As filed with the Securities and Exchange Commission on June 6, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________________

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

______________________

Patterson-UTI Energy, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware (State or Other Jurisdiction of Incorporation or Organization) | 75-2504748 (I.R.S. Employer Identification No.) |

Patterson-UTI Energy, Inc.

10713 W. Sam Houston Pkwy N, Suite 800

Houston, Texas 77064

(Address of Principal Executive Offices, Zip Code)

Patterson-UTI Energy, Inc. 2021 Long-Term Incentive Plan

(Full title of the plan)

Seth D. Wexler

Executive Vice President, General Counsel and Secretary

Patterson-UTI Energy, Inc.

10713 W. Sam Houston Pkwy N, Suite 800

Houston, Texas 77064

(281) 765-7100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Krista P. Hanvey Gibson, Dunn & Crutcher, LLP 2001 Ross Ave, Suite 2100 Dallas, Texas 75201 (214) 698-3100 |

______________________________________________

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐ |

EXPLANATORY NOTE

This Registration Statement on Form S-8 (this “Registration Statement”) registers 20,000,000 shares of common stock, par value $0.01 per share (the “Common Stock”) of Patterson-UTI Energy, Inc. (the “Registrant”) that may be issued pursuant to the Patterson-UTI Energy, Inc. 2021 Long-Term Incentive Plan (the “Plan”). The Registrant’s stockholders approved an amendment to the Plan on June 6, 2024 that increased the number of shares available for issuance under the Plan by 20,000,000 shares of Common Stock. This Registration Statement relates to such shares of Common Stock authorized to be issued under the Plan, which shares are in addition to (i) the 13,467,480 shares of Common Stock previously registered on the Registrant’s Form S-8 filed on June 3, 2021 (SEC File No. 333-256752 ) with respect to the Plan, (ii) the 5,445,000 shares of Common Stock previously registered on the Registrant’s Form S-8 filed on June 8, 2023 (SEC File No. 333-272520) with respect to the Plan, and (iii) the 10,050,932 shares of Common Stock previously registered on the Registrant’s Form S-8 filed on September 1, 2023 (SEC File No. 333-274321) with respect to the Plan (collectively, the “Prior Registration Statements”). As permitted by General Instruction E to Form S-8, this Registration Statement incorporates by reference the contents of the Prior Registration Statements, including all exhibits filed therewith or incorporated therein by reference, to the extent not otherwise amended or superseded by the contents hereof.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 8. Exhibits.

| | | | | | | | | |

| Exhibit No. | | Exhibit Description | |

| 4.1* | | | |

| 4.2 | | | |

| 5.1* | | | |

| 23.1* | | | |

| 23.2* | | | |

| 24.1* | | | |

| 99.1* | | | |

| 107.1* | | | |

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Houston, Texas, on the 6th day of June, 2024.

| | | | | |

| PATTERSON-UTI ENERGY, INC. |

| |

| By: | /s/ William Andrew Hendricks, Jr. |

| Name: | William Andrew Hendricks, Jr. |

| Title: | President and Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints William Andrew Hendricks, Jr. and C. Andrew Smith, or either of them, severally, the individual’s true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign any and all amendments, including post-effective amendments, to this Registration Statement, and any registration statement relating to the offering covered by this Registration Statement and filed pursuant to Rule 462(b) under the Securities Act of 1933, and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that each of said attorneys-in-fact and agents or their substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities indicated on June 6, 2024.

| | | | | |

Signature

| Title

|

| /s/ William Andrew Hendricks, Jr. | President, Chief Executive Officer and Director |

| William Andrew Hendricks, Jr. | (Principal Executive Officer) |

| |

| /s/ C. Andrew Smith | Executive Vice President and Chief Financial Officer |

| C. Andrew Smith | (Principal Financial and Accounting Officer) |

| |

| /s/ Curtis W. Huff | Chairman of the Board and Director |

| Curtis W. Huff | |

| |

| /s/ Robert W. Drummond | Vice Chairman of the Board and Director |

| Robert W. Drummond | |

| |

| /s/ Leslie A. Beyer | Director |

| Leslie A. Beyer | |

| |

| Director |

| Tiffany (TJ) Thom Cepak | |

| |

| /s/ Gary M. Halverson | Director |

| Gary M. Halverson | |

| |

| /s/ Cesar Jaime | Director |

| Cesar Jaime | |

| |

| /s/ Janeen S. Judah | Director |

| Janeen S. Judah | |

| |

| | | | | |

| /s/ Amy H. Nelson | Director |

| Amy H. Nelson | |

| |

| /s/ Julie J. Robertson | Director |

| Julie J. Robertson | |

| |

| /s/ James C. Stewart | Director |

| James C. Stewart | |

Exhibit 107.1

Calculation of Filing Fee Tables

FORM S-8

(Form Type)

PATTERSON-UTI ENERGY, INC.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

Security Type | Security Class Title (1) | Fee Calculation Rule | Amount Registered | Proposed Maximum Offering Price Per Share | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

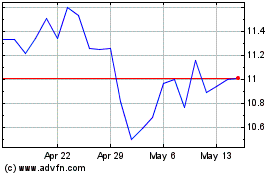

Equity | Common Stock, par value $0.01 | Rule 457(a) (2) | 20,000,000 | $ 10.15 | $203,000,000.00 | $147.60 per $1,000,000 | $29,962.80 |

Total Offering Amounts | | | | $29,962.80 |

Total Fee Offsets | | | | $— |

Net Fee Due | | | | $29,962.80 |

| | | | | |

(1) | Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement on Form S-8 shall also cover any additional shares of common stock, par value $0.01 (“Common Stock”), that may become issuable pursuant to the adjustment provisions of the Patterson-UTI Energy, Inc. 2021 Long-Term Incentive Plan, as amended, including stock splits, stock dividends or similar transactions, and any other securities with respect to which the outstanding shares are converted or exchanged. |

| | | | | |

(2) | Calculated solely for the purpose of determining the registration fee pursuant to Rule 457(c) and 457(h) based upon the average of the high and low prices of the Common Stock as reported on The Nasdaq Global Select Market on June 4, 2024. |

Exhibit 4.1

RESTATED CERTIFICATE OF INCORPORATION OF

PATTERSON-UTI ENERGY, INC.

(Originally incorporated on October 14, 1993 under the name Patterson Energy, Inc.)

FIRST: The name of the Corporation is Patterson-UTI Energy, Inc.

SECOND: The address of the Corporation’s registered office in the State of Delaware is Corporation Trust Center, 1209 Orange Street, in the City of Wilmington, County of New Castle. The name of its registered agent at such address is The Corporation Trust Company.

THIRD: The nature of the business or purposes to be conducted or promoted are to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the State of Delaware.

