Paychex, Inc. (Nasdaq: PAYX) (“Paychex”), an industry-leading

human capital management (HCM) company delivering a full suite of

technology and advisory solutions in human resources, employee

benefit solutions, insurance, and payroll, announced that the

waiting period under the Hart-Scott Rodino Antitrust Improvements

Act of 1976, as amended ("HSR"), has expired with respect to

Paychex’s previously announced acquisition of Paycor HCM, Inc.

(Nasdaq: PYCR) (“Paycor”), a leading provider of HCM, payroll and

talent software.

The expiration of the HSR waiting period satisfies one of the

major conditions to the closing of the acquisition, which remains

subject to other customary closing conditions. The transaction is

expected to close within the first half of calendar year 2025.

About Paychex

Paychex, Inc. (Nasdaq: PAYX) is an industry-leading HCM company

delivering a full suite of technology and advisory services in

human resources, employee benefit solutions, insurance, and

payroll. The company serves over 745,000 customers in the U.S. and

Europe and pays one out of every 12 American private sector

employees. The more than 16,000 people at Paychex are committed to

helping businesses succeed and building thriving communities where

they work and live. To learn more, visit www.paychex.com.

About Paycor

Paycor’s HR, payroll, and talent platform connects leaders to

people, data, and expertise. We help leaders drive engagement and

retention by giving them tools to coach, develop, and grow

employees. We give them unprecedented insights into their

operational data with a unified HCM experience that can seamlessly

connect to other mission-critical technology. By providing expert

guidance and consultation, we help them achieve business results

and become an extension of their teams. Learn more at

paycor.com.

Cautionary Note Regarding Forward-Looking Statements

Certain written statements in this press release may contain,

and members of management may from time to time make or discuss

statements which constitute, "forward-looking statements" within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by such words and phrases as "expect,"

"outlook," "will," guidance," "projections," "anticipate,"

"believe," "can," "could," "design," "may," "possible,"

"potential," "should" and other similar words or phrases.

Forward-looking statements include, without limitation, all matters

that are not historical facts. Examples of forward-looking

statements include, among others, statements we make regarding

operating performance, events, or developments that we expect or

anticipate will occur in the future, including statements relating

to our outlook, revenue growth, earnings, earnings-per-share

growth, and similar projections.

Forward-looking statements are neither historical facts nor

assurances of future performance. Instead, they are based only on

our current beliefs, expectations, and assumptions regarding the

future of our business, future plans and strategies, projections,

anticipated events and trends, the economy, and other future

conditions. Because forward-looking statements relate to the

future, they are subject to known and unknown uncertainties, risks,

changes in circumstances, and other factors that are difficult to

predict, many of which are outside our control. Our actual

performance and outcomes, including without limitation, our actual

results and financial condition, may differ materially from those

indicated in or suggested by the forward-looking statements.

Therefore, you should not rely on any of these forward-looking

statements. Important factors that could cause our actual results

and financial condition to differ materially from those indicated

in the forward-looking statements include, among others, the

following:

- our ability to keep pace with changes in technology or provide

timely enhancements to our solutions and support;

- software defects, undetected errors, and development delays for

our solutions;

- the possibility of cyberattacks, security vulnerabilities or

Internet disruptions, including data security and privacy leaks,

and data loss and business interruptions;

- the possibility of failure of our business continuity plan

during a catastrophic event;

- the failure of third-party service providers to perform their

functions;

- the possibility that we may be exposed to additional risks

related to our co-employment relationship with our PEO

business;

- changes in health insurance and workers’ compensation insurance

rates and underlying claim trends;

- risks related to acquisitions and the integration of the

businesses we acquire;

- our clients’ failure to reimburse us for payments made by us on

their behalf;

- the effect of changes in government regulations mandating the

amount of tax withheld or the timing of remittances;

- our failure to comply with covenants in our debt

agreements;

- changes in governmental regulations, laws, and policies;

- our ability to comply with U.S. and foreign laws and

regulations;

- our compliance with data privacy and artificial intelligence

laws and regulations;

- our failure to protect our intellectual property rights;

- potential outcomes related to pending or future litigation

matters;

- the impact of macroeconomic factors on the U.S. and global

economy, and in particular on our small- and medium-sized business

clients;

- volatility in the political and economic environment, including

inflation and interest rate changes;

- our ability to attract and retain qualified people; and

- the possible effects of negative publicity on our reputation

and the value of our brand.

Any of these factors, as well as such other factors as discussed

in our SEC filings, could cause our actual results to differ

materially from our anticipated results. The information provided

in this document is based upon the facts and circumstances known as

of the date of this press release, and any forward-looking

statements made by us in this document speak only as of the date on

which they are made. Except as required by law, we undertake no

obligation to update these forward-looking statements after the

date of issuance of this press release to reflect events or

circumstances after such date, or to reflect the occurrence of

unanticipated events.

No Offer or Solicitation

This communication is not intended to and shall not constitute

an offer to buy or sell or the solicitation of an offer to buy or

sell any securities, or a solicitation of any vote or approval, nor

shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction.

Additional Information about the Proposed Transaction and

Where to Find It

In connection with the proposed transaction, Paycor has prepared

and mailed a definitive information statement for its stockholders

containing the information with respect to the proposed transaction

specified in Schedule 14C promulgated under the Securities Exchange

Act of 1934, as amended, and describing the proposed transaction.

Paycor stockholders are strongly advised to read all relevant

documents filed by Paycor with the SEC, including Paycor’s

definitive information statement, because they will contain

important information about the proposed transaction. These

documents will be available at no charge on the SEC’s website at

www.sec.gov. In addition, documents will also be available without

charge by visiting the Paycor website at paycor.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227135815/en/

Paychex Investor Relations: Jason

Harbes, Director, Investor Relations Phil Nicosia, Manager,

Investor Relations (800) 828-4411 investors@paychex.com

Paychex Media Inquiries: Tracy

Volkmann Manager, Public Relations (585) 387-6705

tvolkmann@paychex.com

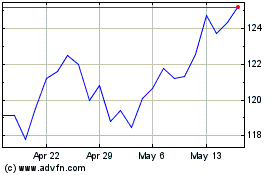

Paychex (NASDAQ:PAYX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Paychex (NASDAQ:PAYX)

Historical Stock Chart

From Mar 2024 to Mar 2025