0000918965false--06-3000009189652024-05-012024-05-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 1, 2024

ScanSource, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| SC | | 00-26926 | | 57-0965380 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

6 Logue Court, Greenville, SC 29615

(Address of principal executive offices, including zip code)

864-288-2432

(Registrant’s telephone number, including area code)

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

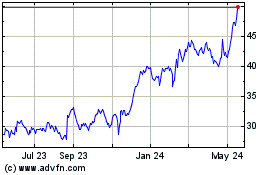

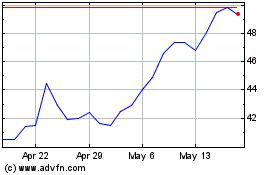

| Common Stock, no par value | | SCSC | | NASDAQ Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On May 7, 2024, ScanSource, Inc. (the "Company") issued a press release announcing its filed results for its third quarter ended March 31, 2024. A copy of the press release and accompanying Earnings Infographic are attached as Exhibits 99.1 and 99.2 hereto and incorporated herein by reference and also made available through the Company’s website at www.scansource.com. An updated investor presentation will be made available on the Company's website within approximately two weeks.

The information in Item 2.02 of this Report, including the Exhibits 99.1 and 99.2 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any other filing under the Securities Act of 1933 or the Exchange Act.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On May 1, 2024, the Company amended its Amended and Restated Bylaws (as amended, the “Bylaws”). The Bylaws were amended to update certain procedural requirements relating to director nominations by shareholders in light of the adoption and effectiveness of Rule 14a-19 promulgated under the Exchange Act.

The Bylaws provide, among other things, that (a) a shareholder who solicits proxies in support of director nominees must comply with Rule 14a-19, including but not limited to the minimum solicitation and notice requirements of Rule 14a-19; (b) if a shareholder provides notice pursuant to Rule 14a-19 with respect to a proposed nominee and subsequently fails to comply with requirements of Rule 14a-19, the Company will disregard the nomination of the proposed nominee; and (c) a shareholder directly or indirectly soliciting proxies from other shareholders must use a proxy card color other than white.

The foregoing summary description of the Bylaws is qualified in its entirety by reference to the Bylaws filed as Exhibit 3.1 hereto and incorporated herein by reference.

Item 8.01 Other Events.

On May 1, 2024, the Board determined that the Company’s Annual Meeting of Shareholders will take place at 9:00 a.m., local time, on Tuesday, December 10, 2024, at 6 Logue Court, Greenville, South Carolina 29615 (the “December 2024 Annual Meeting”). All other relevant information concerning the December 2024 Annual Meeting will be included in the Company’s proxy materials to be distributed in connection with the December 2024 Annual Meeting, which will be filed with the Securities and Exchange Commission (“SEC”) and made available to the Company’s shareholders at a later date.

Because the date of the December 2024 Annual Meeting is more than 30 days prior to the anniversary date of the Company’s Annual Meeting of Shareholders held on January 25, 2024, the Company is providing in this Current Report on Form 8-K the due dates for submissions of qualified shareholder proposals and shareholder director nominations.

To be eligible for inclusion in the proxy materials for the December 2024 Annual Meeting pursuant to Rule 14a-8 of the Exchange Act, shareholder proposals (including any additional information specified in the Bylaws) must be received by our Corporate Secretary at the Company’s principal executive offices no later than August 12, 2024.

A shareholder proposal or director nomination (including nominations pursuant to Rule 14a-19 under the Exchange Act) outside of Rule 14a-8 under the Exchange Act and pursuant to the Bylaws must be received by our Corporate Secretary at the Company’s principal executive offices by September 11, 2024.

Shareholder proposals and shareholder director nominations must comply with all applicable requirements set forth in the rules and regulations of the SEC, the Exchange Act, and the Bylaws. Any stockholder proposal for inclusion in the Company’s proxy materials, notice of proposed business to be brought before the December 2024 Annual Meeting or director nomination should be sent to the Corporate Secretary and the following address: ScanSource, Inc., 6 Logue Court, Greenville, South Carolina 29615, Attention: Shana C. Smith, Corporate Secretary.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

3.1 - Amended and Restated Bylaws.

99.1 – Press release issued by ScanSource, Inc. on May 7, 2024. The information contained in the attached exhibit is unaudited and should be read in conjunction with the Company’s annual and quarterly reports filed with the Securities and Exchange Commission.

99.2 – Earnings Infographic for the financial results conference call held on May 7, 2024. The information contained in the attached exhibit is unaudited and should be read in conjunction with the Company’s annual and quarterly reports filed with the Securities and Exchange Commission.

| | | | | |

Exhibit

Number | Description |

| |

| 3.1 | |

| 99.1 | |

| 99.2 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | ScanSource, Inc. |

| | | | |

| Date: | May 7, 2024 | | | | | | /s/ STEVE JONES |

| | | | | | | Steve Jones |

| | | | | | | Senior Executive Vice President and Chief Financial Officer |

AMENDED AND RESTATED BYLAWS OF SCANSOURCE, INC. Amended through January 27May 1, 20222024 ARTICLE I OFFICES AND REGISTERED AGENT Section 1.01. Principal Office. The Corporation shall maintain its Principal Office in the City of Greenville, State of South Carolina or such other place as designated from time to time by the Board of Directors for the principal executive offices of the Corporation. Section 1.02. Registered Office. The Corporation shall maintain a Registered Office as required by the South Carolina Business Corporation Act of 1988, as amended from time to time (the “Act”), at a location in the State of South Carolina designated by the Board of Directors from time to time. In the absence of a contrary designation by the Board of Directors, the Registered Office of the Corporation shall be located at its Principal Office. Section 1.03. Other Offices. The Corporation may have such other offices within and without the State of South Carolina as the business of the Corporation may require from time to time. The authority to establish or close such other offices may be delegated by the Board of Directors to one or more of the Corporation’s Officers. Section 1.04. Registered Agent. The Corporation shall maintain a Registered Agent as required by the Act who shall have a business office at the Corporation’s Registered Office. The Registered Agent shall be designated by the Board of Directors from time to time to serve at its pleasure. In the absence of such designation the Registered Agent shall be the Corporation’s Secretary. Section 1.05. Filings. In the absence of directions from the Board of Directors to the contrary, the Secretary of the Corporation shall cause the Corporation to maintain currently all filings in respect of the Registered Office and Registered Agent with the Secretary of State as required by the Act or otherwise by law. ARTICLE II SHAREHOLDERS Section 2.01. Annual Meetings. An annual meeting of the Corporation’s shareholders shall be held once each fiscal year for the purpose of electing Directors and for the transaction of such other business as may properly come before the meeting. No matters other than those proposed by the Board of Directors may be brought before the annual meeting by any shareholder unless written notice of such other matters, together with an adequate description thereof, shall have been provided to the corporation in compliance with Section 2.13. The annual meeting shall be held at the time and place designated by the Chairman of the Board or the Board of Directors from time to time. Section 2.02. Special Meetings. Special meetings of the Corporation’s shareholders may be called for any one or more lawful purposes by the Corporation’s Chief Executive Officer, the Chairman of the Board, or a majority of the Directors. Only such business shall be conducted at a special shareholder meeting as shall have been brought before the meeting pursuant to the Corporation’s notice of the meeting. Special meetings of the shareholders shall be held at a time and location as reflected in the notice of the meeting provided for hereinafter. Section 2.03. Notice of Meetings. Written or electronic notice of all meetings of shareholders shall be delivered not less than ten nor more than sixty days before the meeting date, (or according to any minimum notice requirement under Rule 14a-19), either personally, by mail, or by any other method permitted under the Act, by or at the direction of the Chairman of the Board or the Board of Directors, to all shareholders of record entitled to vote at Exhibit 3.1

