false

0001692427

0001692427

2024-10-30

2024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

October 30, 2024

Date of Report (Date of earliest event reported)

NCS Multistage Holdings, Inc.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

001-38071

|

46-1527455

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

19350 State Highway 249, Suite 600

Houston, Texas 77070

(Address of principal executive offices) (Zip code)

(281) 453-2222

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

NCSM

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 30, 2024, NCS Multistage Holdings, Inc. (the “Company”) issued a press release announcing its results for the quarter ended September 30, 2024. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in this Item 2.02 and the accompanying exhibit is being furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of Section 18. Furthermore, the information contained in this Item 2.02 and the accompanying exhibit shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

| |

(d)

|

|

Exhibits.

|

| |

|

|

|

| |

Exhibit

|

|

|

| |

Number

|

|

Description of the Exhibit

|

| |

99.1

|

|

|

| |

104

|

|

Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: October 30, 2024

|

NCS Multistage Holdings, Inc.

|

| |

|

|

| |

By:

|

/s/ Mike Morrison

|

| |

|

Mike Morrison

|

| |

|

Chief Financial Officer and Treasurer

|

Exhibit 99.1

|

|

NCS Multistage Holdings, Inc.

19350 State Highway 249, Suite 600

Houston, Texas 77070

|

PRESS RELEASE

NCS MULTISTAGE HOLDINGS, INC. ANNOUNCES THIRD QUARTER 2024 RESULTS

Third Quarter Results

| |

●

|

Total revenues of $44.0 million, a 15% year-over-year improvement, driven in part by increased international revenues

|

| |

●

|

Net income of $4.1 million and diluted earnings per share of $1.60, compared to $4.4 million and diluted earnings per share of $1.77 one year ago

|

| |

●

|

Adjusted EBITDA of $7.1 million, a $0.3 million year-over-year improvement

|

| |

|

|

| |

● |

Cash flows from operating activities of $2.1 million for the first nine months of 2024; free cash flow less distributions to non-controlling interest of $0.4 million, a $3.3 million improvement over the first nine months of 2023 |

| |

|

|

| |

● |

$15.3 million in cash and $8.6 million of total debt as of September 30, 2024 |

HOUSTON, October 30, 2024 – NCS Multistage Holdings, Inc. (Nasdaq: NCSM) (the “Company,” “NCS,” “we” or “us”), a leading provider of highly engineered products and support services that facilitate the optimization of oil and natural gas well construction, well completions and field development strategies, today announced its results for the quarter ended September 30, 2024.

Financial Review

Total revenues were $44.0 million for the quarter ended September 30, 2024 compared to $38.3 million for the third quarter of 2023. Revenue growth was driven by increases in international services revenues, U.S. product sales, and Canada product sales and services. These gains were partially offset by lower U.S. services revenues and international product sales. The significant increase in international revenues was driven by Middle East tracer work and North Sea frac systems, while the increase in the United States reflects higher frac plug and perforating gun sales by our joint venture, Repeat Precision, LLC ("Repeat Precision"). Despite the increase in U.S. revenues, customer activity continues to be negatively impacted by lower natural gas prices. The increase in our Canadian revenue was due in part to higher fracturing systems activity in 2024, as the prior year was impacted more significantly by Canadian wildfires stemming from drought conditions.

Compared to the second quarter of 2024, total revenues increased by 48%, with an increase in Canada of 139%, primarily due to seasonality associated with spring break-up in the second quarter. This increase was partially offset by a decline of 31% in international revenues, primarily associated with the timing of tracer service work in the Middle East, and a 6% decline in the United States.

Gross profit was $17.8 million, with a gross margin of 41%, for the third quarter of 2024, compared to $15.2 million, with a gross margin of 40%, for the third quarter of 2023. Gross margin for 2024 improved due to an increase in higher-margin international work in both the Middle East and North Sea, an increase in frac plug and perforating gun sales in the United States, as well as the benefits realized from operational restructurings enacted in 2023. Adjusted gross profit, which we define as total revenues less total cost of sales, exclusive of depreciation and amortization ("DD&A"), was $18.5 million, or an adjusted gross margin of 42%, for the third quarter of 2024, compared to $15.7 million, or 41%, for the third quarter of 2023.

Selling, general and administrative (“SG&A”) expenses totaled $14.1 million for the third quarter of 2024, an increase of $1.5 million compared to the same period in 2023. This increase in expense reflects a higher annual incentive bonus accrual year-over-year partially offset by the benefit of cost-saving measures implemented through our restructuring efforts in 2023.

Other income was $1.5 million for the third quarter of 2024 compared to $2.0 million for the third quarter of 2023. This change in other income is primarily attributable to the prior year recovery of unpaid invoices through a litigation settlement and the reversal of a legal contingency fee in 2023 that was not repeated in 2024. This was partially offset in 2024 by increases in royalty income from licensees and the benefit associated with our technical services and assistance agreement with our local partner in Oman.

Net income was $4.1 million, or $1.60 per diluted share, for the quarter ended September 30, 2024 compared to net income of $4.4 million, or $1.77 per diluted share for the quarter ended September 30, 2023.

Adjusted EBITDA was $7.1 million for the quarter ended September 30, 2024, an increase of $0.3 million compared to the same period a year ago. This improvement is primarily the result of an increase in higher-margin international projects partially offset by an increase in SG&A expenses due to higher annual incentive bonus accruals. Our resulting Adjusted EBITDA margin of 16% for the quarter ended September 30, 2024 compared to 18% for the same period a year ago.

