MYR Group Inc. (“MYR”) (NASDAQ: MYRG), a holding

company of leading specialty contractors serving the electric

utility infrastructure, commercial and industrial construction

markets in the United States and Canada, announced today its

third-quarter and first nine-months 2024 financial results.

Highlights for

Third Quarter

2024

- Quarterly revenues of $888.0

million

- Quarterly net income of $10.6

million, or $0.65 per diluted share

- Quarterly EBITDA of $37.2

million

- Backlog of $2.60 billion

Management CommentsRick Swartz, MYR’s President

and CEO, said, “Our core markets remain active, and bidding

activity continued at a robust pace during the quarter.

Opportunities for long-term growth remain healthy as we continue to

strategically expand our strong customer relationships across our

business segments.” Mr. Swartz also said, “Our third quarter

performance showed improvement over the second quarter,

demonstrating strong project execution in core areas of our

business as we continue to resolve unfavorable impacts from a

relatively small group of projects expected to complete this

year.”

Third Quarter ResultsMYR

reported third-quarter 2024 revenues of $888.0 million, a decrease

of $51.5 million, or 5.5 percent, compared to the third quarter of

2023. Specifically, our Transmission and Distribution (“T&D”)

segment reported quarterly revenues of $481.9 million, a decrease

of $66.7 million, or 12.2 percent, from the third quarter of 2023,

due to a decrease of $81.0 million in revenue on transmission

projects and an increase of $14.3 million in revenue on

distribution projects. Our Commercial and Industrial (“C&I”)

segment reported quarterly revenues of $406.2 million, an increase

of $15.3 million, or 3.9 percent, from the third quarter of 2023,

which was primarily due to an increase in revenue on fixed priced

contracts and T&E contracts.

Consolidated gross profit decreased to $77.3 million for the

third quarter of 2024, compared to $92.4 million for the third

quarter of 2023. The decrease in gross profit was due to lower

margin and lower revenues. Gross margin decreased to 8.7 percent

for the third quarter of 2024 from 9.8 percent for the third

quarter of 2023. The decrease in gross margin was primarily related

to clean energy projects in T&D, the unfavorable impact of a

C&I project, as well as an increase in costs associated with

unfavorable job closeouts, and labor and project inefficiencies.

These margin decreases were partially offset by

better-than-anticipated productivity and a favorable change order.

Changes in estimates of gross profit on certain projects resulted

in gross margin decreases of 3.9 percent and 1.3 percent for the

third quarter of 2024 and 2023, respectively.

Selling, general and administrative expenses (“SG&A”)

decreased to $57.5 million for the third quarter of 2024, compared

to $59.9 million for the third quarter of 2023. The

period-over-period decrease was primarily due to a decrease in

employee incentive compensation costs and a decrease in contingent

compensation expense related to a prior acquisition, partially

offset by an increase in employee-related expenses to support

future growth.

Income tax expense was $7.9 million for the third quarter of

2024, with an effective tax rate of 42.5 percent, compared to

income tax expense of $9.3 million for the third quarter of 2023,

with an effective tax rate of 30.3 percent. The period-over-period

change in tax rate was primarily due to higher permanent difference

items mostly related to deductibility limits of contingent

compensation, associated with a prior acquisition, which was

successfully achieved during the third quarter of 2024, as well as

higher U.S. taxes on Canadian income.

For the third quarter of 2024, net income was $10.6 million, or

$0.65 per diluted share, compared to $21.5 million, or $1.28 per

diluted share, for the same period of 2023. Third-quarter 2024

EBITDA, a non-GAAP financial measure, was $37.2 million, compared

to $47.0 million in the third quarter of 2023.

First Nine-Months ResultsMYR

reported first nine-months 2024 revenues of $2.53 billion, a

decrease of $107.2 million, or 4.1 percent, compared to the first

nine months of 2023. Specifically, our T&D segment reported

revenues of $1.43 billion, a decrease of $67.2 million, from the

first nine months of 2023, due to a decrease of $105.0 million in

revenue on transmission projects, offset by an increase of $37.8

million in revenue on distribution projects. Our C&I segment

reported revenues of $1.10 billion, a decrease of $40.1 million, or

3.5 percent from the first nine months of 2023, which was primarily

due to the delayed start of certain projects in 2024.

Consolidated gross profit decreased to $204.4 million in the

first nine months of 2024, compared to $266.9 million in the first

nine months of 2023. The decrease in gross profit was due to lower

margin and lower revenues. Gross margin decreased to 8.1 percent

for the first nine months of 2024 from 10.1 percent for the first

nine months of 2023. The decrease in gross margin was primarily

related to clean energy projects in T&D, the unfavorable impact

of a C&I project, labor and project inefficiencies, an increase

in costs associated with schedule compression on certain projects,

an unfavorable change order and an unfavorable job closeout. These

margin decreases were partially offset by better-than-anticipated

productivity, favorable change orders, favorable job closeouts and

favorable joint venture results. Changes in estimates of gross

profit on certain projects resulted in a gross margin decreases of

4.4 percent and 1.2 percent for the first nine months of 2024 and

2023, respectively.

