on increasing revenues at a faster rate than expenses with increasing adjusted operating margins over time.

Market Environment 3. Most of your competitors called out the revenue headwinds related to the UBS and Credit Suisse merger. Did you also have negative implications from the event in 1Q/2Q? If so, could you please tell us the magnitude of the revenue headwind? Client M&A can at times have a negative impact on our business, including in H1 24 within certain areas including Morningstar Data. However, the UBS Credit Suisse merger in particular did not create a material headwind. We look forward to growing our global UBS relationship in the years ahead. Cash Flows 4. Q2 24 was a very strong quarter for operating cash flow. Were there any timing issues, i.e., where cash was received early and/or cash payments deferred? What should we expect for annualized cash flow relative to net income or adjusted operating profit (or any other metric)? In Q2 24, cash provided by operating activities increased from $24.5 million to $152.7 million compared to the prior-year period. In our second quarter earnings release and supplemental deck, we provided operating and free cash flow metrics excluding certain items, specifically severance payments related to the reduction and shift of our China operations and payments related to M&A- and related activity in the prior-year period that were recorded in operating cash flow and affect the year-over-year comparison. Adjusting for those items, cash provided by operating activities increased 74.3% from $87.6 million to $152.7 million. The primary driver of this increase was higher cash earnings; improvements in working capital also contributed. There were no other significant items, including timing issues, that affected Q2 24 cash provided by operating activities or impacted the prior-year comparisons. While we do not provide guidance on future expected cash flows, we would expect 2024 to be a stronger year for cash flow generation consistent with the trend we’ve observed in the first half of the year. PitchBook 5. There were around 8,000 PitchBook licenses added in 2Q24, which is substantially higher than recent quarters. What drove this acceleration? Can you quantify the impact of LCD license conversions on overall license growth at PitchBook in Q2 2024? How much did the transition of legacy LCD clients to PitchBook impact YoY license growth? Would license growth have exceeded revenue growth without this impact? As of Q2 24, PitchBook had 119,571 licensed users, which represented an increase of 16.6% over the prior-year period and an increase of roughly 7.5% or approximately 8,000 licensed users from Q1 24. Licensed user growth was driven by a couple of factors. First, as we transition legacy Leveraged Commentary & Data (LCD) clients to the PitchBook platform, we’ve seen an accompanying increase in PitchBook licensed users. Second, we’ve also seen growth coming from an increase in PitchBook licensed users who did not previously have LCD access. Licensed user growth for this group compared to the prior-year period was a few percentage points higher than revenue growth and accounted for the majority of licensed user growth compared to the prior-year period. It included the impact of a significant increase coming from clients with firmwide, unlimited licenses. We often see fluctuations driven by these firmwide licenses, both on the upside, as clients add licensed users during the course of their contract, and on the downside, as user lists are at times rationalized at renewal.

