Registration No. 333 - ______

As filed with the Securities and Exchange Commission

on March 10, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT

OF 1933

RED CAT HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

7372 |

|

88-0490034 |

| (State or jurisdiction of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Classification Code Number) |

|

Identification No.) |

15 Ave. Munoz Rivera, Ste.

2200

San Juan, PR 00901

(833) 373-3228

(Address, including zip code, and telephone number,

including area code of registrant’s principal executive offices)

VCorp Services, LLC

701 S. Carson St., Ste. 200

Carson City, NV 89701

(888) 528-2677

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

| Joe Laxague, Esq. |

| The Crone Law Group, P.C. |

| 1 East Liberty, Suite 600 |

| Reno, NV 89501 |

| Telephone: (775) 234-5221 |

Approximate date of commencement of proposed sale

to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form

are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box.

☑

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction

I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the

Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement

filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule

413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See

the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and

“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☑ |

Smaller reporting company |

☑ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

The registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to Section 8(a), may determine.

The information contained in this preliminary

prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities

and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an

offer to buy these securities in any state where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS |

|

SUBJECT TO COMPLETION |

|

DATED MARCH 10, 2025 |

Red Cat Holdings, Inc.

13,375,000 Shares of Common Stock to be Offered

by the Selling Stockholder

This prospectus relates to the

proposed resale or other disposition from time to time of up to 13,375,000 shares of common stock, $0.001 par value per share, of Red

Cat Holdings, Inc. (the “Company”) by the selling shareholder identified in this prospectus. We are not selling any shares

of common stock under this prospectus and will not receive any of the proceeds from the sale or other disposition of common stock by the

selling shareholder.

The selling shareholder or its

pledgees, assignees or successors-in-interest may offer and sell or otherwise dispose of the shares of common stock described in this

prospectus from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market

prices or at privately negotiated prices. The selling shareholder will bear all commissions and discounts, if any, attributable to the

sales of such shares. We will bear all other costs, expenses and fees in connection with the registration of such shares. See “Plan

of Distribution” beginning on page 5 for more information about how the selling shareholder may sell or dispose of its shares of

common stock.

Our common stock is listed on

The Nasdaq Capital Market under the symbol “RCAT.” The last reported per share price for our common stock was $5.28, as quoted

on The Nasdaq Capital Market on March 6, 2025.

Investing in our common stock

involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider carefully the risks that we

have described on page 3 of this prospectus under the caption “Risk Factors” and in the documents incorporated by reference

into this prospectus.

Neither the Securities and

Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or

accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 10, 2025.

TABLE OF CONTENTS

You should rely only on information

contained in this prospectus. We have not authorized anyone to provide you with additional information or information different from that

contained in this prospectus. Neither the delivery of this prospectus nor the sale of our securities means that the information contained

in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell or the solicitation of an offer

to buy our securities in any circumstances under which the offer or solicitation is unlawful or in any state or other jurisdiction where

the offer is not permitted.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration

statement that we have filed with the Securities and Exchange Commission (the “SEC”), pursuant to which the selling shareholder

may, from time to time, offer and sell or otherwise dispose of the securities covered by this prospectus. You should not assume that the

information contained in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus

or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by

reference, even though this prospectus is delivered or securities are sold or otherwise disposed of on a later date. It is important for

you to read and consider all information contained in this prospectus, including the information incorporated by reference into this prospectus,

in making your investment decision. You should also read and consider the information in the documents to which we have referred you under

the captions “Where You Can Find More Information” and “Important Information Incorporated by Reference” in this

prospectus.

Neither

we nor the selling shareholder have authorized any dealer, salesman or other person to give any information or to make any representation

other than those contained or incorporated by reference in this prospectus. You should not rely upon any information or representation

not contained or incorporated by reference in this prospectus. This prospectus does not constitute an offer to sell or the solicitation

of an offer to buy any of our securities other than the securities covered hereby, nor does this prospectus constitute an offer to sell

or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation

in such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform

themselves about, and to observe, any restrictions as to the offering and the distribution of this prospectus applicable to those jurisdictions.

We

further note that the representations, warranties and covenants made in any agreement that is filed as an exhibit to any document that

is incorporated by reference in the prospectus were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or

covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

The terms “Red

Cat,” “Red Cat Holdings,” the “Company,” “we,” “our” or “us” in this

prospectus refer to Red Cat Holdings, Inc., unless the context suggests otherwise.

This prospectus does not

constitute, and any prospectus supplement or other offering materials related to an offering of securities described in this prospectus

will not constitute, an offer to sell, or a solicitation of an offer to purchase, the offered securities in any jurisdiction to or from

any person to whom or from whom it is unlawful to make such offer or solicitation in such jurisdiction.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking

statements. Such statements include statements regarding our expectations, hopes, beliefs or intentions regarding the future, including

but not limited to statements regarding our market, strategy, competition, development plans (including acquisitions and expansion), financing,

revenues, operations, and compliance with applicable laws. Forward-looking statements involve certain risks and uncertainties, and actual

results may differ materially from those discussed in any such statement. Factors that could cause actual results to differ materially

from such forward-looking statements include the risks described in greater detail in the following paragraphs. All forward-looking statements

in this document are made as of the date hereof, based on information available to us as of the date hereof, and we assume no obligation

to update any forward-looking statement. Market data used throughout this prospectus is based on published third party reports or the

good faith estimates of management, which estimates are based upon their review of internal surveys, independent industry publications

and other publicly available information.

PROSPECTUS SUMMARY

Overview

The Company was originally incorporated

under the laws of the State of Colorado in 1984 under the name Oravest International, Inc. In November 2016, we changed our name to TimefireVR,

Inc. and re-incorporated in Nevada. In May 2019, the Company completed a share exchange agreement with Propware which resulted in the

Propware shareholders acquiring an 83% ownership interest, and management control, of the Company. In connection with the share exchange

agreement, we changed our name to Red Cat Holdings, Inc. (“Red Cat” or the “Company” or “we”) and

our operating focus to the drone industry.

