PubMatic, Inc.0001422930FALSE601 Marshall St4th FloorRedwood CityCalifornia9406300014229302024-11-122024-11-1200014229302024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported): November 12, 2024

PubMatic, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

Delaware | | 001-39748 | | 20-5863224 |

(State or other jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

N/A

(Address of Principal Executive Offices) (Zip Code)

N/A

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | | PUBM | | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 12, 2024, PubMatic, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished with this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

The Company is making reference to non-GAAP financial information in the press release. A reconciliation of GAAP to non-GAAP results is provided in the attached Exhibit 99.1 press release.

The Company announces material information to the public through a variety of means, including filings with the Securities and Exchange Commission, press releases, public conference calls, and the Company’s investor relations website (https://investors.pubmatic.com/investor-relations) as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| PubMatic, Inc. |

Date: November 12, 2024 | By: | /s/ Steven Pantelick |

| | Steven Pantelick |

| | Chief Financial Officer |

EXHIBIT 99.1

PubMatic Announces Third Quarter 2024 Financial Results

Delivered Q3 results ahead of guidance

Delivered revenue of $71.8 million, up 13% over Q3 2023; Revenue from omnichannel video up 25%;

Gross profit was $46.3 million, up 23% over Q3 2023

Net loss of $(0.9) million or (1)% margin;

Adjusted EBITDA of $18.5 million or 26% margin;

Repurchased 3.6 million shares year to date, representing 6.5% of fully diluted shares as of September 30, 2024

NO-HEADQUARTERS/REDWOOD CITY, Calif., November 12, 2024 (GLOBE NEWSWIRE) -- PubMatic, Inc. (Nasdaq: PUBM), an independent technology company delivering digital advertising’s supply chain of the future, today reported financial results for the third quarter ending September 30, 2024.

“Our third quarter results exceeded expectations, driven by strong growth in CTV and mobile app. With 70% of the top streamers now on PubMatic, we offer a critical mass of premium CTV inventory to meet the surge in ad demand on our platform. We also prioritized innovation, building new generative AI solutions to unlock inventory and increase monetization. As a result, customers and partners are using PubMatic technology to build and enhance their ad businesses,” said Rajeev Goel, co-founder and CEO at PubMatic.

“Sell-side technology has become a critical component for publishers, buyers and data partners, particularly as they capitalize on the growing commerce media and CTV opportunities in the open internet. This growing importance has led Forrester to address the SSP category for the first time in more than a decade, recognizing PubMatic as a leader in The Forrester Wave™: Sell-Side Platforms, Q4 2024. I’m extremely proud of the team and their accomplishments. Our infrastructure, vision and resources to develop technology solutions that adapt to market dynamics and meet customer needs is what, I believe, will drive long-term outsized growth.”

Third Quarter 2024 Financial Highlights

•Revenue in the third quarter of 2024 was $71.8 million, up 13% compared to the same period of 2023;

•Net dollar-based retention1 was 112% for the trailing twelve-months ended September 30, 2024, compared to 97% in the comparable trailing twelve-month period a year ago;

•GAAP net loss was $(0.9) million with a margin of (1)%, or $(0.02) per diluted share in the third quarter, compared to GAAP net income of $1.8 million with a margin of 3%, or $0.03 per diluted share in the same period of 2023;

•Adjusted EBITDA was $18.5 million, or 26% margin, compared to $18.2 million, or a 29% margin, in the same period of 2023;

1 Net dollar-based retention is calculated by starting with the revenue from publishers in the trailing twelve months ended September 30, 2023 (Prior Period Revenue). We then calculate the revenue from these same publishers in the trailing twelve months ended September 30, 2024 (Current Period Revenue). Current Period Revenue includes any upsells and is net of contraction or attrition, but excludes revenue from new publishers. Our net dollar-based retention rate equals the Current Period Revenue divided by Prior Period Revenue. Net dollar-based retention rate is an important indicator of publisher satisfaction and usage of our platform, as well as potential revenue for future periods

