Filed by Rocket Companies,

Inc.

Pursuant to Rule 425

under the Securities Act of 1933, as amended,

and deemed filed pursuant

to

Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Subject Company: Redfin Corporation

Commission File No.: 001-38160

The following set of Frequently Asked Questions were distributed by Rocket

Companies, Inc. to certain employees on March 10, 2025.

Team Members

| 1. | What does this mean for Team Members? How will this announcement affect

my day-to-day responsibilities? |

| · | As Rocket and Redfin succeed, we expect the same for our team members, including

new opportunities to grow and develop your careers in the combined organization over time. |

| · | While there is a lot to be excited about, this is just the beginning of the

process. |

| · | Until the close of the transaction, Rocket and Redfin are operating independently,

and there are no immediate changes to roles, responsibilities or reporting structure. |

| 2. | How do the cultures of the two companies compare? |

| · | One

of the most important parts of Rocket is our people and culture. Through all of Rocket’s

evolutions, the ISMS and our culture have been our constant and that will never change. |

| · | One

of the things we evaluate in a move like this is culture and values, and in our talks with

Redfin, it became clear that our values are closely aligned, and we share a client-first

culture. |

| · | We

are both mission-driven companies that are obsessed with finding a better way, aimed at helping

our clients achieve homeownership. |

| 3. | How will Redfin be integrated into Rocket? Who will lead the integration

efforts? How long will the integration take? |

| · | Upon

closing of the transaction, it is anticipated that Redfin CEO Glenn Kelman will continue

to lead the Redfin business, reporting to Rocket Companies CEO Varun Krishna. |

| · | We

are still in the early stages of the process. Additional decisions will be made as we work

to integrate Redfin. |

| · | We

will take a thoughtful approach to integrating our companies and functions that leverages

our prior experience to ensure a smooth transition. |

| · | We

will aim to communicate transparently throughout this entire process. |

| · | At

the appropriate time, we will form a planning team from both companies, which will develop

a process to bring together our organizations. |

| 4. | Will there be any changes to my compensation or benefits as a result of

this transaction? |

| · | We do not expect any changes to team member compensation or benefits as a

result of this transaction. |

| 5. | Will there be changes to reporting structures as a result of the transaction?

|

| · | We

do not expect any immediate changes to reporting structure as a result of this transaction. |

| 6. | Will the Redfin leadership team continue to lead that business? |

| · | Following the closing of the transaction, we expect that Redfin CEO Glenn

Kelman will continue to lead the Redfin business, reporting to Varun Krishna. |

| 7. | Will any offices be closed as a result of the transaction? |

| · | We

expect all offices to remain open and for team members to come to offices as they do today. |

| 8. | Will Redfin’s headquarters remain in Seattle? |

| · | We expect Redfin’s headquarters to remain in Seattle. |

| 9. | Will team members be able to transfer to any Redfin locations? |

| · | We have no immediate plans to offer office location changes based upon this

transaction. If we make changes, we will communicate that to the company. |

| 10. | How will Rocket team members work with Redfin team members? Can I begin

to work with Redfin team members now? |

| · | Until

the close of the transaction, both Rocket and Redfin will continue to operate as two independent

companies working separately. |

| · | We

will take a thoughtful approach to integration that leverages our prior experience to ensure

a smooth transition. |

| · | At

the appropriate time, we will form a planning team from both companies, which will develop

a process to bring together our organizations. |

| 11. | What can team members expect between now and the close of the transaction?

|

| · | The transaction is expected to close in the second or third quarter of this

year. |

| · | Until then, we are operating as usual, and there is no change to your day-to-day

responsibilities. |

| · | We’ll keep you informed as we move through the process. |

| 12. | What does this mean for the stock I own in Rocket Companies? |

| · | Rocket’s stock will continue to trade on the New York Stock Exchange

as it does today. |

| · | Under the terms of the agreement, there will be no change in the number, or

form, of the Rocket shares that you may hold. |

| 13. | What should team members tell clients, partners and agents about the transaction?