6. Has PitchBook average revenue per license fallen over the last year? If so, can you speak to drivers, and is there a mix impact from selling to larger enterprises? Between June 30, 2023 and June 30, 2024, the underlying PitchBook revenue per license has increased, excluding revenue associated with PitchBook direct data and making certain adjustments for revenue associated with legacy LCD clients who have not yet fully transitioned to PitchBook licenses. That said, there is some mild volatility in the licensed user count over time. One notable driver comes from firms with unlimited firmwide (enterprise) licenses. During the life of a contract, firms with unlimited licenses can add users without immediate cost increases, which drives licensed user counts higher and exerts downward pressure on revenue per license. We take user counts into account when pricing a contract and, as a result, at times there is a rationalization of licensed users at renewal even when there is an expansion of the client relationship, which can result in a subsequent drop in associated licensed user counts. Another source of volatility is the transition of LCD users to the PitchBook platform, which is described in more detail in a response to a related question this month. 7. How has LCD cross-selling been in 1H 2024? What needs to happen to improve the growth rate of LCD’s clients? With the integration of LCD news, research, and data on the PitchBook platform, we’ve been focused on migrating LCD legacy users while ensuring that we provide a comprehensive onboarding experience that helps them access the LCD data, news, and tools available on the platform. Our goal during the transition period has been client retention and we’ve been successful here, with LCD continuing to perform in line with our expectations at the time of the transaction. We’ve also continued to add features targeted at debt and credit use cases as part of our ongoing enhancement of the PitchBook platform’s capabilities. Throughout the first half of the year, we introduced a new credit dashboard, integrated the Morningstar’s LSTA Leveraged Loans Index family, enhanced debt and lender screeners, and added loan and bond forward calendars from LCD. Data plans include enhancing private credit, including more business development (BDC), and collateralized loan obligation (CLO) coverage. Meanwhile, our sales and marketing teams are focused on educating legacy PitchBook and LCD clients and potential clients on the PitchBook platform’s credit capabilities, with the ultimate goal of driving licensed user and revenue growth across all groups. To that end, we recently completed an integrated marketing campaign across existing PitchBook and legacy LCD clients and prospects, including credit market participants and other customer segments (commercial and investment banks, private equity firms, lenders and issuers, etc.) with credit use cases. This effort succeeded in driving awareness of PitchBook’s credit offering, showcasing our strengths in credit news, research, and data as well as the addition of the Morningstar LSTA Leveraged Loan Index family to the platform. 8. Can you discuss opportunities for PitchBook to continue penetrating the core VC and PE segment? We would have expected that most VCs are by now aware of PitchBook, given its leading presence in the market. Is growth in PitchBook coming more from new logos, or selling of more licenses to existing clients? What are the most common reasons why VCs do not choose to use PitchBook? As you note, PitchBook is well-known in its core venture capital (VC) and private equity (PE) segments. That’s especially true with larger firms in North America and EMEA who have expansive use cases that require a comprehensive view of the flow of capital across asset classes and financial products and are primarily focused on large transactions. Our growth in VC and PE is driven by both expansion with current clients and the addition of new logos. For new logos, we see the best growth opportunities with middle market and smaller, regional firms across geographies and are focused on helping potential clients in this group better understand the product and potential use cases. Overall, when a VC firm chooses not to go with PitchBook, they’re often a firm with fewer use cases and cite cost considerations as a barrier. We believe there is still opportunity to serve the needs of and expand our business with VC and PE firms. We have maintained an acute focus on our product offering with the delivery of new and expanded datasets, research and IP, and new capabilities that inform decision making and accelerate workflows. For example, PitchBook released its VC Exit Predictor in 2023 to support VC market intelligence and deal execution workflows. Additionally, PitchBook’s ongoing investment in integrating LCD news, data, and research supports new use cases and data requirements for PE firms navigating a high-interest rate environment and the fast growth of private credit. Finally, we continue to work on expanding our data coverage to capture the needs of smaller, niche players.

