false

0001689548

0001689548

2024-10-11

2024-10-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 11, 2024

PRAXIS PRECISION MEDICINES, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-39620 |

47-5195942 |

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

Praxis Precision Medicines, Inc.

99 High Street, 30th Floor

Boston, Massachusetts 02110

(Address of principal executive offices, including

zip code)

(617) 300-8460

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trade

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.0001 par value per share |

|

PRAX |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In October 2024, Praxis Precision Medicines, Inc.

(the “Company”) entered into amendments (the “Amendments”)

to the Company’s employment agreements (the “Employment Agreements”)

with each of the Company’s named executive officers, Marcio Souza, President and Chief Executive Officer, Timothy Kelly, Chief Financial

Officer, and Alex Nemiroff, General Counsel (collectively, the “Executives”).

Amendments to Severance in Connection with

a Change-in-Control

Pursuant to the Amendments, in the event an Executive’s

termination of employment by the Company without “cause” or due to the Executive’s resignation for “good reason”

(as each such term is defined in the applicable Employment Agreement) (each, a “qualifying termination”)

occurs within three months before or 18 months after a “change of control” (as defined in the applicable

Employment Agreement), then, in lieu of the payments and benefits described in the section below, the Executive will be eligible to receive

(i) a lump sum in cash in an amount equal to (x) one (1) times (or 1.75 times for Mr. Souza) the sum of (A) the Executive’s then

current annual base salary (or the annual base salary in effect immediately prior to the change of control, if higher) plus (B) the Executive’s

target annual bonus for the year of termination (or the target annual bonus in effect immediately prior to the change of control, if higher);

plus (y) a prorated portion of the Executive’s target annual bonus for the year of termination; (ii) any earned but unpaid annual

bonus for the year prior to the year of the Executive’s qualifying termination; (iii) subject to the Executive’s co-payment

of premium amounts at the applicable active employees’ rate and proper election to continue COBRA health coverage, the Company will

cover the portion of the premium amount equal to the amount that the Company would have paid to provide health insurance to the Executive

had the Executive remained employed with the Company (the “COBRA Payments”)

until the earliest of (x) 12 months (or 18 months for Mr. Souza) following termination, (y) the date the Executive becomes eligible for

group health insurance coverage through a new employer, or (z) the date the Executive ceases to be eligible for COBRA; and (iv) accelerated

vesting of the Executive’s stock options and other stock-based awards in the Company that are subject solely to time-based vesting,

with any stock options and other stock-based awards that vest in whole or in part based on the attainment of performance-vesting conditions

being governed by the terms of the applicable award agreement.

Amendments to Severance Outside of a Change-in-Control

In the event of an Executive’s

qualifying termination,

the Executive will be eligible to receive (i) base salary continuation for nine months (or 12 months for Mr. Souza) following

termination; (ii) any earned but unpaid annual bonus for the year prior to the year of the Executive’s termination; (iii) a

prorated portion of the Executive’s annual bonus for the calendar year in which the termination occurs, based on actual

performance for the year and payable when bonuses for such year are paid to actively employed senior executives of the Company; and

(iv) the COBRA Payments until the earliest of (x) nine months (or 12 months for Mr. Souza) following termination, (y) the date the

Executive becomes eligible for group health insurance coverage through a new employer, or (z) the date the Executive ceases to be

eligible for COBRA.

The applicable Executive’s receipt of the

severance payments and benefits described above is subject to the Executive’s execution and non-revocation of a general release

of claims in favor of the Company and, if the payments would be subject to the golden parachute excise tax under Section 4999 of the Internal

Revenue Code, potential reduction if it results in a higher net after-tax benefit to the Executive.

