false

0001697851

0001697851

2024-11-14

2024-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 14, 2024

REKOR SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-38338

|

81-5266334

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

| |

|

|

|

6721 Columbia Gateway Drive, Suite 400, Columbia, MD 21046

|

|

(Address of Principal Executive Offices)

|

| |

|

Registrant's Telephone Number, Including Area Code: (410) 762-0800

|

| |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value per share

|

|

REKR

|

|

The Nasdaq Stock Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

On November 14, 2024, Rekor Systems, Inc. (the “Company”) issued a press release summarizing the Company’s financial results for the third quarter ended September 30, 2024. A copy of this press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

The foregoing information is intended to be furnished under Item 2.02 of Form 8-K, “Results of Operations and Financial Condition.” This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

A conference call has been scheduled for November 14, 2024, at 4:30 PM ET. Listeners may access the call live by telephone at (877) 407-8037 (toll free) and internationally at (201) 689-8037; or, via the Internet at https://event.choruscall.com/mediaframe/webcast.html?webcastid=pzPTSDpm. An archived webcast will also be available to replay this conference call directly from the investor relations section of the Company’s website at https://www.rekor.ai/investors.

In its discussion, management may reference certain non-GAAP financial measures related to company performance. A reconciliation of that information to the most directly comparable GAAP measures is provided in the press release, furnished herewith, and a copy of which can also be accessed in the investor relations section of the Company’s website referenced above.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

Exhibit

No.

|

|

Description

|

| |

|

|

|

99.1

|

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

REKOR SYSTEMS, INC.

|

|

| |

|

|

| |

|

|

|

Date: November 14, 2024

|

/s/ Eyal Hen

|

|

| |

Name: Eyal Hen

Title: Chief Financial Officer

|

|

| |

|

|

Exhibit 99.1

Rekor Systems Reports Third Quarter 2024 Financial Results

Company commences implementation of Rekor Discover™ in Florida after receiving FDOT-approved product list certification

Highlights

| |

●

|

Q3 2024 gross revenue increased 16% to $10.5 million compared to $9.1 million in Q3 2023

|

| |

●

|

Q3 recurring revenue increased 14% to $5.5 million compared to $4.8 million

|

| |

●

|

Rekor Discover™ now on the Florida DOT Approved Product List, and deployments commenced

|

| |

●

|

Our CEO, David Desharnais, was inducted into the ITS America Board

|

COLUMBIA, MD – November 14, 2024 - Rekor Systems, Inc. (NASDAQ: REKR) ("Rekor" or the "Company"), a leader in developing and implementing advanced roadway intelligence technology, today announced its financial results for the quarter ending September 30, 2024.

Rekor Discover™ was recently added to the Florida DOT’s Approved Product List and is now beginning implementation across all Florida DOT districts simultaneously. In October, we amended the Pre-Paid advance Agreement with an affiliate of Yorkville Global Advisors, LP and eliminated the option for additional advances to the Company of $20 million. Below are some highlights of the Company's other achievements during the quarter:

| |

●

|

Rekor Highlighted by Texas DOT: The Texas Department of Transportation presented the Rekor Command™ solution to the Texas House Legislature as a model for the future of roadway management. Rekor's deployment and its successful outcomes were also showcased in a recent video featuring testimonials from the department's senior leaders.

|

| |

●

|

New York Moves to Procurement: The New York State Department of Transportation has advanced Rekor Discover™ from the proof-of-concept stage to the procurement phase. This initial implementation establishes a foundation for Rekor to collaborate with various engineering and construction firms, inviting bids for numerous data collection sites across the state.

|

| |

●

|

New Mexico Selects Rekor for AI Count Class and Speed: In New Mexico, Rekor Discover™ has been selected to replace the side-firing radars on major roadwork along I-25. This decision highlights Rekor's ability to enhance roadside intelligence and monitor critical infrastructure as part of New Mexico’s $200 million improvement initiative.

|

| |

●

|

Partnership with Goldwings Establishes Hawaiian Presence: Rekor Discover™ is now available to the communities in Hawaii with high demand for roadway intelligence through a new partnership with Goldwings.