such meeting. If mailed, the notice shall be deemed to be delivered when deposited with postage thereon prepaid in the United States mail, addressed to the shareholder at the shareholder’s address as it appears on the Corporation’s records. Such notice shall state the date, time, and place of the meeting and, in the case of a special meeting, the purpose or purposes for which such meeting was called. Electronic notice may be communicated to a shareholder by email or any other form of wire or wireless communication permitted by the Act. In addition, so long as the Corporation is a public corporation (as defined in the Act), a notice to a shareholder which accompanies a proxy statement or information statement is effective when it is addressed and mailed or transmitted in any manner which satisfies the applicable rules of the Securities and Exchange Commission (the “SEC”) requiring delivery of a proxy statement including, without limitation, rules regarding delivery to shareholders sharing an address and implied consent to such delivery. Any previously scheduled meeting of the shareholders may be postponed, and any special meeting of the shareholders may be canceled, by resolution of the Board of Directors, upon public notice given prior to the date previously scheduled for such meeting of shareholders. Section 2.04. Quorum. Except as may otherwise be required by the Act or the Corporation’s Articles of Incorporation (as amended from time to time, the “Articles of Incorporation”), at any meeting of shareholders the presence, in person or by proxy, of the holders of a majority of the outstanding shares entitled to vote thereat shall constitute a quorum for the transaction of any business properly before the meeting. Shares entitled to vote as a separate voting group on a matter may take action at a meeting on such matter only if a quorum of the shares in the separate voting group are present in person or by proxy at the meeting. Except as may otherwise be required by law or the Articles of Incorporation, at any meeting of shareholders the presence, in person or by proxy, of the holders of a majority of the outstanding shares in a separate voting group entitled to vote thereat as a separate voting group, if any, shall constitute a quorum of such separate voting group for purposes of such matter. In the absence of a quorum a meeting may be adjourned from time to time, in accordance with the provisions concerning adjournments contained elsewhere in these Bylaws, by the holders of a majority of the shares represented at the meeting in person or by proxy. At such adjourned meeting a quorum of shareholders may transact such business as might have been properly transacted at the original meeting. Section 2.05. Transaction of Business. Business transacted at an annual meeting of shareholders may include all such business as may properly come before the meeting. Business transacted at a special meeting of shareholders shall be limited to the purposes stated in the notice of the meeting. Section 2.06. Shareholders of Record. For the purpose of determining shareholders entitled to vote at any meeting of shareholders, or entitled to receive dividends or other distributions, or in connection with any other proper purpose requiring a determination of shareholders, the Board of Directors shall by resolution fix a record date for such determination. The date shall be not more than seventy and not less than ten days prior to the date on which the activity requiring the determination is to occur. The shareholders of record appearing in the Corporation’s records at the close of business on the record date so fixed shall constitute the shareholders of right in respect of the activity in question. In the absence of action by the Board of Directors to fix a record date, the record date shall be ten days prior to the date on which the activity requiring a determination of shareholders is to occur. A determination of shareholders of record entitled to notice of or to vote at a meeting of shareholders shall apply to any adjournment of the meeting to a date not later than one hundred twenty days after the date fixed for the original meeting; provided, however, that the Board of Directors may in its discretion fix a new record date for any adjourned meeting and shall fix a new record date for any meeting adjourned to a date more than one hundred twenty days after the date of the original meeting. Section 2.07. Voting. Except as may otherwise be required by the Act or the Articles of Incorporation, each shareholder entitled to vote at any meeting of shareholders shall be entitled to one vote for each share held by such shareholder that has voting power upon the matter in question. The vote of the holders of a majority of the votes cast shall decide any question brought before such meeting, unless otherwise provided by the Act, the Articles of Incorporation, or these Bylaws. Section 2.08 Voting Inspectors. For each meeting of shareholders one or more persons shall be appointed to serve as voting inspectors by the Board of Directors. The voting inspectors may include one or more representatives of the Corporation’s Transfer Agent. The voting inspectors shall by majority decision resolve all disputes which may arise concerning the qualification of voters, the validity of proxies, the existence of a quorum, the voting power of shares, Exhibit 3.1

and the acceptance, rejection, and tabulation of votes. Each voting inspector shall take an oath to execute his or her duties impartially and to the best of his or her ability. Such oath shall be administered by the presiding officer to each voting inspector following the call to order and before a voting inspector enters upon the discharge of his or her duties. Section 2.09. Adjournments. The chairman of the meeting may adjourn a meeting from time to time to a date, time, and place fixed by the chairman of the meeting and announced at the original meeting prior to adjournment. If a new record date is set pursuant to Section 2.06 following an adjournment a notice of the adjourned meeting will be sent to the shareholders of record as of that date. At the adjourned meeting the Corporation may transact any business which might have been transacted at the original meeting. Section 2.10. Action Without Meeting. Holders of record of voting shares may take action without meeting by written consent as to such matters and in accordance with such requirements and procedures as may be permitted by the Act. Section 2.11. Proxies. At all meetings of shareholders, a shareholder may vote in person or by proxy. Such proxy shall be filed with the Secretary of the Corporation or other person authorized to tabulate votes before or at the time of the meeting. A proxy must be filed (a) in writing executed by the shareholder or by his or her duly authorized attorney in fact, (b) by a telegram or cablegram appearing to have been transmitted by the shareholder, or (c) by an electronic transmission of appointment; provided, however that the Board of Directors may also establish procedures by which shareholders can file proxies with the Secretary by telecopier facsimile or electronic transmission and that any electronic transmission must contain or be accompanied by sufficient information to determine that the transmission appointing the proxy is authorized. No proxy shall be valid after three years from the date of its execution unless it qualifies as an irrevocable proxy under the Act or the proxy provides for a longer period. A stockholder may revoke any proxy which is not irrevocable by attending the meeting and voting in person or by filing an instrument in writing revoking the proxy or another duly executed proxy bearing a later date with the Secretary. Any shareholder directly or indirectly soliciting proxies from other shareholders must use a proxy card color other than white, which shall be reserved for the exclusive use by the Board of Directors. Section 2.12. Voting of Shares by Certain Holders. Shares standing in the name of another corporation may be voted, either in person or by proxy, by the officer, agent, or proxy as the bylaws of that corporation may prescribe, or in the absence of such provision, as the board of directors of that corporation may determine. Shares held by an administrator, executor, guardian or conservator may be voted by him or her, either in person or by proxy, without a transfer of such shares into his or her name. Shares standing in the name of a trustee may be voted by such trustee, either in person or by proxy, but no trustee shall be entitled to vote shares held by such trustee without a transfer of the shares into such trustee’s name as trustee. Shares standing in the name of a receiver may be voted, either in person or by proxy, by the receiver, and shares held by or under the control of a receiver may be voted, either in person or by proxy, by the receiver without the transfer thereof into such receiver’s name if authority to do so is contained in an appropriate order of the court by which such receiver was appointed. A shareholder whose shares are pledged shall be entitled to vote such shares until the shares have been transferred into the name of the pledgee, and thereafter the pledgee shall be entitled to vote, either in person or by proxy, the shares so transferred. Section 2.13. Advance Notice of Shareholder Nominees for Director and Other Shareholder Proposals. (a) The matters to be considered and brought before any annual or special meeting of shareholders of the Corporation shall be limited to only such matters, including the nomination and election of directors, as shall be brought properly before such meeting in compliance with the procedures set forth in this Section 2.13. (b) For any matter to be brought properly before any annual meeting of shareholders, the matter must be (i) specified in the notice of the annual meeting given by or at the direction of the Board of Directors, (ii) otherwise brought before the annual meeting by or at the direction of the Board of Directors or (iii) brought before the annual meeting Exhibit 3.1