The foregoing description of the Amendments is

qualified in its entirety by reference to the full text of each Amendment, which are filed as Exhibits 10.1, 10.2 and 10.3 to this Current

Report on Form 8-K and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit

No. |

|

Description |

| 10.1 |

|

Employment Agreement Amendment Letter, dated October 11, 2024, by and between Marcio Souza and Praxis Precision Medicines, Inc. |

| 10.2 |

|

Employment Agreement Amendment Letter, dated October 11, 2024, by and between Timothy Kelly and Praxis Precision Medicines, Inc. |

| 10.3 |

|

Employment Agreement Amendment Letter, dated October 11, 2024, by and between Alex Nemiroff and Praxis Precision Medicines, Inc. |

| 104 |

|

Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

PRAXIS PRECISION MEDICINES, INC. |

| |

|

|

| Date: October 15, 2024 |

By: |

/s/ Marcio Souza |

| |

|

Marcio Souza |

| |

|

Chief Executive Officer |

Exhibit 10.1

|

Praxis Precision

Medicines, Inc.

99 High Street, 30th

Floor

Boston, MA 02110

www.praxismedicines.com |

October 11, 2024

Marcio Souza

[***]

[***]

RE: Employment Agreement Amendment

Dear Marcio:

Reference is made to the amended

and restated employment agreement, executed by you September 30, 2020, between Praxis Precision Medicines, Inc. (the “Company”)

and you (the “Employment Agreement”).

By your signature to this

letter, effective as of the date hereof, the Employment Agreement will be amended as follows:

1.

All references in the Employment Agreement to Section “5.2” and Section “5.3” shall be replaced with references

to Section “6.2” and Section “6.3”, respectively.

2.

The following will be added as a new Section 6.2(ii)(c) of the Employment Agreement:

“(c) To the extent unpaid as

of the date of Executive’s employment termination, the Company shall pay Executive an amount in cash equal to the Annual Bonus earned

by Executive for the calendar year prior to the calendar year in which the date of Executive’s employment termination occurs, based

on actual performance as determined in accordance with established policies for the determination of the Annual Bonus, which Annual Bonus,

if any, shall be paid to Executive in the calendar year in which the date of Executive’s employment termination occurs when bonuses

for such year are paid to actively employed senior executives of the Company.”

3.

The following will be added as a new Section 6.2(ii)(d) of the Employment Agreement:

“(d) The Company shall pay

Executive an amount in cash equal to a pro-rata portion of the Annual Bonus for the calendar year in which the date of Executive’s

employment termination occurs, determined by multiplying (i) the Annual Bonus amount based on actual performance for the year as determined

in accordance with established policies for the determination of the Annual Bonus by (ii) a fraction, using the number of days of the

calendar year elapsed prior to the date of Executive’s employment termination as the numerator and the number of days in such calendar

year as the denominator, payable when bonuses for such year are paid to actively employed senior executives of the Company, but in no

event later than March 15 of the year following the year in which such date of termination occurs.”

4.

Section 6.3(i) of the Employment Agreement will be amended and restated in its entirety to read as follows:

“(i) The provisions of this

Section 6.3 shall apply in lieu of, and expressly supersede, the provisions of Section 6.2 regarding severance pay and benefits upon a

termination of employment by the Company without Cause or by Executive for Good Reason if such termination of employment occurs within

three (3) months prior to or on or within eighteen (18) months after the occurrence of the first event constituting a Change of Control

(such period, the “Change of Control Period”). These provisions shall terminate and be of no further force or effect

after the Change of Control Period.”

5.

Sections 6.3(ii)(a) and (b) of the Employment Agreement will be amended and restated in their entirety to read as follows:

“(ii) In the event that Executive’s

employment with the Company is terminated by the Company without Cause or by Executive for Good Reason, in either case during the Change

of Control Period, then, provided Executive remains in compliance with the terms of this Agreement, the Company shall provide Executive

with the following severance benefits:

(a)

The Company shall pay Executive, as severance, a lump sum in cash in an amount equal to (A) 1.75 times the sum of (x) Executive’s

then current Base Salary (or Executive’s Base Salary in effect immediately prior to the Change of Control, if higher) plus (y) Executive’s

target Annual Bonus for the then-current year (or Executive’s target Annual Bonus in effect immediately prior to the Change of Control,

if higher); plus (B) a pro-rata portion of Executive’s target Annual Bonus for the calendar year in which the date of Executive’s

employment termination occurs, determined by multiplying (1) such target Annual Bonus by (2) a fraction, using the number of days of the

calendar year elapsed prior to the date of Executive’s employment termination as the numerator and the number of days in such calendar

year as the denominator. The payments described in this Section 6.3(ii)(a), the “Change of Control Severance”.

