Filed

by Rocket Companies, Inc.

Pursuant

to Rule 425 under the Securities Act of 1933, as amended

and

deemed filed pursuant to

Rule

14a-12 under the Securities Exchange Act of 1934, as amended

Subject

Company: Redfin Corporation

Commission

File No.: 001-38160

The

following is a transcript for the investor call delivered by Varun Krishna, the Chief Executive Officer of Rocket Companies, Inc. (“Rocket”),

Sharon Ng, the Head of Investor Relations of Rocket, and Brian Brown, the Chief Financial Officer of Rocket, on March 10, 2025.

CORPORATE

SPEAKERS:

Sharon

Ng

Rocket

Companies; Head of Investor Relations

Varun

Krishna

Rocket

Companies; Chief Executive Officer

Brian

Brown

Rocket

Companies; Chief Financial Officer

PARTICIPANTS:

Ryan

McKeveny

Zelman;

Analyst

Naved

Khan

B.

Riley Securities; Analyst

Operator

Thank

you for standing by. And welcome to the Rocket Companies to Acquire Redfin Conference Call.

I'd now

like to turn the call over to Sharon Ng, Head of Investor Relations. You may begin.

Sharon

NG, Head of Investor Relations at Rocket Companies

Good

morning, everyone, and welcome.

Joining

me today are Varun Krishna, Chief Executive Officer of Rocket Companies, and Brian Brown, Chief Financial Officer of Rocket Companies.

Rocket

– Redfin Transaction Investor Call Transcript

March 10, 2025

Before

we begin, please note that this call may contain forward-looking statements. These statements include, but are not limited to, discussions

about the anticipated benefits of the proposed transaction between Rocket Companies and Redfin, expected financial and operational outcomes,

the timing of the transaction’s completion, and plans for the combined company. Any statements made today that are not historical

facts should be considered forward-looking statements.

We

do not undertake any obligation to update these statements based on new information or future events, except as required by law. This

call is being broadcast live and is accessible on our Investor Relations website at ir.rocketcompanies.com, where a recording will also

be available later today.

Additionally,

we have posted a press release and a copy of our presentation on our Investor Relations website for reference.

With

that, I’ll turn the call over to Varun.

Varun

Krishna, CEO of Rocket Companies

Good

morning, everyone, and thank you for joining us. I’m thrilled to be here to talk about Rocket’s acquisition of Redfin.

I’ve

been a longtime Redfin user—I even found my first home on their platform and have been an active user ever since.

Redfin

is a true category leader—a pioneering disruptor that turned the concept of a digital realtor into reality. Their technology- and

data-driven approach has transformed the home search experience. As the #1-ranked brokerage in the U.S., Redfin's 2,200 lead agents and

broader network helped facilitate 61,000 home transactions in 2024 alone.

I

want to thank Glenn and the entire Redfin team for building such a respected brand and outstanding business that I so admire, and I look

forward to welcoming them to the Rocket family. I know I speak for all of Rocket when I say—we can’t wait to move this industry

forward together.

On

our earnings call last month, we talked about how Rocket is executing a strategic evolution to fulfill our mission to Help Everyone Home.

Over the past year, we’ve made bold investments and moved with urgency to redefine the homeownership experience, and we’re

continuing to do so.

Today's

announcement is the latest milestone in that journey. Our agreement to acquire Redfin is a perfect fit with our mission to Help Everyone

Home.

Brian

will share more details shortly, but I want to highlight a few key transaction points. This is an all-stock transaction at $12.50 per

share. The deal is expected to generate over $200 million in cost and

Rocket

– Redfin Transaction Investor Call Transcript

March 10, 2025

revenue synergies and is projected to close in the second or third

quarter of 2025. This is pending Redfin shareholder approval, regulatory clearance, and standard closing conditions.

We

are incredibly excited about the impact this will have and the significant value it creates for both Rocket and Redfin shareholders.

Let

me share why this combination makes so much sense.

First,

we’re bringing together two market leaders to bring more consumers into the Rocket ecosystem.

For

far too long, the homeownership process has been outdated and disconnected. Home search, brokerage, mortgage, title, closing, servicing,

all exist in separate ecosystems, forcing consumers to piece together a complex and frustrating journey.

This

disjointed system creates confusion, adds friction, and drives up transaction fees—totaling roughly 10% of a home’s cost.

And yet, this inefficient, costly experience is still the accepted norm.

We

reject that status quo. There’s a better way, and we’re going to make it happen. By uniting search, buying, selling, mortgage,

title, and servicing all under Rocket, we’re creating a modern, intuitive experience that puts the consumer first.

