UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 11-K

| | | | | |

| ý | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-1183

| | | | | | | | |

| A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: | |

The PepsiCo Savings Plan

| | | | | | | | |

| B. | Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: | |

PepsiCo, Inc.

700 Anderson Hill Road

Purchase, New York 10577

THE PEPSICO SAVINGS PLAN

December 31, 2023 and 2022

Index

| | | | | |

| |

| Page |

| Report of Independent Registered Public Accounting Firm | |

| |

| Financial Statements: | |

| |

| Statements of Net Assets Available for Benefits as of December 31, 2023 and 2022 | |

| |

| Statement of Changes in Net Assets Available for Benefits for the year ended | |

| December 31, 2023 | |

| |

| Notes to Financial Statements | |

| |

| Supplemental Schedules: | |

| |

Schedule H, line 4a - Schedule of Delinquent Participant Contributions for the year | |

| ended December 31, 2023 | |

| |

| Schedule H, line 4i - Schedule of Assets (Held at End of Year) as of | |

| December 31, 2023 | |

| |

| Signature | |

| |

| Index to Exhibit | |

Report of Independent Registered Public Accounting Firm

To the Plan Administrator and Plan Participants of

The PepsiCo Savings Plan:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of The PepsiCo Savings Plan (the Plan) as of December 31, 2023 and 2022, the related statement of changes in net assets available for benefits for the year ended December 31, 2023, and the related notes (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023 and 2022, and the changes in net assets available for benefits for the year ended December 31, 2023, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Accompanying Supplemental Information

The Schedule H, line 4a - Schedule of Delinquent Participant Contributions for the year ended December 31, 2023 and Schedule H, line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2023 have been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ KPMG LLP

We have served as the Plan's auditor since 2000.

Cleveland, Ohio

June 14, 2024

THE PEPSICO SAVINGS PLAN

Statements of Net Assets Available for Benefits

as of December 31, 2023 and 2022

(dollars in thousands)

| | | | | | | | | | | | | | |

| | 2023 | | 2022 |

| Assets | | | | |

| Investments: | | | | |

Plan interest in the PepsiCo, Inc. Defined Contribution Plans Master Trust | | $ | 13,335,034 | | | $ | 11,787,830 | |

| | | | |

| Receivables: | | | | |

| Participant contributions | | 15,999 | | | 11,321 | |

| Employer contributions | | 21,566 | | | 11,982 | |

| Notes receivable from participants | | 278,697 | | | 256,089 | |

| Total receivables | | 316,262 | | | 279,392 | |

| | | | |

| Liabilities | | | | |

| Participant contribution payable | | 39 | | | 145 | |

| Net Assets Available for Benefits | | $ | 13,651,257 | | | $ | 12,067,077 | |

See accompanying notes to financial statements.

THE PEPSICO SAVINGS PLAN

Statement of Changes in Net Assets Available for Benefits

for the year ended December 31, 2023

(dollars in thousands)

| | | | | |

| Additions to net assets attributed to: | |

| Gain: | |

| Investment gain from the PepsiCo, Inc. Defined Contribution Plans Master Trust | $ | 1,703,294 | |

| Interest income on notes receivable from participants | 19,752 | |

| Total gain | 1,723,046 | |

| Contributions: | |

| Participants | 709,007 | |

| Rollovers | 86,476 | |

| Employer | 361,547 | |

| Total additions | 2,880,076 | |

| Deductions from net assets attributed to: | |

| Benefits paid to participants | 1,290,759 | |

| Dividends paid to participants | 3,199 | |

| Administrative expenses | 1,938 | |

| Total deductions | 1,295,896 | |

| Net Increase in Net Assets | 1,584,180 | |

| Net Assets Available for Benefits at Beginning of Year | 12,067,077 | |

| Net Assets Available for Benefits at End of Year | $ | 13,651,257 | |

| |

See accompanying notes to financial statements.

