UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2015

Commission File Number 001-36866

SUMMIT

THERAPEUTICS PLC

(Translation of registrant’s name into English)

85b Park Drive

Milton

Park, Abingdon

Oxfordshire OX14 4RY

United Kingdom

(Address

of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

FORM

20-F x FORM 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information

contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

YES ¨ NO

x

If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b):

On August 27, 2015, Summit Therapeutics plc (the “Company”) issued a press release reporting its

financial results for its second quarter and half year ended July 31, 2015. The Company also provided an operational review. The press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein. The information contained

in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as

amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

SUMMIT THERAPEUTICS PLC |

|

|

| By: |

|

/s/ Erik Ostrowski |

|

|

Erik Ostrowski |

|

|

Chief Financial Officer |

Date: August 27, 2015

EXHIBIT INDEX

|

|

|

| Exhibit Number |

|

Description |

|

|

| 99.1 |

|

Press Release dated August 27, 2015 reporting results for the second quarter and half year ended July 31, 2015 |

Exhibit 99.1

Summit Therapeutics plc

(‘Summit’ or the ‘Company’)

SUMMIT THERAPEUTICS REPORTS FINANCIAL RESULTS FOR THE SECOND QUARTER ENDED 31 JULY 2015 AND OPERATIONAL PROGRESS

Oxford, UK, 27 August 2015 – Summit Therapeutics plc (AIM: SUMM, NASDAQ: SMMT), the drug discovery and development company advancing therapies

for Duchenne muscular dystrophy (‘DMD’) and C. difficile infection (‘CDI’), today reports its financial results for the second quarter and half-year ended 31 July 2015.

Mr Glyn Edwards, Chief Executive Officer of Summit commented: “We have made very substantial progress with our utrophin modulator programme to

treat boys with DMD with the recent announcement that our lead candidate, SMT C1100, achieved its primary objective in a Phase 1b clinical trial, allowing us to advance this molecule into a Phase 2 open-label trial that is expected to start by the

end of this year. We further strengthened this programme with the publication of data on a second-generation utrophin modulator demonstrating its disease-modifying potential in animal models of this devastating disease. Importantly, we also received

Fast Track designation from the US FDA for SMT19969 in CDI, highlighting the promise of our novel antibiotic treatment with the potential to address disease recurrence, the key clinical issue of CDI. With top-line data from our ongoing Phase 2 proof

of concept trial in CDI expected to report in the fourth quarter of 2015, we continue to be excited about progress in both of our clinical programmes.”

RECENT OPERATIONAL HIGHLIGHTS

| |

• |

|

Utrophin Modulation Programme for DMD: |

SMT C1100 Highlights

| |

• |

|

Phase 1b modified diet clinical trial achieved primary objective in DMD |

| |

• |

|

Plasma absorption of SMT C1100 observed at a level suitable for further development |

| |

• |

|

SMT C1100 to progress into Phase 2 open-label clinical trial planned to commence in Q4 2015 |

| |

• |

|

Key composition of matter patent granted by European Patent Office for SMT C1100 |

Utrophin

Modulation Pipeline

| |

• |

|

Positive preclinical data published on second-generation utrophin modulator showing increase in utrophin expression along entire length of muscle fibre, reduction in disease pathology and improvement in muscle function

|

SMT19969 Highlights

| |

• |

|

Phase 2 proof of concept clinical trial of novel antibiotic SMT19969 against vancomycin on-going with top-line data expected to be reported in Q4 2015 |

| |

• |

|

SMT19969 granted Fast Track status by the US Food and Drug Administration |

| |

• |

|

Grant of key patent in the US protecting the use of SMT19969 in the treatment of CDI |

FINANCIAL HIGHLIGHTS

| |

• |

|

Cash and cash equivalents at 31 July 2015 of £26.4 million compared to £11.3 million at 31 January 2015 |

| |

• |

|

Loss for the three months ended 31 July 2015 of £4.0 million compared to a loss of £3.3 million for the three months ended 31 July 2014 |

| |

• |

|

Initial Public Offering of American Depositary Shares in the US completed in March 2015 raising gross proceeds of $39.3 million |

Conference Call

Summit will host a conference call and

webcast to discuss the financial results for the second quarter and half-year ended 31 July 2015 today at 1:00pm BST / 8:00am EDT. To participate in the conference call please dial +44(0)20 7136 2050 (UK and international participants) or +1

718 354 1359 (US local number) and use the conference confirmation code 4691341. Investors may also access a live audio webcast of the call via the investors section of the Company’s website www.summitplc.com. A replay of the webcast will be

available shortly after the presentation finishes.