Prior to the share exchange agreement,

Propware was focused on the research and development of software solutions that could provide secure cloud-based analytics, storage and

services for the drone industry. Following the share exchange agreement and its name change, Red Cat has completed a series of acquisitions

and financings which have broadened the scope of its activities in the drone industry. These acquisitions included:

·

In January 2020, we acquired Rotor Riot, a reseller of drones and related parts, primarily to the

consumer marketplace through its digital storefront located at www.rotorriot.com. The total purchase price was $2.0 million.

·

In November 2020, the Company acquired Fat Shark which sells consumer electronics products to the

first-person view (“FPV”) sector of the drone industry. Fat Shark’s flagship products are headsets with a built-in display

(or “goggles”) that allow a pilot to see a real-time video feed from a camera typically mounted on an aerial platform or drone.

The total purchase price was $8.4 million.

·

In May 2021, we acquired Skypersonic, a provider of drone products and software solutions that enable

drone inspection flights that can be executed by pilots anywhere in the world. Skypersonic powers drones to “Fly Anywhere”

and “Inspect the Impossible”. Its patented software and hardware solutions allow for inspection services in restricted spaces

where GPS is denied or unavailable. The total purchase price was $2.8 million.

·

In August 2021, the Company acquired Teal, a leader in providing sophisticated and complex unmanned

aerial vehicle (“UAV”) technology, primarily drones, to government and commercial enterprises, most notably, the military.

Teal manufactures drones approved by the U.S. Department of Defense for reconnaissance, public safety, and inspection applications. The

total purchase price was $10.0 million.

Following the Teal acquisition

in August 2021, we concentrated on integrating and organizing these businesses. Effective May 1, 2022, we established the Enterprise segment

and the Consumer segment to focus on the unique opportunities in each sector. The Enterprise segment’s initial strategy was to provide

UAVs to commercial enterprises, and the military, to navigate dangerous military environments and confined industrial and commercial interior

spaces. Subsequently, the segment narrowed its near-term attention on the military and other government agencies. Skypersonic’s

technology has been redirected to military applications and its operations consolidated into Teal.

The Enterprise segment’s

current business strategy is focused on providing integrated robotic hardware and software for use across a variety of applications. Its

solutions provide critical situational awareness and actionable intelligence to on-the-ground warfighters and battlefield commanders as

well as firefighters and public safety officials. Our Enterprise segment’s efforts are centered on developing and scaling an American

made family of systems. We have since completed construction of a manufacturing facility in Salt Lake City and believe that an increased

focus by the United States government and American businesses on purchasing products that are “Made in America” provide our

Enterprise segment with a competitive advantage.

On February 16, 2024, we closed

the sale of our Consumer segment, consisting of Rotor Riot and Fat Shark, to Unusual Machines, Inc. (or “Unusual Machines”

or “UMAC”). The sale reflects our decision to focus our efforts and capital on defense where we believe there are more opportunities

to create long term shareholder value.

Key Business Accomplishments during Fiscal 2024

and to date include:

Scaling Teal 2, a military-grade sUAS Designed

to “Dominate the Night™”

Following its acquisition by Red

Cat in August 2021, Teal accelerated efforts on the development of its next generation drone for our Enterprise segment. These efforts

culminated in the launch of the Teal 2 in April 2023. The Teal 2 is the first small, unmanned aircraft system (“sUAS”) designed

to “Dominate the Night”, when most combat operations take place, through its enhanced capabilities. The Teal 2 offers the

latest intelligence, surveillance, and reconnaissance (“ISR”) technology and delivers time-critical information that enables

the warfighter to make faster and smarter decisions.

The Teal 2 is manufactured exclusively

at Teal’s purpose-built factory in Salt Lake City, Utah. Teal originally moved into the facility in October 2021. In January 2022,

Teal doubled the size of the facility, which now totals approximately 22,000 square feet, to fully scale production capacity to meet the

forecast growth in demand and to house its expanding team of software and technology engineers. We believe that maximum production capacity

for this facility can reach 5,000 or more drones per month over the next few years, provided that additional capital investments are made

and manufacturing efficiencies realized. Manufacturing in the United States, “Made in the USA,” is a critical consideration

of the U.S. government and other state and local government agencies.

During Fiscal 2024, Teal continued

to scale the manufacturing facility, including dedicated teams for production and assembly, manufacturing engineering, supply chain and

logistics, warranty and returns, as well as a flight operations team that is focused on manufacturing and quality assurance and quality

control.

Designation of Teal 2 as Blue UAS received from

U.S. Department of Defense

In June 2023, the Teal 2 received

clearance from the U.S. Department of Defense (“DoD”) to be designated as a Blue UAS. The DoD defines these drones as NDAA

(National Defense Authorization Act) compliant, validated as cyber secure, and safe to fly. This designation enables Teal to fill orders

from federal, state, and local government agencies subject to oversight by the DoD, including those orders that were contingent upon receiving

certification. In addition, many governments of allied nations are more likely to purchase Blue UAS approved drones. Teal’s legacy

drone, the Golden Eagle, is also on the cleared list.

After the U.S. Army banned its

forces from using Chinese-made quadcopters due to security risks (the radio controls of the drone are unencrypted and the devices could

potentially capture, store and upload sensitive information to the Chinese government), the DoD began developing its own alternatives

under a defense program known as Blue sUAS. Blue sUAS is an initiative of the Defense Innovation Unit (“DIU”), the only DoD

organization focused on accelerating the adoption of commercial and dual use technology to solve operational challenges at a speed and

scale that is faster and higher than normal for government agencies.

Red Cat Futures Initiative

In May 2024, we announced the

formation of the Red Cat Futures Initiative (RFI). RFI is an independent, industry-wide consortium of robotics and autonomous systems

(RAS) partners dedicated to putting the most advanced and interoperable uncrewed aircraft systems into the hands of warfighters. Anchored

by Red Cat’s Teal Drones, the RFI unites the world’s most innovative UAS hardware and software companies focused on AI/ML,

swarming, FPV, command and control, and payloads.