by a shareholder who is a shareholder of record of the Corporation on the date the notice provided for in this Section 2.13 is delivered to the Secretary of the Corporation, who is entitled to vote at the annual meeting and who complies with the procedures set forth in this Section 2.13. In addition to any other requirements under applicable law, the Articles of Incorporation and Bylaws, written notice (the “Shareholder Notice”) of any nomination or other proposal must be timely and any proposal, other than a nomination, must constitute a proper matter for shareholder action. To be timely, the Shareholder Notice must be delivered to the Secretary of the Corporation at the principal executive office of the Corporation not less than 90 nor more than 120 days prior to the first anniversary date of the annual meeting for the preceding year; provided, however, that if (and only if) the annual meeting is not scheduled to be held within a period that commences 30 days before such anniversary date and ends within 60 days after such anniversary date (an annual meeting date outside such period being referred to herein as an “Other Meeting Date”), the Shareholder Notice shall be given in the manner provided herein by the later of the close of business on (i) the date 90 days prior to such Other Meeting Date or (ii) the tenth day following the date such Other Meeting Date is first publicly announced or disclosed. A Shareholder Notice must contain the following information: (i) whether the shareholder is providing the notice at the request of a beneficial holder of shares, whether the shareholder, any such beneficial holder or any nominee has any agreement, arrangement or understanding with, or has received any financial assistance, funding or other consideration from, any other person with respect to the investment by the shareholder or such beneficial holder in the Corporation or the matter the Shareholder Notice relates to, and the details thereof, including the name of such other person (the shareholder, any beneficial holder on whose behalf the notice is being delivered, any nominees listed in the notice and any persons with whom such agreement, arrangement or understanding exists or from whom such assistance has been obtained are hereinafter collectively referred to as “Interested Persons”), (ii) the name and address of all Interested Persons, (iii) a complete listing of the record and beneficial ownership positions (including number or amount) of all equity securities and debt instruments, whether held in the form of loans or capital market instruments, of the Corporation or any of its subsidiaries held by all Interested Persons, (iv) whether and the extent to which any hedging, derivative or other transaction is in place or has been entered into within the prior six months preceding the date of delivery of the Shareholder Notice by or for the benefit of any Interested Person with respect to the Corporation or its subsidiaries or any of their respective securities, debt instruments or credit ratings, the effect or intent of which transaction is to give rise to gain or loss as a result of changes in the trading price of such securities or debt instruments or changes in the credit ratings for the Corporation, its subsidiaries or any of their respective securities or debt instruments (or, more generally, changes in the perceived creditworthiness of the Corporation or its subsidiaries), or to increase or decrease the voting power of such Interested Person, and if so, a summary of the material terms thereof, and (v) a representation that the shareholder is a holder of record of stock of the Corporation that would be entitled to vote at the meeting and intends to appear in person or by proxy at the meeting to propose the matter set forth in the Shareholder Notice. As used herein, “beneficially owned” has the meaning provided in Rules 13d-3 and 13d-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Shareholder Notice shall be updated not later than 10 days after the record date for the determination of shareholders entitled to vote at the meeting to provide any material changes in the foregoing information as of the record date. Any Shareholder Notice relating to the nomination of directors must also contain (i) the information regarding each nominee required by paragraphs (a), (e) and (f) of Item 401 of Regulation S-K adopted by the Securities and Exchange CommissionSEC (or the corresponding provisions of any successor regulation), (ii) each nominee’s signed consent to serve as a director of the Corporation if elected, and (iii) whether each nominee is eligible for consideration as an independent director under the relevant standards contemplated by Item 407(a) of Regulation S-K (or the corresponding provisions of any successor regulation). The Corporation may also require any proposed nominee to furnish such other information, including completion of the Corporation’s directors questionnaire, as it may reasonably require to determine whether the nominee would be considered “independent” as a director or as a member of the audit committee of the Board of Directors under the various rules and standards applicable to the Corporation. Any Shareholder Notice with respect to a matter other than the nomination of directors must contain (i) the text of the proposal to be presented, including the text of any resolutions to be proposed for consideration by shareholders and (ii) a brief written statement of the reasons why such shareholder favors the proposal. Notwithstanding anything in this Section 2.13(b) to the contrary, in the event that the number of directors to be elected to the Board of Directors of the Corporation is increased and either all of the nominees for director or the size of the increased Board of Directors is not publicly announced or disclosed by the Corporation at least 100 days prior to the first anniversary of the preceding year’s annual meeting, a Shareholder Notice shall also be considered timely hereunder, but only with respect to nominees for any new positions created by such increase, if it shall be delivered to the Secretary of the Corporation at the principal executive office of the Corporation not later than the close of business on the tenth day following the first date all of such nominees or the size of the increased Board of Directors shall have been publicly announced or disclosed. Exhibit 3.1