|

| · | We are operating as usual. |

| · | We expect the transaction’s closing to be seamless for our clients.

|

| · | There are no changes to how we work with clients. We will continue providing

the same exceptional client experience they have come to expect from Rocket. |

| 14. | What do team members do if contacted by the press, financial analysts or

investors? |

| · | If you are contacted by a member of the press, consistent with our policy,

please forward the inquiry to aaronemerson@rocket.com. |

| 15. | Who can I contact if I have more questions? |

| · | If you have any further questions, please reach out to your leaders for

information. |

| 16. | What can I share on my social media/LinkedIn about this announcement? |

| · | Varun and Rocket both posted on this and you should feel free to comment on,

or repost, those messages. |

The attached PDF contains standard disclosures required for communications

about the acquisition. Please ensure these disclosures are included where applicable.

FORWARD-LOOKING STATEMENTS

This communication contains statements herein

regarding the proposed transaction between Rocket and Redfin; future financial and operating results; benefits and synergies of the transaction;

future opportunities for the combined company; the conversion of equity interests contemplated by the Merger Agreement; the issuance of

common stock of Rocket contemplated by the Merger Agreement; the expected filing by Rocket with the SEC of a registration statement on

Form S-4 (the “Registration Statement”) and a prospectus of Rocket and a proxy of Redfin to be included therein (the “Proxy

Statement/Prospectus”); the expected timing of the closing of the proposed transaction; the ability of the parties to complete the

proposed transaction considering the various closing conditions and any other

statements

about future expectations that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act

of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements in this communication,

other than statements of historical fact, are forward-looking statements that may be identified by the use of words “anticipate,”

“believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,”

“would” and, in each case, their negative or other various or comparable terminology. Such forward-looking statements are

based upon current beliefs, expectations and discussions related to the proposed transaction and are subject to significant risks and

uncertainties that could cause actual results to differ materially from the results expressed in such statements.

Risks and uncertainties include, among other

things, (i) the risk that the proposed transaction may not be completed in a timely basis or at all, which may adversely affect Rocket’s

and Redfin’s businesses and the price of their respective securities; (ii) the potential failure to receive, on a timely basis

or otherwise, the required approvals of the proposed transaction, including stockholder approval by Redfin’s stockholders, and the

potential failure to satisfy the other conditions to the consummation of the proposed transaction; (iii) the effect of the announcement,

pendency or completion of the proposed transaction on each of Rocket’s or Redfin’s ability to attract, motivate, retain and

hire key personnel and maintain relationships with lead agents, partner agents and others with whom Rocket or Redfin does business, or

on Rocket’s or Redfin’s operating results and business generally; (iv) that the proposed transaction may divert management’s

attention from each of Rocket’s and Redfin’s ongoing business operations; (v) the risk of any legal proceedings related

to the proposed transaction or otherwise, including the risk of stockholder litigation in connection with the proposed transaction, or

the impact of the proposed transaction thereupon, including resulting expense or delay; (vi) that Rocket or Redfin may be adversely

affected by other economic, business and/or competitive factors; (vii) the occurrence of any event, change or other circumstance

that could give rise to the termination of the Merger Agreement, including in circumstances which would require payment of a termination

fee; (viii) the risk that restrictions during the pendency of the proposed transaction may impact Rocket’s or Redfin’s

ability to pursue certain business opportunities or strategic transactions; (ix) the risk that the anticipated benefits and synergies

of the proposed transaction may not be fully realized or may take longer to realize than expected; (x) the impact of legislative,

regulatory, economic, competitive and technological changes; (xi) risks relating to the value of Rocket securities to be issued in

the proposed transaction; (xii) the risk that integration of the Rocket and Redfin businesses post-closing may not occur as anticipated

or the combined company may not be able to achieve the growth prospects expected from the transaction; and (xiii) the effect of the

announcement, pendency or completion of the proposed transaction on the market price of the common stock of each of Rocket and Redfin.