9. Of the 400bp of y/y margin expansion, what was the contribution from John’s stock forfeiture vs. operating leverage? When was (will?) the plan be terminated? Roughly how much in annual stock-based compensation would you expect to save? Please clarify how much of the increase in PitchBook margins in Q2 came from the termination of the PitchBook management plan and forfeiture of stock. Will the termination of the plan continue to be a benefit to PitchBook margins going forward? Now that the PitchBook management bonus plan has been terminated, how much will the forfeiture of the PitchBook management bonus plan save Morningstar in compensation costs in H2 2024 and 2025 as a result of the bonus plan termination? What should stock compensation as a % of PitchBook sales to trend towards following this plan termination? Following the departure of John Gabbert, PitchBook’s founder and former CEO, we terminated the PitchBook management bonus plan in Q3 24. The plan was designed primarily as a compensation vehicle for John. The forfeiture of bonus plan stock accounted for roughly half of the improvement in PitchBook’s adjusted operating margin to 31.2% in Q2 24 from 27.2% in the prior-year period as we reversed our year-to-date accrual for the associated stock-based compensation with the full benefit reflected in Q2 24. While we do not provide guidance on the expected level of stock-based compensation in future quarters, termination of the PitchBook management bonus plan will continue to be a benefit to PitchBook margins through Q1 25. In addition, the termination of the plan will eliminate an important driver of volatility in PitchBook’s adjusted operating margins; the plan and its predecessors covered three-year periods with higher awards in the third year. 10. You’ve called out the weakness in the corporate client segment before. It looks like that end-market is hopefully beginning to inflect. How long do you think it would take for that to flow through PitchBook’s business once it turns? As you note, we’ve seen better fundamentals in M&A with U.S. corporate and private equity led M&A having their best years since 2021. In H1 2024, U.S deal value increased 20% and deal count increased 10% from the prior year. That said, as of Q2 24, we had not yet seen this translate into stronger demand in our corporate client segment. While we’d expect to see renewed interest from corporate development teams focused on M&A growth strategies, it’s not clear how long this will take to flow through to our results. Given the softness in new sales and client retention within the client segment, we’ve reevaluated sales and customer support strategies for corporates with limited use cases who tend to have higher churn over time and lower lifetime customer value. This will allow PitchBook to prioritize prospects and clients with stronger use cases and the potential for higher customer lifetime value. 11. What’s PitchBook’s differentiated value proposition compared to Preqin? How can you defend your market share now that BlackRock has acquired Preqin and may invest significant growth capital? How do you expect Preqin’s acquisition by BlackRock to impact PitchBook’s future growth prospects? Why do you believe that to be the case? Where does PitchBook compete directly with Preqin vs. provide a complementary product? To what degree do these two businesses overlap in terms of both (a) underlying data sets, (b) customer bases? PitchBook is the market leader in private market data based on the breadth and depth of our coverage, which spans venture capital, private equity, private credit and bank loans, and merger and acquisition activities. When it comes to private fund and benchmark data along with related private market coverage, our coverage is comparable to Preqin’s. We don’t have detailed data on the share of our customers who also use Preqin, but we do observe some overlap, especially among limited partners and general partners. While we’re not in a position to comment on BlackRock’s plans for Preqin, we remain focused on our long-term strategy for PitchBook of delivering value to customers and continue to see a strong runway for growth. Our value to customers comes from both the breadth and depth of our data and our continued introduction of new and innovative IP, such as the Manager Score, a recently introduced benchmarking tool that leverages our proprietary methodology to compare fund manager performance. In addition, we remain intensely focused on servicing our customers, which we believe to be a core advantage in our competitive positioning.

12. Please provide more information on the mix of clients at PitchBook. Specifically, what is the mix of credit investors and how has that trended over time, given the increased market interest in Private Credit? PitchBook’s data, insights, and tools make it a powerful tool for a wide range of client segments across asset classes, geographies, and sectors. This includes firms and service providers operating within private equity, venture capital, and credit markets, as well as institutional investors, allocators, asset managers, and corporates (companies). We provide detail on PitchBook’s customer segments annually and, as of January 31, 2024, investors (including private equity, asset management, and venture capital firms) comprised 37% of PitchBook’s client mix, followed by corporates (35%), service providers (22%), and limited partners (3%), with the remaining 3% in non-core client segments. Credit investors and market participants are included with service providers and accounted for a relatively small portion of PitchBook’s client mix (roughly 1%). That said, credit workflows and use cases are not limited to credit investors and are becoming more important to clients and potential clients across PitchBook’s core user base as the private credit market continues to grow. Following a targeted marketing campaign focused on PitchBook platform’s credit capabilities earlier this year, we’ve been encouraged by increased adoption and usage of PitchBook’s credit features. 13. Rod Diefendorf, President and Chief Operating Officer of PitchBook, was described as a “Rule of 40” disciple. What does this imply for PitchBook’s operating leverage & profitability as sales growth has stabilized? What should be PitchBook’s operating profit flow-through for each incremental dollar of revenue? The “Rule of 40” is a rule of thumb popularized by Brad Feld, an investor and entrepreneur, that states that the sum of a SaaS company’s revenue growth rate and its profit margin (typically EBITDA) should be equal to or exceed 40%. We agree that it is necessary to strike a balance between revenue growth and profitability to generate long-term value for shareholders. As we’ve noted in a related response this month, we see meaningful opportunity for additional growth for PitchBook. We continue to monitor commonly used SaaS-based performance metrics carefully, including customer acquisition costs and customer lifetime values and the relationship between these metrics remains attractive. At the same time, while we don’t disclose incremental margins, we also see continued room for margin expansion at PitchBook over time. We are committed to balancing the right level of investment in data, research, and platform capabilities to capitalize on what we still believe is a significant global market opportunity. 14. How large were the price increases for PitchBook on 1/1/24? What has been the approximate split of pricing contribution vs. volume and split of new business wins vs existing client wallet share increases for PitchBook in 1H 2024? As PitchBook's client base has grown, the expansion opportunity with existing clients has generally increased. This is the foundation of PitchBook’s business model: We sell to new customers and then increase the number of licensed users within those organizations. Over time, we’ve seen the growth opportunity with existing clients surpass that of new client sales, reflecting our large and growing customer base and high annual renewal rates with core customers. That was true through the first six months of 2024 as existing clients contributed more to gross sales growth than new clients, although both groups continued to be important growth drivers. We don’t disclose pricing specifics, although as you note, we did institute price increases for new logos in January 2024. We also tend to see price increases at a renewal, with a particular focus on price when we see fewer opportunities for expansion. Through the first half of 2024, both volume and price have been drivers of revenue growth. Morningstar Credit 15. Do you think there was any pull-forward of debt issuance in 2Q24 from 2H24 or even 2025? If so, what would “normalized” growth have been in the quarter? The combination of relatively stable risk-free rates, narrow credit spreads, and the overall decline in the cost of funding has contributed to significant growth in debt issuance across asset classes and geographies through the first six months of 2024. This growth was driven in part by pent-up demand coming into 2024 after the Fed raised short-term rates by more than 500 basis points between March 2022 and July 2023, creating a challenging borrowing environment.

