false000167377200016737722025-03-062025-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 06, 2025 |

RAPT Therapeutics, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38997 |

47-3313701 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

561 Eccles Avenue |

|

South San Francisco, California |

|

94080 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (650) 489-9000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

RAPT |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 6, 2025, RAPT Therapeutics, Inc. (the “Company”) issued a press release announcing its financial results for the quarter and year ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information in this Item 2.02 and in the press release furnished as Exhibit 99.1 to this current report shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information contained in this Item 2.02 and in the press release furnished as Exhibit 99.1 to this current report shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

RAPT Therapeutics, Inc. |

|

|

|

|

Date: |

March 6, 2025 |

By: |

/s/ Rodney Young |

|

|

|

Rodney Young

Chief Financial Officer |

Exhibit 99.1

RAPT Therapeutics Reports Fourth Quarter and Full Year 2024 Financial Results

SOUTH SAN FRANCISCO, Calif. – March 6, 2025 – RAPT Therapeutics, Inc. (Nasdaq: RAPT) (“RAPT” or the “Company”) is a clinical-stage immunology-based biopharmaceutical company focused on discovering, developing and commercializing novel therapies for patients living with inflammatory and immunological diseases, today reported financial results for the fourth quarter and year ended December 31, 2024.

“Our focus for 2025 will be on advancing development of RPT904, a novel, potential best-in-class option to treat the large and underserved population of patients suffering from food allergy and chronic spontaneous urticaria,” said Brian Wong, President and CEO of RAPT. “We believe RPT904 can be a differentiated product to treat these diseases by targeting IgE, an approach validated by omalizumab. We expect to initiate a Phase 2b clinical trial for RPT904 in food allergy in the second half of 2025 and await clinical data later this year from our partner Jemincare to guide our development strategy in CSU.”

Financial Results for the Fourth Quarter and Year Ended December 31, 2024

Fourth Quarter Ended December 31, 2024

Net loss for the fourth quarter of 2024 was $53.2 million, compared to $30.9 million for the fourth quarter of 2023.

Research and development expenses for the fourth quarter of 2024 were $46.5 million, compared to $26.8 million for the same period in 2023. The increase in research and development expenses was primarily due to the $35.0 million upfront license fee for RPT904, partially offset by lower development costs related to zelnecirnon, tivumecirnon and early-stage programs, as well as decreased expenses for personnel, professional services, non-cash stock-based compensation and lab supplies.

General and administrative expenses for the fourth quarter of 2024 were $8.0 million, compared to $6.5 million for the same period in 2023. The increase in general and administrative expenses was primarily due to increases in expenses for professional services, non-cash stock-based compensation, personnel and facilities.

In December 2024, the Company entered into a license agreement with Shanghai Jemincare Pharmaceutical Co., Ltd. (“Jemincare”), a company incorporated in the People’s Republic of China, under which the Company obtained exclusive rights to RPT904 throughout the world, excluding mainland China, Hong Kong, Macau and Taiwan. As consideration for those rights, the Company paid a $35.0 million upfront license fee and could pay up to $672.5 million in additional milestone payments, as well as tiered royalty payments (at percentages ranging from high single-digit to low double-digit) on future net sales.

Also in December 2024, the Company sold through a private placement to a select group of accredited investors 100,000,000 shares of common stock at a price of $0.85 per share and pre-funded warrants to purchase 76,452,000 shares of common stock at a purchase price of $0.8499 per pre-funded warrant, resulting in net proceeds of $143.0 million after deducting offering expenses.

Year Ended December 31, 2024

Net loss for the year ended December 31, 2024 was $129.9 million, compared to $116.8 million for the same period in 2023.

Research and development expenses for the year ended December 31, 2024 were $107.2 million, compared to $101.0 million for the same period in 2023. The increase in research and development expenses was primarily due to the $35.0 million upfront license fee for RPT904 and an increase in non-cash stock-based compensation expense, partially offset by lower development costs related to zelnecirnon, tivumecirnon and early-stage programs, as well as decreased expenses for personnel, professional services and lab supplies.

General and administrative expenses for the year ended December 31, 2024 were $28.9 million, compared to $26.1 million for the same period in 2023. The increase in general and administrative expenses was primarily due to increased expenses for non-cash stock-based compensation, consultants, personnel, and facilities, partially offset by decrease in expenses for insurance premiums.

As of December 31, 2024, the Company had cash and cash equivalents and marketable securities of $231.1 million.

About RAPT Therapeutics, Inc.

RAPT Therapeutics, Inc. (“RAPT” or the “Company”) is a clinical-stage immunology-based biopharmaceutical company focused on discovering, developing and commercializing novel therapies for patients living with inflammatory and immunological diseases. Utilizing our deep and proprietary expertise in immunology, we develop novel therapies that are designed to modulate the critical immune responses underlying these diseases.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “estimates,” “expects,” “will” and similar expressions (as well as other words or expressions referencing future events, conditions or circumstances) are intended to identify forward-looking statements. These statements relate to future events and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future performances or achievements expressed or implied by the forward-looking statements. Each of these statements is based only on current information, assumptions and expectations that are inherently subject to change and involve a number of risks and uncertainties. Forward-looking statements include, but are not limited to, statements about the therapeutic potential of RAPT’s product candidates, the timing of the initiation of or data from clinical trials, the market opportunity for RAPT’s product candidates, potential milestone and royalty payments and other statements that are not historical fact. Many factors may cause differences between current expectations and actual results, including unexpected or unfavorable safety or efficacy data observed during clinical studies, preliminary data and trends that may not be predictive of future data or results or that may not demonstrate safety or efficacy or lead to regulatory approval, clinical trial site activation or enrollment rates that are lower than expected, unanticipated or greater than anticipated impacts or delays due to macroeconomic and geopolitical conditions (including the long-term impacts of ongoing overseas conflicts, fluctuations in inflation and interest rates and other economic uncertainty), changes in expected or existing competition, changes in the regulatory environment, the uncertainties and timing of the regulatory approval process and the sufficiency of RAPT’s cash resources. Detailed information regarding risk factors that may cause actual results to differ materially from the results expressed or implied by statements in this press release may be found in RAPT’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 6, 2025 and subsequent filings made by RAPT with the Securities and Exchange Commission. These forward-looking statements speak only as of the date hereof. RAPT disclaims any obligation to update these forward-looking statements, except as required by law.