THE PEPSICO SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

Note 1 – Description of the Plan

The following brief description of The PepsiCo Savings Plan (the Plan) provides only general information. Participants should refer to the Plan document for a more complete description of the Plan's provisions.

General

In general, the Plan provides a program under which eligible salaried and hourly employees (eligible employees) of PepsiCo, Inc. and certain of its subsidiaries (the Company) may accumulate funds for long-term retirement savings. All eligible employees who are paid in U.S. dollars from a U.S. payroll and classified as full time, and certain other employees as defined in the Plan document, are immediately eligible on their first day of service. Part-time eligible employees who are paid in U.S. dollars from a U.S. payroll who have completed 1,000 hours of service during a 12-month period are eligible to participate in the Plan. Effective January 1, 2024, part-time eligible employees who have completed two consecutive 12-month periods of at least 500 hours of service are eligible to participate in the Plan. Certain employees who are part of a collective bargaining unit and certain other employees, as defined in the Plan document, are not eligible to participate in the Plan.

The Plan is a defined contribution plan with a cash or deferred arrangement and is intended to satisfy the qualification requirements under Sections 401(a) and 401(k) of the Internal Revenue Code of 1986, as amended (the Code). The Plan has an employee stock ownership plan component within its PepsiCo Common Stock Fund. The Plan also has a Roth 401(k) feature. Effective January 1, 2024, the Plan will include an after-tax contribution feature. The participant-directed accounts under the Plan are intended to meet the requirements of Section 404(c) of the Employee Retirement Income Security Act of 1974, as amended (ERISA). In addition, the Plan is subject to the provisions of ERISA.

Administration

The Company maintains sponsorship of the Plan and has established the PepsiCo Investment Committee to oversee the Plan's investment structure. Overall responsibility for administering the Plan rests with the PepsiCo Administration Committee (the Plan Administrator). The trustee for the Plan is Fidelity Management Trust Company (the Trustee), and the recordkeeper for the Plan is Fidelity Workplace Services LLC.

Contributions

Each year, participants are allowed to contribute up to 50% of their earnings, in whole percentage increments, up to a maximum pre-tax and Roth amount under the Code ($22,500 for 2023). Participants may contribute to the Plan any portion of lump-sum distributions received from other qualified plans when the contributions qualify as a tax-free rollover.

Participants who are expected to reach or are over age 50 during a Plan year and are making the maximum contribution are eligible to make additional catch-up contributions (up to an additional 25% of their annual compensation for such Plan year). Under the Code, the maximum allowable catch-up contribution was $7,500 for 2023.

Participants may elect to have their contributions invested in one or more investment options. In general, participants may change their investment elections and transfer their investment amounts between funds on a daily basis, except for transfers from the stable value fund to the self-directed brokerage account; such transfers must be invested into another investment option for a 90-day waiting period. Initial transfers from other investment options to the self-directed brokerage account must be at least $1,000.

THE PEPSICO SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

Salaried employees who are actively accruing benefits, or in a waiting period to actively accrue benefits, under a Company-sponsored defined benefit pension plan are currently not eligible for Company matching or non-matching contributions in the Plan. Benefits will be frozen for salaried employees who are actively accruing benefits under a Company-sponsored defined benefit pension plan effective December 31, 2025, and they will become eligible for Company matching and non-matching contributions as of January 1, 2026. In general, for other eligible employees, the Company matches 50% of employee contributions up to a limit ranging from 4% to 8% of eligible pay based on years of service, which is invested in accordance with employee elections. Company non-matching contributions are based on age and years of service regardless of employee contribution, up to a maximum of 9% of eligible employee pay. Company non-matching contributions are invested in accordance with the employee's investment elections; however, they may not be invested in the self-directed brokerage option or the PepsiCo Common Stock Fund. Effective January 1, 2023, certain eligible hourly employees who are participants in a Company-sponsored defined benefit plan will receive Company non-matching contributions ranging from 6% to 8% of eligible pay above a certain threshold depending on years of service. Eligible union employees may receive different Company matching and other Company contribution amounts.

