0001675634false00016756342023-09-012023-11-30iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

As filed with the Securities and Exchange Commission on January 29, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SHIFTPIXY, INC. |

(Exact name of registrant as specified in its charter) |

Wyoming | | 7361 | | 47-4211438 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

4101 NW 25th Street

Miami, FL 33142

(888) 798-9100

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Scott Absher

Chief Executive Officer

4101 NW 25th Street

Miami, FL 33142

(888) 798-9100

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Gregory Sichenzia, Esq. Jeff Cahlon, Esq. Sichenzia Ross Ference Carmel LLP 1185 Avenue of the Americas, 31st Floor New York, New York 10036 Tel: (212) 930-9700 | | Mark Crone, Esq. David Aboudi, Esq. Cassi Olson, Esq. The Crone Law Group P.C. 420 Lexington Avenue, Suite 2446 New York, New York 10170 Tel: (646) 861-7891 |

As soon as practicable after the effective date of this registration statement

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JANUARY 29, 2024 |

Up to shares of Common Stock

Common Warrants to Purchase up to Shares of Common Stock

Pre-Funded Warrants to Purchase up to Shares of Common Stock

Up to shares of Common Stock underlying the Common Warrants

Up to shares of Common Stock underlying the Pre-Funded Warrants

ShiftPixy, Inc. is offering, on a best efforts basis, up to $ of shares of our common stock, par value $0.0001 per share, together with common warrants to purchase up to shares of common stock, (the “Common Warrants”). Each share of our common stock, or pre-funded warrant in lieu thereof (the “Pre-Funded Warrants”), is being sold together with a Common Warrant. The shares of common stock and Common Warrants are immediately separable and will be issued separately in this offering, but must be purchased together in this offering.

We have assumed a public offering price of $ per share and accompanying Common Warrant, based on the last reported sale price of our common stock on , 2024. The Common Warrants will be exercisable immediately, have an assumed initial exercise price of per share, and will expire five years from the date of issuance. The actual public offering price will be determined between us, A.G.P./Alliance Global Partners (whom we refer to herein as “AGP” or the “Placement Agent”) and the investors in the offering, and may be at a discount to the current market price of our common stock. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price.

We are also offering Pre-funded Warrants to purchase up to shares of common stock to those purchasers whose purchase of shares of common stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, in lieu of shares of common stock that would result in beneficial ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each Pre-funded Warrant is exercisable for one share of our common stock and has an exercise price of $0.0001 per share. Each Pre-funded Warrant is being offered together with the Common Warrants. The Pre-funded Warrants and Common Warrants are immediately separable and will be issued separately in this offering, but must be purchased together in this offering. For each Pre-funded Warrant that we sell, the number of shares of common stock we are offering will be reduced on a one-for-one basis.

Pursuant to this prospectus, we are also offering the shares of common stock issuable upon the exercise of Pre-funded Warrants and Common Warrants offered hereby. These securities are being sold in this offering to certain purchasers under a securities purchase agreement dated , 2024 between us and the purchasers.

We have engaged the Placement Agent in connection with the securities offered in this prospectus. The Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of securities but has agreed to use its best efforts to sell the securities offered by this prospectus. We have agreed to pay the Placement Agent a fee based upon the aggregate gross proceeds raised in this offering as set forth in the table below.

The shares of our common stock, Pre-funded Warrants or Common Warrants being offered will be sold in a single closing. The shares issuable upon exercise of the Pre-funded Warrants or Common Warrants will be issued upon the exercise thereof. The offering is being conducted on a best effort basis and there is no minimum number of securities or minimum aggregate amount of proceeds for this offering to close. We may sell fewer than all of the securities offered hereby, and investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to pursue the business goals outlined in this prospectus. Because there is no escrow account and there is no minimum offering amount, investors could be in a position where they have invested in our company, but we are unable to fulfill our objectives due to a lack of interest in this offering. Also, any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan. The offering of the shares of our common stock, Pre-funded Warrants or Common Warrants will terminate no later than , 2024; however, the shares of our common stock underlying the Pre-funded Warrants and the Common Warrants will be offered on a continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”).

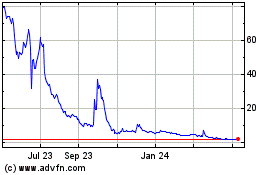

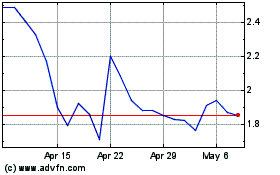

Our common stock is listed on The Nasdaq Capital Market (“Nasdaq”), under the symbol “PIXY.” On January 26, 2024, the last reported sale price of our common stock was $5.49 per share. We do not intend to list the Pre-funded Warrants or the Common Warrants offered pursuant to this prospectus on any national securities exchange or other nationally recognized trading system.

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and, as such, have elected to comply with certain reduced public disclosure requirements for this prospectus and future filings. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus to read about factors you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | Per Share and Common Warrant | | | Per Pre-Funded Warrant and Accompanying Common Warrant | | | Total | |

Public offering price | | $ | | | | | | | | $ | | |

Placement Agent Fees(1) | | $ | | | | | | | | $ | | |

Proceeds to us, before expenses(2) | | $ | | | | | | | | $ | | |

(1) | Does not include certain expenses of the Placement Agent. See “Plan of Distribution” beginning on page __ of this prospectus for additional information regarding compensation to be received by the Placement Agent. |

(2) | The amount of proceeds, before expenses, to us does not give effect to any exercise of the Pre-funded Warrants or Common Warrants. |

Delivery of the shares of our common stock, Pre-funded Warrants and Common Warrants is expected to be made on or about , 2024.

Sole Placement Agent

A.G.P.

The date of this prospectus is , 2024

TABLE OF CONTENTS

You should rely only on the information contained in or incorporated by reference in this prospectus or in any free writing prospectus that we may provide to you in connection with this offering. Neither we nor the Placement Agent have authorized anyone to provide you with information different from, or in addition to, that contained in or incorporated by reference in this prospectus or any such free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We can provide no assurance as to the reliability of any other information that others may give you. Neither we nor the placement agent is making an offer to sell or seeking offers to buy these securities in any jurisdiction where or to any person to whom the offer or sale is not permitted. The information in this prospectus is accurate only as of the date on the front cover of this prospectus, and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of such free writing prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates.

