0001069530 False 0001069530 2024-11-25 2024-11-25 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 25, 2024

_______________________________

Cassava Sciences, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 001-41905 | 91-1911336 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

6801 N Capital of Texas Highway, Building 1; Suite 300

Austin, Texas 78731

(Address of Principal Executive Offices) (Zip Code)

(512) 501-2444

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value | SAVA | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On November 25, 2024, Cassava Sciences, Inc. (the “Company”) issued a press release announcing that the topline results from the Phase 3 ReThink-ALZ study of simufilam in mild-to-moderate Alzheimer’s disease did not meet each of the pre-specified co-primary, secondary and exploratory biomarker endpoints. The press release also announced the Company’s decision to discontinue its Phase 3 ReFocus-ALZ study and its open label extension study.

The full text of this press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | Cassava Sciences, Inc. |

| | a Delaware corporation |

| | | |

| | | |

| Date: November 25, 2024 | By: | /s/ Eric J. Schoen |

| | | Eric J. Schoen |

| | | Chief Financial Officer |

| | | |

EXHIBIT 99.1

Cassava Sciences Topline Phase 3 Data Did Not Meet Co-Primary Endpoints

Simufilam did not show a significant reduction in cognitive or functional decline versus placebo in patients with mild-to-moderate Alzheimer’s disease in the ReThink-ALZ Phase 3 study

Simufilam continued to demonstrate an overall favorable safety profile

Cassava intends to present the data at an upcoming medical meeting

The Company will hold a webcast today, November 25, 2024, at 8:00 AM ET

AUSTIN, Texas, Nov. 25, 2024 (GLOBE NEWSWIRE) -- Cassava Sciences, Inc. (NASDAQ: SAVA, “Cassava”, the “Company”), a clinical-stage biotechnology company focused on developing a novel, investigational treatment for Alzheimer’s disease (AD) dementia, today announced that the topline results from the Phase 3 ReThink-ALZ study of simufilam in mild-to-moderate AD did not meet each of the pre-specified co-primary, secondary and exploratory biomarker endpoints. The co-primary endpoints were the change in cognition and function from baseline to the end of the double-blind treatment period at week 52, assessed by the ADAS-COG12 and ADCS-ADL scales, comparing simufilam to placebo. Simufilam continued to demonstrate an overall favorable safety profile. The Company will hold a webcast today at 8 AM ET.

“The results are disappointing for patients and their families who are living with this disease and physicians who have been looking for novel treatment options. We took careful measures to enroll patients with mild-to-moderate AD. Despite that, the loss of cognition in the placebo group was less pronounced than was previously reported in other placebo-controlled studies in AD. We are working to understand this better,” said Rick Barry, President and Chief Executive Officer. “A result like this has implications on our second Phase 3 trial, ReFocus-ALZ. We have made the difficult decision to discontinue ReFocus-ALZ, given the nature of today’s reported results. The complete 52-week dataset will be available from the study along with a large portion of 76-week data. We intend to report detailed analyses of both studies in the future. We will also be discontinuing the Open Label Extension study.”

Mr. Barry continued, “We have a special gratitude for the patients and their families and caregivers who participated in our clinical program for AD. We are also immensely grateful to our employees, study investigators and site coordinators, as well as our other partners, for their commitment to this program. We hope the information we have gathered can ultimately be used to benefit ongoing research in AD.”

The table below provides a high-level summary of the co-primary endpoints data. Topline analysis of the mild and moderate sub-groups, likewise, did not demonstrate statistical significance at week 52.