SG&A increased to $181.5 million in the first nine months of

2024, compared to $174.6 million for the first nine months of 2023.

The period-over-period increase was primarily due to an increase in

contingent compensation expense related to a prior acquisition and

an increase in employee-related expenses to support future growth,

partially offset by a decrease in employee incentive compensation

costs.

Interest expense increased to $4.3 million in the first nine

months of 2024, compared to $3.1 million for the first nine months

of 2023. The period-over-period increase was primarily due to

higher average debt balances during the first nine months of 2024

as compared to the first nine months of 2023.

Income tax expense was $5.2 million for the first nine months of

2024, with an effective tax rate of 26.6 percent, compared to

income tax expense of $22.6 million for the first nine months of

2023, with an effective tax rate of 25.2 percent. The

period-over-period change in tax rate was primarily due to lower

pretax income and higher other permanent difference items, offset

by lower stock compensation excess tax benefits. The increase in

permanent difference items primarily related to deductibility

limits of contingent compensation, associated with a prior

acquisition, as well as higher U.S. taxes on Canadian income.

For the first nine months of 2024, net income was $14.3 million,

or $0.86 per diluted share, compared to $66.9 million, or $3.98 per

diluted share, for the same period of 2023.

BacklogAs of September 30, 2024, MYR's

backlog was $2.60 billion, compared to $2.54 billion as of

June 30, 2024. As of September 30, 2024, T&D backlog

was $798.7 million, and C&I backlog was $1.80 billion. Total

backlog at September 30, 2024 decreased $19.7 million, or 0.8

percent, from the $2.62 billion reported at September 30,

2023.

Balance SheetAs of September 30, 2024, MYR

had $375.5 million of borrowing availability under its $490 million

revolving credit facility.

Non-GAAP Financial MeasuresTo supplement MYR’s

financial statements presented in accordance with generally

accepted accounting principles in the United States (“GAAP”), MYR

uses certain non-GAAP measures. Reconciliation to the nearest GAAP

measures of all non-GAAP measures included in this press release

can be found at the end of this release. MYR’s definitions of these

non-GAAP measures may differ from similarly titled measures used by

others. These non-GAAP measures should be considered supplemental

to, and not a substitute for, financial information prepared in

accordance with GAAP.

MYR believes that these non-GAAP measures are useful because

they (i) provide both management and investors meaningful

supplemental information regarding financial performance by

excluding certain expenses and benefits that may not be indicative

of recurring core business operating results, (ii) permit investors

to view MYR’s performance using the same tools that management uses

to evaluate MYR’s past performance, reportable business segments

and prospects for future performance, (iii) publicly disclose

results that are relevant to financial covenants included in MYR’s

credit facility and (iv) otherwise provide supplemental information

that may be useful to investors in evaluating MYR.

Conference CallMYR will host a conference call

to discuss its third-quarter 2024 results on Thursday,

October 31, 2024 at 8:00 a.m. Mountain time. To participate

via telephone and join the call live, please register in advance

here:

https://register.vevent.com/register/BIcf56e5d4dfbd47ab90fa168c7ef8653c.

Upon registration, telephone participants will receive a

confirmation email detailing how to join the conference call,

including the dial-in number and a unique passcode. Participants

may access the audio-only webcast of the conference call from the

Investors page of MYR Group’s website at myrgroup.com. A replay of

the webcast will be available for seven days.

About MYR Group Inc. MYR Group is a holding

company of leading, specialty electrical contractors providing

services throughout the United States and Canada through two

business segments: Transmission & Distribution (T&D) and

Commercial & Industrial (C&I). MYR Group subsidiaries have

the experience and expertise to complete electrical installations

of any type and size. Through their T&D segment they provide

services on electric transmission, distribution networks,

substation facilities, clean energy projects and electric vehicle

charging infrastructure. Their comprehensive T&D services

include design, engineering, procurement, construction, upgrade,

maintenance and repair services. T&D customers include

investor-owned utilities, cooperatives, private developers,

government-funded utilities, independent power producers,

independent transmission companies, industrial facility owners and

other contractors. Through their C&I segment, they provide a

broad range of services which include the design, installation,

maintenance and repair of commercial and industrial wiring

generally for airports, hospitals, data centers, hotels, stadiums,

commercial and industrial facilities, clean energy projects,

manufacturing plants, processing facilities, water/waste-water

treatment facilities, mining facilities, intelligent transportation

systems, roadway lighting, signalization and electric vehicle

charging infrastructure. C&I customers include general

contractors, commercial and industrial facility owners, government

agencies and developers. For more information, visit

myrgroup.com.

Forward-Looking StatementsVarious statements in

this announcement, including those that express a belief,

expectation, or intention, as well as those that are not statements

of historical fact, are forward-looking statements. The

forward-looking statements may include projections and estimates

concerning the timing and success of specific projects and our

future production, revenue, income, capital spending, segment

improvements and investments. Forward-looking statements are

generally accompanied by words such as “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “likely,” “may,” “objective,”

“outlook,” “plan,” “project,” “possible,” “potential,” “should,”

“unlikely,” or other words that convey the uncertainty of future

events or outcomes. The forward-looking statements in this

announcement speak only as of the date of this announcement. We

disclaim any obligation to update these statements (unless required

by securities laws), and we caution you not to rely on them unduly.