For more information, please contact:

|

|

|

|

|

| Summit Therapeutics Glyn Edwards /

Richard Pye (UK office) Erik Ostrowski (US office) |

|

Tel: +44 (0)1235 443 951

+1 617 294 6607 |

|

|

| Cairn Financial Advisers LLP (Nominated

Adviser) Liam Murray / Tony Rawlinson |

|

Tel: +44 (0)20 7148 7900 |

|

|

| N+1 Singer (Broker)

Aubrey Powell / Jen Boorer |

|

Tel: +44 (0)20 7496 3000 |

|

|

| MacDougall Biomedical Communications (US

media contact) Michelle Avery |

|

Tel: +1 781 235 3060

mavery@macbiocom.com |

|

|

| Peckwater PR (Financial public

relations, UK) Tarquin Edwards |

|

Tel: +44 (0)7879 458 364

tarquin.edwards@peckwaterpr.co.uk |

SUMMIT OVERVIEW

Summit

is seeking to treat all boys affected with the fatal disease Duchenne muscular dystrophy (‘DMD’) using its pioneering utrophin modulation technology. Summit is also advancing a highly selective antibiotic to treat Clostridium

difficile infection (‘CDI’).

Summit’s DMD utrophin modulation programme is a treatment approach that is independent of the underlying

mutations in the dystrophin gene that cause the disease and therefore has the potential to address the entire population of DMD patients. Summit has established a leadership position in the field of utrophin modulation and is developing a robust

pipeline of first-, second- and future-generation product candidates. Summit is preparing to advance its lead utrophin modulator, SMT C1100, into Phase 2 clinical trials following the completion of a Phase 1b clinical trial in patients with DMD that

achieved its primary objective.

Summit’s CDI therapy in clinical development is SMT19969, an orally administered small molecule antibiotic. SMT19969

is designed to selectively target Clostridium difficile bacteria without causing collateral damage to the healthy gut flora of patients, thereby reducing CDI recurrence rates, the key clinical issue in this disease.

Duchenne Muscular Dystrophy: Utrophin Modulation Programme

SMT C1100 is a small molecule, orally administered utrophin modulator that is being evaluated in patient clinical trials. SMT C1100 has received orphan drug

designation in the US and Europe.

SMT C1100: Phase 1b Modified Diet Clinical Trial

Earlier this month, Summit reported that it achieved the primary objective of its Phase 1b modified diet clinical trial of SMT C1100 in patients with DMD. The

placebo controlled trial was designed to increase plasma levels of SMT C1100 in patients by recommending a diet with balanced proportions of fat, proteins and carbohydrates combined with consuming a small glass of full fat milk at the time of

dosing.

Initial analysis shows that six of 12 patients achieved the desired plasma level after receiving the higher dose of 2,500 mg of SMT C1100 twice

daily for 14 days. In a prior Phase 1b trial, only two of 12 patients dosed with SMT C1100 achieved the desired plasma level.

SMT C1100 was well

tolerated at all doses tested in the modified diet trial with no serious adverse events reported. This outcome increases the human safety database for this investigational drug.

The trial enrolled a total of 12 patients with DMD between the ages of five and 13 who were divided equally into three dose cohorts. Patients were randomised

to three groups over 14-day treatment periods during which each patient received a low dose of SMT C1100, a high dose of SMT C1100 and a placebo. There was a wash-out period of at least 14 days between each of the treatment periods. The trial was

conducted at four sites in the United Kingdom. The trial also measured enzyme biomarkers of muscle damage, such as creatine kinase. In this modified diet study, there was no change in the measured enzyme levels when patients received SMT C1100

compared to when they received a placebo. The Company plans to evaluate levels of creatine kinase as well as additional biomarkers over a longer duration of exposure to SMT C1100 in future clinical trials.

Summit expects to report further data from this trial at an upcoming medical meeting.

SMT C1100: Phase 2 Clinical Trial Plans

Summit will now

progress SMT C1100 into Phase 2 clinical trials. Summit plans to commence a Phase 2 open-label trial during the fourth quarter of 2015. The trial will evaluate the longer-term benefits of SMT C1100 on muscle health, function and safety. Summit also

plans to initiate a larger, multinational Phase 2 placebo-controlled trial that is expected to include sites in the US and Europe.

Utrophin Modulation

Pipeline

As part of the Company’s strategy to maintain its leadership position in the field of utrophin modulation research, Summit is advancing

a pipeline of second- and future-generation utrophin modulators. The second generation utrophin modulators are structurally related to SMT C1100 but are designed to have more favourable pharmaceutical properties to achieve higher drug uptake.

