As

filed with the Securities and Exchange Commission on November 15, 2024

Registration

No. 333-282840

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

Amendment

No. 1 to

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

MICROVISION,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

91-1600822 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

Number) |

18390

NE 68th Street

Redmond,

WA 98052

(425)

936-6847

(Address,

including zip code, and telephone number, including area code of registrant’s principal executive offices)

Drew

G. Markham

Senior

Vice President, General Counsel, and Secretary

MicroVision,

Inc.

18390

NE 68th Street

Redmond,

Washington 98052

(425)

936-6847

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Please

send copies of all communications to:

Thomas

Fraser

Ropes

& Gray LLP

Prudential

Tower

800

Boylston Street

Boston,

MA 02199

(617)

951-7000

Approximate

date of commencement of proposed sale to the public: From time to time after the effectiveness of the registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☒ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated

filer |

☐ |

Smaller

reporting company |

☐ |

| |

|

|

|

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED NOVEMBER 15, 2024

PROSPECTUS

MicroVision,

Inc.

Up

to 42,692,019 Shares of Common Stock

High

Trail Special Situations, LLC, or the Selling Stockholder, and any additional selling stockholders who may be identified in one or more

prospectus supplements, may sell from time to time up to 42,692,019 shares of our common stock, or the Shares, in one or more

transactions.

The

42,692,019 shares offered hereby are issuable upon the potential conversion of the senior secured convertible note in the aggregate principal amount of $45,000,000, or the

Convertible Note, sold by us pursuant to the Securities Purchase Agreement dated October 14, 2024, in a private placement that we

consummated on October 23, 2024, or the Private Placement.

The

registration of these Shares does not necessarily mean that any holder will sell any of its Shares or that the Convertible Note will

be converted into shares of common stock. We are not offering for sale any shares of our common stock pursuant to this prospectus and

we will not receive any proceeds from the resale of the shares of our common stock offered hereby. We have agreed to pay certain expenses

in connection with this registration statement.

The

Selling Stockholder may offer the Shares from time to time as it may determine, through public or private transactions or through other

means, as described in the section entitled “Plan of Distribution” or a supplement to this prospectus. The Selling Stockholder

may offer all or part of the Shares registered hereby for resale from time to time directly to purchasers, through agents selected by

the Selling Stockholder, or to or through underwriters or dealers, at either prevailing market prices or at privately negotiated prices.

If agents, underwriters or dealers are used in the sale of the Shares by the Selling Stockholder, such agents, underwriters or dealers

will be named and their compensation described in any applicable prospectus supplement. The Selling Stockholder may also sell the Shares

under Rule 144 under the Securities Act of 1933, as amended, if available, rather than under this prospectus.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should carefully read

this prospectus and any amendments or supplements, together with the additional information described under the heading “Where

You Can Find More Information,” before you invest.

Our

common stock is traded on The Nasdaq Global Market under the symbol “MVIS.” On November 12, 2024, the closing price

of our common stock on The Nasdaq Global Market was $0.99 per share.

The

securities offered in this prospectus involve a high degree of risk. You should carefully consider the information under the heading

“Risk Factors” set forth herein on page 6 and in our filings made with the Securities and Exchange

Commission, which are incorporated by reference in this prospectus, in determining whether to purchase our

securities.

Our

executive offices are located at 18390 NE 68th Street, Redmond, Washington 98052, and our telephone number is (425) 936-6847.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is November , 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a shelf registration statement that we filed with the Securities and Exchange Commission, or the SEC. Pursuant

to this prospectus, the Selling Stockholder may, from time to time, sell the Shares described in this prospectus in one or more offerings

if, and to the extent, the Selling Stockholder converts the Convertible Note for shares of our common stock.

A

prospectus supplement and, if necessary, a free writing prospectus, may also add to, update or change information contained in this prospectus.

Accordingly, to the extent inconsistent, the information in this prospectus, including the information incorporated by reference into

this prospectus, will be deemed to be modified or superseded by any inconsistent information contained in a prospectus supplement or

a free writing prospectus. You should read carefully this prospectus, any applicable prospectus supplement and any free writing prospectus,

together with the additional information incorporated by reference in this prospectus described below under “Where You Can Find

More Information” before making an investment in our securities.

We

have not authorized anyone to give you any additional information different from that contained in this prospectus, any accompanying

prospectus supplement or any free writing prospectus provided in connection with an offering. We take no responsibility for, and can

provide no assurance as to the reliability of, any other information that others may give you.

You

should assume that the information appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and

any related free writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations

and prospects may have changed since that date.

This

prospectus is not an offer to sell or solicitation of an offer to buy our securities in any circumstances under which or jurisdiction

in which the offer or solicitation is unlawful. Unless the context otherwise indicates, the terms “MicroVision,” “Company,”

“we,” “us,” and “our” as used in this prospectus refer to MicroVision, Inc. and its consolidated

subsidiaries. The phrase “this prospectus” refers to this prospectus and any applicable prospectus supplement, unless the

context otherwise requires.

NOTE

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference in this prospectus contain forward-looking statements, within the meaning of Section

27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended,

or the Exchange Act, and is subject to the safe harbor created by those sections. Such statements may include, but are not limited to,

projections of revenues, income or loss, capital expenditures, plans for product development and cooperative arrangements, future operations,

financing needs or plans of MicroVision, as well as assumptions relating to the foregoing. The words “anticipate,” “believe,”

“estimate,” “expect,” “goal,” “may,” “plan,” “project,” “will,”

and similar expressions identify forward-looking statements, which speak only as of the date the statement was made.