Cash flow from operating activities for the nine months ended September 30, 2024 was $2.1 million, a $3.5 million improvement compared to the same period in 2023. For the nine months ended September 30, 2024, free cash flow, less distributions to non-controlling interest, provided cash of $0.4 million compared to a use of cash of $(3.0) million for the same period in 2023. The overall increase in free cash flow was largely attributed to our operating results, change in net working capital, and a reduction in net cash used in investing activities, partially offset by a distribution to our non-controlling interest.

Liquidity and Capital Expenditures

As of September 30, 2024, NCS had $15.3 million in cash and $8.6 million in total debt, and a borrowing base under the undrawn asset-based revolving credit facility (“ABL Facility”) of $21.7 million. Our working capital, defined as current assets minus current liabilities, was $77.3 million and $71.2 million as of September 30, 2024 and December 31, 2023, respectively.

Net working capital, calculated as working capital, less cash and excluding the current maturities of long-term debt, was $64.1 million and $56.3 million as of September 30, 2024 and December 31, 2023, respectively. The increase in our net working capital was primarily attributable to an increase in our accounts receivable, partially offset by an increase in accrued expenses.

NCS incurred capital expenditures, net of proceeds from the sale of property and equipment, of $0.7 million and $1.5 million for the nine months ended September 30, 2024 and 2023, respectively.

Review and Outlook

NCS’s Chief Executive Officer, Ryan Hummer commented, “NCS has continued to outperform expectations in a challenging market environment. This quarter marks the third consecutive quarter in which our total revenue has been at the high end or exceeded our expectations, and in which our Adjusted EBITDA exceeded the high end of our expectations.

Our revenue for the first nine months of 2024 of $117.6 million is over $10 million, or approximately 10%, higher than the same period last year. Importantly, we are also demonstrating the operating leverage in our business, with a modest improvement in gross margin percentage paired with a reduction in SG&A expenses for these periods. Our resulting Adjusted EBITDA of $14.1 million for the first nine months of 2024 is approximately 50% higher than the same period last year, a demonstration of the attractive incremental margins our business can generate as we grow.

This performance reflects the way our team has embraced and executed our core strategies to build upon our leading market positions, capitalize on international and offshore opportunities and to commercialize innovative solutions to complex customer challenges. One example of this is the 124% improvement in revenue derived outside North America for the first nine months of 2024 as compared to 2023, with international revenue comprising 10% of our total revenue in that period, as compared to 5% last year. Our multi-year efforts to grow our customer base in the North Sea and to enter certain markets in the Middle East are being rewarded.

Our team at NCS and Repeat Precision has delivered year-over-year revenue growth of 15% in the U.S. through the first nine months of the year, an impressive performance in light of meaningful reductions in industry activity, whether measured by the rig count or unconventional completion counts.

We are pairing this growth with improved free cash flow generation, with free cash flow after distributions to non-controlling interest for the first nine months of 2024 of $0.4 million, increasing by more than $3 million as compared to the same period in 2023. We maintain a net cash position of $6.7 million, and had total liquidity of over $37 million as of September 30, 2024, which includes our cash on hand and availability under our undrawn revolving credit facility.

We expect that we will continue to deliver improved revenue performance in the fourth quarter of 2024 as compared to 2023 in each of the U.S., Canada and international markets. However, sequentially we expect a 5-15% reduction in revenue in each of these markets, reflecting the potential for a more significant reduction in year-end activity than in prior years for the U.S. and Canadian markets due to industry drilling and completion efficiencies, and more challenging winter operating conditions in selected international markets, including the North Sea.

We believe the value that we bring to our customers across our product and service portfolio, our continued product and service innovation, and our targeted efforts to penetrate international markets positions us to outperform the anticipated changes in industry drilling and completion activity. As demonstrated thus far in 2024, we believe that this revenue growth, paired with previously enacted and continued efforts to control our operating expenses, will enable higher year-over-year Adjusted EBITDA Margins.

These results are reflective of the talent, effort and dedication of the outstanding team at NCS and at Repeat Precision. By delivering on our core strategies, we are providing extraordinary outcomes to our customers, driving innovation in the industry and creating value for our shareholders.”

EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EBITDA Less Share-Based Compensation, Adjusted Net Income (Loss), Adjusted Earnings (Loss) per Diluted Share, Adjusted Gross Profit, Adjusted Gross Margin, Free Cash Flow, Free Cash Flow Less Distributions to Non-Controlling Interest and Net Working Capital are non-GAAP financial measures. For an explanation of these measures and a reconciliation, refer to “Non-GAAP Financial Measures” below.

Conference Call

The Company will host a conference call to discuss its third quarter 2024 results and updated guidance on Thursday, October 31, 2024 at 7:30 a.m. Central Time (8:30 a.m. Eastern Time). The conference call will be available via a live audio webcast. Participants who wish to ask questions may register for the call here to receive the dial-in numbers and unique PIN. If you wish to join the conference call but do not plan to ask questions, you may join the listen-only webcast here. The live webcast can also be accessed by visiting the Investors section of the Company’s website at ir.ncsmultistage.com. It is recommended that participants join at least 10 minutes prior to the event start.

The replay will be available in the Investors section of the Company’s website shortly after the conclusion of the call and will remain available for approximately seven days.