We have based these forward-looking statements on our current

expectations and assumptions about future events. While our

management considers these expectations and assumptions to be

reasonable, they are inherently subject to significant business,

economic, competitive, regulatory and other risks, contingencies

and uncertainties, most of which are difficult to predict and many

of which are beyond our control. No forward-looking statement can

be guaranteed and actual results may differ materially from those

projected. Forward-looking statements in this announcement should

be evaluated together with the many uncertainties that affect MYR's

business, particularly those mentioned in the risk factors and

cautionary statements in Item 1A. of MYR's Annual Report on Form

10-K for the fiscal year ended December 31, 2023, and in any

risk factors or cautionary statements contained in MYR's subsequent

Quarterly Reports on Form 10-Q or Current Reports on Form 8-K.

MYR Group Inc. Contact:Kelly M. Huntington,

Chief Financial Officer, 847-290-1891,

investorinfo@myrgroup.com

Investor Contact:David Gutierrez, Dresner

Corporate Services, 312-780-7204, dgutierrez@dresnerco.com

Financial tables follow…

MYR GROUP

INC.Consolidated Balance SheetsAs

of September 30, 2024

and December 31, 2023

| (in thousands, except

share and per share data) |

September 30,2024 |

|

December 31,2023 |

| |

(unaudited) |

|

|

|

ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

7,569 |

|

|

$ |

24,899 |

|

|

Accounts receivable, net of allowances of $977 and $1,987,

respectively |

|

571,342 |

|

|

|

521,893 |

|

|

Contract assets, net of allowances of $582 and $610,

respectively |

|

411,843 |

|

|

|

420,616 |

|

|

Current portion of receivable for insurance claims in excess of

deductibles |

|

9,056 |

|

|

|

8,267 |

|

|

Refundable income taxes |

|

6,280 |

|

|

|

4,034 |

|

|

Prepaid expenses and other current assets |

|

25,532 |

|

|

|

46,535 |

|

|

Total current assets |

|

1,031,622 |

|

|

|

1,026,244 |

|

| Property and equipment, net of

accumulated depreciation of $388,180 and $380,465,

respectively |

|

279,634 |

|

|

|

268,978 |

|

| Operating lease right-of-use

assets |

|

40,665 |

|

|

|

35,012 |

|

| Goodwill |

|

115,970 |

|

|

|

116,953 |

|

| Intangible assets, net of

accumulated amortization of $34,036 and $30,534, respectively |

|

79,077 |

|

|

|

83,516 |

|

| Receivable for insurance

claims in excess of deductibles |

|

34,925 |

|

|

|

33,739 |

|

| Investment in joint

ventures |

|

5,835 |

|

|

|

8,707 |

|

| Other assets |

|

5,331 |

|

|

|

5,597 |

|

|

Total assets |

$ |

1,593,059 |

|

|

$ |

1,578,746 |

|

| |

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Current portion of long-term debt |

$ |

4,364 |

|

|

$ |

7,053 |

|

|

Current portion of operating lease obligations |

|

11,136 |

|

|

|

9,237 |

|

|

Current portion of finance lease obligations |

|

1,168 |

|

|

|

2,039 |

|

|

Accounts payable |

|

329,971 |

|

|

|

359,363 |

|

|

Contract liabilities |

|

262,557 |

|

|

|

240,411 |

|

|

Current portion of accrued self-insurance |

|

25,394 |

|

|

|

28,269 |

|

|

Accrued income taxes |

|

— |

|

|

|

237 |

|

|

Other current liabilities |

|

127,846 |

|

|

|

100,593 |

|

|

Total current liabilities |

|

762,436 |

|

|

|

747,202 |

|

| Deferred income tax

liabilities |

|

47,722 |

|

|

|

48,230 |

|

| Long-term debt |

|

88,822 |

|

|

|

29,188 |

|

| Accrued self-insurance |

|

54,262 |

|

|

|

51,796 |

|

| Operating lease obligations,

net of current maturities |

|

29,529 |

|

|

|

25,775 |

|

| Finance lease obligations, net

of current maturities |

|

2,312 |

|

|

|

314 |

|

| Other liabilities |

|

19,467 |

|

|

|

25,039 |

|

|

Total liabilities |

|

1,004,550 |

|

|

|

927,544 |

|

| Commitments and

contingencies |

|

|

|

| Shareholders’ equity: |

|

|

|

|

Preferred stock—$0.01 par value per share; 4,000,000 authorized

shares; none issued and outstanding at September 30, 2024 and

December 31, 2023 |

|

— |

|

|

|

— |

|

|

Common stock—$0.01 par value per share; 100,000,000 authorized

shares; 16,121,901 and 16,684,492 shares issued and outstanding at

September 30, 2024 and December 31, 2023,

respectively |

|

161 |

|

|

|

167 |

|

|

Additional paid-in capital |

|

156,799 |

|

|

|

162,386 |

|

|

Accumulated other comprehensive loss |

|

(6,216) |

|

|

|

(3,880) |

|

|

Retained earnings |

|

437,765 |

|

|

|

492,529 |

|

|

Total shareholders’ equity |

|

588,509 |

|

|

|

651,202 |

|

|

Total liabilities and shareholders’ equity |

$ |

1,593,059 |

|

|

$ |

1,578,746 |

|

MYR GROUP INC.Unaudited

Consolidated Statements of OperationsThree and

Nine Months Ended

September 30, 2024 and

2023

| |

Three months endedSeptember

30, |

|

Nine months endedSeptember

30, |

|

(in thousands, except per share data) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Contract revenues |