These

forward-looking statements are not guarantees of future performance. Factors that could cause actual results to differ materially from

those projected in such forward-looking statements include our ability to operate with limited cash or to raise additional capital when

needed; risks relating to the Convertible Note; market acceptance of our technologies and products or for products incorporating our

technologies; the failure of our commercial partners to perform as expected under our agreements; our financial and technical resources

relative to those of our competitors; our ability to keep up with rapid technological change; government regulation of our technologies;

our ability to enforce our intellectual property rights and protect our proprietary technologies; the ability to obtain additional contract

awards and develop partnership opportunities; the timing of commercial product launches and delays in product development; the ability

to achieve key technical milestones in key products; dependence on third parties to develop, manufacture, sell and market our products;

potential product liability claims; our ability to maintain our listing on The Nasdaq Stock Market; and other risk factors identified

from time to time in this prospectus (including any prospectus supplement) and our SEC reports, including the our Annual Report on Form

10-K filed with the SEC. These factors are not intended to represent a complete list of the general or specific factors that may affect

us. It should be recognized that other factors, including general economic factors and business strategies, may be significant, now or

in the future, and the factors set forth in this prospectus may affect us to a greater extent than indicated. Except as expressly required

by federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result

of new information, future events, changes in circumstances or any other reason.

SUMMARY

The

following summary is qualified in its entirety by, and should be read together with, our consolidated financial statements and related

notes thereto and the more detailed information appearing elsewhere or incorporated by reference in this prospectus. Before you decide

to invest in our common stock, you should read the entire prospectus carefully, including the risk factors and the financial statements

and related notes included or incorporated by reference in this prospectus.

Our

Company

Overview

MicroVision

is a global developer and supplier of lidar hardware and software solutions focused primarily on automotive lidar and advanced driver-assistance

systems, or ADAS, markets where we can deliver safe mobility at the speed of life. We offer a suite of light detection and ranging, or

lidar, sensors and perception and validation software to automotive original equipment manufacturers, or OEMs, for ADAS and autonomous

vehicle, or AV, applications, as well as to complementary markets for non-automotive applications including industrial, robotics and

smart infrastructure. Our long history of developing and commercializing the core components of our lidar hardware and related software,

combined with the experience of the team we acquired from Ibeo Automotive Systems, or Ibeo, with automotive-grade qualification, gives

us a compelling advantage as a development and commercial partner.

Founded

in 1993, MicroVision, Inc. is a pioneer in laser beam scanning, or LBS, technology, which is based on our patented expertise in micro-electromechanical

systems, or MEMS, laser diodes, opto-mechanics, electronics, algorithms and software and how those elements are packaged into a small

form factor. Throughout our history, we have combined our proprietary technology with our development expertise to create innovative

solutions to address existing and emerging market needs, such as augmented reality microdisplay engines; interactive display modules;

consumer lidar components; and, most recently, automotive lidar sensors and software solutions for the automotive market.

In

January 2023, we acquired certain strategic assets of Germany-based Ibeo, which was founded in 1998 as a lidar hardware and software

provider. Ibeo developed and launched the first lidar sensor to be automotive qualified for serial production with a Tier 1 automotive

supplier and that is currently available in passenger cars by premium OEMs. Ibeo developed software solutions, including perception and

validation software, which are also used by premium OEMs. In addition, Ibeo sold its products for non-automotive uses such as industrial,

smart infrastructure and robotics applications.

For

the automotive market, our integrated solution combines our MEMS-based dynamic-range lidar sensor and perception software, to be integrated

on our custom application specific integrated circuit, or ASIC, targeted for sale to premium automotive OEMs and Tier 1 automotive suppliers.

Our ADAS solution is intended to leverage edge computing and custom ASICs to enable our hardware and perception software to be integrated

into an OEM’s ADAS stack.

In

addition to our dynamic-range and long-range MAVIN sensor and perception software solution for the automotive market, our product suite

includes our short-range flash-based MOVIA lidar sensor, for automotive and industrial applications, including smart infrastructure,

robotics, and other commercial segments. Also, our validation software tool, the MOSAIK suite, is used by OEMs and other customers including

Tier 1s for validating vehicle sensors for ADAS and AV applications. The tool includes software that automates the manual data classification

or annotation process, significantly reducing the time and resources required by OEMs to validate their ADAS and AV systems.

In

the recent past, we developed micro-display concepts and designs for use in head-mounted augmented reality, or AR, headsets and developed

a 1440i MEMS module supporting AR headsets. We also developed an interactive display solution targeted at the smart speakers market and

a small consumer lidar sensor for use indoors with smart home systems.

To

date, we have been unable to secure the customers at the scale needed to successfully launch our products. We have incurred substantial

losses since inception, incurred a significant loss during the fiscal year ended December 31, 2023 and expect to incur a significant

loss during the fiscal year ended December 31, 2024.

Corporate

Information

We

were founded in 1993 as a Washington corporation and reincorporated in 2003 under the laws of the State of Delaware. Our principal office

is located at 18390 NE 68th Street, Redmond, WA 98052 and our telephone number is 425-936-6847. We maintain a website at www.microvision.com,

where general information about us is available. We do not incorporate the information on our website into this prospectus supplement

or the accompanying prospectus and you should not consider it part of this prospectus supplement or the accompanying prospectus.

Convertible

Note

On

October 14, 2024, we entered into a Securities Purchase Agreement, or the Purchase Agreement, pursuant to which we agreed to sell and

issue to the Selling Stockholder senior secured convertible notes in the aggregate principal amount of up to $75,000,000. On October

23, 2024, we issued the Convertible Note to the Selling Stockholder in the aggregate principal amount of $45,000,000, or the Principal

Amount. Upon satisfaction of additional conditions set forth in the Purchase Agreement, we may issue additional senior secured convertible

notes to the Selling Stockholder in the aggregate principal amount of up to $30,000,000 at subsequent closings. The shares of common

stock underlying any subsequently issued senior secured convertible notes will be registered in a future registration statement.

The Convertible Note bears zero coupon and matures on October 1, 2026. The Convertible Note ranks senior to all of our outstanding and

future indebtedness, and is secured by a first priority perfected security interest in all of our bank and securities accounts, now owned

and hereafter created or acquired.

