UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number: 001-39032

PROFOUND MEDICAL

CORP.

(Translation of registrant's name into English)

2400 Skymark Avenue, Unit 6, Mississauga, Ontario

L4W 5K5

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x

INCORPORATION BY REFERENCE

Exhibits 99.1 and 99.2 to this report on Form 6-K

are hereby incorporated by reference as Exhibits to the Registration Statement on Form F-10 of Profound Medical Corp.

(File No. 333-280236), as amended and supplemented.

EXHIBIT INDEX

The following document is attached as an exhibit hereto and is incorporated

by reference herein:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

PROFOUND MEDICAL CORP. |

| |

(Registrant) |

| |

|

| Date: December 5, 2024 |

/s/ Rashed Dewan |

| |

Rashed Dewan |

| |

Chief Financial Officer |

Exhibit 99.1

| |

|

200 Bay Street, South Tower

Suite 2800

Toronto, ON

647 499 2828

mintz.com |

December 5, 2024

Profound Medical Corp.

2400 Skymark Avenue, Unit 6

Mississauga, Ontario

L4W 5K5, Canada

Ladies and Gentlemen:

Re: Registration

Statement on Form F-10

We hereby consent to the references to our firm

name in the prospectus filed as part of this registration statement on Form F-10 of Profound Medical Corp. In giving this consent,

we do not thereby admit that we come within the category of persons whose consent is required by the Securities Act of 1933, as amended,

or the rules and regulations promulgated thereunder.

Yours truly,

/s/ “Mintz LLP”

Mintz LLP

BOSTON LOS ANGELES NEW YORK SAN DIEGO SAN FRANCISCO TORONTO WASHINGTON MINTZ LLP

Exhibit 99.2

Osler, Hoskin & Harcourt llp

Box 50, 1 First Canadian Place

Toronto, Ontario, Canada M5X 1B8

416.362.2111 main

416.862.6666 facsimile |

|

|

Toronto

Montréal

Ottawa

Calgary

New York

December 5, 2024

Profound Medical Corp.

2400 Skymark Avenue, Unit #6

Mississauga, Ontario

L4W 5K5

Dear Sirs/Mesdames:

Profound Medical Corp. (the “Issuer”)

We refer you to the prospectus supplement dated

December 5, 2024 to the short form base shelf prospectus of the Issuer dated July 10, 2024 filed in all provinces and territories

of Canada (the “Prospectus Supplement”), forming part of the Registration Statement on Form F-10, as amended

(Registration No. 333-280236) filed by the Issuer with the U.S. Securities and Exchange Commission.

We hereby consent to the references to this firm

on the second cover page and under the headings “Documents Filed as Part of the Registration Statement” and “Interest

of Experts” and to the reference to and use of our opinion under the heading “Eligibility For Investment” in the Prospectus

Supplement.

In giving this consent, we do not thereby admit

that we come within the category of persons whose consent is required by the Securities Act of 1933, as amended, or the rules and

regulations promulgated thereunder.

Yours very truly,

“Osler, Hoskin & Harcourt LLP”

Osler, Hoskin & Harcourt LLP

Exhibit 99.3

Profound Medical Announces Proposed Public Offering

of Common Shares

BASE SHELF PROSPECTUS IS ACCESSIBLE, AND PROSPECTUS

SUPPLEMENT WILL BE ACCESSIBLE WITHIN TWO BUSINESS DAYS, ON SEDAR+

TORONTO, ON (December 5, 2024) -- Profound

Medical Corp. (TSX: PRN; NASDAQ: PROF) (“Profound” or the “Company”) today announced that it intends to offer

and sell common shares (the “Common Shares”) in an underwritten public offering (the “Offering”). In addition,

Profound expects to grant the underwriters of the Offering a 30-day option to purchase up to an additional 15% of the Common Shares sold

in the Offering. All of the securities in the Offering are being offered by Profound. The Offering is subject to market conditions, and

there can be no assurance as to whether or when the Offering may be completed, or as to the actual size or terms of the Offering.

The net proceeds of the Offering are expected

to be used: (i) to fund the continued commercialization of the TULSA-PRO® system in the United States, (ii) to fund the

continued development and commercialization of the TULSA-PRO® system and the Sonalleve® system globally, and (iii) for working

capital and general corporate purposes.

The Offering is expected to be completed pursuant

to an underwriting agreement to be entered into between the Company and Raymond James Ltd. and Lake Street Capital Markets as co-lead

underwriters and joint bookrunners, and a third underwriter. The Offering is expected to take place in each of the provinces and territories

of Canada, except the province of Québec, and in the United States.

The Offering is expected to close on or about

December 10, 2024, subject to customary closing conditions including, but not limited to, the receipt of all necessary approvals

including the approval of the Toronto Stock Exchange. Profound will notify the Nasdaq Capital Market in accordance with the rules of that exchange.