FOURTH: The total number of shares of stock that the Corporation shall have authority to issue is eight hundred one million (801,000,000) shares, of which 800 million (800,000,000) shares shall be Common Stock, having a par value of $0.01 per share, and one million (1,000,000) shares shall be Preferred Stock, having a par value of $0.01 per share. The shares of such classes of stock shall have the following express terms:

SECTION 1. PREFERRED STOCK

1.1 Authority of the Board of Directors to Create Series. The Board of Directors is hereby expressly granted authority, to the full extent now or hereafter permitted herein and by the General Corporation Law of the State of Delaware, at any time or from time to time, by resolution or resolutions, to create one or more series of Preferred Stock, to fix the authorized number of shares of any series (which number of shares may vary as between series and be changed from time to time by like action), and to fix the terms of such series, including, but not limited to, the following:

(a)the designation of such series, which may be by distinguishing number, letter, or title;

(b)the rate or rates at which shares of such series shall be entitled to receive dividends; the periods in respect of which dividends are payable; the conditions upon, and times of payment of, such dividends; the relationship and preference, if any, of such dividends to dividends payable on any other class or classes or any other series of stock; whether such dividends shall be cumulative and, if cumulative, the date or dates from which such dividends shall accumulate; and the other terms and conditions applicable to dividends upon shares of such series;

(c)the rights of the holders of the shares of such series in case the Corporation be liquidated, dissolved or wound up (which may vary depending upon the time, manner, or voluntary or involuntary nature or other circumstances of such liquidation, dissolution, or winding up) and the relationship and preference, if any, of such rights to rights of holders of shares of stock of any other class or classes or any other series of stock;

(d)the right, if any, of the Corporation to redeem shares of such series at its option, including any limitation of such right, and the amount or amounts to be payable in respect of the shares of such series in case of such redemption (which may vary depending on the time, manner, or other circumstances of such redemption), and the manner, effect, and other terms and conditions of any such redemption;

(e)the obligation, if any, of the Corporation to purchase, redeem, or retire shares of such series and/or to maintain a fund for such purpose, and the amount or amounts to be payable from time to time for such purpose or into such fund, or the number of shares to be purchased, redeemed, or retired, the per share purchase price or prices, and the other terms and conditions of any such obligation or obligations;

(f)the voting rights, if any, which, if granted, may be full, special, or limited, to be given the shares of such series, including, without limiting the generality of the foregoing, the right, if any, as a series or in conjunction with other series or classes, to elect one or more members of the Board of Directors either generally or at certain times or under certain circumstances, and restrictions, if any, on particular corporate acts without a specified vote or consent of holders of such shares (such as, among others, restrictions on modifying the terms of such series or of the Preferred Stock, restricting the permissible terms of other series or the permissible variations between series of the Preferred Stock, authorizing or issuing additional shares of the Preferred Stock, creating debt, or creating any class of stock ranking prior to or on a parity with the Preferred Stock or any series thereof as to dividends, or assets remaining for distribution to the stockholders in the event of the liquidation, dissolution, or winding up of the Corporation);

(g)the right, if any, to exchange or convert the shares into shares of any other series of the Preferred Stock or into shares of any other class of stock of the Corporation or the securities of any other corporation, and the rate or basis, time, manner, terms, and conditions of exchange or conversion or the method by which the same shall be determined; and

(h)the other special powers, preferences, or rights, if any, and the qualifications, limitations, or restrictions thereof, of the shares of such series.

The Board of Directors shall fix the terms of each such series by resolution or resolutions adopted at any time prior to the issuance of the shares thereof, and the terms of each such series may, subject only to restrictions, if any, imposed by this Certificate of Incorporation or by applicable law, vary from the terms of other series to the extent determined by the Board of Directors from time to time and provided in the resolution or resolutions fixing the terms of the respective series of the Preferred Stock.

1.2 Status of Certain Shares. Shares of any series of the Preferred Stock, whether provided for herein or by resolution or resolutions of the Board of Directors, which have been redeemed (whether through the operation of a sinking fund or otherwise) or which, if convertible or exchangeable, have been converted into or exchanged for shares of stock of any other class or classes, or which have been purchased or otherwise acquired by the Corporation, shall have the status of authorized and unissued shares of the Preferred Stock of the same series and may be reissued as a part of the series of which they were originally a part or may be reclassified and reissued as part of a new series of the Preferred Stock to be created by resolution or resolutions of the Board of Directors or as a part of any other series of the Preferred Stock, all subject to the conditions or restrictions on issuance set forth herein or in the resolution or resolutions adopted by the Board of Directors providing for the issue of any series of the Preferred Stock.

SECTION 2. COMMON STOCK

2.1 Issuance, Consideration, and Terms. Any unissued shares of the Common Stock may be issued from time to time for such consideration, having a value of not less than the par value thereof, as may be fixed from time to time by the Board of Directors. Any treasury shares may be disposed of for such consideration as may be determined from time to time by the Board of Directors. The Common Stock shall be subject to the express terms of the Preferred Stock and any series thereof. Each share of Common Stock shall be of equal rank and shall be identical to every other share of Common Stock. Holders of Common Stock shall have such rights as are provided herein and by law.

2.2 Voting Rights. Except as expressly required by law or as provided in or fixed and determined pursuant to Section 1 of this Article FOURTH, the entire voting power and all voting rights shall be vested exclusively in the Common Stock. Each holder of shares of Common Stock shall be entitled to one (1) vote for each share standing in such holder’s name on the books of the Corporation.

2.3 Dividends. Subject to Section 1 of this Article FOURTH, the holders of Common Stock shall be entitled to receive, and shall share equally share for share, when and as declared by the Board of Directors, out of the assets of the Corporation which are by law available therefor, dividends or distributions payable in cash, in property, or in securities of the Corporation.

FIFTH: The Board of Directors is authorized to make, alter, or repeal the Bylaws of the Corporation.

SIXTH: Meetings of stockholders shall be held at such place, within or without the State of Delaware, as may be designated by or in the manner provided in the Bylaws, or, if not so designated, at the registered office of the Corporation in the State of Delaware. Elections of directors need not be by written ballot unless and to the extent that the Bylaws so provide.

SEVENTH: Special meetings of the stockholders of the Corporation for any purpose or purposes may be called at any time by the Board of Directors (or a majority of the members thereof) of the Corporation by action at a meeting, a majority of the members of the Board of Directors of the Corporation acting without a meeting, the Chief Executive Officer of the Corporation, the President of the Corporation or the holders of a majority of the issued and outstanding stock of the Corporation entitled to be voted at such special meeting. Such special meetings may not be called by any other person or persons or in any other manner.

EIGHTH: The Corporation reserves the right to amend, alter, or repeal any provision contained in this Certificate of Incorporation in the manner now or hereafter prescribed by statute, and all rights of stockholders herein are subject to this reservation.

NINTH: To the fullest extent permitted by the General Corporation Law of the State of Delaware, as the same exists or may hereafter be amended, a director or officer of the Corporation shall not be liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director or officer, as applicable.

TENTH: Any action required or permitted to be taken by the holders of the stock of the Corporation entitled to vote in the election of directors must be effected at a duly called annual meeting or special meeting of such holders and may not be effected by any consent in writing by such holders.

ELEVENTH: Whenever a compromise or arrangement is proposed between the Corporation and its creditors or any class of them and/or between the Corporation and its stockholders or any class of them, any court of equitable jurisdiction within the State of Delaware may, on the application in a summary way of the Corporation or of any creditor or stockholder thereof or on the application of any receiver or receivers appointed for the Corporation under the provisions of Section 291 of Title 8 of the Delaware Code or on the application of trustees in dissolution or of any receiver or receivers appointed for the Corporation under the provisions of Section 279 of Title 8 of the Delaware Code order a meeting of the creditors or class of creditors, and/or of the stockholders or class of stockholders of the Corporation, as the case may be, to be summoned in such manner as the said court directs. If a majority in number representing three-fourths in value of the creditors or class of creditors, and/or of the stockholders or class of stockholders of the Corporation, as the case may be, agree to any compromise or arrangement and to any reorganization of the Corporation as a consequence of such compromise or arrangement, the said compromise or arrangement and the said reorganization shall, if sanctioned by the court to which the said application has been made, be binding on all the creditors or class of creditors, and/or on all the stockholders or class of stockholders, of the Corporation, as the case may be, and also on the Corporation.