|

| |

●

|

Nvidia Case Study: NVIDIA recently published a case study highlighting Rekor's integration of its comprehensive accelerated computing platform for roadway intelligence. By leveraging NVIDIA's AI technologies, Rekor is advancing new generative AI applications, including enhanced internal data annotation, streamlined workflows, and more effective calibration and configuration of systems.

|

"Our third quarter financial results reflect the delays in revenue realization we recently experienced due to the variability we've previously noted in servicing government customers. Consequently, we are aggressively optimizing our cost structure and accelerating our path to achieve positive cash flow in 2025. To stay resilient in this environment, we’ve taken the necessary steps to adjust to the unpredictability of government procurement timelines and trim our expenses. This expense realignment has been designed to achieve an annual reduction in costs of up to $15 million.," said Eyal Hen, CFO of Rekor. "Concurrent with this optimization program, we eliminated the option to tap additional advances of $20 million under our agreement with Yorkville Advisors. This reflects our confidence in our forward outlook, growing operating momentum, and commitment to protecting shareholder value. As our actions have been targeted to support near-term revenue generation, we continue to look forward to delivering strong future growth in the coming quarters."

Our President and CEO, David Desharnais, was recently appointed to the Board of ITS America. “I am truly honored to be inducted into the ITS America Board of Directors and to join forces with visionary leaders from both the public and private sectors to shape the future of transportation,” said Mr. Desharnais. “ITS America is leading the way in transforming the movement of people and goods, championing innovation, and advancing intelligent transportation systems to build safer, more resilient, and connected communities. I look forward to contributing to this bold mission and helping to accelerate the adoption of groundbreaking solutions that will shape the future of our transportation infrastructure."

Three and Nine Months Ended September 30, 2024 Financial Results

This section highlights the changes for the three and nine months ended September 30, 2024, compared to the three and nine months ended September 30, 2023.

Revenues

| |

|

Three Months Ended September 30,

|

|

|

Change

|

|

|

Nine Months Ended September 30,

|

|

|

Change

|

|

|

(Dollars in thousands)

|

|

2024

|

|

|

2023

|

|

|

$

|

|

|

%

|

|

|

2024

|

|

|

2023

|

|

|

$

|

|

|

%

|

|

|

Revenue

|

|

$ |

10,546 |

|

|

$ |

9,119 |

|

|

$ |

1,427 |

|

|

|

16 |

% |

|

$ |

32,751 |

|

|

$ |

23,867 |

|

|

$ |

8,884 |

|

|

|

37 |

% |

The increase in revenue for the three and nine months ended September 30, 2024, compared to the three and nine months ended September 30, 2023, was primarily attributable to our Urban Mobility revenue stream which consists of revenue derived from roadway data aggregation activities. During the three and nine months ended September 30, 2024, revenue attributable to ATD was $1,723,000 and $7,428,000, respectively, and is included as part of the Urban Mobility revenue stream.

Cost of Revenue, excluding Depreciation and Amortization

| |

|

Three Months Ended September 30,

|

|

|

Change

|

|

|

Nine Months Ended September 30,

|

|

|

Change

|

|

|

(Dollars in thousands)

|

|

2024

|

|

|

2023

|

|

|

$

|

|

|

%

|

|

|

2024

|

|

|

2023

|

|

|

$

|

|

|

%

|

|

|

Cost of revenue, excluding depreciation and amortization

|

|

$ |

5,903 |

|

|

$ |

4,320 |

|

|

$ |

1,583 |

|

|

|

37 |

% |

|

$ |

16,964 |

|

|

$ |

11,319 |

|

|

$ |

5,645 |

|

|

|

50 |

% |

For the three and nine months that ended September 30, 2024, the cost of revenue, excluding depreciation and amortization, increased compared to the corresponding prior periods primarily due to an increase in personnel and other direct costs, such as hardware, that were incurred to support our increase in revenue. Additionally, during the three and nine months ended September 30, 2024, $809,000 and $2,608,000 of the increase was related to our acquisition of ATD.