Founding members include Ocean

Power Technologies (NYSE: OPTT), Sentien Robotics, Primordial Labs, Athena AI, Unusual Machines, Reach Power, Doodle Labs, and MMS Products.

The shared goal is advocacy, integrations and comarketing that bridges considerable technology gaps through modular open architecture.

Government Contracts and Orders

The Enterprise segment is focused

on U.S. federal government agencies, particularly the DoD, as its initial target market. Its longer term target customer base includes

U.S. state and local government agencies, as well as governments of foreign allies. An overview of existing government contracts and recent

developments include:

Selection for U.S. Army Short Range Reconnaissance

Program of Record

On November 19, 2024, we announced

that Teal was selected as the winner of the U.S. Army’s Short Range Reconnaissance (SRR) Program of Record. The goal of the program

is to provide a small, rucksack portable, fully encrypted small, unmanned aircraft system (“sUAS”) that provides all Army

infantry platoons (consisting of 20-50 soldiers) with situational awareness beyond the next terrain. The production selection was made

after a test and evaluation process of Teal’s next generation sUAS, completed by the Army Project Management Office for Uncrewed

Aircraft Systems, Army Maneuver Battle Lab, Army Test and Evaluation Command, and Army Operational Test Center.

U.S. Border Patrol

$1.8 Million Purchase Order from U.S. Border Patrol

In September 2023, Teal was awarded

a $1.8 million contract from U.S. Customs and Border Protection to provide Teal 2 systems to U.S. Border Patrol. The U.S. Border Patrol

is using the Teal 2 to provide supplemental airborne reconnaissance, surveillance and tracking capability, enhancing situational awareness

for U.S. field commanders and agents.

Customs and Border Protection Contract Worth up

to $90 Million over Five Years

In December 2021, Teal was one

of only five contractors designated to participate in a firm, fixed price, multiple award blanket purchase agreement (BPA) by the United

States Customs and Border Protection. The BPA has an estimated value of $90 million in total over a 5-year period.

The Department of Homeland Security

agencies can place orders through the BPA for unmanned aircraft systems (UAS). The drones will provide supplemental airborne reconnaissance,

surveillance, and tracking capability to enhance situational awareness for field commanders and agents in areas that lack nearby traditional

surveillance systems or available manned air support.

U.S. Defense Logistics Agency

In August 2023, Teal received

two purchase orders totaling $5.2 million from the U.S. Defense Logistics Agency (DLA). Both orders were requested by U.S. Air Force Security

Forces, whose role is to defend Air Force bases and installations.

The procurements were sourced

by global operations support company Noble Supply & Logistics, LLC (NOBLE) as part of the DLA’s Special Operational Equipment

Tailored Logistics Support (“SOE TLS Program”). NOBLE is a DLA-designated provider for the SOE TLS Program. This 10-year program,

capped at $33 billion, covers the delivery of logistics support to federal agencies, military bases and other DLA customers worldwide,

helping them meet their special operational equipment requirements.

NATO Allied Countries

In March 2024, Teal received $2.5

million in new contract awards with two NATO allied countries. As part of our expanded global sales strategy, the contract delivery featured

Teal 2 drone systems, training, and accessories.

Recent Developments

Acquisition from Flightwave Aerospace Systems Corporation;

Contracts to Supply the Edge 130 Blue Drone

On September 4, 2024, the Company,

Teal, Teal subsidiary FW Acquisition, Inc. entered into an Asset Purchase Agreement (the “APA”) with and Flightwave Aerospace

Systems Corporation, a Delaware corporation (“Flightwave”). Under the APA, the Company acquired Flightwave’s assets

used in designing, developing, manufacturing, and selling long range, AI-Powered Unmanned Aerial Vehicles for commercial use. The purchase

price under the APA was equal to $14 million worth of shares of the Company’s common stock, paid as follows:

·

$7 million worth of the Company’s common stock issued on September 30, 2024, at a price per

share equal to the VWAP on such date, which was paid to the preferred shareholders of Flightwave as set forth in a schedule to the APA;

and

·

$7 million worth of the Company’s common stock to issued on December 31, 2024, at a price per

share equal to the VWAP on such date, of which (i) $2 million was paid to preferred shareholders of Flightwave, and (ii) $5 million waspaid

to common shareholders and option-holders of Flightwave as set forth in a schedule to the APA.

The acquisition brought the Edge

130, Flightwave’s Blue UAS approved military-grade tricopter, into Red Cat’s family of low-cost, portable unmanned reconnaissance

and precision lethal strike systems. On October 6, 2024, the Company secured $1.6 million in contracts to supply the Edge 130 Blue drones

to the U.S. Customs & Border Protection. On October 15, 2024, the Company secured a $1 million contract to supply Edge 130 Blue Drones

to the United States Army Communications-Electronics Command (CECOM).

Financings with Lind Global Asset Management X

LLC

On September 23, 2024, the Company

entered into a Securities Purchase Agreement (the “SPA”) with Lind Global Asset Management X LLC (“Lind X”). Upon

closing of the SPA, the Company received $8 million in funding from Lind X in exchange for its issuance to Lind X of a Senior Secured

Convertible Promissory Note in the amount of $9,600,000 (the “Note”) and a Common Stock Purchase Warrant for the purchase

of 750,000 shares of the Company’s common stock at a price of $6.50 per share, exercisable for 5 years (the “Warrant”).

As additional consideration to Lind X, the Company agreed to pay a commitment fee in the amount of $280,000, which may be paid by deduction

from the funding to be received. The Note, which did not accrue interest, was repayable in eighteen (18) consecutive monthly installments

in the amount of $533,334 beginning six months from the issuance date.

