REE Automotive (NASDAQ: REE), an automotive technology company and

provider of full by-wire electric trucks and platforms, and

Motherson Group (IN: MOTHERSON), an engineering and manufacturing

specialist and a major supplier to the automotive industry with

long standing relationships with global OEMs such as Mercedes Benz,

Audi, Volkswagen, Suzuki, BMW, Porsche, GM, Ford, Stellantis,

Daimler Trucks, Paccar and John Deere today announced a strategic

agreement. Pursuant to the agreement, Motherson will manage

sourcing and supply chain of all production parts and support the

assembly of the REEcorner® and REE P7 electric trucks, the first

full by-wire, software-driven certified medium duty electric truck

available on the market today. Motherson will also nominate a

director to join REE’s board of directors.

In addition, REE has entered into definitive

agreements with certain investors, including M&G Investments,

Motherson, and Varana Capital, for the purchase and sale of

11,001,941 shares of its Class A ordinary shares (or pre-funded

warrants in lieu thereof) at a purchase price of $4.122 per share

in a registered direct offering, for gross proceeds of $45.35

million before deducting applicable fees and expenses. REE intends

to use the proceeds for general working capital. The offering is

expected to close on or by September 19, 2024, subject to the

satisfaction of customary closing conditions.

M&G Investments, REE’s long-term supportive

shareholder, led the investment with $20 million followed by

Motherson participating with a $15 million investment. Following

the closing of the offering, M&G will hold approximately 16.00%

of REE’s issued and outstanding Ordinary Shares; Motherson will

hold approximately 19% on a non-diluted basis; and, similarly,

Varana Capital 8.00%

Benefiting from the new collaboration, the

buying power, manufacturing capability, and industry relationships

of Motherson, REE aims to expedite production to meet growing

demand and anticipated fleet orders from significant multi-national

customers. REE offers the only software-driven medium duty electric

truck that can meet an expected fleet transition to electric of

more than 240,000 medium duty trucks in the U.S. alone and more

than double across the rest of the world. By collaborating with

Motherson, REE can focus on further growing its customer base,

pulling forward orders, increasing gross and cash flow margins, and

expanding its patent portfolio.

Laksh Vaaman Sehgal, Vice Chairman, Motherson

Group, said, "We are pleased to announce our long-term agreement

with REE to accelerate its industrialization within a mutually

beneficial commercial framework. We have been truly impressed by

REE's remarkable technology, exceptional product offerings, and

robust team. We look forward to facilitating REE's growth and

technological advancement by expertly managing its supply chain and

utilizing our world-class engineering and manufacturing

capabilities to drive commercialization and industrialization. We

also want to strengthen REE's integration into the automotive

ecosystem by delivering unparalleled customer support across the

value chain. We believe that this strategic partnership will

contribute towards Motherson’s diversification and increasing

content per vehicle strategy.”

REE Co-founder and CEO, Daniel Barel, said, “We

are very excited to enter into this agreement with Motherson, as I

believe this agreement will enable us to leapfrog over many of the

challenges others face when ramping up production. Motherson’s

global footprint and manufacturing prowess combines perfectly with

REE’s technology and innovation mindset. This combination will

benefit our customers and investors alike, by pushing forward the

transition towards electrification and carbon neutrality. We are

proud to join forces with Motherson and looking forward to learning

from their incredible story and amazing culture.”

M&G Investments’ Portfolio Manager, Carl

Vine, said, “I believe that this is a transformational transaction

for REE and we are delighted to be involved. As shareholders in

both companies, we are confident that the combination of core

competencies from both sides will result in a sigh of relief from

global fleet owners, who have been starved of an electrified

product line-up that can be produced and serviced at scale. This is

a win-win all round.”

The offering is being made pursuant to an

effective shelf registration statement on Form F-3 (File No.

333-266902) previously filed with the U.S. Securities and Exchange

Commission (the "SEC"). A prospectus supplement describing the

terms of the proposed offering will be filed with the SEC and will

be available on the SEC's website located at http://www.sec.gov.