(b)

Notwithstanding anything to the contrary in the Equity Documents, all time-based stock options and other stock-based awards subject

to time-based vesting held by Executive (the “Time-Based Equity Awards”) shall immediately accelerate and become fully

exercisable or nonforfeitable as of the last to occur of (i) the date of termination; (ii) the effective date of the Separation Agreement

(as defined below) or (iii) if such termination precedes a Change of Control, the date of a Change of Control that occurs within three

(3) months after the date of such termination (“Accelerated Vesting Date”); provided that, any termination or forfeiture

of the unvested portion of such Time-Based Equity Awards that would otherwise occur on the date of termination in the absence of this

Agreement will be delayed until the applicable Accelerated Vesting Date and will only occur if the vesting pursuant to this subsection

does not occur due to the absence of the Separation Agreement becoming fully effective within the time period set forth therein or, if

applicable, the Change of Control not occurring within three (3) months following the termination date; provided further that in no event

will any such award remain outstanding beyond the final expiration date of the award as set forth in the applicable Equity Documents.

Notwithstanding the foregoing, no additional vesting of the Time-Based Equity Awards shall occur during the period between Executive’s

date of termination and the Accelerated Vesting Date. All stock options and other stock-based awards that vest in whole or in part based

on the attainment of performance-vesting conditions will be governed by the terms of the applicable award agreement.”

6.

The following will be added as a new Section 6.3(ii)(d) of the Employment Agreement:

“(d) To the extent unpaid as

of the date of Executive’s employment termination, the Company shall pay Executive an amount in cash equal to the Annual Bonus earned

by Executive for the calendar year prior to the calendar year in which the date of Executive’s employment termination occurs, based

on actual performance as determined in accordance with established policies for the determination of the Annual Bonus, which Annual Bonus,

if any, shall be paid to Executive in the calendar year in which the date of Executive’s employment termination occurs when bonuses

for such year are paid to actively employed senior executives of the Company.”

7.

Section 6.3(iii) of the Employment Agreement will be amended and restated in its entirety to read as follows:

“(iii) The amounts payable

under this Section 6.3, to the extent taxable, shall be paid or commence to be paid within 60 days after the later of the date of Executive’s

termination and the date of the Change of Control; provided, however, that (A) if the 60-day period begins in one calendar year

and ends in a second calendar year, such payments to the extent they qualify as “non-qualified deferred compensation” within

the meaning of Section 409A of the Code, shall be paid or commence to be paid in the second calendar year by the last day of such 60-day

period or (B) if Executive’s termination occurs during the three (3) month period prior to the date of the Change of Control, during

the period commencing on Executive’s termination date and ending on the date of the Change of Control, Executive shall be paid the

Change of Control Severance in accordance with Sections 6.2(ii)(a) and 6.2(iii) as if it were Severance and any Change of Control Severance

amounts that remain unpaid as of the date of the Change of Control will be paid in a lump sum by the later of 60 days after the date of

Executive’s termination and 15 days after the date of the Change of Control.”

Except as stated in this letter,

all terms and provisions of the Employment Agreement will remain in full force and effect. This letter represents the entire understanding

of the parties with respect to the subject matter hereof and supersedes all prior arrangements and understandings regarding the same.