(c) For any matter to be brought properly before a special meeting of shareholders, the matter must be set forth in the Corporation’s notice of the meeting given by or at the direction of the Board of Directors. In the event that the Corporation calls a special meeting of shareholders for the purpose of electing one or more persons to the Board of Directors, any shareholder may nominate a person or persons (as the case may be), for election to such position(s) as specified in the Corporation’s notice of the meeting, if the Shareholder Notice required by Section 2.13(b) hereof shall be delivered to the Secretary of the Corporation at the principal executive office of the Corporation not later than the close of business on the tenth day following the day on which the date of the special meeting and of the nominees proposed by the Board of Directors to be elected at such meeting is publicly announced or disclosed. (d) For purposes of this Section 2.13, a matter shall be deemed to have been “publicly announced or disclosed” if such matter is disclosed in a press release reported by the Dow Jones News Service, Associated Press or comparable national news service or in a document publicly filed by the Corporation with the Securities and Exchange CommissionSEC. (e) Only persons who are nominated in accordance with (i) the procedures set forth in this Section 2.13 and (ii) the requirements of Regulation 14A under the Exchange Act including, without limitation, the requirements of Rule 14a-19 (as such regulations and rules may be amended from time to time by the SEC including any interpretations by the staff of the SEC relating thereto), shall be eligible for election as directors of the Corporation. In no event shall the postponement or adjournment of an annual meeting already publicly noticed, or any announcement of such postponement or adjournment, commence a new period (or extend any time period) for the giving of notice as provided in this Section 2.13. This Section 2.13 shall not apply to (i) shareholders proposals made pursuant to Rule 14a-8 under the Exchange Act or (ii) the election of directors selected by or pursuant to the provisions of Article 3(b) of the Articles of Incorporation relating to the rights of the holders of any class or series of stock of the Corporation having a preference over the Common Stock as to dividends or upon liquidation to elect directors under specified circumstances. (f) The person presiding at any meeting of shareholders, in addition to making any other determinations that may be appropriate to the conduct of the meeting, shall have the power and duty to determine whether notice of nominees and other matters proposed to be brought before a meeting has been duly given in the manner provided in this Section 2.13 and Rule 14a-19 and, if not so given, shall direct and declare at the meeting that such nominees and other matters are not properly before the meeting and shall not be considered. Notwithstanding the foregoing provisions of this Section 2.13, if the shareholder or a qualified representative of the shareholder does not appear at the annual or special meeting of shareholders of the Corporation to present any such nomination, or make any such proposal, such nomination or proposal shall be disregarded, notwithstanding that proxies in respect of such vote may have been received by the Corporation. (g) In addition to the requirements set forth in this Section 2.13, unless otherwise required by law, (i) no shareholder shall solicit proxies in support of director nominees other than the Corporation’s nominees unless such shareholder has complied with Rule 14a-19 promulgated under the Exchange Act in connection with the solicitation of such proxies in all respects, including but not limited to the minimum solicitation and notice requirements thereof. If any shareholder (1) provides notice pursuant to Rule 14a-19(b) promulgated under the Exchange Act and (2) subsequently fails to comply with the requirements of Rules 14a-19(a)(2) and Rule 14a-19(a)(3) promulgated under the Exchange Act, then the Corporation shall disregard any proxies or votes solicited for such shareholder’s candidates. Upon request by the Corporation, if any shareholder provides notice pursuant to Rule14a-19(b) promulgated under the Exchange Act, such shareholder shall deliver to the Corporation, no later than five (5) business days prior to the applicable meeting, reasonable evidence that it has met the requirements of Rule 14a-19(a)(3) and 14a-19(b). Section 2.14. Inspection Rights. The shareholders shall have only such rights to inspect records of this Corporation to the extent, and according to the procedures and limitations, prescribed by the Act. Section 2.15. Conduct of Meetings. The Chairman of the Board of Directors shall be the chairman of each meeting of shareholders. In the absence of the Chairman, the meeting shall be chaired by such person as shall be appointed by the Nominating Committee of the Board of Directors or, in the absence of such appointment, an officer of the Exhibit 3.1

Corporation in accordance with the following order: Chief Executive Officer, Vice Chairman of the Board, President and Vice President. In the absence of all such officers, the meeting shall be chaired by an officer of the Corporation chosen by the vote of a majority in interest of the shareholders present in person or represented by proxy and entitled to vote thereat. The Secretary or in his or her absence an Assistant Secretary or in the absence of the Secretary and all Assistant Secretaries a person whom the chairman of the meeting shall appoint shall act as secretary of the meeting and keep a record of the proceedings thereof. The Board of Directors of the Corporation shall be entitled to make such rules or regulations for the conduct of meetings of shareholders as it shall deem necessary, appropriate or convenient. Subject to such rules and regulations of the Board of Directors, if any, the chairman of the meeting shall have the right and authority to prescribe such rules, regulations and procedures and to do all such acts as, in the judgment of such chairman, are necessary, appropriate or convenient for the proper conduct of the meeting, including, without limitation, establishing an agenda or order of business for the meeting, rules and procedures for maintaining order at the meeting and the safety of those present, limitations on participation in such meeting to shareholders of record of the Corporation and their duly authorized and constituted proxies and such other persons as the chairman shall permit, restrictions on entry to the meeting after the time fixed for the commencement thereof, limitations on the time allotted to questions or comment by participants and regulation of the opening and closing of the polls for balloting on matters which are to be voted on by ballot. Unless, and to the extent, determined by the Board of Directors or the chairman of the meeting, meetings of shareholders shall not be required to be held in accordance with rules of parliamentary procedure. Section 2.16. Dissenters’ Rights. Each shareholder shall have the right to dissent from, and obtain payment for, the shareholder’s shares only when so authorized by the Act. ARTICLE III DIRECTORS Section 3.01. Authority. The Board of Directors shall have ultimate authority over the conduct and management of the business and affairs of the Corporation. Section 3.02. Number. The number of Directors that shall constitute the whole Board of Directors shall be established from time to time without amendment to these Bylaws by resolution of the Board of Directors. The established number of Directors may be increased or decreased from time to time by resolution of the Board of Directors. No decrease in the established number of Directors shall have the effect of shortening the term of any incumbent Director. Section 3.03. Tenure. Each Director shall hold office from the date of such Director’s election and qualification until such Director’s successor shall have been duly elected and qualified, or until such Director’s earlier removal, resignation, death, or incapacity. An election of all Directors by the shareholders shall be held at each annual meeting of the Corporation’s shareholders. A Director need not be a shareholder or a resident of the State of South Carolina. In case of any increase in the number of Directors, the additional directorships so created may be filled in the first instance in the same manner as a vacancy in the Board of Directors. Section 3.04. Removal. Any Director may be removed from office, with or without cause, if by a vote of the shareholders the number of votes cast to remove such Director exceeds the number of votes cast not to remove such Director. A Director may be removed from office by the shareholders only at a meeting called for the purpose of removing such Director and the meeting notice must state the purpose, or one of the purposes, of the meeting is removal of the Director. Section 3.05. Vacancies. The Board of Directors may by majority vote of the Directors then in office, regardless of whether such Directors constitute a quorum, elect a new Director to fill a vacancy on the Board of Directors; provided, however, that no person may be elected to fill a vacancy created by such person’s removal from office pursuant to these Bylaws. Exhibit 3.1

