NCS Multistage Holdings, Inc. (Nasdaq: NCSM) (the “Company,” “NCS,”

“we” or “us”), a leading provider of highly engineered products and

support services that facilitate the optimization of oil and

natural gas well construction, well completions and field

development strategies, today announced its results for the quarter

ended June 30, 2024.

Financial Review

Total revenues were $29.7 million for the quarter ended

June 30, 2024 compared to $25.4 million for

the second quarter of 2023. Increases in international

and U.S. revenues were partially offset by a decrease in

Canada revenues. The significant increase in international

revenues was driven by North Sea frac systems and Middle East

tracer work, and the increase in the United States was driven

by frac systems sales. Despite the increase in our U.S.

revenues, customer activity continues to be negatively impacted by

lower natural gas prices. The decline in our Canada revenues was

due in part to certain customers deferring planned frac systems

work into the second half of the year due to wet weather conditions

and E&P consolidation transactions.

Compared to the first quarter of 2024, total revenues decreased

by 32%, with a decrease in Canada of 62%, primarily

due to the normal seasonal decline during spring

break-up. This decrease was partially offset by an

increase in international revenues of 168%, driven

by projects in the North Sea and Middle East, and 18% in the

United States.

Gross profit was $11.3 million, or a gross margin of 38%,

for the second quarter of 2024, compared to $7.9 million, or

31%, for the second quarter of 2023. Gross margin for 2024

improved due to an increase in higher-margin

international work in both the North Sea and Middle East, higher

activity with our customers in the United States and the benefit

realized from operational restructurings enacted in

2023. Adjusted gross profit, which we define as total revenues

less total cost of sales, exclusive of depreciation and

amortization ("DD&A"), was $12.0 million, or an adjusted

gross margin of 40%, for the second quarter of 2024, compared to

$8.5 million, or 33%, for the second quarter of 2023.

Selling, general and administrative (“SG&A”) expenses

totaled $14.8 million for the second quarter of 2024, an

increase of $0.3 million compared to the same period in 2023.

This increase in expense reflects a higher annual incentive bonus

accrual year-over-year partially offset by the benefit of

cost-saving measures implemented through our

restructuring efforts in 2023.

Other income was $2.2 million for

the second quarter of 2024 compared

to $1.5 million for the second quarter of

2023. This change in other income primarily relates to an

increase in royalty income from licensees.

Net loss was $(3.1) million, or $(1.21) per

share, for the quarter ended June 30, 2024 compared to net

loss of $(32.2) million, or $(13.02) per share for

the quarter ended June 30, 2023. Our net loss for the

second quarter of 2023 was impacted by a $24.9 million

litigation provision primarily associated with a jury verdict in

Texas issued against us in early May 2023. In December 2023,

we settled the matter whereby the insurance carrier agreed to pay

the mutually-agreed settlement amounts to the plaintiff in an

amount within insurance coverage limits, with no cash impact to

NCS.

Adjusted EBITDA was $0.9 million for the quarter ended June

30, 2024, an increase of $3.2 million compared to the same

period a year ago. This improvement is primarily the result of

an increase in higher-margin international projects and an

increase in our royalty income (other income) partially offset by

an increase in SG&A expenses due to higher incentive bonus

accruals. Our resulting Adjusted EBITDA margin of 3% for the

quarter ended June 30, 2024 improved from (9)% for the

same period a year ago.

Cash flow from operating activities for the six months

ended June 30, 2024 was $4.1 million, a $5.1 million

improvement compared to the same period in 2023. For the

six months ended June 30, 2024, free cash flow, less

distributions to non-controlling interest, provided cash of

$3.2 million compared to a use of cash of $(2.0) million

for the same period in 2023. The overall increase in free

cash flow was largely attributed to our operating results,

change in net working capital, and a reduction in net cash

used in investing activities, partially offset by

a distribution to our non-controlling interest.

Liquidity and Capital Expenditures

As of June 30, 2024, NCS had $18.6 million in cash and

$8.9 million in total debt, and a borrowing base under

the undrawn asset-based revolving credit facility (“ABL

Facility”) of $14.4 million. Our working capital, defined as

current assets minus current liabilities, was $71.9 million

and $71.2 million as of June 30, 2024 and

December 31, 2023, respectively. Net working

capital, calculated in the same manner as working capital,

with the exception of excluding cash from current assets and

excluding current maturities of long-term debt from current

liabilities, was $55.4 million and $56.3 million as

of June 30, 2024 and December 31, 2023, respectively.

NCS incurred capital expenditures, net of proceeds from the sale

of property and equipment, of $0.4 million and

$1.0 million for the six months ended June 30,

2024 and 2023, respectively.

Review and Outlook

NCS’s Chief Executive Officer, Ryan Hummer commented, “NCS

continued its strong start to 2024, with our total revenue in the

second quarter near the high end of our expectations and our

Adjusted EBITDA exceeding the expectations we provided in our last

earnings call. This was led by revenue outperformance in the

U.S. and international markets, gross margin benefits from higher

international activity and increased royalty income.