Please sign this letter in

the space provided below and return it to me to indicate your acceptance and agreement with the terms contained in this letter.

| |

Sincerely, |

| |

|

|

| |

PRAXIS PRECISION MEDICINES, INC. |

| |

|

|

| |

|

|

| |

By: |

/s/ Alex Nemiroff |

| |

Name: |

Alex Nemiroff |

| |

Title: |

General Counsel |

Accepted and Agreed by:

| /s/ Marcio Souza |

|

| Marcio Souza |

|

Exhibit 10.2

|

Praxis Precision

Medicines, Inc.

99 High Street, 30th

Floor

Boston, MA 02110

www.praxismedicines.com |

October 11, 2024

Timothy E. Kelly

[***]

[***]

RE: Employment Agreement Amendment

Dear Timy:

Reference is made to the employment

agreement, executed by you May 13, 2021, between Praxis Precision Medicines, Inc. (the “Company”) and you (the “Employment

Agreement”).

By your signature to this

letter, effective as of the date hereof, the Employment Agreement will be amended as follows:

1.

The following will be added as a new Section 5.2(ii)(c) of the Employment Agreement:

“(c) To the extent unpaid as

of the date of Executive’s employment termination, the Company shall pay Executive an amount in cash equal to the Annual Bonus earned

by Executive for the calendar year prior to the calendar year in which the date of Executive’s employment termination occurs, based

on actual performance as determined in accordance with established policies for the determination of the Annual Bonus, which Annual Bonus,

if any, shall be paid to Executive in the calendar year in which the date of Executive’s employment termination occurs when bonuses

for such year are paid to actively employed senior executives of the Company.”

2.

The following will be added as a new Section 5.2(ii)(d) of the Employment Agreement:

“(d) The Company shall pay

Executive an amount in cash equal to a pro-rata portion of the Annual Bonus for the calendar year in which the date of Executive’s

employment termination occurs, determined by multiplying (i) the Annual Bonus amount based on actual performance for the year as determined

in accordance with established policies for the determination of the Annual Bonus by (ii) a fraction, using the number of days of the

calendar year elapsed prior to the date of Executive’s employment termination as the numerator and the number of days in such calendar

year as the denominator, payable when bonuses for such year are paid to actively employed senior executives of the Company, but in no

event later than March 15 of the year following the year in which such date of termination occurs.”

3.

Section 5.3(i) of the Employment Agreement will be amended and restated in its entirety to read as follows:

“(i) The provisions of this

Section 5.3 shall apply in lieu of, and expressly supersede, the provisions of Section 5.2 regarding severance pay and benefits upon a

termination of employment by the Company without Cause or by Executive for Good Reason if such termination of employment occurs within

three (3) months prior to or on or within eighteen (18) months after the occurrence of the first event constituting a Change of Control

(such period, the “Change of Control Period”). These provisions shall terminate and be of no further force or effect

after the Change of Control Period.”

4.

Sections 5.3(ii)(a) and (b) of the Employment Agreement will be amended and restated in their entirety to read as follows:

“(ii) In the event that Executive’s

employment with the Company is terminated by the Company without Cause or by Executive for Good Reason, in either case during the Change

of Control Period, then, provided Executive remains in compliance with the terms of this Agreement, the Company shall provide Executive

with the following severance benefits:

(a)

The Company shall pay Executive, as severance, a lump sum in cash in an amount equal to (A) one (1) times the sum of (x) Executive’s

then current Base Salary (or Executive’s Base Salary in effect immediately prior to the Change of Control, if higher) plus (y) Executive’s

target Annual Bonus for the then-current year (or Executive’s target Annual Bonus in effect immediately prior to the Change of Control,

if higher); plus (B) a pro-rata portion of Executive’s target Annual Bonus for the calendar year in which the date of Executive’s

employment termination occurs, determined by multiplying (1) such target Annual Bonus by (2) a fraction, using the number of days of the

calendar year elapsed prior to the date of Executive’s employment termination as the numerator and the number of days in such calendar

year as the denominator. The payments described in this Section 5.3(ii)(a), the “Change of Control Severance”.