With

the entire journey under Rocket, we gain powerful economies of scale that benefit both Rocket and the consumer. We can introduce unique

product offerings and pass value back to buyers and sellers because we earn revenue across multiple parts of the transaction.

We’ve

already seen early success with integrated solutions like Buy+, and this combination with Redfin takes that to an entirely new level.

The opportunity to transform homebuying at scale is here, and we’re ready to lead the way.

Second,

we expect our combination will drive purchase mortgage growth.

Rocket

and Redfin have long had an advantage in engaging homebuyers at critical points in their journey. Redfin attracts 50 million potential

homebuyers each month—the majority searching on a mobile phone. Rocket connects with 2 million purchase contacts annually when

they explore affordability and mortgage financing. In fact, 40% of homebuyers start their journey by determining how much home they can

afford. These are highly valuable buyers and sellers with a strong intent to transact.

When

these clients are then connected with the best agents and the best loan officers, it creates a virtuous cycle.

Redfin’s

2,200 lead agents and 5,000 partner agents are among the very best in the industry. Now, by joining forces with Rocket’s 3,000

loan officers and expansive mortgage broker network, we’re building a highly efficient funnel that matches motivated buyers with

top professionals. This strengthens what we believe is the most effective homeownership distribution platform in the industry—

and the best

Rocket

– Redfin Transaction Investor Call Transcript

March 10, 2025

place for real estate and mortgage professionals to grow, succeed, and deliver exceptional client experiences.

Rocket

and Redfin sit at the crossroads of technology and human connection. We empower our team members with AI-driven tools that help them

provide the best client service in the industry. AI eliminates paperwork and administrative work, allowing agents and loan officers to

focus more time on advising clients.

We’re

already seeing results. In Q4, Rocket’s loan officers served 54% more clients per team member than the previous year—driven

by AI-powered efficiency. Rocket aims to be the homeownership company where top professionals come to grow their business and serve more

clients. Their success is our success.

Third,

our combined scale in AI, technology and data put us further ahead. In today’s world, the companies with the most data will win,

and no industry is safe from the disruption or the opportunity that AI creates. As commoditization and disintermediation accelerate,

access to scaled, proprietary data is what separates industry leaders from the rest.

Rocket

and Redfin are AI- and data-driven at our core, and our combined scale will accelerate the transformation of homebuying. Rocket has already

invested $500 million in AI, data infrastructure, and predictive modeling. Our platform processes 10 petabytes of data and over 65 million

call logs annually, powering AI-driven tools that have already saved over 1 million hours of productivity.

Redfin

adds an invaluable layer of data on top of that—4 petabytes of real estate data, insights on 100 million properties, buyer interactions,

and pricing trends. The Redfin Estimate is widely recognized as the most accurate online home-value estimate, with a median error rate

of just 2.1% for on-market homes.

AI

delivers speed, accuracy, efficiency, and personalization—and these advantages only compound exponentially.

Rocket

and Redfin are the original disruptors of their industries, using technology to redefine the status quo. Redfin revolutionized real estate

by turning a paper-driven process into a data-powered, digital-first experience, making buying and selling homes faster and more transparent.

Rocket pioneered online mortgage lending, bringing home financing into the digital era.

Now,

together, we’re taking this even further—using AI to drive the next wave of transformation in homeownership.

Through

this acquisition, we are combining the strengths of Rocket and Redfin – creating a more seamless, data-driven homebuying experience

that will set a new industry standard. I’m so excited for what’s ahead. I can’t wait to show the world what we can

achieve together.

Now,

I’ll hand it over to Brian to walk through the financial details of this transaction.

Rocket

– Redfin Transaction Investor Call Transcript

March 10, 2025

Brian

Brown, CFO of Rocket Companies

Thanks

Varun, today is a major moment for the homeownership industry. This milestone marks the beginning

of real change, and I couldn’t be more excited for what Rocket and Redfin will accomplish together.

Now,

I want to talk a little more about the

financial opportunities ahead.

When

it comes to homebuying, we believe Rocket and Redfin have built one of the largest top-of-funnel purchase pipelines in the industry.

Redfin

attracts 50 million people actively searching for homes each month. This traffic generates nearly a million buy-side contacts each year.

A buy-side contact is someone who has taken an action like asking a question, setting up a consultation with an agent, or requesting

a home tour. These are high intent clients.