Section 3.06. Annual and Regular Meetings. An annual meeting of the Board of Directors shall be called and held for the purpose of annual organization, appointment of Officers and committees, and transaction of any other business. If such meeting is held promptly after and at the place specified for the annual meeting of shareholders, no notice of the annual meeting of the Board of Directors need be given. Otherwise, such annual meeting of the Board of Directors shall be held at such time (at any time prior to and not more than thirty days after the annual meeting of shareholders) and place as may be specified in the notice of the meeting. The Board of Directors may by resolution provide for the holding of additional regular meetings without notice other than such resolution provided, however, the resolution shall fix the dates, times, and places (which may be anywhere within or without the State of South Carolina) for these regular meetings. Except as otherwise provided by law, any business may be transacted at any annual or regular meeting of the Board of Directors. Section 3.07. Special Meetings; Notice of Special Meeting. Special meetings of the Board of Directors may be called for any lawful purpose or purposes by two Directors or by the Chief Executive Officer of the Corporation. The person(s) calling a special meeting shall give, or cause to be given, to each Director at his or her business address, reasonable notice of the date, time and place of the meeting by any normal means of communication. The notices may, but need not, describe the purpose of the meeting. If mailed, the notice shall be deemed to be delivered when deposited in the United States mail addressed to the Director’s business address, with postage thereon prepaid. If notice is given by telecopier or other electronic transmission, the notice shall be deemed delivered when the notice is transmitted to a telecopier facsimile receipt number or electronic mail address designated by the receiving Director. Any time or place fixed for a special meeting must permit participation in the meeting by means of telecommunications as authorized in Section 3.09 below. Section 3.08. Waiver of Notice of Special Meetings. Notice of a special meeting need not be given to any Director who signs a waiver of notice either before or after the meeting. A Director’s attendance at or participation in a meeting waives any required notice to him of the meeting unless the Director at the beginning of the meeting (or promptly upon his arrival) objects to holding the meeting or transacting business at the meeting and does not thereafter vote for or assent to action taken at the meeting. Section 3.09. Participation by Telecommunications. Any Director may participate in, and be regarded as present at, any meeting of the Board of Directors by means of conference telephone or any other means of communication by which all persons participating in the meeting can hear each other at the same time. Section 3.10. Quorum. A majority of Directors in office shall constitute a quorum for the transaction of business at any meeting of the Board of Directors. If a quorum shall not be present at any meeting of the Board of Directors, the Directors present thereat may adjourn the meeting from time to time, without notice other than announcement at the meeting, until a quorum is present. Section 3.11. Action. The Board of Directors shall take action pursuant to resolutions adopted by the affirmative vote of a majority of the Directors participating in a meeting at which a quorum is present, or the affirmative vote of a greater number of Directors where required by the Articles of Incorporation or otherwise by law. Section 3.12. Action Without Meeting. Any action required or permitted by the Act and required or permitted to be taken by the Board of Directors at an annual, regular, or special meeting may be taken without a meeting if the action is assented to by all members of the Board. The action may be evidenced by one or more written consents describing the action taken, signed by each Director, and included in the minutes or filed with the corporate records reflecting the action taken. Action evidenced by written consents under this Section 3.12 is effective when the last Director signs the consent, unless the consent specifies a different effective date. A consent signed under this Section 3.12 has the effect of a meeting vote and may be described as such in any document. Section 3.13. Presumption of Assent. A director who is present at a meeting of the board of directors or a committee of the board of directors when corporate action is taken is considered to have assented to the action taken unless: (1) he objects at the beginning of the meeting (or promptly upon his arrival) to holding it or transacting business at the meeting; (2) his dissent or abstention from the action taken is entered in the minutes of the meeting; or (3) he delivers written notice of his dissent or abstention to the presiding officer of the meeting before its Exhibit 3.1

adjournment or to the corporation immediately after adjournment of the meeting. The right of dissent or abstention is not available to a director who votes in favor of the action taken. Section 3.14. Executive Committee. The Board of Directors may by resolution, adopted in accordance with the Act, designate and delegate authority to an Executive Committee with any or all such authority as may be permitted by the Act. The Executive Committee may be a standing committee appointed annually. The Executive Committee, if appointed, shall be composed of two or more members, who shall serve at the pleasure of the Board of Directors. All voting members of the Executive Committee must be Directors of the Corporation appointed by the Board of Directors in accordance with Section 33-8-250 of the Act. The Chairman of the Executive Committee shall be elected by the Board of Directors from the Directors appointed to the Executive Committee. The Chairman of the Executive Committee shall have such duties and authority as set forth by the Board of Directors. The duties, constitution, and procedures of the Executive Committee shall be prescribed by the Board of Directors. Section 3.15. Other Committees. The Board of Directors may from time to time by resolution, adopted in accordance with the Act, designate and delegate authority to an Audit Committee, a Compensation Committee, and other committees, with any or all such authority as may be permitted by the Act. Any such committee may be designated as a standing committee appointed annually or as a special committee for specific circumstances or transactions with a limited duration. Each committee shall be composed of two or more members, who shall serve at the pleasure of the Board of Directors. All committee members must be Directors of the Corporation appointed by the Board of Directors in accordance with Section 33-8-250 of the Act. The Chairman of the Board shall be given notice of all committee meetings and may in the Chairman’s discretion attend meetings of any committee to which he or she is not appointed as a member. The duties, constitution, and procedures of any committee shall be prescribed by the Board of Directors. The Board of Directors shall designate one member of each committee as its chairman. Section 3.16. Committee Meetings. A majority of each committee’s voting members shall constitute a quorum for the transaction of business by the committee, and each committee shall take action pursuant to resolutions adopted by a majority of the committee’s voting members participating in a meeting at which a quorum of the committee is present. Each committee may also take action without a meeting if a consent in writing, setting forth the action taken, shall be signed by all of the committee’s voting members in accordance with the procedures authorized by the Act. Special meetings of any committee may be called at any time by any Director who is a member of the committee or by any person entitled to call a special meeting of the full Board of Directors. Except as otherwise provided in this section, the conduct of all meetings of any committee, including notice thereof, and the taking of any action by such committee, shall be governed by Sections 3.06 through 3.13 of this Article. Section 3.17. Authority. Unless limited by the Articles of Incorporation, each committee may exercise those aspects of the authority of the Board of Directors which the Board of Directors confers upon such committee in the resolution creating the committee. Provided, however, a committee may not: (1) authorize distributions; (2) approve or propose to shareholders action that the Act requires be approved by shareholders; (3) fill vacancies on the Board of Directors or on any of its committees; (4) amend the Articles of Incorporation pursuant to the authority of Directors; (5) adopt, amend, or repeal bylaws; (6) approve a plan of merger not requiring shareholder approval; (7) authorize or approve reacquisition of shares, except according to a formula or method prescribed by the Board of Directors; or (8) authorize or approve the issuance or sale or contract for sale of shares or determine the designation and relative rights, preferences, and limitations of a class or series of shares, except that the Board of Directors may authorize a committee (or an executive officer of the Corporation) to do so within limits specifically prescribed by the Board of Directors. Section 3.18. Compensation. The Board of Directors may by resolution authorize payment to all Directors of a uniform fixed sum or other benefit, including equity awards, such as capital stock of the Corporation, options to purchase capital stock of the Corporation, or other forms of equity, for attendance at each meeting or a stated salary Exhibit 3.1