(b)

Notwithstanding anything to the contrary in the Equity Documents, all time-based stock options and other stock-based awards subject

to time-based vesting held by Executive (the “Time-Based Equity Awards”) shall immediately accelerate and become fully

exercisable or nonforfeitable as of the last to occur of (i) the date of termination; (ii) the effective date of the Separation Agreement

(as defined below) or (iii) if such termination precedes a Change of Control, the date of a Change of Control that occurs within three

(3) months after the date of such termination (“Accelerated Vesting Date”); provided that, any termination or forfeiture

of the unvested portion of such Time-Based Equity Awards that would otherwise occur on the date of termination in the absence of this

Agreement will be delayed until the applicable Accelerated Vesting Date and will only occur if the vesting pursuant to this subsection

does not occur due to the absence of the Separation Agreement becoming fully effective within the time period set forth therein or, if

applicable, the Change of Control not occurring within three (3) months following the termination date; provided further that in no event

will any such award remain outstanding beyond the final expiration date of the award as set forth in the applicable Equity Documents.

Notwithstanding the foregoing, no additional vesting of the Time-Based Equity Awards shall occur during the period between Executive’s

date of termination and the Accelerated Vesting Date. All stock options and other stock-based awards that vest in whole or in part based

on the attainment of performance-vesting conditions will be governed by the terms of the applicable award agreement.”

5.

The following will be added as a new Section 5.3(ii)(d) of the Employment Agreement:

“(d) To the extent unpaid as

of the date of Executive’s employment termination, the Company shall pay Executive an amount in cash equal to the Annual Bonus earned

by Executive for the calendar year prior to the calendar year in which the date of Executive’s employment termination occurs, based

on actual performance as determined in accordance with established policies for the determination of the Annual Bonus, which Annual Bonus,

if any, shall be paid to Executive in the calendar year in which the date of Executive’s employment termination occurs when bonuses

for such year are paid to actively employed senior executives of the Company.”

6.

Section 5.3(iii) of the Employment Agreement will be amended and restated in its entirety to read as follows:

“(iii) The amounts payable

under this Section 5.3, to the extent taxable, shall be paid or commence to be paid within 60 days after the later of the date of Executive’s

termination and the date of the Change of Control; provided, however, that (A) if the 60-day period begins in one calendar year

and ends in a second calendar year, such payments to the extent they qualify as “non-qualified deferred compensation” within

the meaning of Section 409A of the Code, shall be paid or commence to be paid in the second calendar year by the last day of such 60-day

period or (B) if Executive’s termination occurs during the three (3) month period prior to the date of the Change of Control, during

the period commencing on Executive’s termination date and ending on the date of the Change of Control, Executive shall be paid the

Change of Control Severance in accordance with Sections 5.2(ii)(a) and 5.2(iii) as if it were Severance and any Change of Control Severance

amounts that remain unpaid as of the date of the Change of Control will be paid in a lump sum by the later of 60 days after the date of

Executive’s termination and 15 days after the date of the Change of Control.”

Except as stated in this letter,

all terms and provisions of the Employment Agreement will remain in full force and effect. This letter represents the entire understanding

of the parties with respect to the subject matter hereof and supersedes all prior arrangements and understandings regarding the same.

Please sign this letter in

the space provided below and return it to me to indicate your acceptance and agreement with the terms contained in this letter.

| |

Sincerely, |

| |

|

|

| |

PRAXIS PRECISION MEDICINES, INC. |

| |

|

|

| |

|

|

| |

By: |

/s/ Alex Nemiroff |

| |

Name: |

Alex Nemiroff |

| |

Title: |

General Counsel |

Accepted and Agreed by:

| /s/ Timothy E. Kelly |

|

| Timothy E. Kelly |

|

Exhibit 10.3

|

Praxis Precision

Medicines, Inc.

99 High Street, 30th

Floor

Boston, MA 02110

www.praxismedicines.com |

October 11, 2024

Alex Nemiroff

[***]

[***]

RE: Employment Agreement Amendment

Dear Alex:

Reference is made to the amended

and restated employment agreement, executed by you on October 1, 2020, between Praxis Precision Medicines, Inc. (the “Company”)

and you (the “Employment Agreement”).

