Sinclair Completes Liquidity Enhancing Transactions

February 12 2025 - 3:05PM

Business Wire

Sinclair, Inc. (Nasdaq: SBGI), the "Company" or "Sinclair,"

today announced that Sinclair Television Group, Inc. (“STG”) and

certain affiliated entities have completed a series of previously

announced transactions (the “Transactions”), which strengthen the

Company’s balance sheet and better position it for long-term

growth.

“The Transactions demonstrate the strong support from our

creditors in positioning the Company for long-term success by

enhancing our financial liquidity and flexibility” said Chris

Ripley, Sinclair’s President and Chief Executive Officer. “The

refinancings push our closest meaningful maturity to December 2029

and extend all of our maturities to a weighted average of 6.6

years, while materially reducing our first lien net leverage and

improving our financial optionality, allowing us to continue to be

opportunistic in the marketplace to deleverage over time while

driving enhanced returns for all of the Company’s

stakeholders.”

The Transactions included the following:

- First-Out First Lien Notes. STG completed a private placement

of $1,430.0 million of STG’s 8.125% First-Out First Lien Secured

Notes due 2033. The net proceeds from the offering were, or will

be, used to repay all of the outstanding $1,175 million of

aggregate principal amount term loans B-2 under the Company’s

previously existing credit agreement (the “Existing Credit

Agreement”), to consummate the AHG Notes Repurchase (as defined

below), and to pay related fees and expenses related to the

Transactions.

- First-Out First Lien Revolving Credit Facility. STG entered

into an up to $575.0 million aggregate principal amount first-out

first lien revolving credit facility, including a letter of credit

sub-facility and a swing-line sub-facility (the “First-Out

Revolving Credit Facility”) pursuant to the terms of a new credit

agreement (the “New Credit Agreement”). Lenders of $75.0 million

aggregate principal amount of revolving loans and commitments

outstanding under the Existing Credit Agreement (the “Existing

Revolving Credit Facility”) did not participate in or consent to

the exchange into obligations under the First-Out Revolving Credit

Facility. As a result, such obligations are ranked as third lien

obligations under the Existing Credit Agreement, as amended to

eliminate substantially all covenants, certain of the events of

default and related definitions contained therein (the “Amended

Credit Agreement”).

- Second-Out Term Loan Facility. Lenders of approximately $711.4

million and $731.3 million aggregate principal amount of

outstanding term loans B-3 and B-4, respectively, under the

Existing Credit Agreement elected to refinance and/or exchange such

term loans into second-out first lien term loans under the New

Credit Agreement (the “Second-Out Term Loan Facility”), consisting

of (x) approximately $711.4 million aggregate principal amount term

loans B-6 maturing December 31, 2029 offered to lenders of the

outstanding term loans B-3 and (y) approximately $731.3 million

aggregate principal amount term loans B-7 maturing December 31,

2030 offered to lenders of the outstanding term loans B-4. The

remaining approximately $2.7 million of term loans B-3 held by

lenders that did not participate in or consent to the exchange into

Second-Out Term Loan Facility are ranked as third lien obligations

under the Amended Credit Agreement.

- Exchange Offer and Consent Solicitation. Holders of

approximately $267.2 million aggregate principal amount of STG’s

4.125% Senior Secured Notes due 2030 (the “Existing Secured Notes”)

exchanged such Existing Secured Notes for approximately $267.2

million aggregate principal amount of STG’s 4.375% Second-Out First

Lien Secured Notes due 2032 (the “Exchange Second-Out Notes”) as of

the early tender time under an exchange offer and related consent

solicitation (the “Exchange Offer”). Holders of Existing Secured

Notes who do not tender prior to the expiration time of the

Exchange Offer will continue to hold Existing Secured Notes under

the indenture related thereto, subject to amendments to release all

collateral securing such Existing Secured Notes and eliminate

substantially all covenants, certain of the events of default and

related definitions. As amended, such Existing Secured Notes will

become unsecured obligations of STG.