PROSPECTUS SUMMARY This summary highlights selected information included elsewhere in or incorporated by reference in this prospectus and does not contain all the information that you should consider before investing in our securities. You should read the entire prospectus carefully, especially “Risk Factors” and the financial statements and related notes and other information incorporated by reference into this prospectus, before deciding whether to participate in the offering described in this prospectus. In this prospectus, unless expressly noted or the content indicates otherwise, the words “we,” “us,” “our,” “ShiftPixy,” “Company” and similar references mean ShiftPixy, Inc. and its subsidiaries. Company Overview ShiftPixy is dedicated to providing a comprehensive Human Capital Management (“HCM”) and Engagement platform that addresses the complete spectrum of employment needs. Our services encompass recruitment, staffing, payroll and related employment tax processing, human resources, employment compliance, employment-related insurance, and administrative solutions. We cater to various business clients, primarily focusing on sectors characterized by high employee turnover and dynamic staffing requirements. Connecting both workers and those that manage them through an elegant AI-powered, cloud based, mobile architecture that navigates and moves all stakeholders through the daily duties of hourly labor. Initially, our core business targeted the restaurant and hospitality sectors, industries known for their high turnover rates and part-time, flexible employment structures. However, recognizing the evolving market demands and opportunities, we have strategically shifted towards light industrial staffing solutions. This pivot aligns with our goal to broaden our market reach and address the substantial needs of warehouses, manufacturing units, logistics, and similar sectors experiencing rapid growth and increasing reliance on flexible staffing solutions. This shift also brings our business into better margin engagements with large national clients. Our revenue comes through the administrative or processing fees we receive as a percentage of a client's gross payroll. These fees vary depending on the level and complexity of services provided, ranging from essential payroll processing to an extensive suite of human resource information system “HRIS” technology and staffing solutions. Our commitment is to provide adaptable, scalable, and cost-effective human capital solutions that align with the unique needs and goals of our clients. |

THE OFFERING

Securities offered | | Up to shares of common stock, and common warrants to purchase an aggregate of shares of our common stock (“Common Warrants”), or pre-funded warrants to purchase shares of common stock (“Pre-funded Warrants”), and Common Warrants to purchase shares of common stock.(1) The shares of common stock or Pre-funded Warrants, respectively, and Common Warrants are immediately separable and will be issued separately in this offering, but must initially be purchased together in this offering. Each Common Warrant has an assumed exercise price of $ per share and will expire five years from the date of issuance. We are also registering the shares of our common stock issuable upon exercise of the Common Warrants and Pre-funded Warrants. |

| | |

Warrants we are offering | | We are also offering to those purchasers whose purchase of common stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the closing of this offering, in lieu of purchasing common stock, Pre-funded Warrants to purchase up to an aggregate of shares of our common stock. Each Pre-funded Warrant is exercisable for one share of our common stock. The purchase price of each Pre-funded Warrant is equal to the price at which a share of common stock is being sold to the public in this offering, minus $0.0001, and the exercise price of each Pre-funded Warrant is $0.0001 per share. The Pre-funded Warrants are exercisable immediately and may be exercised at any time until all of the Pre-funded Warrants are exercised in full. This offering also relates to the shares of common stock issuable upon exercise of any Pre-funded Warrants sold in this offering. For each Pre-funded Warrant that we sell, the number of shares of common stock that we are offering will be reduced on a one-for-one basis. |

| | |

Common stock outstanding immediately before this offering | | 5,397,698 |

| | |

Common stock to be outstanding after this offering | | shares of common stock. |

| | |

Use of proceeds | | We estimate that the net proceeds to us from this offering will be approximately $ million, after deducting placement agent fees and commissions and estimated offering expenses. We intend to use the net proceeds of this offering for general corporate purposes, including working capital, operating expenses and capital expenditures. See “Use of Proceeds.” |

| | |

Risk factors | | Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page __ of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

| | |

Nasdaq symbol | | Our common stock is listed on Nasdaq under the symbol “PIXY.” |

(1) Based on assumed public offering price of $ , the closing price of our common stock on ____, 2024.

Unless otherwise indicated, all information contained in this prospectus assumes the sale of all of the shares offered hereby at an assumed public offering price of $ per share and accompanying Common Warrant, no sale of any Pre-Funded Warrants, and no exercise of any Common Warrants. The number of shares of our common stock that are and will be outstanding immediately before and after this offering as shown above is based on 5,397,698 shares outstanding as of January 22, 2024. The number of shares outstanding as of January 22, 2024, as used throughout this prospectus, unless otherwise indicated, excludes, as of that date:

| · | 232,679 shares issuable upon exercise of outstanding warrants with a weighted average exercise price of $131.47; |

| | |

| · | 295 shares issuable upon exercise of outstanding options with a weighted average exercise price of $11,581.79; and |

| | |

| · | 1,208 shares issuable to certain of our directors as compensation for accrued services. |

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the following risks and all of the other information contained or incorporated by reference in this prospectus before deciding whether to invest in our securities, including the risks and uncertainties described below and under the caption “Risk Factors” in our most recently filed Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the SEC, in each case as these risk factors are amended or supplemented by subsequent Annual Reports on Form 10-K or Quarterly Reports on Form 10-Q. Our business, financial condition, results of operations and future prospects may be adversely affected as a result of such risks. In such an event, the market price of our common stock could decline, and you could lose part or all of your investment.

Risks Relating to this Offering and Ownership of Our Securities

We have incurred losses in the past, our financial statements have been prepared on a going concern basis and we may be unable to achieve or sustain profitability in the future.

We are an emerging business and are in the process of developing our products and services. We have been in business since July 2015. We expect to continue to incur operating losses for the foreseeable future and may never achieve profitability. Furthermore, even if we do achieve profitability, we may not be able to sustain or increase profitability on an ongoing basis. If we do not achieve profitability, it will be more difficult for us to finance our business and accomplish our strategic objectives.

Our recurring losses from operations and negative cash flows raise substantial doubt about our ability to continue as a going concern. As a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements for the fiscal years ended, August 31, 2023 and 2022, describing the existence of substantial doubt about our ability to continue as a going concern.

If we are unable to continue to meet the listing requirements of Nasdaq, our common stock will be delisted.