In addition, there’s broad agreement that there was at least some “pull-forward” of transactions in the first half of 2024 from the second half of 2024 globally given the favorable borrowing environment and uncertainty surrounding the upcoming U.S. elections and geopolitical risk. In 2025, we do not expect that credit markets will benefit from high levels of pent-up demand that contributed to H1 2024 issuance. However, we do not believe that there has been significant pull-forward of demand from 2025 and private debt markets are likely to keep growing. Given the cyclicality and sensitivity of credit markets to the interest rate and spread environment, it’s difficult to provide a “normalized” growth rate. Our aim is to grow market share regardless of the environment. 16. We appreciate the increase in margins at Morningstar Credit. To what extent should we expect further growth in issuance activity, and in revenue, to flow through to margins? What investment plans does Morningstar have for Credit? As you note, we’ve seen a meaningful improvement in margins for Morningstar Credit, with adjusted operating margins increasing to 29.2% in H1 24 from 1.0% in H1 23, supported by 36.5% revenue growth. We did not make significant investments in H1 24, and overall Morningstar Credit headcount was lower as of June 30, 2024 than it was as of June 30, 2023. In H2 24, we are adding analyst capacity in a few key targeted areas including private and middle market credit and “esoteric” asset-backed securities, as well as project finance and infrastructure. We don’t provide guidance around margins. However, as Kunal noted at the annual shareholders meeting, as we start to get to scale in certain areas of the business where we are challengers to the incumbents, including Morningstar Credit, we see opportunity for continued growth and margin expansion over time. Morningstar Data and Analytics 17. In the second quarter 2024, Morningstar Data grew +4.7% y/y organically (about 5% slowdown from 1Q), the first quarter since 2017 that the growth rate went below 6%. Could you elaborate on what drove the slowdown and how you are addressing it? Can you offer more detail on why Morningstar Data was down sequentially in Q2 24? Where did you see major changes in your internal KPIs for the segment (pricing, retention, volume growth, etc.? Will the factors that caused the slower growth persist or were they more one-off in nature? Was there a loss of market share? As you note, in Q2 24 Morningstar Data revenue grew 4.5% or 4.7% on an organic basis compared to the prior-year period and reported revenue declined 2.8% on a sequential basis. The slowdown reflected several broad drivers. Starting in early 2023, we started to roll out a meaningful price increase which has been an important contributor to revenue growth. With the price increase, we completed several, large multi-year renewals in 2023 which contributed to growth in recent prior quarters but also made for a tougher comparison for Q2 24. At the same time, we’ve seen a modest decline in net revenue renewal rates, reflecting in part a slowdown in client spending on new initiatives and new data use cases in the first half of the year as well as M&A activity. Finally, there were several product-specific drivers, including softness in our “broadcast feed” product within exchange market data, where we’ve been less focused given that it does not align as well with our other core data sets. These are described in a related response this month. It is difficult to pinpoint short- term trends in market share, especially given that Morningstar Data revenue is driven in part on how the end data is distributed, complicating market share measurements. Despite the slowdown in Q2 24, we continue to see attractive long-term growth opportunities for Morningstar Data supported by its sizable addressable global market.

