0001906324false00019063242024-05-012024-05-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 1, 2024

QUIDELORTHO CORPORATION

(Exact name of Registrant as specified in its Charter)

| | | | | | | | |

Delaware

| 001-41409

| 87-4496285

|

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

9975 Summers Ridge Road, San Diego, California 92121

(Address of principal executive offices, including zip code)

(858) 552-1100

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 Par Value | QDEL | The Nasdaq Stock Market |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The Board of Directors (the “Board”) of QuidelOrtho Corporation (the “Company”) has appointed Brian J. Blaser to serve as the Company’s President and Chief Executive Officer, effective as of May 6, 2024 (the “Effective Date”). In addition, effective as of May 15, 2024, the Board expanded its size from ten to eleven directors and appointed Mr. Blaser to serve as a director until the Company’s 2025 Annual Meeting of Stockholders.

In connection with the foregoing, effective as of the Effective Date, the Board dissolved the interim Office of the Chief Executive Officer, and each of Michael S. Iskra, who served as the Company’s Interim Chief Executive Officer, and Robert J. Bujarski, who served as the Company’s Interim President, stepped down from these interim positions. Messrs. Iskra and Bujarski will continue to serve as the Company’s Executive Vice President, Chief Commercial Officer and Executive Vice President, Chief Operating Officer, respectively.

Mr. Blaser (age 59) most recently served as Executive Vice President, Diagnostic Products of Abbott Laboratories (NYSE: ABT), a global medical device company, from 2012 to June 2019, where he oversaw the company’s global diagnostics organization, including its core laboratory, point of care, rapid diagnostics and molecular diagnostics businesses. Prior to that role, Mr. Blaser served in various strategic, operational and diagnostic roles at Abbott Laboratories, since joining the company in 2004. Previously, he served in various leadership positions in operations, finance and engineering at the Ortho Clinical Diagnostics division of Johnson & Johnson, Eastman Kodak and General Motors. Mr. Blaser served on the board of directors of Quanterix Corp. (Nasdaq: QTRX), a life sciences company, from 2023 to 2024. He also served on the board of directors of Meridian Bioscience Inc. and as senior advisor to McKinsey & Company. He currently serves as the Advisory Council Chair of the University of Dayton School of Engineering and Chairman of the Board of Trustees for Cristo-Rey St. Martin College Prep. He earned his M.B.A. with a concentration in Finance from the Rochester Institute of Technology and his B.Sc. in Mechanical Engineering Technology from the University of Dayton.

The Company and Mr. Blaser have entered into an employment offer letter, dated April 30, 2024 (the “Offer Letter”), pursuant to which Mr. Blaser is entitled to receive (i) an annual base salary of $1,000,000 and (ii) an annual target cash bonus opportunity of not less than 125% of base salary and a maximum cash bonus opportunity of not less than 150% of target. In addition, he will receive (i) an annual equity grant for 2024 pursuant to the Company’s Long-Term Equity Incentive Plan (the “Plan”) with a total grant date value of $7,000,000, consisting of (a) 40% time-based restricted stock units (“RSUs”), which will vest in equal annual installments over a three-year period and (b) 60% performance-based RSUs, which will vest if certain relative total shareholder return criteria are met over the performance period (the period from the Effective Date through December 31, 2026), and (ii) a one-time sign-on grant of performance-based RSUs with a grant date value of $3,000,000 and with the same vesting criteria as the performance-based RSUs granted pursuant to the Plan. In addition, Mr. Blaser will receive a monthly travel and housing allowance through December 2024 and is also entitled to reimbursement of reasonable legal fees incurred in connection with the negotiation of the Offer Letter.

The Company and Mr. Blaser also have entered into (i) a Severance and Change in Control Agreement (the “Severance and CIC Agreement”), substantially in the form as filed as Exhibit 10.17 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “Annual Report”), but modified as described in Exhibit A to the Offer Letter such that (a) the Company generally may not provide a notice of non-renewal prior to the third anniversary of the Effective Date, to the extent necessary to continue certain non-change in control termination protections through the third anniversary of the Effective Date, (b) the non-change in control severance benefits will be payable upon a termination by the Company without Cause (as such term is defined in the Severance and CIC Agreement) or as a result of the Company’s material breach of the Offer Letter during the first three years following the Effective Date, (c) the bonus portion of any severance payment triggered during the first three years following the Effective Date will be based on the greater of the average bonus paid over the preceding two years and Mr. Blaser’s target annual bonus, and (d) in the event of a non-change in control termination during the first three years following the Effective Date, the time-based RSUs described above will become fully vested, (ii) an Indemnification Agreement, substantially in the form as filed as Exhibit 10.16 to the Annual Report and (iii) the Company’s standard form of Confidential Information, Inventions, Non-Solicitation, and Non-Competition Agreement.

