- Total investment income increased 18% to $2.1 million for

the quarter compared with the second quarter last year driven by

strong growth in interest income from an expanded portfolio of debt

investments

- Net asset value per share (“NAV”) was $26.56 at June 30,

2024, up 11% from March 31, 2024 and up 13% from year-end

2023

- Capitalized on market conditions with the sale of certain

BDC holdings that resulted in a realized gain of $1.3

million

- Reduced debt balance $2.0 million during the quarter and

repaid an additional $2.3 million subsequent to

quarter-end

- Portfolio company SciAps expected to be acquired in 2024

after definitive purchase agreement signed

- Announced a quarterly dividend of $0.29 per share for third

quarter 2024

Rand Capital Corporation (Nasdaq: RAND) (“Rand” or the

“Company”), a business development company providing alternative

financing for lower middle market companies, announced its results

for the second quarter ended June 30, 2024.

Daniel P. Penberthy, President and Chief Executive Officer of

Rand, commented, "We are consistent and persistent in the execution

of our strategy, driving strong growth in total investment income

through prudent and strategic investments in income-generating debt

instruments. During the quarter, our efforts to optimize the

portfolio, including selective exits, generated capital that we

advantageously deployed to improve our balance sheet. This

positions us well for future growth opportunities. Additionally, we

look forward to leveraging the capital expected from the pending

sale of our portfolio investment company, SciAps, which we had

previously announced and is expected to close later this year.

“Looking ahead, our plan is to continue scaling our business

through new investments and also reinvesting in high-potential

existing portfolio companies. Our goal is to focus on new debt

investments in smaller opportunities, replicating our past

successes in helping these companies grow. We believe this will

cultivate a robust and steady income stream, strengthening our

ability to increase cash dividends over the long term.”

Second Quarter Highlights (compared with the prior-year

period unless otherwise noted)

- Total investment income grew $321,000, or 18%, to $2.1 million,

which reflected a 35% increase in interest from portfolio

companies, partially offset by lower dividend and fee income.

- Total expenses were $2.7 million compared with $1.3 million in

last year’s second quarter. The change largely reflects a $1.2

million increase in capital gains incentive fees to the Company’s

external investment adviser. The increase in total expenses also

reflects $393,000 in interest expense from the senior revolving

credit facility compared with $259,000 for the second quarter of

2023.

- Adjusted expenses, which exclude capital gains incentive fees

and is a non-GAAP financial measure, were $1.0 million compared

with $816,000 in the second quarter of 2023. See the attached

description of this non-GAAP financial measure and reconciliation

table for adjusted expenses.

- Net investment loss was $517,000, or $0.20 per share, compared

with net investment income of $493,000, or $0.19 per share, in the

second quarter of 2023. Adjusted net investment income per share, a

non-GAAP financial measure, which excludes the capital gains

incentive fee accrual expense, was $0.44 per share, up 16% from

$0.38 per share in last year’s second quarter. See the attached

description of this non-GAAP financial measure and reconciliation

table for adjusted net investment income per share.

Portfolio and Investment Activity

As of June 30, 2024, Rand’s portfolio included investments with

a fair value of $87.1 million across 26 portfolio businesses. This

was an increase of $9.9 million, or 13%, from December 31, 2023,

and reflected new and follow-on investments and valuation

adjustments in multiple portfolio companies, partially offset by

stock sales and other portfolio company loan repayments. At June

30, 2024, Rand’s portfolio was comprised of approximately 66% in

debt investments, 32% in equity investments in private companies,

and 2% in publicly traded equities of other BDCs. The annualized

weighted average yield of debt investments, which includes PIK

interest, was 13.8% at June 30, 2024, compared with 13.6% at the

end of 2023.

Second quarter 2024:

- Funded a follow-on equity investment of $108,000 in Food

Service Supply Holdco LLC (FSS). Rand’s total debt and equity

investment in FSS had a fair value of $7.5 million at

quarter-end.

- Sold shares in three publicly traded BDCs for total proceeds of

$3.3 million, which included a realized gain of $1.3 million.

- Received $740,000 principal loan repayment from Pressure Pro,

Inc.

- Realized a gain of $397,000 from a partial asset sale of a

Tilson affiliated company.

- At quarter-end, Rand’s total debt and equity investment in

SciAps had a fair value of $10.8 million.

- Exited remaining equity investment in KNOA Software.

Liquidity and Capital Resources

Cash was $2.3 million at June 30, 2024. The Company also held

shares valued at approximately $1.3 million in other publicly

traded BDCs, which are available for future operational and

liquidity needs.

