false

0000740664

0000740664

2024-06-13

2024-06-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): June 13, 2024

| |

R F INDUSTRIES, LTD.

|

|

| |

(Exact name of registrant as specified in its charter)

|

|

|

Nevada

(State or Other Jurisdiction

of Incorporation)

|

0-13301

(Commission File Number)

|

88-0168936

(I.R.S. Employer

Identification No.)

|

|

16868 Via Del Campo Court, Suite 200 San Diego, CA 92127

(Address of Principal Executive Offices, including Zip Code)

(858) 549-6340

(Registrant’s Telephone Number, Including Area Code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

| |

|

|

|

Common Stock, $0.01 par value per share

|

RFIL

|

NASDAQ Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On June 13, 2024, RF Industries, Ltd. (the “Company”) issued a press release announcing information regarding the Company’s financial results for the second quarter ended April 30, 2024. A copy of the press release is attached to this Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information furnished under this Item 2.02, including the accompanying Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall such information be deemed to be incorporated by reference in any subsequent filing by the Company under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, regardless of the general incorporation language of such filing, except as specifically stated in such filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

(d) Exhibits.

|

|

|

| |

|

|

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Date File (embedded within the Inline XBRL document).

|

| |

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

RF INDUSTRIES, LTD.

|

| |

|

|

June 13, 2024

|

By:/s/ Peter Yin

Peter Yin

Chief Financial Officer

|

Exhibit 99.1

RF Industries Reports Second Quarter Fiscal Year 2024 Financial Results

SAN DIEGO, CA, June 13, 2024 – RF Industries, Ltd, (NASDAQ: RFIL), a national manufacturer and marketer of interconnect products and systems, today announced second quarter fiscal year 2024 financial results for the quarter ended April 30, 2024.

Second Quarter Fiscal Year 2024 Highlights and Operating Results:

| |

●

|

Net sales were $16.1 million; up 19.7% from $13.5 million in the first quarter of fiscal 2024 and down from $22.3 million in the prior-year second quarter.

|

| |

●

|

Backlog of $18.0 million at the end of the second quarter on bookings of $17.9 million. As of today, the backlog stands at $20.0 million.

|

| |

●

|

Gross profit margin was 29.9%, an improvement from 24.5% in the first quarter of fiscal 2024, and up from 27.4% year-over-year.

|

| |

●

|

Operating loss was $415,000, an improvement from a loss of $2.1 million in the first quarter of 2024 and down from income of $489,000 year-over-year.

|

| |

●

|

Due to the recording of a non-cash valuation allowance on our deferred tax balance during the current fiscal quarter, consolidated net loss was $4.3 million or $0.41 per diluted share, a sequential decline from a loss of $1.4 million or $0.13 per diluted share in the first quarter of fiscal 2024 and down from income of $581,000 or $0.06 per diluted share year-over-year.

|

| |

●

|

Excluding the non-cash income tax provision adjustment, non-GAAP net income was $132,000 or $0.01 per diluted share, an improvement from a non-GAAP net loss of $1.4 million or $0.14 per diluted share in the first quarter of fiscal 2024 and down from non-GAAP net income of $1.2 million or $0.11 per share year-over-year.

|

| |

●

|

Adjusted EBITDA was $572,000, up from an Adjusted EBITDA loss of $1.1 million in the first quarter of fiscal 2024 and down from Adjusted EBITDA of $1.4 million year-over-year.

|

| |

|

|

| |

See "Note Regarding Use of Non-GAAP Financial Measures," "Unaudited Reconciliation of GAAP to non-GAAP Net Income (Loss)" and "Unaudited Reconciliation of Net (Loss) Income to Adjusted EBITDA" below for additional information. |

Management Commentary

“In the second quarter, we saw sequential improvement across the board in our business. Net sales were up 19.7%, gross profit margin improved 540 basis points to 29.9%, and Adjusted EBITDA returned to positive territory. This is the strongest indication yet that our business is trending in the right direction after a very challenging 2023 marked by significant reductions in telecom capex spending. This quarter, we recorded a non-cash valuation allowance on our deferred tax asset that resulted in a significant tax provision driving the GAAP net loss. This accounting adjustment is unrelated to our operations and should not take away from the significant recovery and improvement we saw in all areas of our business,” said Robert Dawson, Chief Executive Officer of RF Industries.

“Furthermore, we have expanded our product offering both organically and through acquisitions and are now in a better position to benefit from heightened activity in the telecom industry. We are seeing increased demand for our higher-value products like our Direct-Air Cooling solutions and integrated small cell solutions. In May, we received several large orders totaling approximately $4 million across multiple product areas including a $2 million win for small cell solutions from one key customer in the Tier 1 wireless carrier ecosystem. With these orders, we saw a material increase to our backlog from the end of the fiscal first quarter of 2024. With the progress our team has made in streamlining operations, we have greatly reduced our cost structure. We have significant operating leverage in our business model that can drive stronger gross margins. Our ongoing focus on operational and cost efficiencies, as well as a shift to higher value products, can have meaningful impact on profitability as sales recover.”

“Looking ahead, we are optimistic these demand trends will continue. I remain confident that we have the right business model, the right products, and the right team to capitalize on improving momentum and to deliver increased shareholder value,” concluded Dawson.

Conference Call and Webcast

RF Industries will host a conference call and live webcast today, June 13, 2024, at 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time) to discuss its fiscal 2024 second quarter results. To access the live call, dial 888-506-0062 (US and Canada) or 973-528-0011 (International) and give the participant access code 804483.

A live and archived webcast of the conference call will be accessible on the investor relations section of the Company's website at www.rfindustries.com.

About RF Industries

RF Industries designs and manufactures a broad range of interconnect products across diversified, growing markets, including wireless/wireline telecom, data communications and industrial. The Company's products include high-performance components used in commercial applications such as RF connectors and adapters, RF passives including dividers, directional couplers and filters, coaxial cables, data cables, wire harnesses, fiber optic cables, custom cabling, energy-efficient cooling systems and integrated small cell enclosures. The Company is headquartered in San Diego, California with additional operations in New York, Connecticut, Rhode Island and New Jersey. Please visit the RF Industries website at www.rfindustries.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to future events. Forward looking statements include, among others, statements concerning our expectations about profitability, revenues, industry trends, markets, increasing shareholder value, current and future purchase orders, and the expected benefits and desirability of our products, in each case which are subject to a number of factors that could cause actual results to differ materially. Factors that could cause or contribute to such differences include, but are not limited to: the Company’s cash and liquidity needs, ability to continue as a going concern, non-compliance with terms and covenants in our credit facility, changes in the telecommunications industry and materialization and timing of expected network buildouts; timing and breadth of new products; our ability to realize increased sales; successfully integrating new products and teams; our ability to execute on its go-to-market strategies and channel models; our reliance on certain distributors and customers for a significant portion of anticipated revenues; the impact of existing and additional future tariffs imposed by U.S. and foreign nations; our ability to expand our OEM relationships; our ability to continue to deliver newly designed and custom fiber optic and cabling products to principal customers; our ability to maintain strong margins and diversify our customer base; our ability to initiate operating efficiencies, cost savings and expense reductions; our ability to address the changing needs of the market and capitalize on new market opportunities; our ability to add value to our customer’s needs; the success of any product launches; and our ability to increase revenue, gross margins or obtain profitability in a timely manner. Further discussion of these and other potential risks and uncertainties may be found in the Company's public filings with the Securities and Exchange Commission (www.sec.gov) including our Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. All forward-looking statements are based upon information available to the Company on the date they are published, and we undertake no obligation to publicly update or revise any forward-looking statements to reflect events or new information after the date of this release.

Note Regarding Use of Non-GAAP Financial Measures

To supplement our unaudited condensed financial statements presented in accordance with U.S. generally accepted accounting principles (GAAP), this earnings release and the accompanying tables and the related earnings conference call contain certain non-GAAP financial measures, including adjusted earnings before interest, taxes, depreciation, amortization (Adjusted EBITDA), non-GAAP net income, non-GAAP net loss and non-GAAP earnings per share, basic and diluted (non-GAAP EPS).

We believe these financial measures provide useful information to investors with which to analyze our operating trends and performance by excluding certain non-cash and other one-time expenses that we believe are not indicative of our operating results.

In computing Adjusted EBITDA, non-GAAP net income, non-GAAP net loss and non-GAAP EPS, we exclude stock-based compensation expense, which represents non-cash charges for the fair value of stock options and other non-cash awards granted to employees, non-cash and other lease charges, and severance. For Adjusted EBITDA, we also exclude depreciation, amortization, interest expense and provision for income taxes. Because of varying available valuation methodologies, subjective assumptions, and the variety of equity instruments that can impact a company's non-cash operating expenses, we believe that providing non-GAAP financial measures that exclude non-cash expense and non-recurring costs and expenses allows for meaningful comparisons between our core business operating results and those of other companies, as well as providing us with an important tool for financial and operational decision-making and for evaluating our own core business operating results over different periods of time.

Our Adjusted EBITDA, non-GAAP net income, non-GAAP net loss and non-GAAP EPS measures may not provide information that is directly comparable to that provided by other companies in our industry, as other companies in our industry may calculate non-GAAP financial results differently, particularly related to non-recurring, unusual items. Our Adjusted EBITDA, non-GAAP net income, non-GAAP net loss and non-GAAP EPS are not measurements of financial performance under GAAP and should not be considered as an alternative to operating or net income or as an indication of operating performance or any other measure of performance derived in accordance with GAAP. We do not consider these non-GAAP measures to be a substitute for, or superior to, the information provided by GAAP financial results. Non-GAAP financial measures are subject to limitations and should be read only in conjunction with the Company’s consolidated financial statements pre-pared in accordance with GAAP. We believe that these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our GAAP results of operations. We compensate for the limitations of non-GAAP financial measures by relying upon GAAP results to gain a complete picture of our performance. A reconciliation of specific adjustments to GAAP results is provided in the last two tables at the end of this press release.

RF Industries Contact:

Peter Yin

SVP and CFO

(858) 549-6340

rfi@rfindustries.com

IR Contact:

Margaret Boyce

Financial Profiles, Inc.

(310) 622-8247

RFIL@finprofiles.com

# # #

RF INDUSTRIES, LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts)

| |

|

Apr. 30,

|

|

|

Oct. 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

ASSETS

|

|

(unaudited)

|

|

|

(audited)

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

1,400 |

|

|

$ |

4,897 |

|

|

Trade accounts receivable, net

|

|

|

10,552 |

|

|

|

10,277 |

|

|

Inventories

|

|

|

16,379 |

|

|

|

18,730 |

|

|

Other current assets

|

|

|

1,894 |

|

|

|

2,136 |

|

|

TOTAL CURRENT ASSETS

|

|

|

30,225 |

|

|

|

36,040 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

4,814 |

|

|

|

4,924 |

|

|

Operating right of use asset, net

|

|

|

14,999 |

|

|

|

15,689 |

|

|

Goodwill

|

|

|

8,085 |

|

|

|

8,085 |

|

|

Amortizable intangible assets, net

|

|

|

12,751 |

|

|

|

13,595 |

|

|

Non-amortizable intangible assets

|

|

|

1,174 |

|

|

|

1,174 |

|

|

Deferred tax assets

|

|

|

- |

|

|

|

2,494 |

|

|

Other assets

|

|

|

775 |

|

|

|

277 |

|

|

TOTAL ASSETS

|

|

$ |

72,823 |

|

|

$ |

82,278 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$ |

7,373 |

|

|

$ |

7,773 |

|

|

Line of Credit

|

|

|

10,460 |

|

|

|

1,000 |

|

|

Current portion of Term Loan

|

|

|

- |

|

|

|

2,424 |

|

|

Current portion of operating lease liabilities

|

|

|

1,424 |

|

|

|

1,314 |

|

|

TOTAL CURRENT LIABILITIES

|

|

|

19,257 |

|

|

|

12,511 |

|

| |

|

|

|

|

|

|

|

|

|

Operating lease liabilities

|

|

|

18,775 |

|

|

|

19,284 |

|

|

Deferred tax liabilities

|

|

|

182 |

|

|

|

- |

|

|

Term Loan, net of debt issuance cost

|

|

|

- |

|

|

|

10,721 |

|

|

TOTAL LIABILITIES

|

|

|

38,214 |

|

|

|

42,516 |

|

| |

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Common stock, authorized 20,000,000 shares of $0.01 par value; 10,495,548 and 10,343,223 shares issued and outstanding at April 30, 2024 and October 31, 2023, respectively

|

|

|

105 |

|

|

|

104 |

|

|

Additional paid-in capital

|

|

|

26,589 |

|

|

|

26,087 |

|

|

Retained earnings

|

|

|

7,915 |

|

|

|

13,571 |

|

|

TOTAL STOCKHOLDERS' EQUITY

|

|

|

34,609 |

|

|

|

39,762 |

|

| |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

$ |

72,823 |

|

|

$ |

82,278 |

|

RF INDUSTRIES, LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share amounts)

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

April 30,

|

|

|

April 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

16,110 |

|

|

$ |

22,298 |

|

|

$ |

29,568 |

|

|

$ |

40,642 |

|

|

Cost of sales

|

|

|

11,286 |

|

|

|

16,178 |

|

|

|

21,441 |

|

|

|

29,435 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

4,824 |

|

|

|

6,120 |

|

|

|

8,127 |

|

|

|

11,207 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Engineering

|

|

|

637 |

|

|

|

882 |

|

|

|

1,405 |

|

|

|

1,845 |

|

|

Selling and general

|

|

|

4,602 |

|

|

|

4,749 |

|

|

|

9,221 |

|

|

|

10,042 |

|

|

Total operating expenses

|

|

|

5,239 |

|

|

|

5,631 |

|

|

|

10,626 |

|

|

|

11,887 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) income

|

|

|

(415 |

) |

|

|

489 |

|

|

|

(2,499 |

) |

|

|

(680 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expense

|

|

|

(230 |

) |

|

|

(72 |

) |

|

|

(339 |

) |

|

|

(225 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income before benefit for income taxes

|

|

|

(645 |

) |

|

|

417 |

|

|

|

(2,838 |

) |

|

|

(905 |

) |

|

Provision (benefit) from income taxes

|

|

|

3,649 |

|

|

|

(164 |

) |

|

|

2,818 |

|

|

|

(324 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated net (loss) income

|

|

$ |

(4,294 |

) |

|

$ |

581 |

|

|

$ |

(5,656 |

) |

|

$ |

(581 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) earnings per share - Basic

|

|

$ |

(0.41 |

) |

|

$ |

0.06 |

|

|

$ |

(0.54 |

) |

|

$ |

(0.06 |

) |

|

(Loss) earnings per share - Diluted

|

|

$ |

(0.41 |

) |

|

$ |

0.06 |

|

|

$ |

(0.54 |

) |

|

$ |

(0.06 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

10,495,548 |

|

|

|

10,290,911 |

|

|

|

10,452,597 |

|

|

|

10,256,158 |

|

|

Diluted

|

|

|

10,495,548 |

|

|

|

10,327,271 |

|

|

|

10,452,597 |

|

|

|

10,256,158 |

|

RF INDUSTRIES, LTD. AND SUBSIDIARIES

Unaudited Reconciliation of GAAP to Non-GAAP Net Income (Loss)

(In thousands, except share and per share amounts)