The

Selling Stockholder will have the option to partially redeem (i) up to $1,925,000 on the first day of each month beginning on and

including January 1, 2025 and ending on and including March 1, 2025 and (ii) up to $3,850,000 on the first day of each

month beginning on and including April 1, 2025 and ending on and including October 1, 2026.

The

Convertible Note will be optionally convertible by the Selling Stockholder, subject to certain limitations as described below. If the

Selling Stockholder elects to convert the Convertible Note with respect to the Initial Principal Amount, which is a portion of the Principal

Amount equal to $12,500,000, the conversion price for such Initial Principal Amount will be an amount equal to (i) $1,000 divided by

(ii) the “First Conversion Rate,” which is an amount equal to one hundred ten percent (110%) of a fraction whose numerator

is $1,000 and whose denominator is the lesser of (A) $1.5960 and (B) ninety percent (90%) of the Nasdaq Minimum Price (as defined in

Nasdaq Rule 5635(d)) as of the effective date of this registration statement, subject to customary anti-dilution adjustments. If the

Selling Stockholder elects to convert the Convertible Note with respect to any Principal Amount not constituting the Initial Principal

Amount, the conversion price will be an amount equal to (i) $1,000 divided by (ii) the “Second Conversion Rate,” which

is an amount equal to 626.5664 shares of common stock per $1,000 Principal Amount.

If

the issuance of Shares requires approval by our stockholders to satisfy Nasdaq Listing Rule 5635(d)(2), until the requisite stockholder

approval is obtained, in no event will the number of shares of our common stock issuable upon conversion or otherwise pursuant to the

Convertible Note exceed 42,692,019 shares in the aggregate. We do not expect such stockholder approval to be required in connection

with the issuance of the Shares. The number of shares registered hereby represents the maximum amount of shares that could be issued

pursuant to the Convertible Note absent stockholder approval. If we elect to issue additional senior secured convertible notes pursuant

to the Purchase Agreement, stockholder approval may be required.

The

conversion of the Convertible Note is subject to certain conditions, including that the Selling Stockholder remains within the Beneficial

Ownership Limitation (as defined below).

Subject

to certain conditions, we can require the Selling Stockholder to convert the Convertible Note, or a Forced Conversion, at any time if,

for the immediately preceding 20 consecutive trading days, the stock price has closed at or above $2.3940. The conversion rate for a

Forced Conversion will be the same as the conversion price which would then be applicable for an optional conversion by the Selling Stockholder

described above.

The

Convertible Note may not be converted into shares of our common stock if such conversion would result in the Selling Stockholder and

its affiliates beneficially owning an aggregate of in excess of 4.99% of the then-outstanding shares of our common stock, provided that

such ownership limitation may be (i) increased by the Selling Stockholder to no greater than 9.99% upon 61 days’ notice

and (ii) decreased immediately by the Selling Stockholder upon notice (such limitation is referred to as the Beneficial Ownership

Limitation).

The

Convertible Note provides for certain events of default, such as our failure to make timely payments under the Convertible Note and failure

to timely comply with the reporting requirements of the Exchange Act. The Purchase Agreement and Convertible Note also contain affirmative

and negative covenants, including limitations on incurring additional indebtedness, the creation of additional liens on our assets, and

entering into investments, as well as a minimum liquidity requirement (for any date prior to the later of May 1, 2025 and the date of

the Authorized Share Increase (as defined in the Purchase Agreement), $30 million and thereafter, as of any date, the greater of (i)

$30 million less the sum of (1) twenty five percent (25%) of the unrestricted net cash proceeds received by us from Equity Issuances

(as defined in the Convertible Note) consummated since the issue date of the Convertible Note, which proceeds shall be available to be

used for general corporate and working capital purposes and shall not be subject to any clawbacks or other repayment covenants or obligations

or held in a blocked account or otherwise subject to any restrictions in use, plus (2) fifty percent (50%) of the aggregate Principal

Amount converted into Common Stock) and a cash burn requirement (on the last calendar date of each calendar month beginning with the

calendar month ended October 31, 2024, each, a Cash Burn Measurement Date, our Available Cash (as defined in the Convertible Note) on

the Cash Burn Measurement Date shall be greater than or equal to (i) our cash and cash equivalents on the Cash Burn Reference Date (as

defined in the Convertible Note), less (ii) $20 million).

Pursuant

to the Purchase Agreement, we agreed to prepare and file with the SEC this registration statement covering the resale of the Shares within

the timeframe set forth in the Purchase Agreement, and to use commercially reasonable efforts to cause this registration statement to

be declared effective within the timeframe set forth in the Purchase Agreement. Additionally, we agreed to prepare and file a proxy statement

with the SEC to seek stockholder approval at our next annual meeting of stockholders (and in any event prior to June 30, 2025) to amend

our certificate of incorporation to increase our authorized common stock by an additional 75,000,000 shares.

The

Offering

This

prospectus relates to the resale by the Selling Stockholder of up to 42,692,019 shares of our common stock issuable upon exercise

of the Convertible Note.