Loss from Operations

| |

|

Three Months Ended September 30,

|

|

|

Change

|

|

|

Nine Months Ended September 30,

|

|

|

Change

|

|

|

(Dollars in thousands)

|

|

2024

|

|

|

2023

|

|

|

$

|

|

|

%

|

|

|

2024

|

|

|

2023

|

|

|

$

|

|

|

%

|

|

|

Loss from operations

|

|

$ |

(12,854 |

) |

|

$ |

(9,803 |

) |

|

$ |

(3,051 |

) |

|

|

31 |

% |

|

$ |

(35,845 |

) |

|

$ |

(32,770 |

) |

|

$ |

(3,075 |

) |

|

|

9 |

% |

Loss from operations for the three and nine months ended September 30, 2024, compared to the three and nine months ended September 30, 2023, increased primarily due to additional costs of ATD including the additional depreciation and amortization of intangible assets associated with the acquisition.

Additional Key Performance Indicators and Non-GAAP Measures

Performance Obligations

As of September 30, 2024, the Company had approximately $23,613,000 in remaining performance obligations not yet satisfied or partially satisfied. This is a decrease of approximately 11%, down from $26,390,000 of remaining performance obligations as of December 31, 2023. Total performance obligations have decreased over time as the contract term of certain of the Company's large long-term contracts begin to near.

Adjusted Gross Profit and Adjusted Gross Margin

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

(Dollars in thousands, except percentages)

|

|

|

(Dollars in thousands, except percentages)

|

|

|

Revenue

|

|

$ |

10,546 |

|

|

$ |

9,119 |

|

|

$ |

32,751 |

|

|

$ |

23,867 |

|

|

Cost of revenue, excluding depreciation and amortization

|

|

|

5,903 |

|

|

|

4,320 |

|

|

|

16,964 |

|

|

|

11,319 |

|

|

Adjusted Gross Profit

|

|

$ |

4,643 |

|

|

$ |

4,799 |

|

|

$ |

15,787 |

|

|

$ |

12,548 |

|

|

Adjusted Gross Margin

|

|

|

44.0 |

% |

|

|

52.6 |

% |

|

|

48.2 |

% |

|

|

52.6 |

% |

Adjusted Gross Margin for the three and nine months ended September 30, 2024, decreased compared to the three and nine months ended September 30, 2023. The fluctuation in Adjusted Gross Margin is typically correlated to the mix of hardware and software sales as well as service-type work. Typically, our software sales carry a higher Adjusted Gross Margin.

EBITDA and Adjusted EBITDA

The Company calculates EBITDA as net loss before interest, taxes, depreciation, and amortization. The Company calculates Adjusted EBITDA as net loss before interest, taxes, depreciation, and amortization, adjusted for (i) impairment of intangible assets, (ii) loss on extinguishment of debt, (iii) stock-based compensation, (iv) losses or gains on sales of subsidiaries, and (v) other unusual or non-recurring items. EBITDA and Adjusted EBITDA are not measurements of financial performance or liquidity under accounting principles generally accepted in the U.S. ("U.S. GAAP") and should not be considered as an alternative to net earnings or cash flow from operating activities as indicators of our operating performance or as a measure of liquidity or any other measures of performance derived in accordance with U.S. GAAP. EBITDA and Adjusted EBITDA are presented because we believe they are frequently used by securities analysts, investors, and other interested parties in the evaluation of a company's ability to service and/or incur debt. However, other companies in our industry may calculate EBITDA and Adjusted EBITDA differently than we do.

The following table sets forth the components of the EBITDA and Adjusted EBITDA for the periods included (dollars in thousands):