This Restated Certificate of Incorporation of Patterson-UTI Energy, Inc. (i) was duly adopted by the Board of Directors of Patterson-UTI Energy, Inc., without a vote of the stockholders, in accordance with Section 245 of the Delaware General Corporation Law, (ii) only restates and integrates and does not further amend the provisions of the Certificate of Incorporation of Patterson-UTI Energy, Inc., as heretofore amended; and there is no discrepancy between those provisions and the provisions of this Restated Certificate of Incorporation.

Dated this 6th day of June, 2024.

/s/ William A. Hendricks, Jr.

William A. Hendricks, Jr., President and Chief

Executive Officer

June 6, 2024

Patterson-UTI Energy, Inc.

10713 W. Sam Houston Pkwy N, Suite 800

Houston, TX 77064

Re: Patterson-UTI Energy, Inc. Registration Statement on Form S-8

Ladies and Gentlemen:

We have examined the Registration Statement on Form S-8 (the “Registration Statement”) of Patterson-UTI Energy, Inc., a Delaware corporation (the “Company”), to be filed with the Securities and Exchange Commission (the “Commission”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”), which is registering up to 20,000,000 shares of the Company’s common stock, par value $0.01 per share (“Common Stock”) for issuance under the Patterson-UTI Energy, Inc. 2021 Long-Term Incentive Plan, as amended (the “Plan,” and such shares of Common Stock, collectively, the “Shares”).

We have examined the originals, or photostatic or certified copies, of such records of the Company and certificates of officers of the Company and of public officials and such other documents as we have deemed relevant and necessary as the basis for the opinions set forth below. In our examination, we have assumed the genuineness of all signatures, the legal capacity and competency of all natural persons, the authenticity of all documents submitted to us as originals and the conformity to original documents of all documents submitted to us as copies. We have also assumed that there are no agreements or understandings between or among the Company and any participants in the Plan that would expand, modify or otherwise affect the terms of the Plan or the respective rights or obligations of the participants thereunder. Finally, we have assumed the accuracy of all other information provided to us by the Company during the course of our investigations, on which we have relied in issuing the opinion expressed below.

Based upon the foregoing examination and in reliance thereon, and subject to the qualifications, assumptions and limitations stated herein and in reliance on the statements of fact contained in the documents that we have examined, we are of the opinion that the Shares, when issued and sold in accordance with the terms set forth in the Plan, as applicable, and against payment therefor in accordance with the terms of the form of agreement documenting the awards under which the Shares may be issued, and when the Registration Statement has become effective under the Securities Act, will be validly issued, fully paid and non-assessable.

We render no opinion herein as to matters involving the laws of any jurisdiction other than the Delaware General Corporation Law (the “DGCL”). This opinion is limited to the effect of the current state of the DGCL and the facts as they currently exist. We assume no obligation to revise or supplement this opinion in the event of future changes in such law or the interpretations thereof or such facts. We express no opinion regarding any state securities laws or regulations.

We consent to the filing of this opinion as an exhibit to the Registration Statement, and we further consent to the use of our name in the Registration Statement and the prospectus that forms a part thereof. In giving these consents, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the Rules and Regulations of the Commission.

| | |

Abu Dhabi • Beijing – Brussels • Century City • Dallas • Denver • Dubai • Frankfurt • Hong Kong • Houston • London • Los Angeles

Munich • New York • Orange County • Palo Alto • Paris • Riyadh • San Francisco • Singapore • Washington, D.C. |

Very truly yours,

/s/ Gibson, Dunn & Crutcher LLP

Gibson, Dunn & Crutcher LLP

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of Patterson-UTI Energy, Inc. of our report dated February 27, 2024 relating to the financial statements, financial statement schedule, and the effectiveness of internal control over financial reporting, which appears in Patterson-UTI Energy, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2023.

/s/ PricewaterhouseCoopers LLP

Houston, Texas

June 6, 2024

PATTERSON-UTI ENERGY, INC.

2021 LONG-TERM INCENTIVE PLAN

(as amended through June 6, 2024)

Patterson-UTI Energy, Inc. (the “Company”), a Delaware corporation, hereby establishes and adopts the following 2021 Long-Term Incentive Plan (as amended from time to time, the “Plan”) effective as of April 9, 2021 (the “Effective Date”), as amended effective June 8, 2023, September 1, 2023, and June 6, 2024.

1. PURPOSE OF THE PLAN

The purpose of the Plan is to assist the Company and its Subsidiaries in attracting and retaining selected individuals to serve as directors, employees, consultants and/or advisors of the Company who are expected to contribute to the Company’s success and to achieve long-term objectives which will inure to the benefit of all stockholders of the Company through the additional incentives inherent in the Awards hereunder.

2. DEFINITIONS

2.1 “Award” shall mean any Option, Stock Appreciation Right, Restricted Stock Award, Performance Award, Performance Unit, Other Stock Unit Award or any other right, interest or option relating to Shares or other property (including cash) granted pursuant to the provisions of the Plan.

2.2 “Award Agreement” shall mean any agreement, contract or other instrument or document evidencing any Award granted by the Committee hereunder, which shall be in written or electronic form, as designated by the Committee.

2.3 “Board” shall mean the board of directors of the Company.

2.4 “Change of Control” shall mean, except as otherwise provided in an Award Agreement, the occurrence of any of the following:

(a) The acquisition by any individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Securities Exchange Act of 1934, as amended) (a “Covered Person”) of beneficial ownership (within the meaning of rule 13d-3 promulgated under the Exchange Act) of 35% or more of either (i) the then outstanding shares of the common stock of the Company (the “Outstanding Company Common Stock”), or (ii) the combined voting power of the then outstanding voting securities of the Company entitled to vote generally in the election of directors (the “Outstanding Company Voting Securities”); provided, however, that for purposes of this Section 2.4(a), the following acquisitions shall not constitute a Change of Control: (A) any acquisition directly from the Company, (B) any acquisition by the Company, (C) any acquisition by any employee benefit plan (or related trust) sponsored or maintained by the Company or any entity controlled by the Company, or (D) any acquisition by any entity pursuant to a transaction which complies with clauses (A), (B) and (C) of Section 2.4(c); or

(b) Individuals who, as of the Effective Date, constitute the Board (the “Incumbent Board”) cease for any reason to constitute at least a majority of the Board; provided, however, that any individual becoming a director subsequent to the Effective Date whose election, or nomination for election by the Company’s stockholders, was approved by a vote of at least a majority of the directors then comprising the Incumbent Board shall be considered as though such individual were a member of the Incumbent Board, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of an actual or threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a Covered Person other than the Board; or

(c) Consummation of (i) a reorganization, merger or consolidation or sale of the Company or any subsidiary of the Company, or (ii) a disposition of all or substantially all of the assets of the Company (a “Business Combination”), in each case, unless, immediately following such Business Combination: (A) all or substantially all of the individuals and entities who were the beneficial owners, respectively, of the Outstanding Company Common Stock and Outstanding Company Voting Securities immediately prior to such Business Combination beneficially own, direct or indirectly, more than 65% of, respectively, the then outstanding shares of common stock and the combined voting power of the then outstanding voting securities entitled to vote generally in the election of directors, as the case may be, of the corporation resulting from such Business Combination (including, without limitation, a corporation which as a result of such transaction owns the Company or all or substantially all of the Company’s assets either directly or through one or more subsidiaries) in substantially the same proportions as their ownership immediately prior to such Business Combination of the Outstanding Company Common Stock and Outstanding Company Voting Securities, as the case may be; (B) no Covered Person (excluding any employee benefit plan (or related trust) of the Company or such corporation resulting from such Business Combination) beneficially owns, directly or indirectly, 35% or more of, respectively, the then outstanding shares of common stock of the corporation resulting from such Business Combination or the combined voting

power of the then outstanding voting securities of such corporation, except to the extent that such ownership existed prior to the Business Combination; and (C) at least a majority of the members of the board of directors of the corporation resulting from such Business Combination were members of the Incumbent Board at the time of the execution of the initial agreement, or, if earlier, of the action of the Board, providing for such Business Combination.