In July 2015, new positive preclinical data on a second-generation utrophin modulator was published in the peer-reviewed journal Human Molecular Genetics. The

data showed that treatment of the in vivo mdx disease model for five weeks resulted in increased utrophin expression that was localised along the entire length of the muscle fibre membrane. This addressed the primary cause of fibre

degeneration and resulted in reduced regeneration and necrosis, enhanced protection of the muscle against contraction-induced damage and improved muscle function. Increases in utrophin were observed in skeletal muscle, including the diaphragm, and

the heart. Summit believes that these data further support the potential of utrophin modulation as a treatment approach for DMD regardless of the underlying genetic mutation.

In parallel to the current clinical development of SMT C1100, Summit is also working to identify an optimised formulation of this drug. The Company is working

with leading formulation companies to identify potential new formulations to progress into human clinical trials.

Intellectual Property

In July, Summit announced that the European Patent Office (‘EPO’) had granted a key composition of matter patent for SMT C1100. The patent, EPO

number 1986633, will provide a period of exclusivity until 2027 and means SMT C1100 has intellectual property protection in major territories including the US and Japan.

C. difficile Infection Programme

SMT19969: Phase 2 Clinical Programme

SMT19969 is a novel

antibiotic for the treatment of CDI that is currently being evaluated in a Phase 2 proof of concept clinical trial being conducted in the US and Canada. This trial, named CoDIFy, is a double-blind, randomised active-control trial evaluating the

efficacy of SMT19969 against the current standard of care, the antibiotic vancomycin. CoDIFy is enrolling up to 100 patients with half the patients receiving ten days of dosing with SMT19969, and the remaining patients receiving ten days of dosing

with vancomycin.

The primary endpoint of the trial is sustained clinical response, which is defined as clinical cure based on the resolution of diarrhoea

at the test of cure visit on day 12 and no recurrence of CDI within 30 days after the end of treatment. The trial will examine a number of secondary endpoints including the safety and tolerability of SMT19969, and its impact on the gut flora of

patients.

Summit expects to report top-line results from this trial in the fourth quarter of 2015.

Intellectual Property and Regulatory

In July, Summit

received notification that the US Food and Drug Administration (‘FDA’) had granted Fast Track designation to SMT19969. Fast Track designation is awarded to expedite the development and regulatory review of drugs intended to treat serious

or life-threatening conditions and that demonstrate the potential to address unmet medical needs. SMT19969 is also designated a Qualified Infectious Disease Product or ‘QIDP’ under the Generating Antibiotics Incentives Now Act which allows

Summit to benefit from a number of incentives supporting the development of new antibiotics.

In April, a key patent protecting the use of SMT19969 in the

treatment of CDI was issued to Summit by the US Patent and Trademark Office. Summit believes this patent, which provides protection through until December 2029, significantly strengthens the intellectual property estate protecting the use of SMT

19969.

The development of SMT19969 is supported by a £4.0 million Wellcome Trust Translational Award through to completion of the Phase 2

proof of concept clinical trial.

FINANCIAL REVIEW

Other Operating Income

Other operating income for the

three months ended 31 July 2015 was £0.4 million compared to £0.5 million for the three months ended 31 July 2014. Other operating income for the six months ended 31 July 2015 was £0.8 million compared

to £1.1 million for the six months ended 31 July 2014. Income recognised as part of the Wellcome Trust Translational Award was lower in both the three months ended 31 July 2015 and the six months ended 31 July 2015 as a

result of a lower contribution rate ascribed to Phase 2 activities as compared to Phase 1 activities under the terms of the funding agreement. The Company has received £3.9 million out of the £4.0 million awarded by the

Wellcome Trust to date. Income recognised as part of funding from Innovate UK for the DMD programme was lower in both the three months ended 31 July 2015 and the six months ended 31 July 2015, in line with the achievement of milestones to

date under the terms of the funding agreement. The Company was awarded up to £2.4 million in funding from Innovate UK and has received £1.2 million to date.

Operating Expenses

Research and Development Expenses

Research and

development expenses increased by £1.7 million to £4.2 million for the three months ended 31 July 2015 from £2.5 million for the three months ended 31 July 2014. Research and development expenses increased

by £2.4 million to £7.4 million for the six months ended 31 July 2015 from £5.0 million for the six months ended 31 July 2014. These increases reflected increased expenditure related to the Company’s

CDI and DMD programme activities as well as an increase in staff related costs.

