Form 8-K/A date of report 02-14-24

true

0001697851

0001697851

2024-01-02

2024-01-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 2, 2024

|

REKOR SYSTEMS, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

|

001-38338

|

|

81-5266334

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

6721 Columbia Gateway Drive , Suite 400 , Columbia , MD 21046

|

|

(Address of Principal Executive Offices)

|

|

|

|

Registrant's Telephone Number, Including Area Code: (410) 762-0800

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

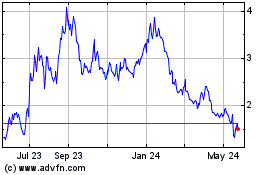

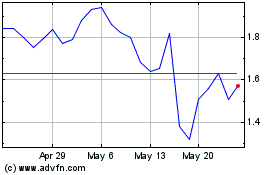

Common Stock, $0.0001 par value per share

|

REKR

|

The Nasdaq Stock Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

On January 3, 2024, Rekor Systems, Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original 8-K”), disclosing, among other things, that on January 2, 2024, the Company acquired All Traffic Data Services, LLC, a Colorado limited liability company (“ATD”), pursuant to that certain Interest Purchase Agreement (the “Purchase Agreement”), dated as of January 2, 2024, by and among the Company, ATD and All Traffic Holdings, LLC. Under the terms of the Purchase Agreement, the Company acquired all of the issued and outstanding limited liability company interests of ATD (the “ATD Acquisition”).

This amendment to the Original 8-K (the “Amendment”) is being filed for the purpose of satisfying the Company’s undertaking to file the financial statements and pro forma financial information required by Item 9.01 of Form 8-K, and this Amendment should be read in conjunction with the Original 8-K. Except as set forth herein, no modifications have been made to information contained in the Original 8-K, and the Company has not updated any information contained therein to reflect events that have occurred since the date of the Original 8-K.

Item 9.01. Financial Statements and Exhibits.

(a) Financial Statements of Business Acquired.

The audited consolidated financial statements of ATD for the year ended December 31, 2022 and the unaudited consolidated financial statements for the nine months ended September 30, 2023 and the related notes are attached hereto as Exhibit 99.1 and incorporated herein by reference.

(b) Pro Forma Financial Information.

Unaudited pro forma condensed combined financial statements, which include a pro forma condensed combined balance sheet as of September 30, 2023 and pro forma condensed combined statements of operations for the year ended December 31, 2022 and the nine months ended September 30, 2023 and the notes related thereto, are filed as Exhibit 99.2 to this report and incorporated herein by reference.

(d) Exhibits

|

Exhibit

No.

|

|

Description

|

| |

|

|

|

23.1

|

|

|

|

99.1

|

|

|

|

99.2

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

REKOR SYSTEMS, INC.

|

|

|

|

|

|

|

|

Date: February 15, 2024

|

|

/s/ Robert A. Berman

|

|

|

|

|

Name: Robert A. Berman

Title: Chief Executive Officer

|

|

EXHIBIT 23.1

Consent of Independent Auditor

We consent to the incorporation by reference in Registration Statements on Form S-8 (File Nos. 333-220864, 333-259041, and 333-260153) and Form S-3 (File Nos. 333-259447, 333-260607 and 333-274422) of Rekor Systems, Inc. of our report dated February 15, 2024 on the financial statements of All Traffic Data Services, LLC, as of December 31, 2022 and for the year ended December 31, 2022, which is included in this Current Report on Form 8-K/A of Rekor Systems, Inc.

|

|

/s/ Crowe LLP |

|

|

|

| Denver, Colorado |

|

|

February 15, 2024

|

|

Exhibit 99.1

ALL TRAFFIC DATA SERVICES, LLC

Wheat Ridge, Colorado

FINANCIAL STATEMENTS

December 31, 2022

All Traffic Data Services, LLC

Wheat Ridge, Colorado

FINANCIAL STATEMENTS

December 31, 2022

CONTENTS

| INDEPENDENT AUDITOR’S REPORT |

1 |

| |

|

| |

|

| FINANCIAL STATEMENTS |

|

| |

|

| BALANCE SHEET |

3 |

| |

|

| STATEMENT OF OPERATIONS |

4 |

| |

|

| STATEMENT OF MEMBER’S EQUITY |

5 |

| |

|

| STATEMENT OF CASH FLOWS |

6 |

| |

|

| NOTES TO FINANCIAL STATEMENTS |

7 |

|

|

Crowe LLP

Independent Member Crowe Global

|

INDEPENDENT AUDITOR'S REPORT

To the Board of Directors and Member of

All Traffic Data Services, LLC

Wheat Ridge, Colorado

Opinion

We have audited the financial statements of All Traffic Data Services, LLC (the “Company”), which comprise the balance sheet as of December 31, 2022, and the related statements of operations, member’s equity, and cash flows for the year then ended, and the related notes to the financial statements.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2022, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Emphasis of Matter

As discussed in Note 1 to the financial statements, effective January 1, 2022, the Company has changed its method of accounting for leases due to the adoption of the new lease accounting standard pursuant to Accounting Standards Update (“ASU”) 2016-02, Leases (Topic 842). The Company adopted the new lease standard using the modified retrospective approach. Our opinion is not modified with respect to this matter.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company ability to continue as a going concern for one year from the date the financial statements are available to be issued.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with GAAS, we:

|

●

|

Exercise professional judgment and maintain professional skepticism throughout the audit.

|

|

●

|

Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

|

|

●

|

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed.

|

|

●

|

Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements.

|

|

●

|

Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time.

|

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control–related matters that we identified during the audit.

