Universal Display Corporation (Nasdaq: OLED), enabling

energy-efficient displays and lighting with its UniversalPHOLED®

technology and materials, today reported financial results for the

third quarter ended September 30, 2024.

“With strong year-to-date results, we are on track to achieve

record revenues, earnings, and operating cash flow in 2024 as we

continue our growth trajectory. The rate of growth this year,

though, is expected to be more modest than previously projected.

With recent updates to customer order expectations for the fourth

quarter, we are lowering our 2024 revenue forecast range to $625

million to $645 million,” said Brian Millard, Vice President and

Chief Financial Officer of Universal Display Corporation. “We

believe that 2024 marks the start of a new OLED adoption cycle for

medium-sized displays, namely IT and automotive. With leading

tablet, notebook, monitor, as well as auto OEMs expected to broaden

their product roadmaps for OLEDs, significant investments in new

OLED facilities are being deployed for these nascent market

segments. As a leader in the OLED ecosystem, we are enabling and

supporting this long runway of growth. Our world-class technology

continues to set industry standards, our global partnerships

continue to expand and deepen, and we continue to leverage our

unparalleled expertise.”

Financial Highlights for the Third

Quarter of 2024

- Total revenue in the third quarter of 2024 was $161.6 million

as compared to $141.1 million in the third quarter of 2023.

- Revenue from material sales was $83.4 million in the third

quarter of 2024 as compared to $92.5 million in the third quarter

of 2023. The decrease in material sales was primarily due to

changes in customer mix as material volumes were relatively flat

between periods.

- Revenue from royalty and license fees was $74.6 million in the

third quarter of 2024 as compared to $45.9 million in the third

quarter of 2023. The increase in royalty and license fees was

primarily the result of changes in customer mix and a $6.8 million

increase in cumulative catch-up adjustment between periods.

- Cost of material sales was $33.2 million in the third quarter

of 2024 as compared to $31.6 million in the third quarter of 2023.

The increase in cost of material sales was primarily due to product

mix.

- Total gross margin was 78% in the third quarter of 2024 as

compared to 76% in the third quarter of 2023.

- Operating income was $67.0 million in the third quarter of 2024

as compared to $48.4 million in the third quarter of 2023.

- The effective income tax rate was 17.9% and 4.4% in the third

quarter of 2024 and 2023, respectively. The relatively low

effective income tax rate in the third quarter of 2023 was

primarily due to the change in IRS regulations, issued in July

2023, that permitted withholding taxes to be credited against U.S.

taxable income for the taxable years 2022 and 2023.

- Net income was $66.9 million or $1.40 per diluted share in the

third quarter of 2024 as compared to $51.5 million or $1.08 per

diluted share in the third quarter of 2023.

Revenue Comparison

($ in thousands)

Three Months Ended September

30,

2024

2023

Material sales

$

83,428

$

92,492

Royalty and license fees

74,590

45,915

Contract research services

3,609

2,670

Total revenue

$

161,627

$

141,077

Cost of Materials

Comparison

($ in thousands)

Three Months Ended September

30,

2024

2023

Material sales

$

83,428

$

92,492

Cost of material sales

33,172

31,639

Gross margin on material sales

50,256

60,853

Gross margin as a % of material sales

60

%

66

%

Financial Highlights for the First Nine

Months of 2024

- Total revenue in the first nine months of 2024 was $485.4

million as compared to $418.1 million in the first nine months of

2023.

- Revenue from material sales was $272.2 million in the first

nine months of 2024 as compared to $239.8 million in the first nine

months of 2023. The increase in material sales was primarily due to

strengthened demand for our emitter materials, partially offset by

changes in customer mix.

- Revenue from royalty and license fees was $202.4 million in the

first nine months of 2024 as compared to $165.5 million in the

first nine months of 2023. The increase in royalty and license fees

was primarily the result of higher unit material volume and changes

in customer mix during the third quarter of 2024.