•Non-GAAP net income was $6.6 million, or $0.12 per diluted share in the third quarter, compared to Non-GAAP net income of $7.6 million, or $0.14 per diluted share in the same period of 2023;

•Net cash provided by operating activities was $19.1 million, compared to $23.8 million in the same period of 2023;

•Total cash, cash equivalents, and marketable securities of $140.4 million as of September 30, 2024 with no debt;

•Since inception of the stock repurchase program through September 30, 2024, used $124.1 million to repurchase 7.6 million shares of Class A common stock, representing 13.9% of fully diluted shares. We have $50.9 million remaining in the repurchase program.

The section titled “Non-GAAP Financial Measures” below describes our usage of non-GAAP financial measures. Reconciliations between historical GAAP and non-GAAP information are contained at the end of this press release following the accompanying financial data.

Business Highlights

Omnichannel platform drives revenue in secular growth areas

•Revenue from high value formats and channels, mobile display and omnichannel video2, grew 19% over Q3 2023 and represented 79% of total revenue in the quarter, up 3 percentage points from 76% in Q3 2023.

•Revenue from omnichannel video, which includes CTV, grew 25% year-over-year.

•Monetized impressions in Q3 2024 increased 5% over Q3 2023. Monetized impressions from omnichannel video, which includes CTV, grew nearly 50% year-over-year. Monetized impressions from CTV grew more than 100% year-over-year for the third straight quarter.

•Diversified across more than 20 advertiser verticals. The top 10 ad verticals, in aggregate, grew 20% year-over-year.

CTV inventory reaches critical mass; new products fuel growth

•PubMatic offers ad buyers access to premium CTV inventory, including 70% of the top 30 streaming publishers.

•Product innovation built on generative AI unlocks inventory on PubMatic platform to increase monetization and scale audience reach. As a result, this new technology drove an incremental 250+ publishers to open up their inventory to political ad budgets via PubMatic in Q3.

•Launched CTV Marketplaces, offering ad buyers pre-curated CTV inventory available only on PubMatic, built directly from our sell side technology. CTV Marketplaces allows publishers to unlock more value from their inventory and provides off-the-shelf, easy to buy premium content and targeted audiences for buyers, including curated live sports inventory.

PubMatic’s sell side technology powers growth from ad-buying partners

•Supply Path Optimization represented ~50% of total activity on our platform in Q3 2024, up from over 45% a year ago, driven by Activate and expanded strategic partnerships with top ad agencies and advertisers.

•Strategic SPO deals continued to fuel buyer consolidation and long-term growth as large holding companies shifted many direct buys on behalf of their clients to PubMatic in order to leverage their SPO relationships with us.

•Partnered with dentsu to integrate Connect and Activate into Merkury for Media, their centralized data, media activation and creative execution platform.

Continued execution on 2024 operating priorities

•Aligned with our growth investments, increased global headcount by 14% in Q3 2024 on a year-over-year basis, adding new team members across product management, engineering and go-to-market teams to accelerate long-term revenue growth.

•Infrastructure optimization initiatives combined with limited capex drove nearly 70 trillion impressions processed in Q3 2024, an increase of 25% over Q3 2023.

•Cost of revenue per million impressions processed decreased 18% on a trailing twelve month period, as compared to the prior period.

2 Omnichannel video spans across desktop, mobile and CTV devices.

•Use of generative AI across software development, testing and release process has driven an estimated 10% - 15% increase in productivity year to date.

Growing importance of sell side technology as open internet opportunities expand

•Forrester Wave names PubMatic a leader among top vendors in the SSP market. The increased need for sell side technology platforms has led Forrester to address the SSP category for the first time in more than a decade.

•Social media companies are opening their inventory up to PubMatic to help them monetize their audiences, curate inventory and expand access to programmatic demand.

•With a strong foothold in the mobile app market, our mobile app business grew over 20% year-over- year in Q3 for the fourth consecutive quarter. Recent client additions indicate continued growth in this channel as app developers expand their ad businesses and compete for brand ad dollars. Per Magna’s forecasts, $58B in mobile app ad spend is expected to flow through the Open Internet this year.

“We delivered strong Q3 results, as revenue growth accelerated to 13% over last year and ahead of guidance. Even more exciting, our business grew 17% year-over-year when excluding political advertising and the large DSP buyer that I called out earlier this year. These accelerated growth rates are being driven by a growing roster of marquee publishers and streamers live on our platform, expanded go-to-market teams, and the launch of new solutions,” said Steve Pantelick, CFO at PubMatic.

“As a result of increased efficiency, infrastructure optimization and favorable product mix, we increased gross profit at an even faster pace, up 23% over last year. We are well positioned to drive profitable growth, prioritize capital allocation and increase market share in our fastest growing areas like CTV and mobile app.”

Financial Outlook

Our Q4 and full year outlook reflects a balance between our fastest growing areas of the business and the continued headwind from one of our top DSP buyers that revised its auction approach in late May. We assume that general market conditions do not significantly deteriorate as it relates to current macroeconomic and geopolitical conditions.

Accordingly, we estimate the following:

For the fourth quarter of 2024, we expect the following:

•Revenue to be between $86 million to $90 million.

•Adjusted EBITDA to be in the range of $34 million to $37 million, representing approximately a 40% margin at the midpoint.

For the full year 2024, we expect the following:

•Year-over-year revenue to be between $292 million and $296 million, representing approximately 10% growth at the midpoint.

•Adjusted EBITDA to be in the range of $89 million to $92 million, representing approximately 31% margin at the midpoint.

Although we provide guidance for adjusted EBITDA, we are not able to provide guidance for net income, the most directly comparable GAAP measure. Certain elements of the composition of GAAP net income, including stock-based compensation expenses, are not predictable, making it impractical for us to provide guidance on net income or to reconcile our adjusted EBITDA guidance to net income without unreasonable efforts. For the same reason, we are unable to address the probable significance of the unavailable information.

Conference Call and Webcast details

PubMatic will host a conference call to discuss its financial results on Tuesday, November 12, 2024 at 1:30 p.m. Pacific Time (4:30 p.m. Eastern Time). A live webcast of the call can be accessed from PubMatic’s Investor Relations website at https://investors.pubmatic.com. An archived version of the webcast will be available from the same website after the call.

Non-GAAP Financial Measures

In addition to our results determined in accordance with U.S. generally accepted accounting principles (GAAP), including, in particular operating income (loss), net cash provided by operating activities, and net income (loss), we believe that adjusted EBITDA, adjusted EBITDA margin, non-GAAP net income, non-GAAP net income per diluted share and free cash flow, each a non-GAAP measure, are useful in evaluating our operating performance. We define adjusted EBITDA as net income (loss) adjusted for stock-based compensation expense, depreciation and amortization, interest income, and provision for (benefit from) income taxes. Adjusted EBITDA margin represents adjusted EBITDA calculated as a percentage of revenue. We define non-GAAP net income as net income (loss) adjusted for stock-based compensation expense and adjustments for income taxes. We define non-GAAP free cash flow as net cash provided by operating activities reduced by purchases of property and equipment and capitalized software development costs.

In addition to operating income and net income, we use adjusted EBITDA, non-GAAP net income, and free cash flow as measures of operational efficiency. We believe that these non-GAAP financial measures are useful to investors for period to period comparisons of our business and in understanding and evaluating our operating results for the following reasons:

•Adjusted EBITDA and non-GAAP net income are widely used by investors and securities analysts to measure a company’s operating performance without regard to items such as stock-based compensation expense, depreciation and amortization, interest expense, and provision for (benefit from) income taxes that can vary substantially from company to company depending upon their financing, capital structures and the method by which assets were acquired; and,

•Our management uses adjusted EBITDA, non-GAAP net income, and free cash flow in conjunction with GAAP financial measures for planning purposes, including the preparation of our annual operating budget, as a measure of operating performance or, in the case of free cash flow, as a measure of liquidity, and the effectiveness of our business strategies and in communications with our board of directors concerning our financial performance; and adjusted EBITDA provides consistency and comparability with our past financial performance, facilitates period-to-period comparisons of operations, and also facilitates comparisons with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results.

Our use of non-GAAP financial measures has limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of our financial results as reported under GAAP. Some of these limitations are as follows:

•Adjusted EBITDA does not reflect: (a) changes in, or cash requirements for, our working capital needs; (b) the potentially dilutive impact of stock-based compensation; or (c) tax payments that may represent a reduction in cash available to us;

•Although depreciation and amortization expense are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; and

•Non-GAAP net income does not include: (a) the potentially dilutive impact of stock-based compensation; and (b) income tax effects for stock-based compensation

Because of these and other limitations, you should consider adjusted EBITDA, non-GAAP net income, and free cash flow along with other GAAP-based financial measures, including net income (loss) and cash flow from operating activities, and our GAAP financial results.

Forward Looking Statements

This press release contains “forward-looking statements” regarding our future business expectations, including our guidance relating to our revenue and adjusted EBITDA for the fourth quarter of 2024 and revenue, adjusted EBITDA, and capital expenditures for full year 2024, our expectations regarding our total addressable market, future market growth, and our ability to gain market share. These forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions and may differ materially from actual results due to a variety of factors including: our dependency on the overall demand for advertising and the channels we rely on; our existing customers not expanding their usage of our platform, or our failure to attract new publishers and buyers; our ability to maintain and expand access to spend from buyers and valuable ad impressions from publishers; the rejection of the use of digital advertising by consumers through opt-in, opt-out or ad-blocking technologies or other means; our failure to innovate and develop new solutions that are adopted by publishers; the war between Ukraine and Russia and the ongoing conflict between Israel and Palestine, and the related measures taken in response by the global community; the impacts of inflation as well as fiscal tightening and changes in the interest rate environment; public health crises, including the resulting global economic uncertainty; limitations imposed on our collection, use or disclosure of data about advertisements; the lack of similar or better alternatives to the use of third-party cookies, mobile device IDs or other tracking technologies if such uses are restricted; any failure to scale our platform infrastructure to support anticipated growth and transaction volume; liabilities or fines due to publishers, buyers, and data providers not obtaining consents from consumers for us to process their personal data; any failure to comply with laws and regulations related to data privacy, data protection, information security, and consumer protection; and our ability to manage our growth. Moreover, we operate in a competitive and rapidly changing market, and new risks may emerge from time to time. For more information about risks and uncertainties associated with our business, please refer to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of our SEC filings, including but not limited to, our annual report on Form 10-K and quarterly reports on Form 10-Q, copies of which are available on our investor relations website at https://investors.pubmatic.com and on the SEC website at www.sec.gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024. All information in this press release is as of November 12, 2024. We undertake no obligation to update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

About PubMatic

PubMatic is an independent technology company maximizing customer value by delivering digital advertising’s supply chain of the future. PubMatic’s sell-side platform empowers the world’s leading digital content creators across the open internet to control access to their inventory and increase monetization by enabling marketers to drive return on investment and reach addressable audiences across ad formats and devices. Since 2006, PubMatic’s infrastructure-driven approach has allowed for the efficient processing and utilization of data in real time. By delivering scalable and flexible programmatic innovation, PubMatic improves outcomes for its customers while championing a vibrant and transparent digital advertising supply chain.

Investors:

The Blueshirt Group for PubMatic

investors@pubmatic.com

Press Contact:

Broadsheet Communications for PubMatic

pubmaticteam@broadsheetcomms.com

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(unaudited)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 78,914 | | | $ | 78,509 | |

| Marketable securities | 61,463 | | | 96,835 | |

| Accounts receivable, net | 376,790 | | | 375,468 | |

| Prepaid expenses and other current assets | 12,640 | | | 11,143 | |

| Total current assets | 529,807 | | | 561,955 | |

| Property, equipment and software, net | 63,247 | | | 60,729 | |

| Operating lease right-of-use assets | 34,440 | | | 21,102 | |

| Acquisition-related intangible assets, net | 4,679 | | | 5,864 | |

| Goodwill | 29,577 | | | 29,577 | |

| Deferred tax assets | 24,711 | | | 13,880 | |

| Other assets, non-current | 2,683 | | | 2,136 | |

| TOTAL ASSETS | $ | 689,144 | | | $ | 695,243 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities | | | |

| Accounts payable | $ | 360,696 | | | $ | 347,673 | |

| Accrued liabilities | 25,697 | | | 25,684 | |

| Operating lease liabilities, current | 6,376 | | | 6,236 | |

| Total current liabilities | 392,769 | | | 379,593 | |

| Operating lease liabilities, non-current | 28,978 | | | 15,607 | |

| | | |

| | | |

| | | |

| Other liabilities, non-current | 4,196 | | | 3,844 | |

| TOTAL LIABILITIES | 425,943 | | | 399,044 | |

| Stockholders' equity | | | |

| Common stock | 6 | | | 6 | |

| Treasury stock | (136,275) | | | (71,103) | |

| Additional paid-in capital | 264,013 | | | 230,419 | |

| Accumulated other comprehensive loss | (29) | | | (4) | |

| Retained earnings | 135,486 | | | 136,881 | |

| TOTAL STOCKHOLDERS’ EQUITY | 263,201 | | | 296,199 | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 689,144 | | | $ | 695,243 | |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 71,786 | | | $ | 63,677 | | | $ | 205,754 | | | $ | 182,414 | |

Cost of revenue(2) | 25,508 | | | 26,091 | | | 76,092 | | | 75,021 | |

| Gross profit | 46,278 | | | 37,586 | | | 129,662 | | | 107,393 | |

Operating expenses:(2) | | | | | | | |

| Technology and development | 8,813 | | | 6,634 | | | 25,432 | | | 19,881 | |

| Sales and marketing | 23,696 | | | 19,513 | | | 71,606 | | | 62,450 | |

General and administrative(1) | 15,134 | | | 12,010 | | | 43,499 | | | 43,439 | |

| Total operating expenses | 47,643 | | | 38,157 | | | 140,537 | | | 125,770 | |

| Operating loss | (1,365) | | | (571) | | | (10,875) | | | (18,377) | |

| Interest income | 1,969 | | | 2,246 | | | 6,873 | | | 6,313 | |

| | | | | | | |

| | | | | | | |

| Other income (expense), net | (930) | | | 210 | | | 3,356 | | | (476) | |

| | | | | | | |

| Income (loss) before income taxes | (326) | | | 1,885 | | | (646) | | | (12,540) | |

| Provision for (benefit from) income taxes | 586 | | | 111 | | | 749 | | | (2,719) | |

| Net income (loss) | $ | (912) | | | $ | 1,774 | | | $ | (1,395) | | | $ | (9,821) | |

| | | | | | | |

Basic and diluted net income (loss) per share of Class A and Class B stock | $ | (0.02) | | | $ | 0.03 | | | $ | (0.03) | | | $ | (0.19) | |

| | | | | | | |

Weighted-average shares used to compute net income (loss) per share attributable to common stockholders: | | | | | | | |

Basic | 49,056 | | | 51,638 | | | 49,623 | | | 52,132 | |

| Diluted | 49,056 | | | 55,979 | | | 49,623 | | | 52,132 | |

(1)On June 30, 2023, a Demand Side Platform buyer of our platform filed for Chapter 11 bankruptcy. As a result, of this bankruptcy we recorded incremental bad debt expense of $5.7 million which is reflected in our GAAP net loss and adjusted EBITDA results for the nine months ended September 30, 2023.

(2)Stock-based compensation expense includes the following:

STOCK-BASED COMPENSATION EXPENSE

(In thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenue | $ | 486 | | $ | 387 | | $ | 1,417 | | $ | 1,089 |

| Technology and development | 1,603 | | 1,112 | | 4,688 | | 3,209 |

| Sales and marketing | 3,450 | | 2,550 | | 10,160 | | 7,873 |

| General and administrative | 3,918 | | 3,151 | | 12,002 | | 9,354 |

| Total stock-based compensation expense | $ | 9,457 | | $ | 7,200 | | $ | 28,267 | | $ | 21,525 |

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(In thousands)

(unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| CASH FLOW FROM OPERATING ACTIVITIES: | | | |

| Net loss | $ | (1,395) | | | $ | (9,821) | |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 33,931 | | | 33,731 | |

| | | |

| Stock-based compensation | 28,267 | | | 21,525 | |

| Provision for doubtful accounts | — | | | 5,675 | |

| Deferred income taxes | (10,831) | | | (14,185) | |

| Accretion of discount on marketable securities | (3,552) | | | (3,061) | |

| Non-cash operating lease expense | 5,098 | | | 4,605 | |

| Other | (78) | | | 3 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (1,322) | | | 8,367 | |

| Prepaid expenses and other assets | (1,554) | | | 3,501 | |

| Accounts payable | 8,841 | | | 4,141 | |

| Accrued liabilities | 2,259 | | | 3,214 | |

| Operating lease liabilities | (4,741) | | | (4,282) | |

| Other liabilities, non-current | 454 | | | (966) | |

| Net cash provided by operating activities | 55,377 | | | 52,447 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchases of property and equipment | (13,268) | | | (5,424) | |

| Capitalized software development costs | (16,068) | | | (13,725) | |

| Purchases of marketable securities | (117,977) | | | (76,932) | |

| Proceeds from sales of marketable securities | — | | | 18,873 | |

| Proceeds from maturities of marketable securities | 156,958 | | | 69,500 | |

| | | |

| Net cash provided by (used in) investing activities | 9,645 | | | (7,708) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

Payment of business combination indemnification claims holdback | (2,148) | | | — | |

| Proceeds from issuance of common stock for employee stock purchase plan | 1,451 | | | 971 | |

| Proceeds from exercise of stock options | 1,578 | | | 1,210 | |

| Principal payments on finance lease obligations | (98) | | | (93) | |

| Payments to acquire treasury stock | (65,400) | | | (41,479) | |

| Net cash used in financing activities | (64,617) | | | (39,391) | |

| NET INCREASE IN CASH AND CASH EQUIVALENTS | 405 | | | 5,348 | |

| CASH AND CASH EQUIVALENTS - Beginning of period | 78,509 | | | 92,382 | |

| CASH AND CASH EQUIVALENTS - End of period | $ | 78,914 | | | $ | 97,730 | |

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In thousands, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Reconciliation of net income (loss): | | | | | | | |

| Net income (loss) | $ | (912) | | $ | 1,774 | | | $ | (1,395) | | | $ | (9,821) | |

| Add back (deduct): | | | | | | | |

| Stock-based compensation | 9,457 | | 7,200 | | | 28,267 | | 21,525 | |

| Depreciation and amortization | 11,384 | | 11,401 | | | 33,931 | | 33,731 | |

| | | | | | | |

| | | | | | | |

| Interest income | (1,969) | | | (2,246) | | | (6,873) | | | (6,313) | |

| | | | | | | |

| Provision for (benefit from) income taxes | 586 | | 111 | | | 749 | | (2,719) |

| Adjusted EBITDA1 | $ | 18,546 | | $ | 18,240 | | | $ | 54,679 | | $ | 36,403 | |