/s/ Crowe LLP

Denver, Colorado

February 15, 2024

ALL TRAFFIC DATA SERVICES, LLC

BALANCE SHEET

December 31, 2022

| |

|

2022

|

|

|

ASSETS

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

Cash

|

|

$ |

1,664,377 |

|

|

Accounts receivable, net

|

|

|

2,400,526 |

|

|

Prepaid expenses and other current assets

|

|

|

581,952 |

|

|

Total current assets

|

|

|

4,646,855 |

|

| |

|

|

|

|

|

Noncurrent assets

|

|

|

|

|

|

Property and equipment, net

|

|

|

1,583,117 |

|

|

Operating lease right of use assets, net

|

|

|

319,210 |

|

|

Customer relationships, net

|

|

|

10,625,414 |

|

|

Trademark, net

|

|

|

978,611 |

|

|

Goodwill

|

|

|

398,174 |

|

| |

|

|

|

|

|

Total noncurrent assets

|

|

|

13,904,526 |

|

| |

|

|

|

|

|

Total assets

|

|

$ |

18,551,381 |

|

| |

|

|

|

|

|

LIABILITIES AND MEMBER'S EQUITY

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

Accounts payable

|

|

$ |

49,955 |

|

|

Accrued expenses

|

|

|

464,550 |

|

|

Payroll liabilities

|

|

|

178,984 |

|

|

Operating lease obligations, current portion

|

|

|

192,436 |

|

|

Total current liabilities

|

|

|

885,925 |

|

| |

|

|

|

|

|

Noncurrent liabilities

|

|

|

|

|

|

Operating lease obligations, net of current portion

|

|

|

126,774 |

|

|

Total noncurrent liabilities

|

|

|

126,774 |

|

| |

|

|

|

|

|

Total liabilities

|

|

|

1,012,699 |

|

| |

|

|

|

|

|

Member's equity

|

|

|

17,538,682 |

|

| |

|

|

|

|

|

Total liabilities and member's equity

|

|

$ |

18,551,381 |

|

See accompanying notes to the financial statements.

ALL TRAFFIC DATA SERVICES, LLC

STATEMENT OF OPERATIONS

Year ended December 31, 2022

| |

|

2022

|

|

| |

|

|

|

|

|

Net revenues

|

|

$ |

8,263,015 |

|

| |

|

|

|

|

|

Cost of revenues

|

|

|

2,391,851 |

|

| |

|

|

|

|

|

Gross profit

|

|

|

5,871,164 |

|

| |

|

|

|

|

|

Operating expenses

|

|

|

2,655,188 |

|

|

Depreciation and amortization

|

|

|

1,648,815 |

|

| |

|

|

4,304,003 |

|

| |

|

|

|

|

|

Income before other income (expense)

|

|

|

1,567,161 |

|

| |

|

|

|

|

|

Other income (expense)

|

|

|

|

|

|

Management and advisory expense

|

|

|

(189,429 |

) |

|

Gain on disposal of property and equipment

|

|

|

30,026 |

|

| |

|

|

(159,403 |

) |

| |

|

|

|

|

|

Net income

|

|

$ |

1,407,758 |

|

See accompanying notes to the financial statements.

ALL TRAFFIC DATA SERVICES, LLC

STATEMENT OF MEMBER’S EQUITY

Year ended December 31, 2022

| |

|

|

|

|

|

|

|

|

|

Total

|

|

| |

|

Contributed

|

|

|

Accumulated

|

|

|

Member's

|

|

| |

|

Capital

|

|

|

Deficit

|

|

|

Equity

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of January 1, 2022

|

|

$ |

22,559,561 |

|

|

$ |

(6,477,258 |

) |

|

$ |

16,082,303 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Incentive unit compensation expense

|

|

|

- |

|

|

|

48,621 |

|

|

|

48,621 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

- |

|

|

|

1,407,758 |

|

|

|

1,407,758 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of December 31, 2022

|

|

$ |

22,559,561 |

|

|

$ |

(5,020,879 |

) |

|

$ |

17,538,682 |

|

See accompanying notes to the financial statements.

ALL TRAFFIC DATA SERVICES, LLC

STATEMENT OF CASH FLOWS

Year ended December 31, 2022

| |

|

2022

|

|

| |

|

|

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

Net income

|

|

$ |

1,407,758 |

|

|

Adjustments to reconcile consolidated net income to net cash provided by operating activities

|

|

|

|

|

|

Depreciation and amortization

|

|

|

1,648,815 |

|

|

Bad debt expense

|

|

|

36,000 |

|

|

Incentive unit compensation expense

|

|

|

48,621 |

|

|

Gain on disposal of property and equipment

|

|

|

(30,026 |

) |

|

Non-cash operating lease activity

|

|

|

160,332 |

|

|

Employee retention credits

|

|

|

(502,841 |

) |

|

Change in operating assets and liabilities

|

|

|

|

|

|

Accounts receivable

|

|

|

(283,723 |

) |

|

Prepaid expenses and other current assets

|

|

|

32,031 |

|

|

Accounts payable

|

|

|

48,343 |

|

|

Accrued expenses

|

|

|

(38,915 |

) |

|

Payroll liabilities

|

|

|

(18,764 |

) |

|

Cash paid for contingent consideration

|

|

|

(262,000 |

) |

|

Cash paid for operating leases

|

|

|

(160,332 |

) |

|

Net cash from operating activities

|

|

|

2,085,299 |

|

| |

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

Purchases of property and equipment

|

|

|

(942,943 |

) |

|

Proceeds from sale of property and equipment

|

|

|

42,066 |

|

|

Net cash used in investing activities

|

|

|

(900,877 |

) |

| |

|

|

|

|

|

Net change in cash

|

|

|

1,184,422 |

|

| |

|

|

|

|

|

Cash, beginning of the year

|

|

|

479,955 |

|

| |

|

|

|

|

|

Cash, end of the year

|

|

$ |

1,664,377 |

|

| |

|

|

|

|

|

Operating lease right-of-use assets entered into during the year

|

|

$ |

186,893 |

|

See accompanying notes to the financial statements.

ALL TRAFFIC DATA SERVICES, LLC

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Operations: All Traffic Data Services, LLC (the “Company”), a Colorado Limited Liability Company, is a wholly owned subsidiary of All Traffic Holdings, LLC (“Holdings”). Under the terms of the respective operating agreements, the Company has an indefinite life. The Company provides traffic data collection and reporting services to a multitude of civil engineering firms, state and local transportation networks, commercial establishments and cities across the United States of America.

Effective January 2, 2024, Rekor Systems, Inc. acquired the Company pursuant to an Interest Purchase Agreement.

Adoption of New Accounting Standards: As of January 1, 2022, the Company adopted Accounting Standard Update (“ASU”) 2016-02, Leases, which requires lessees to recognize a lease liability and a right-of-use (“ROU”) asset on the balance sheet for most operating leases, except for those leases with an original term of 12 months or less. Accounting for finance leases is substantially unchanged. This accounting standard was adopted using a modified retrospective transition. There were no adjustments recorded to the opening balance of member’s deficit as of the effective date.