18. With respect to the slowdown in Morningstar Data growth in Q2 24: How large are the Essentials and equity and exchange market data products as a percentage of the total Morningstar Data product area and how much did they impact Q2 2024 growth rate for that product area? What were the Morningstar Essentials and equity & exchange market data growing/contributing to sales growth historically and what did they contribute in Q2 2024? Who are your competitors for each of these products and did your competitors also experience a slowing (e.g. end market related)? Morningstar Essentials, equity data, and exchange market data accounted for roughly a third of Morningstar Data revenue for the trailing 12 months ended June 30, 2024; together with managed investment (fund) data, they comprised more than 95% of Morningstar Data revenue. While we do not generally disclose product revenue or specific growth rates for individual products, we would note that we saw softness compared to the prior-year period in Q2 24 compared to Q1 24 for each of the products you reference. Revenue from managed investment data, the largest product in the Morningstar Data product area, grew at a higher rate than the broader Morningstar Data product area compared to the prior-year period, but still slowed compared to recent periods. Product specific drivers included lumpiness from a large transaction in managed investment data and a large, nonstandard transaction in equity data that closed in Q2 23, both of which contributed to growth in subsequent quarters through Q1 24. Meanwhile, exchange market data performance reflected softness especially in our “broadcast feed” product. We have not been as focused on this product given that it does not align as well with our other core data sets. Our main global competitors for managed investment data, including mutual fund data, include FE fundinfo and LSEG (Refinitiv). We also compete against smaller players that focus on local or regional information. For market and equity data, we primarily compete with Bloomberg, FactSet, ICE Data Services, LSEG (Refinitiv), and S&P Global. While we don’t comment on revenue trends for our competitors, we would note that we have observed that some clients are tightening certain spending due to the macroeconomic environment. 19. Can you elaborate on what drove the slowdown in Advisor Workstation in Q2? Morningstar Advisor Workstation revenue grew 2.0% on reported and organic basis in Q2 24 compared to the prior-year period, a slowdown from 4.5% reported and organic growth in Q1 24 compared to the prior-year period. At a high level, this slowdown reflected a more challenging environment as clients, especially in our enterprise client segment, have tightened certain spending. The slowdown is due in part to the upcoming U.S. election. Demand for Morningstar Advisor Workstation benefited from regulatory tailwinds in recent years, but many potential clients are waiting to see how the election plays out before committing to additional investments in this space. Morningstar Retirement 20. What is the ceiling on Morningstar Retirement margins? Why are they so much higher than other areas of the business? Morningstar Retirement margins reflect the successful scaling of our business and distribution model. We started offering online retirement advice in 2000 and launched our first managed accounts in 2003, which we manage on a discretionary basis, well before the concept of a “roboadvisor” became common. Our distribution model is based on close collaboration with recordkeepers, and we spent our early years building these relationships and integrating managed accounts on recordkeeper platforms. Today, we’re one of the leading providers of managed accounts for defined contribution plans in the U.S. with $149.9 billion in AUMA as of June 30, 2024. Our relationships with recordkeepers and registered investment advisors (built more recently to support advisor managed accounts), as well as our recordkeeper integrations, allow us to add new employer plans and enroll participants quickly and efficiently. We see ongoing opportunities for growth in assets under management and revenue in Morningstar Retirement. While we also have future opportunities for margin growth in Morningstar Retirement, they are not as meaningful as the potential expansion in other parts of our business.