About NCS Multistage Holdings, Inc.

NCS Multistage Holdings, Inc. is a leading provider of highly engineered products and support services that facilitate the optimization of oil and natural gas well construction, well completions and field development strategies. NCS provides products and services primarily to exploration and production companies for use in onshore and offshore wells, predominantly wells that have been drilled with horizontal laterals in both unconventional and conventional oil and natural gas formations. NCS’s products and services are utilized in oil and natural gas basins throughout North America and in selected international markets, including the North Sea, the Middle East, Argentina and China. NCS’s common stock is traded on the Nasdaq Capital Market under the symbol “NCSM.” Additional information is available on the website, www.ncsmultistage.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and similar references to future periods, or by the inclusion of forecasts or projections. Examples of forward-looking statements include, but are not limited to, statements we make regarding the outlook for our future business and financial performance. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, our actual results may differ materially from those contemplated by the forward-looking statements. Important factors that could cause our actual results to differ materially from those in the forward-looking statements include regional, national or global political, economic, business, competitive, market and regulatory conditions and the following: declines in the level of oil and natural gas exploration and production activity in Canada, the United States and internationally; oil and natural gas price fluctuations; significant competition for our products and services that results in pricing pressures, reduced sales, or reduced market share; inability to successfully implement our strategy of increasing sales of products and services into the U.S. and international markets; loss of significant customers; losses and liabilities from uninsured or underinsured business activities and litigation; our failure to identify and consummate potential acquisitions; the financial health of our customers including their ability to pay for products or services provided; our inability to integrate or realize the expected benefits from acquisitions; our inability to achieve suitable price increases to offset the impacts of cost inflation; loss of any of our key suppliers or significant disruptions negatively impacting our supply chain; risks in attracting and retaining qualified employees and key personnel; risks resulting from the operations of our joint venture arrangement; currency exchange rate fluctuations; impact of severe weather conditions; our inability to accurately predict customer demand, which may result in us holding excess or obsolete inventory; impairment in the carrying value of long-lived assets including goodwill; failure to comply with or changes to federal, state and local and non-U.S. laws and other regulations, including anti-corruption and environmental regulations, guidelines and regulations for the use of explosives; change in trade policy, including the impact of tariffs; our inability to successfully develop and implement new technologies, products and services that align with the needs of our customers, including addressing the shift to more non-traditional energy markets as part of the energy transition; our inability to protect and maintain critical intellectual property assets or losses and liabilities from adverse decisions in intellectual property disputes; loss of, or interruption to, our information and computer systems; system interruptions or failures, including complications with our enterprise resource planning system, cybersecurity breaches, identity theft or other disruptions that could compromise our information; our failure to establish and maintain effective internal control over financial reporting; restrictions on the availability of our customers to obtain water essential to the drilling and hydraulic fracturing processes; changes in legislation or regulation governing the oil and natural gas industry, including restrictions on emissions of greenhouse gases; our inability to meet regulatory requirements for use of certain chemicals by our tracer diagnostics business; the reduction in our ABL Facility borrowing base or our inability to comply with the covenants in our debt agreements; and our inability to obtain sufficient liquidity on reasonable terms, or at all and other factors discussed or referenced in our filings made from time to time with the Securities and Exchange Commission. Any forward-looking statement made by us in this press release speaks only as of the date on which we make it. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Contact

Mike Morrison

Chief Financial Officer and Treasurer

(281) 453-2222

IR@ncsmultistage.com

NCS MULTISTAGE HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales

|

|

$ |

31,675 |

|

|

$ |

27,286 |

|

|

$ |

82,455 |

|

|

$ |

76,149 |

|

|

Services

|

|

|

12,331 |

|

|

|

10,993 |

|

|

|

35,099 |

|

|

|

31,075 |

|

|

Total revenues

|

|

|

44,006 |

|

|

|

38,279 |

|

|

|

117,554 |

|

|

|

107,224 |

|

|

Cost of sales

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product sales, exclusive of depreciation and amortization expense shown below

|

|

|

19,408 |

|

|

|

17,118 |

|

|

|

51,309 |

|

|

|

47,945 |

|

|

Cost of services, exclusive of depreciation and amortization expense shown below

|

|

|

6,066 |

|

|

|

5,449 |

|

|

|

18,171 |

|

|

|

16,564 |

|

|

Total cost of sales, exclusive of depreciation and amortization expense shown below

|

|

|

25,474 |

|

|

|

22,567 |

|

|

|

69,480 |

|

|

|

64,509 |

|

|

Selling, general and administrative expenses

|

|

|

14,139 |

|

|

|

12,669 |

|

|

|

42,789 |

|

|

|

43,297 |

|

|

Depreciation

|

|

|

1,188 |

|

|

|

1,001 |

|

|

|

3,395 |

|

|

|

2,892 |

|

|

Amortization

|

|

|

168 |

|

|

|

168 |

|

|

|

502 |

|

|

|

502 |

|

|

Income (loss) from operations

|

|

|

3,037 |

|

|

|

1,874 |

|

|

|

1,388 |

|

|

|

(3,976 |

) |

|

Other income (expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

(108 |

) |

|

|

(27 |

) |

|

|

(323 |

) |

|

|

(447 |

) |

|

Provision for litigation, net of recoveries

|

|

|

— |

|

|

|

(98 |

) |

|

|

— |

|

|

|

(42,498 |

) |

|

Other income, net

|

|

|

1,523 |

|

|

|

1,983 |

|

|

|

4,863 |

|

|

|

3,753 |

|

|

Foreign currency exchange gain (loss), net

|

|

|

217 |

|

|

|

(157 |

) |

|

|

(788 |

) |

|

|

(79 |

) |

|

Total other income (expense)