2.5 “Code” shall mean the Internal Revenue Code of 1986, as amended from time to time.

2.6 “Committee” shall mean the Compensation Committee of the Board, consisting of no fewer than two Directors, each of whom is (a) a “Non-Employee Director” within the meaning of Rule 16b-3 of the Exchange Act and (b) an “independent director” for purpose of the rules and regulations of the Nasdaq Stock Market.

2.7 “Director” shall mean a non-employee member of the Board.

2.8 “Disability” shall, except as otherwise provided in an Award Agreement, exist (a) if the Participant qualifies for long-term disability benefits under a long-term disability program sponsored by the Company in which employees participate generally or (b) if the Company does not sponsor such a long-term disability program, if the Participant is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than 12 months.

2.9 “Employee” shall mean any employee of the Company or any Subsidiary and any prospective employee conditioned upon, and effective not earlier than, such person’s becoming an employee of the Company or any Subsidiary. Solely for purposes of the Plan, an Employee shall also mean any consultant or advisor who provides services to the Company or any Subsidiary, so long as such person (a) renders bona fide services that are not in connection with the offer and sale of the Company’s securities in a capital raising transaction and (b) does not directly or indirectly promote or maintain a market for the Company’s securities.

2.10 “Exchange Act” shall mean the Securities Exchange Act of 1934, as amended.

2.11 “Fair Market Value” shall mean, with respect to any property other than Shares, the market value of such property determined by such methods or procedures as shall be established from time to time by the Committee. The Fair Market Value of Shares as of any date shall be the per Share closing price of the Shares as reported on the Nasdaq Stock Market on that date (or if there were no reported prices on such date, on the last preceding date on which the prices were reported) or, if the Company is not then listed on the Nasdaq Stock Market, on the principal national securities exchange on which the Company is listed, and if the Company is not then listed on the Nasdaq Stock Market or any national securities exchange, the Fair Market Value of Shares shall be determined by the Committee in its sole discretion using appropriate criteria.

2.12 “Incentive Stock Option” shall mean an Option intended to qualify as an “incentive stock option” as defined in Section 422 of the Code.

2.13 “Option” shall mean any right granted to a Participant under the Plan allowing such Participant to purchase Shares at such price or prices and during such period or periods as the Committee shall determine.

2.14 “Participant” shall mean an Employee or Director who is selected by the Committee to receive an Award under the Plan.

2.15 “Performance Award” shall mean any Award of Performance Shares or Performance Units granted pursuant to Article 9.

2.16 “Performance Period” shall mean that period established by the Committee at the time any Performance Award is granted or at any time thereafter during which any performance goals specified by the Committee with respect to such Award are to be measured.

2.17 “Performance Share” shall mean any grant pursuant to Section 9 of a unit valued by reference to a designated number of Shares, which value may be paid to the Participant by delivery of such property as the Committee shall determine, including cash, Shares, other property, or any combination thereof, upon achievement of such performance goals during the Performance Period as the Committee shall establish at the time of such grant or thereafter.

2.18 “Performance Unit” shall mean any grant pursuant to Section 9 of a unit valued by reference to a designated amount of property (including cash) other than Shares, which value may be paid to the Participant by delivery of such property as the Committee shall determine, including cash, Shares, other property, or any combination thereof, upon achievement of such performance goals during the Performance Period as the Committee shall establish at the time of such grant or thereafter.

2.19 “Prior Plans” shall mean, collectively, the Company’s 2005 Long-Term Incentive Plan, as amended, and the Company’s Amended and Restated 2014 Long-Term Incentive Plan, as amended.

2.20 “Restricted Stock” shall mean any Share issued with the restriction that the holder may not sell, transfer, pledge or assign such Share and with such other restrictions as the Committee, in its sole discretion, may impose (including any restriction on the right to vote such Share and the right to receive any dividends), which restrictions may lapse separately or in combination at such time or times, in installments or otherwise, as the Committee may deem appropriate in its sole discretion.

2.21 “Shares” shall mean the shares of common stock of the Company, par value $.01 per share.

2.22 “Stock Appreciation Right” shall mean the right granted to a Participant pursuant to Section 6.

2.23 “Subsidiary” shall mean any corporation or other entity, whether domestic or foreign, in which the Company has or obtains, directly or indirectly, a proprietary interest of more than 50% by reason of stock ownership or otherwise.

2.24 “Substitute Awards” shall mean Awards granted or Shares issued by the Company in assumption of, or in substitution or exchange for, awards previously granted, or the right or obligation to make future awards, by a company acquired by the Company or any Subsidiary or with which the Company or any Subsidiary combines.

3. SHARES SUBJECT TO THE PLAN

3.1 Number of Shares.

(a) Subject to adjustment as provided in Section 11.2 and this Section 3.1, the total number of Shares authorized for grant under the Plan shall be the sum of (i) 34,045,000 Shares, plus (ii) the total number of Shares remaining available for grant under the Prior Plans as of the Effective Date. Any Shares that are subject to Awards of Options or Stock Appreciation Rights shall be counted against this limit as one Share for every one Share granted. Any Shares that are subject to Awards other than Options or Stock Appreciation Rights shall be counted against this limit as two Shares for every one Share awarded. No further awards will be granted under any Prior Plans.

(b) If any Shares subject to an Award or to an award under the Prior Plans are forfeited, expire or otherwise terminate without issuance of such Shares, or any Award or award under the Prior Plans is settled for cash or otherwise does not result in the issuance of all or a portion of the Shares subject to such Award, the Shares shall, to the extent of such forfeiture, expiration, termination, cash settlement or non-issuance, again be (or become with respect to Shares subject to awards under the Prior Plans) available for grant subject to Awards under the Plan, subject to Section 3.1(d) below. Notwithstanding the foregoing, the following Shares shall not become available for grant under the Plan: (i) Shares subject to an Option or Stock Appreciation Right or to a stock option or stock appreciation right under the Prior Plans that are used to satisfy the exercise price of stock options or are not issued upon the stock-settlement of a stock appreciation right, (ii) Shares withheld by the Company for income or employment taxes on any Award granted under the Plan or (iii) Shares repurchased on the open market with the proceeds of the option exercise price.

(c) Substitute Awards shall not reduce the Shares authorized for grant under the Plan. Additionally, in the event that a company acquired by the Company or any Subsidiary or with which the Company or any Subsidiary combines has shares available under a pre-existing plan approved by shareholders and not adopted in contemplation of such acquisition or combination, the shares available for grant pursuant to the terms of such pre-existing plan (as adjusted, to the extent appropriate, using the exchange ratio or other adjustment or valuation ratio or formula used in such acquisition or combination to determine the consideration payable to the holders of common stock of the entities party to such acquisition or combination) may be used for Awards under the Plan and shall not reduce the Shares authorized for grant under the Plan; provided that Awards using such available shares shall only be made (i) until the last date that awards or grants could have been made under the terms of the pre-existing plan, absent the acquisition or combination, and (ii) to individuals who were not Employees or Directors prior to such acquisition or combination.

(d) Any Shares that become available for grant pursuant to Section 3.1(b) shall be added to the share reserve set forth in Section 3.1(a): (i) as one Share if such Shares were subject to options or stock appreciation rights granted under the Plan or Prior Plans or (ii) as two Shares if such Shares were subject to awards other than options or stock appreciation rights that were granted under the Plan or the Prior Plans.