Before investing in this offering, interested parties should read

in their entirety the prospectus supplement and the accompanying

prospectus and the other documents that the Company has filed with

the SEC that are incorporated by reference in such prospectus

supplement and the accompanying prospectus, which provide more

information about the Company and such offering.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities in any state in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of any such state.

REE was represented on the transactions by

Sullivan & Worcester LLP with respect to matters relating to

U.S. law and by Herzog Fox & Neeman with respect to matters

relating to Israeli law.

About REE AutomotiveREE

Automotive Ltd. (Nasdaq: REE) is an automotive technology company

that allows companies to build electric vehicles of various shapes

and sizes on their modular platforms. With complete design freedom,

vehicles Powered by REE® are equipped with the revolutionary

REEcorner®, which packs critical vehicle components (steering,

braking, suspension, powertrain and control) into a single compact

module positioned between the chassis and the wheel. As the first

company to FMVSS certify a full by-wire vehicle in the U.S., REE’s

proprietary by-wire technology for drive, steer and brake control

eliminates the need for mechanical connection. Using four identical

REEcorners® enables REE to make the industry’s flattest EV

platforms with more room for passengers, cargo and batteries. REE

platforms are future proofed, autonomous capable, offer a low total

cost of ownership (TCO), and drastically reduce the time to market

for fleets looking to electrify. To learn more

visit www.ree.auto.

Motherson Group

Founded in 1975, Motherson today is a global

engineering and manufacturing specialist and one of the world’s

leading automotive suppliers for OEMs. For FY24, it achieved gross

revenue of USD 17.2 billion1. Motherson supports its customers from

more than 400 facilities across 44 countries, with a team of over

190,000 dedicated professionals. Motherson operates as a full

system solutions provider and serves its customers with multiple

products and services through its 12 business divisions. The

product portfolio includes electrical distribution systems, fully

assembled vehicle interior and exterior modules, automotive rear

vision systems, moulded plastic parts and assemblies, injection

moulding tools, moulded and extruded rubber components, lighting

systems, electronics, precision metals and modules, Industrial IT

solutions and services etc. The group has expanded its presence to

support customers in new segments, including health and medical,

aerospace and logistics. The diversified range of technologies and

capabilities allows Motherson to support a wide spectrum of

sectors, with automotive as the main industry served. Thanks to the

trust of its customers, the group is ranked among the top 15

automotive suppliers worldwide and is listed among the “World’s

Best Companies of 2024 by Time”. For more information please

visit www.motherson.com.

1 based on an exchange rate of INR to USD

83.4534 reference exchange rate published by RBI as of June 28,

2024)

REE Contacts

Media & Analysts:Keren Shemesh Chief

Marketing OfficerKerens@ree.auto

Investor relations:Dana Rubinstein Chief

Strategy OfficerDanar@ree.auto

Caution About Forward-Looking

Statements

This communication includes certain

forward-looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements include, but are not limited to,

statements regarding REE or its management team’s expectations,

hopes, beliefs, intentions or strategies regarding the future. For

example, REE is using forward-looking statements when it discusses

the expected benefits to be realized by the collaboration with

Motherson, that with the collaboration agreement with Motherson,

REE believes its ability to service customers at scale will

materially accelerate, that significant order growth is anticipated

and that in addition to faster revenue, improved unit costs are

anticipated, accelerating the road to meaningful free-cash flow

generation, that Motherson intends to nominate a member to REE’s

board of directors, the expected ownership of certain of REE’s

shareholders following the closing of the offering, the expected

timing of the closing of the offering and the expected use of

proceeds. In addition, any statements that refer to plans,

projections, forecasts or other characterizations of future events

or circumstances, including any underlying assumptions, are

forward-looking statements. The words “aim” “anticipate,” “appear,”

“approximate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “foresee,” “intends,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “seek,” “should,” “would”,

“designed,” “target” and similar expressions (or the negative

version of such words or expressions) may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. All statements, other than

statements of historical facts, may be forward-looking statements.