On November 26, 2024, we entered

into a First Amendment to the SPA (the “SPA Amendment”). Upon closing of the SPA Amendment, we received an additional $6,000,000

in funding from Lind X in exchange for our issuance to Lind X of a new Senior Secured Convertible Promissory Note in the amount of $7,200,000

(the “Second Note”) and a Common Stock Purchase Warrant for the purchase of 326,000 shares of our common stock at a price

of $9.20 per share, exercisable for 5 years (the “Second Warrant”). As additional consideration to Lind X, we have agreed

to pay a commitment fee in the amount of $210,000, which may be paid by deduction from the funding to be received. The Second Note, which

did not accrue interest, was repayable in eighteen (18) consecutive monthly installments in the amount of $400,000 beginning six months

from the issuance date.

As of the date of this prospectus,

the Note and the Second Note have been fully converted to common stock.

Financing with Lind Global

Asset Management XI LLC

On February

10, 2025, we entered into a Securities Purchase Agreement (the “SPA”) with Lind Global Asset Management XI LLC (“Lind”).

Upon closing of the SPA, we received $15 million in funding from Lind in exchange for our issuance to Lind of a Senior Secured Convertible

Promissory Note in the amount of $16,500,000 (the “Note”) and a Common Stock Purchase Warrant for the purchase of 1,000,000

shares of our common stock at a price of $15.00 per share, exercisable for 5 years (the “Warrant”). As additional consideration

to Lind, we paid a commitment fee in the amount of $525,000, which was paid by deduction from the funding received. Our obligations

under the Note are secured by all of our assets and the assets of our subsidiaries pursuant to a Security Agreement and related ancillary

documents.

The Note,

which does not accrue interest, shall be due and payable on February 10, 2026. The Note may be converted by Lind from time to time at

a price equal to the lower of “Conversion Price” of $16.15 per share, or the “Repayment Share Price,” which is

defined as ninety percent (90%) of the average of the five (5) lowest daily VWAPs for our common stock during the twenty (20) trading

days prior to the conversion date, subject to a floor price. Conversions under the Note are limited to a maximum of $1,650,000 in any

calendar month, subject to increase upon our optional written consent. Upon receipt of a conversion notice under the Note, we may, if

the applicable Repayment Share Price is below the Conversion Price, elect to pay the conversion amount in cash and in lieu of issuing

common stock. Cash repayments under this provision must be equal to 1.025 times the conversion amount. If applicable, we must elect the

cash repayment option within one business day of receiving the conversion notice and tender cash payment within two business days of

receiving the conversion notice.

The Note may be prepaid in whole

upon 5 days’ notice, but in the event of a prepayment notice, Lind may convert up to 25% of principal amount due at the lesser of

the Repayment Share Price (but only if the Repayment Share Price is equal to or greater than an applicable threshold) or the Conversion

Price.

Change in Fiscal Year End

On September 21, 2024, the Board

of Directors of the Company approved a change to the Company’s fiscal year end from April 30 to December 31 in accordance with Article

XIII of the bylaws of the Company that authorize the Board to change the Company’s fiscal year. The Company will file a transition

report on Form 10-K for the transition period from May 1, 2024 to December 31, 2024.

Our internet address is www.redcat.red.

Information on our website is not incorporated into this prospectus.

Risk Factors

Our business is subject to numerous risks. For a discussion

of the risks you should consider before purchasing shares of our common stock, see “Risk Factors” on page 3 of this prospectus.

The Offering

This prospectus relates to the proposed resale or

other disposition from time to time of up to 12,333,033 shares of our common stock, $0.001 par value per share, by the selling shareholder

identified in this prospectus. See “Selling Shareholder” and “Plan of Distribution.”

The selling shareholder may offer to sell the shares

being offered pursuant to this prospectus at fixed prices, at prevailing market prices at the time of sale, at varying prices or at negotiated

prices. Our common stock is listed on the Nasdaq Capital Market under the symbol “RCAT.”

We will not receive any of the proceeds from the sale

of shares of our common stock in this offering.

RISK FACTORS

Any investment in our securities

involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in

this prospectus before deciding whether to purchase our securities. Our business, financial condition and results of operations could

be materially adversely affected by these risks if any of them actually occur. This prospectus also contains forward-looking statements

that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements

as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus.

Multiple conversions and/or Share-based Repayments

of the Note held by Lind Global Asset Management XI LLC (“Lind”), if conducted during a decline in our market share price,

may cause stockholders to suffer substantial dilution.

This Registration

Statement registers the resale of all shares issuable to Lind upon conversions of its $16.5 million Senior Secured Convertible Note

(the “Note”). The Note is convertible by Lind from time to time at the lower of the fixed conversion price of

$16.15 per share, or the “Repayment Share Price,” which is defined as ninety percent (90%) of the average of the five

(5) lowest daily VWAPs for our common stock during the twenty (20) trading days prior to the conversion date, subject to a floor

price of $0.75 per share. Although we have the option to honor conversions of the Note with cash payment in lieu of issuing shares

if the “Repayment Share Price” is below $16.15 per share, we may be unable or unwilling to do so. Repeated conversions

of the Note during a time when our market share price has declined could lead to the issuance of a substantial number of new shares

of common stock, resulting in significant dilution to existing shareholders.

The trading price of our common stock has been

and may continue to be volatile, which could result in substantial losses to investors.

