false0001394056NONE00013940562024-05-152024-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 15, 2024 |

One Stop Systems, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38371 |

33-0885351 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2235 Enterprise Street #110 |

|

Escondido, California |

|

92029 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 760 745-9883 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

OSS |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As described in Item 5.07 below, on May 15, 2024, at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of One Stop Systems, Inc. (the “Company”), the Company’s stockholders approved an amendment (the “Plan Amendment”) to the Company’s 2017 Equity Incentive Plan, as amended (the “2017 Plan”), to increase the number of shares of common stock authorized for issuance thereunder from 3,000,000 shares to 5,000,000 shares. The Plan Amendment was previously approved by the Board of Directors (the “Board”) of the Company, subject to stockholder approval, on March 15, 2024. The Plan Amendment became effective on May 15, 2024 following receipt of stockholder approval.

Additional information regarding the Plan Amendment is set forth in the Company’s Definitive Proxy Statement on Schedule 14A (the “Proxy Statement”) filed by the Company with the Securities and Exchange Commission on April 15, 2024, which information is incorporated herein by reference. Such information and the foregoing description of the Plan Amendment do not purport to be complete and are qualified in their entirety by reference to the full text of the Amendment No. 3 to 2017 Equity Incentive Plan of the Company, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On May 15, 2024, the Company held the Annual Meeting in a virtual format. At the close of business on March 22, 2024, the record date for the Annual Meeting, there were 20,765,435 shares of Company common stock issued and outstanding, which constituted all of the issued and outstanding capital stock of the Company as of the record date. At the Annual Meeting, 13,735,961 of the Company’s 20,765,435 shares of common stock entitled to vote as of the record date, or approximately 66.2%, were represented by proxy or in person (virtually), and, therefore, a quorum was present.

The proposals voted on at the Annual Meeting are more fully described in the Proxy Statement.

The final voting results on the proposals presented for stockholder approval at the Annual Meeting were as follows:

Proposal No. 1: The Company’s stockholders elected seven directors, each to hold office until the Company’s next annual meeting of stockholders, or until their successors are duly elected and qualified, subject to prior death, resignation, or removal, as follows:

|

|

|

|

|

|

|

|

Nominees |

Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

Kenneth Potashner |

3,526,601 |

|

5,645,764 |

|

534,365 |

|

4,029,231 |

Mitchell Herbets |

9,489,709 |

|

207,473 |

|

9,548 |

|

4,029,231 |

Mike Dumont |

9,488,078 |

|

207,671 |

|

10,981 |

|

4,029,231 |

Joseph Manko, Jr. |

9,288,456 |

|

269,732 |

|

148,542 |

|

4,029,231 |

Greg Matz |

7,421,818 |

|

2,275,547 |

|

9,365 |

|

4,029,231 |

Gioia Messinger |

6,092,286 |

|

3,595,118 |

|

19,326 |

|

4,029,231 |

Michael Knowles |

9,493,156 |

|

204,904 |

|

8,670 |

|

4,029,231 |

Proposal No. 2: The Company’s stockholders ratified the appointment of Haskell & White LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024, as follows:

|

|

|

|

|

|

|

Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

12,875,165 |

|

850,599 |

|

10,197 |

|

- |

Proposal No. 3: The Company’s stockholders approved the Plan Amendment to increase the number of shares of the Company's common stock authorized for issuance under the 2017 Plan from 3,000,000 shares to 5,000,000 shares, pursuant to the terms and conditions of the 2017 Plan, as follows:

|

|

|

|

|

|

|

Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

5,782,090 |

|

3,909,420 |

|

15,220 |

|

4,029,231 |

Proposal No. 4: The Company’s stockholders approved, on a non-binding advisory basis, the compensation of the Company’s named executive officers, as follows:

|

|

|

|

|

|

|

Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

6,937,032 |

|

2,336,838 |

|

432,860 |

|

4,029,231 |

Proposal No. 5: The Company’s stockholders voted, on a non-binding advisory basis, in favor of holding an advisory vote to approve the compensation of the Company’s named executive officers on an annual basis, as follows:

|

|

|

|

|

|

|

|

1 Year |

|

2 Years |

|

3 Years |

|

Abstentions |

Broker Non-Votes |

6,415,225 |

|

146,185 |

|

2,729,065 |

|

416,255 |

4,029,231 |

Based on these advisory vote results, the Board has determined that the Company will hold a stockholder advisory vote on executive compensation annually until the next required vote on the frequency of named executive officer compensation votes. As a result, the Company expects that the next advisory vote on the compensation of the Company’s named executive officers will be submitted to stockholders at the Company’s 2025 Annual Meeting.