|

|

|

1,632 |

|

|

|

1,701 |

|

|

|

3,752 |

|

|

|

(39,271 |

) |

|

Income (loss) before income tax

|

|

|

4,669 |

|

|

|

3,575 |

|

|

|

5,140 |

|

|

|

(43,247 |

) |

|

Income tax (benefit) expense

|

|

|

(35 |

) |

|

|

(537 |

) |

|

|

722 |

|

|

|

(287 |

) |

|

Net income (loss)

|

|

|

4,704 |

|

|

|

4,112 |

|

|

|

4,418 |

|

|

|

(42,960 |

) |

|

Net income (loss) attributable to non-controlling interest

|

|

|

557 |

|

|

|

(296 |

) |

|

|

1,296 |

|

|

|

(168 |

) |

|

Net income (loss) attributable to NCS Multistage Holdings, Inc.

|

|

$ |

4,147 |

|

|

$ |

4,408 |

|

|

$ |

3,122 |

|

|

$ |

(42,792 |

) |

|

Earnings (loss) per common share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings (loss) per common share attributable to NCS Multistage Holdings, Inc.

|

|

$ |

1.63 |

|

|

$ |

1.78 |

|

|

$ |

1.23 |

|

|

$ |

(17.33 |

) |

|

Diluted earnings (loss) per common share attributable to NCS Multistage Holdings, Inc.

|

|

$ |

1.60 |

|

|

$ |

1.77 |

|

|

$ |

1.21 |

|

|

$ |

(17.33 |

) |

|

Weighted average common shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

2,548 |

|

|

|

2,479 |

|

|

|

2,535 |

|

|

|

2,469 |

|

|

Diluted

|

|

|

2,588 |

|

|

|

2,489 |

|

|

|

2,571 |

|

|

|

2,469 |

|

NCS MULTISTAGE HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS*

(In thousands, except share data)

(Unaudited)

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

15,330 |

|

|

$ |

16,720 |

|

|

Accounts receivable—trade, net

|

|

|

36,652 |

|

|

|

23,981 |

|

|

Inventories, net

|

|

|

41,199 |

|

|

|

41,612 |

|

|

Prepaid expenses and other current assets

|

|

|

1,996 |

|

|

|

1,862 |

|

|

Other current receivables

|

|

|

4,276 |

|

|

|

4,042 |

|

|

Insurance receivable

|

|

|

— |

|

|

|

15,000 |

|

|

Total current assets

|

|

|

99,453 |

|

|

|

103,217 |

|

|

Noncurrent assets

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

22,656 |

|

|

|

23,336 |

|

|

Goodwill

|

|

|

15,222 |

|

|

|

15,222 |

|

|

Identifiable intangibles, net

|

|

|

3,905 |

|

|

|

4,407 |

|

|

Operating lease assets

|

|

|

3,644 |

|

|

|

4,847 |

|

|

Deposits and other assets

|

|

|

777 |

|

|

|

937 |

|

|

Deferred income taxes, net

|

|

|

186 |

|

|

|

66 |

|

|

Total noncurrent assets

|

|

|

46,390 |

|

|

|

48,815 |

|

|

Total assets

|

|

$ |

145,843 |

|

|

$ |

152,032 |

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable—trade

|

|

$ |

7,512 |

|

|

$ |

6,227 |

|

|

Accrued expenses

|

|

|

6,874 |

|

|

|

3,702 |

|

|

Income taxes payable

|

|

|

713 |

|

|

|

364 |

|

|

Operating lease liabilities

|

|

|

1,388 |

|

|

|

1,583 |

|

|

Accrual for legal contingencies

|

|

|

— |

|

|

|

15,000 |

|

|

Current maturities of long-term debt

|

|

|

2,111 |

|

|

|

1,812 |

|

|

Other current liabilities

|

|

|

3,511 |

|

|

|

3,370 |

|

|

Total current liabilities

|

|

|

22,109 |

|

|

|

32,058 |

|

|

Noncurrent liabilities

|

|

|

|

|

|

|

|

|

|

Long-term debt, less current maturities

|

|

|

6,525 |

|

|

|

6,344 |

|

|

Operating lease liabilities, long-term

|

|

|

2,588 |

|

|

|

3,775 |

|

|

Other long-term liabilities

|

|

|

200 |

|

|

|

213 |

|

|

Deferred income taxes, net

|

|

|

311 |

|

|

|

249 |

|

|

Total noncurrent liabilities

|

|

|

9,624 |

|

|

|

10,581 |

|

|

Total liabilities

|

|

|

31,733 |

|

|

|

42,639 |

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value, 10,000,000 shares authorized, no shares issued and outstanding at September 30, 2024 and December 31, 2023

|

|

|

— |

|

|

|

— |

|

|

Common stock, $0.01 par value, 11,250,000 shares authorized, 2,557,648 shares issued and 2,502,680 shares outstanding at September 30, 2024 and 2,482,796 shares issued and 2,443,744 shares outstanding at December 31, 2023