General and Administration Expenses

General and administration expenses decreased by £0.6 million to £1.0 million for the three months ended 31 July 2015 from

£1.6 million for the three months ended 31 July 2014. General and administration expenses decreased by £0.4 million to £2.1 million for the six months ended 31 July 2015 from £2.5 million for the

six months ended 31 July 2014. These decreases were primarily due to the provision of £0.7 million for milestone payments owed to two US DMD patient groups as part of funding agreements recognised in July 2014, offset by costs

associated with being a publicly traded company in the US following the Company’s NASDAQ listing, as well as expenses associated with the Company’s US office which opened last year.

Cash Flows

Operating Activities

Net cash outflow from operating activities increased by £1.7 million to £7.0 million for the six months ended 31 July 2015 compared

to an outflow of £5.3 million for the six months ended 31 July 2014. This was driven by an increase in operating expenses and working capital requirements, offset by the receipt in July 2015 of a £1.4 million research and

development tax credit.

Investing Activities

Net

cash outflow from investing activities for the six months ended 31 July 2015 and inflow for the six months ended 31 July 2014 includes the net amount of bank interest received on cash deposits less amounts paid to acquire property and

equipment.

Financing Activities

Net cash inflow

from financing activities for the six months ended 31 July 2015 and the six months ended 31 July 2014 relates to proceeds received from the sale of the Company’s equity securities and the exercise of share options. The Company

received net proceeds of £22.1 million from the sale of equity securities including the exercise of share options during the six months ended 31 July 2015 compared with net proceeds of £20.7 million received from the sale

of equity securities during the six months ended 31 July 2014.

|

|

|

| Glyn Edwards |

|

Erik Ostrowski |

| Chief Executive Officer |

|

Chief Financial Officer |

26 August 2015

About Summit Therapeutics

Summit is a biopharmaceutical company focused on the discovery, development and commercialisation of novel medicines for indications for which there are no

existing or only inadequate therapies. Summit is conducting clinical programs focused on the genetic disease Duchenne muscular dystrophy and the infectious disease C. difficile infection. Further information is available at

www.summitplc.com and Summit can be followed on Twitter (@summitplc).

Forward Looking Statements

Any statements in this press release about Summit’s future expectations, plans and prospects, including but not limited to, statements about the clinical

and preclinical development of Summit’s product candidates, the therapeutic potential of Summit’s product candidates, the timing of initiation, completion and availability of data from clinical trials and expectations regarding the

sufficiency of Summit’s cash balance to fund operating expenses and capital expenditures, and other statements containing the words “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “would,” and similar expressions, constitute forward

looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including: the

uncertainties inherent in the initiation of future clinical trials, availability and timing of data from on-going and future clinical trials and the results of such trials, whether preliminary results from a clinical trial will be predictive of the

final results of that trial or whether results of early clinical trials or preclinical studies will be indicative of the results of later clinical trials, expectations for regulatory approvals, availability of funding sufficient for Summit

foreseeable and unforeseeable operating expenses and capital expenditure requirements and other factors discussed in the “Risk Factors” section of filings that Summit make with the Securities and Exchange Commission including Summit’s

Annual Report on Form 20-F for the fiscal year ended January 31, 2015. Accordingly readers should not place undue reliance on forward looking statements or information. In addition, any forward looking statements included in this press release

represent Summit’s views only as of the date of this release and should not be relied upon as representing Summit’s views as of any subsequent date. Summit specifically disclaim any obligation to update any forward-looking statements

included in this press release.

Risks and Uncertainties

A detailed analysis of the risks faced by Summit is set out in the Company’s Annual Report on Form 20-F that was filed with the Securities and Exchange

Commission on 7 May 2015.

FINANCIAL STATEMENTS

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (unaudited)

For the three months ended 31 July 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Three months

ended

31 July

2015 |

|

|

Three months

ended

31 July

2015 |

|

|

Three months

ended

31 July 2014 |

|

| |

|

Note |

|

|

$000s |

|

|

£000s |

|

|

£000s |

|

| Other operating income |

|

|

|

|

|

|

668 |

|

|

|

427 |

|

|

|

504 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

|

|

|

|

(6,604 |

) |

|

|

(4,224 |

) |

|

|

(2,485 |

) |

| General and administration |

|

|

|

|

|

|

(1,567 |

) |

|

|

(1,002 |

) |

|

|

(1,597 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

|

|

|

|

(8,171 |

) |

|

|

(5,226 |

) |

|

|

(4,082 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

|

|

|

|

(7,503 |

) |

|

|

(4,799 |

) |

|

|

(3,578 |

) |

| Finance income |

|

|

|

|

|

|

14 |

|

|

|

9 |

|

|

|

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income tax |

|

|

|

|

|

|

(7,489 |

) |

|

|

(4,790 |

) |

|

|

(3,556 |

) |

| Income tax |

|

|

|

|

|

|

1,183 |

|

|

|

757 |

|

|

|

274 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss for the period |

|

|

|

|

|

|

(6,306 |

) |

|

|

(4,033 |

) |

|

|

(3,282 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss for the period attributable to owners of the parent |