Morningstar Sustainalytics 21. Morningstar Sustainalytics’ revenue growth rate has slowed significantly in recent periods. What has driven this? How is Sustainalytics positioned if or when data becomes more important than ratings to customers? Can you also discuss any differences in regional growth trends for Sustainalytics? Through the first half of the year, Morningstar Sustainalytics product area revenue increased 6.2% compared to the prior- year period, or 6.3% on an organic basis, a trend that reflects continued but slowing growth in EMEA, and a modestly negative revenue trend in the U.S. Regulatory use cases and demand from institutional clients in Europe remained areas of strength, partially offset by challenges in several different areas. First, although new sales have remained solid, we’ve experienced pressure on retention rates. After a period of strong growth when many clients purchased overlapping ESG products, we’re seeing vendor consolidation and rationalization. At the same time, slower growth rates reflect softness especially in the retail asset management customer segment as ESG fund launches and flows slowed sharply in 2023 and into the first half of 2024 driven by net outflows in the U.S. and weaker inflows in Europe compared to stronger dynamics in 2021 and 2022. Finally, Morningstar Sustainalytics’ second quarter 2024 revenue was negatively impacted by actions taken to streamline the licensed ratings product in corporate solutions, which is described in more detail in a related response this month. As the market reduces its reliance on ESG ratings, we’re working to make sure that we have the right data and analytics available to serve our clients. To that end, we’ve enhanced our data offering with the underlying data behind our ESG risk ratings, improvements to our carbon datasets, impact metrics, and new datasets to support the Corporate Sustainability Reporting Directive (CSRD). 22. For Morningstar Sustainalytics, I know you continue to right-size the employee/ fixed cost base given the challenging business situation. What are the near-term business priorities for the segment? Should we assume that subdued revenue growth will continue until Sustainalytics recovers its self-funding mechanism? We’d highlight three key near-term priorities for Morningstar Sustainalytics. The first is in climate, where we are focused on regulatory and reporting use cases and are also exploring opportunities to support emerging needs within the banking client segment. Secondly, beyond climate, we are targeting improvements to our data set more broadly, including the introduction of new impact metrics, expanding the availability of data supporting our ESG risk ratings, and making improvements to our regulatory data set and data to support the European Union’s Corporate Sustainability Reporting Directive (CSRD). Finally, we are committed to strengthening our market-leading second party-opinion product (SPOs) and finding opportunities to leverage our strength there in investor solutions, especially in supporting banks exploring transition-financing investment opportunities. We believe this strategy will position us for long-term success, supported by the rationalization of providers, greater personalization in investment products, and a less contentious political environment in the future. 23. How is Morningstar Sustainalytics differentiated compared to MSCI and competing ESG ratings/information services? Are there certain niches where Sustainalytics outperforms from a market share perspective? Is Sustainalytics gaining or losing market share? We believe that a key differentiator for Morningstar Sustainalytics is our ability to connect our strengths in ESG data and analytics with our capabilities elsewhere in the Sustainalytics product suite and the broader Morningstar business to meet client demands. For example, we’re increasingly focused on the ESG portfolio analytics and reporting use case, drawing on our portfolio analytics capabilities, a core Morningstar competency. We also see an opportunity to draw on our expertise in second-party opinions (SPOs) to support transition-finance related use cases for banks in investor solutions. Morningstar Sustainalytics is one of the leading providers of ESG data. We continue to win new business in our core product sets with institutional investors across Europe. We remained focused on the regulatory, compliance, and risk management requirements in this segment and have been able to win new business and increase share from existing clients. That said, we’re not aware of any independent market share estimates for Morningstar Sustainalytics’ license- based products, which makes it difficult to track short-term market changes. In general, it’s our observation that we’re