- Cost of material sales was $102.8 million in the first nine

months of 2024 as compared to $89.7 million in the first nine

months of 2023 primarily due to an increase in materials sales

volume and product mix, partially offset by a $4.0 million decrease

in inventory reserve expense.

- Total gross margin was 77% in the first nine months of 2024 as

compared to 76% in the first nine months of 2023.

- Operating income was $186.3 million in the first nine months of

2024 as compared to $152.4 million in the first nine months of

2023.

- The effective income tax rate was 18.8% and 16.8% in the first

nine months of 2024 and 2023, respectively.

- Net income was $176.1 million or $3.69 per diluted share in the

first nine months of 2024 compared to $141.0 million or $2.95 per

diluted share in the first nine months of 2023.

Revenue Comparison

($ in thousands)

Nine Months Ended September

30,

2024

2023

Material sales

$

272,154

$

239,789

Royalty and license fees

202,409

165,524

Contract research services

10,828

12,796

Total revenue

$

485,391

$

418,109

Cost of Materials

Comparison

($ in thousands)

Nine Months Ended September

30,

2024

2023

Material sales

$

272,154

$

239,789

Cost of material sales

102,759

89,697

Gross margin on material sales

169,395

150,092

Gross margin as a % of material sales

62

%

63

%

2024 Revised Guidance

The Company now believes that its 2024 revenue will be in the

range of $625 million to $645 million. The OLED industry remains at

a stage where many variables can have a material impact on results,

and the Company thus caveats its financial guidance

accordingly.

Dividend

The Company also announced a fourth quarter cash dividend of

$0.40 per share on the Company’s common stock. The dividend is

payable on December 31, 2024 to all shareholders of record as of

the close of business on December 17, 2024.

Conference Call

Information

In conjunction with this release, Universal Display will host a

conference call on Wednesday, October 30, 2024 at 5:00 p.m. Eastern

Time. The live webcast of the conference call can be accessed under

the events page of the Company's Investor Relations website at

ir.oled.com. Those wishing to participate in the live call should

dial 1-877-524-8416 (toll-free) or 1-412-902-1028. Please dial in

5-10 minutes prior to the scheduled conference call time. An online

archive of the webcast will be available within two hours of the

conclusion of the call.

About Universal Display

Corporation

Universal Display Corporation (Nasdaq: OLED) is a leader in the

research, development and commercialization of organic light

emitting diode (OLED) technologies and materials for use in display

and solid-state lighting applications. Founded in 1994 and with

subsidiaries and offices around the world, the Company currently

owns, exclusively licenses or has the sole right to sublicense more

than 6,000 patents issued and pending worldwide. Universal Display

licenses its proprietary technologies, including its breakthrough

high-efficiency UniversalPHOLED® phosphorescent OLED technology

that can enable the development of energy-efficient and

eco-friendly displays and solid-state lighting. The Company also

develops and offers high-quality, state-of-the-art UniversalPHOLED

materials that are recognized as key ingredients in the fabrication

of OLEDs with peak performance. In addition, Universal Display

delivers innovative and customized solutions to its clients and

partners through technology transfer, collaborative technology

development and on-site training. To learn more about Universal

Display Corporation, please visit https://oled.com/.

Universal Display Corporation and the Universal Display

Corporation logo are trademarks or registered trademarks of

Universal Display Corporation. All other Company, brand or product

names may be trademarks or registered trademarks.

All statements in this document that are not historical, such as

those relating to the projected adoption, development and

advancement of the Company’s technologies, and the Company’s

expected results, as well as the growth of the OLED market and the

Company’s opportunities in that market, are forward-looking

financial statements within the meaning of the Private Securities

Litigation Reform Act of 1995. You are cautioned not to place undue

reliance on any forward-looking statements in this document, as

they reflect Universal Display Corporation’s current views with

respect to future events and are subject to risks and uncertainties

that could cause actual results to differ materially from those

contemplated. These risks and uncertainties are discussed in

greater detail in Universal Display Corporation’s periodic reports

on Form 10-K and Form 10-Q filed with the Securities and Exchange

Commission, including, in particular, the section entitled “Risk

Factors” in Universal Display Corporation’s Annual Report on Form

10-K for the year ended December 31, 2023. Universal Display

Corporation disclaims any obligation to update any forward-looking

statement contained in this document.