$ |

888,043 |

|

|

$ |

939,476 |

|

|

$ |

2,532,495 |

|

|

$ |

2,639,708 |

|

| Contract costs |

|

810,755 |

|

|

|

847,093 |

|

|

|

2,328,121 |

|

|

|

2,372,806 |

|

|

Gross profit |

|

77,288 |

|

|

|

92,383 |

|

|

|

204,374 |

|

|

|

266,902 |

|

| Selling, general and

administrative expenses |

|

57,456 |

|

|

|

59,879 |

|

|

|

181,528 |

|

|

|

174,618 |

|

| Amortization of intangible

assets |

|

1,221 |

|

|

|

1,231 |

|

|

|

3,666 |

|

|

|

3,686 |

|

| Gain on sale of property and

equipment |

|

(1,750) |

|

|

|

(754) |

|

|

|

(4,745) |

|

|

|

(3,293) |

|

|

Income from operations |

|

20,361 |

|

|

|

32,027 |

|

|

|

23,925 |

|

|

|

91,891 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

Interest income |

|

73 |

|

|

|

226 |

|

|

|

296 |

|

|

|

740 |

|

|

Interest expense |

|

(2,016) |

|

|

|

(1,319) |

|

|

|

(4,311) |

|

|

|

(3,059) |

|

|

Other income (expense), net |

|

112 |

|

|

|

(91) |

|

|

|

(421) |

|

|

|

(61) |

|

|

Income before provision for income taxes |

|

18,530 |

|

|

|

30,843 |

|

|

|

19,489 |

|

|

|

89,511 |

|

| Income tax expense |

|

7,881 |

|

|

|

9,331 |

|

|

|

5,178 |

|

|

|

22,563 |

|

| Net income |

$ |

10,649 |

|

|

$ |

21,512 |

|

|

$ |

14,311 |

|

|

$ |

66,948 |

|

| Income per common share: |

|

|

|

|

|

|

|

|

—Basic |

$ |

0.65 |

|

|

$ |

1.29 |

|

|

$ |

0.86 |

|

|

$ |

4.01 |

|

|

—Diluted |

$ |

0.65 |

|

|

$ |

1.28 |

|

|

$ |

0.86 |

|

|

$ |

3.98 |

|

| Weighted average number of

common shares and potential common shares outstanding: |

|

|

|

|

|

|

|

|

—Basic |

|

16,283 |

|

|

|

16,710 |

|

|

|

16,582 |

|

|

|

16,678 |

|

|

—Diluted |

|

16,324 |

|

|

|

16,829 |

|

|

|

16,647 |

|

|

|

16,821 |

|

MYR GROUP INC.Unaudited

Consolidated Statements of Cash FlowsNine Months

Ended September 30, 2024

and 2023

| |

Nine months endedSeptember

30, |

|

(in thousands) |

|

2024 |

|

|

|

2023 |

|

| Cash flows from

operating activities: |

|

|

|

|

Net income |

$ |

14,311 |

|

|

$ |

66,948 |

|

|

Adjustments to reconcile net income to net cash flows provided by

operating activities: |

|

|

|

|

Depreciation and amortization of property and equipment |

|

45,131 |

|

|

|

39,848 |

|

|

Amortization of intangible assets |

|

3,666 |

|

|

|

3,686 |

|

|

Stock-based compensation expense |

|

6,198 |

|

|

|

6,562 |

|

|

Deferred income taxes |

|

(144) |

|

|

|

— |

|

|

Gain on sale of property and equipment |

|

(4,745) |

|

|

|

(3,293) |

|

|

Other non-cash items |

|

1,044 |

|

|

|

564 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable, net |

|

(50,193) |

|

|

|

(76,349) |

|

|

Contract assets, net |

|

8,212 |

|

|

|

(109,803) |

|

|

Receivable for insurance claims in excess of deductibles |

|

(1,975) |

|

|

|

1,558 |

|

|

Other assets |

|

21,687 |

|

|

|

21,503 |

|

|

Accounts payable |

|

(20,607) |

|

|

|

62,276 |

|

|

Contract liabilities |

|

22,294 |

|

|

|

3,941 |

|

|

Accrued self-insurance |

|

(402) |

|

|

|

(1,119) |

|

|

Other liabilities |

|

21,519 |

|

|

|

12,070 |

|

|

Net cash flows provided by operating activities |

|

65,996 |

|

|

|

28,392 |

|

| Cash flows from

investing activities: |

|

|

|

|

Proceeds from sale of property and equipment |

|

6,815 |

|

|

|

3,998 |

|

|

Purchases of property and equipment |

|

(63,634) |

|

|

|

(63,791) |

|

|

Net cash flows used in investing activities |

|

(56,819) |

|

|

|

(59,793) |

|

| Cash flows from

financing activities: |

|

|

|

|

Borrowings under revolving lines of credit |

|

584,070 |

|

|

|

354,467 |

|

|

Repayments under revolving lines of credit |

|

(520,076) |