The Plan has an automatic enrollment program for full-time and part-time hires. Under the program, eligible employees automatically make pre-tax contributions in the amount of 4% to 10% of earnings. Employees that are automatically enrolled have their contribution invested in a target date fund, based on a target date closest to the employee's 65th birthday. An employee may elect out of the automatic enrollment program at any time, as well as make changes to (or maintain) the level of contributions and may re-direct how those contributions are invested.

Participant Accounts

Each participant account is credited with participant contributions, Company contributions, if applicable, and allocations of investment earnings/losses and expenses. Investment earnings/losses and expenses are allocated based on average daily balances. Certain participant investment accounts are also charged with short-term trading and/or monthly investment service fees, depending on the participant's investment elections.

Vesting

Participants are immediately vested in their own contributions and associated investment earnings/losses. In general, participants are fully vested in the Company contributions and associated investment earnings/losses after three years of service. Forfeited non-vested amounts are used to reduce future Company contributions or pay plan administrative expenses. The forfeited non-vested amounts used to reduce Company contributions were $21.3 million in 2023. As of December 31, 2023 and 2022, remaining unused forfeited non-vested accounts totaled $0.2 million and $1.8 million, respectively.

Notes Receivable from Participants

In general, participants who have a vested balance of $2,000 or more in the Plan may borrow from the total of their investment accounts a minimum of $1,000 up to a maximum equal to the lesser of $50,000 (subject to certain offsets for prior loans) or 50% of their vested balance. A participant may have two outstanding loans at a time only if one of them is a principal residence loan. Loan terms range from one to five years for personal loans and up to 15 years for loans related to the purchase of a primary residence. The loans are secured by the balance in the participant's account.

Loans issued before January 1, 2013 bear a fixed rate of interest at the prime lending rate plus 1% at the time the loans were issued. Loans issued on or after January 1, 2013 bear a fixed rate of interest at the prime lending rate plus 2% at the time the loans are issued. Loan repayments are made directly through

THE PEPSICO SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

payroll deductions and are applied first to interest and then to principal according to a payment schedule. There were 41,485 and 37,878 loans outstanding at December 31, 2023 and 2022, respectively, with interest rates ranging from 3.3% to 10.5% with maturities through 2038.

Benefits Paid to Participants

In general, participants may elect to receive a distribution upon hardship, termination, disability, retirement or after the age of 591/2; however, loans and hardship withdrawals may not be taken from Company contribution balances. Hardship distributions are allowed for purchasing a primary residence or financing the higher education of the participant, the participant's spouse or dependent, as well as paying unreimbursed medical bills or alleviating certain other financial hardships. Upon termination, disability or retirement, participants may elect to receive benefits in a lump sum or rollover their account balances into other qualified plans. If a participant dies, the total account balance will be paid to the designated or default beneficiary or to his or her estate. Under certain circumstances, participants may also elect to take in-service distributions of any after-tax contributions, rollover contributions and vested Company matching contributions.

If only a portion of the account is distributed, the remaining balance will continue to be adjusted for any contributions and investment earnings/losses. Participants can elect to receive benefit payments in a lump sum or annual installments for a period no longer than the participant's life expectancy. However, vested account balances of $5,000 or less must be distributed in a lump sum. If the account balance is greater than $1,000 and less than or equal to $5,000, and if a distribution election is not made within the required time frame, that account will be rolled over into a Fidelity Rollover IRA and invested in the Fidelity Government Cash Reserves Fund. If a distribution election is not made within the required time frame for an account balance of $1,000 or less, the account will be distributed automatically.

Termination

Although it has not expressed any intent to do so, the Company may terminate the Plan in accordance with ERISA and the Code. In the event the Plan is terminated, participants would become 100% vested in any Company contributions and the Plan Administrator can direct that all accounts be distributed to the participants or continued in trust for his or her benefit.