The adoption of ASU 2016-02 had an impact on the Company’s balance sheet due to the recognition of approximately $281,000 of operating lease right-of-use assets and operating lease liabilities recorded as of January 1, 2022. The Company does not have any material finance leases.

Basis of Accounting and Use of Estimates: The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America. Conformity with such principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Estimates and assumptions are periodically reviewed, and the effects of revisions are reflected in the financial statements in the period they are determined to be necessary. Estimates that are more susceptible to change in the near term are the Company’s allowance for doubtful accounts, useful lives and related depreciation of property and equipment and intangible assets, the valuation of equity incentive unit awards, and the valuation of long-lived assets, including goodwill. Actual results could differ from these estimates.

Concentrations of Credit Risk: The Company’s financial instruments that are at times exposed to concentrations of credit risk consist primarily of cash and accounts receivable. The Company maintains cash in bank accounts which at times may exceed federally insured limits. The Company has not experienced any losses in such accounts. Management believes that the Company is not exposed to significant credit risk relating to cash because the Company maintains its cash with high credit quality institutions.

As of December 31, 2022, one customer accounted for 11% of the Company’s accounts receivables. The same customer also accounted for 8%, of the Company’s revenues for the period ended December 31, 2022.

ALL TRAFFIC DATA SERVICES, LLC

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Revenue Recognition: The Company records revenue in accordance with FASB Accounting Standards Codification (“ASC 606”) Revenue from Contracts with Customers. Under ASC 606, revenue from goods and services is recognized when an entity transfers control of promised goods and services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. Refer to Note 2 for additional disclosure regarding revenue recognition.

Accounts Receivable and Allowance for Doubtful Accounts: Accounts receivable, net consists of billed accounts receivable and allowances for doubtful accounts. Billed accounts receivable represents amounts billed to clients that have not yet been collected. Allowances for doubtful accounts represent the amounts that may become uncollectible or unrealizable in the future. The Company determines an estimated allowance for doubtful accounts based on management’s judgment regarding operating performance related to the adequacy of the services performed and delivered, and the financial condition of the Company’s clients. After all reasonable attempts to collect an account have failed, the amount receivable is written off against the allowance. As of December 31, 2022, the allowance for doubtful accounts is approximately $133,000.

Property and Equipment: Property and equipment are generally stated at cost less accumulated depreciation, except for assets acquired in a business combination, whereby these items are initially recorded at fair value at the acquisition date under FASB ASC 805, Business Combinations. Depreciation is calculated using the straight-line method over the estimated useful lives of the assets. Maintenance and repairs are charged to operations as incurred and major improvements are capitalized.

Estimated useful lives are as follows:

|

Service equipment

|

|

5 years

|

|

Vehicles

|

|

5 years

|

|

Computer and equipment software

|

|

3-5 years

|

Leases: At the inception of an arrangement, the Company determines if an arrangement is a lease based on all relevant facts and circumstances. Leases are classified as operating or finance leases at the lease commencement date. Operating leases are included in operating lease ROU assets, current operating lease liabilities and noncurrent operating lease liabilities on the balance sheet. Leases are classified between current and long-term liabilities based on their payment terms. Lease expense for operating leases is recognized on a straight-line basis over the lease term. Leases with a term of 12 months or less (short-term leases) are not recorded on the balance sheet.

ROU assets represent the right to use an underlying asset for the lease term and lease liabilities represent the obligation to make lease payments arising from the lease. ROU assets and lease liabilities are recognized at the lease commencement date based on the estimated present value of lease payments over the lease term. ROU assets also include prepaid rent and are adjusted by the unamortized balance of lease incentives. The implicit rate within the Company’s operating leases are generally not determinable and the Company uses an estimated incremental borrowing rate at the lease commencement date to determine the present value of lease payments.

ALL TRAFFIC DATA SERVICES, LLC

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Some leases include one or more options to extend the lease, with extension terms that can extend the lease term. The exercise of lease extension options is at the Company’s sole discretion. The lease term includes options to extend or terminate the lease when it is reasonably certain that the Company will exercise that option. The Company generally concludes options to extend the lease are reasonably certain to be exercised when it concludes that it is cost prohibitive to relocate operations or pursue alternative leased assets.

Goodwill: Goodwill represents the excess of the purchase price over the fair value of the acquired tangible assets and liabilities and identifiable intangible assets. The Company will assess goodwill for impairment annually, or more often if events or changes in circumstances indicate that it might be impaired, by comparing its carrying value to the reporting unit’s fair value.

In testing for goodwill impairment, the Company has the option first to perform a qualitative assessment to determine whether it is more likely than not that goodwill is impaired or the entity can bypass the qualitative assessment and proceed directly to the quantitative test by comparing the carrying amount, including goodwill, of the entity with its fair value. The goodwill impairment loss, if any, is measured as the amount by which the carrying amount of the entity, including goodwill, exceeds its fair value. Subsequent increases in goodwill value are not recognized in the financial statements. The Company recorded a goodwill impairment charge of $4,470,000 during the year ended December 31, 2021. Management of the Company has determined that there was no goodwill impairment during the year ended December 31, 2022.

Identifiable Intangible Assets: Identifiable intangible assets acquired in a business combination are recorded at fair values at the date of acquisition. The Company’s intangible assets consist of a trade name and customer relationships. The trade name and customer relationship intangible assets are amortized on a straight-line basis over 15 years, which approximates useful life.

Impairment of Long-Lived Assets: The Company evaluates long-lived assets for impairment whenever events or circumstances indicate that the carrying value of an asset may not be recoverable. If the estimated future cash flows (undiscounted and without interest charges) are less than the carrying value or the value in use, a write-down is recorded to reduce the related asset to its estimated fair value.

Fair Value of Financial Instruments: The Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) 820, Fair Value Measurements and Disclosures, establishes a common definition for fair value to be applied to generally accepted accounting principles in the United States of America requiring use of fair value, establishes a framework for measuring fair value, and expands disclosure about such fair value measurements.

FASB ASC 820-10 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (exit price). FASB ASC 820 classifies the inputs used to measure fair value into the following hierarchy:

Level 1 – Quoted prices (unadjusted) for identical assets or liabilities in active markets that the entity has the ability to access as of the measurement date.

ALL TRAFFIC DATA SERVICES, LLC

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Level 2 – Significant other observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

Level 3 – Significant unobservable inputs that reflect a company’s own assumptions about the assumptions that market participants would use in pricing an asset or liability.