The foregoing summary of the terms and conditions of Mr. Blaser’s employment does not purport to be complete and is qualified in its entirety by reference to the full text of the Offer Letter, a copy of which is attached hereto as Exhibit 10.1 to this Current Report on Form 8-K (“Form 8-K”) and is incorporated herein by reference.

There is no arrangement or understanding between Mr. Blaser and any other person pursuant to which he was appointed as an officer and director of the Company; there is no family relationship between Mr. Blaser and any of the Company’s directors or other executive officers; and Mr. Blaser is not a party to any transactions of the type that would require disclosure under Item 404 of Regulation S-K.

Item 7.01 Regulation FD Disclosure.

On May 2, 2024, the Company issued a press release announcing the appointment of Mr. Blaser as President and Chief Executive Officer and a director of the Company. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

Item 9.01 Financial Statements and Exhibits. | | | | | | | | | | | | | | |

| | | | |

| (d) Exhibits. |

| | | | |

| The following exhibits are filed or furnished with this Form 8-K: |

| | |

| Exhibit Number | Description of Exhibit |

| 10.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL Document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 7, 2024 | | | | | | | | |

|

| | |

| | | |

| QUIDELORTHO CORPORATION |

| | |

| By: | /s/ Joseph M. Busky | |

| Name: | Joseph M. Busky | |

| Its: | Chief Financial Officer | |

April 30, 2024

Dear Brian,

I am pleased to confirm this conditional offer of employment from QuidelOrtho Corporation (the “Company”) in the position of President and Chief Executive Officer reporting to the Board of Directors of the Company (the “Board”). In your capacity as President and Chief Executive Officer, you will perform duties and responsibilities that are reasonable and consistent with such position as may be assigned to you from time to time by the Board. You agree to devote your full-time attention, and best efforts to the performance of your duties and to the furtherance of the Company’s interests. Your anticipated start date is May 6, 2024.

In your capacity as Chief Executive Officer, the Board has determined to appoint you to the Board effective as of the later of your start date and May 15, 2024; however, in the event your employment with the Company terminates for any reason or you otherwise cease to serve as Chief Executive Officer, you agree that you will tender your resignation from all positions as an officer of the Company and all of its subsidiaries and affiliates and as a member of the Board and the board of directors (or similar body) of all of the Company’s subsidiaries and affiliates.

Provided the following outside activities do not interfere with the performance of your duties hereunder and engaging in such outside activities does not violate any Company policies applicable to you, you may serve on one corporate board as may be approved by the Board and, subject to providing advance notice to the Board, be involved in civic, charitable and industry matters. It is expected that you would not request approval to join a corporate board prior to the second anniversary of your start date.

This offer and your employment relationship with the Company will be “at will,” and are subject to the terms and conditions of this letter, as well as to the Company’s standard hiring and personnel policies, rules and practices.

The Company’s headquarters address and telephone number are 9975 Summers Ridge Road, San Diego, California, 92121 and (858) 552-1100.

The following further represents our offer to you:

Compensation

The Company maintains highly competitive compensation programs, with programs intended to provide you with an incentive to help you achieve targeted results.

Salary

Your initial annualized base salary, which will be paid bi-weekly unless otherwise determined by state or local law, will be $1,000,000.00. You will receive payment of your earned compensation at the employee address that the Company has on file for you or direct deposit can also be established during onboarding. Your base salary shall be reviewed at least annually for possible increase, with the first review to occur in the first quarter of 2025.

Brian J. Blaser

April 30, 2024

Page 2

Annual Global Bonus Plan

Your position makes you eligible for participation in the annual cash Global Bonus Plan (GBP) pursuant to the terms and conditions of the GBP, with a target bonus opportunity of not less than 125% of your base salary and a maximum bonus opportunity of not less than 150% of target. This eligibility begins in the current calendar year and will be pro-rated based on your period of service in 2024.