Our common stock currently trades on Nasdaq, where it is subject to various listing requirements. On September 15, 2023, we received a letter from the staff of the Listing Qualifications Department (the “Staff”) of Nasdaq, which notified the Company that its common stock failed to maintain a minimum bid price of $1.00 over the previous 30 consecutive business days as required by Nasdaq’s Listing Rule 5550(a)(2). On October 30, 2023, the Company received a letter from the Staff notifying the Company that for the last 10 consecutive business days, the closing bid price of the Company’s common stock has been at $1.00 per share or greater and accordingly, the Company has regained compliance with Listing Rule 5550(a)(2). On June 5, 2023, Nasdaq notified us that we were not in compliance with Nasdaq Listing Rule 5550(b)(1) as our listed securities had a market value of less than $35 million. On December 14, 2023, we received a letter from the Staff notifying the Company that the Staff determined that for the last 10 consecutive business days, the Company’s market value of listed securities has been $35 million or greater and accordingly, the Company has regained compliance with Rule 5550(b)(1). If we are unable to maintain compliance with such listing standards or other Nasdaq listing requirements in the future, we could be subject to suspension and delisting proceedings. A delisting of our common stock and our inability to list on another national securities market could negatively impact us by: (i) reducing the liquidity and market price of our common stock; (ii) reducing the number of investors willing to hold or acquire our common stock, which could negatively impact our ability to raise equity financing; (iii) limiting our ability to use certain registration statements to offer and sell freely tradable securities, thereby limiting our ability to access the public capital markets; and (iv) impairing our ability to provide equity incentives to our employees.

Purchasers in the offering will suffer immediate dilution.

If you purchase securities in this offering, the value of your shares based on our net tangible book value will immediately be less than the offering price you paid. This reduction in the value of your equity is known as dilution. At the assumed public offering price of $ per share, purchasers of common stock in this offering will experience immediate dilution of approximately $ per share. See “Dilution.”

The Common Warrants are speculative in nature.

The Common Warrants will be exercisable for five years from the date of initial issuance at an assumed exercise price of $ per share (assuming an exercise price equal to ___% of the assumed public offering price per share). There can be no assurance that the market price of the common stock will ever equal or exceed the exercise price of the Common Warrants. In the event that our common stock price does not exceed the exercise price of the Common Warrants during the period when the Common Warrants are exercisable, a holder of the Common Warrants may be unable to profit from exercising such Common Warrants before they expire.

The Pre-funded Warrants or the Common Warrants will not be listed or quoted on any exchange.

There is no established public trading market for the Pre-funded Warrants or Common Warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the Pre-funded Warrants or Common Warrants on any national securities exchange or other nationally recognized trading system, including Nasdaq. Without an active market, the liquidity of the Pre-funded Warrants and the Common Warrants will be limited.

Except as otherwise provided in the Common Warrants and Pre-funded Warrants, holders of Common Warrants and Pre-funded Warrants purchased in this offering will have no rights as stockholders until such holders exercise their Common Warrants or Pre-funded Warrants and acquire our common stock.

Except as otherwise provided in the Common Warrants and Pre-funded Warrants, until holders of Common Warrants or Pre-funded Warrants acquire our common stock upon exercise of the Common Warrants or Pre-funded Warrants, holders of Common Warrants and Pre-funded warrants will have no rights with respect to our common stock underlying such Common Warrants and Pre-funded Warrants. Upon exercise of the Common Warrants and Pre-funded Warrants, the holders will be entitled to exercise the rights of a holder of our common stock only as to matters for which the record date occurs after the exercise date.

This is a best efforts offering; no minimum amount of securities is required to be sold, and we may not raise the amount of capital we believe is required for our business.

The Placement Agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. There is no required minimum number of securities that must be sold as a condition to completion of this offering. Because there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, Placement Agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth in this prospectus. We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to pursue the business goals outlined in this prospectus. Thus, we may not raise the amount of capital we believe is required for our business and may need to raise additional funds, which may not be available or available on terms acceptable to us. Despite this, any proceeds from the sale of securities offered by us will be available for our immediate use, and because there is no escrow account and no minimum offering amount in this offering, investors could be in a position where they have invested in us, but we are unable to fulfill our objectives due to a lack of interest in this offering.

Our management will have broad discretion over the use of the net proceeds from this offering.

We currently intend to use the net proceeds from the sale of our securities under this offering for general corporate purposes, including working capital. We have not reserved or allocated specific amounts for any of these purposes and we cannot specify with certainty how we will use the net proceeds (see “Use of Proceeds”). Accordingly, our management will have considerable discretion in the application of the net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. We may use the net proceeds for corporate purposes that do not increase our operating results or market value.

Future sales of our common stock could lower our stock price and dilute existing stockholders.

We may, in the future, sell additional shares of common stock in subsequent public or private offerings. We cannot predict the size or terms of future issuances of our common stock or the effect, if any, that future sales and issuances of shares of our common stock will have on the market price of our common stock. Sales of substantial amounts of our common stock, or the perception that such sales could occur, may adversely affect prevailing market prices for our common stock. In addition, these sales may be dilutive to existing stockholders.

We have not paid cash dividends in the past and do not expect to pay dividends in the future. Any return on investment may be limited to the value of our common stock, which may decrease in value.

We have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting us at such time as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if our stock price appreciates.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

All statements in this prospectus and the documents incorporated by reference that are not historical facts should be considered “Forward Looking Statements” within the meaning of the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Some of the forward-looking statements can be identified by the use words such as “believe,” “expect,” “may,” “estimates,” “should,” “seek,” “approximately,” “intend,” “plan,” “estimate,” “project,” “continue” or “anticipates” or similar expressions or words, or the negatives of those expressions or words. These statements may be made directly in this prospectus and they may also be incorporated by reference in this prospectus from other documents filed with the SEC, and include, but are not limited to, statements about future financial and operating results and performance, statements about our plans, objectives, expectations and intentions with respect to future operations, products and services, and other statements that are not historical facts. These forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements.

USE OF PROCEEDS

We estimate that the net proceeds to us from this offering from the sale of the securities will be approximately $ million, after deducting the Placement Agent fees and estimated offering expenses.

We intend to use the net proceeds we receive from this offering for general corporate purposes, including working capital. Our management will have broad discretion in the application of the net proceeds.

As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds to us from this offering. Accordingly, our management will have broad discretion in the timing and application of these proceeds.