During the quarter, Rand reduced its outstanding borrowings by

$2.0 million, leaving a balance of $17.2 million on its existing

$25.0 million senior secured revolving credit facility at June 30,

2024. The outstanding borrowings carried an interest rate of 8.8%

at quarter-end. Subsequent to quarter-end, Rand repaid an

additional $2.3 million on its outstanding borrowings.

The Company did not repurchase any outstanding common stock

during the second quarter of 2024.

Dividends

On May 8, 2024, Rand declared its regular quarterly cash

dividend distribution of $0.29 per share, which was paid during the

second quarter to shareholders of record as of May 31, 2024.

On July 31, 2024, Rand declared its regular quarterly cash

dividend distribution of $0.29 per share. The cash dividend will be

distributed on or about September 13, 2024, to shareholders of

record as of August 30, 2024.

Webcast and Conference Call

Rand will host a conference call and webcast on Tuesday August

6, 2024, at 1:30 p.m. Eastern Time, to review its financial

results. The review will be accompanied by a slide presentation,

which will be available on Rand’s website at www.randcapital.com in

the “Investor Relations” section. Rand’s conference call can be

accessed by calling (201) 689-8263. Alternatively, the webcast can

be monitored on Rand’s website at www.randcapital.com under

“Investor Relations” where the replay will also be available.

A telephonic replay will be available from 5:30 p.m. ET on the

day of the call through Tuesday, August 20, 2024. To listen to the

archived call, dial (412) 317-6671 and enter replay pin number

13747031. A transcript of the call will also be posted once

available.

ABOUT RAND CAPITAL

Rand Capital (Nasdaq: RAND) is an externally managed business

development company (BDC). The Company’s investment objective is to

maximize total return to its shareholders with current income and

capital appreciation by focusing its debt and related equity

investments in privately-held, lower middle market companies with

committed and experienced managements in a broad variety of

industries. Rand invests in businesses that have sustainable,

differentiated and market-proven products, revenue of more than $10

million and EBITDA in excess of $1.5 million. The Company’s

investment activities are managed by its external investment

adviser, Rand Capital Management, LLC. Additional information can

be found at the Company’s website where it regularly posts

information: www.randcapital.com.

Safe Harbor Statement

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements, other than historical facts, including but

not limited to statements regarding the strategy of the Company and

its outlook; statements regarding pending sale of portfolio company

SciAps and the timing for the expected closing of such transaction;

statements regarding the implementation of the Company’s strategy

and the growth of its dividend; and any assumptions underlying any

of the foregoing, are forward-looking statements. Forward-looking

statements concern future circumstances and results and other

statements that are not historical facts and are sometimes

identified by the words “may,” “will,” “should,” “potential,”

“intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,”

“overestimate,” “underestimate,” “believe,” “could,” “project,”

“predict,” “continue,” “target” or other similar words or

expressions. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove to be

incorrect, actual results may vary materially from those indicated

or anticipated by such forward-looking statements. The inclusion of

such statements should not be regarded as a representation that

such plans, estimates or expectations will be achieved. Important

factors that could cause actual results to differ materially from

such plans, estimates or expectations include, among others, (1)

evolving legal, regulatory and tax regimes; (2) changes in general

economic and/or industry specific conditions; and (3) other risk

factors as detailed from time to time in Rand’s reports filed with

the Securities and Exchange Commission (“SEC”), including Rand’s

annual report on Form 10-K for the year ended December 31, 2023,

quarterly reports on Form 10-Q, and other documents filed with the

SEC. Consequently, such forward-looking statements should be

regarded as Rand’s current plans, estimates and beliefs. Except as

required by applicable law, Rand assumes no obligation to update

the forward-looking information contained in this release.

FINANCIAL TABLES FOLLOW

Rand Capital Corporation and

Subsidiaries

Consolidated Statements of

Financial Position

June 30, 2024

(Unaudited)

December 31, 2023

ASSETS

Investments at fair value:

Control investments (cost of $5,721,856

and $5,272,770, respectively)

$

4,598,046

$

4,148,960

Affiliate investments (cost of $45,250,676

and $45,720,974, respectively)

61,779,019

53,499,372

Non-Control/Non-Affiliate investments

(cost of $22,449,599 and $17,371,862, respectively)

20,693,902

19,477,380

Total investments, at fair value (cost of

$73,422,131 and $68,365,606, respectively)

87,070,967

77,125,712

Cash

2,293,226

3,295,321

Interest receivable

516,617

244,600

Prepaid income taxes

149,863

127,869

Deferred tax asset, net

174,053

39,179

Other assets

584,343

189,301

Total assets

$

90,789,069

$

81,021,982

LIABILITIES AND STOCKHOLDERS’ EQUITY

(NET ASSETS)