Follow Universal Display Corporation X Facebook

YouTube

(OLED-C)

UNIVERSAL DISPLAY CORPORATION

AND SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)

(in thousands, except share and

per share data)

September 30, 2024

December 31, 2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

79,559

$

91,985

Short-term investments

471,993

422,137

Accounts receivable

87,693

139,850

Inventory

175,958

175,795

Other current assets

126,643

87,365

Total current assets

941,846

917,132

PROPERTY AND EQUIPMENT, net of accumulated

depreciation of $158,992 and $143,908

191,195

175,150

ACQUIRED TECHNOLOGY, net of accumulated

amortization of $199,428 and $186,850

77,747

90,325

OTHER INTANGIBLE ASSETS, net of

accumulated amortization of $11,484 and $10,414

5,804

6,874

GOODWILL

15,535

15,535

INVESTMENTS

396,931

299,548

DEFERRED INCOME TAXES

72,138

59,108

OTHER ASSETS

109,686

105,289

TOTAL ASSETS

$

1,810,882

$

1,668,961

LIABILITIES AND SHAREHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$

24,698

$

10,933

Accrued expenses

52,955

52,080

Deferred revenue

47,393

47,713

Other current liabilities

6,119

8,096

Total current liabilities

131,165

118,822

DEFERRED REVENUE

2,376

12,006

RETIREMENT PLAN BENEFIT LIABILITY

54,288

52,249

OTHER LIABILITIES

36,303

38,658

Total liabilities

224,132

221,735

SHAREHOLDERS’ EQUITY:

Preferred Stock, par value $0.01 per

share, 5,000,000 shares authorized, 200,000 shares of Series A

Nonconvertible Preferred Stock issued and outstanding (liquidation

value of $7.50 per share or $1,500)

2

2

Common Stock, par value $0.01 per share,

200,000,000 shares authorized, 48,826,922 and 48,731,026 shares

issued, and 47,461,274 and 47,365,378 shares outstanding, at

September 30, 2024 and December 31, 2023, respectively

488

487

Additional paid-in capital

717,190

699,554

Retained earnings

907,776

789,553

Accumulated other comprehensive income

(loss)

2,578

(1,086

)

Treasury stock, at cost (1,365,648 shares

at September 30, 2024 and December 31, 2023)

(41,284

)

(41,284

)

Total shareholders’ equity

1,586,750

1,447,226

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$

1,810,882

$

1,668,961

UNIVERSAL DISPLAY CORPORATION

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME

(UNAUDITED)

(in thousands, except share and

per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

REVENUE:

Material sales

$

83,428

$

92,492

$

272,154

$

239,789

Royalty and license fees

74,590

45,915

202,409

165,524

Contract research services

3,609

2,670

10,828

12,796

Total revenue

161,627

141,077

485,391

418,109

COST OF SALES

35,812

34,248

111,109

99,357

Gross margin

125,815

106,829

374,282

318,752

OPERATING EXPENSES:

Research and development

36,089

33,099

110,900

96,840

Selling, general and administrative

15,664

18,084

54,757

50,557

Amortization of acquired technology and

other intangible assets

4,551

4,557

13,648

11,442

Patent costs

2,352

2,572

6,735

7,056

Royalty and license expense

154

81

1,928

414

Total operating expenses

58,810

58,393

187,968

166,309

OPERATING INCOME

67,005

48,436

186,314

152,443

Interest income, net

10,592

7,136

30,073

20,301

Other income (loss), net

3,819

(1,693

)