CAPITALIZATION

The following table sets forth our cash, as well as our capitalization, as of November 30, 2023, as follows:

| · | on an actual basis; and |

| | |

| · | on an as adjusted basis, giving effect to the assumed sale by us of shares of common stock in this offering at an assumed public offering price of $ per share and accompanying Common Warrant, after deducting the Placement Agent fees and other estimated offering expenses payable by us. |

You should read this table in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements for the period ended November 30, 2023, and the related notes thereto, included in our quarterly report on Form 10-Q for the period ended November 30, 2023 and incorporated by reference in this prospectus.

| | Actual | | | As Adjusted | |

Cash | | $ | 1,493,000 | | | $ | | |

Total liabilities | | $ | 61,656,000 | | | $ | 61,656,000 | |

Stockholders’ deficit: | | | | | | | | |

Preferred stock, 50,000,000 authorized shares; $0.0001 par value: 0 shares issued and outstanding | | $ | 0 | | | $ | 0 | |

Common stock, 750,000,000 authorized shares; $0.0001 par value; 5,397,687 shares issued and outstanding, actual, shares issued and outstanding, as adjusted | | $ | - | | | $ | - | |

Additional paid-in capital | | $ | 177,417,000 | | | $ | | |

Accumulated deficit | | $ | (231,899,000 | ) | | $ | (231,899,000 | ) |

Total stockholders’ deficit | | $ | | | | $ | | |

The number of shares to be outstanding immediately after giving effect to this offering as shown above is based on 5,397,687 shares outstanding as of November 30, 2023, and excludes, as of such date:

| · | 232,679 shares issuable upon exercise of outstanding warrants with a weighted average exercise price of $131.47; |

| | |

| · | 295 shares issuable upon exercise of outstanding options with a weighted average exercise price of $11,581.79; and |

| | |

| · | 1,208 shares issuable to certain of our directors as compensation for accrued services. |

DILUTION

If you invest in our common stock in this offering, your ownership interest will be diluted immediately to the extent of the difference between the public offering price per share of our common stock and the as adjusted net tangible book value per share of our common stock after this offering.

Our historical net tangible (negative) book value as of November 30, 2023, was $_________, or $____ per share of common stock based on 5,397,687 shares of common stock outstanding as of November 30, 2023. Historical net tangible book value per share is calculated by subtracting our total liabilities from our total tangible assets, which is total assets less intangible assets, and dividing this amount by the number of shares of common stock outstanding as of such date.

After giving effect to the assumed sale by us of shares of common stock at an assumed public offering price of $ per share (without attributing any value to the Common Warrants), and after deducting the Placement Agent fees and estimated offering expenses payable by us, our as adjusted net tangible negative book value as of November 30, 2023 would have been approximately $ or $ per share of common stock. This represents an immediate increase in the net tangible negative book value of $ per share to our existing shareholders and an immediate and substantial dilution in net tangible book value of $ per share to new investors. The following table illustrates this hypothetical per share dilution:

Assumed public offering price per share | | $ | | |

Historical net tangible negative book value per share as of November 30, 2023 | | $ | | |

Increase in net tangible negative book value, as adjusted, per share attributable to this offering | | $ | | |

As adjusted net tangible negative book value per share as of November 30, 2023, after giving effect to this offering | | $ | | |

Dilution per share to new investors purchasing shares in this offering | | $ | | |

A $1.00 increase (decrease) in the assumed combined public offering price per share of common stock, would result in an incremental increase (decrease) in our as adjusted net tangible negative book value of approximately $___ million or approximately $__ per share, and would result in an incremental increase (decrease) in the dilution to new investors of approximately $___ per share, assuming that the number of shares of our common stock sold by us remains the same and after deducting the Placement Agent fees and estimated offering expenses payable by us.

The information discussed above is illustrative only and will adjust based on the actual public offering price, the actual number of securities sold in this offering and other terms of this offering determined at pricing.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of January 22, 2024, with respect to the beneficial ownership of the outstanding common stock by (i) any holder of more than five (5%) percent; (ii) each of our executive officers and directors; and (iii) our directors and executive officers as a group.

We have determined beneficial ownership in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities. The table lists applicable percentage ownership based on 5,397,698 shares of common stock outstanding as of January 22, 2024. In addition, under SEC rules, beneficial ownership of common stock includes shares of our common stock issuable pursuant to the conversion or exercise of securities that are either immediately exercisable or convertible into common stock or exercisable or convertible into common stock within 60 days of January 22, 2024. These shares are deemed to be outstanding and beneficially owned by the person holding those securities for the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated, the persons identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws. Except as otherwise noted below, the address for persons listed in the table is c/o ShiftPixy Inc., 4101 NW 25th Street, Miami, FL 33142

Name | | Number of Shares Beneficially Owned | | | Beneficial Ownership Percentage Prior to the Offering | | | Beneficial Ownership Percentage After the Offering(3) | |

Scott W. Absher | | | 4,750,298 | (1) | | | 88.0 | % | | | % |

Douglas Beck | | | 0 | | | | - | | | | - | |

Martin Scott | | | 0 | | | | - | | | | - | |

Whitney J. White | | | 1 | | | * | | | * | |

Christopher Sebes | | | 0 | | | | - | | | | - | |

Amanda Murphy | | | 25 | (2) | | * | | | * | |

All executive officers and directors (6 persons) | | | 4,750,323 | | | | 88.0 | % | | | % |

* | Less than 1% |

(1) | Includes 21 shares of common stock underlying options exercisable within 60 days of January 22, 2024. |

(2) | Represents shares underlying options exercisable within 60 days of January 22, 2024. |

(3) | Assumes the sale of shares of common stock and Common Warrants at a combined assumed public offering price of $ per share and accompanying Common Warrant in this offering. |

DESCRIPTION OF CAPITAL STOCK

We are authorized to issue up to 750,000,000 shares of common stock, par value $0.0001 per share, and 50,000,000 shares of preferred stock, par value $0.0001 per share.

The following is a summary of the material terms of our capital stock and certain provisions of our certificate of incorporation and bylaws. Since the terms of our certificate of incorporation and bylaws, and Wyoming law, are more detailed than the general information provided below, you should only rely on the actual provisions of those documents and Wyoming law. If you would like to read those documents, they are on file with the SEC, as described under the heading “Where You Can Find More Information” below. The summary below is also qualified by provisions of applicable law.