|

|

|

(328,085) |

|

|

Payment of principal obligations under equipment notes |

|

(7,049) |

|

|

|

(4,597) |

|

|

Payment of principal obligations under finance leases |

|

(2,083) |

|

|

|

(872) |

|

|

Proceeds from exercise of stock options |

|

— |

|

|

|

20 |

|

|

Repurchase of common stock |

|

(75,000) |

|

|

|

— |

|

|

Debt refinancing costs |

|

(34) |

|

|

|

(2,129) |

|

|

Payments related to tax withholding for stock-based

compensation |

|

(5,866) |

|

|

|

(7,936) |

|

|

Net cash flows provided by (used in) financing activities |

|

(26,038) |

|

|

|

10,868 |

|

|

Effect of exchange rate changes on cash |

|

(469) |

|

|

|

(36) |

|

|

Net decrease in cash and cash equivalents |

|

(17,330) |

|

|

|

(20,569) |

|

| Cash and cash

equivalents: |

|

|

|

|

Beginning of period |

|

24,899 |

|

|

|

51,040 |

|

|

End of period |

$ |

7,569 |

|

|

$ |

30,471 |

|

MYR GROUP INC.Unaudited

Consolidated Selected Data,Unaudited Performance

Measure and Reconciliation of Non-GAAP MeasureFor

the Three, Nine and Twelve Months

Ended September 30, 2024

and 2023

andAs of

September 30, 2024,

December 31, 2023,

September 30, 2023 and

September 30, 2022

| |

Three months endedSeptember

30, |

|

Last twelve months ended September

30, |

|

|

(dollars in thousands, except share and per share

data) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

| Summary Statement of

Operations Data: |

|

|

|

|

|

|

|

|

| Contract revenues |

$ |

888,043 |

|

|

$ |

939,476 |

|

|

$ |

3,536,692 |

|

|

$ |

3,503,664 |

|

|

| Gross profit |

$ |

77,288 |

|

|

$ |

92,383 |

|

|

$ |

301,869 |

|

|

$ |

363,171 |

|

|

| Income from operations |

$ |

20,361 |

|

|

$ |

32,027 |

|

|

$ |

61,127 |

|

|

$ |

128,676 |

|

|

| Income before provision for

income taxes |

$ |

18,530 |

|

|

$ |

30,843 |

|

|

$ |

54,982 |

|

|

$ |

125,285 |

|

|

| Income tax expense |

$ |

7,881 |

|

|

$ |

9,331 |

|

|

$ |

16,629 |

|

|

$ |

33,764 |

|

|

| Net income |

$ |

10,649 |

|

|

$ |

21,512 |

|

|

$ |

38,353 |

|

|

$ |

91,521 |

|

|

| Tax rate |

|

42.5% |

|

|

|

30.3% |

|

|

|

30.2% |

|

|

|

26.9% |

|

|

| |

|

|

|

|

|

|

|

|

| Per Share

Data: |

|

|

|

|

|

|

|

|

|

Income per common share: |

|

|

|

|

|

|

|

|

|

- Basic |

$ |

0.65 |

|

|

$ |

1.29 |

|

|

$ |

2.31 |

|

(1) |

|

$ |

5.49 |

|

(1) |

|

|

- Diluted |

$ |

0.65 |

|

|

$ |

1.28 |

|

|

$ |

2.29 |

|

(1) |

|

$ |

5.45 |

|

(1) |

|

|

Weighted average number of common shares and potential

common shares outstanding: |

|

|

|

|

|

|

|

|

|

- Basic |

|

16,283 |

|

|

|

16,710 |

|

|

|

16,611 |

|

(2) |

|

|

16,653 |

|

(2) |

|

|

- Diluted |

|

16,324 |

|

|

|

16,829 |

|

|

|

16,702 |

|

(2) |

|

|

16,812 |

|

(2) |

|

| (in

thousands) |

September 30,2024 |

|

December 31,2023 |

|

September 30,2023 |

|

September 30,2022 |

| Summary Balance Sheet

Data: |

|

|

|

|

|

|

|

|

Total assets |

$ |

1,593,059 |

|

$ |

1,578,746 |

|

$ |

1,560,733 |

|

$ |

1,329,956 |

| Total shareholders’

equity |

$ |

588,509 |

|

$ |

651,202 |

|

$ |

625,459 |

|

$ |

535,877 |

| Goodwill and intangible

assets |

$ |

195,047 |

|

$ |

200,469 |

|

$ |

199,518 |

|

$ |

204,275 |

| Total funded debt (3) |

$ |

93,186 |

|

$ |

36,241 |

|

$ |

62,338 |

|

$ |

85,912 |

| |

Three months endedSeptember

30, |

|

Nine months endedSeptember

30, |

| (dollars in

thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Segment

Results: |

Amount |

|

Percent |

|

Amount |

|

Percent |

|

Amount |

|

Percent |

|

Amount |

|

Percent |

|

Contract revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transmission & Distribution |