|

|

|

|

|

|

(6,306 |

) |

|

|

(4,033 |

) |

|

|

(3,282 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exchange differences on translating foreign operations |

|

|

|

|

|

|

(19 |

) |

|

|

(12 |

) |

|

|

(3 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive loss for the period attributable to owners of the parent |

|

|

|

|

|

|

(6,325 |

) |

|

|

(4,045 |

) |

|

|

(3,285 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted loss per ordinary share from continuing operations (post consolidation and subdivision) |

|

|

2 |

|

|

|

(11 |

)cents |

|

|

(7 |

)pence |

|

|

(8 |

)pence |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCIAL STATEMENTS

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (unaudited)

For the six months ended 31 July 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Six months

ended

31 July

2015 |

|

|

Six months

ended

31 July

2015 |

|

|

Six months

ended

31 July

2014 |

|

| |

|

Note |

|

|

$000s |

|

|

£000s |

|

|

£000s |

|

| Other operating income |

|

|

|

|

|

|

1,305 |

|

|

|

835 |

|

|

|

1,144 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

|

|

|

|

(11,502 |

) |

|

|

(7,357 |

) |

|

|

(5,046 |

) |

| General and administration |

|

|

|

|

|

|

(3,247 |

) |

|

|

(2,077 |

) |

|

|

(2,495 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

|

|

|

|

(14,749 |

) |

|

|

(9,434 |

) |

|

|

(7,541 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

|

|

|

|

(13,444 |

) |

|

|

(8,599 |

) |

|

|

(6,397 |

) |

| Finance income |

|

|

|

|

|

|

25 |

|

|

|

16 |

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income tax |

|

|

|

|

|

|

(13,419 |

) |

|

|

(8,583 |

) |

|

|

(6,372 |

) |

| Income tax |

|

|

|

|

|

|

1,851 |

|

|

|

1,184 |

|

|

|

466 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss for the period |

|

|

|

|

|

|

(11,568 |

) |

|

|

(7,399 |

) |

|

|

(5,906 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss for the period attributable to owners of the parent |

|

|

|

|

|

|

(11,568 |

) |

|

|

(7,399 |

) |

|

|

(5,906 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exchange differences on translating foreign operations |

|

|

|

|

|

|

5 |

|

|

|

3 |

|

|

|

(3 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive loss for the period attributable to owners of the parent |

|

|

|

|

|

|

(11,563 |

) |

|

|

(7,396 |

) |

|

|

(5,909 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted loss per ordinary share from continuing operations (post consolidation and subdivision) |

|

|

2 |

|

|

|

(20 |

)cents |

|

|

(13 |

)pence |

|

|

(15 |

)pence |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (unaudited)

As at 31 July 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

31 July

2015 |

|

|

31 July

2015 |

|

|

31 January

2015 |

|

| |

|

Note |

|

|

$000s |

|

|

£000s |

|

|

£000s |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Goodwill |

|

|

|

|

|

|

1,038 |

|

|

|

664 |

|

|

|

664 |

|

| Intangible assets |

|

|

|

|

|

|

5,438 |

|

|

|

3,478 |

|

|

|

3,483 |

|

| Property, plant and equipment |

|

|

|

|

|

|

94 |

|

|

|

60 |

|

|

|

55 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,570 |

|

|

|

4,202 |

|

|

|

4,202 |

|

| Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Prepayments and other receivables |