Common Stock

Voting Rights. Holders of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of the shareholders. Wyoming law provides for cumulative voting for the election of directors. As a result, any shareholder may cumulate his or her votes by casting them all for any one director nominee or by distributing them among two or more nominees. This may make it easier for minority shareholders to elect a director.

Dividends. Subject to preferences that may be granted to any then outstanding preferred stock, holders of our common stock are entitled to receive ratably such dividends as may be declared by our board of directors out of funds legally available therefor as well as any distributions to the shareholders. The payment of dividends on our common stock will be a business decision to be made by our board of directors from time to time based upon results of our operations and our financial condition and any other factors that our board of directors considers relevant. Payment of dividends on our common stock may be restricted by loan agreements, indentures and other transactions we enter into from time to time.

Liquidation Rights. In the event of our liquidation, dissolution or winding up, holders of our common stock are entitled to share ratably in all of our assets remaining after payment of liabilities and the liquidation preference of any then outstanding preferred stock.

Absence of Other Rights or Assessments. Holders of our common stock have no preferential, preemptive, conversion or exchange rights. There is no redemption or sinking fund provisions applicable to our common stock. When issued in accordance with our articles of incorporation and bylaws, shares of our common stock are fully paid and not liable for further calls or assessment by us.

Pre-funded Warrants to be issued in this offering

The following summary of certain terms and conditions of the Pre-funded Warrants is not complete and is subject to, and qualified in its entirety by, the provisions of Pre-funded Warrant, the form of which is filed as an exhibit to the registration statement of which this prospectus forms a part. Prospective investors should carefully review the terms and provisions of the form of Pre-funded Warrant for a complete description of the terms and conditions of the Pre-funded Warrants.

General

The term “pre-funded” refers to the fact that the purchase price of the Pre-funded Warrants in this offering includes almost the entire exercise price that will be paid under the Pre-funded Warrants, except for a nominal remaining exercise price of $0.0001. The purpose of the Pre-funded Warrants is to enable investors that may have restrictions on their ability to beneficially own more than 4.99% (or, at the election of the holder, 9.99%) of our outstanding common stock following the consummation of this offering the opportunity to invest capital into the Company without triggering their ownership restrictions, by receiving Pre-funded Warrants in lieu of shares of our common stock which would result in such ownership of more than 4.99% (or, at the election of the holder, 9.99%), and receiving the ability to exercise their option to purchase the shares underlying the Pre-funded Warrants at a nominal price at a later date.

Form

The Pre-funded Warrants will be issued as individual warrant agreements to the investors. You should review the form of Pre-funded Warrant, filed as an exhibit to the registration statement of which this prospectus forms a part, for a complete description of the terms and conditions applicable to the Pre-funded Warrants.

Exercisability

The Pre-funded Warrants are exercisable at any time after their original issuance. The Pre-funded Warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full in immediately available funds for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as described below). A holder (together with its affiliates) may not exercise any portion of the Pre-funded Warrant to the extent that the holder would own more than 4.99% (or, at the election of the holder, 9.99%) of the outstanding common stock immediately after exercise, except that upon at least 61 days’ prior notice from the holder to us, the holder may increase the amount of ownership of outstanding stock after exercising the holder’s Pre-funded Warrants up to 9.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Pre-funded Warrants.

Duration and Exercise Price

The exercise price per whole share of our common stock purchasable upon the exercise of the Pre-funded Warrants is $0.0001 per share of common stock. The Pre-funded Warrants will be immediately exercisable and may be exercised at any time until the Pre-funded Warrants are exercised in full.

Cashless Exercise

If, at any time after the issuance of the Pre-funded Warrants, the holder exercises its pre-funded warrants and a registration statement registering the issuance of the shares of common stock underlying the Pre-funded Warrants under the Securities Act is not then effective or available (or a prospectus is not available for the resale of shares of common stock underlying the Pre-funded Warrants), then in lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder shall instead receive upon such exercise (either in whole or in part) only the net number of shares of common stock determined according to a formula set forth in the Pre-funded Warrants. Notwithstanding anything to the contrary, in the event we do not have or maintain an effective registration statement, there are no circumstances that would require us to make any cash payments or net cash settle the Pre-funded Warrants to the holders.

Transferability

Subject to applicable laws, the Pre-funded Warrants may be offered for sale, sold, transferred or assigned at the option of the holder upon surrender of the Pre-funded Warrants to us together with the appropriate instruments of transfer.

Exchange Listing

There is no established trading market for the Pre-funded Warrants and we do not plan on applying to list the Pre-funded Warrants on The Nasdaq Capital Market any other national securities exchange or any other nationally recognized trading system.

Fundamental Transactions

If, at any time while the Pre-funded Warrants are outstanding, (1) we consolidate or merge with or into another corporation whether or not the Company is the surviving corporation, (2) we sell, lease, license, assign, transfer, convey or otherwise dispose of all or substantially all of our assets, or any of our significant subsidiaries, (3) any purchase offer, tender offer or exchange offer (whether by us or another individual or entity) is completed pursuant to which holders of our common stock are permitted to sell, tender or exchange their shares for other securities, cash or property and has been accepted by the holders of 50% or more of our common stock, (4) we consummate a securities purchase agreement or other business combination with another person or entity whereby such other person or entity acquires more than 50% of our outstanding common stock, or (5) we effect any reclassification or recapitalization of our common stock or any compulsory exchange pursuant to which our common stock is converted into or exchanged for other securities, cash or property, or each, a “Fundamental Transaction,” then upon any subsequent exercise of pre-funded warrants, the holders thereof will have the right to receive the same amount and kind of securities, cash or property as they would have been entitled to receive upon the occurrence of such Fundamental Transaction if they had been, immediately prior to such Fundamental Transaction, the holder of the number of shares of common stock then issuable upon exercise of those pre-funded warrants, and any additional consideration payable as part of the Fundamental Transaction.

Rights as a Stockholder

Except by virtue of such holder’s ownership of shares of our common stock or as otherwise set forth in the Pre-Funded Warrants, the holder of a Pre-funded Warrant does not have the rights or privileges of a holder of our common stock, including any voting rights, until the holder exercises the Pre-funded Warrant.

Common warrants to be issued in this offering

The following summary of certain terms and provisions of the Common Warrants offered hereby is not complete and is subject to, and qualified in its entirety by the provisions of the form of Common Warrant, which is filed as an exhibit to the registration statement of which this prospectus is a part. Prospective investors should carefully review the terms and provisions set forth in the form of Common Warrant.