RAPT Media Contact:

Aljanae Reynolds

areynolds@wheelhouselsa.com

RAPT Investor Contact:

Sylvia Wheeler

swheeler@wheelhouselsa.com

RAPT THERAPEUTICS INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In thousands, except share per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

46,456 |

|

|

|

26,764 |

|

|

|

107,217 |

|

|

|

101,002 |

|

General and administrative |

|

|

8,009 |

|

|

|

6,453 |

|

|

|

28,884 |

|

|

|

26,060 |

|

Total operating expenses |

|

|

54,465 |

|

|

|

33,217 |

|

|

|

136,101 |

|

|

|

127,062 |

|

Loss from operations |

|

|

(54,465 |

) |

|

|

(33,217 |

) |

|

|

(136,101 |

) |

|

|

(127,062 |

) |

Other income, net |

|

|

1,216 |

|

|

|

2,341 |

|

|

|

6,236 |

|

|

|

10,264 |

|

Net loss |

|

$ |

(53,249 |

) |

|

$ |

(30,876 |

) |

|

$ |

(129,865 |

) |

|

$ |

(116,798 |

) |

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(655 |

) |

Unrealized gain (loss) on marketable securities |

|

|

(57 |

) |

|

|

224 |

|

|

|

(53 |

) |

|

|

784 |

|

Total comprehensive loss |

|

$ |

(53,306 |

) |

|

$ |

(30,652 |

) |

|

$ |

(129,918 |

) |

|

$ |

(116,669 |

) |

Net loss per share, basic and diluted |

|

$ |

(1.14 |

) |

|

$ |

(0.80 |

) |

|

$ |

(3.19 |

) |

|

$ |

(3.05 |

) |

Weighted average number of shares used in computing

net loss per share, basic and diluted |

|

|

46,687,525 |

|

|

|

38,383,867 |

|

|

|

40,761,143 |

|

|

|

38,338,161 |

|

RAPT THERAPEUTICS, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

December 31,

2024 |

|

|

December 31,

2023 |

|

Assets |

|

(Unaudited) |

|

|

(1) |

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

169,735 |

|

|

$ |

47,478 |

|

Marketable securities |

|

|

61,320 |

|

|

|

111,384 |

|

Prepaid expenses and other current assets |

|

|

4,181 |

|

|

|

2,920 |

|

Total current assets |

|

|

235,236 |

|

|

|

161,782 |

|

Property and equipment, net |

|

|

1,367 |

|

|

|

2,448 |

|

Operating lease right-of-use assets |

|

|

3,333 |

|

|

|

5,228 |

|

Other assets |

|

|

389 |

|

|

|

3,871 |

|

Total assets |

|

$ |

240,325 |

|

|

$ |

173,329 |

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

1,275 |

|

|

$ |

5,176 |

|

Accrued expenses |

|

|

9,597 |

|

|

|

14,103 |

|

License fees payable |

|

|

35,000 |

|

|

|

— |

|

Operating lease liabilities, current |

|

|

2,422 |

|

|

|

2,448 |

|

Other current liabilities |

|

|

57 |

|

|

|

109 |

|

Total current liabilities |

|

|

48,351 |

|

|

|

21,836 |

|

Operating lease liabilities, non-current |

|

|

2,070 |

|

|

|

4,458 |

|

Total liabilities |

|

|

50,421 |

|

|

|

26,294 |

|

Commitments |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock |

|

|

— |

|

|

|

— |

|

Common stock |

|

|

13 |

|

|

|

3 |

|

Additional paid-in capital |

|

|

804,388 |

|

|

|

631,611 |

|

Accumulated other comprehensive gain |

|

|

50 |

|

|

|

103 |

|

Accumulated deficit |

|

|

(614,547 |

) |

|

|

(484,682 |

) |

Total stockholders’ equity |

|

|

189,904 |

|

|

|

147,035 |

|

Total liabilities and stockholders’ equity |

|

$ |

240,325 |

|

|

$ |

173,329 |

|

(1)The consolidated balance sheet for December 31, 2023 has been derived from audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

v3.25.0.1

Document And Entity Information

|

Mar. 06, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 06, 2025

|

| Entity Registrant Name |

RAPT Therapeutics, Inc.

|

| Entity Central Index Key |

0001673772

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38997

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

47-3313701

|

| Entity Address, Address Line One |

561 Eccles Avenue

|

| Entity Address, City or Town |

South San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94080

|

| City Area Code |

(650)

|

| Local Phone Number |

489-9000

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

RAPT

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

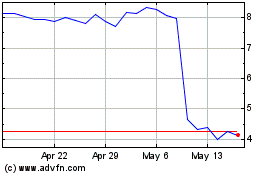

RAPT Therapeutics (NASDAQ:RAPT)

Historical Stock Chart

From Feb 2025 to Mar 2025

RAPT Therapeutics (NASDAQ:RAPT)

Historical Stock Chart

From Mar 2024 to Mar 2025