|

|

|

|

|

|

2,891 |

|

|

|

1,849 |

|

|

|

2,630 |

|

| Current tax |

|

|

|

|

|

|

1,745 |

|

|

|

1,116 |

|

|

|

1,299 |

|

| Cash and cash equivalents |

|

|

|

|

|

|

41,328 |

|

|

|

26,435 |

|

|

|

11,265 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45,964 |

|

|

|

29,400 |

|

|

|

15,194 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

|

|

|

|

52,534 |

|

|

|

33,602 |

|

|

|

19,396 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deferred tax |

|

|

|

|

|

|

(1,038 |

) |

|

|

(664 |

) |

|

|

(664 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,038 |

) |

|

|

(664 |

) |

|

|

(664 |

) |

| Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Trade and other payables |

|

|

|

|

|

|

(4,165 |

) |

|

|

(2,663 |

) |

|

|

(3,721 |

) |

| Provisions for other liabilities and charges |

|

|

|

|

|

|

(92 |

) |

|

|

(59 |

) |

|

|

(45 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4,257 |

) |

|

|

(2,722 |

) |

|

|

(3,766 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

|

|

|

|

(5,295 |

) |

|

|

(3,386 |

) |

|

|

(4,430 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net assets |

|

|

|

|

|

|

47,239 |

|

|

|

30,216 |

|

|

|

14,966 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share capital |

|

|

3 |

|

|

|

958 |

|

|

|

613 |

|

|

|

411 |

|

| Share premium account |

|

|

3 |

|

|

|

71,971 |

|

|

|

46,035 |

|

|

|

24,101 |

|

| Share-based payment reserve |

|

|

|

|

|

|

4,857 |

|

|

|

3,107 |

|

|

|

2,597 |

|

| Merger reserve |

|

|

|

|

|

|

(3,038 |

) |

|

|

(1,943 |

) |

|

|

(1,943 |

) |

| Special reserve |

|

|

|

|

|

|

31,257 |

|

|

|

19,993 |

|

|

|

19,993 |

|

| Currency translation reserve |

|

|

|

|

|

|

102 |

|

|

|

65 |

|

|

|

62 |

|

| Accumulated losses reserve |

|

|

|

|

|

|

(58,868 |

) |

|

|

(37,654 |

) |

|

|

(30,255 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity attributable to the equity shareholders of the Parent |

|

|

|

|

|

|

47,239 |

|

|

|

30,216 |

|

|

|

14,966 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED STATEMENT OF CASH FLOWS (unaudited)

For the six months ended 31 July 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six months

ended

31 July

2015 |

|

|

Six months

ended

31 July

2015 |

|

|

Six months

ended

31 July

2014 |

|

| |

|

$000s |

|

|

£000s |

|

|

£000s |

|

| Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income tax |

|

|

(13,419 |

) |

|

|

(8,583 |

) |

|

|

(6,372 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(13,419 |

) |

|

|

(8,583 |

) |

|

|

(6,372 |

) |

| Adjusted for: |

|

|

|

|

|

|

|

|

|

|

|

|

| Finance income |

|

|

(25 |

) |

|

|

(16 |

) |

|

|

(25 |

) |

| Foreign exchange (gain) / loss |

|

|

(14 |

) |

|

|

(9 |

) |

|

|

3 |

|

| Depreciation |

|

|

27 |

|

|

|

17 |

|

|

|

10 |

|

| Amortisation of intangible fixed assets |

|

|

8 |

|

|

|

5 |

|

|

|

5 |

|

| Movement in provisions |

|

|

22 |

|

|

|

14 |

|

|

|

752 |

|

| Research and development expenditure credit |

|

|

(33 |

) |

|

|

(21 |

) |

|

|

(32 |

) |

| Share-based payment expense |

|

|

797 |

|

|

|

510 |

|

|

|

446 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted loss from operations before changes in working capital |

|

|

(12,637 |

) |

|

|

(8,083 |

) |

|

|

(5,213 |

) |

| Decrease / (Increase) in prepayments and other receivables |

|

|

1,221 |

|

|

|

781 |

|

|

|

(859 |

) |

| (Decrease) / Increase in trade and other payables |

|

|

(1,653 |

) |

|

|

(1,057 |

) |

|

|

773 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash used by operations |

|

|

(13,069 |

) |

|

|

(8,359 |

) |

|

|

(5,299 |

) |

| Taxation received |

|

|

2,190 |

|

|

|

1,401 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used in operating activities |

|

|

(10,879 |

) |

|

|

(6,958 |

) |

|

|

(5,299 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase of property, plant and equipment |

|

|

(38 |

) |

|

|

(24 |

) |

|

|

(16 |

) |

| Interest received |

|

|

25 |

|

|

|

16 |

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash (used in) / generated by investing activities |

|

|

(13 |

) |

|

|

(8 |

) |

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from issue of share capital |

|

|

40,808 |

|

|

|

26,101 |

|

|

|

22,000 |

|

| Transaction costs on share capital issued |

|

|

(6,546 |

) |

|

|

(4,187 |

) |

|

|

(1,298 |

) |

| Exercise of share options |

|

|

346 |

|

|

|

222 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash generated from financing activities |

|

|

34,608 |

|

|

|

22,136 |

|

|

|

20,702 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Increase in cash and cash equivalents |

|

|

23,716 |

|

|

|

15,170 |

|

|

|

15,412 |

|

| Cash and cash equivalents at beginning of period |

|

|

17,612 |

|

|

|

11,265 |

|

|

|

2,030 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

|

41,328 |

|

|

|

26,435 |

|

|

|

17,442 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (unaudited)