Shares

of common stock offered by the Selling Stockholder: |

|

Up

to 42,692,019. |

| |

|

|

Common

stock outstanding after this offering: |

|

259,619,994,

assuming that all Shares being offered pursuant

to this prospectus are actually issued upon conversion of the Convertible Note. |

| |

|

|

| Use

of proceeds: |

|

We

will not receive any proceeds from the sale of the Shares by the Selling Stockholder. |

| |

|

|

| Risk

factors: |

|

Investing

in our common stock involves a high degree of risk. See “Risk Factors” and other information contained in this

prospectus and incorporated by reference before deciding to invest in shares of our common stock. |

| |

|

|

Listing: |

|

Our

common stock is listed on The Nasdaq Global Market under the symbol “MVIS”. |

The

number of shares of our common stock to be outstanding after this offering is based on 219,018,180 shares outstanding as of November

4, 2024 and excludes, as of that date, the following:

| ● | 666,058 shares

of common stock issuable upon the exercise of outstanding options, of which 666,058

were exercisable at a weighted average exercise price of $1.43 per share under

our 2022 Incentive Plan, as amended, or the Incentive Plan; |

| ● | 12,655,588

shares

of common stock underlying unvested and/or deferred stock awards; and |

| ● | 2,822,270

shares

of our common stock reserved for issuance pursuant to the Incentive Plan. |

RISK

FACTORS

You

should carefully consider the specific risks set forth under the caption “Risk Factors” in our most recent annual report

on Form 10-K and quarterly report on Form 10-Q, each as amended or supplemented, which are incorporated by reference in this prospectus,

as the same may be amended, supplemented or superseded by our subsequent quarterly or annual reports or other filings, including filings

after the date hereof, with the SEC under the Exchange Act. The risks and uncertainties we describe are not the only ones facing us.

Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. If any of these

risks were to occur, our business, financial condition or results of operations would likely suffer. In that event, the trading price

of our common stock could decline, and you could lose all or part of your investment.

Risks

Related to Our Common Stock and this Offering

Our

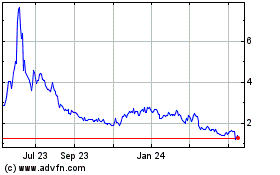

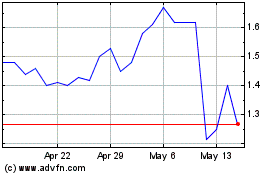

stock price has fluctuated in the past, has recently been volatile and may be volatile in the future, and as a result, investors in our

common stock could incur substantial losses.

Our

stock price has fluctuated in the past, has recently been volatile and may be volatile in the future. During the 12 months prior to the

date of this prospectus, our common stock has traded at a low of $0.83 and a high of $2.78. We may continue to experience sustained depression

or substantial volatility in our stock price in the foreseeable future unrelated to our operating performance or prospects. For the year

ended December 31, 2023, we incurred a loss per share of $0.45.

| ● | As

a result of this volatility, investors may experience losses on their investment in our common

stock. The market price for our common stock may be influenced by many factors, including

the following: |

| ● | investor

reaction to our business strategy; |

| ● | the

success of competitive products or technologies; |

| ● | strategic

alternatives; |

| ● | the

timing and results of our development efforts with respect to our lidar sensors and ADAS

solutions; |

| ● | changes

in regulatory or industry standards applicable to our technologies; |

| ● | variations

in our or our competitors’ financial and operating results; |

| ● | developments

concerning our collaborations or partners; |

| ● | developments

or disputes with any third parties that supply, manufacture, sell or market any of our products; |

| ● | developments

or disputes concerning patents or other proprietary rights, including patents, litigation

matters and our ability to obtain patent protection for our products; |

| ● | actual

or perceived defects in any of our products, if commercialized, and any related product liability

claims; |

| ● | our

ability or inability to raise additional capital and the terms on which we raise it; |

| ● | declines

in the market prices of stocks generally; |

| ● | trading

volume of our common stock; |

| ● | sales

of our common stock by us or our stockholders; |

| ● | general

economic, industry and market conditions; and |

| ● | other

events or factors, including war, terrorism and other international conflicts, public health

issues including health epidemics or pandemics, such as the COVID-19 outbreak, and natural

disasters such as fire, hurricanes, earthquakes, tornados or other adverse weather and climate

conditions, whether occurring in the United States or elsewhere. |

Since

the stock price of our common stock has fluctuated in the past, has been recently volatile and may be volatile in the future, investors

in our common stock could incur substantial losses. In the past, following periods of volatility in the market, securities class-action

litigation has often been instituted against companies. Such litigation, if instituted against us, could result in substantial costs

and diversion of management’s attention and resources, which could materially and adversely affect our business, financial condition,

results of operations and growth prospects. There can be no guarantee that our stock price will remain at current levels or that future

sales of our common stock will not be at prices lower than those sold to investors.

Additionally,

securities of certain companies have recently experienced significant and extreme volatility in stock price due to short sellers of shares

of common stock, known as a “short squeeze.” These short squeezes have caused extreme volatility in both the stock prices

of those companies and in the market, and have led to the price per share of those companies to trade at a significantly inflated rate

that is disconnected from the underlying value of the company. Many investors who have purchased shares in those companies at an inflated

rate face the risk of losing a significant portion of their original investment, as in many cases the price per share has declined steadily

as interest in those stocks have abated. While we have no reason to believe our shares would be the target of a short squeeze, there

can be no assurance that we will not be in the future, and you may lose a significant portion or all of your investment if you purchase

our shares at a rate that is significantly disconnected from our underlying value.

You

will experience further dilution if we issue additional securities in future fundraising transactions.

We

are generally not restricted from issuing additional common stock, including any securities that are convertible into or exchangeable

for, or that represent the right to receive, common stock. If we issue additional common stock, or securities convertible into or exchangeable

or exercisable for common stock (including the additional $30,000,000 aggregate principal amount of senior secured convertible

notes which we could issue to the Selling Stockholder pursuant to the Purchase Agreement), our stockholders, including investors

who purchase shares of common stock in this offering, could experience additional dilution, and any such issuances may result in downward

pressure on the price of our common stock.

Sales

of shares of our common stock by the Selling Stockholder may cause our stock price to decline.

As

of November 4, 2024, we had 219,018,180 shares of common stock outstanding. Sales of substantial amounts of our shares

of common stock in the public market by the Selling Stockholder, or the perception that those sales may occur, could cause the market

price of shares of our common stock to decline and impair our ability to raise capital through the sale of additional shares of our common

stock.

We

do not currently intend to pay dividends on our common stock, and any return to investors is expected to come, if at all, only from potential

increases in the price of our common stock.