3.2 Character of Shares. Any Shares issued hereunder may consist, in whole or in part, of authorized and unissued shares, treasury shares or shares purchased in the open market or otherwise.

3.3 Minimum Vesting for Awards. Notwithstanding any other provision of the Plan to the contrary, Awards granted under the Plan (other than cash-based awards) shall vest no earlier than the first anniversary of the date on which the Award is granted; provided, however, that the following Awards shall not be subject to the foregoing minimum vesting requirement: (i) Substitute Awards, (ii) Shares delivered in lieu of fully-vested cash obligations, (iii) Awards to non-employee Directors that vest on the earlier of the one-year anniversary of the date of grant and the next annual meeting of stockholders which is at least 50 weeks after the immediately preceding year’s annual meeting, and (iv) any additional Awards the Committee may grant, up to a maximum of 5% of the available share reserve authorized for issuance under the Plan pursuant to Section 3.1 (subject to adjustment under Section 11.2); provided, further, that the foregoing restriction does not apply to the Committee’s discretion to provide for accelerated exercisability or vesting of any Award, including in cases of retirement, death, Disability or a Change in Control, in the terms of the Award Agreement or otherwise.

3.4 Limits on Non-Employee Director Compensation. The aggregate dollar value of equity-based Awards (based on the grant date fair value of such Awards for financial reporting purposes) and cash compensation granted under the Plan or otherwise during any fiscal year to any non-employee director for services provided as a director shall not exceed $750,000; provided, however, that in the fiscal year in which a non-employee director first joins the Board or during any fiscal year in which a non-employee director is designated as Chairman of the Board or Lead Director, the maximum aggregate dollar value of equity-based and cash compensation granted to the non-employee director for services provided as a director may be up to $1,000,000.

4. ELIGIBILITY AND ADMINISTRATION

4.1 Eligibility. Any Employee or Director shall be eligible to be selected as a Participant.

4.2 Administration.

(a) The Plan shall be administered by the Committee. The Committee shall have full power and authority, subject to the provisions of the Plan and subject to such orders or resolutions not inconsistent with the provisions of the Plan as may from time to time be adopted by the Board, to, in its sole discretion: (i) select the Employees and Directors to whom Awards may from time to time be granted hereunder; (ii) determine the type or types of Awards, not inconsistent with the provisions of the Plan, to be granted to each Participant hereunder; (iii) determine the number of Shares to be covered by each Award granted hereunder; (iv) determine the terms and conditions, not inconsistent with the provisions of the Plan, of any Award granted hereunder; (v) determine whether, to what extent and under what circumstances Awards may be settled in cash, Shares or other property, subject to Section 8.1; (vi) determine whether, to what extent, and under what circumstances cash, Shares, other property and other amounts payable with respect to an Award made under the Plan shall be (A) deferred either automatically or at the election of the Participant or (B) accelerated; (vii) determine whether, to what extent and under what circumstances any Award shall be canceled or suspended; (viii) interpret and administer the Plan and any instrument or agreement entered into under or in connection with the Plan, including any Award Agreement; (ix) correct any defect, supply any omission or reconcile any inconsistency in the Plan or any Award in the manner and to the extent that the Committee shall deem desirable to carry it into effect; (x) establish such rules and regulations and appoint such agents as it shall deem appropriate for the proper administration of the Plan; (xi) determine whether any Award (other than Options or Stock Appreciation Rights) will have Dividend Equivalents; and (xii) make any other determination and take any other action that the Committee deems necessary or desirable for administration of the Plan. Notwithstanding the foregoing, the Board shall have the same powers as the Committee with respect to Awards to Directors.

(b) Decisions of the Committee shall be final, conclusive and binding on all persons or entities, including the Company, any Participant, and any Subsidiary. A majority of the members of the Committee may determine its actions and fix the time and place of its meetings.

(c) To the extent not inconsistent with applicable law or the rules and regulations of the Nasdaq Stock Market (or any other principal national securities exchange on which the Company is then listed), the Committee may delegate to a committee of one or more directors of the Company or, to the extent permitted by law, to one or more executive officers or a committee of executive officers the right to grant Awards to Employees who are not Directors or executive officers of the Company and the authority to take action on behalf of the Committee pursuant to the Plan to cancel or suspend Awards to Employees who are not Directors or executive officers of the Company; provided, however, (i) the resolution providing such authorization sets forth the total number of Shares subject to such Awards that such officer(s) may grant; and (ii) the officer(s) shall report periodically to the Committee regarding the nature and scope of the Awards granted pursuant to the authority delegated.

5. OPTIONS

5.1 Grant of Options. Options may be granted hereunder to Participants either alone or in addition to other Awards granted under the Plan; provided that Incentive Stock Options may be granted only to eligible Employees of the

Company or of any parent or subsidiary corporation (as permitted by Section 422 of the Code and the regulations thereunder). Any Option shall be subject to the terms and conditions of this Article 5 and to such additional terms and conditions, not inconsistent with the provisions of the Plan, as the Committee shall determine in its sole discretion.

5.2 Award Agreements. All Options granted pursuant to this Article 5 shall be evidenced by an Award Agreement in such form and containing such terms and conditions as the Committee shall determine which are not inconsistent with the provisions of the Plan. The terms of Options need not be the same with respect to each Participant. Granting of an Option pursuant to the Plan shall impose no obligation on the recipient to exercise such Option. Any individual who is granted an Option pursuant to this Article 5 may hold more than one Option granted pursuant to the Plan at the same time. The Award Agreement also shall specify whether the Option is intended to qualify as an Incentive Stock Option.

5.3 Option Price. Other than in connection with Substitute Awards or an adjustment in connection with Section 11.2, the option price per each Share purchasable under any Option granted pursuant to this Article 5 shall not be less than 100% of the Fair Market Value of such Share on the date of grant of such Option.

5.4 Option Term. The term of each Option shall be fixed by the Committee in its sole discretion; provided that no Option shall be exercisable after the expiration of ten years from the date the Option is granted other than as a result of any extension of the term in compliance with applicable law as provided in an Award Agreement.

5.5 Exercise of Options. Vested Options granted under the Plan shall be exercised by the Participant or by a Permitted Assignee thereof (or by the Participant’s executors, administrators, guardian or legal representative, as may be provided in an Award Agreement) as to all or part of the Shares covered thereby, by the giving of written notice of exercise to the Company or its designated agent, specifying the number of Shares to be purchased, accompanied by payment of the full purchase price for the Shares being purchased. Unless otherwise provided in an Award Agreement, full payment of such purchase price shall be made at the time of exercise and shall be made (a) in cash or cash equivalents (including certified check or bank check or wire transfer of immediately available funds), (b) by tendering previously acquired Shares (either actually or by attestation, valued at their then Fair Market Value) that have been owned for a period of at least six months (or such other period to avoid accounting charges against the Company’s earnings), (c) with the consent of the Committee, by delivery of other consideration (including, where permitted by law and the Committee, other Awards) having a Fair Market Value on the exercise date equal to the total purchase price, (d) with the consent of the Committee, by withholding Shares otherwise issuable in connection with the exercise of the Option, (e) through any other method specified in an Award Agreement, or (f) any combination of any of the foregoing. The notice of exercise, accompanied by such payment, shall be delivered to the Company at its principal business office or such other office as the Committee may from time to time direct, and shall be in such form, containing such further provisions consistent with the provisions of the Plan, as the Committee may from time to time prescribe. In no event may any Option granted hereunder be exercised for a fraction of a Share. No adjustment shall be made for cash dividends or other rights for which the record date is prior to the date of such issuance.