In connection with the Offering, the Company

has filed a preliminary prospectus supplement (the “Preliminary Prospectus Supplement”) and intends to file a subsequent

prospectus supplement (the “Prospectus Supplement”) to its short form base shelf prospectus dated July 10, 2024

(the “Base Shelf Prospectus”) in each of the provinces and territories of Canada relating to the proposed Offering. The

Prospectus Supplement will also be filed in the United States with the U.S. Securities and Exchange Commission (the

“SEC”) as part of the Company’s effective registration statement on Form F-10 (File no. 333-280236), as

amended, previously filed under the multijurisdictional disclosure system adopted by the United States.

Access to the Base Shelf Prospectus, the Prospectus

Supplement, and any amendments to the documents will be provided in accordance with securities legislation relating to procedures for

providing access to a shelf prospectus supplement, a base shelf prospectus and any amendment. The Base Shelf Prospectus is, and the Prospectus

Supplement will be (within two business days of the date hereof), accessible on SEDAR+ at www.sedarplus.com and on EDGAR at www.sec.gov.

The Common Shares are offered under the Prospectus Supplement. An electronic or paper copy of the Base Shelf Prospectus, the Prospectus

Supplement (when filed), and any amendment to the documents may be obtained without charge, from Raymond James Ltd., Scotia Plaza, 40

King St. W., 54th Floor, Toronto, Ontario M5H 3Y2, Canada, or by telephone at 416-777-7000 or by email at ECM-Syndication@raymondjames.ca

by providing the contact with an email address or address, as applicable. Copies of the Prospectus Supplement and the Base Shelf Prospectus

will be available on EDGAR at www.sec.gov or may be obtained without charge from Raymond James & Associates, Inc., Attention: Equity Syndicate, 880 Carillon Parkway, St. Petersburg, Florida 33716, by telephone at (800)

248-8863, or by email at prospectus@raymondjames.com, and from Lake Street Capital Markets, LLC, 920 2nd Ave S - Ste 700, Minneapolis,

MN 55402, prospectus@lakestreetcm.com, (612) 326-1305. The Base Shelf Prospectus

and Prospectus Supplement contain important, detailed information about the Company and the proposed Offering. Prospective investors

should read the Base Shelf Prospectus and Prospectus Supplement (when filed) before making an investment decision.

No securities regulatory authority has either

approved or disapproved of the contents of this news release. This news release shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall there be any sale of these securities in any province, territory, state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such province, territory,

state or jurisdiction.

About Profound Medical Corp.

Profound is a commercial-stage medical device

company that develops and markets customizable, incision-free therapies for the ablation of diseased tissue.

Profound is commercializing TULSA-PRO®, a

technology that combines real-time MRI, robotically-driven transurethral ultrasound and closed-loop temperature feedback control. Profound

is also commercializing Sonalleve®, an innovative therapeutic platform that is CE marked for the treatment of uterine fibroids and

palliative pain treatment of bone metastases.

Forward-Looking Statements

This release includes forward-looking

statements regarding Profound and its business which may include, but is not limited to, the Offering, including the

Offering’s timing, pricing, underwriters, size, terms, selling jurisdictions, closing, over-allotment option, and use of

proceeds; the availability and timing of the final prospectus supplement; and, the expectations regarding the efficacy and

commercialization of Profound’s technology. Often, but not always, forward-looking statements can be identified by the use of

words such as "plans", "is expected", "expects", "scheduled", "intends",

"contemplates", "anticipates", "believes", "proposes" or variations (including negative

variations) of such words and phrases, or state that certain actions, events or results "may", "could",

"would", "might" or "will" be taken, occur or be achieved. Such statements are based on the current

expectations of the management of Profound. The forward-looking events and circumstances discussed in this release, may not occur by

certain specified dates or at all and could differ materially as a result of known and unknown risk factors and uncertainties

affecting the Company, including risks regarding the medical device industry, regulatory approvals, reimbursement, economic factors,

the equity markets generally and risks associated with growth and competition. Although Profound has attempted to identify important

factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements,

there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. No

forward-looking statement can be guaranteed. Additional information about the risks and uncertainties of forward-looking statements

and the assumptions upon which they are based is contained in the Company’s filings with securities regulators, which are

available electronically through SEDAR+ at www.sedarplus.com and EDGAR at www.sec.gov. Except as required by applicable securities

laws, forward-looking statements speak only as of the date on which they are made and Profound undertakes no obligation to publicly

update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, other than as

required by law.

For further information, please contact:

Stephen Kilmer

Investor Relations

skilmer@profoundmedical.com

T: 647.872.4849

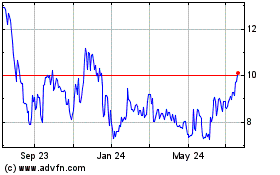

Profound Medical (NASDAQ:PROF)

Historical Stock Chart

From Dec 2024 to Jan 2025

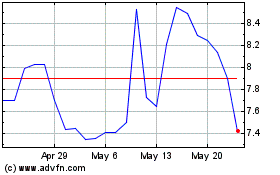

Profound Medical (NASDAQ:PROF)

Historical Stock Chart

From Jan 2024 to Jan 2025