|

|

|

26 |

|

|

|

25 |

|

|

Additional paid-in capital

|

|

|

446,721 |

|

|

|

444,638 |

|

|

Accumulated other comprehensive loss

|

|

|

(86,300 |

) |

|

|

(85,752 |

) |

|

Retained deficit

|

|

|

(262,495 |

) |

|

|

(265,617 |

) |

|

Treasury stock, at cost, 54,968 shares at September 30, 2024 and 39,052 shares at December 31, 2023

|

|

|

(1,913 |

) |

|

|

(1,676 |

) |

|

Total stockholders' equity

|

|

|

96,039 |

|

|

|

91,618 |

|

|

Non-controlling interest

|

|

|

18,071 |

|

|

|

17,775 |

|

|

Total equity

|

|

|

114,110 |

|

|

|

109,393 |

|

|

Total liabilities and stockholders' equity

|

|

$ |

145,843 |

|

|

$ |

152,032 |

|

_____________________

NCS MULTISTAGE HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| |

Nine Months Ended

|

|

| |

September 30,

|

|

| |

2024

|

|

2023

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

Net income (loss)

|

$ |

4,418 |

|

$ |

(42,960 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities:

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

3,897 |

|

|

3,394 |

|

|

Amortization of deferred loan costs

|

|

155 |

|

|

153 |

|

|

Share-based compensation

|

|

3,403 |

|

|

4,198 |

|

|

Provision for inventory obsolescence

|

|

945 |

|

|

256 |

|

|

Deferred income tax expense

|

|

3 |

|

|

147 |

|

|

Gain on sale of property and equipment

|

|

(363 |

) |

|

(423 |

) |

|

Provision for credit losses

|

|

44 |

|

|

112 |

|

|

Provision for litigation, net of recoveries

|

|

— |

|

|

42,498 |

|

|

Net foreign currency unrealized loss (gain)

|

|

855 |

|

|

(127 |

) |

|

Proceeds from note receivable

|

|

61 |

|

|

338 |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

Accounts receivable—trade

|

|

(13,050 |

) |

|

(2,847 |

) |

|

Inventories, net

|

|

(1,210 |

) |

|

(6,356 |

) |

|

Prepaid expenses and other assets

|

|

821 |

|

|

544 |

|

|

Accounts payable—trade

|

|

1,124 |

|

|

2,894 |

|

|

Accrued expenses

|

|

3,224 |

|

|

(1,025 |

) |

|

Other liabilities

|

|

(2,433 |

) |

|

(2,023 |

) |

|

Income taxes receivable/payable

|

|

188 |

|

|

(219 |

) |

|

Net cash provided by (used in) operating activities

|

|

2,082 |

|

|

(1,446 |

) |

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

Purchases of property and equipment

|

|

(1,083 |

) |

|

(1,704 |

) |

|

Purchase and development of software and technology

|

|

(70 |

) |

|

(263 |

) |

|

Proceeds from sales of property and equipment

|

|

421 |

|

|

454 |

|

|

Net cash used in investing activities

|

|

(732 |

) |

|

(1,513 |

) |

|

Cash flows from financing activities

|

|

|

|

|

|

|

|

Payments on finance leases

|

|

(1,442 |

) |

|

(1,159 |

) |

|

Line of credit borrowings

|

|

3,062 |

|

|

11,702 |

|

|

Payments of line of credit borrowings

|

|

(3,062 |

) |

|

(11,758 |

) |

|

Treasury shares withheld

|

|

(237 |

) |

|

(265 |

) |

|

Distribution to noncontrolling interest

|

|

(1,000 |

) |

|

— |

|

|

Net cash used in financing activities

|

|

(2,679 |

) |

|

(1,480 |

) |

|

Effect of exchange rate changes on cash and cash equivalents

|

|

(61 |

) |

|

(397 |

) |

|

Net change in cash and cash equivalents

|

|

(1,390 |

) |

|

(4,836 |

) |

|

Cash and cash equivalents beginning of period

|

|

16,720 |

|

|

16,234 |

|

|

Cash and cash equivalents end of period

|

$ |

15,330 |

|

$ |

11,398 |

|

|

Noncash investing and financing activities

|

|

|

|

|

|

|

|

Assets obtained in exchange for new finance lease liabilities

|

$ |

2,145 |

|

$ |

1,665 |

|

|

Assets obtained in exchange for new operating lease liabilities

|

$ |

— |

|

$ |

1,791 |

|

NCS MULTISTAGE HOLDINGS, INC.

REVENUES BY GEOGRAPHIC AREA

(In thousands)

(Unaudited)