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Net loss

|

|

$ |

(12,646 |

) |

|

$ |

(10,566 |

) |

|

$ |

(41,055 |

) |

|

$ |

(34,361 |

) |

|

Interest

|

|

|

496 |

|

|

|

906 |

|

|

|

2,094 |

|

|

|

2,576 |

|

|

Depreciation and amortization

|

|

|

2,399 |

|

|

|

1,963 |

|

|

|

7,075 |

|

|

|

5,925 |

|

|

EBITDA

|

|

$ |

(9,751 |

) |

|

$ |

(7,697 |

) |

|

$ |

(31,886 |

) |

|

$ |

(25,860 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation

|

|

$ |

1,148 |

|

|

$ |

1,081 |

|

|

$ |

3,430 |

|

|

$ |

3,237 |

|

|

Loss (gain) on extinguishment of debt

|

|

|

- |

|

|

|

- |

|

|

|

4,693 |

|

|

|

(527 |

) |

|

Loss on offering costs - Prepaid Advance

|

|

|

888 |

|

|

|

- |

|

|

|

888 |

|

|

|

- |

|

|

Gain on the sale of Global Public Safety

|

|

|

(1,500 |

) |

|

|

- |

|

|

|

(1,500 |

) |

|

|

- |

|

|

Adjusted EBITDA

|

|

$ |

(9,215 |

) |

|

$ |

(6,616 |

) |

|

$ |

(24,375 |

) |

|

$ |

(23,150 |

) |

Rekor has scheduled a conference call to discuss the third quarter 2024 results on Thursday, November 14, 2024, at 4:30 P.M. (Eastern).

Any person interested in participating in the call should please dial in approximately 10 minutes prior to the start of the call using the following information:

North America: 877-407-8037/ 201-689-8037

International:

Click here for participant International Toll-Free access numbers

Webcast : https://event.choruscall.com/mediaframe/webcast.html?webcastid=pzPTSDpm

REPLAY INFORMATION

A replay will be made available online approximately two hours following the live call for a period of two weeks. To access the replay, use the following numbers:

Replay Dial-In: 877-660-6853 / 201-612-7415

Access ID: 13748129

An archived webcast will also be available to replay this conference call directly from the Company's website under Investors, Events & Presentations.

About Rekor Systems, Inc.

Rekor Systems, Inc. (NASDAQ: REKR) is a leader in developing and implementing state-of-the-art roadway intelligence systems using AI-enabled computer vision and machine learning. As a pioneer in the implementation of digital infrastructure, Rekor is collecting, connecting, and organizing the world's mobility data – laying the foundation for a digitally-enabled operating system for the roadway. With our Rekor One® Roadway Intelligence Engine at the core of our technology, we aggregate and transform trillions of data points into intelligence through proprietary computer vision, machine learning, and big data analytics that power our platforms and applications. Our solutions provide actionable insights that give governments and businesses a comprehensive picture of roadways while providing a collaborative environment that drives the world to be safer, greener, and more efficient. To learn more, please visit our website: https://rekor.ai, and follow Rekor on social media on LinkedIn, X (formerly Twitter), Threads, and Facebook.

Forward-Looking Statements

This press release and its links and attachments contain statements concerning Rekor Systems, Inc. and its future expectations, plans, and prospects that constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the impact of Rekor's core suite of AI-powered technology and the size and shape of the global market for ALPR systems. Such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. For this purpose, any statements that are not statements of historical fact may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as "may," "should," "expects," "plans," "anticipates," "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential," or "continue," by the negative of these terms or by other similar expressions. You are cautioned that such statements are subject to many risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual circumstances, events or results may differ materially from those projected in the forward-looking statements, particularly as a result of various risks and other factors identified in our filings with the Securities and Exchange Commission. All forward-looking statements contained in this press release speak only as of the date on which they were made and are based on management's assumptions and estimates as of such date. We do not undertake any obligation to publicly update any forward-looking statements, whether as a result of the receipt of new information, the occurrence of future events, or otherwise.

Company Contact:

Rekor Systems, Inc.

Eyal Hen

Chief Financial Officer

Phone: +1 (443) 545-7260

ehen@rekor.ai

Media & Investor Relations Contact:

Rekor Systems, Inc.

Charles Degliomini

ir@rekor.ai

REKOR SYSTEMS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Dollars in thousands, except share data)