5.6 Vesting. Subject to Section 3.3, the vesting schedule shall be set forth in the Award Agreement.

5.7 Incentive Stock Options. The Committee may grant Options intended to qualify as Incentive Stock Options to any employee of the Company or any subsidiary corporation (as defined in Section 424 of the Code), subject to the requirements of Section 422 of the Code. Notwithstanding anything in Section 3.1 to the contrary and solely for the purposes of determining whether Shares are available for the grant of Incentive Stock Options under the Plan, the maximum aggregate number of Shares with respect to which Incentive Stock Options may be granted under the Plan shall be the number of Shares authorized for grant under Section 3.1.

5.8 Form of Settlement. In its sole discretion, the Committee may provide, at the time of grant, that the Shares to be issued upon an Option’s exercise shall be in the form of Restricted Stock or other similar securities, or if provided for in the Award Agreement, may reserve the right to provide so after the time of grant.

5.9 No Repricing. Notwithstanding anything in the Plan to the contrary, except in connection with a corporate transaction involving the Company (including, without limitation, any stock dividend, stock split, extraordinary cash dividend, recapitalization, reorganization, merger, consolidation, split-up, spin-off, combination, or exchange of shares), the terms of outstanding Awards may not be amended without stockholder approval to (a) reduce the option price of outstanding Options, (b) cancel outstanding Options in exchange for cash, other awards or Options with an option price that is less than the option price of the original Options, (c) take any other action with respect to an Option that would be treated as a repricing under the rules and regulations of the principal national securities exchange on which they are listed or (d) permit the grant of any Options that contains a so-called “reload” feature under which additional Options or other Awards are granted automatically to the Participant upon exercise of the original Option.

6. STOCK APPRECIATION RIGHTS

6.1 Grant and Exercise. The Committee may provide Stock Appreciation Rights (a) in conjunction with all or part of any Option granted under the Plan (“Tandem Stock Appreciation Right”), (b) in conjunction with all or part of any Award (other than an Option) granted under the Plan, or (c) without regard to any Option or other Award (a “Freestanding Stock Appreciation Right”), in each case, upon such terms and conditions as the Committee may establish in its sole discretion.

6.2 Terms and Conditions. Stock Appreciation Rights shall be subject to such terms and conditions, not inconsistent with the provisions of the Plan, as shall be determined from time to time by the Committee, including the following:

(a) Except in the case of Substitute Awards or in connection with an adjustment provided in Section 11.2, the grant price of a Stock Appreciation Right shall not be less than the Fair Market Value of one Share on such date of grant of the right. Upon the exercise of a Stock Appreciation Right, the holder shall have the right to receive the excess of (i) the Fair Market Value of one Share on the date of exercise over (ii) the grant price of the right on the date of grant.

(b) Upon the exercise of a Stock Appreciation Right, payment shall be made in the sole discretion of the Committee in (i) whole Shares, (ii) cash or (iii) a combination of (i) or (ii).

(c) Any Tandem Stock Appreciation Right shall be granted at the same time as the related Option is granted.

(d) Any Tandem Stock Appreciation Right related to an Option may be exercised only when the related Option would be exercisable and the Fair Market Value of the Shares subject to the related Option exceeds the option price at which Shares can be acquired pursuant to the Option. In addition, (i) if a Tandem Stock Appreciation Right exists with respect to less than the full number of Shares covered by a related Option, then an exercise or termination of such Option shall not reduce the number of Shares to which the Tandem Stock Appreciation Right applies until the number of Shares then exercisable under such Option equals the number of Shares to which the Tandem Stock Appreciation Right applies, and (ii) no Tandem Stock Appreciation Right granted under the Plan to a person then subject to Section 16 of the Exchange Act shall be exercised during the first six months of its term for cash, except as provided in Article 10.

(e) Any Option related to a Tandem Stock Appreciation Right shall no longer be exercisable to the extent the Tandem Stock Appreciation Right has been exercised.

(f) The provisions of Stock Appreciation Rights need not be the same with respect to each recipient.

(g) Subject to Section 11.2, a Freestanding Stock Appreciation Right shall have the same terms and conditions as Options, including (i) an exercise price not less than Fair Market Value on the date of grant and (ii) a term not greater than ten years other than as a result of any extension of the term in compliance with applicable law as provided in an Award Agreement. Subject to Section 3.3, the vesting schedule shall be set forth in the Award Agreement.

(h) The Committee may impose such terms and conditions on Stock Appreciation Rights granted in conjunction with any Award (other than an Option) as the Committee shall determine in its sole discretion.

6.3 No Repricing. Notwithstanding anything in the Plan to the contrary, except in connection with a corporate transaction involving the Company (including, without limitation, any stock dividend, stock split, extraordinary cash dividend, recapitalization, reorganization, merger, consolidation, split-up, spin-off, combination, or exchange of shares), the terms of outstanding awards may not be amended without stockholder approval to (a) reduce the exercise price of outstanding Stock Appreciation Rights, (b) cancel outstanding Stock Appreciation Rights in exchange for cash, other awards or Stock Appreciation Rights with an exercise price that is less than the exercise price of the original Stock Appreciation Rights, (c) take any other action with respect to the Stock Appreciation Rights that would be treated as a repricing under the rules and regulations of the principal national securities exchange on which they are listed, or (d) permit the grant of any Stock Appreciation Rights that contains a so-called “reload” feature under which additional Stock Appreciation Rights or other Awards are granted automatically to the Participant upon exercise of the original Stock Appreciation Rights.

7. RESTRICTED STOCK AWARDS

7.1 Grants. Awards of Restricted Stock may be issued hereunder to Participants either alone or in addition to other Awards granted under the Plan (a “Restricted Stock Award”), and such Restricted Stock Awards shall also be available as a form of payment of Performance Awards and other earned cash-based incentive compensation. A Restricted Stock Award shall be subject to restrictions imposed by the Committee covering a period of time specified by the Committee (the “Restriction Period”). The Committee has sole discretion to determine whether any consideration

(other than services) is to be received by the Company or any Subsidiary as a condition precedent to the issuance of Restricted Stock.

7.2 Award Agreements. The terms of any Restricted Stock Award granted under the Plan shall be set forth in an Award Agreement which shall contain provisions determined by the Committee and not inconsistent with the Plan. The terms of Restricted Stock Awards need not be the same with respect to each Participant.

7.3 Rights of Holders of Restricted Stock. Beginning on the date of grant of the Restricted Stock Award and subject to execution of the Award Agreement, the Participant shall become a shareholder of the Company with respect to all Shares subject to the Award Agreement and shall have all of the rights of a shareholder, including the right to vote such Shares and the right to receive distributions made with respect to such Shares unless otherwise provided in such Award Agreement; provided, however, that any Shares, any other property, or cash distributed as a dividend or otherwise with respect to any Restricted Stock as to which the restrictions have not yet lapsed shall be subject to the same restrictions as such Restricted Stock.

7.4 Vesting. Subject to Section 3.3, the vesting schedule shall be set forth in the Award Agreement.

7.5 Section 83(b) Election. The Committee may provide in an Award Agreement that the Award of Restricted Stock is conditioned upon the Participant making or refraining from making an election with respect to the Award under Section 83(b) of the Code. If a Participant makes an election pursuant to Section 83(b) of the Code concerning a Restricted Stock Award, the Participant shall be required to file promptly a copy of such election with the Company.