(which need not be uniform) as a Director, or a combination thereof, in such amounts as the Board may determine from time to time. The Board of Directors may, in its discretion, authorize payments of greater amounts or different forms to the Chairman of the Board or particular Directors or committee members than are paid to other Directors. No such payment shall preclude any Director from serving the Corporation in any other capacity and receiving compensation therefor. The Board of Directors may also by resolution authorize the payment or reimbursement of all expenses of each Director related to the Director’s attendance at meetings or other service to the Corporation. Section 3.19. Notification of Nominations. Nominations for the election of Directors may be made by the Board of Directors or by any shareholder entitled to vote for the election of directors. Any shareholder entitled to vote for the election of directors at a meeting may nominate persons for election as Directors only by complying with the procedures set forth above in Section 2.13. ARTICLE IV OFFICERS Section 4.01. In General. The Officers of the Corporation shall consist of a Chief Executive Officer, a President, one or more Vice Presidents, a Chief Financial Officer, a Secretary, a Treasurer, and such additional vice presidents, assistant secretaries, assistant treasurers and such other officers and agents as the Board of Directors deems advisable from time to time. The Chairman of the Board may by action of the Board be an officer of the Corporation. All Officers shall be appointed by the Board of Directors to serve at the pleasure of the Board. Except as may otherwise be provided by the Act or in the Articles of Incorporation, any Officer may be removed by the Board of Directors at any time, with or without cause. Any vacancy, however occurring, in any office may be filled by the Board of Directors for the unexpired term. One person may hold two or more offices. Each Officer shall exercise the authority and perform the duties as may be set forth in these Bylaws, the Board of Directors or by direction of an officer authorized by the Board of Directors to prescribe the duties of other officers. Section 4.02. Chairman of the Board. The Board of Directors shall elect from the Directors a Chairman of the Board to serve at the pleasure of the Board of Directors. The Chairman of the Board shall whenever possible preside at all meetings of shareholders and all meetings of the Board of Directors. Except as otherwise provided herein and as may be specifically limited by resolution of the Board of Directors or Executive Committee, the Chairman of the Board may execute on the Corporation’s behalf any and all contracts, agreements, notes, bonds, deeds, mortgages, certificates, instruments, and other documents. The Chairman of the Board shall exercise such additional authority and duties as set forth in these Bylaws and as the Board of Directors shall determine from time to time. Section 4.03. Chief Executive Officer. The Chief Executive Officer, subject to the authority of the Board of Directors, shall manage the business and affairs of the Corporation. The Chief Executive Officer shall see that the resolutions of the Board of Directors are put into effect. Except as otherwise provided herein and as may be specifically limited by resolution of the shareholders or the Board of Directors or an authorized committee thereof, the Chief Executive Officer shall have full authority to execute on the Corporation’s behalf any and all contracts, agreements, notes, bonds, deeds, mortgages, certificates, instruments, and other documents. The Chief Executive Officer shall also perform such other duties and may exercise such other powers as are incident to the office of Chief Executive Officer and as are from time to time assigned to him or her by the Act, these Bylaws, the Board of Directors, or an authorized committee thereof. Section 4.04. President. The President, subject to the authority of the Board of Directors and the Chief Executive Officer, shall manage the business and affairs of the Corporation. The President shall serve under the direction of the Chief Executive Officer. Except as otherwise provided herein and as may be specifically limited by resolution of the shareholders or the Board of Directors or an authorized committee thereof, the President shall have full authority to execute on the Corporation’s behalf any and all contracts, agreements, notes, bonds, deeds, mortgages, certificates, instruments, and other documents. The President shall also perform such other duties and may exercise such other powers as are incident to the office of President and as are from time to time assigned to him or her by the Act, these Bylaws, the Board of Directors or an authorized committee thereof, or the Chief Executive Officer. Section 4.05. Chief Financial Officer. The Chief Financial Officer, subject to the authority of the Board of Directors, the Chief Executive Officer, and the President, shall be the chief financial officer of the Corporation and Exhibit 3.1

shall perform all of the duties customary to that office. The Chief Financial Officer shall be responsible for all of the Corporation’s financial affairs, subject to the supervision and direction of the Chief Executive Officer and President, and shall have and perform such further powers and duties as the Board of Directors may, from time to time, prescribe and as the Chief Executive Officer or President may, from time to time, delegate. The Chief Financial Officer shall also perform such other duties and may exercise such other powers as are incident to the office of Chief Financial Officer and as are from time to time assigned to him or her by the Act, these Bylaws, the Board of Directors or an authorized committee thereof, or the Chief Executive Officer. Section 4.06. Vice Presidents. Except as otherwise determined by the Board of Directors or the Chief Executive Officer, each Vice President shall serve under the direction of the President and the Chief Executive Officer. Except as otherwise provided herein, each Vice President shall perform such duties and may exercise such powers as are incident to the office of vice president and as are from time to time assigned to him or her by the Act, these Bylaws, the Board of Directors, the Chairman of the Board, the President or the Chief Executive Officer. Section 4.07. Secretary. Except as otherwise provided by these Bylaws or determined by the Board of Directors, the Secretary shall serve under the direction of the Chief Executive Officer. The Secretary shall whenever possible attend all meetings of the shareholders and the Board of Directors, and whenever the Secretary cannot attend such meetings, such duty shall be delegated by the presiding officer for such meeting to a duly authorized assistant secretary. The Secretary shall record or cause to be recorded under the Secretary’s general supervision the proceedings of all such meetings and any other actions taken by the shareholders or the Board of Directors (or by any committee of the Board in place of the Board) in a book or books (or similar collection) to be kept for such purpose. The Secretary shall give, or cause to be given, all notices in connection with such meetings. The Secretary shall be the custodian of the Corporate seal and affix the seal to any document requiring it, and to attest thereto by signature. The Secretary may delegate the Secretary’s authority to affix the Corporation’s seal and attest thereto by signature to any Assistant Secretary. The Board of Directors may give general authority to any other officer or specified agent to affix the Corporation’s seal and to attest thereto by signature. Unless otherwise required by law, the affixing of the Corporation’s seal shall not be required to bind the Corporation under any documents duly executed by the Corporation and the use of the seal shall be precatory in the discretion of the Corporation’s duly authorized signing officers. The Secretary shall properly keep and file, or cause to be properly kept and filed under the Secretary’s supervision, all books, reports, statements, notices, waivers, proxies, tabulations, minutes, certificates, documents, records, lists, and instruments required by the Act or these Bylaws to be kept or filed, as the case may be. The Secretary may when requested, and shall when required, authenticate any records of the Corporation. Except to the extent otherwise required by the Act, the Secretary may maintain, or cause to be maintained, such items within or without the State of South Carolina at any reasonable place. In the event the Board of Directors designates and engages a Transfer Agent, as permitted by these Bylaws, such duties of keeping such shareholder records and the like accepted by such Transfer Agent shall be deemed delegated from the Secretary to such Transfer Agent, but such Transfer Agent shall be subject to supervision of the Secretary. The Secretary shall perform such other duties and may exercise such other powers as are incident to the office of secretary and as are from time to time assigned to such office by the Act, these Bylaws, the Board of Directors, the Chairman of the Board, or the Chief Executive Officer. Section 4.08. Treasurer. Except as otherwise provided by these Bylaws or determined by the Board of Directors or the Chief Executive Officer, the Treasurer shall serve under the direction of the Chief Financial Officer. The Treasurer shall, under the direction of the Chief Financial Officer, keep safe custody of the Corporation’s funds and securities, maintain and give complete and accurate books, records, and statements of account, give and receive receipts for moneys, and make deposits of the Corporation’s funds, or cause the same to be done under the Treasurer’s supervision. The Treasurer shall upon request report to the Board of Directors or the Chief Executive Officer on the financial condition of the Corporation. The Treasurer may be required by the Board of Directors or the Chief Executive Officer at any time and from time to time to give such bond as the Board of Directors or the Chief Executive Officer may determine. The Treasurer shall perform such other duties and may exercise such other powers as are incident to the office of treasurer and as are from time to time assigned to such office by the Act, these Bylaws, the Board of Directors, the Chairman of the Board, the Chief Executive Officer or the Chief Financial Officer. Section 4.09. Assistant Officers. Except as otherwise provided by these Bylaws or determined by the Board of Directors or the Chief Executive Officer, the Assistant Secretaries and Assistant Treasurers, if any, shall serve under Exhibit 3.1