Six months ended 31 July 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Group |

|

Share

capital

£000s |

|

|

Share

premium

account

£000s |

|

|

Share-based

payment

reserve

£000s |

|

|

Merger

reserve

£000s |

|

|

Special

reserve

£000s |

|

|

Currency

translation

adjustment

£000s |

|

|

Accumulated

losses

£000s |

|

|

Total

£000s |

|

| At 1 February 2015 |

|

|

411 |

|

|

|

24,101 |

|

|

|

2,597 |

|

|

|

(1,943 |

) |

|

|

19,993 |

|

|

|

62 |

|

|

|

(30,255 |

) |

|

|

14,966 |

|

| Loss for the period from continuing operations |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(7,399 |

) |

|

|

(7,399 |

) |

| Currency translation adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3 |

|

|

|

— |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive loss for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3 |

|

|

|

(7,399 |

) |

|

|

(7,396 |

) |

| New share capital issued |

|

|

198 |

|

|

|

25,903 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

26,101 |

|

| Transaction costs on share capital issued |

|

|

— |

|

|

|

(4,187 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,187 |

) |

| Share options exercised |

|

|

4 |

|

|

|

218 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

222 |

|

| Share-based payment |

|

|

— |

|

|

|

— |

|

|

|

510 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

510 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| At 31 July 2015 |

|

|

613 |

|

|

|

46,035 |

|

|

|

3,107 |

|

|

|

(1,943 |

) |

|

|

19,993 |

|

|

|

65 |

|

|

|

(37,654 |

) |

|

|

30,216 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended 31 January 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Group |

|

Share

capital

£000s |

|

|

Share

premium

account

£000s |

|

|

Share-based

payment

reserve

£000s |

|

|

Merger

reserve

£000s |

|

|

Special

reserve

£000s |

|

|

Currency

translation

adjustment

£000s |

|

|

Accumulated

losses

£000s |

|

|

Total

£000s |

|

| At 1 February 2014 |

|

|

10,075 |

|

|

|

40,177 |

|

|

|

1,636 |

|

|

|

(1,943 |

) |

|

|

— |

|

|

|

— |

|

|

|

(45,183 |

) |

|

|

4,762 |

|

| Loss for the year from continuing operations |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(11,363 |

) |

|

|

(11,363 |

) |

| Currency translation adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

62 |

|

|

|

— |

|

|

|

62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive loss for the year |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

62 |

|

|

|

(11,363 |

) |

|

|

(11,301 |

) |

| New share capital issued |

|

|

3,384 |

|

|

|

18,616 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

22,000 |

|

| Transaction costs on share capital issued |

|

|

— |

|

|

|

(1,482 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,482 |

) |

| Cancellation of deferred shares |

|

|

(13,048 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13,048 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Reduction of share premium account |

|

|

— |

|

|

|

(33,236 |

) |

|

|

— |

|

|

|

— |

|

|

|

33,236 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Elimination of losses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(26,291 |

) |

|

|

— |

|

|

|

26,291 |

|

|

|

— |

|

| Share options exercised |

|

|

— |

|

|

|

26 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

26 |

|

| Share-based payment |

|

|

— |

|

|

|

— |

|

|

|

961 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

961 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| At 31 January 2015 |

|

|

411 |

|

|

|

24,101 |

|

|

|

2,597 |

|

|

|

(1,943 |

) |

|

|

19,993 |

|

|

|

62 |

|

|

|

(30,255 |

) |

|

|

14,966 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six months ended 31 July 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Group |

|

Share

capital

£000s |

|

|

Share

premium

account

£000s |

|

|

Share-based

payment

reserve

£000s |

|

|

Merger

reserve

£000s |

|

|

Special

reserve

£000s |

|

|

Currency

translation

adjustment

£000s |

|

|

Accumulated

losses

£000s |

|

|

Total

£000s |

|

| At 1 February 2014 |

|

|

10,075 |

|

|

|

40,177 |

|

|

|

1,636 |

|

|

|

(1,943 |

) |

|

|

— |

|

|

|

— |

|

|

|

(45,183 |

) |

|

|

4,762 |

|

| Loss for the period from continuing operations |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,906 |