Commencing in 2025 and each year thereafter, the performance criteria under the GBP applicable to each performance year shall be determined by the Board or Committee in consultation with you.

In addition, you will be eligible to participate in the Employee Deferred Compensation Plan, in accordance with the terms and conditions of the plan, under which you may defer either 50% or 100% of any annual cash bonus, which deferred portion will be converted into RSUs which vest immediately. Based on the length of the deferral period chosen (1-4 years), you will receive a premium award of additional RSUs in an amount from 10-30% of the deferred portion of the bonus, which additional RSUs vest between one and four years following the date the award is granted. Any election to participate in this plan with respect to your bonus for 2024 must be provided to the Company prior to your start date.

Long-Term Equity Incentive Plan

Annual LTI Grant

You will also be eligible to receive equity grants under the Company’s Long-term Equity Incentive Plan (“Plan”) in accordance with the terms and conditions of the Plan. You will receive a 2024 equity grant with a value (determined as of the close of business on the Grant Date (as defined below) of $7,000,000 as follows:

40% of the total value of the award ($2,800,000) will be granted in the form of time-based RSUs, which vest in equal annual installments over a three year period from the Grant Date.

60% of the total value of the award ($4,200,000) will be granted in the form of performance-based RSUs, which vest if relative Total Shareholder Return criteria are met over the performance period (which will be the period from your start date through December 31, 2026). Details concerning how achievement of rTSR is determined will be set forth in the form of award agreement (a sample of which has been provided to you), but in summary it is based on a comparison of the performance of QuidelOrtho stock price compared to a well-known health care company index (the S&P Midcap 400 Health Sector Index as of January 1, 2024) over the performance period. Achievement of rTSR of 75% of the benchmark index during the performance period will result in a payout equal to 200% of the target shares.

Commencing in 2025 and each year thereafter, you will be eligible to receive additional LTI grants during the normal annual grant award cycle of the Company (which is usually in February). The amount and terms of such annual awards shall be determined by the Board or Committee consistent with the process used for determining the amount and terms of such awards for other senior executives.

One-Time Sign-on Grant

In addition to the LTI grant described above, you will receive an additional one-time sign on equity grant with a total value (determined as of the Grant Date) of $3,000,000. The full amount of this additional

Brian J. Blaser

April 30, 2024

Page 3

grant will be in the form of performance-based RSUs, using the same vesting criteria described above (rTSR performance versus benchmark through December 31, 2026).

The effective date of your equity grants described herein is expected to be May 15, 2024, assuming a start date of May 6, 2024 (the “Grant Date”). The number of shares is dependent upon the stock valuation and the effective date of the grant. The award will be subject to the Plan’s and the applicable award agreement’s terms and conditions, the form of which has been provided to you, including vesting restrictions that will be set forth in a separate agreement.

Note: Subject to the terms and conditions herein, any compensation or award granted to you shall be in the discretion of the Board and/or Committee. The amount you may receive under any award is contingent upon the performance of the Company, the performance criteria defined by the Company, the terms of the applicable incentive and compensation plans, and your length of service during the applicable performance year, if applicable. All salary, performance-based pay awards, bonuses, allowances, and other forms of compensation and incentives referred to in this letter will be considered normal income and will be subject to applicable Federal, State and Local income taxes, withholdings, and deductions.

Severance and Change in Control Agreement

You will be provided with severance and change in control protection consistent with other arrangements for those eligible at the executive officer level. You are being provided with a copy of the Severance and Change in Control Agreement with this offer letter. The provisions of such Severance and Change in Control Agreement are amended as set forth on Exhibit A attached hereto.

Indemnification Agreement

You will be provided with indemnification consistent with other arrangements for those eligible at the executive officer level. You are being provided with a copy of the Indemnification Agreement with this offer letter.

Vacation

Vacation for employees at this level is unlimited. You will be entitled to take vacation in accordance with the Company’s vacation policy as in effect for executive officers from time to time.

Benefits

The Company’s flexible benefits program includes medical, dental, life, and accident coverage for employees and qualified dependents, for which coverage begins on the first day of employment. In addition, the Company has a 401K Savings Plan that employees may choose to participate in. Eligibility and coverage are determined and governed exclusively by the underlying plan documents. A Benefits Summary will be delivered to you promptly after this offer letter. The Company shall pay or reimburse the reasonable legal fees you incur with respect to your review and execution of this letter agreement and the concurrent review and execution of the agreements referred to herein, subject to a cap of $25,000.