the immediate direction of the Secretary and the Treasurer, respectively, and under the ultimate direction of the Chief Executive Officer. The Assistant Officers shall assume the authority and perform the duties of their respective immediate superior officer as may be necessary at the direction of such immediately superior officer, or in the absence, incapacity, inability, or refusal of such immediate superior officer to act. The seniority of Assistant Officers shall be determined from their dates of appointment unless the Board of Directors or the Chief Executive Officer shall otherwise specify. Section 4.10. Salaries. The salaries and other compensation of the Corporation’s executive officers shall be fixed from time to time by the Board of Directors and no officer shall be prevented from receiving a salary or other compensation by reason of the fact that such officer is also a Director of the Corporation. ARTICLE V INDEMNIFICATION Section 5.01. Scope. Every person who was or is a party to, or is threatened to be made a party to, or is otherwise involved in, any action, suit, or proceeding, whether civil, criminal, administrative, or investigative, by reason of the fact that such person or a person of whom such person is the legal representative is or was a Director or Officer of the Corporation or is or was serving at the request of the Corporation or for its benefit as a director or officer of another corporation, or as its representative in a partnership, joint venture, trust, or other enterprise, shall be indemnified and held harmless to the fullest extent legally permissible under and pursuant to the Act (and regardless of whether such proceeding is by or in the right of the Corporation), against all expenses, liabilities, and losses (including without limitation attorneys’ fees, judgments, fines, and amounts paid or to be paid in settlement) suffered, or reasonably incurred by such person in connection therewith. Such right of indemnification shall be a contract right that may be enforced in any manner desired by such person. Such right of indemnification shall not be exclusive of any other right which such Directors, Officers, or representatives may have or hereafter acquire and, without limiting the generality of such statement, they shall be entitled to their respective rights of indemnification under any bylaw, agreement, vote of shareholders, insurance, provision of law, or otherwise, as well as their rights under this Article V. The Corporation may contract in advance to provide indemnification. Section 5.02. Advances and Reimbursements. The determination that indemnification under this Article V is permissible and the evaluation as to the reasonableness of expenses in a specific case shall be made, in the case of a Director, as provided by the Act, and in the case of an Officer or other person indemnified under Section 5.03, if any, as provided in Section 5.03 of this Article; provided, however, that if a majority of the Directors of the Corporation has changed after the date of the alleged conduct giving rise to a claim for indemnification, such determination and evaluation shall, at the option of the person claiming indemnification, be made by special legal counsel agreed upon by the Board of Directors and such person. Unless a determination has been made that indemnification is not permissible, and upon receipt of such written affirmation as required by the Act from the person to be indemnified, the Corporation shall make advances and reimbursements for expenses incurred by a Director or Officer or other person indemnified under Section 5.03, if any, in a proceeding upon receipt of an undertaking from such person to repay the same if it is ultimately determined that such person is not entitled to indemnification. Such undertaking shall be an unlimited, unsecured general obligation of the Director or Officer and shall be accepted without reference to such person’s ability to make repayment. The termination of a proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contendere or its equivalent shall not of itself create a presumption that a Director or Officer acted in such a manner as to make such person ineligible for indemnification. Section 5.03. Indemnification of Other Persons. The Corporation may, to a lesser extent or to the same extent that the Corporation is required to provide indemnification to its Directors and Officers, provide indemnification and make advances and reimbursements for expenses to (a) its employees, agents, and advisors, (b) the directors, officers, employees, agents, and advisors of its subsidiaries and predecessor entities, and (c) any person serving any other legal entity in any capacity at the request of the Corporation; and, if authorized by general or specific action of the Board of Directors, may contract in advance to do so. The determination that indemnification under this Section is permissible, the authorization of such indemnification, and the advance or reimbursement, if any, and the evaluation as to the reasonableness of expenses in a specific case, shall be made as authorized from time to time by general or specific action of the Board of Directors, which action may be taken before or after a claim for Exhibit 3.1

indemnification is made, or as otherwise provided by the Act. No person’s rights under Sections 5.01 or 5.02 of this Article shall be limited by the provisions of this Section 5.03. Section 5.04. Indemnification Plan. The Board of Directors may from time to time adopt an Indemnification Plan implementing the rights granted in Section 5.01. This Indemnification Plan shall set forth in detail any other mechanics for exercise of the indemnification rights granted in this Article V, and shall be binding upon all parties except to the extent it is proven to be inconsistent with these Bylaws or the Act. The absence of the adoption of such plan, however, shall not vitiate the effectiveness of the rights conferred by this Article V. Section 5.05. Insurance. The Board of Directors may cause the Corporation to purchase and maintain insurance on behalf of any person who is or was a Director or Officer of the Corporation, or is or was serving at the request of the Corporation as a Director or Officer of another corporation, or as its representative in a partnership, joint venture, trust, or other enterprise, or any other person indemnified or described as the subject of potential indemnification in this Article V, against any liability asserted against such person and incurred in any such capacity or arising out of such status, whether or not the Corporation would have the power to indemnify such person. Section 5.06. Miscellaneous. Every reference in this Article V to persons who are or may be entitled to indemnification shall include all persons who formerly occupied any of the positions referred to and their respective heirs, executors, and administrators. Special legal counsel selected to make determinations under this Article V may be counsel for the Corporation. Indemnification pursuant to this Article V shall not be exclusive of any other right of indemnification to which any person may be entitled, including indemnification pursuant to valid contract, indemnification by legal entities other than the Corporation and indemnification under policies of insurance purchased and maintained by the Corporation or others. However, no person shall be entitled to indemnification by the Corporation to the extent prohibited by the Act or to the extent such person is indemnified by another, including an insurer; provided, however, that the Corporation may make advances and reimbursements, subject to appropriate repayment obligations, under Section 5.02 if the effectiveness of such other indemnification will be delayed. The provisions of this Article shall not be deemed to prohibit the Corporation from entering into contracts otherwise permitted by law with any individuals or legal entities, including those named above, for the purpose of conducting the business of the Corporation. Indemnification of any person under this Article V shall be implemented only in accordance with procedures and requirements mandated by the Act and by plans, if any, adopted pursuant to Section 5.04. Should the Act be amended subsequent to the date of these Bylaws so as to place limitations or restrictions on the indemnification rights granted to any person by this Article V, such restriction or limitation shall not apply to any indemnification provided by the Corporation for acts or events that occurred prior to the effective date of such revised statutory provision or provisions. If any provision of this Article V or its application to any person or circumstance is held invalid by a court of competent jurisdiction, the invalidity shall not affect other provisions or applications of this Article V, and to this end the provisions of this Article V are severable. ARTICLE VI TRANSACTIONS Section 6.01. Contracts. The Board of Directors may authorize any Officer or Officers, or agent or agents, to enter into any contract or execute and deliver any instrument in the name of and on behalf of the Corporation, and such authority may be general or confined to specific instances. Section 6.02. Loans. The Board of Directors may authorize any Officer or Officers, or agent or agents, to contract any indebtedness and grant evidence of indebtedness and collateral therefor in the name of and on behalf of the Corporation, and such authority may be general or confined to specific instances. Section 6.03. Deposits. All funds of the Corporation not otherwise employed shall be deposited from time to time to the credit of the Corporation in such banks, trust companies or other depositories as the Board of Directors may select. Exhibit 3.1