- Private Debt Repurchase. STG agreed to repurchase or redeem for

cash approximately $63.6 million aggregate principal amount of

Existing Secured Notes at 84% of the principal amount thereof and

approximately $104.0 million aggregate principal amount of STG’s

5.125% Senior Unsecured Notes due 2027 at 97% of the principal

amount thereof (the “AHG Notes Repurchase”), each together with any

accrued and unpaid interest, held by certain parties to the

Company’s previously announced transaction support agreement (the

“Transaction Support Agreement”). Certain of these repurchases

occurred on the closing date of the Transactions. The repurchases

that remain are expected to occur as soon as practicable following

the closing date of the Transactions.

- Private Exchange Offer. STG agreed to issue to certain holders

of the Existing Secured Notes party to the Transaction Support

Agreement $432 million aggregate principal amount of STG’s 9.75%

Senior Secured Second Lien Notes due 2033 in exchange for $432

million aggregate principal amount of Existing Secured Notes, with

accrued and unpaid interest on the exchanged amount of Existing

Secured Notes paid in cash. The exchanges are expected to occur

over the next three weeks, as previously agreed with such

holders.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any offer or sale of securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of such

jurisdiction. This press release does not constitute a notice of

redemption with respect to any securities.

Pillsbury Winthrop Shaw Pittman LLP and Fried Frank Harris

Shriver & Jacobson LLP served as legal advisors to the Company

and STG, J.P. Morgan acted as exclusive capital markets advisor to

Sinclair in connection with structuring and negotiating the

Transactions, with Simpson Thacher & Bartlett LLP acting as its

counsel, and Moelis acted as co-financial advisor to Sinclair in

connection with the Transactions. Milbank LLP served as legal

advisor to an ad hoc group of certain of STG’s creditors, and

Perella Weinberg Partners LP served as financial advisor to an ad

hoc group of certain of STG’s creditors.

Forward-Looking

Statements:

The matters discussed in this news release include

forward-looking statements regarding, among other things, the

Transactions. When used in this news release, the words “outlook,”

“intends to,” “believes,” “anticipates,” “expects,” “achieves,”

“estimates,” and similar expressions are intended to identify

forward-looking statements. Such statements are subject to a number

of risks and uncertainties. Actual results in the future could

differ materially and adversely from those described in the

forward-looking statements as a result of various important

factors, including and in addition to the assumptions set forth

therein, but not limited to, the Company’s ability to achieve the

anticipated benefits from the Transactions; the rate of decline in

the number of subscribers to services provided by traditional and

virtual multi-channel video programming distributors

(“Distributors”); the Company’s ability to generate cash to service

its substantial indebtedness; the successful execution of

outsourcing agreements; the successful execution of retransmission

consent agreements; the successful execution of network and

Distributor affiliation agreements; the Company’s ability to

identify and consummate acquisitions and investments, to manage

increased financial leverage resulting from acquisitions and

investments, and to achieve anticipated returns on those

investments once consummated; the Company’s ability to compete for

viewers and advertisers; pricing and demand fluctuations in local

and national advertising; the appeal of the Company’s programming

and volatility in programming costs; material legal, financial and

reputational risks and operational disruptions resulting from a

breach of the Company’s information systems; the impact of FCC and

other regulatory proceedings against the Company; compliance with

laws and uncertainties associated with potential changes in the

regulatory environment affecting the Company’s business and growth

strategy; the impact of pending and future litigation claims

against the Company; the Company’s limited experience in operating

or investing in non-broadcast related businesses; and any risk

factors set forth in the Company’s recent reports on Form 10-Q

and/or Form 10-K, as filed with the Securities and Exchange

Commission. There can be no assurances that the assumptions and

other factors referred to in this release will occur. The Company

undertakes no obligation to publicly release the result of any

revisions to these forward-looking statements except as required by

law.

Category: Financial

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212013791/en/

Investor Contacts: Christopher C. King, VP, Investor Relations

Billie-Jo McIntire, VP, Corporate Finance (410) 568-1500

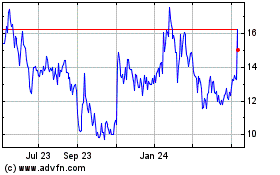

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Jan 2025 to Feb 2025

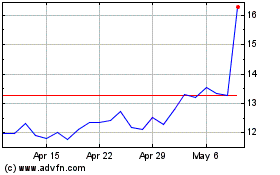

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Feb 2024 to Feb 2025