Location

The Company headquarters are located in San Diego and your position is based at the Company’s headquarters. Remote work is acceptable to a limited degree, but your presence on-site at Company

Brian J. Blaser

April 30, 2024

Page 4

headquarters is very important and necessary. To defray travel and temporary housing related expenses, you will receive a monthly allowance of $10,000 payable through December 2024. The amount of such allowance thereafter, if any, shall be determined by the Board or Committee, in its discretion.

Agreement re Confidential Information, Inventions, Non-Solicitation, and Non-Competition

As a condition of employment, you will be required to review and accept the Company’s AGREEMENT RE CONFIDENTIAL INFORMATION, INVENTIONS, NON-SOLICITATION AND NON-COMPETITION. You are being provided with a copy of the agreement with this offer letter. If you accept this conditional offer and you are hired, you must agree to and sign the agreement by or before your first day of employment with the Company and provide the signed agreement to the Company. In addition to requiring you to enter into the agreement, we expect you to keep confidential and not disclose or use in your employment with us any trade secrets or confidential information you have obtained from your present or previous employer(s). We do not need or want their confidential or trade secret information.

Employee Arbitration Agreement

As a condition of being hired and employed by the Company, the Company requires all new hires to enter into an Arbitration Agreement. Except as otherwise provided in the Arbitration Agreement, the Arbitration Agreement is the exclusive means for resolving and attempting to resolve disputes between you and the Company, both during or after your employment with the Company. You are being provided with a copy of the Arbitration Agreement with this offer letter. If you accept this conditional offer and you are hired, you must agree to and sign and deliver the Arbitration Agreement by or before your first day of employment with the Company and provide the signed agreement to the Company.

Clawback Policy

Your compensation shall be subject to the terms and conditions of any recoupment policy that the Company may adopt from time to time, to the extent such policy is applicable to you and to such compensation, including, but not limited to, the Company’s Amended and Restated Clawback Policy, designed to comply with the requirements of Rule 10D-1 promulgated under the U.S. Securities Exchange Act of 1934, as amended, as well as any recoupment provisions required under applicable law.

At-Will Employment

This employment offer is only for “at-will” employment with the Company. The Company also maintains an employment-at-will relationship with its employees. This means that both you and the Company retain the right to terminate the employment relationship at any time, with or without notice or cause, and for any reason or no reason not contrary to law. As for all the Company’s job candidates, this offer letter shall not create an express or implied contract of employment.

Invitation to Self-Identify

As a Federal contractor subject to Section 503 of the Rehabilitation Act of 1973, the Vietnam-era Veterans Readjustment Assistance Act of 1974 and the Veterans Employment Opportunity Act of 1998, the Company is required to extend to applicants a post-offer invitation to self-identify as a Vietnam-era veteran, or veteran covered by the Veterans Employment Opportunities Act of 1998. Providing this information is voluntary and will be kept confidential in accordance with the law. Choosing not to provide it will not have an adverse impact on employment. This information will be used only in accordance with our equal employment opportunity policy.

Brian J. Blaser

April 30, 2024

Page 5

Offer Requirements

This offer and, if hired, your subsequent employment, are contingent upon your accurately, honestly, and satisfactorily completing all pre-employment forms, requirements and conditions, submitting all requested information, and agreeing to and meeting all necessary requirements for employment. Failure to do so can render this offer or any employment begun null and void, and result in the Company not hiring you or terminating any employment already started.

Work Authorization (1-9 Documentation): Employers must verify the employment eligibility and identity of all new employees. In accordance with the Immigration Reform and Control Act, you must provide the Company with appropriate work authorization documents by or on your first day of employment.

This offer letter constitutes our complete offer. Any promises or representations, either oral or written, not contained in this letter and the documents referred to herein, are not valid, authorized, or binding on the Company.

Subject to the terms of this Agreement and the agreements referred to herein, we may review, adjust, modify, or suspend Company policies, compensation levels, incentive or bonus programs and awards, benefit plans, and any other practices or programs for business reasons at any time and for any reason. Your eligibility will be determined per the standard terms and eligibility requirements of the policies, plans, and programs in effect at that time.