The trading price of our common

stock has been and may continue to be volatile and could fluctuate widely due to factors beyond our control. For instance, between February

7, 2025 and March 7, 2025 the trading price of our common stock fluctuated between $10.76 and $5.28 per share. This may happen because

of broad market and industry factors, including the performance and fluctuation of the market prices of other companies in our industry

or broad macro-economic and political factors. In addition to market and industry factors, the price and trading volume for our common

stock may be highly volatile for factors specific to our own operations, including the following:

| |

● |

variations in our revenues, earnings, cash flow; |

| |

● |

fluctuations in operating metrics; |

| |

● |

announcements of new investments, acquisitions, strategic partnerships or joint ventures by us or our competitors; |

| |

● |

announcements of new solutions and services and expansions by us or our competitors; |

| |

● |

termination or non-renewal of contracts or any other material adverse change in our relationship with our key customers; |

| |

● |

changes in financial estimates by securities analysts; |

| |

● |

detrimental negative publicity about us, our competitors or our industry; and |

| |

● |

additions or departures of key personnel. |

Such volatility, including any

stock run-up or decline, may be unrelated to our actual or expected operating performance and financial condition or prospects, making

it difficult for prospective investors to assess the rapidly changing value of our stock. Furthermore, the stock market in general experiences

price and volume fluctuations that are often unrelated or disproportionate to the operating performance of companies like us. Volatility

or a lack of positive performance in the price of our common stock may also adversely affect our ability to retain key employees, most

of whom have been granted share incentives.

Investing in our securities involves

a high degree of risk. Before making an investment decision, you should consider carefully the additional risks, uncertainties and other

factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports on Form 10-Q

and current reports on Form 8-K that we have filed or will file with the SEC, which are incorporated by reference into this prospectus.

Our business, affairs, prospects,

assets, financial condition, results of operations and cash flows could be materially and adversely affected by these risks. For more

information about our SEC filings, please see “Where You Can Find More Information”.

USE OF PROCEEDS

We will not receive any of the

proceeds from the sale of shares of our common stock in this offering. The selling shareholder will receive all of the proceeds from this

offering.

SELLING SHAREHOLDER

The shares of common stock being

offered by the selling shareholder are shares issuable conversion of a Senior Secured Convertible Promissory Note and a Warrant issued

February 10, 2025. We are registering the shares of common stock pursuant to our contractual obligation to the selling shareholder in

order to permit the selling shareholder to offer the shares for resale from time to time.

The table below lists the selling

shareholder and other information regarding the beneficial ownership of the shares of common stock by the selling shareholder. The second

column lists the number of shares of common stock beneficially owned by the selling shareholder as of March 7, 2025. On March 7, 2025,

we had a total of 85,616,951 shares of common stock issued and outstanding. The third column lists the shares of common stock being offered

by this prospectus by the selling shareholder.

The selling shareholder may sell

all, some or none of its shares in this offering. See “Plan of Distribution.”

| Name of Selling Shareholder |

Number of Shares of

Common Stock

Owned Prior to

Offering |

Maximum Number of

Shares of Common

Stock to be Sold

Pursuant to this

Prospectus |

Number of Shares of

Common Stock

Owned After

Offering |

Percentage of Common Stock to be Owned After Offering |

| Lind Global Asset Management XI LLC(1) |

4,496,669(2) |

13,375,000(3) |

0 |

0% |

(1) Jeff Easton is the Managing Member of The Lind Partners, LLC, which is the Investment Manager of Lind Global Asset Management XI LLC

and, in that capacity, has the power to make voting and investment decisions regarding its common stock. Mr. Easton disclaims beneficial

ownership over the securities listed except to the extent of his pecuniary interest therein. The address of the Selling Stockholder is

444 Madison Avenue, Floor 41, New York, NY 10022.

(2)

Lind Global Asset Management XI LLC (“Lind”) holds a Senior Secured Convertible Promissory Note (the “Note”) and

a Common Stock Purchase Warrant (the “Warrant”). Conversions of the Note and exercises of the Warrant are limited such that

no conversions or exercises may be made to the extent that, after such conversion or exercise, Lind would own more than 4.99% of our issued

and outstanding common stock. This figure represents the number of shares issuable under the Note and/or the Warrant which, immediately

following their issuance, would constitute 4.99% of our outstanding shares of common stock, based on 85,616,951 shares of common stock

issued and outstanding on March 7,2025.

(3)

Represents 1,000,000 shares of common stock issuable upon exercise of the Warrant and up to 12,375,000

shares of common stock potentially issuable upon conversion of the full $16,500,000 balance of the Note at the contractual “Floor

Price” of $0.75 per share.

PLAN OF DISTRIBUTION

The selling shareholder (the “Selling

Shareholder”) of the securities and any of its pledgees, assignees and successors-in-interest may, from time to time, sell any

or all of their securities covered hereby on the principal trading market or any other stock exchange, market or trading facility on which

the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. The Selling Shareholder may use

any one or more of the following methods when selling securities:

| |

● |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately negotiated transactions; |

| |

|

|

| |

● |

settlement of short sales; |

| |

|

|

| |

● |

in transactions through broker-dealers that agree with the Selling Shareholder to sell a specified number of such securities at a stipulated price per security; |

| |

|

|

| |

● |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

|

| |

|

|

| |

● |

a combination of any such methods of sale; or |

| |

|

|

| |

● |

any other method permitted pursuant to applicable law. |

The

Selling Shareholder may also sell securities under Rule 144 or any other exemption from registration under the Securities Act of 1933,

as amended (the “Securities Act”), if available, rather than under this prospectus.

Broker-dealers

engaged by the Selling Shareholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the Selling Shareholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or

markdown in compliance with FINRA Rule 2121.

In connection

with the sale of the securities or interests therein, the Selling Shareholder may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they

assume. The Selling Shareholder may also sell securities short and deliver these securities to close out its short positions, or loan

or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Shareholder may also enter into option

or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling

Shareholder and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under

the Securities Act. The selling shareholder has informed the Company that it does not have any written or oral agreement or understanding,

directly or indirectly, with any person to distribute the securities.

Under applicable

rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage

in market making activities with respect to the shares of common stock for the applicable restricted period, as defined in Regulation

M, prior to the commencement of the distribution. In addition, the Selling Shareholder will be subject to applicable provisions of the

Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the

shares of common stock by the Selling Shareholder or any other person. We will make copies of this prospectus available to the Selling

Shareholder and have informed it of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale

(including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

The Crone Law Group, P.C. has

opined on the validity of the securities being offered hereby.