The asset or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs. The Company’s financial instruments include cash, accounts receivable, accounts payable and equity incentive units.

The carrying amounts of cash, accounts receivable, and accounts payable approximate fair value due to the short maturities of these instruments. Contingent consideration is recorded at fair value at the time of acquisition and re-measured at fair value each reporting period. Fair value is estimated using present value analysis of payment probability outcomes which requires judgmental Level 3 measurement assumptions. During the year ended December 31, 2022, the Company settled contingent consideration liabilities through payment of $262,000.

The fair value of equity incentive unit awards is estimated at the grant date using an option pricing model. The option pricing model requires judgmental Level 3 measurement assumptions on the date of grant including: volatility, value of the underling equity instrument and expected life.

Equity Incentive Units: The Company expenses the fair value of equity-based incentive awards on the date of grant if there is no service requisite or over the vesting period when there is a service requisite.

Advertising and Marketing Costs: The Company expenses all advertising and marketing costs as incurred. Total advertising and marketing expense was approximately $260,000 for the year ended December 31, 2022.

Income Taxes: The Company is a limited liability company and as such, is not subject to income taxes. Therefore, no provision for income taxes has been provided in the accompanying financial statements because as an LLC that has elected to file as a partnership, such taxes are the responsibility of the individual members. The Company assesses the likelihood of the financial statement effect of a tax position that should be recognized when it is more likely than not that the position will be sustained upon examination by a taxing authority based on the technical merits of the tax position, circumstances, and information available as of the reporting date. Management believes that there are no current tax positions that would result in an asset or liability for taxes being recognized in the accompanying financial statements.

Contingencies and Uncertainties: Liabilities for loss contingencies arising from claims, assessments, litigation, and other sources are recorded when it is probable that a liability has been incurred and the amount of the claim, assessment, or damages can be reasonably estimated.

ALL TRAFFIC DATA SERVICES, LLC

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Under provisions of the Coronavirus Aid, Relief and Economic Security (CARES) Act and the subsequent extension thereof, the Company was eligible for refundable employee retention credits (“ERCs”) subject to certain criteria. The ERCs are equal to (a) 50% of qualified wages paid to employees paid during the qualifying quarters of calendar year 2020 for a maximum credit per employee of $5,000 per employee through December 31, 2020 or (b) 70% of qualified wages paid to employees during the qualifying quarters of calendar year 2021 for a maximum credit per employee of $7,000 per quarter through June 30, 2021. During the year ended December 31, 2022, the Company claimed approximately $503,000 of ERC and recorded approximately $377,000 as a reduction to cost of revenue and $126,000 as a reduction of operating expenses. As of December 31, 2022, the Company had not received any ERC refund payments and a receivable of approximately $503,000 is included in prepaid expenses and other current assets on the balance sheet. Subsequent to December 31, 2022, the Company received ERC refund payments of approximately $461,000 and also interest credit of approximately $54,000.

Litigation: In the normal course of business, the Company’s business is such that the Company is involved in a variety of claims and disputes that are associated with the performance of its services. In addition to the usual liabilities of contractors for performance and completion of contracts, including letters of credit supporting performance guarantees, the Company is involved in limited lawsuits, claims, and inquiries. It is the opinion of management, based on advice of legal counsel, that these matters will not have a material effect on the Company’s financial position, results of operations, or cash flows.

NOTE 2 - REVENUE RECOGNITION

The Company provides traffic data collection and reporting services to civil engineering firms, state and local transportation networks, commercial establishments and cities across the United States of America.

Revenue is recorded at the amount of consideration the Company expects to be entitled to in exchange for the delivered goods and services, which includes an estimate of expected returns or refunds when applicable. When the Company enters into a sales arrangement with a customer, it believes it is probable that it will collect substantially all of the consideration to which it will be entitled in exchange for the goods that will be transferred to the customer.

Revenue is recognized at the point in time when control is transferred to the customer. In general, control transfers to the customer when data and information derived from information collection process is provided to the customer. Once the data and information are provided to the customer, the customer can direct the use and obtain substantially all the remaining benefits from the asset at this point in time.

Payment from customers is typically due at the time the data and information, derived from collection services, is provided to the customer.

ALL TRAFFIC DATA SERVICES, LLC

NOTES TO FINANCIAL STATEMENTS

NOTE 3 - PROPERTY AND EQUIPMENT

Property and equipment consists of the following as of December 31, 2022:

| |

|

2022

|

|

| |

|

|

|

|

|

Service equipment

|

|

$ |

1,982,910 |

|

|

Vehicles

|

|

|

1,093,328 |

|

|

Computer equipment and software

|

|

|

191,585 |

|

| |

|

|

3,267,823 |

|

|

Accumulated depreciation

|

|

|

(1,684,706 |

) |

| |

|

|

|

|

|

Total

|

|

$ |

1,583,117 |

|

Depreciation expense was $626,521 during the year ended December 31, 2022.

NOTE 4 - GOODWILL AND INTANGIBLE ASSETS

Goodwill and intangible assets consist of the following as of December 31, 2022:

| |

|

|

|

|

|

December 31, 2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

|

|

| |

|

Useful

|

|

|

Gross Carrying

|

|

|

Accumulated

|

|

|

Carrying

|

|

| |

|

Life (years)

|

|

|

Amount

|

|

|

Amortization

|

|

|

Amount

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer relationships

|

|

15 |

|

|

$ |

14,034,385 |

|

|

$ |

(3,408,971 |

) |

|

$ |

10,625,414 |

|

|

Trademark

|

|

15 |

|

|

|

1,300,000 |

|

|

|

(321,389 |

) |

|

|

978,611 |

|

|

Goodwill

|

|

Indefinite

|

|

|

|

398,174 |

|

|

|

- |

|

|

|

398,174 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

$ |

15,732,559 |

|

|

$ |

(3,730,360 |

) |

|

$ |

12,002,199 |

|

Intangible asset amortization expense was $1,022,294 during year ended December 31, 2022.