We are pleased to offer you this position and, assuming you complete and meet our pre-employment conditions satisfactorily, we are looking forward to your acceptance of this offer and to your joining the Company.

Brian J. Blaser

April 30, 2024

Page 6

Please signify your agreement to and acceptance of this offer of employment by signing below and entering the date in the Agreed & Accepted section below and by emailing to michelle.hodges@quidelortho.com.

| | | | | |

Sincerely,

/s/ Kenneth F. Buechler Kenneth F. Buechler, Ph.D.

Chairman

on behalf of QuidelOrtho

| |

Agreed and Accepted:

/s/ Brian J. Blaser

Name: Brian J. Blaser

Date: May 1, 2024

| |

Brian J. Blaser

April 30, 2024

Page 7

Exhibit A to Letter Agreement

Modifications to Severance and Change in Control Agreement

The Severance and Change in Control Agreement (the “Agreement”) is hereby amended as set forth below:

1)Section 1, “Term of Agreement”, of the Agreement is amended to add the following at the end of such section:

“Notwithstanding the foregoing, the Company shall not provide a notice of non-renewal that terminates this Agreement before the third anniversary of the Effective Date, to the extent necessary, to continue the protections set forth in Sections 3, 5 and 6 hereof, that would apply in the case of a Non-CIC Qualifying Termination that occurs prior to the third anniversary of the Effective Date unless the Company enters into a mutually satisfactory replacement agreement with respect to such terms.”

2)Section 3, Non-CIC Qualifying Termination, of the Agreement is amended to read:

“Non-CIC Qualifying Termination. In the event (a) Executive’s employment with the Company is terminated without Cause during the term of this Agreement or (b) Executive terminates his employment with the Company prior to the third anniversary of the Effective Date due to a Company Breach, in each case, outside of the Protection Period (“Cause” and “Protection Period” each as defined in Section 4 of this Agreement), such termination shall be conclusively considered a “Non-CIC Qualifying Termination.” In the event of a Non-CIC Qualifying Termination, Sections 5 through 12 of this Agreement shall become applicable to Executive, to the extent applicable to such termination.” For purposes hereof, a “Company Breach” shall mean, prior to the third anniversary of Executive’s commencement of employment, all of the following shall have occurred (i) the Company has materially breached the terms of that certain offer letter agreement between the Company and Executive dated as of April 30, 2024, as may be amended (the “Offer Letter”), including by, without Executive’s consent, reducing Executive’s base salary or diminishing Executive’s title or job responsibilities, (ii) Executive has provided written notice to the Company of such material breach (which notice shall state in reasonable detail the facts and circumstances claimed to be a material breach) and given the Company an opportunity to cure the circumstances constituting such breach, (iii) the Company does not cure such breach within sixty (60) days after receiving such notice, and (iv) Executive actually terminates employment within thirty (30) days thereafter.”

3)Paragraph (a) of Section 5, Severance Payment, of the Agreement is amended to add the following at the end of such section:

“Notwithstanding the foregoing, if such Involuntary Termination occurs prior to the third anniversary of the Effective Date, the “Bonus Increment” shall equal the greater of: (A) the annualized average of all cash bonuses and cash incentive compensation payments paid to Executive during the two (2) year period immediately before the date of Executive’s Involuntary Termination under all of the Company’s bonus and incentive compensation plans or arrangements, and (B) Executive’s highest target bonus opportunity under the Company’s annual bonus plan for any period prior to the date of Executive’s Involuntary Termination.”

4) Paragraph (a) of Section 6, Additional Benefits, of the Agreement is amended to add the following at the end of such section:

“Notwithstanding the foregoing, in the event of a Non-CIC Qualifying Termination (but not, for avoidance of doubt, a CIC Qualifying Termination) that occurs prior to the third anniversary of the Effective Date, any and

Brian J. Blaser

April 30, 2024

Page 8

all unvested time-based restricted stock units granted to Executive during 2024 that are specifically described in the Offer Letter and held by Executive shall immediately become fully vested (but for the avoidance of doubt no performance based restricted stock units shall accelerate vesting as described in this sentence in the event of a Non-CIC Qualifying Termination).”

Except as set forth above, the terms and conditions of the Agreement shall remain in full force and effect.

QuidelOrtho Appoints Brian J. Blaser as President and Chief Executive Officer

Brings More Than Two Decades of Leadership Experience in the In-Vitro Diagnostics Industry

SAN DIEGO, CA May 2, 2024–QuidelOrtho Corporation (Nasdaq: QDEL) (the “Company” or “QuidelOrtho”), a global provider of innovative in-vitro diagnostic technologies designed for point of care settings, clinical labs and transfusion medicine, announced the Company’s Board of Directors (the “Board”) has appointed Brian J. Blaser as President and Chief Executive Officer (“CEO”) effective May 6. In addition to his appointment as President and CEO, Mr. Blaser will join the Board, effective May 15, 2024, when the Board will be expanded from ten to eleven members.

“We are excited to welcome Brian as our new president, CEO and director,” said Kenneth F. Buechler, Ph.D., Chairman of the Board. “Brian brings over 25 years of senior leadership experience in the in-vitro diagnostics industry, including seven years of full responsibility for Abbott’s global diagnostics business. His proven track record of executing transformational strategies to streamline operations and driving revenue growth to dramatically improve profitability makes him an ideal leader to guide QuidelOrtho through its next phase of growth.”

Mr. Blaser most recently served as Executive Vice President, Diagnostic Products of Abbott Laboratories, where he oversaw the global diagnostics organization, including core laboratory, point of care, rapid diagnostics, and molecular diagnostics businesses. Prior to that role, Mr. Blaser held various strategic, operational, and diagnostic roles at Abbott, as well as previous leadership positions at the Ortho Clinical Diagnostics division of Johnson & Johnson, Eastman Kodak, and General Motors.

“I am honored and excited to join QuidelOrtho as president and CEO during this pivotal point in the Company’s journey. The Company’s commitment to customer service and its dedication to improving healthcare outcomes align closely with my own values,” said Brian J. Blaser, President and CEO, QuidelOrtho. “I am eager to collaborate with the QuidelOrtho team to drive innovation and continued growth, while delivering value to customers, shareholders and employees.”

Mr. Blaser holds an MBA with a concentration in Finance from the Rochester Institute of Technology and a Bachelor of Sciences in Mechanical Engineering Technology from the University of Dayton. He is actively involved in various industry and community organizations, including serving as Advisory Council Chair of the University of Dayton School of Engineering and Chairman of the Board of Trustees for Cristo-Rey St. Martin College Prep.

“The Board would also like to take this opportunity to thank Michael Iskra, Robert Bujarski and Joseph Busky for their leadership during this transition period. Together, they advanced many critical initiatives while stabilizing a solid foundation for the Company’s continued growth,” Dr. Buechler said.

The Company will report its first quarter 2024 financial results on May 8, 2024.

About QuidelOrtho Corporation

QuidelOrtho Corporation (Nasdaq: QDEL) is a world leader in in-vitro diagnostics, developing and manufacturing intelligent solutions that transform data into understanding and action for more people in more places every day.

Offering industry-leading expertise in immunoassay and molecular testing, clinical chemistry, and transfusion medicine, bringing fast, accurate and reliable diagnostics when and where they are needed–from home to hospital, lab to clinic. So that patients, clinicians and health officials can spot trends sooner, respond quicker and chart the course ahead with accuracy and confidence.

Building upon its many years of groundbreaking innovation, QuidelOrtho continues to partner with customers across the healthcare continuum and around the globe to forge a new diagnostic frontier. One where insights and solutions know no bounds, expertise seamlessly connects, and a more informed path is illuminated for each of us.

QuidelOrtho is advancing diagnostics to power a healthier future.

For more information, please visit www.quidelortho.com.

Source: QuidelOrtho Corporation

| | | | | |

Investor Contact: Juliet Cunningham Vice President, Investor Relations IR@QuidelOrtho.com | Media Contact: D. Nikki Wheeler Senior Director, Corporate Communications media@QuidelOrtho.com |

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

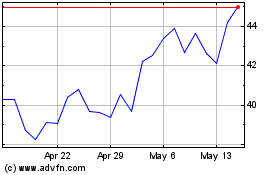

QuidelOrtho (NASDAQ:QDEL)

Historical Stock Chart

From Oct 2024 to Nov 2024

QuidelOrtho (NASDAQ:QDEL)

Historical Stock Chart

From Nov 2023 to Nov 2024