Proposal No. 6: The Company’s stockholders approved the adjournment of the Annual Meeting to another place, or a later date or dates, if necessary or appropriate, to solicit additional proxies in favor of the proposal listed above at the time of the Annual Meeting, as follows:

|

|

|

|

|

|

|

Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

10,234,907 |

|

3,138,187 |

|

57,986 |

|

304,881 |

Although Proposal No. 6 was approved by the Company’s stockholders, the chair of the Annual Meeting did not elect to adjourn the meeting, as all of the foregoing proposals were also approved.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ONE STOP SYSTEMS, INC. |

|

|

|

|

Date: |

May 20, 2024 |

By: |

/s/ John Morrison |

|

|

|

John Morrison

Chief Financial Officer |

Exhibit 10.1

AMENDMENT NO. 3 TO THE 2017 EQUITY INCENTIVE PLAN

OF

ONE STOP SYSTEMS, INC.

WHEREAS, the Board of Directors and stockholders of One Stop Systems, Inc. (the “Company”) have each adopted and approved the Company’s 2017 Equity Incentive Plan, dated as of October 10, 2017, as amended by (i) that Amendment No. 1 to the 2017 Equity Incentive Plan of the Company, dated as of June 24, 2020, and (ii) that Amendment No. 2 to the 2017 Equity Incentive Plan of the Company, dated as of May 19, 2021 (as amended, the “Plan”);

WHEREAS, pursuant to Section 4(a) of the Plan, a total of 3,000,000 shares of the common stock, par value $0.0001 per share, of the Company (the “Common Stock”) have been reserved for issuance under the Plan;

WHEREAS, the Company desires to increase the aggregate number of shares authorized for issuance under the Plan to 5,000,000 shares of Common Stock, including shares previously issued thereunder; and

WHEREAS, Section 16 of the Plan permits the Company to amend the Plan from time to time, subject only to certain limitations specified therein;

NOW, THEREFORE, the following amendments and modifications are hereby made a part of the Plan subject to, and effective as of the date of, the approval of stockholders of the Plan on May 15, 2024:

1. Section 4(a) of the Plan is hereby amended and restated to read in its entirety as follows:

(a) Shares Subject to the Plan. Subject to the provisions of Section 11 relating to adjustments upon changes in stock, the Award Shares that may be issued pursuant to Stock Awards shall not exceed in the aggregate Five Million (5,000,000) shares of the Company’s Common Stock. Of such amount, Five Million (5,000,000) Award Shares may be issued pursuant to Incentive Stock Options. In the event that (a) all or any portion of any Stock Award granted or offered under the Plan can no longer under any circumstances be exercised or otherwise become vested, or (b) any Award Shares are reacquired by the Company which were initially the subject of a Stock Award Agreement, the Award Shares allocable to the unexercised or unvested portion of such Stock Award, or the Award Shares so reacquired, shall again be available for grant or issuance under the Plan.

2. In all other respects, the Plan, as amended, is hereby ratified and confirmed and shall remain in full force and effect.

IN WITNESS WHEREOF, the Company has executed this Amendment No. 3 to the 2017 Equity Incentive Plan as of May 15, 2024.

|

|

|

|

|

ONE STOP SYSTEMS, INC. |

|

|

|

|

By: |

|

/s/ Michael Knowles |

|

Name: Its: |

|

Michael Knowles

President and Chief Executive Officer |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

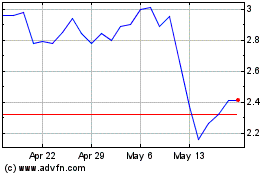

One Stop Systems (NASDAQ:OSS)

Historical Stock Chart

From Feb 2025 to Mar 2025

One Stop Systems (NASDAQ:OSS)

Historical Stock Chart

From Mar 2024 to Mar 2025