Duration and Exercise Price. Each Common Warrant offered hereby will have an assumed initial exercise price per share equal to $ (assuming an exercise price equal to ___% of the public offering price per share). The Common Warrants will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. The exercise price and number of shares of common stock issuable upon exercise is subject to appropriate adjustment in the event of stock dividends, stock splits, reorganizations or similar events affecting our common stock and the exercise price. A Common Warrant to purchase one share of our common stock will be issued for every one share of common stock and Pre-funded Warrant purchased in this offering. The Common Warrants will be issued in certificated form.

Exercisability. The Common Warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of the Common Warrant to the extent that the holder would own more than 4.99% (or, at the election of the purchaser, 9.99%) of the outstanding common stock immediately after exercise, except that upon notice from the holder to us, the holder may increase or decrease the beneficial ownership limitation up to 9.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Common Warrants, provided that any increase in such beneficial ownership limitation shall not be effective until 61 days following notice from the holder to us. No fractional shares of common stock will be issued in connection with the exercise of a Common Warrant. In lieu of fractional shares, we will round up to the next whole share.

Cashless Exercise. If, at the time a holder exercises its Common Warrants, a registration statement registering the issuance of the shares of common stock underlying the Common Warrants under the Securities Act is not then effective or available, then in lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of common stock determined according to a formula set forth in the Common Warrants.

Transferability. Subject to applicable laws, the Common Warrants may be transferred at the election of the holder upon surrender of the Common Warrant to the Company together with the appropriate instruments of transfer.

Exchange Listing. There is no established public trading market for the Common Warrants, and we do not expect a market to develop. In addition, we do not intend to list the Common Warrants on any securities exchange or nationally recognized trading system.

Fundamental Transaction. In the event of a fundamental transaction, as described in the form of Common Warrant, and generally including any reorganization, recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding common stock, or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding common stock, the holders of the Common Warrants will be entitled to receive upon exercise of the common warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the Common Warrants immediately prior to such fundamental transaction.

Right as a Stockholder. Except as otherwise provided in the Common Warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of the Common Warrants do not have the rights or privileges of holders of our common stock, including any voting rights, until they acquire shares of our common stock upon exercise of their Common Warrants.

Preferred Stock

Our board of directors is authorized by our articles of incorporation to establish classes or series of preferred stock and fix the designation, powers, preferences and rights of the shares of each such class or series and the qualifications, limitations or restrictions thereof without any further vote or action by our shareholders. Any shares of preferred stock so issued would have priority over our common stock with respect to dividend or liquidation rights. Any future issuance of preferred stock may have the effect of delaying, deferring or preventing a change in our control without further action by our shareholders and may adversely affect the voting and other rights of the holders of our common stock.

Outstanding Warrants

As of January 22, 2024, we had 232,679 outstanding warrants with a weighted average exercise price of $131.47 per share, with a weighted average remaining life of 5.3 years.

Outstanding Options

As of January 22, 2024, we have 295 outstanding options with a weighted average exercise price of $11,581.79 per share, with a weighted average remaining contractual life of 6.6 years. There are 30,955 shares remaining available under the 2017 Stock Option/Stock Issuance Plan .

Certain Anti-Takeover Effects

Certain provisions of Wyoming law may have an anti-takeover effect and may delay or prevent a tender offer or other acquisition transaction that a shareholder might consider to be in his or her best interest. The summary of the provisions of Wyoming law set forth below does not purport to be complete and is qualified in its entirety by reference to Wyoming law.

The issuance of shares of preferred stock, the issuance of rights to purchase such shares, and the imposition of certain other adverse effects on any party contemplating a takeover could be used to discourage an unsolicited acquisition proposal. For instance, the issuance of the preferred stock, if the option to acquire such shares is exercised, would impede a business combination by the voting rights that would enable a holder to block such a transaction. In addition, under certain circumstances, the issuance of other preferred stock could adversely affect the voting power of holders of our common stock.

Under Wyoming law, a director, in determining what he or she reasonably believes to be in or not opposed to the best interests of the corporation, does not need to consider only the interests of the corporation’s shareholders in any matter but may also, in his or her discretion, consider any of the following:

| (i) | The interests of the corporation’s employees, suppliers, creditors and customers; |

| | |

| (ii) | The economy of the state and nation; |

| | |

| (iii) | The impact of any action upon the communities in or near which the corporation’s facilities or operations are located; |

| | |

| (iv) | The long-term interests of the corporation and its shareholders, including the possibility that those interests may be best served by the continued independence of the corporation; and |

| | |

| (v) | Any other factors relevant to promoting or preserving public or community interests. |

Because our board of directors is not required to make any determination on matters affecting potential takeovers solely based on its judgment as to the best interests of our shareholders, our board of directors could act in a manner that would discourage an acquisition attempt or other transaction that some, or a majority, of our shareholders might believe to be in their best interests or in which such shareholders might receive a premium for their stock over the then market price of such stock. Our board of directors presently does not intend to seek shareholder approval prior to the issuance of currently authorized stock, unless otherwise required by law or applicable stock exchange rules.

PLAN OF DISTRIBUTION

A.G.P. has agreed to act as our exclusive placement agent in connection with this offering subject to the terms and conditions of the letter agreement dated January 8, 2024. The Placement Agent is not purchasing or selling any of the securities offered by this prospectus, nor is it required to arrange the purchase or sale of any specific number or dollar amount of securities, but has agreed to use its reasonable best efforts to arrange for the sale of all of the securities offered hereby. Therefore, we may not sell the entire amount of securities offered pursuant to this prospectus. We will enter into a securities purchase agreement directly with certain investors, at the investor’s option, who purchase our securities in this offering. Investors who do not enter into a securities purchase agreement shall rely solely on this prospectus in connection with the purchase of our securities in this offering.

We will deliver the securities being issued to the investors upon receipt of such investor’s funds for the purchase of the securities offered pursuant to this prospectus. We expect to deliver the securities being offered pursuant to this prospectus on or about , 2024.

We have agreed to indemnify the Placement Agent and specified other persons against specified liabilities, including liabilities under the Securities Act, and to contribute to payments the Placement Agent may be required to make in respect thereof.