At

the present time, we intend to use available funds to finance our operations. Accordingly, while payment of dividends rests within the

discretion of our board of directors, no cash dividends on our common shares have been declared or paid by us and we have no intention

of paying any such dividends in the foreseeable future. Any return to investors is expected to come, if at all, only from potential increases

in the price of our common stock.

Risks

Related to the Convertible Note

There

are risks associated with our outstanding Convertible Note, and any additional convertible notes issuable under the Purchase Agreement,

that could adversely affect our business and financial condition.

As

of November 15, 2024, we had $45,000,000 of outstanding indebtedness under the Convertible Note. Pursuant to the Purchase Argument,

we can incur up to an aggregate of $75,000,000 million by issuing additional senior secured convertible notes to the Selling Stockholder

(up to an additional $30,000,000 additional aggregate principal amount), subject to certain limitations. The terms of any additional

senior secured convertible notes issued under the Purchase Agreement would be similar to those under the Convertible Note.

The

Convertible Note provides for certain events of default, such as our failing to make timely payments under the Convertible Note and failing

to timely comply with the reporting requirements of the Exchange Act. The Purchase Agreement and the Convertible Note also contain customary

affirmative and negative covenants, including limitations on incurring additional indebtedness, the creation of additional liens on our

assets, and entering into investments, as well as a minimum liquidity requirement described in “Summary—Convertible Note”

above.

Our

ability to remain in compliance with the covenants under the Convertible Note depends on, among other things, our operating performance,

competitive developments, financial market conditions and stock exchange listing of our common stock, all of which are significantly

affected by financial, business, economic and other factors. We are not able to control many of these factors. Accordingly, our cash

flow may not be sufficient to allow us to pay principal on the Convertible Note and any additional convertible notes issued under the

Purchase Agreement or meet our other obligations under the Purchase Agreement. Our level of indebtedness under the Purchase Agreement

could have other important consequences, including the following:

| ● | We

may need to use a substantial portion of our cash flow from operations to pay principal on

the Convertible Note and any additional convertible notes issued under the Purchase Agreement,

which would reduce funds available to us for other purposes such as working capital, capital

expenditures, potential acquisitions and other general corporate purposes; |

| ● | We

may be unable to refinance our indebtedness under the Purchase Agreement or to obtain additional

financing for working capital, capital expenditures, acquisitions, or general corporate purposes; |

| ● | We

may be unable to comply with financial and other covenants in the Convertible Note, which

could result in an event of default that, if not cured or waived, may result in acceleration

of the Convertible Note and any additional convertible notes issued under the Purchase Agreement

and would have an adverse effect on our business and prospects, could cause us to lose the

rights to our intellectual property, and could force us into bankruptcy or liquidation; |

| ● | The

conversion of the Convertible Note and any additional convertible notes issued under the

Purchase Agreement could result in significant dilution of our common stock, which could

result in significant dilution to our existing stockholders and cause the market price of

our common stock to decline; and |

| ● | We

may be more vulnerable to an economic downturn or recession and adverse developments in our

business. |

There

can be no assurance that we will be able to manage any of these risks successfully.

Our

obligations to the Selling Stockholder under the Convertible Note, and any additional senior secured convertible notes, are secured

by a security interest in all of our bank and securities accounts, now owned and hereafter created or acquired, and if we default on

those obligations, the Selling Stockholder could foreclose on our bank and securities accounts.

Our

obligations under the Convertible Note, and any additional senior secured convertible notes, and the related transaction documents,

are secured by a security interest in all of our bank and securities accounts, now owned and hereafter created or acquired. As a result,

if we default on our obligations under the Convertible Note, or additional senior secured convertible notes, the collateral agent

on behalf of the Selling Stockholder could foreclose on the security interests and liquidate some or all of our bank and securities accounts,

which would harm our business, financial condition and results of operations and could require us to reduce or cease operations and investors

may lose all or part of your investment.

USE

OF PROCEEDS

We

are registering the Shares on behalf of the Selling Stockholder, to be offered and sold by the Selling Stockholder from time to time,

and we will not receive proceeds from the sale of the Shares from time to time by the Selling Stockholder.

We

have agreed to pay all costs, expenses and fees relating to the registration of the Shares covered by this prospectus. These may include,

without limitation, all registration and filing fees, and fees and expenses of our counsel and accountants. The Selling Stockholder will

pay any underwriting discounts and expenses incurred for brokerage, accounting, tax or legal services or any other expenses incurred

in disposing of the Shares covered hereby.

DESCRIPTION

OF CAPITAL STOCK

Our

Amended and Restated Certificate of Incorporation, as amended, authorizes us to issue 310,000,000 shares of common stock, $0.001 par

value per share, and 25,000,000 shares of preferred stock, $0.001 par value per share. As of November 4, 2024, there were 219,018,180

shares of common stock, and no shares of preferred stock, outstanding.

Common

Stock. All outstanding common stock is, and any stock issued under this prospectus will be, duly authorized, fully paid and nonassessable.

Subject to the rights of the holders of our outstanding preferred stock, holders of common stock:

| |

● |

are

entitled to any dividends validly declared; |

| |

● |

will

share ratably in our net assets in the event of a liquidation; and |

| |

● |

are

entitled to one vote per share. |

The

common stock has no conversion rights. Holders of common stock have no preemption, subscription, redemption, or call rights related to

those shares.

Equiniti

Trust Company, LLC is the transfer agent and registrar for our common stock.

Preferred

Stock. The Board of Directors has the authority, without further action by the shareholders, to issue shares of preferred stock in

one or more series and to fix the rights, preferences, privileges and restrictions thereof, including dividend rights, conversion rights,

voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting any series or the

designation of such series. The issuance of preferred stock could adversely affect the voting power of holders of our common stock and

the likelihood that such holders will receive dividend payments and payments upon liquidation may have the effect of delaying, deferring

or preventing a change in control of MicroVision, which could depress the market price of our common stock. If we offer preferred stock,

the terms of that series of preferred stock will be set forth in the prospectus supplement relating to that series.