Forward-looking statements in this communication may include, among

other things, statements about REE’s strategic and business plans,

technology, relationships and objectives, including its ability to

meet certification requirements, the impact of trends on and

interest in our business, or product, intellectual property, REE’s

expectation for growth, and its future results, operations and

financial performance and condition.

These forward-looking statements are based on

REE’s current expectations and assumptions about future events and

are based on currently available information as of the date of this

communication and current expectations, forecasts, and assumptions.

Although REE believes that the expectations reflected in

forward-looking statements are reasonable, such statements involve

an unknown number of risks, uncertainties, judgments, and other

factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by forward-looking

statements. These factors are difficult to predict accurately and

may be beyond REE’s control. Forward-looking statements in this

communication speak only as of the date made and REE undertakes no

obligation to update its forward-looking statements, whether as a

result of new information, future developments or otherwise, should

circumstances change, except as otherwise required by securities

and other applicable laws. In light of these risks and

uncertainties, investors should keep in mind that results, events

or developments discussed in any forward-looking statement made in

this communication may not occur.

Uncertainties and risk factors that could affect

REE’s future performance and could cause actual results to differ

include, but are not limited to: REE’s ability to commercialize its

strategic plan, including its plan to successfully evaluate, obtain

regulatory approval, produce and market its P7 lineup; REE’s

ability to maintain and advance relationships with current Tier 1

suppliers and strategic partners; development of REE’s advanced

prototypes into marketable products; REE’s ability to grow and

scale manufacturing capacity through relationships with Tier 1

suppliers; REE’s estimates of unit sales, expenses and

profitability and underlying assumptions; REE’s reliance on its UK

Engineering Center of Excellence for the design, validation,

verification, testing and homologation of its products; REE’s

limited operating history; risks associated with building out of

REE’s supply chain; risks associated with plans for REE’s initial

commercial production; REE’s dependence on potential suppliers,

some of which will be single or limited source; development of the

market for commercial EVs; risks associated with data security

breach, failure of information security systems and privacy

concerns; risks related to lack of compliance with Nasdaq’s minimum

bid price requirement; future sales of our securities by existing

material shareholders or by us could cause the market price for the

Class A Ordinary Shares to decline; potential disruption of

shipping routes due to accidents, political events, international

hostilities and instability, piracy or acts by terrorists; intense

competition in the e-mobility space, including with competitors who

have significantly more resources; risks related to the fact that

REE is incorporated in Israel and governed by Israeli law; REE’s

ability to make continued investments in its platform; the impact

of the COVID-19 pandemic, interest rate changes, the ongoing

conflict between Ukraine and Russia and any other worldwide health

epidemics or outbreaks that may arise and adverse global

conditions, including macroeconomic and geopolitical uncertainty;

the global economic environment, the general market, political and

economic conditions in the countries in which we operate; the

ongoing military conflict in Israel; fluctuations in interest rates

and foreign exchange rates; the need to attract, train and retain

highly-skilled technical workforce; changes in laws and regulations

that impact REE; REE’s ability to enforce, protect and maintain

intellectual property rights; REE’s ability to retain engineers and

other highly qualified employees to further its goals; and other

risks and uncertainties set forth in the sections entitled “Risk

Factors” and “Cautionary Note Regarding Forward-Looking Statements”

in REE’s annual report filed with the U.S. Securities and Exchange

Commission (the “SEC”) on March 27, 2024 and in subsequent filings

with the SEC.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/0909afd3-d34b-40c8-ba30-3c9bf60381dc

https://www.globenewswire.com/NewsRoom/AttachmentNg/ffc3a3aa-31bc-43d1-844d-7e9a2d757aa2

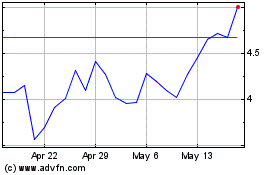

REE Automotive (NASDAQ:REE)

Historical Stock Chart

From Dec 2024 to Jan 2025

REE Automotive (NASDAQ:REE)

Historical Stock Chart

From Jan 2024 to Jan 2025