Through

our marketing efforts, Rocket connects with more than

2 million prospective home buyers a year. Additionally, our servicing portfolio includes 2.8 million homeowners

who are looking to potentially sell their existing home and buy a new one. Taken together, the combined companies have an unmatched ecosystem

of future homebuyers.

But

audience reach alone isn’t enough; engagement and fulfilment options are what convert the top-of-the funnel audience into eventual

home buyers. Redfin’s 2,200 lead agents and Rocket's 3,000 loan officers help move these home searchers through the home buying

process to an eventual closing.

Redfin’s

brand and high-intent users bring more home buyers

into Rocket’s mortgage ecosystem, while Rocket’s leading mortgage platform provides a simple and fast mortgage experience

for Redfin buyers. With this high-quality client base, we expect to drive higher conversion rates and stronger

mortgage attachment. Redfin already has one of the highest real estate brokerage to mortgage attachment

rates in the industry at 27%, with some markets as high as 60%. More

engaged buyers, a seamless experience, and the best professionals in the industry —this is the power of the Rocket-Redfin end-to-end

experience.

And

the opportunity before us is enormous. Combining the homebuyers

across both platforms, we see a 200 billion dollar annual addressable mortgage

opportunity, with one in six purchase originations coming through

this ecosystem.

Beyond

a large addressable audience,

this deal allows us to lower homebuying costs for consumers. The traditional purchase process is fragmented and requires interacting

with many entities along the journey—home search, buyer agents,

listing agents, a mortgage originator, a title and closing

provider,

Rocket

– Redfin Transaction Investor Call Transcript

March 10, 2025

and a servicer. Each stop adds layers of transaction

costs, stress, and friction. This friction is

our opportunity.

We've

never seen home affordability challenged as acutely as it is today. The median home price now exceeds $400,000, and the typical home

transaction incurs $40,000 in fees—roughly 10% of the home price.

The

combined companies will eliminate inefficiencies and earn revenue across multiple parts of the transaction while operating with a single

fixed cost base. This allows us to deliver a modern, seamless, and more cost-effective homebuying experience for consumers that are listing,

buying, and financing their homes.

This

acquisition also unlocks meaningful financial value. We expect to capture over $200 million in annual run-rate revenue and expense synergies.

This includes approximately

$140 million of expense synergies from the rationalization of duplicative operations and other costs.

We

expect an additional $60 million in revenue synergies from higher attach rates to mortgage, real

estate brokerage, and title at an even greater scale. This transaction is expected to be accretive to our

adjusted earnings per share by the end of next year. We will

maintain our strong balance sheet and conservative leverage profile upon close.

There

is one more piece of news that I’d like to share with you today. With an eye toward simplifying Rocket’s corporate structure,

we are also collapsing our existing Up-C.

Mechanically,

the Up-C collapse converts our current Class D shares into newly created Class L shares. These Class L shares will be subject to a structured

two-year lockup period to maintain market stability, after which they will be convertible into Class A shares upon their sale. It’s

also important to note that these new Class L shares will only have one vote - just as the Class A shares have also only one vote. In

short, the collapse of the Up-C effectively eliminates the super voting right currently held by our parent company Rock Holdings Inc.

We

believe that the collapse of the Up-C comes with other benefits, including a simplified corporate structure with easier to understand

tax obligations and financial statement reporting. lt also makes it easier to use stock as our currency for acquisitions such as this.

Finally,

Rocket Companies, Inc., the holding company owned by Class A shareholders, has $119 million of cash that has accumulated since our last

dividend in March of 2022. As part of the Up-C collapse, we are distributing this cash to Class A shareholders through an $0.80 per share

dividend.

Rocket

– Redfin Transaction Investor Call Transcript

March 10, 2025

These

strategic moves—acquiring Redfin and simplifying our corporate structure—put us in prime position for our next stage of growth.

We are accelerating our mission to Help Everyone Home and creating long-term value for our shareholders.

Thank

you for your support and being part of this journey with us.

Operator,

we are ready to open up the line for questions.

Operator

Your

first question comes from the line of Ryan McKeveny from Zelman. Your line is open.

Ryan

McKeveny, Analyst at Zelman

Hey,

good morning Varun and Brian. Exciting announcement for you guys, so congrats. A couple of questions for me.

So

I guess on just the big picture integration of Redfin and Rocket on the purchase side, obviously they've structured things with their

brokerage business with the 2,200 agents, and they also have a partner network, kind of the Rocket Homes side of Rocket has kind of a

partner network. Maybe you can give some more insight on how you see it all coming together and what the look and feel is you know fast

forward a year or two years down the road as this comes together would be part one.