SELLING

STOCKHOLDER

The

shares of Common Stock that may be offered and sold by the Selling Stockholder are those issuable to the Selling Stockholder upon conversion

of the Convertible Note. For additional information regarding the issuance of the Convertible Note, see “Summary—Convertible

Note” above. We are registering the resale of such Shares in order to provide the Selling Stockholder with freely tradable securities.

Based

upon information provided by the Selling Securityholder, none of the Selling Stockholder nor any of its affiliates, officers, directors

or principal equity holders has held any position or office or has had any material relationship with us within the past three years.

Pursuant

to the terms of the Convertible Note, the Convertible Note may not be converted into shares of common stock if such conversion would

result in the Selling Stockholder owning an aggregate of in excess of 4.99% of the then-outstanding shares of common stock, provided

that such ownership limitation may be (i) increased by the Selling Stockholder to no greater than 9.99% upon 61 days’

notice and (ii) decreased immediately by the Selling Stockholder upon notice (such limitation the “Beneficial

Ownership Limitation”). The Selling Stockholder may sell all, some or none of its shares in this offering. See “Plan of Distribution.”

The

table below lists the Selling Stockholder and other information regarding the beneficial ownership (as determined under Section 13(d)

of the Exchange Act, and the rules and regulations thereunder) of the Shares held by the Selling Stockholder. The second column lists

the number of shares of common Stock beneficially owned by the Selling Stockholder, as of November 4, 2024, after giving effect

to the Beneficial Ownership Limitation. The percentages of common stock beneficially owned and being offered are based on 219,018,180

shares of our common stock outstanding as of November 4, 2024. The table below assumes that no Subsequent Closings (as defined

in the Purchase Agreement) have occurred.

The

fourth column lists the Shares that are being registered by this prospectus by the Selling Stockholder, without regard to the Beneficial

Ownership Limitation.

We

cannot advise you as to whether the Selling Stockholder will in fact convert the Convertible Note or sell any or all Shares issued pursuant

to such conversion. The fifth and sixth columns assume the sale of all of the Shares offered by the Selling Stockholder pursuant to this

prospectus, without regard to the Beneficial Ownership Limitation.

| | |

Number of Shares

of Common

Stock

Beneficially

Owned Prior

to

the Offering | | |

Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus | | |

Number of Shares

of Common

Stock

Beneficially

Owned After

the Offering | |

| Selling Stockholder | |

Number | | |

% | | |

Number | | |

Number | | |

% | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| High Trail Special Situations

LLC(1) | |

| 10,929,008 | | |

| 4.99 | | |

| 42,692,019 | | |

| - | | |

| * | |

*

Less than 1%

| (1) |

Consists

of Shares issuable pursuant to the conversion of the Convertible Note, with the conversion thereof subject to the ownership limitations

described therein. Hudson Bay Capital Management LP, the investment manager of High Trail Special Situations LLC, has voting

and investment power over these securities. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner

of Hudson Bay Capital Management LP. Each of High Trail Special Situations LLC and Sander Gerber disclaims beneficial ownership over

these securities. The address of the Selling Stockholder is c/o Hudson Bay Capital Management LP, 28 Havemeyer Place, 2nd Place, Greenwich,

CT 06830. |

PLAN

OF DISTRIBUTION

We

are registering the Shares to permit the resale of the Shares by the Selling Stockholder from time to time after the date of this prospectus.

We will not receive any of the proceeds from the sale of the Shares by the Selling Stockholder. We will bear all fees and expenses incident

to our obligation to register the Shares.

The

Selling Stockholder, which, as used herein, includes its respective pledgees, assignees, donees, transferees and successors-in-interest,

may, from time to time, sell any or all of the Shares covered hereby on the Nasdaq Global Market or any other stock exchange, market

or trading facility on which the Shares are traded or in private transactions. These sales may be at market prices prevailing at the

time of sale, at prices related to such prevailing market prices, at fixed prices or negotiated prices. The Selling Stockholder may use

any one or more of the following methods when selling the Shares:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

● |

privately

negotiated transactions; |

| |

● |

settlement

of short sales; |

| |

● |

in

transactions through broker-dealers that agree with the Selling Stockholder to sell a specified number of such securities at a stipulated

price per security; |

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

● |

a

combination of any such methods of sale; or |

| |

● |

any

other method permitted pursuant to applicable law. |

The

Selling Stockholder may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available,

rather than under this prospectus.

There

can be no assurance that the Selling Stockholder will sell all or any of the Shares.

Broker-dealers

engaged by the Selling Stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the Selling Stockholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2121, and in the case of a principal transaction a markup or

markdown in compliance with FINRA Rule 2121.

In

connection with the sale of the Shares or interests therein, the Selling Stockholder may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the Shares in the course of hedging the positions they assume.

The Selling Stockholder may also sell securities short and deliver these Shares to close out their short positions, or loan or pledge

the securities to broker-dealers that in turn may sell these Shares. The Selling Stockholder may also enter into option or other transactions

with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer

or other financial institution of the Shares, which Shares such broker-dealer or other financial institution may resell pursuant to this

prospectus (as supplemented or amended to reflect such transaction).