| |

|

September 30, 2024

|

|

|

December 31, 2023

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

10,602 |

|

|

$ |

15,385 |

|

|

Restricted cash

|

|

|

365 |

|

|

|

328 |

|

|

Accounts receivable, net

|

|

|

6,728 |

|

|

|

4,955 |

|

|

Inventory

|

|

|

3,944 |

|

|

|

3,058 |

|

|

Note receivable, current portion

|

|

|

340 |

|

|

|

340 |

|

|

Other current assets

|

|

|

1,238 |

|

|

|

1,270 |

|

|

Total current assets

|

|

|

23,217 |

|

|

|

25,336 |

|

|

Long-term assets

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

12,693 |

|

|

|

13,188 |

|

|

Right-of-use operating lease assets, net

|

|

|

9,283 |

|

|

|

9,584 |

|

|

Right-of-use financing lease assets, net

|

|

|

2,494 |

|

|

|

1,989 |

|

|

Goodwill

|

|

|

24,313 |

|

|

|

20,593 |

|

|

Intangible assets, net

|

|

|

25,830 |

|

|

|

17,239 |

|

|

Note receivable, long-term

|

|

|

227 |

|

|

|

482 |

|

|

Deposits

|

|

|

3,138 |

|

|

|

3,740 |

|

|

Total long-term assets

|

|

|

77,978 |

|

|

|

66,815 |

|

|

Total assets

|

|

$ |

101,195 |

|

|

$ |

92,151 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

|

5,773 |

|

|

|

5,139 |

|

|

Notes payable, current portion

|

|

|

1,000 |

|

|

|

1,000 |

|

|

Loan payable, current portion

|

|

|

78 |

|

|

|

75 |

|

|

Prepaid Advance liability, at fair value

|

|

|

11,621 |

|

|

|

- |

|

|

Lease liability operating, short-term

|

|

|

1,914 |

|

|

|

1,261 |

|

|

Lease liability financing, short-term

|

|

|

855 |

|

|

|

547 |

|

|

Contract liabilities

|

|

|

3,200 |

|

|

|

3,604 |

|

|

Liability for ATD Holdback Shares, at fair value

|

|

|

698 |

|

|

|

- |

|

|

Other current liabilities

|

|

|

5,467 |

|

|

|

5,610 |

|

|

Total current liabilities

|

|

|

30,606 |

|

|

|

17,236 |

|

|

Long-term Liabilities

|

|

|

|

|

|

|

|

|

|

Notes payable, long-term

|

|

|

- |

|

|

|

1,000 |

|

|

2023 Promissory Notes, net of debt discount of $0 and $1,012, respectively

|

|

|

- |

|

|

|

2,988 |

|

|

2023 Promissory Notes - related party, net of debt discount of $0 and $2,149, respectively

|

|

|

- |

|

|

|

6,351 |

|

|

Series A Prime Revenue Sharing Notes, net of debt discount of $296 and $447, respectively

|

|

|

9,704 |

|

|

|

9,553 |

|

|

Series A Prime Revenue Sharing Notes - related party, net of debt discount of $148 and $223, respectively

|

|

|

4,852 |

|

|

|

4,777 |

|

|

Loan payable, long-term

|

|

|

214 |

|

|

|

273 |

|

|

Lease liability operating, long-term

|

|

|

12,486 |

|

|

|

13,445 |

|

|

Lease liability financing, long-term

|

|

|

1,151 |

|

|

|

1,057 |

|

|

Contract liabilities, long-term

|

|

|

1,196 |

|

|

|

1,449 |

|

|

Deferred tax liability

|

|

|

65 |

|

|

|

65 |

|

|

Other non-current liabilities

|

|

|

587 |

|

|

|

587 |

|

|

Total long-term liabilities

|

|

|

30,255 |

|

|

|

41,545 |

|

|

Total liabilities

|

|

|

60,861 |

|

|

|

58,781 |

|

|

Commitments and contingencies (Note 8)

|

|

|

|

|

|

|

|

|

|

Stockholders' equity

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.0001 par value, 2,000,000 authorized, 505,000 shares designated as Series A and 240,861 shares designated as Series B as of September 30, 2024 and December 31, 2023, respectively. No preferred stock was issued or outstanding as of September 30, 2024 or December 31, 2023, respectively.

|

|

|

- |

|

|

|

- |

|

|

Common stock, $0.0001 par value; 300,000,000 authorized shares; 91,114,540 and 69,273,334 shares issued as of September 30, 2024 and December 31, 2023, respectively; 90,955,020 and 69,176,826 shares outstanding as of September 30, 2024 and December 31, 2023, respectively.

|

|

|

9 |

|

|

|

7 |

|

|

Treasury stock, 159,520 and 96,508 shares as of September 30, 2024 and December 31, 2023, respectively.