8. OTHER STOCK UNIT AWARDS

8.1 Grants. Other Awards of units having a value equal to an identical number of Shares (“Other Stock Unit Awards”) may be granted hereunder to Participants, in addition to other Awards granted under the Plan. Other Stock Unit Awards shall also be available as a form of payment of other Awards granted under the Plan and other earned cash-based incentive compensation.

8.2 Award Agreements. The terms of Other Stock Unit Award granted under the Plan shall be set forth in an Award Agreement which shall contain provisions determined by the Committee and not inconsistent with the Plan. The terms of such Awards need not be the same with respect to each Participant.

8.3 Vesting. Subject to Section 3.3, the vesting schedule shall be set forth in the Award Agreement.

8.4 Payment. Except as provided in Article 10 or as maybe provided in an Award Agreement, Other Stock Unit Awards may be paid in cash, Shares, other property, or any combination thereof, in the sole discretion of the Committee at the time of payment. Other Stock Unit Awards may be paid in a lump sum or in installments following the lapse of the restrictions applicable to such Awards, but, unless expressly provided in an Award Agreement, no later than two and one-half months following the end of the calendar year in which such restrictions lapse, or in accordance with procedures established by the Committee, on a deferred basis subject to the requirements of Section 409A of the Code.

9. PERFORMANCE AWARDS

9.1 Grants. Performance Awards in the form of Performance Shares or Performance Units, as determined by the Committee in its sole discretion, may be granted hereunder to Participants, for no consideration or for such minimum consideration as may be required by applicable law, either alone or in addition to other Awards granted under the Plan. The performance goals to be achieved for each Performance Period shall be conclusively determined by the Committee.

9.2 Award Agreements. The terms of any Performance Award granted under the Plan shall be set forth in an Award Agreement which shall contain provisions determined by the Committee and not inconsistent with the Plan, including whether such Awards shall have Dividend Equivalents. The terms of Performance Awards need not be the same with respect to each Participant.

9.3 Terms and Conditions. The performance criteria to be achieved during any Performance Period and the length of the Performance Period shall be determined by the Committee upon the grant of each Performance Award. Performance Awards shall be subject to the vesting requirements as set forth in Section 3.3. The amount of the Award to be distributed shall be conclusively determined by the Committee.

9.4 Payment. Except as provided in Article 10 or as may be provided in an Award Agreement, Performance Awards will be distributed only after the end of the relevant Performance Period. Performance Awards may be paid in cash, Shares, or any combination thereof, in the sole discretion of the Committee at the time of payment. Performance Awards may be paid in a lump sum or in installments, but, unless expressly provided in an Award Agreement, no later

than two and one-half months following the close of the calendar year that contains the end of the Performance Period or, in accordance with procedures established by the Committee, on a deferred basis subject to the requirements of Section 409A of the Code.

9.5 Performance Award Dividend Equivalents. Subject to the provisions of the Plan and any Award Agreement, the Committee in its sole discretion may award currently or on a deferred basis, Dividend Equivalents with respect to the number of Shares covered by a Performance Unit or Performance Share Award, provided, that such Dividend Equivalents (if any) shall be deemed to have been reinvested in additional Performance Shares or Performance Units and shall provide that such Dividend Equivalents are subject to the same vesting conditions as the underlying Award.

10. CHANGE OF CONTROL PROVISIONS

Upon the occurrence of a Change of Control, unless otherwise specifically set forth in an Award Agreement or other agreement applicable to any Award, the Committee may effect one or more of the following alternatives, which may vary among individual holders and which may vary among Awards held by any individual holder:

(a) Awards outstanding as of the date of the Change of Control immediately vest and become free of all restrictions and limitations and, to the extent applicable, become fully exercisable and/or immediately settled or distributed;

(b) Options and Stock Appreciation Rights outstanding shall terminate within a specified number of days after notice to the Participant;

(c) Participants shall receive, with respect to each Share subject to an Award (or vested portion thereof), an amount equal to the excess, if any, of the Fair Market Value of such Share immediately prior to the occurrence of such Change of Control over the exercise price per share, if applicable, of such Award, such amount to be payable in cash, in one or more kinds of stock or property (including the stock or property, if any, payable in the transaction) or in a combination thereof, as the Committee, in its sole discretion, shall determine;

(d) Options and Stock Appreciation Rights outstanding as of the date of the Change of Control may be cancelled and terminated without payment therefor if the Fair Market Value of one Share as of the date of the Change of Control is less than the per Share Option exercise price or Stock Appreciation Right grant price; or

(e) such other adjustments or benefits as the Committee deems appropriate in its sole discretion shall apply (including the substitution, assumption or continuation of Awards by the successor company or a parent or subsidiary thereof);

in each case, (i) to the extent permitted under Section 409A of the Code and (ii) subject to any terms and conditions contained in the Award Agreement evidencing such Award or other agreement applicable to such Award.

11. GENERALLY APPLICABLE PROVISIONS

11.1 Amendment and Termination of the Plan. The Board may, from time to time, alter, amend, suspend or terminate the Plan as it shall deem advisable in its sole discretion, subject to any requirement for stockholder approval imposed by applicable law, including the rules and regulations of the Nasdaq Stock Market (or any other principal national securities exchange on which the Company is listed) provided that the Board may not amend the Plan in any manner that would result in noncompliance with Rule 16b-3 of the Exchange Act; and further provided that the Board may not, without the approval of the Company’s stockholders, amend the Plan to (a) increase the number of Shares that may be the subject of Awards under the Plan (except for adjustments pursuant to Section 11.2), (b) expand the types of awards available under the Plan, (c) materially expand the class of persons eligible to participate in the Plan, (d) amend any provision of Section 5.9, (e) increase the maximum permissible term of any Option specified by Section 5.4 or any Stock Appreciation Right specified by Section 6.2(g), or (f) amend any provision of Section 6.3. In addition, no amendments to, or termination of, the Plan shall in any way materially impair the rights of a Participant under any Award previously granted without such Participant’s consent.

11.2 Adjustments. In the event of any merger, reorganization, consolidation, recapitalization, dividend or distribution (whether in cash, shares or other property, other than a regular cash dividend), stock split, reverse stock split, spin-off, joint venture, subsidiary or division sale or similar transaction or other change in corporate structure affecting the Shares or the value thereof, such adjustments and other substitutions shall be made to the Plan and to Awards as the Committee, in its sole discretion, deems equitable or appropriate, including such adjustments (a) in the aggregate number, class and kind of securities that may be delivered under the Plan, in the aggregate or to any one Participant, (b) in the number, class, kind and option or exercise price of securities subject to outstanding Awards granted under the Plan

(including, if the Committee deems appropriate, the substitution of similar options to purchase the shares of, or other awards denominated in the shares of, another company) and (c) to the terms and conditions of any outstanding Awards (including any applicable performance targets or criteria with respect thereto), in each case, as the Committee may determine to be appropriate in its sole discretion; provided, however, that the number of Shares subject to any Award shall always be a whole number. No adjustment or substitution pursuant to this Section 11.2 shall be made in a manner that results in noncompliance with the requirements of Section 409A of the Code, to the extent applicable.