Any

broker-dealers or agents that are involved in selling the Shares may be deemed to be “underwriters” within the meaning of

the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit

on the resale of the Shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

We

are required to pay certain fees and expenses incurred by us incident to the registration of the Shares. We have agreed to indemnify

the Selling Stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities Act. We agreed

to keep this prospectus effective until all of the Shares have been sold pursuant to this prospectus or Rule 144 under the Securities

Act or any other rule of similar effect or the Shares are otherwise freely tradeable under Rule 144. The Shares will be sold only through

registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the Shares

may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration

or qualification requirement is available and is complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the Shares may not simultaneously

engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M,

prior to the commencement of the distribution. In addition, the Selling Stockholder will be subject to applicable provisions of the Exchange

Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common

stock by the Selling Stockholder or any other person.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and special reports, proxy statements and other information with the SEC. These documents are on file with the

SEC. Our SEC filings are also available to the public from the SEC’s website at www.sec.gov.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” the information we file with them, which means that we can disclose important

information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus,

and the information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference

the documents listed below and any future filings we will make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange

Act prior to the time that all securities covered by this prospectus have been sold; provided, however, that we are not incorporating

any information furnished under any of Item 2.02 or Item 7.01 (including exhibits furnished under Item 9.01 in connection with information

furnished under Item 2.02 or Item 7.01) of any current report on Form 8-K:

| |

● |

Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the SEC on February 29, 2024; |

| |

● |

Our

Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 29, 2024 (to the extent incorporated by reference into Part

III of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023); |

| |

● |

Our

Quarterly Reports on Form 10-Q for the quarters ended March

31, 2024 , June

30, 2024 and September

30, 2024 filed with the SEC on May

10, 2024, August

8, 2024 and November

7, 2024, respectively; |

| |

● |

Our

Current Reports on Form 8-K filed with the SEC on February

3, 2023, as amended on April

18, 2023, on March

5, 2024, April

8, 2024, June

10, 2024, July

25, 2024, September

27, 2024, October 15, 2024 and October

15, 2024; and |

| |

● |

The

description of our Common Stock contained in Exhibit 4.2 to our Form 10-K for the fiscal year ended December 31, 2020, filed with

the SEC on March 15, 2021, including any amendments or reports filed for the purpose of updating this description. |

You

may request a copy of these filings, at no cost, by writing or telephoning us at the following address:

MicroVision,

Inc.

18390

NE 68th Street

Redmond,

Washington 98052

Attention:

Investor Relations

(425)

936-6847

You

can also find these filings on our website at www.microvision.com. We are not incorporating the information on our website other than

these filings into this prospectus.

This

prospectus is part of a registration statement that we have filed with the SEC. You should rely only on the information or representations

provided in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these

securities in any state where the offer is not permitted. You should not assume that the information in this prospectus is accurate as

of any date other than the date on the front of the document.

LEGAL

MATTERS

For

the purpose of this offering, Ropes & Gray LLP, is giving its opinion on the validity of the securities offered hereby.

EXPERTS

The

consolidated financial statements and financial

statement schedule of the Company as of December 31, 2023 and 2022 and for each of the three-years in the period ended December

31, 2023 incorporated in this prospectus by reference from the Annual Report on Form 10-K of the Company for the year ended December

31, 2023 and the effectiveness of our internal control over financial reporting, have been audited by Moss Adams LLP, an independent

registered public accounting firm, as stated in their report. Such consolidated financial statements and financial statement

schedule are incorporated by reference in reliance upon the report of such firm given their authority as experts in accounting and

auditing.

The

financial statements of Ibeo Automotive Systems GmbH appearing in our Current Report on Form 8-K/A Amendment No. 1 and filed with

the Securities and Exchanges Commission on April 18, 2023, have been audited by EY GmbH & Co. KG Wirtschaftsprüfungsgesellschaft

(formerly Ernst & Young GmbH Wirtschaftsprüfungsgesellschaft), an independent auditor, as set forth in their report

thereon, included therein and incorporated herein by reference. Such financial statements are incorporated herein by

reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Distribution

The

following table sets forth the estimated expenses payable by us in connection with the sale and distribution of the securities registered

hereby. All of the amounts shown are estimated except the SEC registration fee.

| SEC Registration Fee | |

$ | 7,255.12 | |

| Legal Fees and Expenses | |

| 40,000.00 | |

| Printing Expenses | |

| 1,000.00 | |

| Accounting Fees and Expenses | |

| 50,000.00 | |

| Miscellaneous | |

| 0.00 | |

| Total Expenses | |

$ | 98,255.12 | |

Item

15. Indemnification of Directors and Officers

Section

145 of the Delaware General Corporation Law, or DGCL, provides that a corporation may indemnify any person who was or is a party or is

threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative

or investigative (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director,

officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee

or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorney’s

fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action,

suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best

interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s

conduct was unlawful. Section 145 further provides that a corporation similarly may indemnify any such person serving in any such capacity

who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of

the corporation to procure a judgment in its favor, against expenses actually and reasonably incurred in connection with the defense

or settlement of such action or suit if the person acted in good faith and in a manner the person reasonably believed to be in or not

opposed to the best interests of the corporation and except that no indemnification shall be made in respect of any claim, issue or matter

as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Delaware Court

of Chancery or such other court in which such action or suit was brought shall determine upon application that, despite the adjudication

of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses

which the Delaware Court of Chancery or such other court shall deem proper.

Section

102(b)(7) of the DGCL permits a corporation to include in its certificate of incorporation a provision eliminating or limiting the personal

liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, provided

that such provision shall not eliminate or limit the liability of a director (i) for any breach of the director’s duty of loyalty

to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing

violation of law, (iii) under Section 174 of the DGCL (relating to unlawful payment of dividends and unlawful stock purchase and redemption)

or (iv) for any transaction from which the director derived an improper personal benefit.

The

Company’s Amended and Restated Certificate of Incorporation provides that the Company’s directors shall not be liable to

the Company or its stockholders for monetary damages for breach of fiduciary duty as a director except to the extent that exculpation

from liabilities is not permitted under the DGCL as in effect at the time such liability is determined. The Company’s Amended and

Restated Certificate of Incorporation further provides that the Company shall indemnify its directors and officers to the fullest extent

permitted by the DGCL.

The

Company has a liability insurance policy in effect which covers certain claims against any officer or director of the Company by reason

of certain breaches of duty, neglect, errors or omissions committed by such person in his or her capacity as an officer or director.