EXPERTS

The consolidated financial

statements of the Company as of April 30, 2024 and 2023, and for the years then ended included by reference in this prospectus have

been so included in reliance on the report of dbbmckennon, an independent registered public accounting firm, given on the authority

of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and

special reports, along with other information with the SEC. The SEC maintains an Internet site that contains reports, proxy and information

statements, and other information regarding issuers that file electronically with the SEC. Our SEC filings are available to the public

over the Internet at the SEC’s website at http://www.sec.gov.

This prospectus is part of a registration

statement on Form S-3 that we filed with the SEC to register the securities offered hereby under the Securities Act of 1933, as amended.

This prospectus does not contain all of the information included in the registration statement, including certain exhibits and schedules.

You may obtain the registration statement and exhibits to the registration statement from the SEC’s internet site.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

This prospectus is part of a registration

statement filed with the SEC. The SEC allows us to “incorporate by reference” into this prospectus the information that we

file with them, which means that we can disclose important information to you by referring you to those documents. The information incorporated

by reference is considered to be part of this prospectus, and information that we file later with the SEC will automatically update and

supersede this information. The following documents are incorporated by reference and made a part of this prospectus:

·

Our Annual Report on Form 10-K for the year ended April 30, 2024 filed with the SEC on August 8,

2024;

·

Our Annual Report to Security Holders for the year ended April 30, 2024 filed with the SEC on August

28, 2024;

·

Our Quarterly Report on Form 10-Q for the quarterly period ended July 31, 2024 filed with the SEC

on September 23, 2024;

·

Our Quarterly Report on Form 10-Q for the quarterly period ended October 31, 2024 filed with the

SEC on December 16, 2024;

·

Our Current Reports on Form 8-K filed with the SEC on September 9, 2024; September 26, 2024; October

3, 2024; October 21, 2024; November 19, 2024; November 20, 2024; November 27, 2024; December 2, 2024, and February 12, 2025; and

·

The description of our common stock contained in our Registration Statement on Form 8-A filed with

the SEC on March 11, 2021, including any amendment or report filed for the purpose of updating such description.

All documents that we file with the SEC pursuant to

Sections 13(a), 13(c), 14, and 15(d) of the Exchange Act: (i) after the date of the initial registration statement and prior to its effectiveness;

and (ii) subsequent to the effective date of this registration statement and prior to the filing of a post-effective amendment to this

registration statement that indicates that all securities offered under this prospectus have been sold, or that deregisters all securities

then remaining unsold; will be deemed to be incorporated in this registration statement by reference and to be a part hereof from the

date of filing of such documents. Nothing in this prospectus shall be deemed to incorporate information furnished but not filed with the

SEC (including without limitation, information furnished under Item 2.02 or Item 7.01 of Form 8-K, and any exhibits relating to such information).

Any statement contained in this prospectus or in a

document incorporated or deemed to be incorporated by reference in this prospectus shall be deemed to be modified or superseded for purposes

of this prospectus to the extent that a statement contained herein or in the applicable prospectus supplement or in any other subsequently

filed document which also is or is deemed to be incorporated by reference modifies or supersedes the statement. Any statement so modified

or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

The information about us contained in this prospectus

should be read together with the information in the documents incorporated by reference. You may request a copy of any or all of these

filings, at no cost, by writing or telephoning us at:

Red Cat Holdings, Inc.

15 Ave. Munoz Rivera, Ste. 2200

San Juan, PR 00901

(833) 373-3228.

PART II

INFORMATION NOT REQUIRED IN A PROSPECTUS

Item 14. Other Expenses of Issuance and

Distribution.

The following table sets forth

an itemization of the various expenses payable by the registrant in connection with the sale of securities being registered. All amounts

are estimates except for the SEC registration fee.

| Item |

|

Amount

to be paid |

|

| SEC registration fee |

|

$ |

10,731.09 |

|

| Legal fees and expenses |

|

|

25,000 |

|

| Accounting fees and expenses |

|

|

-- |

|

| Miscellaneous expenses |

|

|

-- |

|

| Total |

|

$ |

35,731.09 |

|

Item 15. Indemnification of Directors

and Officers.

Section 78.7502(1) of the Nevada

Revised Statutes (“NRS”) provides that a corporation may indemnify any person who was or is a party or is threatened to be

made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative

(except an action by or in the right of the corporation) by reason of the fact that such person is or was a director, officer, employee

or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another

corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines

and amounts paid in settlement actually and reasonably incurred in connection with such action, suit or proceeding if such person: (i)

is not liable for a breach of fiduciary duties that involved intentional misconduct, fraud or a knowing violation of law; or (ii) acted

in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests of the corporation, and,

with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful.

NRS Section 78.7502(2) further

provides that a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending

or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that such person

is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director,

officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including

amounts paid in settlement and attorneys’ fees actually and reasonably incurred in connection with the defense or settlement of

the action or suit if such person: (i) is not liable for a breach of fiduciary duties that involved intentional misconduct, fraud or a

knowing violation of law; or (ii) acted in good faith and in a manner that he or she reasonably believed to be in or not opposed to the

best interests of the corporation. Indemnification may not be made for any claim, issue or matter as to which such a person has been adjudged

by a court of competent jurisdiction, after exhaustion of all appeals therefrom, to be liable to the corporation or for amounts paid in

settlement to the corporation, unless and only to the extent that the court in which the action or suit was brought or other court of

competent jurisdiction determines upon application that in view of all the circumstances of the case the person is fairly and reasonably

entitled to indemnity for such expenses as the court deems proper.

To the extent that a director,

officer, employee or agent of a corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding

referred to in subsections (1) and (2) of NRS Section 78.7502, as described above, or in defense of any claim, issue or matter therein,

the corporation shall indemnify him or her against expenses (including attorneys’ fees) actually and reasonably incurred by such

person in connection with the defense.