ALL TRAFFIC DATA SERVICES, LLC

NOTES TO FINANCIAL STATEMENTS

NOTE 4 - GOODWILL AND INTANGIBLE ASSETS (Continued)

The estimated amortization expense related to intangible assets for the next five years and thereafter is as follows:

| |

|

Customer

|

|

|

|

|

|

|

|

|

|

| |

|

Relationships

|

|

|

Trademark

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

2023

|

|

$ |

935,628 |

|

|

$ |

86,664 |

|

|

$ |

1,022,292 |

|

|

2024

|

|

|

935,628 |

|

|

|

86,664 |

|

|

|

1,022,292 |

|

|

2025

|

|

|

935,628 |

|

|

|

86,664 |

|

|

|

1,022,292 |

|

|

2026

|

|

|

935,628 |

|

|

|

86,664 |

|

|

|

1,022,292 |

|

|

2027

|

|

|

935,628 |

|

|

|

86,664 |

|

|

|

1,022,292 |

|

|

Thereafter

|

|

|

5,947,274 |

|

|

|

545,291 |

|

|

|

6,492,565 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$ |

10,625,414 |

|

|

$ |

978,611 |

|

|

$ |

11,604,025 |

|

NOTE 5 - LEASE COMMITMENTS

The Company leases office and storage space from third parties and related parties. The leases expire at various dates through October 31, 2025. The Company’s lease expense, including short-term and variable lease costs expense, totaled $472,906 during the year ended December 31, 2022. A summary of amounts reported within the December 31, 2022 balance sheet is as follows:

|

Operating lease right of use assets, net

|

|

$ |

319,210 |

|

| |

|

|

|

|

|

Operating lease obligations, current portion

|

|

$ |

192,436 |

|

| |

|

|

|

|

|

Operating lease obligations, net of current portion

|

|

$ |

126,774 |

|

The estimated future minimum lease payments under non-cancellable leases as of December 31, 2022 are as follows:

|

Operating lease cost

|

|

$ |

148,449 |

|

|

Short-term and variable lease cost

|

|

|

324,457 |

|

| |

|

|

|

|

|

Total lease cost

|

|

$ |

472,906 |

|

| |

|

|

|

|

|

2023

|

|

$ |

203,021 |

|

|

2024

|

|

|

111,283 |

|

|

2025

|

|

|

18,190 |

|

|

Total minimum lease payments

|

|

|

332,494 |

|

| |

|

|

|

|

|

Less: financing component

|

|

|

(13,284 |

) |

| |

|

|

|

|

|

Net present value of minimum lease payments

|

|

|

319,210 |

|

| |

|

|

|

|

|

Less: current portion of operating lease obligations

|

|

|

(192,436 |

) |

| |

|

|

|

|

|

Long-term operating obligations, net of current portion

|

|

$ |

126,774 |

|

| |

|

|

|

|

|

Weighted-average remaining lease term

|

|

21 months

|

|

|

Weighted-average discount rate

|

|

|

5.00 |

% |

Effective in March 2023, the Company entered into a building lease agreement with a third party through February 2026. The total lease commitment during this period will be approximately $52,000.

ALL TRAFFIC DATA SERVICES, LLC

NOTES TO FINANCIAL STATEMENTS

NOTE 6 - RELATED PARTY TRANSACTIONS

As discussed in Note 5, the Company leases certain property from a related party. Lease expense includes related party lease expense of $287,000 for the year ended December 31, 2022. Each of the Company’s related party leases have lease terms of 12 months or less and are not recorded as operating lease ROU assets or lease liabilities on the Company’s balance sheet.

On April 16, 2019, the Company entered into an Investment Oversight Agreement (the “IO Agreement”) with a member of the Company. Pursuant to the IO Agreement, the member will provide the Company with ongoing financial consulting and management advisory services so long as the member or its affiliated designees have any equity ownership in the Company. A quarterly fee of $43,750 and reimbursement for out-of-pocket business expenses are due to the member subject to a 3% annual increase effective as of July 31 of each successive year. For the year ended December 31, 2022, the Company recognized management advisory fee expense of $189,429, which is included in other income (expense) in the statement of operations. As of December 31, 2022, accrued management advisory fees was $45,876.

NOTE 7 - MEMBER’S EQUITY

The Company equity consists of one class of membership interests, all of which is held by Holdings. During the year ended December 31, 2022, the Company did not receive any capital contributions or make any distributions to Holdings. Subsequent to December 31, 2022, the Company made distributions totaling $2,000,000 to Holdings.

Holdings awarded Class B incentive units to certain employees of the Company. In accordance with ASC 718, share-based payments awarded to an employee of the reporting entity by a holder of an economic interest in the entity as compensation for services provided to the entity are share-based payment transactions. The substance of such a transaction is that the economic interest holder makes a capital contribution to the reporting entity and that entity makes a share-based payment to its employee in exchange for services rendered. As Holdings is an economic interest holder of the Company, these share-based awards have been accounted for and disclosed in accordance with ASC 718.

The Class B incentive units participate in distributions from the Company to the extent such distributions exceed defined participation levels. The incentive units do not have voting rights. These units vest 20% per year on each one-year anniversary from the date of the grant. The Class B incentive units provide for accelerated vesting upon consummation of a sale transaction so long as the employee has been continuously employed by the Company thereof from the vesting start date through the date a sale transaction is consummated. Any Class B incentive units held by the employees are nontransferable. As of December 31, 2022, 5,905 Class B incentive units were vested. Unvested Class B incentive units are forfeited upon termination of employment. During the year ended December 31, 2022, 3,761 Class B incentive units were forfeited.

The Company expenses the fair value of the Class B incentive units as determined on the date of grant, over the requisite service period. The Company granted 5,261 Class B incentive units to members of Company management during the year ended December 31, 2022. As of December 31, 2022, 12,957 Class B incentive units, were outstanding. The Company recorded compensation expense of $48,621 during the year ended December 31, 2022.

ALL TRAFFIC DATA SERVICES, LLC

NOTES TO FINANCIAL STATEMENTS

NOTE 7 - MEMBER’S EQUITY (Continued)

Upon the sale of the Company to Rekor Systems, Inc. on January 2, 2024, Holdings management determined the valuation of the Company at the time of sale did not allow for Class B incentive units to participate in the sale proceeds of the Company. Therefore, no proceeds from the sale of the Company were provided to the Class B incentive unit holders and no additional compensation expense was recorded by the Company. The Class B incentive units were settled upon the sale of the Company with no carry over to the buyer.

NOTE 8 - SUBSEQUENT EVENTS

The Company has evaluated subsequent events through February 15, 2024, the date on which the Company’s financial statements were available to be issued.