Co-Primary Endpoint

Data* | Simufilam 100 mg BID

N= 403 | Placebo BID

N=401 | Delta | P-value |

Co-Primary Endpoints

LS means change from baseline to the end of the double-blind treatment period |

| ADAS-COG12 (SE) | 2.8 ( 0.36) | 3.2 ( 0.36) | -0.39 ( 0.50) | P=0.43 |

| ADCS-ADL (SE) | -3.3 ( 0.44) | -3.8 ( 0.44) | 0.51 ( 0.61) | P=0.40 |

*Based on the intent-to-treat population

BID = twice daily

ADAS-COG12 = The Alzheimer’s Disease Assessment Scale – Cognitive Subscale (a lower number represents less cognitive impairment)

ADCS-ADL = Alzheimer’s Disease Cooperative Study – Activities of Daily Living (a higher number represents less functional impairment) |

The table below provides a high-level summary of the patient demographic and safety data. Simufilam continued to demonstrate an overall favorable safety profile.

| Metrics for Simufilam and Placebo | Simufilam 100 mg BID | Placebo BID |

| Baseline* |

| Age, mean (SD), in years | 73.7 7.9 | 74.3 7.6 |

| Sex, n (%) female | 225 (55.8%) | 222 (55.4%) |

| MMSE Score (No.%,) | | |

| 21-27 | 244 (60.5%) | 250 (62.3%) |

| 16-20 | 155 (38.5%) | 146 (36.4%) |

| Race/Ethnicity | | |

| White | 366 (90.8%) | 376 (93.8%) |

| Black | 20 (5.0%) | 18 (4.5%) |

| Asian | 8 (2.0%) | 2 (0.5%) |

| Other | 9 (2.2%) | 5 (1.0%) |

| Safety** |

| Any Adverse Event (AE) | 284 (71.2%) | 269 (67.6%) |

| Serious AEs | 52 (13.0%) | 36 (9.0%) |

| Death | 1 (0.3%) | 3 (0.8%) |

| AEs leading to discontinuation from the study | 26 (6.5%) | 17 (4.3%) |

| Most Frequent AEs | | |

| 1: COVID-19 | 32 (8.0%) | 36 (9.0%) |

| 2: Urinary Tract Infection | 31 (7.8%) | 29 (7.3%) |

| 3: Fall | 30 (7.5%) | 30 (7.5%) |

| 4: Dizziness | 21 (5.3%) | 1 (0.3%) |

| 5: Headache | 18 (4.5%) | 11 (2.8%) |

*Based on the intent-to-treat population

**Based on the safety population

BID = twice daily

AD = Alzheimer’s disease

MMSE = Mini-Mental State Examination |

Cassava will continue to review all of the data and evaluate next steps. We plan to share the detailed results at a future medical meeting.

Eric Schoen, Chief Financial Officer at Cassava commented, “We remain focused on the interests of Cassava shareholders and are committed to enhancing shareholder value. Cassava is well-capitalized with approximately $149.0 million in cash and cash equivalents as of the end of the third quarter of 2024.”

| Webcast Info |

| Date: | Monday, November 25th |

| Time: | 8:00 a.m. Eastern Time |

| Webcast: | https://lifescievents.com/event/cassava/ |

| | |

A webcast of the live call will be available in the investor relations section of the Cassava website. Access to the webcast replay will be available on the Company’s website approximately two hours after completion of the call for approximately 90 days.

About Re-THINK-ALZ

ReThink-ALZ (NCT04994483) is a Phase 3 trial designed to evaluate the safety and efficacy of simufilam compared to a placebo in a multi-center, double-blinded, placebo-controlled, randomized parallel group study involving over 75 clinical trial sites in the U.S., Canada and Australia. The trial randomized 804 people with confirmed mild or moderate AD, defined by several well validated parameters including a mini-mental state examination (MMSE) of >16 and <27, stratified as mild or moderate. Subjects were randomized 1:1 to receive simufilam 100 mg (n=403) or a matched placebo (n=401), dosed orally twice daily (BID) for 52 weeks.

The co-primary endpoints were the change in cognition and function from baseline to the end of the double-blind treatment period at week 52, assessed by the ADAS-COG12 and ADCS-ADL scales, comparing simufilam to placebo. Secondary endpoints also included several well validated measures of neuropsychiatric symptoms and caregiver burden. Safety was evaluated through multiple measures, including adverse event monitoring. The study also included a pharmacokinetic and plasma biomarker sub-study comprised of approximately 100 subjects, evaluated at three timepoints. ReThink-ALZ was conducted under a Special Protocol Assessment (SPA) with the U.S. Food and Drug Administration (FDA).