The articles of incorporation,

as amended, and the amended and restated bylaws of the Company provide that the Company shall, to the fullest extent permitted by the

NRS, as now or hereafter in effect, indemnify any person who was or is a party or is threatened to be made a party to any threatened,

pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in the

right of the Company, by reason of the fact that he is or was a director, officer, employee or agent of the Company, or is or was serving

at the request of the Company as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other

enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably

incurred by him in connection with the action, suit or proceeding if he: (i) is not liable pursuant to NRS Section 78.138; or (ii) acted

in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the Company, and, with respect

to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful.

Under the terms of an Indemnification

Agreement, subject to certain exceptions specified in the Indemnification Agreement, we have also agreed to indemnify our officers and

directors (the “Indemnitees”) to the fullest extent permitted by Nevada law in the event the Indemnitee becomes subject to

or a participant in certain claims or proceedings as a result of the Indemnitee’s service as a director or officer. We will also,

subject to certain exceptions and repayment conditions, advance to the Indemnitees specified indemnifiable expenses incurred in connection

with such claims or proceedings.

Item 16. Exhibits and Financial Statement Schedules

| Exhibit No. |

|

Description |

| 3.1 |

|

Amended and Restated Articles of Incorporation, dated July 17, 2019 (incorporated by reference to Exhibit B to the Company’s Schedule 14C Information Statement filed with the SEC on July 2, 2019) |

| 3.2 |

|

Certification of Designation of Series A Preferred Stock, dated May 10, 2019 (incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K filed with the SEC on May 16, 2019) |

| 3.3 |

|

Certification of Designation of Series B Preferred Stock, dated May 10, 2019 (incorporated by reference to Exhibit 3.3 to the Company’s Current Report on Form 8-K filed with the SEC on May 16, 2019) |

| 3.4 |

|

Bylaws, as amended March 31, 2021 (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the SEC on April 6, 2021). |

| 5.1 |

|

Opinion of The Crone Law Group, P.C.* |

| 10.1 |

|

Securities Purchase Agreement dated February 10, 2025 (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on February 12, 2025). |

| 10.2 |

|

Senior Secured Convertible Promissory Note issued February 10, 2025 (incorporated by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K filed with the SEC on February 12, 2025). |

| 10.3 |

|

Common Stock Purchase Warrant issued February 10, 2025 (incorporated by reference to Exhibit 10.3 to the Company’s Current Report on Form 8-K filed with the SEC on February 12, 2025). |

| 10.4 |

|

Security Agreement dated February 10, 2025 (incorporated by reference to Exhibit 10.4 to the Company’s Current Report on Form 8-K filed with the SEC on February 12, 2025). |

| 23.1 |

|

Consent of Independent Registered Public Accounting Firm* |

| 23.2 |

|

Consent of The Crone Law Group, P.C. (included as part of Exhibit 5.1)* |

| 107 |

|

Filing Fee Table* |

* Filed herewith

Item 17. Undertakings

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers

or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by section

10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or

events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually

or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing,

any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which

was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus

filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change

in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration

statement.

(iii) To include any material information with

respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information

in the registration statement;

provided, however, Paragraphs (a)(1)(i), (a)(1)(ii)

and (a)(1)(iii) of this section do not apply if the registration statement is on Form S-3 or Form F-3 and the information required to

be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the

registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration

statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any

liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating

to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof.

(3) To remove from registration by means of a

post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability

under the Securities Act of 1933 to any purchaser:

(A) Each prospectus filed by the registrant pursuant

to Rule 424(b)(3)shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of

and included in the registration statement; and

(B) Each prospectus required to be filed pursuant

to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made

pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities

Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus

is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus.

As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall

be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that

prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided,

however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document

incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement

will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made

in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior

to such effective date; or

(5) That, for the purpose of determining liability

of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant

undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless

of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means

of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or

sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus

of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to

the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus

relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of

the undersigned registrant; and

(iv) Any other communication that is an offer

in the offering made by the undersigned registrant to the purchaser.

(b) The registrant hereby undertakes that for

purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to

section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration

statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities

arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to

the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission

such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for

indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer

or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer

or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the

matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification

by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

(d) The registrant hereby undertakes that:

(1) For purposes of determining any liability

under the Securities Act, the information omitted from the form of prospectus filed as part of this registration statement in reliance

upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h)

under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared effective.

(2) For the purpose of determining any liability

under the Securities Act, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof.

SIGNATURES

Pursuant to the requirements of

the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for

filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in the San Juan, Puerto Rico on March 10, 2025.

| |

RED CAT HOLDINGS, INC. |

| |

|

| |

By: |

/s/ Jeffery M. Thompson |

|

| |

Jeffrey M. Thompson |

| |

President and Chief Executive Officer

(Principal Executive Officer)

|

| |

/s/ Jeffery M. Thompson |

|

| |

Jeffrey M. Thompson |

| |

Interim Chief Financial Officer |

| |

(Principal Financial and Accounting Officer)

|

POWER OF ATTORNEY

We, the undersigned officers and

directors of Red Cat Holdings, Inc. hereby severally constitute and appoint Jeffrey M. Thompson our true and lawful attorney-in-fact and

agents, with full power of substitution and resubstitution for him and in his name, place and stead, and in any and all capacities, to

sign for us and in our names in the capacities indicated below any and all amendments (including post-effective amendments) to this registration

statement (or any other registration statement for the same offering that is to be effective upon filing pursuant to Rule 462(b) under

the Securities Act of 1933, as amended), and to file the same, with all exhibits thereto and other documents in connection therewith,

with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent, full power and authority to do and perform

each and every act and thing requisite or necessary to be done in and about the premises, as full to all intents and purposes as he might

or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his substitute or substitutes, may

lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of

the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and on

the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

|

/s/ Jeffrey M. Thompson

Jeffrey M. Thompson |

|

President,

Chief Executive Officer, Interim Chief Financial Officer,

and Director

(Principal executive officer and principal

financial officer) |

|

March 10, 2025 |

| |

|

|

|

|

|

/s/ Joseph Freedman

Joseph Freedman |

|

Director |

|

March 10, 2025 |

| |

|

|

|

|

|

/s/ Nicholas Liuzza Jr.