Note 2 – Summary of Significant Accounting Policies

Basis of Presentation

The financial statements are prepared under the accrual basis of accounting. The preparation of the financial statements in conformity with U.S. generally accepted accounting principles requires the Plan's management to make estimates and assumptions that affect the reported amounts of assets, liabilities, additions to net assets, deductions from net assets and disclosure of contingent assets and liabilities. Actual results could differ from those estimates and assumptions.

Investment Valuation and Income Recognition

The Plan retains a 100% interest in the PepsiCo, Inc. Defined Contribution Plans Master Trust (PepsiCo Master Trust), which holds investments in various securities, commingled trust funds and a stable value fund. These investments are recorded at fair value, except for the fully benefit-responsive investment contracts within the stable value fund. Within the stable value fund, the collective investment trust is recorded at fair value, while the synthetic investment contracts are recorded at contract value. Contract value is the relevant measure for the portion of the net assets available for benefits of fully benefit-responsive investment contracts because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan.

THE PEPSICO SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

Purchases and sales of securities are recognized on the trade date. Interest income is recorded as earned and dividend income is recorded as of the ex-dividend date.

Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Notes receivable from participants are deemed delinquent as of the end of the calendar quarter following the calendar quarter in which the loan repayment is due and unpaid. Delinquent notes receivable from participants are recorded as benefits paid to participants.

Payment of Benefits

The Plan accounts for benefits when paid.

Note 3 – PepsiCo Master Trust

Plan Interest

The Plan is the only investor in the PepsiCo Master Trust. The Plan's interest in the net assets of the PepsiCo Master Trust was 100% at December 31, 2023 and 2022.

The PepsiCo Master Trust net assets are detailed below by asset category.

| | | | | | | | |

| December 31,

2023 | December 31,

2022 |

| (in thousands) |

| Investments, at fair value: | | |

| Cash and cash equivalents | $ | 47,719 | | $ | 53,995 | |

| PepsiCo common stock | 1,680,941 | | 1,894,177 | |

| | |

| Money market fund | 10,546 | | 12,140 | |

| Fixed income securities | 252,310 | | 251,149 | |

| | |

| Commingled trust funds | 9,853,660 | | 8,116,014 | |

| | |

| | |

| | |

| Self-directed brokerage | 687,232 | | 534,204 | |

| 12,532,408 | | 10,861,679 | |

Investments at contract value: fully benefit-responsive synthetic investment contracts | 793,291 | | 917,267 | |

| Interest and dividends receivable | 12,672 | | 9,577 | |

| Other receivables | 25,351 | | 24,174 | |

| Other liabilities | (28,688) | | (24,867) | |

| Net assets | $ | 13,335,034 | | $ | 11,787,830 | |

| | |

| Year ended

December 31,

2023 | |

| (in thousands) |

| Investment gain: | |

| Net appreciation in value of investments* | $ | 1,636,040 | |

| |

| |

| |

| |

| |

| |

| |

Interest and dividends | 67,254 | |

| Net investment gain | $ | 1,703,294 | |

| * Includes net appreciation of investments at contract value | |

| |

THE PEPSICO SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

Stable Value Fund

The PepsiCo Master Trust holds investments in a stable value fund, which consists of bond portfolios wrapped in fully benefit-responsive synthetic investment contracts. The majority of the portfolios are made up of government, corporate, mortgage-backed and asset-backed securities. The fully benefit-responsive investment contracts enable the fund to realize a specific known value for the assets if it needs to liquidate them for benefit payments.

The synthetic investment contracts are issued by five investment grade financial institutions and intend to preserve the value of the fund's investments by mitigating fluctuations in the market value of the associated bond portfolios. These synthetic investment contracts are benefit-responsive in that they allow for participant withdrawals at contract value. Contract value represents contributions made under the contract plus earnings, less participant withdrawals and administrative expenses. The contract value of these investments was $793.3 million and $917.3 million as of December 31, 2023 and 2022, respectively.

The crediting interest rate is based on a formula agreed upon with the issuer, but may not be less than zero. Such interest rates are reviewed on a quarterly basis.