Fees and Expenses

We have engaged A.G.P. as our exclusive placement agent in connection with this offering. This offering is being conducted on a “best efforts” basis and the Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay the Placement Agent a fee based on the aggregate proceeds as set forth in the table below:

| | Per share and Common Warrant | | | Per Pre-Funded Warrant and Accompanying Common Warrant | | | Total | |

Public offering price | | $ | | | | $ | | | | $ | | |

Placement Agent fees(1) | | $ | | | | $ | | | | $ | | |

Proceeds to us, before expenses(2) | | $ | | | | $ | | | | $ | | |

(1) | We have agreed to pay the Placement Agent a cash placement commission equal to 7.0% of the aggregate proceeds from the sale of the shares of common stock, the Common Warrants and Pre-funded Warrants sold in this offering. |

(2) | The amount of proceeds, before expenses, to us does not give effect to any exercise of the Pre-funded Warrants or Common Warrants. |

We have agreed to pay the Placement Agent’s accountable legal expenses relating to the offering in the amount of $100,000, and to pay the Placement Agent non-accountable expenses in connection with the offering in the amount of $50,000. We estimate the total expenses payable by us for this offering, excluding the Placement Agent fees and expenses, will be approximately $ .

The Placement Agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized on the resale of the shares sold by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. As an underwriter, the Placement Agent would be required to comply with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares by the Placement Agent acting as principal. Under these rules and regulations, the Placement Agent:

| · | may not engage in any stabilization activity in connection with our securities; and |

| · | may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed its participation in the distribution. |

Listing

Our common stock is listed on The Nasdaq Capital Market under the trading symbol “PIXY.” We do not plan to list the Pre-funded Warrants or the Common Warrants on the Nasdaq Capital Market or any other securities exchange or trading market.

Lock-Up Agreements

Pursuant to “lock-up” agreements, we and our executive officers and directors have agreed, subject to limited exceptions, not to directly or indirectly offer to sell, sell, pledge or otherwise transfer or dispose of any of shares of (or enter into any transaction or device that is designed to, or could be expected to, result in the transfer or disposition by any person at any time in the future of) our common stock, enter into any swap or other derivatives transaction that transfers to another, in whole or in part, any of the economic benefits or risks of ownership of shares of our common stock, make any demand for or exercise any right or cause to be filed a registration statement, including any amendments thereto, with respect to the registration of any shares of common stock or securities convertible into or exercisable or exchangeable for common stock or any of our other securities or publicly disclose the intention to do any of the foregoing, subject to customary exceptions, for a period of 90 days from the effective date of this registration statement, with respect to our officers and directors, and 30 days from the closing date of this offering, with respect to us.

Discretionary Accounts

The Placement Agent does not intend to confirm sales of the securities offered hereby to any accounts over which it has discretionary authority.

Transfer Agent and Registrar

VStock Transfer LLC as the transfer agent and registrar for our common stock.

Other Activities and Relationships

The Placement Agent and certain of its affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. The Placement Agent and certain of its affiliates have, from time to time, performed, and may in the future perform, various commercial and investment banking and financial advisory services for us and our affiliates, for which they received or will receive customary fees and expenses.

In the ordinary course of their various business activities, the Placement Agent and certain of its affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers, and such investment and securities activities may involve securities and/or instruments issued by us and our affiliates. If the Placement Agent or its affiliates have a lending relationship with us, they routinely hedge their credit exposure to us consistent with their customary risk management policies. The Placement Agent and its affiliates may hedge such exposure by entering into transactions that consist of either the purchase of credit default swaps or the creation of short positions in our securities or the securities of our affiliates, including potentially the common stock offered hereby. Any such short positions could adversely affect future trading prices of the common stock offered hereby. The Placement Agent and certain of its affiliates may also communicate independent investment recommendations, market color or trading ideas and/or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

The foregoing does not purport to be a complete statement of the terms and conditions of the placement agent agreement or the securities purchase agreement, copies of which are attached to the registration statement of which this prospectus is a part. See “Where You Can Find More Information.”

LEGAL MATTERS

We are being represented by Sichenzia Ross Ference Carmel LLP, New York, New York, with respect to certain legal matters as to United States federal securities and New York state law. The enforceability of the Pre-Funded Warrants and Common Warrants will be passed upon for us by Sichenzia Ross Ference Carmel LLP, New York, New York. The validity of the securities offered hereby will be passed upon for us by Bailey, Stock, Harmon, Cottam, Lopez LLP, Cheyenne, Wyoming. The Placement Agent is being represented by The Crone Law Group P.C., New York, New York in connection with this offering.

EXPERTS

The consolidated financial statements of ShiftPixy, Inc. as of August 31, 2023 and for each of the two years in the period ended August 31, 2023 appearing in our Annual Report on Form 10-K for the year ended August 31, 2023, have been audited by Marcum LLP, an independent registered public accountant, as set forth in its report thereon included therein, which include an explanatory paragraph as to the Company’s ability to continue as a going concern and an emphasis of matter paragraph related to the risks and uncertainties related to the Company’s outstanding payroll tax liabilities and which are incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” information that we file with them. Incorporation by reference allows us to disclose important information to you by referring you to those other documents. The information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. We filed a registration statement on Form S-1 under the Securities Act with the SEC with respect to the securities being offered pursuant to this prospectus. This prospectus omits certain information contained in the registration statement, as permitted by the SEC. You should refer to the registration statement, including the exhibits and schedules attached to the registration statement and the information incorporated by reference, for further information about us and the securities being offered pursuant to this prospectus. Statements in this prospectus regarding the provisions of certain documents filed with, or incorporated by reference in, the registration statement are not necessarily complete, and each statement is qualified in all respects by that reference. Copies of all or any part of the registration statement, including the documents incorporated by reference or the exhibits, may be obtained upon payment of the prescribed rates at the offices of the SEC listed below in “Where You Can Find More Information.” The documents we are incorporating by reference into this prospectus are:

| · | Our Annual Report on Form 10-K for the fiscal year ended August 31, 2023, filed with the SEC on December 14, 2023; |

| · | Our Quarterly Report on Form 10-Q for the period ended November 30, 2023, filed with the SEC on January 22 2024; |

| · | Our Current Reports on Form 8-K filed on September 18, 2023, September 26, 2023, September 29, 2023, October 10, 2023, October 12, 2023, October 18, 2023, and October 31, 2023; and |

| · | The description of our common stock contained in our Registration Statement on Form 8-A, registering our common stock under Section 12(b) under the Exchange Act, filed with the SEC on June 28, 2017. |

All documents subsequently filed by us with the SEC under Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act (other than current reports on Form 8-K furnished pursuant to Item 2.02 or Item 7.01 of Form 8-K, including any exhibits included with such information, unless otherwise indicated therein) prior to the termination or completion of the offering made pursuant to this prospectus are also incorporated herein by reference and will automatically update and supersede information contained or incorporated by reference in this prospectus.