Our total revenue in the second quarter of 2024 of $29.7 million

grew by $4.3 million, or 17%, compared to the second quarter

of last year. This was primarily the result of our concerted effort

to grow our international revenues in the North Sea, where we have

been growing our customer base for fracturing systems work, and the

Middle East, where we are primarily supporting our customers with

our tracer diagnostics services. Our total revenue for

the first half of 2024 of $73.5 million was 7% higher than the

year-ago period.

Our adjusted gross profit for the second quarter of 2024 of 40%,

significantly higher than 33% for the same period last

year, exceeded the high end of our second quarter

adjusted gross margin guidance. Our Adjusted EBITDA for the

second quarter of 2024 was $0.9 million, a year-over-year

improvement of $3.2 million and our Adjusted EBITDA for the

first half of 2024 was $7.0 million, a year-over-year improvement

of $4.4 million. The year-over-year improvement for the first

six months included contributions from increased revenue, higher

adjusted gross margins, lower SG&A expense and increased other

income, primarily royalty income generated from licensing of

certain intellectual property.

During the first six months of 2024, we generated free cash

flows, less distributions to our non-controlling interest, of

$3.2 million, an increase of $5.2 million to the same period

one year ago. This has further strengthened our balance sheet,

as our cash balance as of June 30, 2024 is up to $18.6

million, with only $8.9 million of total debt which consisted

entirely of finance leases.

We believe that average 2024 industry drilling and completion

activity in Canada will be flat to slightly higher compared to

2023 and activity in the United States will decline on average by

5% to 10% compared to 2023. We expect international

industry activity to improve on average by approximately

5% in 2024 compared to 2023.

For the third quarter, we expect revenues to improve

year-over-year and sequentially. The year-over-year expected

revenue increase is driven by an increase in international revenues

and increased sales at Repeat Precision in the U.S. The

sequential improvement will be driven by our Canada operations as

customer activity increases following the seasonal spring break-up

in the second quarter, offset by modest sequential declines in our

U.S. and international operations.

We believe the value that we bring to our customers across our

product and service portfolio, our continued product and service

innovation, and our targeted efforts to penetrate international

markets positions us to outperform the anticipated changes in

industry drilling and completion activity, and to grow our revenue

in 2024 as compared to 2023. As we demonstrated during the first

half of 2024, we believe that this revenue growth, paired with

previously enacted and continued efforts to control our operating

expenses, will enable higher year-over-year Adjusted EBITDA

Margins.

These results reflect the talent, effort and dedication of the

outstanding team at NCS and at Repeat Precision. We are delivering

on our core strategies to build upon our leading market positions,

capitalize on opportunities in international and offshore markets

and to bring new and innovative solutions to our customers around

the world. Through these strategies, we are delivering

extraordinary outcomes to our customers, driving innovation in the

industry and creating value for our shareholders.”

EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EBITDA

Less Share-Based Compensation, Adjusted Net (Loss) Income, Adjusted

(Loss) Earnings per Diluted Share, Adjusted Gross Profit,

Adjusted Gross Margin, Free Cash Flow, Free Cash Flow Less

Distributions to Non-Controlling Interest and Net Working Capital

are non-GAAP financial measures. For an explanation of these

measures and a reconciliation, refer to “Non-GAAP Financial

Measures” below.

Conference Call

The Company will host a conference call to discuss its

second quarter 2024 results and updated guidance on

Thursday, August 1, 2024 at 7:30 a.m. Central Time

(8:30 a.m. Eastern Time). The conference call will be

available via a live audio webcast. Participants who wish to ask

questions may register for the call here to receive the

dial-in numbers and unique PIN. If you wish to join the conference

call but do not plan to ask questions, you may join the listen-only

webcast here. The live webcast can also be accessed by visiting the

Investors section of the Company’s website at ir.ncsmultistage.com.

It is recommended that participants join at least 10 minutes prior

to the event start.

The replay will be available in the Investors section of the

Company’s website shortly after the conclusion of the call and will

remain available for approximately seven days.

About NCS Multistage Holdings, Inc.

NCS Multistage Holdings, Inc. is a leading provider of highly

engineered products and support services that facilitate the

optimization of oil and natural gas well construction, well

completions and field development strategies. NCS provides products

and services primarily to exploration and production companies for

use in onshore and offshore wells, predominantly wells that have

been drilled with horizontal laterals in both unconventional and

conventional oil and natural gas formations. NCS’s products and

services are utilized in oil and natural gas basins throughout

North America and in selected international markets, including the

North Sea, the Middle East, Argentina and China. NCS’s common stock

is traded on the Nasdaq Capital Market under the symbol “NCSM.”

Additional information is available on the website,

www.ncsmultistage.com.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by words such as “anticipates,”

“intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and

similar references to future periods, or by the inclusion of

forecasts or projections. Examples of forward-looking statements

include, but are not limited to, statements we make regarding the

outlook for our future business and financial performance.

Forward-looking statements are based on our current expectations

and assumptions regarding our business, the economy and other

future conditions. Because forward-looking statements relate to the

future, by their nature, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. As a result, our actual results may differ

materially from those contemplated by the forward-looking

statements. Important factors that could cause our actual results

to differ materially from those in the forward-looking statements

include regional, national or global political, economic, business,

competitive, market and regulatory conditions and the following:

declines in the level of oil and natural gas exploration and

production activity in Canada, the United States and

internationally; oil and natural gas price fluctuations;

significant competition for our products and services that results

in pricing pressures, reduced sales, or reduced market share;

inability to successfully implement our strategy of increasing

sales of products and services into the U.S. and international

markets; loss of significant customers; losses and liabilities from

uninsured or underinsured business activities and litigation; our

failure to identify and consummate potential acquisitions; the

financial health of our customers including their ability to pay

for products or services provided; our inability to integrate or

realize the expected benefits from acquisitions; our inability to

achieve suitable price increases to offset the impacts of cost

inflation; loss of any of our key suppliers or significant

disruptions negatively impacting our supply chain; risks in

attracting and retaining qualified employees and key personnel;

risks resulting from the operations of our joint venture

arrangement; currency exchange rate fluctuations; impact of severe

weather conditions; our inability to accurately predict customer

demand, which may result in us holding excess or obsolete

inventory; impairment in the carrying value of long-lived assets

including goodwill; failure to comply with or changes to federal,

state and local and non-U.S. laws and other regulations, including

anti-corruption and environmental regulations, guidelines and

regulations for the use of explosives; change in trade policy,

including the impact of tariffs; our inability to successfully

develop and implement new technologies, products and services that

align with the needs of our customers, including addressing the

shift to more non-traditional energy markets as part of the energy

transition; our inability to protect and maintain critical

intellectual property assets or losses and liabilities from adverse

decisions in intellectual property disputes; loss of, or

interruption to, our information and computer systems; system

interruptions or failures, including complications with our

enterprise resource planning system, cybersecurity breaches,

identity theft or other disruptions that could compromise our

information; our failure to establish and maintain effective

internal control over financial reporting; restrictions on the

availability of our customers to obtain water essential to the

drilling and hydraulic fracturing processes; changes in legislation

or regulation governing the oil and natural gas industry, including

restrictions on emissions of greenhouse gases; our inability to

meet regulatory requirements for use of certain chemicals by our

tracer diagnostics business; the reduction in our ABL Facility

borrowing base or our inability to comply with the covenants in our

debt agreements; and our inability to obtain sufficient liquidity

on reasonable terms, or at all and other factors discussed or

referenced in our filings made from time to time with the

Securities and Exchange Commission. Any forward-looking statement

made by us in this press release speaks only as of the date on

which we make it. Factors or events that could cause our actual

results to differ may emerge from time to time, and it is not

possible for us to predict all of them. We undertake no obligation

to publicly update or revise any forward-looking statement, whether

as a result of new information, future developments or otherwise,

except as may be required by law.

Contact

Mike MorrisonChief Financial Officer and Treasurer(281)

453-2222IR@ncsmultistage.com

|

NCS MULTISTAGE HOLDINGS, INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS(In thousands, except

per share data)(Unaudited) |

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product sales |

|

$ |

19,022 |

|

|

$ |

17,433 |

|

|

$ |

50,780 |

|

|

$ |

48,863 |

|

| Services |

|

|

10,668 |

|

|

|

7,958 |

|

|

|

22,768 |

|

|

|

20,082 |

|

|

Total revenues |

|

|

29,690 |

|

|

|

25,391 |

|

|

|

73,548 |

|

|

|

68,945 |

|

| Cost of

sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of product sales,

exclusive of depreciation and amortization expense shown below |

|

|

12,209 |

|

|

|

11,994 |

|

|

|

31,901 |

|

|

|

30,827 |

|

| Cost of services, exclusive of

depreciation and amortization expense shown below |

|

|

5,510 |

|

|

|

4,935 |

|

|

|

12,105 |

|

|

|

11,115 |

|

|

Total cost of sales, exclusive of depreciation and amortization

expense shown below |

|

|

17,719 |

|

|

|

16,929 |

|

|

|

44,006 |

|

|

|

41,942 |

|

| Selling, general and

administrative expenses |

|

|

14,820 |

|

|

|

14,477 |

|

|

|

28,650 |

|

|

|

30,628 |

|

| Depreciation |

|

|

1,134 |

|

|

|

948 |

|

|

|

2,207 |

|

|

|

1,891 |

|

| Amortization |

|

|

167 |

|

|

|

167 |

|

|

|

334 |

|

|

|

334 |

|

|

Loss from operations |

|

|

(4,150 |

) |

|

|

(7,130 |

) |

|

|

(1,649 |

) |

|

|

(5,850 |

) |

| Other income

(expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

(115 |

) |

|

|

(211 |

) |

|

|

(215 |

) |

|

|

(420 |

) |

| Provision for litigation, net

of recoveries |

|

|

— |

|

|

|

(24,886 |

) |

|

|

— |

|

|

|

(42,400 |

) |

| Other income, net |

|

|

2,203 |

|

|

|

1,478 |

|

|

|

3,340 |

|

|

|

1,770 |

|

| Foreign currency exchange

(loss) gain |

|

|

(507 |

) |

|

|

23 |

|

|

|

(1,005 |

) |

|

|

78 |

|

|

Total other income (expense) |

|

|

1,581 |

|

|

|

(23,596 |

) |

|

|

2,120 |

|

|

|

(40,972 |

) |

|

(Loss) income before income tax |

|

|

(2,569 |

) |

|

|

(30,726 |

) |

|

|

471 |

|

|

|

(46,822 |

) |

|

Income tax expense |

|

|

270 |

|

|

|

1,350 |

|

|

|

757 |

|

|

|

250 |

|

| Net loss |

|

|

(2,839 |

) |

|

|

(32,076 |

) |

|

|

(286 |

) |

|

|

(47,072 |

) |

| Net income attributable to

non-controlling interest |

|

|

256 |

|

|

|

155 |

|

|

|

739 |

|

|

|

128 |

|

| Net loss attributable

to NCS Multistage Holdings, Inc. |

|

$ |

(3,095 |

) |

|

$ |

(32,231 |

) |

|

$ |

(1,025 |

) |

|

$ |

(47,200 |

) |

| Loss per common

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic loss per common share attributable to NCS Multistage