Certain events, such as layoffs or early retirement incentives, may limit the ability of participants to access their investments at contract value. The likelihood of such events limiting the ability of the Plan to transact at contract value is not probable. Consistent with industry practice, a contract provider can terminate its contract with, on average, 30 days' notice, provided a for-cause termination event has not occurred. The Plan's contractual right for a wind-down period allows the contract to remain in force, including maintaining benefit-responsive payments to participants, for a period required to converge the market and book values of the contract, which is expected to be, on average, two to three years.

Note 4 – Fair Value Measurements

The guidance on fair value measurements defines fair value, establishes a framework for measuring fair value and identifies required disclosures related to fair value measurements. The fair value framework requires the categorization of assets and liabilities into three levels based upon the assumptions (inputs) used to value the assets and liabilities. Level 1 provides the most reliable measure of fair value, whereas Level 3 generally requires significant judgment.

THE PEPSICO SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

PepsiCo Master Trust assets measured at fair value as of December 31, 2023 and 2022 are categorized consistently by Level 1 (Quoted Prices in Active Markets for Identical Assets) and Level 2 (Significant Other Observable Inputs) in both years, with no assets categorized as Level 3 (Significant Unobservable Inputs), and are as follows:

| | | | | | | | | | | | | | | | | |

| Fair Value Hierarchy Level | | 2023 | | 2022 |

| | | | | |

| | | (in thousands) |

| Assets | | | | | |

| | | | | |

Cash and cash equivalents(a) | 1 | | $ | 47,719 | | | $ | 53,995 | |

PepsiCo common stock(b) | 1 | | 1,680,941 | | | 1,894,177 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Money market fund(b) | 1 | | 10,546 | | | 12,140 | |

Fixed income securities(c) | 2 | | 252,310 | | | 251,149 | |

| | | | | |

| | | | | |

Commingled trust funds(d) | 1 | | 9,853,660 | | | 8,116,014 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Self-directed brokerage(b,d,e) | 1 | | 687,232 | | | 534,204 | |

| Total assets at fair value | | | $ | 12,532,408 | | | $ | 10,861,679 | |

(a)Restricted in use.

(b)Based on quoted market prices in active markets.

(c)Based primarily on yields currently available on comparable securities with similar credit ratings and a compilation of primary observable market information.

(d)Based on the published price of the fund.

(e)Includes cash and cash equivalents held in self-directed brokerage accounts.

Note 5 – Administrative Expenses

In general, the Company pays most of the usual and reasonable direct expenses of the Plan and the Plan Administrator. Any direct expenses not borne by the Company are paid by the Trustee out of the PepsiCo Master Trust. If applicable, expenses related to short-term trading fees, monthly investment service fees and loan fees are charged to participants' investment balances and are reflected in the value of the participants' accounts. Any other indirect expenses, such as investment management fees, are reflected in the change in net asset value of the various funds.

Note 6 – Risks and Uncertainties

The Plan provides for investment options in various securities and funds that invest in equity and debt securities and other investments. Such investments are exposed to risks and uncertainties, such as interest rate risk, credit risk, economic changes, political unrest, geopolitical instability, regulatory changes and foreign currency risk. The Plan's exposure to a concentration of credit risk is dependent upon the investments selected by participants. These risks and uncertainties could impact the participants' account balances and the amounts reported in the financial statements. Approximately 12% and 16% of the Plan's net assets available for benefits were invested in common stock of the Company through the PepsiCo Master Trust at December 31, 2023 and 2022, respectively. The underlying value of the Company's stock is impacted by the performance of the Company, the market's evaluation of such performance and other factors.

Note 7 – Tax Status

The Plan's latest favorable determination letter, received from the Internal Revenue Service, is dated March 11, 2015. Although the Plan has been amended since receiving this determination letter, the Plan Administrator believes the Plan is designed and currently being operated in compliance with the

THE PEPSICO SAVINGS PLAN

Notes to Financial Statements

December 31, 2023 and 2022

applicable requirements of the Code and, therefore, the Plan is qualified and the related master trust is tax exempt.