11.3 Transferability of Awards. Except as provided below, no Award and no Shares subject to Other Stock Unit Awards or Performance Units that have not been issued or as to which any applicable restriction, performance or deferral period has not lapsed, may be sold, assigned, transferred, pledged or otherwise encumbered, other than by will or the laws of descent and distribution or pursuant to a domestic relations order, as determined by the Committee, and such Award may be exercised during the life of the Participant only by the Participant or the Participant’s guardian or legal representative. Notwithstanding the foregoing, a Participant may assign or transfer an Award with the consent of the Committee (a) for charitable donations; (b) to the Participant’s spouse, children or grandchildren (including any adopted and stepchildren and grandchildren), or (c) a trust for the benefit of one or more of the Participants or the persons referred to in clause (b) (each transferee thereof, a “Permitted Assignee”); provided that such Permitted Assignee shall be bound by and subject to all of the terms and conditions of the Plan and the Award Agreement relating to the transferred Award and shall execute an agreement satisfactory to the Company evidencing such obligations; and provided further that such Participant shall remain bound by the terms and conditions of the Plan. The Company shall cooperate with any Permitted Assignee and the Company’s transfer agent in effectuating any transfer permitted under this Section 11.3. Notwithstanding the foregoing, no Incentive Stock Option granted under the Plan may be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, other than by will or by the laws of descent and distribution. Further, all Incentive Stock Options granted to a Participant under the Plan shall be exercisable during his or her lifetime only by such Participant. For the avoidance of doubt, in no event may an Award (excluding any fully vested and unrestricted Shares received pursuant to an Award) be transferred by a Participant to a third party for monetary value.

11.4 Termination of Employment. The Committee shall determine and set forth in each Award Agreement whether any Awards granted in such Award Agreement will continue to be exercisable, and the terms of such exercise, on and after the date that a Participant ceases to be employed by or to provide services to the Company or any Subsidiary (including as a Director), whether by reason of death, Disability, voluntary or involuntary termination of employment or services, or otherwise. The date of termination of a Participant’s employment or services will be determined by the Committee, which determination will be final.

11.5 Deferral. The Committee shall be authorized to establish procedures pursuant to which the payment of any Award may be deferred. Such deferrals shall be administered in a manner that is intended to comply with Section 409A of the Code and shall be construed and interpreted in accordance with such intent.

11.6 Dividend Equivalents. Subject to the provisions of the Plan and any Award Agreement, the recipient of an Award (including any deferred Award) may, if so determined by the Committee, be entitled to receive, on a deferred basis, cash, stock or other property dividends, or cash payments in amounts equivalent to cash, stock or other property dividends on Shares (“Dividend Equivalents”) with respect to the number of Shares covered by the Award, as determined by the Committee, in its sole discretion. Dividend Equivalents may accrue but will not, in any event, be payable until the vesting conditions of the underlying Award have been met. The Committee may provide that such amounts and Dividend Equivalents (if any) shall be deemed to have been reinvested in additional Shares or otherwise reinvested. Notwithstanding the foregoing, Dividend Equivalents shall not be made part of any Options or Stock Appreciation Rights.

12. MISCELLANEOUS

12.1 Tax Withholding. The Company shall have the right to make all payments or distributions pursuant to the Plan to a Participant (or a Permitted Assignee thereof) (any such person, a “Payee”) net of any applicable federal, state and local taxes required to be paid or withheld as a result of (a) the grant of any Award, (b) the exercise of an Option or Stock Appreciation Right, (c) the delivery of Shares or cash, (d) the lapse of any restrictions in connection with any Award or (e) any other event occurring pursuant to the Plan. The Company or any Subsidiary shall have the right to withhold from wages or other amounts otherwise payable to such Payee such minimum statutory withholding taxes as may be required by law, or to otherwise require the Payee to pay such withholding taxes. If the Payee shall fail to make such tax payments as are required, the Company or its Subsidiaries shall, to the extent permitted by law, have the right to deduct any such taxes from any payment of any kind otherwise due to such Payee or to take such other action as may be necessary to satisfy such withholding obligations. The Committee shall be authorized to establish procedures for election by Participants to satisfy such obligation for the payment of such taxes by tendering previously acquired Shares (either actually or by attestation, valued at their then Fair Market Value) that have been owned for a period of at least six months (or such other period to avoid accounting charges against the Company’s earnings), or by directing the Company to retain Shares (up to the Participant’s minimum required tax withholding rate or such other rate that will not trigger a negative accounting impact) otherwise deliverable in connection with the Award.

12.2 Right of Discharge Reserved; Claims to Awards. Nothing in the Plan nor the grant of an Award hereunder shall confer upon any Employee or Director the right to continue in the employment or service of the Company or any Subsidiary or affect any right that the Company or any Subsidiary may have to terminate the employment or service of (or to demote or to exclude from future Awards under the Plan) any such Employee or Director at any time for any reason. Except as specifically provided by the Committee, the Company shall not be liable for the loss of existing or potential profit from an Award granted in the event of termination of an employment or other relationship. No Employee or Participant shall have any claim to be granted any Award under the Plan, and there is no obligation for uniformity of treatment of Employees or Participants under the Plan.

12.3 Prospective Recipient. Unless otherwise determined by the Committee, the prospective recipient of any Award under the Plan shall not, with respect to such Award, be deemed to have become a Participant, or to have any rights with respect to such Award, until and unless such recipient shall have executed or acknowledged an Award Agreement and delivered a copy thereof to the Company, in each case, in the manner prescribed by the Committee, and otherwise complied with the then applicable terms and conditions.

12.4 Cancellation of Award. Notwithstanding anything to the contrary contained herein, all outstanding Awards granted to any Participant may be canceled if the Participant, without the consent of the Company, while employed by the Company or any Subsidiary or after termination of such employment or service, establishes a relationship with a competitor of the Company or any Subsidiary or engages in activity that is in conflict with or adverse to the interest of the Company or any Subsidiary, as determined by the Committee in its sole discretion.

12.5 Stop Transfer Orders. All certificates for Shares delivered under the Plan pursuant to any Award shall be subject to such stop-transfer orders and other restrictions as the Committee may deem advisable in its sole discretion under the rules, regulations and other requirements of the Securities and Exchange Commission, any stock exchange upon which the Shares are then listed, and any applicable federal or state securities law, and the Committee may cause a legend or legends to be put on any such certificates to make appropriate reference to such restrictions.

12.6 Nature of Payments. All Awards made pursuant to the Plan are in consideration of services performed or to be performed for the Company or any Subsidiary, division or business unit of the Company. Neither Awards made under the Plan nor Shares or cash paid pursuant to such Awards, may be included as “compensation” for purposes of computing the benefits payable to any Participant under the Company’s or any Subsidiary’s retirement plans (both qualified and non-qualified), welfare benefit plans or other employee benefit plans unless such plan expressly provides that such compensation shall be taken into account in computing a participant’s benefit.

12.7 Other Plans. Nothing contained in the Plan shall prevent the Board from adopting other or additional compensation arrangements, subject to stockholder approval if such approval is required; and such arrangements may be either generally applicable or applicable only in specific cases.

12.8 Severability. If any provision of the Plan shall be held unlawful or otherwise invalid or unenforceable in whole or in part by a court of competent jurisdiction, such provision shall (a) be deemed limited to the extent that such court of competent jurisdiction deems it lawful, valid and/or enforceable and as so limited shall remain in full force and effect, and (b) not affect any other provision of the Plan or part thereof, each of which shall remain in full force and effect. If the making of any payment or the provision of any other benefit required under the Plan shall be held unlawful or otherwise invalid or unenforceable by a court of competent jurisdiction, such unlawfulness, invalidity or unenforceability shall not prevent any other payment or benefit from being made or provided under the Plan, and if the making of any payment in full or the provision of any other benefit required under the Plan in full would be unlawful or otherwise invalid or unenforceable, then such unlawfulness, invalidity or unenforceability shall not prevent such payment or benefit from being made or provided in part, to the extent that it would not be unlawful, invalid or unenforceable, and the maximum payment or benefit that would not be unlawful, invalid or unenforceable shall be made or provided under the Plan.