$ |

481,876 |

|

|

54.3% |

|

|

$ |

548,595 |

|

|

58.4% |

|

|

$ |

1,430,480 |

|

|

56.5% |

|

|

$ |

1,497,655 |

|

|

56.7% |

|

| Commercial &

Industrial |

|

406,167 |

|

|

45.7% |

|

|

|

390,881 |

|

|

41.6% |

|

|

|

1,102,015 |

|

|

43.5% |

|

|

|

1,142,053 |

|

|

43.3% |

|

| Total |

$ |

888,043 |

|

|

100.0% |

|

|

$ |

939,476 |

|

|

100.0% |

|

|

$ |

2,532,495 |

|

|

100.0% |

|

|

$ |

2,639,708 |

|

|

100.0% |

|

|

Operating income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transmission &

Distribution |

$ |

17,568 |

|

|

3.6% |

|

|

$ |

36,262 |

|

|

6.6% |

|

|

$ |

39,104 |

|

|

2.7% |

|

|

$ |

106,817 |

|

|

7.1% |

|

| Commercial &

Industrial |

|

20,309 |

|

|

5.0% |

|

|

|

13,932 |

|

|

3.6% |

|

|

|

33,340 |

|

|

3.0% |

|

|

|

37,182 |

|

|

3.3% |

|

| Total |

$ |

37,877 |

|

|

4.3% |

|

|

$ |

50,194 |

|

|

5.3% |

|

|

$ |

72,444 |

|

|

2.9% |

|

|

$ |

143,999 |

|

|

5.5% |

|

| Corporate |

|

(17,516) |

|

|

(2.0)% |

|

|

|

(18,167) |

|

|

(1.9)% |

|

|

|

(48,519) |

|

|

(1.9)% |

|

|

|

(52,108) |

|

|

(2.0)% |

|

| Consolidated |

$ |

20,361 |

|

|

2.3% |

|

|

$ |

32,027 |

|

|

3.4% |

|

|

$ |

23,925 |

|

|

1.0% |

|

|

$ |

91,891 |

|

|

3.5% |

|

See notes at the end of this earnings release

MYR GROUP INC.Unaudited

Performance Measures and Reconciliation of Non-GAAP

MeasuresThree and Twelve Months Ended

September 30, 2024 and

2023

| |

Three months endedSeptember

30, |

|

Last twelve months ended September

30, |

|

(in thousands, except share, per share data, ratios and

percentages) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

| Financial Performance

Measures (4): |

|

|

|

|

|

|

|

| EBITDA

(5) |

$ |

37,166 |

|

|

$ |

46,975 |

|

|

$ |

125,130 |

|

|

$ |

187,343 |

|

| EBITDA per Diluted

Share (6) |

$ |

2.27 |

|

|

$ |

2.79 |

|

|

$ |

7.49 |

|

|

$ |

11.14 |

|

| EBIA, net of taxes

(7) |

$ |

12,468 |

|

|

$ |

23,132 |

|

|

$ |

45,776 |

|

|

$ |

98,368 |

|

| Free Cash Flow

(8) |

$ |

17,952 |

|

|

$ |

(9,513) |

|

|

$ |

24,041 |

|

|

$ |

29,825 |

|

| Book Value per Period

End Share (9) |

$ |

36.41 |

|

|

$ |

37.17 |

|

|

|

|

|

| Tangible Book Value

(10) |

$ |

393,462 |

|

|

$ |

425,941 |

|

|

|

|

|

| Tangible Book Value

per Period End Share (11) |

$ |

24.34 |

|

|

$ |

25.31 |

|

|

|

|

|

| Funded Debt to Equity

Ratio (12) |

|

0.16 |

|

|

|

0.10 |

|

|

|

|

|

| Asset Turnover

(13) |

|

|

|

|

|

2.27 |

|

|

|

2.63 |

|

| Return on Assets

(14) |

|

|

|

|

|

2.5% |

|

|

|

6.9% |

|

| Return on Equity

(15) |

|

|

|

|

|

6.1% |

|

|

|

17.1% |

|

| Return on Invested

Capital (16) |

|

|

|

|

|

6.9% |

|

|

|

15.8% |

|

| |

|

|

|

|

|

|

|

| Reconciliation of

Non-GAAP Measures: |

|

|

|

|

|

|

|

| Reconciliation of Net

Income to EBITDA: |

|

|

|

|

|

|

|

| Net income |

$ |

10,649 |

|

|

$ |

21,512 |

|

|

$ |

38,353 |

|

|

$ |

91,521 |

|

|

Interest expense, net |

|

1,943 |

|

|

|

1,093 |

|

|

|

5,747 |

|

|

|

3,518 |

|

|

Income tax expense |

|

7,881 |

|

|

|

9,331 |

|

|

|

16,629 |

|

|

|

33,764 |

|

|

Depreciation and amortization |

|

16,693 |

|

|

|

15,039 |

|

|

|

64,401 |

|

|

|

58,540 |

|

| EBITDA

(5) |

$ |

37,166 |

|

|

$ |

46,975 |

|

|

$ |

125,130 |

|

|

$ |

187,343 |

|

| |

|

|

|

|

|

|

|

| Reconciliation of Net