By your signature to this

letter, effective as of the date hereof, the Employment Agreement will be amended as follows:

1.

The following will be added as a new Section 5.2(ii)(c) of the Employment Agreement:

“(c) To the extent unpaid as

of the date of Executive’s employment termination, the Company shall pay Executive an amount in cash equal to the Annual Bonus earned

by Executive for the calendar year prior to the calendar year in which the date of Executive’s employment termination occurs, based

on actual performance as determined in accordance with established policies for the determination of the Annual Bonus, which Annual Bonus,

if any, shall be paid to Executive in the calendar year in which the date of Executive’s employment termination occurs when bonuses

for such year are paid to actively employed senior executives of the Company.”

2.

The following will be added as a new Section 5.2(ii)(d) of the Employment Agreement:

“(d) The Company shall pay

Executive an amount in cash equal to a pro-rata portion of the Annual Bonus for the calendar year in which the date of Executive’s

employment termination occurs, determined by multiplying (i) the Annual Bonus amount based on actual performance for the year as determined

in accordance with established policies for the determination of the Annual Bonus by (ii) a fraction, using the number of days of the

calendar year elapsed prior to the date of Executive’s employment termination as the numerator and the number of days in such calendar

year as the denominator, payable when bonuses for such year are paid to actively employed senior executives of the Company, but in no

event later than March 15 of the year following the year in which such date of termination occurs.”

3.

Section 5.3(i) of the Employment Agreement will be amended and restated in its entirety to read as follows:

“(i) The provisions of this

Section 5.3 shall apply in lieu of, and expressly supersede, the provisions of Section 5.2 regarding severance pay and benefits upon a

termination of employment by the Company without Cause or by Executive for Good Reason if such termination of employment occurs within

three (3) months prior to or on or within eighteen (18) months after the occurrence of the first event constituting a Change of Control

(such period, the “Change of Control Period”). These provisions shall terminate and be of no further force or effect

after the Change of Control Period.”

4.

Sections 5.3(ii)(a) and (b) of the Employment Agreement will be amended and restated in their entirety to read as follows:

“(ii) In the event that Executive’s

employment with the Company is terminated by the Company without Cause or by Executive for Good Reason, in either case during the Change

of Control Period, then, provided Executive remains in compliance with the terms of this Agreement, the Company shall provide Executive

with the following severance benefits:

(a)

The Company shall pay Executive, as severance, a lump sum in cash in an amount equal to (A) one (1) times the sum of (x) Executive’s

then current Base Salary (or Executive’s Base Salary in effect immediately prior to the Change of Control, if higher) plus (y) Executive’s

target Annual Bonus for the then-current year (or Executive’s target Annual Bonus in effect immediately prior to the Change of Control,

if higher); plus (B) a pro-rata portion of Executive’s target Annual Bonus for the calendar year in which the date of Executive’s

employment termination occurs, determined by multiplying (1) such target Annual Bonus by (2) a fraction, using the number of days of the

calendar year elapsed prior to the date of Executive’s employment termination as the numerator and the number of days in such calendar

year as the denominator. The payments described in this Section 5.3(ii)(a), the “Change of Control Severance”.

(b)

Notwithstanding anything to the contrary in the Equity Documents, all time-based stock options and other stock-based awards subject

to time-based vesting held by Executive (the “Time-Based Equity Awards”) shall immediately accelerate and become fully

exercisable or nonforfeitable as of the last to occur of (i) the date of termination; (ii) the effective date of the Separation Agreement

(as defined below) or (iii) if such termination precedes a Change of Control, the date of a Change of Control that occurs within three

(3) months after the date of such termination (“Accelerated Vesting Date”); provided that, any termination or forfeiture

of the unvested portion of such Time-Based Equity Awards that would otherwise occur on the date of termination in the absence of this

Agreement will be delayed until the applicable Accelerated Vesting Date and will only occur if the vesting pursuant to this subsection

does not occur due to the absence of the Separation Agreement becoming fully effective within the time period set forth therein or, if

applicable, the Change of Control not occurring within three (3) months following the termination date; provided further that in no event

will any such award remain outstanding beyond the final expiration date of the award as set forth in the applicable Equity Documents.