About Simufilam

Simufilam is a proprietary, investigational oral small molecule that targets the filamin A protein.

About Cassava Sciences, Inc.

Cassava Sciences is a clinical-stage biotechnology company based in Austin, Texas. Our mission is to detect and treat neurodegenerative diseases, such as Alzheimer’s disease.

Simufilam, an investigational oral, small molecule drug candidate that targets the filamin A protein, is under evaluation for the potential treatment of Alzheimer's disease. Cassava Sciences owns exclusive, worldwide rights to its investigational product candidates and related technologies, without royalty obligations to any third party.

For more information, please visit: https://www.CassavaSciences.com

For More Information Contact:

Investors

Sandya von der Weid

svonderweid@lifesciadvisors.com

Media

media@cassavasciences.com

Company

Eric Schoen, Chief Financial Officer

(512) 501-2450

ESchoen@CassavaSciences.com

ir@cassavasciences.com

Cautionary Note Regarding Forward-Looking Statements:

This news release contains forward-looking statements that include but are not limited to statements regarding: the completion and future results of our Phase 3 clinical studies of simufilam in patients with Alzheimer's disease; the planned discontinuation of the ReFocus-ALZ and open-label extension studies; our intent to share detailed study results at a future medical meeting; the timing of anticipated milestones; and the potential for simufilam to be approved as a treatment for Alzheimer’s disease. These statements may be identified by words such as “anticipate”, “before,” “believe”, “could”, “expect”, “forecast”, “intend”, “may”, “pending,” “plan”, “possible”, “potential”, “prepares for,” “will”, and other words and terms of similar meaning.

Such statements are based on our current expectations and projections about future events. Such statements speak only as of the date of this news release and are subject to a number of risks, uncertainties and assumptions, including, but not limited to, those risks relating to the ability to conduct or complete clinical studies on expected timelines; the ability to demonstrate the specificity, safety, efficacy or potential health benefits of simufilam; our current expectations regarding timing of clinical data for our Phase 3 studies; and other risks inherent in drug discovery and development or specific to Cassava Sciences, Inc., as described in the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the period ended September 30, 2024, and future reports to be filed with the SEC. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from expectations in any forward-looking statement. In light of these risks, uncertainties and assumptions, the forward-looking statements and events discussed in this news release are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Except as required by law, we disclaim any intention or responsibility for updating or revising any forward-looking statements. For further information regarding these and other risks related to our business, investors should consult our filings with the SEC, which are available on the SEC's website at www.sec.gov.

All of our pharmaceutical assets under development are investigational product candidates. These have not been approved for use in any medical indication by any regulatory authority in any jurisdiction and their safety, efficacy or other desirable attributes, if any, have not been established in any patient population. Consequently, none of our product candidates is approved or available for sale anywhere in the world.

v3.24.3

Cover

|

Nov. 25, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 25, 2024

|

| Entity File Number |

001-41905

|

| Entity Registrant Name |

Cassava Sciences, Inc.

|

| Entity Central Index Key |

0001069530

|

| Entity Tax Identification Number |

91-1911336

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

6801 N Capital of Texas Highway, Building 1; Suite 300

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78731

|

| City Area Code |

512

|

| Local Phone Number |

501-2444

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

SAVA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

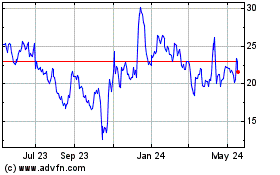

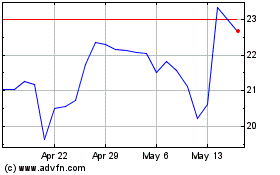

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

From Nov 2023 to Nov 2024