These risks, as well as other risks related to

the proposed transaction, will be described in the Registration Statement that will be filed with the SEC in connection with the proposed

transaction. While the list of factors presented here and the list of factors to be presented in the Registration Statement are considered

representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Additional factors

that may affect future results are contained in each company’s filings with the SEC, including each company’s most recent

Annual Report on Form 10-K, as it may be updated from time to time by quarterly reports on Form 10-Q and current reports on Form 8-K,

all of which are available at the SEC’s website http://www.sec.gov. The information set forth herein speaks only as of the date

hereof, and any intention or obligation to update any forward looking statements as a result of developments occurring after the date

hereof is hereby disclaimed.

IMPORTANT INFORMATION FOR INVESTORS AND STOCKHOLDERS

In connection with the proposed transaction,

Rocket plans to file with the SEC the Registration Statement on Form S-4, containing the Proxy Statement/Prospectus. After the Registration

Statement has been declared effective by the SEC, the Proxy Statement/Prospectus will be delivered to stockholders of Redfin. Investors

and securityholders of Rocket and Redfin are urged to read the Registration Statement and any other relevant documents filed with the

SEC, including the Proxy Statement/Prospectus that will be part of the Registration Statement when they are available because they will

contain important information about Rocket, Redfin, the proposed transaction

and related

matters. Investors and securityholders of Rocket and Redfin will be able to obtain copies of the Registration Statement and the Proxy

Statement/Prospectus, when they become available, as well as other filings with the SEC that will be incorporated by reference into such

documents, containing information about Rocket and Redfin, without charge, at the SEC’s website (http://www.sec.gov).

Copies of the documents filed with the SEC by Rocket will be available free of charge under the SEC Filings heading of the Investor Relations

section of Rocket’s website at ir.rocketcompanies.com. Copies of the documents filed with the SEC by Redfin will be available free

of charge under the Financials & Filings heading of the Investor Relations section of Redfin’s website investors.redfin.com.

PARTICIPANTS IN SOLICITATION

Rocket and Redfin and their respective directors

and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies

from Redfin’s stockholders in respect of the transaction under the rules of the SEC. Information regarding Rocket’s directors

and executive officers is available in Rocket’s Annual Report on Form 10-K for the year ended December 31, 2024 and Rocket’s

proxy statement, dated April 26, 2024, for its 2024 annual meeting of stockholders, which can be obtained free of charge through the

website maintained by the SEC at http://www.sec.gov. Any changes in the holdings of the Rocket’s securities by Rocket’s directors

or executive officers from the amounts described in Rocket’s 2024 proxy statement have been reflected in Statements of Change in

Ownership on Form 4 filed with the SEC subsequent to the filing date of Rocket’s 2024 proxy statement and are available at the

SEC’s website at www.sec.gov. Information regarding Redfin’s directors and executive

officers is available in Redfin’s Annual Report on Form 10-K for the year ended December 31, 2024 and Redfin’s proxy statement,

dated April 25, 2024, for its 2024 annual meeting of stockholders, which can be obtained free of charge through the website maintained

by the SEC at http://www.sec.gov. Any changes in the holdings of Redfin’s securities by Redfin’s directors or executive officers

from the amounts described in Redfin’s 2024 proxy statement have been reflected in Statements of Change in Ownership on Form 4

filed with the SEC subsequent to the filing date of Redfin’s 2024 proxy statement and are available at the SEC’s website

at www.sec.gov. Additional information regarding the interests of such participants will be included

in the Registration Statement containing the Proxy Statement/Prospectus and other relevant materials to be filed with the SEC when they

become available.

NO OFFER OR SOLICITATION

This communication shall not constitute an offer

to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale

of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as amended.

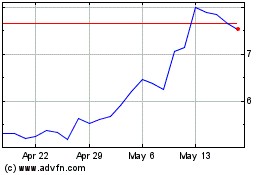

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Mar 2024 to Mar 2025