Holdings, Inc. |

|

$ |

(1.21 |

) |

|

$ |

(13.02 |

) |

|

$ |

(0.41 |

) |

|

$ |

(19.16 |

) |

|

Diluted loss per common share attributable to NCS Multistage

Holdings, Inc. |

|

$ |

(1.21 |

) |

|

$ |

(13.02 |

) |

|

$ |

(0.41 |

) |

|

$ |

(19.16 |

) |

| Weighted average

common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

2,548 |

|

|

|

2,476 |

|

|

|

2,528 |

|

|

|

2,464 |

|

|

Diluted |

|

|

2,548 |

|

|

|

2,476 |

|

|

|

2,528 |

|

|

|

2,464 |

|

|

NCS MULTISTAGE HOLDINGS, INC.CONDENSED

CONSOLIDATED BALANCE SHEETS*(In thousands, except share

data)(Unaudited) |

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

18,614 |

|

|

$ |

16,720 |

|

|

Accounts receivable—trade, net |

|

|

24,505 |

|

|

|

23,981 |

|

|

Inventories, net |

|

|

41,563 |

|

|

|

41,612 |

|

|

Prepaid expenses and other current assets |

|

|

3,206 |

|

|

|

1,862 |

|

|

Other current receivables |

|

|

3,958 |

|

|

|

4,042 |

|

|

Insurance receivable |

|

|

— |

|

|

|

15,000 |

|

|

Total current assets |

|

|

91,846 |

|

|

|

103,217 |

|

| Noncurrent assets |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

23,147 |

|

|

|

23,336 |

|

|

Goodwill |

|

|

15,222 |

|

|

|

15,222 |

|

|

Identifiable intangibles, net |

|

|

4,073 |

|

|

|

4,407 |

|

|

Operating lease assets |

|

|

4,056 |

|

|

|

4,847 |

|

|

Deposits and other assets |

|

|

823 |

|

|

|

937 |

|

|

Deferred income taxes, net |

|

|

198 |

|

|

|

66 |

|

|

Total noncurrent assets |

|

|

47,519 |

|

|

|

48,815 |

|

|

Total assets |

|

$ |

139,365 |

|

|

$ |

152,032 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable—trade |

|

$ |

7,567 |

|

|

$ |

6,227 |

|

|

Accrued expenses |

|

|

5,406 |

|

|

|

3,702 |

|

|

Income taxes payable |

|

|

736 |

|

|

|

364 |

|

|

Operating lease liabilities |

|

|

1,471 |

|

|

|

1,583 |

|

|

Accrual for legal contingencies |

|

|

— |

|

|

|

15,000 |

|

|

Current maturities of long-term debt |

|

|

2,074 |

|

|

|

1,812 |

|

|

Other current liabilities |

|

|

2,679 |

|

|

|

3,370 |

|

|

Total current liabilities |

|

|

19,933 |

|

|

|

32,058 |

|

| Noncurrent liabilities |

|

|

|

|

|

|

|

|

|

Long-term debt, less current maturities |

|

|

6,828 |

|

|

|

6,344 |

|

|

Operating lease liabilities, long-term |

|

|

2,994 |

|

|

|

3,775 |

|

|

Other long-term liabilities |

|

|

199 |

|

|

|

213 |

|

|

Deferred income taxes, net |

|

|

372 |

|

|

|

249 |

|

|

Total noncurrent liabilities |

|

|

10,393 |

|

|

|

10,581 |

|

|

Total liabilities |

|

|

30,326 |

|

|

|

42,639 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value, 10,000,000 shares authorized, no

shares issued and outstanding at June 30, 2024 and December 31,

2023 |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.01 par value, 11,250,000 shares authorized,

2,557,482 shares issued and 2,502,564 shares outstanding at June

30, 2024 and 2,482,796 shares issued and 2,443,744 shares

outstanding at December 31, 2023 |

|

|

26 |

|

|

|

25 |

|

|

Additional paid-in capital |

|

|

446,070 |

|

|

|

444,638 |

|

|

Accumulated other comprehensive loss |

|

|

(86,516 |

) |

|

|

(85,752 |

) |

|

Retained deficit |

|

|

(266,642 |

) |

|

|

(265,617 |

) |

|

Treasury stock, at cost, 54,918 shares at June 30, 2024 and 39,052

shares at December 31, 2023 |

|

|

(1,913 |

) |

|

|

(1,676 |

) |

|

Total stockholders' equity |

|

|

91,025 |

|

|

|

91,618 |

|

|

Non-controlling interest |

|

|

18,014 |

|

|

|

17,775 |

|

|

Total equity |

|

|

109,039 |

|

|

|

109,393 |

|

|

Total liabilities and stockholders' equity |

|

$ |

139,365 |

|

|

$ |

152,032 |

|

_____________________

|

NCS MULTISTAGE HOLDINGS, INC.CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(In