) |

|

|

(5,906 |

) |

| Currency translation adjustment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3 |

) |

|

|

— |

|

|

|

(3 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive loss for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3 |

) |

|

|

(5,906 |

) |

|

|

(5,909 |

) |

| New share capital issued |

|

|

3,384 |

|

|

|

18,616 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

22,000 |

|

| Transaction costs on share capital issued |

|

|

— |

|

|

|

(1,298 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,298 |

) |

| Share-based payment |

|

|

— |

|

|

|

— |

|

|

|

446 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

446 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| At 31 July 2014 |

|

|

13,459 |

|

|

|

57,495 |

|

|

|

2,082 |

|

|

|

(1,943 |

) |

|

|

— |

|

|

|

(3 |

) |

|

|

(51,089 |

) |

|

|

20,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTES TO THE FINANCIAL STATEMENTS

For the three and six months ended 31 July 2015

1.

Basis of accounting

The unaudited consolidated interim financial statements of Summit and its subsidiaries (the ‘Group’) for the three

months and six months ended 31 July 2015 have been prepared in accordance with International Financial Reporting Standards (‘IFRS’) and International Financial Reporting Interpretations Committee (‘IFRIC’) interpretations

endorsed by the European Union and as issued by the International Accounting Standards Board and with those parts of the Companies Act 2006 applicable to companies reporting under IFRS including those applicable to accounting periods ending

31 January 2016 and the accounting policies set out in Summit’s consolidated financial statements. They do not include all the statements required for full annual financial statements, and should be read in conjunction with the

consolidated financial statements of the Group as at 31 January 2015. The interim financial statements are prepared in accordance with the historical cost convention. Whilst the financial information included in this announcement has been

prepared in accordance with IFRSs adopted for use in the European Union and as issued by the International Accounting Standards Board, this announcement does not itself contain sufficient information to comply with IFRSs.

The interim financial statements have been prepared on a going concern basis. Management, having reviewed the future operating costs of the business in

conjunction with the cash held at 31 July 2015, believes the Group has sufficient funds to continue as a going concern for the foreseeable future.

The financial information for the three month and six month periods ended 31 July 2015 and 2014 is unaudited.

The interim financial statements are not the Company’s statutory accounts. The Company’s statutory accounts for the year ended 31 January 2015

in which the Company’s auditors made an unqualified report have been filed with the Registrar of Companies England and Wales.

Solely for the

convenience of the reader, unless otherwise indicated, all pound sterling amounts stated in the Consolidated Balance Sheet as at 31 July 2015, in the Consolidated Income Statement for the three and six months ended 31 July 2015 and in the

Consolidated Cash Flow Statement for the six months ended 31 July 2015 have been translated into US dollars at the rate on 31 July 2015 of $1.5634 to £1.00. These translations should not be considered representations that any such

amounts have been, could have been or could be converted into US dollars at that or any other exchange rate as at that or any other date.

The Board of

Directors of the Company approved this statement on 26 August 2015.

2. Loss per ordinary share calculation

The loss per ordinary share has been calculated by dividing the loss for the period by the weighted average number of ordinary shares in issue during the six

month period to 31 July 2015: 56,853,054 and during the three month period to 31 July 2015: 61,122,601 (for the six month period to 31 July 2014: 38,082,944, for the three month period to 31 July 2014: 41,061,411).

Since the Group has reported a net loss, diluted loss per ordinary share is equal to basic loss per ordinary share.

3. Issue of share capital

On 5 March 2015 the Group

announced an initial public offering on the NASDAQ Global Market issuing 3,450,000 American Depository Shares (‘ADSs’) at a price of $9.90 per ADS. On 18 March 2015 the underwriters exercised in full their over-allotment option to

purchase an additional 517,500 ADSs, on the same

terms. Each ADS represents five ordinary shares of 1 penny each in the capital of the Company, thus 19,837,500 ordinary shares were issued. Total gross proceeds of $39.3 million (£25.8

million) were raised. Following the initial public offering and the exercise of the over-allotment option, the number of ordinary shares in issue was 60,955,197.

During the six months ended 31 July 2015, 335,543 new ordinary shares were issued following various exercises of share options which generated gross

proceeds of £0.2 million. Following these exercises, the number of ordinary shares in issue was 61,290,740.

All new ordinary shares rank pari

passu with existing ordinary shares.

- END -

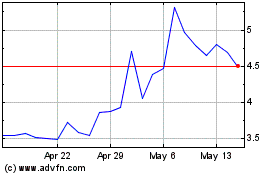

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Jul 2023 to Jul 2024