Income per Diluted Share to EBITDA per Diluted Share: |

|

|

|

|

|

|

|

| Net income per share |

$ |

0.65 |

|

|

$ |

1.28 |

|

|

$ |

2.29 |

|

|

$ |

5.45 |

|

|

Interest expense, net, per share |

|

0.12 |

|

|

|

0.07 |

|

|

|

0.34 |

|

|

|

0.21 |

|

|

Income tax expense per share |

|

0.48 |

|

|

|

0.55 |

|

|

|

1.00 |

|

|

|

2.00 |

|

|

Depreciation and amortization per share |

|

1.02 |

|

|

|

0.89 |

|

|

|

3.86 |

|

|

|

3.48 |

|

| EBITDA per Diluted

Share (6) |

$ |

2.27 |

|

|

$ |

2.79 |

|

|

$ |

7.49 |

|

|

$ |

11.14 |

|

| |

|

|

|

|

|

|

|

| Reconciliation of

Non-GAAP measure: |

|

|

|

|

|

|

|

| Net income |

$ |

10,649 |

|

|

$ |

21,512 |

|

|

$ |

38,353 |

|

|

$ |

91,521 |

|

|

Interest expense, net |

|

1,943 |

|

|

|

1,093 |

|

|

|

5,747 |

|

|

|

3,518 |

|

|

Amortization of intangible assets |

|

1,221 |

|

|

|

1,231 |

|

|

|

4,887 |

|

|

|

5,848 |

|

|

Tax impact of interest and amortization of intangible assets |

|

(1,345) |

|

|

|

(704) |

|

|

|

(3,211) |

|

|

|

(2,519) |

|

| EBIA, net of taxes

(7) |

$ |

12,468 |

|

|

$ |

23,132 |

|

|

$ |

45,776 |

|

|

$ |

98,368 |

|

| |

|

|

|

|

|

|

|

| Calculation of Free

Cash Flow: |

|

|

|

|

|

|

|

| Net cash flow from operating

activities |

$ |

35,625 |

|

|

$ |

12,548 |

|

|

$ |

108,620 |

|

|

$ |

122,150 |

|

|

Less: cash used in purchasing property and equipment |

|

(17,673) |

|

|

|

(22,061) |

|

|

|

(84,579) |

|

|

|

(92,325) |

|

| Free Cash Flow

(8) |

$ |

17,952 |

|

|

$ |

(9,513) |

|

|

$ |

24,041 |

|

|

$ |

29,825 |

|

| |

|

|

|

|

|

|

|

See notes at the end of this earnings

release.MYR GROUP INC.Unaudited

Performance Measures and Reconciliation of Non-GAAP

MeasuresAs of September 30,

2024, 2023

and 2022

| (in thousands, except

per share amounts) |

September 30, 2024 |

|

September 30, 2023 |

| Reconciliation of Book

Value to Tangible Book Value: |

|

|

|

|

Book value (total shareholders' equity) |

$ |

588,509 |

|

|

$ |

625,459 |

|

|

Goodwill and intangible assets |

|

(195,047) |

|

|

|

(199,518) |

|

| Tangible Book Value

(10) |

$ |

393,462 |

|

|

$ |

425,941 |

|

| |

|

|

|

| Reconciliation of Book

Value per Period End Share to Tangible Book Value per Period End

Share: |

|

|

|

|

Book value per period end share |

$ |

36.41 |

|

|

$ |

37.17 |

|

|

Goodwill and intangible assets per period end share |

|

(12.07) |

|

|

|

(11.86) |

|

| Tangible Book Value

per Period End Share (11) |

$ |

24.34 |

|

|

$ |

25.31 |

|

| |

|

|

|

| Calculation of Period

End Shares: |

|

|

|

| Shares outstanding |

|

16,122 |

|

|

|

16,710 |

|

|

Plus: common equivalents |

|

41 |

|

|

|

119 |

|

| Period End Shares

(17) |

|

16,163 |

|

|

|

16,829 |

|

| (in

thousands) |

September 30, 2024 |

|

September 30, 2023 |

|

September 30, 2022 |

| Reconciliation of

Invested Capital to Shareholders Equity: |

|

|

|

|

|

|

Book value (total shareholders' equity) |

$ |

588,509 |

|

|

$ |

625,459 |

|

|

$ |

535,877 |

|

|

Plus: total funded debt |

|

93,186 |

|

|

|

62,338 |

|

|

|

85,912 |

|

|

Less: cash and cash equivalents |

|

(7,569) |

|

|

|

(30,471) |

|

|

|

(35,767) |

|

| Invested Capital |

$ |

674,126 |

|

|

$ |

657,326 |

|

|

$ |

586,022 |

|

| Average Invested

Capital (18) |

$ |

665,726 |

|

|

$ |

621,674 |

|

|

|

See notes at the end of this earnings

release.