And

then second question would be maybe about a month ago, Redfin and Zillow announced a partnership related to rental listings.

I

assume that partnership will remain in place, but maybe you can comment on that with the change in ownership, if I'm thinking about that

correctly.

Thank

you so much.

Varun

Krishna, CEO of Rocket Companies

Yeah,

Ryan, thank you for the question.

I

appreciate it. Let me start, and then I'll ask if Brian wants to chime in as well. Let's start with the why. And you know I think the

biggest thing is we've been very clear about our strategy, and we've talked about that over many calls.

Rocket

– Redfin Transaction Investor Call Transcript

March 10, 2025

And

we want to grow in purchase. We want to invest deeply in data and AI. And we see this deal as really accelerating both.

We're

going to bring together the leading home search company, the leading mortgage company, and we're going to create and construct a better

end-to-end experience that we think is going to create better value for consumers.

When

you think about just the fact that these companies are so complementary to each other in terms of our brand, the scale of what we do

as well as the culture of the different companies, that is really the genesis of this deal. And then when you sit behind that and look

at the data, just to share a few examples, Redfin has 50 million monthly active users, 2,200 agents, a network of 5,000 agents.

We

think that will be very complementary to our existing agent network.

So

you have a very highly engaged top of funnel to focus on purchase.

And

then you have the most scaled mortgage platform built for 50 states, 3,100 counties and parishes. And so when you put that together,

you can connect the entire value chain, right, from search to realtor to broker to banker to financing, title, closing, servicing. And

when you think about the amount of time data, friction and expense that exists through individual facets of that, that's where we see

the biggest opportunity. And so we think if we do a good job with this, we can create better economics across the value chain for ourselves,

our clients, our realtors, really for anyone who participates in our network.

And

so we really think of this as two data and tech companies sort of coming together to solve an important problem of homeownership.

In

terms of how we think about the integration plan, I think we have three real focus areas. The first one is to make sure that we think

about the team, we think about the culture, and we're thoughtful about that integration. The second is we think there's a lot of low-hanging

fruit to go after in terms of new products and services that the two companies can start to think about building right away.

And

then, of course, to us, this is about accelerating our AI and data strategy and how do we bring those pieces together thoughtfully so

that we can get maximum benefit from the models and infrastructure and sort of knowledge engineering platforms that we're building. And

so we're going to be thoughtful about that over the coming weeks and months.

We've

obviously put together an integration team who will be dedicated and focused on this from both companies.

But

that's the high-level plan.

Rocket

– Redfin Transaction Investor Call Transcript

March 10, 2025

In

terms of the Zillow partnership, I would just say quickly that we absolutely support the partnership.

We

think it's good for industry, and we think it's a great deal for both Redfin and Zillow.

Brian

Brown, CFO of Rocket Companies

Yes.

Maybe, Ryan, I'll just chime in on the synergy case here real quick and just hit a few highlights.

But

we expect the transaction to close in the second or third quarter of this year, and we expect it to be accretive next year.

We

do see significant synergy value in the transaction.

We

talked about about $200 million in total.

That's

comprised of about $60 million of estimated revenue synergies. Kind of going back to your question about the realtor and the brokerage,

we do see a potential to increase mortgage attachment from the Redfin lead agents and even agent network there.

We've

obviously proved that in our own four walls. And if you think about what we have to offer at Rocket Mortgage, it's just a larger product

suite.

It's

a competitive pricing. It's best-in-class digital experiences, super-fast close time so that's one aspect of the revenue synergies. And

then, of course, we talked about this a lot on our earnings calls.

We

have lots of clients that come into our funnel without a realtor, and that provides a great opportunity to increase attachment.

One

of the things we really like is the Redfin brokerage is the realtors perform in the very top of all realtors across the industry.

So

very exciting there. And then, of course, you have the expense side of the house, which is probably not a surprise. We've sized that

up at about $140 million. And those are things you would expect.

We,

of course, have duplicative public company costs. We have some overlapping corporate and G&A functions.

We

definitely expect some marketing synergies, particularly on brand optimization between the two properties. And then you have some mortgage

and search cost overlap, too.

Rocket

– Redfin Transaction Investor Call Transcript

March 10, 2025

So

when you kind of piece all that together, the synergy value here is really exciting and gives us a lot of confidence as we move to integration

and -- closing and integration.

Ryan

McKeveny, Analyst at Zelman

That

makes sense, thank you very much, appreciate it.