thousands)(Unaudited) |

| |

Six Months Ended |

|

| |

June 30, |

|

| |

2024 |

|

2023 |

|

|

Cash flows from operating activities |

|

|

|

|

|

|

| Net loss |

$ |

(286 |

) |

$ |

(47,072 |

) |

| Adjustments to reconcile net

loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

2,541 |

|

|

2,225 |

|

|

Amortization of deferred loan costs |

|

103 |

|

|

102 |

|

|

Share-based compensation |

|

2,062 |

|

|

2,542 |

|

|

Provision for inventory obsolescence |

|

679 |

|

|

245 |

|

|

Deferred income tax expense |

|

21 |

|

|

57 |

|

|

Gain on sale of property and equipment |

|

(340 |

) |

|

(333 |

) |

|

(Recovery of) provision for credit losses |

|

(5 |

) |

|

58 |

|

|

Provision for litigation, net of recoveries |

|

— |

|

|

42,400 |

|

|

Net foreign currency unrealized loss (gain) |

|

956 |

|

|

(279 |

) |

|

Proceeds from note receivable |

|

61 |

|

|

271 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

Accounts receivable—trade |

|

(1,024 |

) |

|

5,759 |

|

|

Inventories, net |

|

(1,501 |

) |

|

(5,907 |

) |

|

Prepaid expenses and other assets |

|

(619 |

) |

|

552 |

|

|

Accounts payable—trade |

|

1,353 |

|

|

545 |

|

|

Accrued expenses |

|

1,761 |

|

|

(4 |

) |

|

Other liabilities |

|

(2,092 |

) |

|

(2,078 |

) |

|

Income taxes receivable/payable |

|

429 |

|

|

(125 |

) |

|

Net cash provided by (used in) operating activities |

|

4,099 |

|

|

(1,042 |

) |

| Cash flows from

investing activities |

|

|

|

|

|

|

| Purchases of property and

equipment |

|

(633 |

) |

|

(1,151 |

) |

| Purchase and development of

software and technology |

|

(53 |

) |

|

(167 |

) |

| Proceeds from sales of

property and equipment |

|

293 |

|

|

340 |

|

|

Net cash used in investing activities |

|

(393 |

) |

|

(978 |

) |

| Cash flows from

financing activities |

|

|

|

|

|

|

| Payments on finance

leases |

|

(932 |

) |

|

(743 |

) |

| Line of credit borrowings |

|

2,974 |

|

|

8,397 |

|

| Payments of line of credit

borrowings |

|

(2,974 |

) |

|

(7,663 |

) |

| Treasury shares withheld |

|

(237 |

) |

|

(264 |

) |

| Distribution to noncontrolling

interest |

|

(500 |

) |

|

— |

|

|

Net cash used in financing activities |

|

(1,669 |

) |

|

(273 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

|

(143 |

) |

|

(195 |

) |

|

Net change in cash and cash equivalents |

|

1,894 |

|

|

(2,488 |

) |

| Cash and cash equivalents

beginning of period |

|

16,720 |

|

|

16,234 |

|

| Cash and cash equivalents end

of period |

$ |

18,614 |

|

$ |

13,746 |

|

| Noncash investing and

financing activities |

|

|

|

|

|

|

| Assets obtained in exchange

for new finance lease liabilities |

$ |

1,821 |

|

$ |

845 |

|

| Assets obtained in exchange

for new operating lease liabilities |

$ |

— |

|

$ |

1,789 |

|

|

NCS MULTISTAGE HOLDINGS, INC.REVENUES BY

GEOGRAPHIC AREA(In

thousands)(Unaudited) |

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

United States |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales |

|

$ |

8,550 |

|

|

$ |

6,942 |

|

|

$ |

16,317 |

|

|

$ |

15,002 |

|

|

Services |

|

|

3,241 |

|

|

|

2,440 |

|

|

|

5,485 |

|

|

|

5,699 |

|

|

Total United States |

|

|

11,791 |

|

|

|

9,382 |

|

|

|

21,802 |

|

|

|

20,701 |

|

| Canada |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales |

|

|

8,263 |

|

|

|

9,970 |

|

|

|

30,938 |

|

|

|

32,531 |

|

|

Services |

|

|

3,795 |

|

|

|

4,351 |

|

|

|

12,789 |

|

|

|

12,461 |

|

|

Total Canada |

|

|

12,058 |

|

|

|

14,321 |

|

|

|

43,727 |

|

|

|

44,992 |

|

| Other

Countries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales |

|

|

2,209 |

|

|

|

521 |

|

|

|

3,525 |

|

|

|

1,330 |

|

|

Services |

|

|

3,632 |

|

|

|

1,167 |

|

|

|

4,494 |

|

|

|

1,922 |

|

|

Total other countries |

|

|

5,841 |

|

|

|

1,688 |

|

|

|

8,019 |

|

|

|

3,252 |

|

| Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales |

|

|

19,022 |

|

|

|

17,433 |

|

|

|

50,780 |

|

|

|

48,863 |

|

|

Services |

|

|

10,668 |

|

|

|

7,958 |

|

|

|

22,768 |

|

|

|

20,082 |

|

|

Total revenues |

|

$ |

29,690 |

|

|

$ |

25,391 |

|

|

$ |

73,548 |

|

|

$ |

68,945 |

|

NCS MULTISTAGE HOLDINGS,

INC.RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

INFORMATION(In thousands, except per share

data)(Unaudited)