416

(3,180

)

Interest and other income, net

14,411

5,443

30,489

17,121

INCOME BEFORE INCOME TAXES

81,416

53,879

216,803

169,564

INCOME TAX EXPENSE

(14,546

)

(2,363

)

(40,743

)

(28,531

)

NET INCOME

$

66,870

$

51,516

$

176,060

$

141,033

NET INCOME PER COMMON SHARE:

BASIC

$

1.40

$

1.08

$

3.69

$

2.95

DILUTED

$

1.40

$

1.08

$

3.69

$

2.95

WEIGHTED AVERAGE SHARES USED IN COMPUTING

NET INCOME PER COMMON SHARE:

BASIC

47,542,114

47,570,099

47,549,976

47,555,734

DILUTED

47,669,439

47,632,431

47,644,026

47,609,692

CASH DIVIDENDS DECLARED PER COMMON

SHARE

$

0.40

$

0.35

$

1.20

$

1.05

UNIVERSAL DISPLAY CORPORATION

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(UNAUDITED)

(in thousands)

Nine Months Ended September

30,

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income

$

176,060

$

141,033

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

19,488

20,128

Amortization of intangibles

13,648

11,442

Amortization of premium and discount on

investments, net

(5,930

)

(9,436

)

Stock-based compensation

23,812

18,623

Deferred income tax (benefit) expense

(12,878

)

7,556

Retirement plan expense, net of benefit

payments

1,385

2,347

Decrease (increase) in assets:

Accounts receivable

52,157

(29,528

)

Inventory

(163

)

1,814

Other current assets

(39,278

)

(37,653

)

Other assets

(4,397

)

8,292

Increase (decrease) in liabilities:

Accounts payable and accrued expenses

9,405

(32

)

Other current liabilities

(1,977

)

(24,186

)

Deferred revenue

(9,950

)

11,809

Other liabilities

(2,355

)

(4,502

)

Net cash provided by operating

activities

219,027

117,707

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of property and equipment

(29,960

)

(52,208

)

Purchases of intangibles

—

(66,563

)

Purchases of investments

(337,949

)

(303,004

)

Proceeds from sale and maturity of

investments

200,768

346,407

Net cash used in investing activities

(167,141

)

(75,368

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from issuance of common stock

1,776

1,532

Payment of withholding taxes related to

stock-based compensation to employees

(8,251

)

(7,895

)

Cash dividends paid

(57,837

)

(50,083

)

Net cash used in financing activities

(64,312

)

(56,446

)

DECREASE IN CASH AND CASH EQUIVALENTS

(12,426

)

(14,107

)

CASH AND CASH EQUIVALENTS, BEGINNING OF

PERIOD

91,985

93,430

CASH AND CASH EQUIVALENTS, END OF

PERIOD

$

79,559

$

79,323

SUPPLEMENTAL DISCLOSURES:

Unrealized gain on available-for-sale

securities

$

4,117

$

3,304

Common stock issued to Board of Directors

and Scientific Advisory Board that was earned and accrued for in a

previous period

300

300

Net change in accounts payable and accrued

expenses related to purchases of property and equipment

(5,573

)

887

Cash paid for income taxes, net of

refunds

60,772

81,132

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030918292/en/

Universal Display Contact: Darice Liu investor@oled.com

media@oled.com +1 609-964-5123

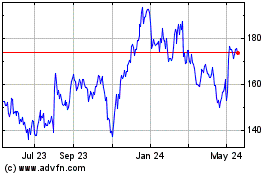

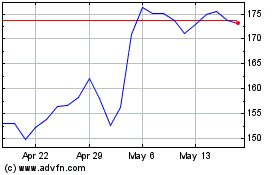

Universal Display (NASDAQ:OLED)

Historical Stock Chart

From Jan 2025 to Feb 2025

Universal Display (NASDAQ:OLED)

Historical Stock Chart

From Feb 2024 to Feb 2025