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

United States

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales

|

|

$ |

9,489 |

|

|

$ |

5,200 |

|

|

$ |

25,806 |

|

|

$ |

20,202 |

|

|

Services

|

|

|

1,645 |

|

|

|

2,812 |

|

|

|

7,130 |

|

|

|

8,511 |

|

|

Total United States

|

|

|

11,134 |

|

|

|

8,012 |

|

|

|

32,936 |

|

|

|

28,713 |

|

|

Canada

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales

|

|

|

22,140 |

|

|

|

21,531 |

|

|

|

53,078 |

|

|

|

54,062 |

|

|

Services

|

|

|

6,725 |

|

|

|

6,613 |

|

|

|

19,514 |

|

|

|

19,074 |

|

|

Total Canada

|

|

|

28,865 |

|

|

|

28,144 |

|

|

|

72,592 |

|

|

|

73,136 |

|

|

Other Countries

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales

|

|

|

46 |

|

|

|

555 |

|

|

|

3,571 |

|

|

|

1,885 |

|

|

Services

|

|

|

3,961 |

|

|

|

1,568 |

|

|

|

8,455 |

|

|

|

3,490 |

|

|

Total other countries

|

|

|

4,007 |

|

|

|

2,123 |

|

|

|

12,026 |

|

|

|

5,375 |

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales

|

|

|

31,675 |

|

|

|

27,286 |

|

|

|

82,455 |

|

|

|

76,149 |

|

|

Services

|

|

|

12,331 |

|

|

|

10,993 |

|

|

|

35,099 |

|

|

|

31,075 |

|

|

Total revenues

|

|

$ |

44,006 |

|

|

$ |

38,279 |

|

|

$ |

117,554 |

|

|

$ |

107,224 |

|

NCS MULTISTAGE HOLDINGS, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION

(In thousands, except per share data)

(Unaudited)

Non-GAAP Financial Measures

EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EBITDA Less Share-Based Compensation, Adjusted Net Income (Loss), Adjusted Earnings (Loss) per Diluted Share, Adjusted Gross Profit, Adjusted Gross Margin, Free Cash Flow, Free Cash Flow Less Distributions to Non-Controlling Interest and Net Working Capital (our “non-GAAP financial measures”) are not defined under generally accepted accounting principles (“GAAP”), are not measures of net income (loss), income (loss) from operations, gross profit and gross margin (inclusive of DD&A), cash provided by (used in) operating activities, working capital or any other performance measure derived in accordance with GAAP, and are subject to important limitations. Our non-GAAP financial measures may not be comparable to similarly titled measures of other companies in our industry and are not measures of performance calculated in accordance with GAAP. Our non-GAAP financial measures have important limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of our financial performance as reported under GAAP, and they should not be considered as alternatives to net income (loss), income (loss) from operations, gross profit, gross margin, cash provided by (used in) operating activities, working capital or any other performance measures derived in accordance with GAAP as measures of operating performance or as alternatives to cash flow from operating activities as measures of our liquidity.

However, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EBITDA Less Share-Based Compensation, Adjusted Net Income (Loss), Adjusted Earnings (Loss) per Diluted Share, Adjusted Gross Profit, Adjusted Gross Margin, Free Cash Flow, Free Cash Flow Less Distributions to Non-Controlling Interest and Net Working Capital are key metrics that management uses to assess the period-to-period performance of our core business operations or metrics that enable investors to assess our performance from period to period to evaluate our performance relative to other companies that are not subject to such factors, or who may provide similar non-GAAP measures in their public disclosures.

The tables below set forth reconciliations of our non-GAAP financial measures to the most directly comparable measures of financial performance calculated under GAAP:

NET WORKING CAPITAL*

Net working capital is defined as total current assets, excluding cash and cash equivalents, minus total current liabilities, excluding current maturities of long-term debt. Net working capital excludes cash and cash equivalents and current maturities of long-term debt in order to evaluate the investments in working capital that we believe are required to support our business. We believe that net working capital is useful in analyzing the cash flow and working capital needs of the Company, including determining the efficiencies of our operations and our ability to readily convert assets into cash.

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Working capital

|

|

$ |

77,344 |

|

|

$ |

71,159 |

|

|

Cash and cash equivalents

|

|

|

(15,330 |

) |

|

|

(16,720 |

) |

|

Current maturities of long term debt

|

|

|

2,111 |

|

|

|

1,812 |

|

|

Net working capital

|

|

$ |

64,125 |

|

|

$ |

56,251 |

|

_____________________

NCS MULTISTAGE HOLDINGS, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION

(In thousands, except per share data)

(Unaudited)

ADJUSTED GROSS PROFIT AND ADJUSTED GROSS MARGIN

Adjusted gross profit is defined as total revenues minus cost of sales, exclusive of depreciation and amortization expense, which we present as a separate line item in our statement of operations. Adjusted gross margin represents adjusted gross profit as a percentage of total revenues.

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Total revenues

|

|

$ |

44,006 |

|

|

$ |

38,279 |

|

|

$ |

117,554 |

|

|

$ |

107,224 |

|

|

Total cost of sales, exclusive of depreciation and amortization expense

|

|

|

25,474 |

|

|

|

22,567 |

|

|

|

69,480 |

|

|

|

64,509 |

|

|

Total depreciation and amortization associated with cost of sales

|

|

|

699 |

|

|

|

558 |

|

|

|

1,968 |

|

|

|

1,601 |

|

|

Gross Profit

|

|

$ |

17,833 |

|

|

$ |

15,154 |

|

|

$ |

46,106 |

|

|

$ |

41,114 |

|

|

Gross Margin

|

|

|

41 |

% |

|

|

40 |

% |

|

|

39 |

% |

|

|

38 |

% |

|

Exclude total depreciation and amortization associated with cost of sales

|

|

|

(699 |

) |

|

|

(558 |

) |

|

|

(1,968 |

) |

|

|

(1,601 |

) |

|

Adjusted Gross Profit

|

|

$ |

18,532 |

|

|

$ |

15,712 |

|

|

$ |

48,074 |

|

|

$ |

42,715 |

|

|

Adjusted Gross Margin

|

|

|

42 |

% |

|

|

41 |

% |

|

|

41 |

% |

|

|

40 |

% |

ADJUSTED NET INCOME (LOSS) AND ADJUSTED EARNINGS (LOSS) PER DILUTED SHARE

Adjusted net income (loss) is defined as net income (loss) attributable to NCS Multistage Holdings, Inc. adjusted to exclude certain items which we believe are not reflective of ongoing performance. Adjusted income (loss) per diluted share is defined as adjusted net income (loss) divided by our diluted weighted average common shares outstanding during the relevant period.