Nicholas Liuzza Jr. |

|

Director |

|

March 10, 2025 |

| |

|

|

|

|

|

/s/ Paul Funk

Paul Funk |

|

Director |

|

March 10, 2025 |

| |

|

|

|

|

|

/s/ Christopher R. Moe

Christopher R. Moe |

|

Director |

|

March 10, 2025 |

20

Exhibit 5.1

March 10, 2025

Red Cat Holdings, Inc.

15 Ave. Munoz Rivera Ste 5

San Juan, PR 00901

Re: Red Cat Holdings, Inc.; Registration

Statement on Form S-3

Ladies and Gentlemen:

We have acted as counsel for Red

Cat Holdings, Inc., a Nevada corporation (the "Company"), in connection with the Registration Statement on Form S-3 (the "Registration

Statement"), filed with the Securities and Exchange Commission (the "Commission") pursuant to the Securities Act of 1933,

as amended (the "Act"), relating to the registration of the public offering and sale of the following securities of the Company

(the “Securities”) by the Selling Shareholder named therein:

1.

Up to 12,375,000 shares of common stock of the Company (the “Note Shares”) issuable upon

conversion of, and/or payment for, the amount due under the Senior Secured Convertible Promissory Note issued to Lind Global Asset Management

XI LLC and dated February 10, 2025 and (the “Note”); and

2.

Up to 1,000,000 shares of common stock of the Company (the “Warrant Shares”) issuable

upon exercise of the Common Stock Purchase Warrant issued to Lind Global Asset Management XI LLC and dated February 10, 2025 (the “Warrant”)

and.

In rendering the opinion

set forth below, we have reviewed: (a) the Registration Statement and the exhibits thereto; (b) the Company's Articles of Incorporation,

as amended; (c) the Company's Bylaws, as amended; (d) certain records of the Company's corporate proceedings as reflected in its minute

books; (e) the Note; (f) the Warrant; and (f) such statutes, records and other documents as we have deemed relevant. We have assumed the

genuineness of all signatures, the authenticity of all documents submitted to us as originals, and conformity with the originals of all

documents submitted to us as copies thereof. In addition, we have made such other examinations of law and fact as we have deemed relevant

in order to form a basis for the opinion hereinafter expressed. We express no opinion herein as to the laws of any state or jurisdiction

other than the substantive laws of the State of Nevada and the federal laws of the United States of America.

Based upon the foregoing,

it is our opinion that:

a.

The Note Shares, when issued upon conversions of the Note and/or as payments toward the balance due

under the Note in accordance with the terms thereof, will be validly issued, fully paid and non-assessable shares of common stock in the

Company.

b.

Warrant Shares, when issued and paid for upon exercises of the Warrant in accordance with the terms

thereof, will be validly issued, fully paid and non-assessable shares of common stock in the Company.

We consent to the inclusion of

this opinion as an exhibit to the Registration Statement and further consent to all references to us under the caption “Legal Matters”

in the Prospectus.

Sincerely,

The Crone Law Group P.C.

______________________________________

EXHIBIT 23.1

Consent of Independent Registered Public Accounting

Firm

We consent to the incorporation

by reference in this Registration Statement on Form S-3, of our report dated August 8, 2024, related to the consolidated financial

statements of Red Cat Holdings, Inc. (the “Company”) as of and for the years ended April 30, 2024 and 2023, included in its

Annual Report on Form 10-K for the year ended April 30, 2024. We also consent to the reference to us under the heading “Experts”

in such Registration Statement.

/s/ dbbmckennon

Newport Beach, California

March 10, 2025

Exhibit 107

Calculation of Filing Fee Tables

S-3

(Form Type)

Red Cat Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward Securities

| |

|

Security Type |

|

Security

Class

Title |

|

Fee

Calculation

or Carry

Forward Rule |

|

Amount

Registered(1) |

|

Proposed

Maximum

Offering Price

Per Unit(2) |

|

Maximum

Aggregate

Offering Price |

|

Fee Rate |

|

Amount of

Registration Fee |

|

Carry

Forward

Form Type |

|

Carry

Forward

File Number |

|

Carry

Forward

Initial

effective date |

|

Filing Fee

Previously Paid

In Connection

with Unsold

Securities

to be Carried

Forward |

|

| Newly Registered Securities |

| Fees to Be Paid |

|

Equity |

|

Common Stock |

|

457(c) |

|

|

13,275,000 |

|

|

$5.28 |

|

$ |

70,092,000 |

|

|

0.00015310 |

|

$ |

10,731.09. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fees Previously Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

-- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Carry Forward Securities |

| Carry Forward Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total Offering Amounts |

|

$ |

. 70,092,000 |

|

|

|

|

$ |

10,731.09. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total Fees Previously Paid |

|

|

|

|

|

|

|

$ |

-- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total Fee Offsets |

|

|

|

|

|

|

|

|

-- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Net Fee Due |

|

|

|

|

|

|

|

$ |

10,731.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Represents up to 1,000,000 shares of common stock issuable upon exercises of a Warrant and up to 12,375,000 shares of common stock issuable upon conversions of a Note at the minimum conversion price set forth therein. Pursuant to Rule 416 under the Securities Act of 1933, as amended, the shares of common stock registered hereby also include an indeterminate number of additional shares of common stock as may from time to time become issuable by reason of share splits, share dividends, recapitalizations or other similar transactions. |

| (2) |

Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(c) under the Securities Act and based upon the average of the high and low sales prices of a share of common stock as reported on the Nasdaq Capital Market on November 12, 2024. |

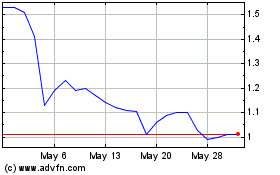

Red Cat (NASDAQ:RCAT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Red Cat (NASDAQ:RCAT)