winning some deals and losing others, but we haven’t seen a strong trend in one direction to suggest our market share has changed materially. Morningstar Sustainalytics has a market-leading position in SPOs according to Environmental Finance, which regularly publishes market share data for SPO providers. For the first six months of 2024, Morningstar Sustainalytics accounted for 22.7% of new and updated assessments of green, social, sustainability, sustainability-linked, and transition finance frameworks for bonds and loans. That represented an increase from 18.3% in 2023, although as we’ve noted previously, we don’t view shorter-term fluctuations in market share as meaningful given the relative immaturity of the market. Private SPOs are not included in these figures. 24. Morningstar Sustainalytics: Walk us through both the cancellations in investor solutions due to vendor consolidations and the actions on streamlining corporate solutions/licensed ratings product. Are there products that Sustainalytics is either missing or lagging in versus large competitors? Are larger competitors becoming more aggressive on price? What are the implications for the outlook for the rest of 2024 for Sustainalytics’ growth rates? How large is the investor solutions portion of Sustainalytics currently relative to a year ago (product mix)? As we discussed in a related response this month, vendor consolidation has contributed to the slowdown in Morningstar Sustainalytics revenue growth through the first half of 2024, following a period of strong growth when many of our clients purchased multiple, overlapping datasets. In particular, we’ve seen pressure in retention rates as clients rationalize their vendor lists. From a product perspective, we’ve lagged our competitors in climate as we work to enhance our climate offering to better meet client needs with a focus on regulatory workflows and addressing gaps in our data. Broadly, we’ve seen strong competition in certain parts of the ESG data and analytics market including in regulatory solutions and in slower-growing markets in North America. The streamlining of the licensed ratings product in corporate solutions also contributed to the slowdown in revenue growth. Historically, we offered a bespoke, on-demand ratings product that we ultimately concluded was not scalable. We’re winding down that offering and instead focusing on licensing the use and distribution of existing ratings and underlying data, benchmarking, and tools to corporates to help them make decisions, compare themselves to peers, and use in marketing materials. Although this shift has contributed to slowing revenue in the short-term, we believe that the updated product strategy is one that we can scale successfully over time. The investor solutions product area accounted for roughly 80% of revenue in the first half of 2024, down modestly from its share in the first half of 2023. Corporate solutions, which includes the licensed ratings product and SPOs, accounted for the remaining roughly 20% of revenue. Morningstar Wealth 25. At the annual meeting, you discussed right sizing the cost structure in Morningstar Wealth. How do you estimate the “right-size” for Wealth? It was great to see the reduction in operating losses this quarter. Should we expect this trend to continue and the unit to potentially turn profitable sooner than expected? When we talk about “right-sizing” the cost structure for Morningstar Wealth, our focus is on growing sustainably with improvements in margins and continuing on a path toward profitability. Subsequent to the annual shareholders meeting, we announced that AssetMark will be acquiring roughly $12 billion in assets administered on the Morningstar Turnkey Asset Management Platform (TAMP) and that we planned to sunset our TAMP. Once this transaction closes, we expect to see a reduction in revenue from TAMP-related fees, while we maintain certain operating costs (and other one-time expenses) through the transition period, which will wind down as clients and assets transfer to AssetMark. As a result, we anticipate that the transaction will have a negative impact on Morningstar Wealth’s profitability in the short term. Once the 12-month transition period has concluded, we expect to see a positive run-rate impact on adjusted operating income for Morningstar Wealth as planned cost reductions will more than offset lower revenue. For more detail, please refer to the June 20, 2024, press release announcing the transaction and the accompanying Investor FAQ which are both available at pressroom.morningstar.com.