Operator

And

again if you would like to ask a question, press star one on your telephone keypad. Your next question comes from the line of Naved Khan

from B. Riley Securities. Your line is open.

Naved

Khan, Analyst at B. Riley Securities

Great.

Thank you very much. Maybe just give us your high-level thoughts on this transaction from an antitrust perspective and potential regulatory

hurdles, if any? And then just curious to know if this was a competitive bidding process or how -- just some kind of background on the

transaction would be very helpful. Thank you.

Varun

Krishna, CEO of Rocket Companies

Yes.

Thank you.

I'll

start with the regulatory question.

Obviously

we don't speculate on regulatory matters, but we believe the transaction will close approximately in the third quarter of '25.

Obviously

we have worked very closely with our advisors, our attorneys.

We

wouldn't be pursuing this agreement if we weren't confident in our ability to complete it.

And

of course, we are actively going to work hard on filing all the required regulatory applications, the right notifications.

We

cooperate fully in any reviews and processes, but we don't anticipate any challenges or risks given the work that we've invested in thus

far.

Brian

Brown, CFO of Rocket Companies

Rocket

– Redfin Transaction Investor Call Transcript

March 10, 2025

Yes.

And on the question around the competitive process, that's probably a better question for the Redfin team, but we started this relationship

a long time ago with the Redfin team. And as Varun talked about in his prepared remarks, we've been long-time admirers of what they've

built, and we're just super happy to get to this point.

Operator

And

that concludes our question and answer session.

I

will now turn the call over to Varun Krishna, CEO, for closing remarks.

Varun

Krishna, CEO of Rocket Companies

Well

thank you, everyone, for joining the call and look forward to speaking with you at our next earnings call. Thanks again.

Operator

This

concludes today's conference call. Thank you for your participation.

You

may now disconnect.

FORWARD-LOOKING

STATEMENTS

This

communication contains statements herein regarding the proposed transaction between Rocket and Redfin; future financial and operating

results; benefits and synergies of the transaction; future opportunities for the combined company; the conversion of equity interests

contemplated by the Merger Agreement; the issuance of common stock of Rocket contemplated by the Merger Agreement; the expected filing

by Rocket with the SEC of a registration statement on Form S-4 (the “Registration Statement”) and a prospectus of Rocket

and a proxy of Redfin to be included therein (the “Proxy Statement/Prospectus”); the expected timing of the closing of the

proposed transaction; the ability of the parties to complete the proposed transaction considering the various closing conditions and

any other statements about future expectations that constitute forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All

statements in this communication, other than statements of historical fact, are forward-looking statements that may be identified by

the use of words “anticipate,” “believe,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,”

“target,” “will,” “would” and, in each case, their negative or other various or comparable terminology.

Such forward-looking statements are based upon current beliefs, expectations and discussions related to the proposed transaction and

are subject to significant risks and uncertainties that could cause actual results to differ materially from the results expressed in

such statements.

Rocket

– Redfin Transaction Investor Call Transcript

March 10, 2025

Risks

and uncertainties include, among other things, (i) the risk that the proposed transaction may not be completed in a timely basis

or at all, which may adversely affect Rocket’s and Redfin’s businesses and the price of their respective securities; (ii) the

potential failure to receive, on a timely basis or otherwise, the required approvals of the proposed transaction, including stockholder

approval by Redfin’s stockholders, and the potential failure to satisfy the other conditions to the consummation of the proposed

transaction; (iii) the effect of the announcement, pendency or completion of the proposed transaction on each of Rocket’s

or Redfin’s ability to attract, motivate, retain and hire key personnel and maintain relationships with lead agents, partner agents

and others with whom Rocket or Redfin does business, or on Rocket’s or Redfin’s operating results and business generally;

(iv) that the proposed transaction may divert management’s attention from each of Rocket’s and Redfin’s ongoing

business operations; (v) the risk of any legal proceedings related to the proposed transaction or otherwise, including the risk

of stockholder litigation in connection with the proposed transaction, or the impact of the proposed transaction thereupon, including

resulting expense or delay; (vi) that Rocket or Redfin may be adversely affected by other economic, business and/or competitive

factors; (vii) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement,

including in circumstances which would require payment of a termination fee; (viii) the risk that restrictions during the pendency

of the proposed transaction may impact Rocket’s or Redfin’s ability to pursue certain business opportunities or strategic

transactions; (ix) the risk that the anticipated benefits and synergies of the proposed transaction may not be fully realized or

may take longer to realize than expected; (x) the impact of legislative, regulatory, economic, competitive and technological changes;

(xi) risks relating to the value of Rocket securities to be issued in the proposed transaction; (xii) the risk that integration

of the Rocket and Redfin businesses post-closing may not occur as anticipated or the combined company may not be able to achieve the

growth prospects expected from the transaction; and (xiii) the effect of the announcement, pendency or completion of the proposed

transaction on the market price of the common stock of each of Rocket and Redfin.