Non-GAAP Financial Measures

EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EBITDA

Less Share-Based Compensation, Adjusted Net (Loss) Income, Adjusted

(Loss) Earnings per Diluted Share, Adjusted Gross Profit, Adjusted

Gross Margin, Free Cash Flow, Free Cash Flow Less Distributions to

Non-Controlling Interest and Net Working Capital (our “non-GAAP

financial measures”) are not defined under generally accepted

accounting principles (“GAAP”), are not measures of net (loss)

income, (loss) income from operations, gross profit and gross

margin (inclusive of DD&A), cash provided by (used in)

operating activities, working capital or any other performance

measure derived in accordance with GAAP, and are subject to

important limitations. Our non-GAAP financial measures may not be

comparable to similarly titled measures of other companies in our

industry and are not measures of performance calculated in

accordance with GAAP. Our non-GAAP financial measures have

important limitations as analytical tools and you should not

consider them in isolation or as substitutes for analysis of our

financial performance as reported under GAAP, and they should not

be considered as alternatives to net (loss) income, (loss) income

from operations, gross profit, gross margin, cash provided by (used

in) operating activities, working capital or any other performance

measures derived in accordance with GAAP as measures of operating

performance or as alternatives to cash flow from operating

activities as measures of our liquidity.

However, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin,

Adjusted EBITDA Less Share-Based Compensation, Adjusted Net (Loss)

Income, Adjusted (Loss) Earnings per Diluted Share, Adjusted

Gross Profit, Adjusted Gross Margin, Free Cash Flow, Free Cash Flow

Less Distributions to Non-Controlling Interest and Net Working

Capital are key metrics that management uses to assess the

period-to-period performance of our core business operations or

metrics that enable investors to assess our performance from period

to period to evaluate our performance relative to other companies

that are not subject to such factors, or who may provide similar

non-GAAP measures in their public disclosures.

The tables below set forth reconciliations of our non-GAAP

financial measures to the most directly comparable measures of

financial performance calculated under GAAP:

NET WORKING CAPITAL*

Net working capital is defined as total current assets,

excluding cash and cash equivalents, minus total current

liabilities, excluding current maturities of long-term debt.

Net working capital excludes cash and cash equivalents and current

maturities of long-term debt in order to evaluate the investments

in working capital that we believe are required to support our

business. We believe that net working capital is useful in

analyzing the cash flow and working capital needs of the Company,

including determining the efficiencies of our operations and our

ability to readily convert assets into cash.

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

Working capital |

|

$ |

71,913 |

|

|

$ |

71,159 |

|

| Cash and cash equivalents |

|

|

(18,614 |

) |

|

|

(16,720 |

) |

| Current maturities of long

term debt |

|

|

2,074 |

|

|

|

1,812 |

|

| Net working capital |

|

$ |

55,373 |

|

|

$ |

56,251 |

|

_____________________

NCS MULTISTAGE HOLDINGS,

INC.RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

INFORMATION(In thousands, except per share

data)(Unaudited)

ADJUSTED GROSS PROFIT AND ADJUSTED GROSS

MARGIN

Adjusted gross profit is defined as total revenues minus cost of

sales, exclusive of depreciation and amortization expense, which we

present as a separate line item in our statement of operations.

Adjusted gross margin represents adjusted gross profit as a

percentage of total revenues.

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Total revenues |

|

$ |

29,690 |

|

|

$ |

25,391 |

|

|

$ |

73,548 |

|

|

$ |

68,945 |

|

| Total cost of sales, exclusive

of depreciation and amortization expense |

|

|

17,719 |

|

|

|

16,929 |

|

|

|

44,006 |

|

|

|

41,942 |

|

| Total depreciation and

amortization associated with cost of sales |

|

|

653 |

|

|

|

527 |

|

|

|

1,269 |

|

|

|

1,043 |

|

| Gross

Profit |

|

$ |

11,318 |

|

|

$ |

7,935 |

|

|

$ |

28,273 |

|

|

$ |

25,960 |

|

| Gross

Margin |

|

|

38.1 |

% |

|

|

31.3 |

% |

|

|

38.4 |

% |

|

|

37.7 |

% |

| Exclude total depreciation and

amortization associated with cost of sales |

|

|

(653 |

) |

|

|

(527 |

) |

|

|

(1,269 |

) |

|

|

(1,043 |

) |

| Adjusted Gross

Profit |

|

$ |

11,971 |

|

|

$ |

8,462 |

|

|

$ |

29,542 |

|

|

$ |

27,003 |

|

| Adjusted Gross

Margin |

|

|

40.3 |

% |

|

|

33.3 |

% |

|

|

40.2 |

% |

|

|

39.2 |

% |

ADJUSTED NET LOSS AND ADJUSTED

LOSS PER DILUTED SHARE

Adjusted net (loss) income is defined as net (loss)

income attributable to NCS Multistage Holdings, Inc. adjusted

to exclude certain items which we believe are not reflective of

ongoing performance. Adjusted (loss) income per diluted share

is defined as adjusted net (loss) income divided by our

diluted weighted average common shares outstanding during the

relevant period.