Notwithstanding the foregoing, no additional vesting of the Time-Based Equity Awards shall occur during the period between Executive’s

date of termination and the Accelerated Vesting Date. All stock options and other stock-based awards that vest in whole or in part based

on the attainment of performance-vesting conditions will be governed by the terms of the applicable award agreement.”

5.

The following will be added as a new Section 5.3(ii)(d) of the Employment Agreement:

“(d) To the extent unpaid as

of the date of Executive’s employment termination, the Company shall pay Executive an amount in cash equal to the Annual Bonus earned

by Executive for the calendar year prior to the calendar year in which the date of Executive’s employment termination occurs, based

on actual performance as determined in accordance with established policies for the determination of the Annual Bonus, which Annual Bonus,

if any, shall be paid to Executive in the calendar year in which the date of Executive’s employment termination occurs when bonuses

for such year are paid to actively employed senior executives of the Company.”

6.

Section 5.3(iii) of the Employment Agreement will be amended and restated in its entirety to read as follows:

“(iii) The amounts payable

under this Section 5.3, to the extent taxable, shall be paid or commence to be paid within 60 days after the later of the date of Executive’s

termination and the date of the Change of Control; provided, however, that (A) if the 60-day period begins in one calendar year

and ends in a second calendar year, such payments to the extent they qualify as “non-qualified deferred compensation” within

the meaning of Section 409A of the Code, shall be paid or commence to be paid in the second calendar year by the last day of such 60-day

period or (B) if Executive’s termination occurs during the three (3) month period prior to the date of the Change of Control, during

the period commencing on Executive’s termination date and ending on the date of the Change of Control, Executive shall be paid the

Change of Control Severance in accordance with Sections 5.2(ii)(a) and 5.2(iii) as if it were Severance and any Change of Control Severance

amounts that remain unpaid as of the date of the Change of Control will be paid in a lump sum by the later of 60 days after the date of

Executive’s termination and 15 days after the date of the Change of Control.”

Except as stated in this letter,

all terms and provisions of the Employment Agreement will remain in full force and effect. This letter represents the entire understanding

of the parties with respect to the subject matter hereof and supersedes all prior arrangements and understandings regarding the same.

Please sign this letter in

the space provided below and return it to me to indicate your acceptance and agreement with the terms contained in this letter.

| |

Sincerely, |

| |

|

|

| |

PRAXIS PRECISION MEDICINES, INC. |

| |

|

|

| |

|

|

| |

By: |

/s/ Marcio Souza |

| |

Name: |

Marcio Souza |

| |

Title: |

CEO |

Accepted and Agreed by:

| /s/ Alex Nemiroff |

|

| Alex Nemiroff |

|

v3.24.3

Cover

|

Oct. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 11, 2024

|

| Entity File Number |

001-39620

|

| Entity Registrant Name |

PRAXIS PRECISION MEDICINES, INC.

|

| Entity Central Index Key |

0001689548

|

| Entity Tax Identification Number |

47-5195942

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

99 High Street

|

| Entity Address, Address Line Two |

30th Floor

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02110

|

| City Area Code |

617

|

| Local Phone Number |

300-8460

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

PRAX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

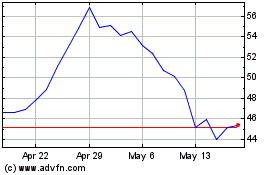

Praxis Precision Medicines (NASDAQ:PRAX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Praxis Precision Medicines (NASDAQ:PRAX)

Historical Stock Chart

From Mar 2024 to Mar 2025