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30, 2024

|

|

|

September 30, 2023

|

|

|

September 30, 2024

|

|

|

September 30, 2023

|

|

| |

|

Effect on Net Income

|

|

|

Impact on Diluted Earnings Per Share

|

|

|

Effect on Net Income

|

|

|

Impact on Diluted Earnings Per Share

|

|

|

Effect on Net Income

|

|

|

Impact on Diluted Earnings Per Share

|

|

|

Effect on Net (Loss) Income

|

|

|

Impact on Diluted (Loss) Earnings Per Share

|

|

|

Net income (loss) attributable to NCS Multistage Holdings, Inc.

|

|

$ |

4,147 |

|

|

$ |

1.60 |

|

|

$ |

4,408 |

|

|

$ |

1.77 |

|

|

$ |

3,122 |

|

|

$ |

1.21 |

|

|

$ |

(42,792 |

) |

|

$ |

(17.33 |

) |

|

Adjustments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for litigation, net of recoveries (a)

|

|

|

— |

|

|

|

— |

|

|

|

98 |

|

|

|

0.04 |

|

|

|

— |

|

|

|

— |

|

|

|

42,498 |

|

|

|

17.21 |

|

|

Foreign currency exchange (gain) loss (b)

|

|

|

(262 |

) |

|

|

(0.10 |

) |

|

|

237 |

|

|

|

0.10 |

|

|

|

679 |

|

|

|

0.26 |

|

|

|

132 |

|

|

|

0.06 |

|

|

Income tax impact from adjustments (c)

|

|

|

2 |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

(90 |

) |

|

|

(0.03 |

) |

|

|

303 |

|

|

|

0.12 |

|

|

Adjusted net income attributable to NCS Multistage Holdings, Inc.

|

|

$ |

3,887 |

|

|

$ |

1.50 |

|

|

$ |

4,744 |

|

|

$ |

1.91 |

|

|

$ |

3,711 |

|

|

$ |

1.44 |

|

|

$ |

141 |

|

|

$ |

0.06 |

|

__________________

|

(a)

|

Represents litigation provision primarily associated with a legal matter in Texas for the nine months ended September 30, 2023. In December 2023, we settled the matter where the insurance carrier agreed to pay the mutually-agreed settlement amounts to the plaintiff in January 2024, resulting in no cash payments by NCS.

|

|

(b)

|

Represents realized and unrealized foreign currency exchange gains and losses attributable to NCS Multistage Holdings, Inc. primarily due to movement in the foreign currency exchange rates during the applicable periods.

|

|

(c)

|

Represents income tax impacts based on applicable effective tax rates.

|

NCS MULTISTAGE HOLDINGS, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION

(In thousands)

(Unaudited)

EBITDA, ADJUSTED EBITDA, ADJUSTED EBITDA MARGIN, AND ADJUSTED EBITDA LESS SHARE-BASED COMPENSATION

EBITDA is defined as net income (loss) before interest expense, net, income tax expense and depreciation and amortization. Adjusted EBITDA is defined as EBITDA adjusted to exclude certain items which we believe are not reflective of ongoing operating performance or which, in the case of share-based compensation, is non-cash in nature. Adjusted EBITDA Margin represents Adjusted EBITDA as a percentage of total revenues. Adjusted EBITDA Less Share-Based Compensation is defined as Adjusted EBITDA minus share-based compensation expense. We believe that Adjusted EBITDA is an important measure that excludes costs that management believes do not reflect our ongoing operating performance, legal proceedings for intellectual property as further described below, and certain costs associated with our capital structure. We believe that Adjusted EBITDA Less Share-Based Compensation presents our financial performance in a manner that is comparable to the presentation provided by many of our peers.

We periodically incur legal costs associated with the assertion of, or defense of, intellectual property, which we exclude from our definition of Adjusted EBITDA and Adjusted EBITDA Less Share-Based Compensation, unless we believe that settlement will occur prior to any material legal spend (included in the table below as “Professional Fees”). Although these costs may recur between periods, depending on legal matters then outstanding or in process, we believe the timing of when these costs are incurred does not typically match the settlement or recoveries associated with such matters, and therefore, can distort our operating results. Similarly, we exclude from Adjusted EBITDA and Adjusted EBITDA Less Share-Based Compensation the one-time settlement or recovery payment associated with these excluded legal matters when realized but would not exclude any go forward royalties or payments, if applicable. We expect to continue to incur these legal costs for current matters under appeal and for any future cases that may go to trial, provided that the amount will vary by period.

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Net income (loss)

|

|

$ |

4,704 |

|

|

$ |

4,112 |

|

|

$ |

4,418 |

|

|

$ |

(42,960 |

) |

|

Income tax (benefit) expense

|

|

|

(35 |

) |

|

|

(537 |

) |

|

|

722 |

|

|

|

(287 |

) |

|

Interest expense, net

|

|

|

108 |

|

|

|

27 |

|

|

|

323 |

|

|

|

447 |

|

|

Depreciation

|

|

|

1,188 |

|

|

|

1,001 |

|

|

|

3,395 |

|

|

|

2,892 |

|

|

Amortization

|

|

|

168 |

|

|

|

168 |

|

|

|

502 |

|

|

|

502 |

|

|

EBITDA

|

|

|

6,133 |

|

|

|

4,771 |

|

|

|

9,360 |

|

|

|

(39,406 |

) |

|

Provision for litigation, net of recoveries (a)

|

|

|

— |

|

|

|

98 |

|

|

|

— |

|

|

|

42,498 |

|

|

Share-based compensation (b)

|

|

|

651 |

|

|

|

1,328 |

|

|

|

2,084 |

|

|

|

3,285 |

|

|

Professional fees (c)

|

|

|

333 |

|

|

|

(375 |

) |

|

|

1,263 |

|

|

|

1,286 |

|

|

Foreign currency exchange (gain) loss (d)

|

|

|

(217 |

) |

|

|

157 |

|

|

|

788 |

|

|

|

79 |

|

|

Severance and other termination benefits (e)

|

|

|

— |

|

|

|

671 |

|

|

|

— |

|

|

|

980 |

|

|

Other (f)

|

|

|

175 |

|

|

|

145 |

|

|

|

573 |

|

|

|

698 |

|

|

Adjusted EBITDA

|

|

$ |

7,075 |

|

|

$ |

6,795 |

|

|

$ |

14,068 |

|

|

$ |

9,420 |

|

|

Adjusted EBITDA Margin

|

|

|

16 |

% |

|

|

18 |

% |

|

|

12 |

% |

|

|

9 |

% |

|

Adjusted EBITDA Less Share-Based Compensation

|

|

$ |

6,424 |

|

|

$ |

5,467 |

|

|

$ |

11,984 |

|

|

$ |

6,135 |

|

___________________

|

(a)

|

Represents litigation provision primarily associated with a legal matter in Texas. See footnote (a) in the “Adjusted Net Income (Loss) and Adjusted Earnings (Loss) per Diluted Share” table above for more information.

|

|

(b)

|

Represents non-cash compensation charges related to share-based compensation granted to our officers, employees and directors.

|

|

(c)

|

Represents non-capitalizable costs of professional services primarily incurred or reversed in connection with our legal proceedings associated with the assertion of, or defense of, intellectual property as further described above as well as the cost incurred for the evaluation of potential strategic transactions.

|

|

(d)

|

Represents realized and unrealized foreign currency exchange gains and losses primarily due to movement in the foreign currency exchange rates during the applicable periods.

|

| (e) |

Represents certain expenses associated with consolidations of our tracer diagnostics business operations and Repeat Precision's manufacturing operations in Mexico. |

|

(f)

|

Represents the impact of a research and development subsidy that is included in income tax expense in accordance with GAAP along with other charges and credits.

|

NCS MULTISTAGE HOLDINGS, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION

(In thousands)

(Unaudited)

FREE CASH FLOW AND FREE CASH FLOW LESS DISTRIBUTIONS TO NON-CONTROLLING INTEREST

Free cash flow is defined as net cash provided by (used in) operating activities less purchases of property and equipment (inclusive of the purchase and development of software and technology) plus proceeds from sales of property and equipment, as presented in our consolidated statement of cash flows. We define free cash flow less distributions to non-controlling interest as free cash flow less amounts reported in the financing activities section of the statement of cash flows as distributions to non-controlling interest. We believe free cash flow is useful because it provides information to investors regarding the cash that was available in the period that was in excess of our needs to fund our capital expenditures and other investment needs. We believe that free cash flow less distributions to non-controlling interest is useful because it provides information to investors regarding the cash that was available in the period that was in excess of our needs to fund our capital expenditures, other investment needs, and cash distributions to our joint venture partner.

| |

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Net cash provided by (used in) operating activities

|

|

$ |

2,082 |

|

|

$ |

(1,446 |

) |

|

Purchases of property and equipment

|

|

|

(1,083 |

) |

|

|

(1,704 |

) |

|

Purchase and development of software and technology

|

|

|

(70 |

) |

|

|

(263 |

) |

|

Proceeds from sales of property and equipment

|

|

|

421 |

|

|

|

454 |

|

|

Free cash flow

|

|

$ |

1,350 |

|

|

$ |

(2,959 |

) |

|

Distributions to non-controlling interest

|

|

|

(1,000 |

) |

|

|

— |

|

|

Free cash flow less distributions to non-controlling interest

|

|

$ |

350 |

|

|

$ |

(2,959 |

) |

v3.24.3

Document And Entity Information

|

Oct. 30, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NCS Multistage Holdings, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 30, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-38071

|

| Entity, Tax Identification Number |

46-1527455

|

| Entity, Address, Address Line One |

19350 State Highway 249, Suite 600

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77070

|

| City Area Code |

281

|

| Local Phone Number |

453-2222

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

NCSM

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001692427

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

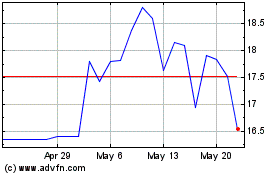

NCS Multistage (NASDAQ:NCSM)

Historical Stock Chart

From Dec 2024 to Jan 2025

NCS Multistage (NASDAQ:NCSM)

Historical Stock Chart

From Jan 2024 to Jan 2025