For

the undertaking with respect to indemnification, see Item 17 herein.

Item

16. Exhibits

| |

|

Title

of Exhibit |

| |

|

|

| 3.1 |

|

Amended

and Restated Certificate of Incorporation of MicroVision, Inc., as amended (incorporated by reference to the Company’s Quarterly

Report on Form 10-Q for the quarterly period ended September 30, 2009). |

| |

|

|

| 3.2 |

|

Certificate of Amendment to the Amended and Restated Certificate of Incorporation of MicroVision, Inc. (incorporated by reference to the Company’s Current Report on Form 8-K filed on February 17, 2012). |

| |

|

|

| 3.3 |

|

Certificate of Amendment to the Amended and Restated Certificate of Incorporation of MicroVision, Inc. dated June 7, 2018 (incorporated by reference to the Company’s Amendment No. 2 to Form S-1 Registration Statement, Registration No. 333-222857). |

| |

|

|

| 3.4 |

|

Certificate

of Amendment to the Amended and Restated Certificate of Incorporation of MicroVision, Inc. dated October 8, 2020 (incorporated by

reference to the Company’s Quarterly Report Form 10-Q for the quarterly period ended September 30, 2020). |

| |

|

|

| 3.5 |

|

Certificate of Amendment to the Amended and Restated Certificate of Incorporation of MicroVision, Inc. dated May, 18, 2023 (incorporated by reference to the Company’s Current Report on Form 8-K filed on May 19, 2023). |

| |

|

|

| 3.6 |

|

Amended and Restated Bylaws of MicroVision, Inc. (incorporated by reference to the Company’s Current Report on Form 8-K filed on July 14, 2023). |

| |

|

|

| 4.1 |

|

Form of Senior Secured Convertible Note (incorporated by reference to the Company’s Current Report on Form 8-K filed on October 15, 2024). |

| |

|

|

| 5.1 |

|

Opinion

of Ropes & Gray LLP (incorporated by reference to the Company’s Form S-3 Registration Statement, Registration No. 333-282840). |

| |

|

|

| 10.1* |

|

Securities Purchase Agreement (incorporated by reference to the Company’s Current Report on Form 8-K filed on October 15, 2024). |

| |

|

|

| 23.1 |

|

Consent

of Moss Adams LLP (incorporated by reference to the Company’s Form S-3 Registration Statement, Registration No. 333-282840). |

| |

|

|

| 23.2 |

|

Consent

of EY GmbH & Co. KG Wirtschaftsprüfungsgesellschaft (incorporated by reference to the Company’s Form S-3 Registration

Statement, Registration No. 333-282840). |

| |

|

|

| 23.3 |

|

Consent of Ropes & Gray LLP (included in the opinion filed as Exhibit 5.1). |

| |

|

|

| 24.1 |

|

Powers

of Attorney (incorporated by reference to the signature page to the Company’s Form S-3 Registration Statement, Registration

No. 333-282840 ). |

| |

|

|

| 107 |

|

Filing

Fee Table (incorporated by reference to the Company’s Form S-3 Registration Statement, Registration No. 333-282840). |

| * |

Certain

schedules to this agreement have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish a copy of all

omitted schedules to the SEC upon its request. Portions of this exhibit have been omitted pursuant to Item 601(a)(5) of Regulation S-K.

The Company agrees to furnish supplementally an unredacted copy of the Exhibits to the SEC upon its request. |

Item

17. Undertakings

The

undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than 20 percent change in the maximum aggregate offering amount set forth in the “Calculation of Filing

Fee Tables” in the effective registration statement.

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement;

Provided,

however, that paragraphs (l)(i), (l)(ii) and (l)(iii) do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section

13 or 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus

filed pursuant to Rule 424(b) that is part of the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act to any purchaser:

(i)

If the registrant is relying on Rule 430B:

(A)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and

(B)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(l)(i), (vii), or (x) for the purpose of providing the information required

by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of

the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering

described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter,

such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement

to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is

part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or

modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in

any such document immediately prior to such effective date; or

(ii)

If the registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating

to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall

be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided,

however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a

document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration

statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was

made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately

prior to such date of first use.

(5)

That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution

of securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant

to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to

the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus relating to the offering required to be filed pursuant to Rule 424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by

the undersigned registrant;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and (iv) Any other communication that is an offer in the offering

made by the undersigned registrant to the purchaser.

(6)

That, for purposes of determining any liability under the Securities Act:

(i)

Each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable,

each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by

reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein,

and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(ii)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the registrant pursuant to the provisions set forth in Item 15 above, or otherwise, the registrant has been advised that in the opinion

of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred

or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication

of such issue.

(iii)

The information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained

in the form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed

to be part of the registration statement as of the time it was declared effective.

(iv)

Each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant

to the requirements of the Securities Act, the registrant certifies that it has reasonable grounds to believe that it meets all of the

requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto

duly authorized, in the city of Redmond, state of Washington, on the 15th day of November, 2024.

| MICROVISION,

INC. |

|

| |

|

|

| By: |

/s/

Drew G. Markham |

|

| Name: |

Drew

G. Markham |

|

| Title: |

Senior

Vice President, General Counsel & Secretary |

|

Pursuant

to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities indicated

below on the 15th day of November, 2024.

| Signature |

|

Title |

| |

|

|

| /s/

Sumit Sharma |

|

Chief

Executive Officer and Director |

| Sumit

Sharma |

|

(Principal

Executive Officer) |

| |

|

|

| /s/

Anubhav Verma |

|

Chief

Financial Officer |

| Anubhav

Verma |

|

(Principal

Financial Officer and Principal Accounting Officer) |

| |

|

|

| * |

|

Director |

| Simon

Biddiscombe |

|

|

| |

|

|

| * |

|

Director |

| Robert