On June 21, 2023, the Company acquired certain assets and operations of Traffic Survey Specialists Inc. ("TSS") for a total purchase price of $650,000, of which $300,000 was paid in cash consideration at the time of closing. The remaining $350,000 will be paid in quarterly installments. On the three-month and six-month anniversaries following the closing date $75,000 is payable to sellers. On the nine-month and twelve-month anniversaries following closing date $100,000 is payable to sellers. The Company recorded $33,800 of transaction expense related to the acquisition.

TSS provides traffic data collection and analysis services for civil engineering firms, government transportation authorities, and commercial customers in southern Florida. The acquisition expands the Company’s existing markets and access to new customers and created revenue and cost synergies which management believes will contribute to future profits. The acquisition has been accounted for as a business combination.

The excess of the consideration transferred in over the net amounts assigned to the fair value of the tangible assets and identifiable intangible assets acquired was recorded as goodwill, which represents the opportunity to expand existing markets and access new customers and to create revenue and cost synergies that management believes will contribute to future profits. Substantially all of goodwill is expected to be deductible for tax purposes.

The following table presents the allocation of consideration to net assets acquired, at fair value:

|

Cash consideration

|

|

$ |

300,000 |

|

|

Consideration payable to seller

|

|

|

350,000 |

|

| |

|

|

|

|

|

Total purchase price

|

|

$ |

650,000 |

|

| |

|

|

|

|

|

Assets acquired

|

|

|

|

|

|

Prepaid expenses

|

|

$ |

2,271 |

|

|

Accounts receivable

|

|

|

51,529 |

|

|

Property and equipment

|

|

|

12,000 |

|

|

Customer relationships

|

|

|

405,834 |

|

| |

|

|

|

|

|

Total assets acquired

|

|

|

471,634 |

|

| |

|

|

|

|

|

Goodwill

|

|

|

178,366 |

|

| |

|

|

|

|

| |

|

$ |

650,000 |

|

ALL TRAFFIC DATA SERVICES, LLC

Wheat Ridge, Colorado

FINANCIAL STATEMENTS

September 30, 2023

(Unaudited)

ALL TRAFFIC DATA SERVICES, LLC

Wheat Ridge, Colorado

FINANCIAL STATEMENTS

September 30, 2023

(Unaudited)

CONTENTS

| FINANCIAL STATEMENTS |

|

| |

|

| BALANCE SHEET (Unaudited) |

2 |

| |

|

| STATEMENT OF OPERATIONS (Unaudited) |

3 |

| |

|

| STATEMENT OF MEMBER’S EQUITY (Unaudited) |

4 |

| |

|

| STATEMENT OF CASH FLOWS (Unaudited) |

5 |

| |

|

| NOTES TO FINANCIAL STATEMENTS (Unaudited) |

6 |

ALL TRAFFIC DATA SERVICES, LLC

BALANCE SHEET

September 30, 2023

(Unaudited)

| |

|

2023

|

|

|

ASSETS

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

1,886,677 |

|

|

Accounts receivable, net

|

|

|

2,872,816 |

|

|

Prepaid expenses and other current assets

|

|

|

285,425 |

|

|

Total current assets

|

|

|

5,044,918 |

|

| |

|

|

|

|

|

Noncurrent assets

|

|

|

|

|

|

Property and equipment, net

|

|

|

1,828,794 |

|

|

Operating lease right of use assets, net

|

|

|

307,184 |

|

|

Customer relationships, net

|

|

|

10,320,507 |

|

|

Trademark, net

|

|

|

913,611 |

|

|

Goodwill

|

|

|

576,540 |

|

| |

|

|

|

|

|

Total noncurrent assets

|

|

|

13,946,636 |

|

| |

|

|

|

|

|

Total assets

|

|

$ |

18,991,554 |

|

| |

|

|

|

|

|

LIABILITIES AND MEMBER'S EQUITY

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

Accounts payable

|

|

$ |

39,743 |

|

|

Accrued expenses

|

|

|

597,709 |

|

|

Consideration payable to seller

|

|

|

350,000 |

|

|

Payroll liabilities

|

|

|

330,589 |

|

|

Operating lease obligations, current portion

|

|

|

194,530 |

|

|

Total current liabilities

|

|

|

1,512,571 |

|

| |

|

|

|

|

|

Noncurrent liabilities

|

|

|

|

|

|

Operating lease obligations, net of current portion

|

|

|

112,654 |

|

|

Total noncurrent liabilities

|

|

|

112,654 |

|

| |

|

|

|

|

|

Total liabilities

|

|

|

1,625,225 |

|

| |

|

|

|

|

|

Member's equity

|

|

|

17,366,329 |

|

| |

|

|

|

|

|

Total liabilities and member's equity

|

|

$ |

18,991,554 |

|

See accompanying notes to the unaudited financial statements.

ALL TRAFFIC DATA SERVICES, LLC

STATEMENT OF OPERATIONS

Period from January 1, 2023 to September 30, 2023

(Unaudited)

| |

|

2023

|

|

| |

|

|

|

|

|

Net revenues

|

|

$ |

6,890,594 |

|

| |

|

|

|

|

|

Cost of revenues

|

|

|

2,034,449 |

|

| |

|

|

|

|

|

Gross profit

|

|

|

4,856,145 |

|

| |

|

|

|

|

|

Operating expenses

|

|

|

2,575,368 |

|

|

Depreciation and amortization

|

|

|

1,387,422 |

|

|

Transaction expenses

|

|

|

33,800 |

|

| |

|

|

3,996,590 |

|

| |

|

|

|

|

|

Income before other income (expense)

|

|

|

859,555 |

|

| |

|

|

|

|

|

Other income (expense)

|

|

|

|

|

|

Management and advisory expense

|

|

|

(143,898 |

) |

|

Other income

|

|

|

54,250 |

|

|

Gain on disposal of property and equipment

|

|

|

2,137 |

|

|

Interest income

|

|

|

13,741 |

|

|

Total other income (expense)

|

|

|

(73,770 |

) |

| |

|

|

|

|

|

Net income

|

|

$ |

785,785 |

|

See accompanying notes to the unaudited financial statements.