26. Can you provide an update on SMArtX? How is this investment performing? How does the commercial relationship change now that Morningstar has sold its TAMP to AssetMark? We do not comment on the operating performance of our minority investments. Morningstar’s commercial relationship with SMArtX is expected to wind down as we transition accounts from our platform to the AssetMark platform. 27. How is Praemium performing? What milestones have been achieved since the acquisition? We have hit several key milestones since the acquisition of Praemium’s U.K. and international business, which is performing well and helping to drive underlying growth in our Morningstar Wealth segment. These milestones include fully integrating all functional teams—people & culture, finance, compliance, sales, marketing, operations—with Morningstar, completing successful technology split from parent company with no down time or impact to customers, launching Morningstar portfolios on International Wealth Platform, merging the Praemium and Morningstar fund ranges to increase scale and reduce cost to end investors, migrating all on-premise technology to the cloud, and, most recently, delivering an enhanced retirement proposition to better serve investors with pension accounts. Growth in the business is being driven by increasing new advisor sign-ups to the platform and new client accounts. We’ve seen an increasing percentage of International Wealth Platform advisors placing clients in Morningstar portfolios. Morningstar Indexes 28. What’s the product roadmap for Morningstar Indexes? What will drive growth over the next 12 months? In Indexes, we continue to focus on our investable products as well as growing our benchmark data product. Through the first eight months of 2024, Morningstar Indexes has enjoyed success with new launches supporting European structured product issuers as well as extensions of our leading index families including the Morningstar LSTA Leveraged Loan Indexes, Morningstar Wide Focus and related indexes, and Morningstar Thematic Indexes, as well as climate and ESG indexes that draw on our collaboration with Morningstar Sustainalytics, a leading global ESG data, ratings, and research provider. We will continue to build on our strengths in these core areas while our near-to-midterm new product roadmap will continue to leverage the unique IP presented by the broader Morningstar enterprise including differentiated offerings in private markets through our collaboration with PitchBook. 29. How is the Morningstar Indexes offering differentiated compared to SPGI, MSCI, and other incumbents? We believe that a major point of differentiation for Morningstar Indexes is our ability to combine our team’s deep experience in indexing and our cutting-edge and independent global calculation capability with Morningstar’s valuable and distinctive research, data, and intellectual property. Further, as a highly flexible challenger brand, we believe that Morningstar Indexes is often better positioned to meet the needs of financial service providers and their investors and provide better value to clients, as evidenced by our continued success in securing benchmark switches and new mandates. Capital Structure 30. Why was the purchase of DBRS funded with floating-rate debt? It would seem that this would introduce a negative sensitivity to higher interest rates, as ratings revenue drops while interest expense increases, leading to margin compression. Why not fund the purchase with fixed rate debt? How does Morningstar think about the appropriate balance between fixed and floating rate debt? We funded our 2019 acquisition of DBRS, with total consideration of $669 million, with floating-rate debt to give us prepayment and refinancing flexibility. That strategy was successful. In 2020, we completed a $350 million private placement transaction, which allowed us to replace a significant portion of that debt at a fixed rate with a 2.32% coupon. As of Q2 24, our outstanding debt stood at $900 million, down from a peak of $1.2 billion in Q2 22 following the LCD acquisition, reflecting our use of excess cash to reduce debt in recent quarters. Our current mix is roughly 60% floating and 40% fixed. While we value the flexibility to prepay without penalty offered by our bank debt, we remain open to future opportunities to add longer-term fixed-rate debt to the capital structure.

31. What is your current Net Leverage ratio and how does it compare to your target range? While we do not have a leverage target, we have always sought to maintain a strong balance sheet to allow for capital allocation flexibility. That has allowed us to invest in the business, be opportunistic with acquisitions (PitchBook, DBRS, and LCD), and return cash to shareholders. Following the LCD acquisition, our consolidated funded indebtedness to EBITDA ratio (as defined in our credit agreements) reached 2.5x as of March 31, 2023. Since then, we have successfully paid down debt, reducing that ratio to 1.4x as of June 30, 2024. We have disclosed this leverage ratio quarterly in our 10- Qs and 10-Ks starting with our 2022 10-K. In the future, we remain open to increasing leverage if it is deemed to be the right thing to do to generate returns. Our covenants limit us to 3.5x consolidated funded indebtedness to EBITDA with some flexibility above that level for M&A activity. Capital Allocation 32. Why hasn’t Morningstar restarted repurchases or increased the dividend more significantly? While both share repurchases and dividends are an important part of our capital allocation strategy (as noted in a related question this month), our recent focus has been on paying down debt. In 2024, we increased our dividend from 37.5 cents per share to 40.5 cents per share. Over the past 10 years, our dividend has grown at a compound annual growth rate of approximately 9%.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

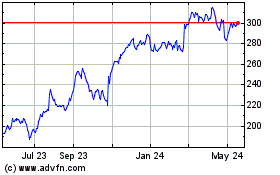

Morningstar (NASDAQ:MORN)

Historical Stock Chart

From Nov 2024 to Dec 2024

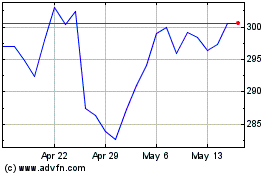

Morningstar (NASDAQ:MORN)

Historical Stock Chart

From Dec 2023 to Dec 2024