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

| |

|

Effect onNet Loss |

|

|

Impact onDilutedLoss PerShare |

|

|

Effect onNet Loss |

|

|

Impact onDilutedLoss PerShare |

|

|

Effect onNet Loss |

|

|

Impact onDilutedLoss PerShare |

|

|

Effect onNet Loss |

|

|

Impact onDilutedLoss PerShare |

|

|

Net loss attributable to NCS Multistage Holdings, Inc. |

|

$ |

(3,095 |

) |

|

$ |

(1.21 |

) |

|

$ |

(32,231 |

) |

|

$ |

(13.02 |

) |

|

$ |

(1,025 |

) |

|

$ |

(0.41 |

) |

|

$ |

(47,200 |

) |

|

$ |

(19.16 |

) |

| Adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for litigation, net of recoveries (a) |

|

|

— |

|

|

|

— |

|

|

|

24,886 |

|

|

|

10.05 |

|

|

|

— |

|

|

|

— |

|

|

|

42,400 |

|

|

|

17.21 |

|

|

Foreign currency exchange loss (gain) (b) |

|

|

432 |

|

|

|

0.17 |

|

|

|

(48 |

) |

|

|

(0.02 |

) |

|

|

941 |

|

|

|

0.37 |

|

|

|

(105 |

) |

|

|

(0.04 |

) |

|

Income tax impact from adjustments (c) |

|

|

44 |

|

|

|

0.01 |

|

|

|

1,197 |

|

|

|

0.49 |

|

|

|

(1,301 |

) |

|

|

(0.51 |

) |

|

|

288 |

|

|

|

0.12 |

|

| Adjusted net loss

attributable to NCS Multistage Holdings, Inc. |

|

$ |

(2,619 |

) |

|

$ |

(1.03 |

) |

|

$ |

(6,196 |

) |

|

$ |

(2.50 |

) |

|

$ |

(1,385 |

) |

|

$ |

(0.55 |

) |

|

$ |

(4,617 |

) |

|

$ |

(1.87 |

) |

__________________

| (a) |

Represents litigation provision

primarily associated with a legal matter in Texas. In

December 2023, we settled the matter where the insurance carrier

agreed to pay the mutually-agreed settlement amounts to the

plaintiff in January 2024, resulting in no cash payments by

NCS. |

| (b) |

Represents realized and

unrealized foreign currency exchange gains and losses

attributable to NCS Multistage Holdings, Inc. primarily due to

movement in the foreign currency exchange rates during the

applicable periods. |

| (c) |

Represents income tax impacts

based on applicable effective tax rates. |

NCS MULTISTAGE HOLDINGS,

INC.RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

INFORMATION(In thousands)

(Unaudited)

EBITDA, ADJUSTED EBITDA, ADJUSTED EBITDA

MARGIN, AND ADJUSTED EBITDA LESS SHARE-BASED

COMPENSATION

EBITDA is defined as net (loss) income before interest

expense, net, income tax expense and depreciation and amortization.

Adjusted EBITDA is defined as EBITDA adjusted to exclude certain

items which we believe are not reflective of ongoing operating

performance or which, in the case of share-based compensation, is

non-cash in nature. Adjusted EBITDA Margin represents Adjusted

EBITDA as a percentage of total revenues. Adjusted EBITDA Less

Share-Based Compensation is defined as Adjusted EBITDA minus

share-based compensation expense. We believe that Adjusted EBITDA

is an important measure that excludes costs that management

believes do not reflect our ongoing operating performance, legal

proceedings for intellectual property as further described below,

and certain costs associated with our capital structure. We believe

that Adjusted EBITDA Less Share-Based Compensation presents our

financial performance in a manner that is comparable to the

presentation provided by many of our peers.

We periodically incur legal costs associated with the assertion

of, or defense of, intellectual property, which we exclude from our

definition of Adjusted EBITDA and Adjusted EBITDA Less Share-Based

Compensation, unless we believe that settlement will occur prior to

any material legal spend (included in the table below as

“Professional Fees”). Although these costs may recur between

periods, depending on legal matters then outstanding or in process,

we believe the timing of when these costs are incurred does not

typically match the settlement or recoveries associated with such

matters, and therefore, can distort our operating results.

Similarly, we exclude from Adjusted EBITDA and Adjusted EBITDA Less

Share-Based Compensation the one-time settlement or recovery

payment associated with these excluded legal matters when realized

but would not exclude any go forward royalties or payments, if

applicable. We expect to continue to incur these legal costs for

current matters under appeal and for any future cases that may go

to trial, provided that the amount will vary by period.