ALL TRAFFIC DATA SERVICES, LLC

STATEMENT OF MEMBER’S EQUITY

Period from January 1, 2023 to September 30, 2023

(Unaudited)

| |

|

|

|

|

|

|

|

|

|

Total

|

|

| |

|

Contributed

|

|

|

Accumulated

|

|

|

Member's

|

|

| |

|

Capital

|

|

|

Deficit

|

|

|

Equity

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of January 1, 2023

|

|

$ |

22,559,561 |

|

|

$ |

(5,020,879 |

) |

|

$ |

17,538,682 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Incentive unit compensation expense

|

|

|

- |

|

|

|

41,862 |

|

|

|

41,862 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution to member

|

|

|

- |

|

|

|

(1,000,000 |

) |

|

|

(1,000,000 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

- |

|

|

|

785,785 |

|

|

|

785,785 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of September 30, 2023

|

|

$ |

22,559,561 |

|

|

$ |

(5,193,232 |

) |

|

$ |

17,366,329 |

|

See accompanying notes to the unaudited financial statements.

ALL TRAFFIC DATA SERVICES, LLC

STATEMENT OF CASH FLOWS

Period from January 1, 2023 to September 30, 2023

(Unaudited)

| |

|

2023

|

|

| |

|

|

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

Net income

|

|

$ |

785,785 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities

|

|

|

|

|

|

Depreciation and amortization

|

|

|

1,387,422 |

|

|

Bad debt expense

|

|

|

27,000 |

|

|

Incentive unit compensation expense

|

|

|

41,862 |

|

|

Gain on disposal of property and equipment

|

|

|

(2,137 |

) |

|

Non-cash operating lease activity

|

|

|

170,765 |

|

|

Change in operating assets and liabilities

|

|

|

|

|

|

Accounts receivable

|

|

|

(447,761 |

) |

|

Prepaid expenses and other current assets

|

|

|

298,798 |

|

|

Accounts payable

|

|

|

(10,212 |

) |

|

Accrued expenses

|

|

|

133,159 |

|

|

Payroll liabilities

|

|

|

151,605 |

|

|

Cash paid for operating leases

|

|

|

(170,765 |

) |

|

Net cash from operating activities

|

|

|

2,365,521 |

|

| |

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

Acquisition of a business

|

|

|

(300,000 |

) |

|

Purchases of property and equipment

|

|

|

(850,221 |

) |

|

Proceeds from sale of property and equipment

|

|

|

7,000 |

|

|

Net cash used in investing activities

|

|

|

(1,143,221 |

) |

| |

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

|

Distribution to member

|

|

|

(1,000,000 |

) |

|

Net cash used in financing activities

|

|

|

(1,000,000 |

) |

| |

|

|

|

|

|

Net change in cash and cash equivalents

|

|

|

222,300 |

|

| |

|

|

|

|

|

Cash and cash equivalents, beginning of the period

|

|

|

1,664,377 |

|

| |

|

|

|

|

|

Cash and cash equivalents, end of the period

|

|

$ |

1,886,677 |

|

| |

|

|

|

|

|

Supplemental disclosure of cash paid for acquisition

|

|

|

|

|

|

Fair value of assets acquired, net of cash acquired

|

|

$ |

650,000 |

|

|

Consideration payable to seller

|

|

|

(350,000 |

) |

| |

|

|

|

|

|

Cash paid for acquisition

|

|

$ |

300,000 |

|

| |

|

|

|

|

|

Operating lease right-of-use assets entered into during the period

|

|

$ |

144,830 |

|

See accompanying notes to the unaudited financial statements.

ALL TRAFFIC DATA SERVICES, LLC

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Operations: All Traffic Data Services, LLC (the “Company”), a Colorado Limited Liability Company, is a wholly owned subsidiary of All Traffic Holdings, LLC (“Holdings”). Under the terms of the respective operating agreements, the Company has an indefinite life. The Company provides traffic data collection and reporting services to a multitude of civil engineering firms, state and local transportation networks, commercial establishments and cities across the United States of America.

Effective January 2, 2024, Rekor Systems, Inc. acquired the Company pursuant to an Interest Purchase Agreement.

Basis of Accounting and Use of Estimates: The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America. Conformity with such principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Estimates and assumptions are periodically reviewed, and the effects of revisions are reflected in the financial statements in the period they are determined to be necessary. Estimates that are more susceptible to change in the near term are the Company’s allowance for doubtful accounts, useful lives and related depreciation of property and equipment and intangible assets, the valuation of equity incentive unit awards, and the valuation of long-lived assets, including goodwill. Actual results could differ from these estimates.

Adoption of New Accounting Standards: In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which significantly changed how entities will measure credit losses for most financial assets and certain other instruments that are not measured at fair value through net income. The most significant change in this standard is a shift from the incurred loss model to the expected loss model. Under the standard, disclosures are required to provide users of the financial statements with useful information in analyzing an entity’s exposure to credit risk and the measurement of credit losses. Financial assets held by the company that are subject to the guidance in FASB ASC 326 were trade accounts receivable. The Company adopted the standard effective January 1, 2023. The adoption of this standard did not have a material impact on the Company's financial statements.

Concentrations of Credit Risk: The Company’s financial instruments that are at times exposed to concentrations of credit risk consist primarily of cash and accounts receivable. The Company maintains cash in bank accounts which at times may exceed federally insured limits. The Company has not experienced any losses in such accounts. Management believes that the Company is not exposed to significant credit risk relating to cash because the Company maintains its cash with high credit quality institutions.

As of September 30, 2023, one customer accounted for 10% and another customer accounted for 10% of the Company’s accounts receivables. The same customers also accounted for 5% and 8%, of the Company’s revenues for the period from January 1, 2023 to September 30, 2023, respectively.

Cash and Cash Equivalents: Cash and cash equivalents include cash and investments with original maturities of three months or less.

ALL TRAFFIC DATA SERVICES, LLC

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Revenue Recognition: The Company records revenue in accordance with FASB Accounting Standards Codification (“ASC 606”) Revenue from Contracts with Customers. Under ASC 606, revenue from goods and services is recognized when an entity transfers control of promised goods and services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. Refer to Note 2 for additional disclosure regarding revenue recognition.

Accounts Receivable and Allowance for Doubtful Accounts: Accounts receivable, net consists of billed accounts receivable and allowances for doubtful accounts. Billed accounts receivable represents amounts billed to clients that have not yet been collected. Unbilled accounts receivable of $562,678 were included in accounts receivable, net as of September 30, 2023.