Certain 2019, 2020 and 2022 participant contributions, including loan repayments, transferred late to the Plan, listed on Schedule H, line 4a - Schedule of Delinquent Participant Contributions, were fully corrected under the U.S. Department of Labor's Voluntary Fiduciary Correction Program (VFCP) as of December 31, 2023.

The Plan is subject to routine audits by taxing jurisdictions. There are currently no audits in progress for any tax periods. U.S. generally accepted accounting principles require the Plan's management to evaluate uncertain tax positions taken by the Plan. The Plan Administrator has concluded that as of December 31, 2023 and 2022, there are no uncertain tax positions taken or expected to be taken that would require recognition of a liability or disclosure in the financial statements.

Note 8 – Related Party Transactions

Certain Plan investments in the PepsiCo Master Trust are shares of mutual funds managed by an affiliate of the Trustee. Additionally, the PepsiCo Master Trust holds investments in shares of the Company's common stock in the PepsiCo Common Stock Fund. The fair value of the PepsiCo Master Trust investments in the Company's common stock was approximately $1.7 billion and $1.9 billion as of December 31, 2023 and 2022, respectively. There have been no known prohibited transactions with a party-in-interest.

Note 9 – Subsequent Events

The Plan Administrator has evaluated subsequent events through the date the financial statements were issued.

THE PEPSICO SAVINGS PLAN

Supplemental Schedule H, line 4a – Schedule of Delinquent Participant Contributions

for the year ended December 31, 2023

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Year Ended | | Participant Contributions Transferred Late to Plan, including Loan Repayments | | Contributions Corrected in VFCP | | Contributions Pending Correction in VFCP |

| 2022 | | $ | 4,675 | | | $ | 4,675 | | | $ | — | |

| 2020 | | $ | 264 | | | $ | 264 | | | $ | — | |

| 2019 | | $ | 14,039 | | | $ | 14,039 | | | $ | — | |

See accompanying report of independent registered public accounting firm.

THE PEPSICO SAVINGS PLAN

Supplemental Schedule H, line 4i – Schedule of Assets (Held at End of Year)

as of December 31, 2023

(dollars in thousands)

| | | | | | | | | | | | | | |

| | | | |

Identity of issuer,

borrower, lessor, or

similar party | | Description of investment including

maturity date, rate of interest,

collateral, par, or maturity value | | Current

value |

| *Notes Receivable from Participants | | Notes Receivable from Participants (41,485 loans outstanding with interest rates ranging from 3.3% to 10.5% with maturities through 2038) | | $ | 278,697 | |

| | | | |

*Party-in-interest as defined by ERISA.

See accompanying report of independent registered public accounting firm.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| Date: June 14, 2024 | | | | THE PEPSICO SAVINGS PLAN |

| | |

| | | | /s/ Duncan Micallef |

| | | | Duncan Micallef |

| | | | Chair, PepsiCo Administration Committee |

THE PEPSICO SAVINGS PLAN

December 31, 2023 and 2022

Index to Exhibit

| | | | | | | | |

| 23.1 | Consent of Independent Registered Public Accounting Firm | |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the registration statements (Nos. 2-82645, No. 33-51514, No. 33-60965, No. 333-65992, No. 333-76204, No. 333-66634, No. 333‑165106, No. 333-89265, No. 333-76196, No. 333-150867, and No. 333-150868) on Form S-8 of our report dated June 14, 2024, with respect to the financial statements of The PepsiCo Savings Plan.

/s/ KPMG LLP

Cleveland, Ohio

June 14, 2024

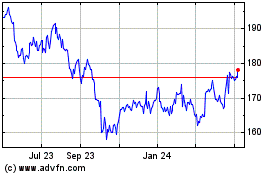

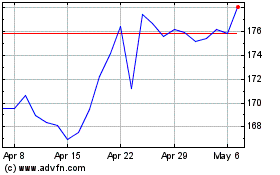

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From May 2024 to Jun 2024

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Jun 2023 to Jun 2024