You may request a copy of these filings, at no cost, by writing or telephoning us at the following address: ShiftPixy, Inc., Attention: Corporate Secretary, 4101 NW 25th Street, Miami, FL 33142, (888) 798-9100.

All documents subsequently filed by us with the SEC under Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act (other than current reports on Form 8-K furnished pursuant to Item 2.02 or Item 7.01 of Form 8-K, including any exhibits included with such information, unless otherwise indicated therein) prior to the termination or completion of the offering made pursuant to this prospectus are also incorporated herein by reference and will automatically update and supersede information contained or incorporated by reference in this prospectus.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-1 under the Securities Act with respect to the securities offered hereby. This prospectus, which constitutes a part of the registration statement, does not contain all of the information set forth in the registration statement or the exhibits and schedules filed therewith. For further information about us and our securities offered hereby, we refer you to the registration statement and the exhibits and schedules filed therewith. Statements contained in this prospectus regarding the contents of any contract or any other document that is filed as an exhibit to the registration statement are not necessarily complete, and each such statement is qualified in all respects by reference to the full text of such contract or other document filed as an exhibit to the registration statement. The SEC maintains a website that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC. The address is http://www.sec.gov.

We are subject to the reporting requirements of the Exchange Act, and file annual, quarterly and current reports, proxy statements and other information with the SEC. You can read our SEC filings, including the registration statement, over the Internet at the SEC’s website.We also maintain a website at http://www.shiftpixy.com, at which you may access these materials free of charge as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The information contained in, or that can be accessed through, our website is not part of this prospectus. You may also request a copy of these filings, at no cost, by writing or telephoning us at: 4101 NW 25th Street, Miami, FL 33142, (888) 798-9100.

Prospectus

Up to shares of Common Stock

Common Warrants to Purchase up to Shares of Common Stock

Pre-Funded Warrants to Purchase up to Shares of Common Stock

Up to shares of Common Stock underlying the Common Warrants

Up to shares of Common Stock underlying the Pre-Funded Warrants

Sole Placement Agent

A.G.P.

, 2024

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 13. Other Expenses of Issuance and Distribution

The following table sets forth all costs and expenses, other than the placement agent fees, expected to be incurred by us in connection with the sale of the securities being registered. All amounts shown are estimates except for the SEC registration fee and the FINRA filing fee.

| | Amount Paid or to be Paid | |

SEC registration fee | | $ | 5,904 | |

FINRA filing fee | | $ | 6,500 | |

Printing and engraving expenses | | $ | 15,000 | |

Legal fees and expenses | | $ | 200,000 | |

Accounting fees and expenses | | $ | 35,000 | |

Transfer agent and registrar fees and expenses | | $ | 5,000 | |

Miscellaneous fees and expenses | | $ | 5,000 | |

Total | | $ | 272,404 | |

Item 14. Indemnification of Directors and Officers

Sections 17-16-851 through -856 of the Wyoming Statutes (the “Applicable Statutes”) provide that directors and officers of Wyoming corporations may, under certain circumstances, be indemnified against expenses (including attorneys’ fees) and other liabilities actually and reasonably incurred by them as a result of any suit brought against them in their capacity as a director or officer, if they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, if they had no reasonable cause to believe their conduct was unlawful. The Applicable Statutes also provide that directors and officers may also be indemnified against expenses (including attorneys’ fees) incurred by them in connection with a derivative suit if they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification may be made without court approval if such person was adjudged liable to the corporation.

Further, Article V of our articles of incorporation, as amended, also provides as follows regarding our indemnification of our directors, officers, employees and agents:

“[t]o the fullest extent permitted by the Wyoming Business Corporation Act or any other applicable law as now in effect or as it may hereafter be amended, no person who is or was a director of the Corporation shall be personally liable to the Corporation or its shareholders for monetary damages for breach of fiduciary duty as a director, except for liability for (A) the amount of financial benefit received by a director to which he or she is not entitled; (B) an intentional infliction of harm on the Corporation or the Shareholders; (C) a violation of Section 17-16-833 of the Wyoming Business Corporation Act; or (D) an intentional violation of criminal law. If the Wyoming Business Corporation Act is amended after the effective date of this Amendment to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the Corporation shall be eliminated or limited to the fullest extent permitted by the Wyoming Business Corporation Act, as so amended.

The Corporation shall indemnify to the fullest extent permitted by the Wyoming Business Corporation Act, as the same may be amended and supplemented from time to time, any and all persons whom it shall have power to indemnify under the Wyoming Business Corporation Act. The indemnification provided for herein shall not be exclusive of any other rights to which those seeking indemnification may be entitled as a matter of law under any Bylaw, agreement, vote of shareholders or disinterested directors of the Corporation, or otherwise, both as to action in such indemnified person’s official capacity and as to action in another capacity while serving as a director, officer, employee, or agent of the Corporation, and shall continue as to a person who has ceased to be a director, officer, employee, or agent of the Corporation, and shall inure to the benefit of the heirs, executors and administrators of such person.

Any repeal or modification of this Article V or amendment to the Wyoming Business Corporation Act shall not adversely affect any right or protection of a director, officer, agent, or other person existing at the time of or increase the liability of any director, officer, agent, or other person of the Corporation with respect to any acts or omissions of such director, officer, or agent occurring prior to, such repeal, modification, or amendment.

The Corporation shall have the power to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the Corporation or is or was serving at the request of the Corporation as a director, officer, employee or agent to another corporation, partnership, joint venture, trust or other enterprise, against any liability asserted against such person and incurred by such person in any such capacity or arising out of his status as such, whether or not the Corporation would have the power to indemnify him against liability under the provisions of this Article V.”

Further, Article XIV of our Bylaws also provides as follows regarding our indemnification of our directors, officers, employees and agents: