Royalty Pharma plc (Nasdaq: RPRX) announced today that it has

priced an offering of $1.5 billion of senior unsecured notes,

comprised of the following (collectively, the “Notes”):

- $500 million of 5.150% Notes due

2029 (the “2029 Notes”);

- $500 million of 5.400% Notes due

2034 (the “2034 Notes”); and

- $500 million of 5.900% Notes due

2054 (the “2054 Notes”).

The Notes will be guaranteed on a senior

unsecured basis by Royalty Pharma Holdings Ltd. The offering is

expected to close on June 10, 2024, subject to the satisfaction of

customary closing conditions.

Royalty Pharma intends to use the net proceeds from the Notes

for general corporate purposes.

BofA Securities, Citigroup, J.P. Morgan, Morgan

Stanley and TD Securities are acting as joint lead book-running

managers and as representatives of the underwriters for the

offering. DNB Markets, SMBC Nikko, SOCIETE GENERALE, US Bancorp,

Academy Securities, AmeriVet Securities, Blaylock Van, LLC, Cabrera

Capital Markets LLC, Drexel Hamilton, R. Seelaus & Co., LLC,

Ramirez & Co., Inc., Siebert Williams Bank and Tigress

Financial Partners are acting as co-managers for the offering.

The Notes are being offered pursuant to an

effective shelf registration statement that the Company filed with

the Securities and Exchange Commission (the “SEC”). The offering is

being made only by means of a preliminary prospectus supplement and

accompanying prospectus. A preliminary prospectus supplement and

accompanying prospectus relating to the offering have been filed

with the SEC and are available free of charge on the SEC’s website

at http://www.sec.gov. The final prospectus supplement and

accompanying prospectus relating to the offering will be filed with

the SEC and may also be obtained, when available, by contacting:

BofA Securities, Inc., NC1-022-02-25, 201 North Tryon Street,

Charlotte, NC, 28255-0001, Attention: Prospectus Department, Email:

dg.prospectus_requests@bofa.com; Citigroup Global Markets Inc., c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

New York 11717 (Tel: 800-831-9146) or by e-mail at

prospectus@citi.com; J.P. Morgan Securities LLC, Attention:

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

New York 11717, by email at prospectus-eq_fi@jpmchase.com; Morgan

Stanley & Co. LLC, Attention: Prospectus Department, 180 Varick

Street, Second Floor, New York, New York 10014, by telephone at

1-866-718-1649 or by e-mail at prospectus@morganstanley.com; or TD

Securities (USA) LLC, 1 Vanderbilt Avenue, New York, New York

10017, by telephone at (855) 495-9846.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy any of the Notes,

nor will there be any sale of these Notes in any jurisdiction in

which such offer, solicitation or sale would be unlawful.

About Royalty Pharma

Founded in 1996, Royalty Pharma is the largest

buyer of biopharmaceutical royalties and a leading funder of

innovation across the biopharmaceutical industry, collaborating

with innovators from academic institutions, research hospitals and

non-profits through small and mid-cap biotechnology companies to

leading global pharmaceutical companies. Royalty Pharma has

assembled a portfolio of royalties which entitles it to payments

based directly on the top-line sales of many of the industry’s

leading therapies. Royalty Pharma funds innovation in the

biopharmaceutical industry both directly and indirectly -directly

when it partners with companies to co-fund late-stage clinical

trials and new product launches in exchange for future royalties,

and indirectly when it acquires existing royalties from the

original innovators. Royalty Pharma’s current portfolio includes

royalties on more than 35 commercial products, including Vertex’s

Trikafta, GSK’s Trelegy, Roche’s Evrysdi, Johnson & Johnson’s

Tremfya, Biogen’s Tysabri and Spinraza, AbbVie and Johnson &

Johnson’s Imbruvica, Astellas and Pfizer’s Xtandi, Novartis’

Promacta, Pfizer’s Nurtec ODT and Gilead’s Trodelvy, and 17

development-stage product candidates.

Forward-Looking Statements

This press release contains statements that

constitute “forward-looking statements” as that term is defined in

the United States Private Securities Litigation Reform Act of 1995,

including statements regarding the receipt and use of the net

proceeds from the offering of the Notes, and statements that

express the company’s opinions, expectations, beliefs, plans,

objectives, assumptions or projections regarding future events or

future results, in contrast with statements that reflect historical

facts. Examples include discussion of our strategies, financing

plans, growth opportunities and market growth. In some cases, you

can identify such forward-looking statements by terminology such as

“anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,”

“project,” “expect,” “may,” “will,” “would,” “could” or “should,”

the negative of these terms or similar expressions. Forward-looking

statements are based on management’s current beliefs and

assumptions and on information currently available to the company.

However, these forward-looking statements are not a guarantee of

our performance, and you should not place undue reliance on such

statements. Forward-looking statements are subject to many risks,

uncertainties and other variable circumstances, and other factors.

Such risks and uncertainties may cause the statements to be

inaccurate and readers are cautioned not to place undue reliance on

such statements. Many of these risks are outside of the company’s

control and could cause its actual results to differ materially

from those it thought would occur. The forward-looking statements

included in this document are made only as of the date hereof. The

company does not undertake, and specifically declines, any

obligation to update any such statements or to publicly announce

the results of any revisions to any such statements to reflect

future events or developments, except as required by law.

Royalty Pharma Investor Relations and

Communications:+1 (212) 883-6637ir@royaltypharma.com

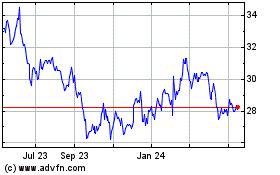

Royalty Pharma (NASDAQ:RPRX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Royalty Pharma (NASDAQ:RPRX)

Historical Stock Chart

From Jan 2024 to Jan 2025