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

April 30,

|

|

|

April 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Consolidated net (loss) income

|

|

$ |

(4,294 |

) |

|

$ |

581 |

|

|

$ |

(5,656 |

) |

|

$ |

(581 |

) |

|

Provision (benefit) from income taxes

|

|

|

3,649 |

|

|

|

(164 |

) |

|

|

2,818 |

|

|

|

(324 |

) |

|

Stock-based compensation expense

|

|

|

248 |

|

|

|

230 |

|

|

|

503 |

|

|

|

441 |

|

|

Non-cash and other one-time charges

|

|

|

50 |

|

|

|

89 |

|

|

|

145 |

|

|

|

533 |

|

|

Severance

|

|

|

56 |

|

|

|

- |

|

|

|

56 |

|

|

|

50 |

|

|

Amortization expense

|

|

|

423 |

|

|

|

426 |

|

|

|

845 |

|

|

|

857 |

|

|

Non-GAAP net income (loss)

|

|

$ |

132 |

|

|

$ |

1,162 |

|

|

$ |

(1,289 |

) |

|

$ |

976 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP earnings (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.01 |

|

|

$ |

0.11 |

|

|

$ |

(0.12 |

) |

|

$ |

0.10 |

|

|

Diluted

|

|

$ |

0.01 |

|

|

$ |

0.11 |

|

|

$ |

(0.12 |

) |

|

$ |

0.09 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

10,495,548 |

|

|

|

10,290,911 |

|

|

|

10,452,597 |

|

|

|

10,256,158 |

|

|

Diluted

|

|

|

10,495,548 |

|

|

|

10,327,271 |

|

|

|

10,452,597 |

|

|

|

10,307,036 |

|

RF INDUSTRIES, LTD. AND SUBSIDIARIES

Unaudited Reconciliation of Net (Loss) Income to Adjusted EBITDA

(In thousands)

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

April 30,

|

|

|

April 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Consolidated net (loss) income

|

|

$ |

(4,294 |

) |

|

$ |

581 |

|

|

$ |

(5,656 |

) |

|

$ |

(581 |

) |

|

Stock-based compensation expense

|

|

|

248 |

|

|

|

230 |

|

|

|

503 |

|

|

|

441 |

|

|

Non-cash and other one-time charges

|

|

|

50 |

|

|

|

89 |

|

|

|

145 |

|

|

|

533 |

|

|

Severance

|

|

|

56 |

|

|

|

- |

|

|

|

56 |

|

|

|

50 |

|

|

Amortization expense

|

|

|

423 |

|

|

|

426 |

|

|

|

845 |

|

|

|

857 |

|

|

Depreciation expense

|

|

|

210 |

|

|

|

197 |

|

|

|

421 |

|

|

|

308 |

|

|

Other expense

|

|

|

230 |

|

|

|

72 |

|

|

|

339 |

|

|

|

225 |

|

|

Provision (benefit) from income taxes

|

|

|

3,649 |

|

|

|

(164 |

) |

|

|

2,818 |

|

|

|

(324 |

) |

|

Adjusted EBITDA

|

|

$ |

572 |

|

|

$ |

1,431 |

|

|

$ |

(529 |

) |

|

$ |

1,509 |

|

v3.24.1.1.u2

Document And Entity Information

|

Jun. 13, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

R F INDUSTRIES, LTD.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jun. 13, 2024

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, File Number |

0-13301

|

| Entity, Tax Identification Number |

88-0168936

|

| Entity, Address, Address Line One |

16868 Via Del Campo Court, Suite 200

|

| Entity, Address, City or Town |

San Diego

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

92127

|

| City Area Code |

858

|

| Local Phone Number |

549-6340

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

RFIL

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000740664

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

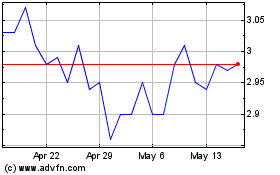

RF Industries (NASDAQ:RFIL)

Historical Stock Chart

From May 2024 to Jun 2024

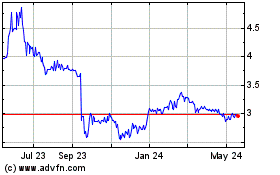

RF Industries (NASDAQ:RFIL)

Historical Stock Chart

From Jun 2023 to Jun 2024