ARTICLE VII STOCK Section 7.01. Certificates for Shares. Shares may be represented by certificates, but need not be so represented. Unless the Act expressly provides otherwise, the rights and obligations of shareholders are identical whether or not their shares are represented by certificates. Certificates representing shares of capital stock of the Corporation shall state upon the face thereof the name of the person to whom issued, the number of shares, the fact that the Corporation is organized under the laws of the State of South Carolina, and such other matters as the Board of Directors may approve or as may be required by the Act. Each certificate shall be signed by (a) any one of the Chairman of the Board, the Chief Executive Officer, the President, or a Vice President, and (b) by any one of the Secretary or an Assistant Secretary. Where a certificate is countersigned by (i) a Transfer Agent other than the Corporation or its employee, or (ii) a registrar other than the Corporation or its employee, any other signature on the certificate may be a facsimile. In case any Officer whose facsimile signature has been placed upon a certificate shall have ceased to be such Officer before such certificate is issued it may be issued by the Corporation with the same effect as if he or she were such Officer at the date of issue. All certificates for shares shall be consecutively numbered. Certificates for shares of different classes, and different series within a class, to the extent authorized, if any, shall bear appropriate designations to identify the class or series as required by the Act. Section 7.02. Shares without Certificates. The Board of Directors of the Corporation may authorize the issue of some or all of the shares of any or all of its classes or series without certificates in accord with the provisions of Chapter 8 of Title 36 of the South Carolina Uniform Commercial Code. Within a reasonable time after the issue or transfer of shares without certificates, the Corporation’s Transfer Agent shall send the shareholder a written statement containing the following information: (a) the name of the Corporation and a statement that it is organized under the laws of South Carolina; (b) the name of the person to whom the shares are issued; (c) the number and class of shares and the designation of the series, if any, of the shares; (d) if at such time the Corporation is authorized to issue different classes of shares or different series within a class, a summary of the designations, relative rights, preferences and limitations applicable to each class and the variations in rights, preferences and limitations determined for each series (and the authority of the Board of Directors to determine variations for future series) or, in lieu thereof, a statement that the Corporation will furnish the shareholder this information in writing, on request, and without charge; and (e) if applicable, a conspicuous notation that the shares are subject to a restriction on their transfer. Section 7.03. Stock Transfer Books. The name and address of the person to whom the shares represented thereby are issued, with the number of shares and date of issuance, shall be entered on the stock transfer books of the Corporation. Such stock transfer books shall be maintained by the Secretary or Transfer Agent as a record of the Corporation’s shareholders, in a form that permits preparation of a list of the names and addresses of all shareholders, in alphabetical order by class of shares showing the number and class of shares held by each shareholder. Section 7.04. Transfer of Shares. Subject to the provisions of the Act and to any transfer restrictions binding on the Corporation, transfer of shares of the Corporation shall be made only on the stock transfer books of the Corporation by the holder of record thereof or by such holder’s agent, attorney-in-fact or other legal representative, who shall furnish proper evidence of authority to transfer, upon surrender for cancellation of the certificate for such shares. Unless the Board of Directors in its discretion has by resolution established procedures, if any, by which a beneficial owner of shares held by a nominee may be recognized by the Corporation as the owner thereof, the person in whose name shares stand on the stock transfer books of the Corporation shall be deemed by the Corporation to be the owner thereof for all purposes. The Corporation’s stock transfer books maintained by the Secretary or the Transfer Agent shall be conclusive in all such regards absent a determination by the Board of Directors of manifest error. All certificate surrendered to the Corporation for transfer shall be canceled. Section 7.05. New or Replacement Certificates. No new stock certificate shall be issued until the former certificate for a like number of shares shall have been surrendered and canceled, except that in case of a lost, destroyed, or mutilated certificate a substitute certificate may be issued therefor upon: (a) the making of an affidavit by the holder Exhibit 3.1

of record of the shares represented by such certificate setting forth the facts concerning the loss, theft, or mutilation thereof; (b) delivery of such bond and/or indemnity to the Corporation as the Secretary or Board of Directors may prescribe or as may be required by law; and (c) satisfaction of such other reasonable requirements as the Secretary or Board of Directors may prescribe. To the extent permitted by applicable law (including Section 36-8-405 of the South Carolina Uniform Commercial Code), a new certificate may be issued without requiring any bond when, in the judgment of the Board of Directors, it is not imprudent to do so; and without limiting the generality of the foregoing, the Secretary or the Board of Directors may in their discretion waive (except as prohibited by law) any bond requirement otherwise applicable where the aggregate fair market value of the shares represented by such lost, stolen, or mutilated certificate is less than five hundred dollars based upon indicia deemed reasonable by the waiving party. Section 7.06. Beneficial Owners. The Corporation shall be entitled to recognize the exclusive right of a person registered on its stock transfer books as the owner of shares to receive dividends or other distributions, and to vote as such owner, a person registered on its books as the owner of shares, and shall not be bound to recognize any equitable or other claim to or interest in such shares on the part of any other person, whether or not the Corporation shall have express or other notice thereof, except as otherwise provided by the Act or by procedures, if any, established by resolution of the Board of Directors in its discretion by which a beneficial owner of shares held by a nominee may be recognized as the owner thereof. Such procedures, if any, shall also set forth the extent of such recognition. Section 7.07. Transfer Agent. The Board of Directors may, in its discretion, appoint an independent institutional Transfer Agent to serve as transfer agent and registrar for the Corporation’s stock at the pleasure of the Board. Such Transfer Agent shall assist the Corporation’s Secretary and voting inspectors in performance of their duties respecting shares of the Corporation’s stock. Such Transfer Agent shall maintain the Corporation’s stock transfer books and stock certificates in accordance with the Act, these Bylaws, instructions of the Board of Directors, and customary procedures consistently applied. Such Transfer Agent shall perform such other duties and shall be entitled to exercise such other powers, as may be assigned to the Transfer Agent from time to time by the Secretary or the Board of Directors. Section 7.08. Transfer Restrictions. The Secretary shall have full power and authority to place or cause to be placed on any and all stock certificates restrictive legends to the extent reasonably believed necessary or appropriate to ensure the Corporation’s compliance with federal or any state’s securities laws, and to issue to any Transfer Agent stop transfer orders to effect compliance with such legends. ARTICLE VIII EMERGENCY BYLAWS Section 8.01. Emergency Bylaws. Unless the Articles of Incorporation provide otherwise, the following provisions of this Article VIII shall be effective during an emergency, which is defined as when a quorum of the Corporation’s Directors cannot be readily assembled because of some catastrophic event. During such emergency: (a) Notice of Board Meetings. Any one member of the Board of Directors or any one of the following officers: Chief Executive Officer, President, any Vice-President, Secretary, Chief Financial Officer or Treasurer, may call a meeting of the Board of Directors. Notice of such meeting need be given only to those Directors whom it is practicable to reach, and may be given in any practical manner, including by publication and radio. Such notice shall be given at least six hours prior to commencement of the meeting. (b) Temporary Directors and Quorum. One or more officers of the Corporation present at the emergency board meeting, as is necessary to achieve a quorum, shall be considered to be Directors for the meeting, and shall so serve in order of rank, and within the same rank, in order of seniority. In the event that less than a quorum (as determined by Section 3.10) of the Directors are present (including any officers who are to serve as Directors for the meeting), those Directors present (including the officers serving as Directors) shall constitute a quorum. Exhibit 3.1