|

|

|

(711 |

) |

|

|

(522 |

) |

|

Additional paid-in capital

|

|

|

280,774 |

|

|

|

232,568 |

|

|

Accumulated deficit

|

|

|

(239,738 |

) |

|

|

(198,683 |

) |

|

Total stockholders’ equity

|

|

|

40,334 |

|

|

|

33,370 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

101,195 |

|

|

$ |

92,151 |

|

REKOR SYSTEMS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in thousands, except share data)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Revenue

|

|

$ |

10,546 |

|

|

$ |

9,119 |

|

|

$ |

32,751 |

|

|

$ |

23,867 |

|

|

Cost of revenue, excluding depreciation and amortization

|

|

|

5,903 |

|

|

|

4,320 |

|

|

|

16,964 |

|

|

|

11,319 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses

|

|

|

8,637 |

|

|

|

6,871 |

|

|

|

23,669 |

|

|

|

19,941 |

|

|

Selling and marketing expenses

|

|

|

1,721 |

|

|

|

1,498 |

|

|

|

6,156 |

|

|

|

5,441 |

|

|

Research and development expenses

|

|

|

4,740 |

|

|

|

4,270 |

|

|

|

14,732 |

|

|

|

14,011 |

|

|

Depreciation and amortization

|

|

|

2,399 |

|

|

|

1,963 |

|

|

|

7,075 |

|

|

|

5,925 |

|

|

Total operating expenses

|

|

|

17,497 |

|

|

|

14,602 |

|

|

|

51,632 |

|

|

|

45,318 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(12,854 |

) |

|

|

(9,803 |

) |

|

|

(35,845 |

) |

|

|

(32,770 |

) |

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) gain on extinguishment of debt

|

|

|

- |

|

|

|

- |

|

|

|

(4,693 |

) |

|

|

527 |

|

|

Interest expense, net

|

|

|

(496 |

) |

|

|

(906 |

) |

|

|

(2,094 |

) |

|

|

(2,576 |

) |

|

Gain on remeasurement of ATD Holdback Shares

|

|

|

192 |

|

|

|

- |

|

|

|

937 |

|

|

|

- |

|

|

Loss on offering costs - Prepaid Advance

|

|

|

(888 |

) |

|

|

- |

|

|

|

(888 |

) |

|

|

- |

|

|

Gain on the sale of Global Public Safety

|

|

|

1,500 |

|

|

|

- |

|

|

|

1,500 |

|

|

|

- |

|

|

Other (expense) income

|

|

|

(100 |

) |

|

|

143 |

|

|

|

28 |

|

|

|

458 |

|

|

Total other income (expense)

|

|

|

208 |

|

|

|

(763 |

) |

|

|

(5,210 |

) |

|

|

(1,591 |

) |

|

Net loss

|

|

$ |

(12,646 |

) |

|

$ |

(10,566 |

) |

|

$ |

(41,055 |

) |

|

$ |

(34,361 |

) |

|

Loss per common share

|

|

$ |

(0.14 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.49 |

) |

|

$ |

(0.56 |

) |

|

Weighted average shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

89,285,197 |

|

|

|

66,671,622 |

|

|

|

84,397,568 |

|

|

|

61,125,035 |

|

v3.24.3

Document And Entity Information

|

Nov. 14, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

REKOR SYSTEMS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 14, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-38338

|

| Entity, Tax Identification Number |

81-5266334

|

| Entity, Address, Address Line One |

6721 Columbia Gateway Drive

|

| Entity, Address, Address Line Two |

Suite 400

|

| Entity, Address, City or Town |

Columbia

|

| Entity, Address, State or Province |

MD

|

| Entity, Address, Postal Zip Code |

21046

|

| City Area Code |

410

|

| Local Phone Number |

762-0800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

REKR

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001697851

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

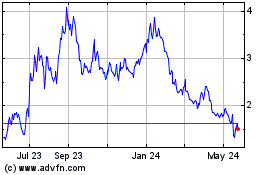

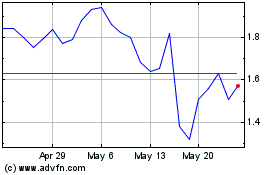

Rekor Systems (NASDAQ:REKR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rekor Systems (NASDAQ:REKR)

Historical Stock Chart

From Dec 2023 to Dec 2024