(1) Last-twelve-months earnings per share is the sum of earnings

per share reported in the last four quarters.(2) Last-twelve-months

weighted average basic and diluted shares were determined by adding

the weighted average shares reported for the last four quarters and

dividing by four.(3) Funded debt includes outstanding borrowings

under our revolving credit facility and our outstanding equipment

notes.(4) These financial performance measures are provided as

supplemental information to the financial statements. These

measures are used by management to evaluate our past performance,

our prospects for future performance and our ability to comply with

certain material covenants as defined within our credit agreement,

and to compare our results with those of our peers. In addition, we

believe that certain of the measures, such as book value, tangible

book value, free cash flow, asset turnover, return on equity, and

debt leverage are measures that are monitored by sureties, lenders,

lessors, suppliers and certain investors. Our calculation of each

measure is described in the following notes; our calculation may

not be the same as the calculations made by other companies.(5)

EBITDA is defined as earnings before interest, taxes, depreciation

and amortization. EBITDA is not recognized under GAAP and does

not purport to be an alternative to net income as a measure of

operating performance or to net cash flows provided by operating

activities as a measure of liquidity. Certain material covenants

contained within our credit agreement are based on EBITDA with

certain additional adjustments, including our interest coverage

ratio and leverage ratio, which we must comply with to avoid

potential immediate repayment of amounts borrowed or additional

fees to seek relief from our lenders. In addition, management

considers EBITDA a useful measure because it provides MYR Group

Inc. and its investors with an additional tool to compare our

operating performance on a consistent basis by removing the impact

of certain items that management believes to not directly reflect

the company’s core operations. Management further believes

that EBITDA is useful to investors and other external users of our

financial statements in evaluating the company’s operating

performance and cash flow because EBITDA is widely used by

investors to measure a company’s operating performance without

regard to items such as interest expense, taxes, depreciation and

amortization, which can vary substantially from company to company

depending upon accounting methods and book value of assets, useful

lives placed on assets, capital structure and the method by which

assets were acquired.(6) EBITDA per diluted share is calculated by

dividing EBITDA by the weighted average number of diluted shares

outstanding for the period. EBITDA per diluted share is not

recognized under GAAP and does not purport to be an alternative to

income per diluted share.(7) EBIA, net of taxes is defined as net

income plus net interest plus amortization of intangible assets,

less the tax impact of net interest and amortization of intangible

assets. The tax impact of net interest and amortization of

intangible assets is computed by multiplying net interest and

amortization of intangible assets by the effective tax rate.

Management uses EBIA, net of taxes, to measure our results

exclusive of the impact of financing and amortization of intangible

assets costs.(8) Free cash flow, which is defined as cash flow

provided by operating activities minus cash flow used in purchasing

property and equipment, is not recognized under GAAP and does not

purport to be an alternative to net income, cash flow from

operations or the change in cash on the balance sheet. Management

views free cash flow as a measure of operational performance,

liquidity and financial health.(9) Book value per period end share

is calculated by dividing total shareholders’ equity at the end of

the period by the period end shares outstanding.(10) Tangible book

value is calculated by subtracting goodwill and intangible assets

outstanding at the end of the period from shareholders’ equity.

Tangible book value is not recognized under GAAP and does not

purport to be an alternative to book value or shareholders’

equity.(11) Tangible book value per period end share is calculated

by dividing tangible book value at the end of the period by the

period end number of shares outstanding. Tangible book value per

period end share is not recognized under GAAP and does not purport

to be an alternative to income per diluted share.(12) The funded

debt to equity ratio is calculated by dividing total funded debt at

the end of the period by total shareholders’ equity at the end of

the period.(13) Asset turnover is calculated by dividing the

current period revenue by total assets at the beginning of the

period.(14) Return on assets is calculated by dividing net income

for the period by total assets at the beginning of the period.(15)

Return on equity is calculated by dividing net income for the

period by total shareholders’ equity at the beginning of the

period.(16) Return on invested capital is calculated by dividing

EBIA, net of taxes, less any dividends, by average invested

capital. Return on invested capital is not recognized under GAAP,

and is a key metric used by management to determine our executive

compensation.(17) Period end shares is calculated by adding average

common stock equivalents for the quarter to the period end balance

of common stock outstanding. Period end shares is not recognized

under GAAP and does not purport to be an alternative to diluted

shares. Management views period end shares as a better measure of

shares outstanding as of the end of the period.(18) Average

invested capital is calculated by adding net funded debt (total

funded debt less cash and marketable securities) to total

shareholders’ equity and calculating the average of the beginning

and ending of each period.

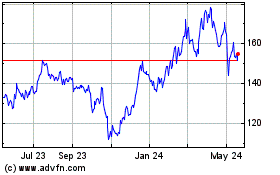

MYR (NASDAQ:MYRG)

Historical Stock Chart

From Dec 2024 to Jan 2025

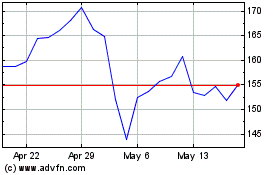

MYR (NASDAQ:MYRG)

Historical Stock Chart

From Jan 2024 to Jan 2025