Liabilities:

Due to investment adviser

$

322,672

$

979,297

Accounts payable and accrued expenses

108,358

145,516

Line of credit

17,200,000

16,250,000

Capital gains incentive fees

4,033,000

2,279,700

Deferred revenue

566,423

552,256

Total liabilities

22,230,453

20,206,769

Stockholders’ equity (net

assets):

Common stock, $0.10 par; shares authorized

100,000,000; shares issued: 2,648,916; shares outstanding:

2,581,021 at 6/30/24 and 12/31/23

264,892

264,892

Capital in excess of par value

55,801,170

55,801,170

Treasury stock, at cost: 67,895 shares at

6/30/24 and 12/31/23

(1,566,605

)

(1,566,605

)

Total distributable earnings

14,059,159

6,315,756

Total stockholders’ equity (net assets)

(per share – 6/30/24: $26.56; 12/31/23: $23.56)

68,558,616

60,815,213

Total liabilities and stockholders’

equity (net assets)

$

90,789,069

$

81,021,982

Rand Capital Corporation and

Subsidiaries

Consolidated Statements of

Operations

(Unaudited)

Three months ended June 30,

2024

Three months ended June 30,

2023

Six months ended June 30,

2024

Six months ended June 30,

2023

Investment income:

Interest from portfolio companies:

Control investments

$

198,885

$

179,922

$

386,368

$

330,838

Affiliate investments

1,192,116

941,201

2,358,201

1,729,022

Non-Control/Non-Affiliate Investments

604,226

352,417

1,064,306

710,583

Total interest from portfolio

companies

1,995,227

1,473,540

3,808,875

2,770,443

Interest from other investments:

Non-Control/Non-Affiliate Investments

144

104

2,058

236

Total interest from other investments

144

104

2,058

236

Dividend and other investment income:

Affiliate investments

13,125

59,677

26,250

406,825

Non-Control/Non-Affiliate Investments

60,050

132,920

198,760

260,515

Total dividend and other investment

income

73,175

192,597

225,010

667,340

Fee income:

Control investments

4,516

4,311

9,032

8,211

Affiliate investments

54,815

138,902

128,535

206,744

Non-Control/Non-Affiliate Investments

8,272

5,978

29,858

13,956

Total fee income

67,603

149,191

167,425

228,911

Total investment income

2,136,149

1,815,432

4,203,368

3,666,930

Expenses:

Base management fee

322,672

255,867

625,267

501,260

Capital gains incentive fees

1,641,000

491,000

1,753,300

782,000

Interest expense

393,172

258,912

783,192

417,312

Professional fees

91,460

100,307

323,767

271,282

Stockholders and office operating

82,667

85,080

151,695

149,384

Directors' fees

66,550

67,391

130,400

131,241

Administrative fees

40,000

37,250

78,167

74,500

Insurance

10,380

10,380

23,424

23,340

Corporate development

4,881

554

10,426

4,267

Total expenses

2,652,782

1,306,741

3,879,638

2,354,586

Net investment (loss) income before

income taxes:

(516,633

)

508,691

323,730

1,312,344

Income taxes, including excise tax

expense

562

16,061

1,340

104,798

Net investment (loss) income

(517,195

)

492,630

322,390

1,207,546

Net realized gain on sales and

dispositions of investments:

Affiliate investments

(831,891

)

2,537,765

(831,891

)

2,596,094

Non-Control/Non-Affiliate Investments

1,259,999

1,280,482

4,710,091

1,275,541

Net realized gain on sales and

dispositions of investments, before income taxes

428,108

3,818,247

3,878,200

3,871,635

Income tax expense

—

338,158

—

338,158

Net realized gain on sales and

dispositions of investments

428,108

3,480,089

3,878,200

3,533,477

Net change in unrealized

appreciation/depreciation on investments:

Affiliate investments

8,849,945

(886,698

)

8,749,945

(886,698

)

Non-Control/Non-Affiliate Investments

(1,070,919

)

(480,572

)

(3,861,215

)

921,401

Change in unrealized

appreciation/depreciation before income taxes

7,779,026

(1,367,270

)

4,888,730

34,703

Deferred income tax benefit

(47,834

)

(66,441

)

(47,834

)

(66,441

)

Net change in unrealized

appreciation/depreciation on investments

7,826,860

(1,300,829

)