Revenue | $ | 71,786 | | $ | 63,677 | | | $ | 205,754 | | $ | 182,414 | |

| Adjusted EBITDA margin | 26% | | 29% | | 27% | | 20% |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Reconciliation of net income (loss) per share: | | | | | | | |

| Net income (loss) | $ | (912) | | $ | 1,774 | | | $ | (1,395) | | | $ | (9,821) | |

| Add back (deduct): | | | | | | | |

| | | | | | | |

| Stock-based compensation | 9,457 | | 7,200 | | | 28,267 | | 21,525 | |

| | | | | | | |

| Adjustment for income taxes | (1,978) | | | (1,397) | | | (5,863) | | | (4,105) | |

Non-GAAP net income1 | $ | 6,567 | | $ | 7,577 | | | $ | 21,009 | | | $ | 7,599 | |

| GAAP diluted EPS | $ | (0.02) | | $ | 0.03 | | $ | (0.03) | | $ | (0.19) |

| Non-GAAP diluted EPS | $ | 0.12 | | $ | 0.14 | | $ | 0.38 | | $ | 0.13 |

GAAP weighted average shares outstanding—diluted | 49,056 | | 55,979 | | 49,623 | | 52,132 |

| Non-GAAP weighted average shares outstanding—diluted | 53,986 | | 55,979 | | 54,854 | | 56,394 |

Reported GAAP diluted loss per share for the three months ended September 30, 2024, nine months ended September 30, 2024, and nine months ended September 30, 2023 were calculated using basic share count. Non-GAAP diluted earnings per share for the three months ended September 30, 2024 was calculated using diluted share count which includes approximately 5 million shares of dilutive securities related to employee stock awards. Non-GAAP diluted earnings per share for the nine months ended June 30, 2024 and 2023 was calculated using diluted share count which includes approximately 5 million and 4 million shares of dilutive securities related to employee stock awards, respectively.

1 Net loss, Adjusted EBITDA, and Non-GAAP net income for the nine months ended September 30, 2024 include other income of $4.0 million related to our efforts to build and test integrations with the Google Privacy Sandbox.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Reconciliation of cash provided by operating activities: | | | | | | | |

| Net cash provided by operating activities | $ | 19,139 | | $ | 23,845 | | $ | 55,377 | | $ | 52,447 |

| Less: Purchases of property and equipment | (11,731) | | (2,872) | | (13,268) | | (5,424) |

| Less: Capitalized software development costs | (4,542) | | (3,806) | | (16,068) | | (13,725) |

| Free cash flow | $ | 2,866 | | $ | 17,167 | | $ | 26,041 | | $ | 33,298 |

Cover

|

Nov. 12, 2024 |

Aug. 08, 2024 |

| Cover [Abstract] |

|

|

| Document Type |

8-K

|

|

| Document Period End Date |

Nov. 12, 2024

|

|

| Entity Registrant Name |

PubMatic, Inc.

|

PubMatic, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

|

| Entity File Number |

001-39748

|

|

| Entity Tax Identification Number |

20-5863224

|

|

| Entity Address, Address Line One |

601 Marshall St

|

|

| Entity Address, Address Line Two |

4th Floor

|

|

| Entity Address, City or Town |

Redwood City

|

|

| Entity Address, State or Province |

CA

|

|

| Entity Address, Postal Zip Code |

94063

|

|

| Written Communications |

false

|

|

| Soliciting Material |

false

|

|

| Pre-commencement Tender Offer |

false

|

|

| Pre-commencement Issuer Tender Offer |

false

|

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

|

| Trading Symbol |

PUBM

|

|

| Security Exchange Name |

NASDAQ

|

|

| Entity Emerging Growth Company |

false

|

|

| Entity Central Index Key |

0001422930

|

|

| Amendment Flag |

false

|

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

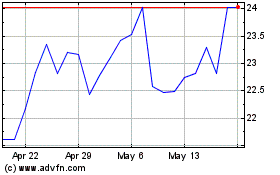

PubMatic (NASDAQ:PUBM)

Historical Stock Chart

From Oct 2024 to Nov 2024

PubMatic (NASDAQ:PUBM)

Historical Stock Chart

From Nov 2023 to Nov 2024