These

risks, as well as other risks related to the proposed transaction, will be described in the Registration Statement that will be filed

with the SEC in connection with the proposed transaction. While the list of factors presented here and the list of factors to be presented

in the Registration Statement are considered representative, no such list should be considered to be a complete statement of all potential

risks and uncertainties. Additional factors that may affect future results are contained in each company’s filings with the SEC,

including each company’s most recent Annual Report on Form 10-K, as it may be updated from time to time by quarterly reports on

Form 10-Q and current reports on Form 8-K, all of which are available at the SEC’s website http://www.sec.gov. The information

set forth herein speaks only as of the date hereof, and any intention or obligation to update any forward looking statements as a result

of developments occurring after the date hereof is hereby disclaimed.

IMPORTANT

INFORMATION FOR INVESTORS AND STOCKHOLDERS

In

connection with the proposed transaction, Rocket plans to file with the SEC the Registration Statement on Form S-4, containing the Proxy

Statement/Prospectus. After the Registration Statement has been declared effective by the SEC, the Proxy Statement/Prospectus will be

delivered to stockholders of Redfin. Investors and securityholders of Rocket and Redfin are urged to read the Registration Statement

and any other relevant documents filed with the SEC, including the Proxy Statement/Prospectus that will be part of the Registration Statement

when they are available because they will contain important information about Rocket, Redfin, the proposed transaction and

Rocket

– Redfin Transaction Investor Call Transcript

March 10, 2025

related matters.

Investors and securityholders of Rocket and Redfin will be able to obtain copies of the Registration Statement and the Proxy Statement/Prospectus,

when they become available, as well as other filings with the SEC that will be incorporated by reference into such documents, containing

information about Rocket and Redfin, without charge, at the SEC’s website (http://www.sec.gov).

Copies of the documents filed with the SEC by Rocket will be available free of charge under the SEC Filings heading of the Investor Relations

section of Rocket’s website at ir.rocketcompanies.com. Copies of the documents filed with the SEC by Redfin will be available free

of charge under the Financials & Filings heading of the Investor Relations section of Redfin’s website investors.redfin.com.

PARTICIPANTS

IN SOLICITATION

Rocket

and Redfin and their respective directors and executive officers and other members of management and employees may be deemed to be participants

in the solicitation of proxies from Redfin’s stockholders in respect of the transaction under the rules of the SEC. Information

regarding Rocket’s directors and executive officers is available in Rocket’s Annual Report on Form 10-K for the year ended

December 31, 2024 and Rocket’s proxy statement, dated April 26, 2024, for its 2024 annual meeting of stockholders, which can be

obtained free of charge through the website maintained by the SEC at http://www.sec.gov. Any changes in the holdings of the Rocket’s

securities by Rocket’s directors or executive officers from the amounts described in Rocket’s 2024 proxy statement have been

reflected in Statements of Change in Ownership on Form 4 filed with the SEC subsequent to the filing date of Rocket’s 2024 proxy

statement and are available at the SEC’s website at www.sec.gov.

Information regarding Redfin’s directors and executive officers is available in Redfin’s Annual Report on Form 10-K for the

year ended December 31, 2024 and Redfin’s proxy statement, dated April 25, 2024, for its 2024 annual meeting of stockholders, which

can be obtained free of charge through the website maintained by the SEC at http://www.sec.gov. Any changes in the holdings of Redfin’s

securities by Redfin’s directors or executive officers from the amounts described in Redfin’s 2024 proxy statement have been

reflected in Statements of Change in Ownership on Form 4 filed with the SEC subsequent to the filing date of Redfin’s 2024 proxy

statement and are available at the SEC’s website at www.sec.gov.

Additional information regarding the interests of such participants will be included in the Registration Statement containing the Proxy

Statement/Prospectus and other relevant materials to be filed with the SEC when they become available.

NO

OFFER OR SOLICITATION

This

communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote

or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

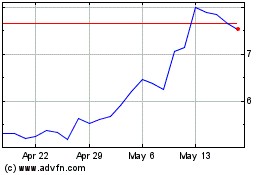

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Mar 2024 to Mar 2025