4,936,564

101,144

Net realized and unrealized gain on

investments

8,254,968

2,179,260

8,814,764

3,634,621

Net increase in net assets from

operations

$

7,737,773

$

2,671,890

$

9,137,154

$

4,842,167

Weighted average shares

outstanding

2,581,021

2,581,021

2,581,021

2,581,021

Basic and diluted net increase in net

assets from operations per share

$

3.00

$

1.04

$

3.54

$

1.88

Rand Capital Corporation and

Subsidiaries

Consolidated Statements of

Changes in Net Assets

(Unaudited)

Three months ended June 30,

2024

Three months ended June 30,

2023

Six months ended June 30,

2024

Six months ended June 30,

2023

Net assets at beginning of

period

$

61,569,339

$

59,375,393

$

60,815,213

$

57,721,320

Net investment (loss) income

(517,195

)

492,630

322,390

1,207,546

Net realized gain on sales and

dispositions of investments

428,108

3,480,089

3,878,200

3,533,477

Net change in unrealized

appreciation/depreciation on investments

7,826,860

(1,300,829

)

4,936,564

101,144

Net increase in net assets from

operations

7,737,773

2,671,890

9,137,154

4,842,167

Declaration of dividend

(748,496

)

(645,255

)

(1,393,751

)

(1,161,459

)

Net assets at end of period

$

68,558,616

$

61,402,028

$

68,558,616

$

61,402,028

Rand Capital Corporation and

Subsidiaries Reconciliation of GAAP Total Expense to

Non-GAAP Adjusted Expenses (Unaudited)

In addition to reporting total expenses, which is a U.S.

generally accepted accounting principle (“GAAP”) financial measure,

Rand presents adjusted expenses, which is a non-GAAP financial

measure. Adjusted expenses is defined as GAAP total expenses

removing the effect of any expenses for capital gains incentive

fees accrual. GAAP total expenses is the most directly comparable

GAAP financial measure. Rand believes that adjusted expenses

provides useful information to investors regarding financial

performance because it is a method the Company uses to measure its

financial and business trends related to its results of operations.

The presentation of this additional information is not meant to be

considered in isolation or as a substitute for financial results

prepared in accordance with GAAP.

Three months ended June

30, 2024

Three months ended June

30, 2023

Six months ended June

30, 2024

Six months ended June

30, 2023

Total expenses

$

2,652,782

$

1,306,741

$

3,879,638

$

2,354,586

Exclude expenses for capital gains

incentive fees

1,641,000

491,000

1,753,300

782,000

Adjusted total expenses

$

1,011,782

$

815,741

$

2,126,338

$

1,572,586

Reconciliation of GAAP Net Investment (Loss)

Income per Share to Adjusted Net Investment Income per

Share (Unaudited)

In addition to reporting Net Investment (Loss) Income per Share,

which is a GAAP financial measure, the Company presents Adjusted

Net Investment Income per Share, which is a non-GAAP financial

measure. Adjusted Net Investment Income per Share is defined as

GAAP Net Investment (Loss) Income per Share removing the effect of

any expenses for capital gains incentive fees. GAAP Net Investment

(Loss) Income per Share is the most directly comparable GAAP

financial measure. Rand believes that Adjusted Net Investment

Income per Share provides useful information to investors regarding

financial performance because it is a method the Company uses to

measure its financial and business trends related to its results of

operations. The presentation of this additional information is not

meant to be considered in isolation or as a substitute for

financial results prepared in accordance with GAAP.

Three months ended June

30, 2024

Three months ended June

30, 2023

Six months ended June

30, 2024

Six months ended June

30, 2023

Net investment (loss) income per share

$

(0.20)

$

0.19

$

0.12

$

0.47

Exclude expenses for capital gains

incentive fees per share

0.64

0.19

0.68

0.30

Adjusted net investment income per

share

$

0.44

$

0.38

$

0.80

$

0.77

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806482417/en/

Company: Daniel P. Penberthy President and CEO

716.853.0802 dpenberthy@randcapital.com

Investors: Deborah K. Pawlowski / Craig P. Mychajluk Kei

Advisors LLC 716-843-3908 / 716-843-3832 dpawlowski@keiadvisors.com

/ cmychajluk@keiadvisors.com

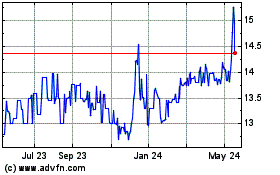

Rand Capital (NASDAQ:RAND)

Historical Stock Chart

From Nov 2024 to Dec 2024

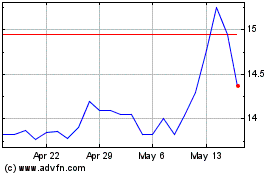

Rand Capital (NASDAQ:RAND)

Historical Stock Chart

From Dec 2023 to Dec 2024