Allowances for doubtful accounts represent the amounts that may become uncollectible or unrealizable in the future. The Company determines an estimated allowance for doubtful accounts based on management’s judgment regarding operating performance related to the adequacy of the services performed and delivered, and the financial condition of the Company’s customers. After all reasonable attempts to collect an account have failed, the amount receivable is written off against the allowance. As of September 30, 2023, the allowance for doubtful accounts is approximately $160,000.

Property and Equipment: Property and equipment are generally stated at cost less accumulated depreciation, except for assets acquired in a business combination, whereby these items are initially recorded at fair value at the acquisition date under FASB ASC 805, Business Combinations. Depreciation is calculated using the straight-line method over the estimated useful lives of the assets. Maintenance and repairs are charged to operations as incurred and major improvements are capitalized.

Estimated useful lives are as follows:

|

Service equipment

|

5 years

|

|

Vehicles

|

5 years

|

|

Computer and equipment software

|

3 - 5 years

|

Leases: At the inception of an arrangement, the Company determines if an arrangement is a lease based on all relevant facts and circumstances. Leases are classified as operating or finance leases at the lease commencement date. Operating leases are included in operating lease ROU assets, current operating lease liabilities and noncurrent operating lease liabilities in the balance sheet as of September 30, 2023. Leases are classified between current and long-term liabilities based on their payment terms. Lease expense for operating leases is recognized on a straight-line basis over the lease term. Leases with a term of 12 months or less (short-term leases) are not recorded on the balance sheet.

ROU assets represent the right to use an underlying asset for the lease term and lease liabilities represent the obligation to make lease payments arising from the lease. ROU assets and lease liabilities are recognized at the lease commencement date based on the estimated present value of lease payments over the lease term. ROU assets also include prepaid rent and are adjusted by the unamortized balance of lease incentives. The implicit rate within the Company’s operating leases are generally not determinable and the Company uses an estimated incremental borrowing rate at the lease commencement date to determine the present value of lease payments.

ALL TRAFFIC DATA SERVICES, LLC

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Some leases include one or more options to extend the lease, with extension terms that can extend the lease term. The exercise of lease extension options is at the Company’s sole discretion. The lease term includes options to extend or terminate the lease when it is reasonably certain that the Company will exercise that option. The Company generally concludes options to extend the lease are reasonably certain to be exercised when it concludes that it is cost prohibitive to relocate operations or pursue alternative leased assets.

Goodwill: Goodwill represents the excess of the purchase price over the fair value of the acquired tangible assets and liabilities and identifiable intangible assets. The Company will assess goodwill for impairment annually, or more often if events or changes in circumstances indicate that it might be impaired, by comparing its carrying value to the reporting unit’s fair value.

In testing for goodwill impairment, the Company has the option first to perform a qualitative assessment to determine whether it is more likely than not that goodwill is impaired or the entity can bypass the qualitative assessment and proceed directly to the quantitative test by comparing the carrying amount, including goodwill, of the entity with its fair value. The goodwill impairment loss, if any, is measured as the amount by which the carrying amount of the entity, including goodwill, exceeds its fair value. Subsequent increases in goodwill value are not recognized in the financial statements. The Company recorded a goodwill impairment charge of $4,470,000 during the year ended December 31, 2021. Management of the Company has determined that there was no goodwill impairment during the period from January 1, 2023 to September 30, 2023.

Identifiable Intangible Assets: Identifiable intangible assets acquired in a business combination are recorded at fair values at the date of acquisition. The Company’s intangible assets consist of a trade name and customer relationships. The trade name and customer relationship intangible assets are amortized on a straight-line basis over 15 years, which approximates useful life.

Impairment of Long-Lived Assets: The Company evaluates long-lived assets for impairment whenever events or circumstances indicate that the carrying value of an asset may not be recoverable. If the estimated future cash flows (undiscounted and without interest charges) are less than the carrying value or the value in use, a write-down is recorded to reduce the related asset to its estimated fair value.

Fair Value of Financial Instruments: The Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) 820, Fair Value Measurements and Disclosures, establishes a common definition for fair value to be applied to generally accepted accounting principles in the United States of America requiring use of fair value, establishes a framework for measuring fair value, and expands disclosure about such fair value measurements.

FASB ASC 820-10 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (exit price). FASB ASC 820 classifies the inputs used to measure fair value into the following hierarchy:

Level 1 – Quoted prices (unadjusted) for identical assets or liabilities in active markets that the entity has the ability to access as of the measurement date.

Level 2 – Significant other observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

ALL TRAFFIC DATA SERVICES, LLC

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Level 3 – Significant unobservable inputs that reflect a company’s own assumptions about the assumptions that market participants would use in pricing an asset or liability.

The asset or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs. The Company’s financial instruments include cash and cash equivalents, accounts receivable, accounts payable and equity incentive units.

The carrying amounts of cash and cash equivalents, accounts receivable, and accounts payable approximate fair value due to the short maturities of these instruments. The fair value of certificates of deposit approximate deposit account balances, as no discounts for credit quality of liquidity are determined to be applicable.

The fair value of equity incentive unit awards is estimated at the grant date using an option pricing model. The option pricing model requires judgmental Level 3 measurement assumptions on the date of grant including: volatility, value of the underling equity instrument and expected life.

Equity Incentive Units: The Company expenses the fair value of equity-based incentive awards on the date of grant if there is no service requisite or over the vesting period when there is a service requisite.

Advertising and Marketing Costs: The Company expenses all advertising and marketing costs as incurred. Total advertising and marketing expense was approximately $195,000 for the period from January 1, 2023 to September 30, 2023.

Income Taxes: The Company is a limited liability company and as such, is not subject to income taxes. Therefore, no provision for income taxes has been provided in the accompanying financial statements because as an LLC that has elected to file as a partnership, such taxes are the responsibility of the individual members. The Company assesses the likelihood of the financial statement effect of a tax position that should be recognized when it is more likely than not that the position will be sustained upon examination by a taxing authority based on the technical merits of the tax position, circumstances, and information available as of the reporting date. Management believes that there are no current tax positions that would result in an asset or liability for taxes being recognized in the accompanying financial statements.

Contingencies and Uncertainties: Liabilities for loss contingencies arising from claims, assessments, litigation, and other sources are recorded when it is probable that a liability has been incurred and the amount of the claim, assessment, or damages can be reasonably estimated.