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net loss |

|

$ |

(2,839 |

) |

|

$ |

(32,076 |

) |

|

$ |

(286 |

) |

|

$ |

(47,072 |

) |

| Income tax expense |

|

|

270 |

|

|

|

1,350 |

|

|

|

757 |

|

|

|

250 |

|

| Interest expense, net |

|

|

115 |

|

|

|

211 |

|

|

|

215 |

|

|

|

420 |

|

| Depreciation |

|

|

1,134 |

|

|

|

948 |

|

|

|

2,207 |

|

|

|

1,891 |

|

| Amortization |

|

|

167 |

|

|

|

167 |

|

|

|

334 |

|

|

|

334 |

|

|

EBITDA |

|

|

(1,153 |

) |

|

|

(29,400 |

) |

|

|

3,227 |

|

|

|

(44,177 |

) |

| Provision for litigation, net

of recoveries (a) |

|

|

— |

|

|

|

24,886 |

|

|

|

— |

|

|

|

42,400 |

|

| Share-based compensation

(b) |

|

|

667 |

|

|

|

1,044 |

|

|

|

1,433 |

|

|

|

1,957 |

|

| Professional fees (c) |

|

|

677 |

|

|

|

577 |

|

|

|

930 |

|

|

|

1,661 |

|

| Foreign currency exchange loss

(gain) (d) |

|

|

507 |

|

|

|

(23 |

) |

|

|

1,005 |

|

|

|

(78 |

) |

| Severance and other

termination benefits (e) |

|

|

— |

|

|

|

309 |

|

|

|

— |

|

|

|

309 |

|

| Other (f) |

|

|

218 |

|

|

|

362 |

|

|

|

398 |

|

|

|

553 |

|

|

Adjusted EBITDA |

|

$ |

916 |

|

|

$ |

(2,245 |

) |

|

$ |

6,993 |

|

|

$ |

2,625 |

|

|

Adjusted EBITDA Margin |

|

|

3 |

% |

|

|

(9 |

%) |

|

|

10 |

% |

|

|

4 |

% |

|

Adjusted EBITDA Less Share-Based Compensation |

|

$ |

249 |

|

|

$ |

(3,289 |

) |

|

$ |

5,560 |

|

|

$ |

668 |

|

___________________

| (a) |

Represents litigation provision

primarily associated with a legal matter in Texas. See

footnote (a) in the “Adjusted Net Loss and Adjusted

Loss Earnings per Diluted Share” table above for more

information. |

| (b) |

Represents non-cash compensation

charges related to share-based compensation granted to our

officers, employees and directors. |

| (c) |

Represents non-capitalizable

costs of professional services primarily incurred or reversed in

connection with our legal proceedings associated with the assertion

of, or defense of, intellectual property as further described above

as well as the valuation of potential strategic

transactions. |

| (d) |

Represents realized and

unrealized foreign currency exchange gains and losses

primarily due to movement in the foreign currency exchange rates

during the applicable periods. |

| (e) |

Represents certain expenses

associated with consolidations of our tracer diagnostics business

operations and Repeat Precision's manufacturing operations in

Mexico. |

| (f) |

Represents the impact of a

research and development subsidy that is included in income tax

expense in accordance with GAAP along with other charges and

credits. |

NCS MULTISTAGE HOLDINGS,

INC.RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

INFORMATION(In thousands)

(Unaudited)

FREE CASH FLOW AND FREE CASH FLOW LESS

DISTRIBUTIONS TO NON-CONTROLLING INTEREST

Free cash flow is defined as net cash provided by (used in)

operating activities less purchases of property and equipment

(inclusive of the purchase and development of software and

technology) plus proceeds from sales of property and equipment, as

presented in our consolidated statement of cash flows. We define

free cash flow less distributions to non-controlling interest as

free cash flow less amounts reported in the financing activities

section of the statement of cash flows as distributions to

non-controlling interest. We believe free cash flow is useful

because it provides information to investors regarding the cash

that was available in the period that was in excess of our needs to

fund our capital expenditures and other investment needs. We

believe that free cash flow less distributions to non-controlling

interest is useful because it provides information to investors

regarding the cash that was available in the period that was in

excess of our needs to fund our capital expenditures, other

investment needs, and cash distributions to our joint venture

partner.

| |

|

Six Months Ended |

|

| |

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

Net cash provided by (used in) operating activities |

|

$ |

4,099 |

|

|

$ |

(1,042 |

) |

| Purchases of property and

equipment |

|

|

(633 |

) |

|

|

(1,151 |

) |

| Purchase and development of

software and technology |

|

|

(53 |

) |

|

|

(167 |

) |

| Proceeds from sales of

property and equipment |

|

|

293 |

|

|

|

340 |

|

| Free cash

flow |

|

$ |

3,706 |

|

|

$ |

(2,020 |

) |

| Distributions to

non-controlling interest |

|

|

(500 |

) |

|

|

— |

|

| Free cash flow less

distributions to non-controlling interest |

|

$ |

3,206 |

|

|

$ |

(2,020 |

) |

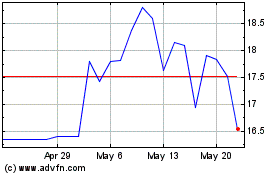

NCS Multistage (NASDAQ:NCSM)

Historical Stock Chart

From Dec 2024 to Jan 2025

NCS Multistage (NASDAQ:NCSM)

Historical Stock Chart

From Jan 2024 to Jan 2025