| | | | | | | | |

Prospectus Supplement | | Filed Pursuant to Rule 424(b)(5) |

| (To Prospectus dated May 12, 2022) | | Registration No. 333-264667 |

Smith Micro Software, Inc.

1,065,000 shares of Common Stock

Pre-Funded Warrants to purchase up to 845,000 shares of Common Stock

(and the 845,000 shares of Common Stock underlying the Pre-Funded Warrants)

We are offering an aggregate of 1,065,000 shares of our common stock, par value $0.001 per share (the “common stock”), to certain institutional and accredited investors in a direct registered offering pursuant to this prospectus supplement and the accompanying prospectus. The per share offering price of the common stock is $2.15.

Because an investor’s purchase of shares of Common Stock in this offering could otherwise result in the investor, together with its affiliates and certain related parties, beneficially owning more than 9.99% of our outstanding Common Stock immediately following consummation of this offering, we are offering to the investors pre-funded warrants to purchase up to 845,000 shares of Common Stock (the “Pre-Funded Warrants”) in lieu of shares of Common Stock pursuant to this prospectus supplement and accompanying prospectus. Each Pre-Funded Warrant will be exercisable for one share of our Common Stock. The purchase price of each Pre-Funded Warrant is $2.149, which is equal to the price per share at which the shares of Common Stock are being sold, minus $0.001, the exercise price of each Pre-Funded Warrant. The Pre-Funded Warrants will be immediately exercisable at a nominal exercise price of $0.001 per Pre-Funded Warrant Share (as defined herein) and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. This prospectus supplement also relates to the shares of Common Stock issuable upon the exercise of any Pre-Funded Warrants sold in this offering (the “Pre-Funded Warrant Shares”).

In a concurrent private placement, we will be issuing to the investors participating in this offering unregistered warrants (the “Warrants”), to purchase up to an aggregate of 1,910,000 shares of our common stock (the “Warrant Shares”) at an exercise price of $2.34 per share.

The Warrants will be exercisable following the six-month anniversary of the closing of this offering and have an expiration date of five years from the initial exercise date of the Warrant. Neither the Warrants nor the Warrant Shares are being registered under the Securities Act of 1933, as amended (the “Securities Act”), nor are they being offered pursuant to the registration statement of which this prospectus supplement and the base prospectus form a part, nor are the Warrants or Warrant Shares being offered pursuant to such prospectus supplement and base prospectus. The Warrants are being offered pursuant to the exemption provided in Section 4(a)(2) of the Securities Act and/or Rule 506(b) promulgated thereunder. The Warrants are being sold together with the shares of common stock being sold in the direct registered offering, and we will receive additional proceeds from the Warrants to the extent such Warrants are exercised for cash. We have agreed to file a registration statement to register for resale the Warrant Shares as soon as practicable, and in any event by the 45th day following the closing of the offering (the “Resale Registration Statement”).

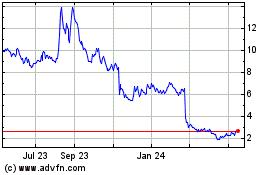

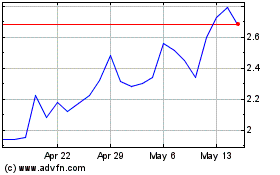

Our common stock is listed for trading on the Nasdaq Capital Market (“Nasdaq”) under the symbol “SMSI.” There is no established trading market for the Warrants and the Pre-Funded Warrants and we do not expect a market to develop. We do not intend to apply for a listing for the Warrants or the Pre-Funded Warrants on any securities exchange or other national recognized trading system. Without an active trading market, the liquidity of the Warrants and the Pre-Funded Warrants will be limited.

On May 9, 2024, the last reported sale price of our common stock on Nasdaq was $2.34. We intend to use the net proceeds of this offering for general corporate purposes and working capital. See “Prospectus Supplement Summary – “Use of Proceeds.” We have engaged Roth Capital Partners, LLC (the “placement agent” or “Roth”) to act as our exclusive placement agent in connection with the securities offered by this prospectus supplement and the accompanying prospectus. The placement agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered in this offering. The placement agent is not purchasing or selling any of the securities we are offering, and the placement agent is not required to arrange the purchase or sale of any specific number of securities or dollar amount. There is no required minimum number of securities that must be sold as a condition to completion of this offering, and there are no arrangements to place the funds in an escrow, trust, or similar account. We have agreed to pay the placement agent the placement agent fees as set forth in the table below.

Investing in our securities involves a high degree of risk. Before making an investment decision, please read the information under the heading “Risk Factors” beginning on page S-11 of this prospectus supplement and page 3 of the accompanying prospectus, and in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. We are a “smaller reporting company” as defined by Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and as such are subject to reduced public company reporting requirements. | | | | | | | | | | | | | | | | | |

| Per Share | | Per Pre-Funded Warrant | | Total |

Offering price | $ | 2.15 | | | $ | 2.149 | | | $ | 4,105,655 | |

Placement agent fees(1) | $ | 0.129 | | | $ | 0.129 | | | $ | 246,390 | |

| Proceeds to Smith Micro Software, Inc., before expenses | $ | 2.021 | | | $ | 2.020 | | | $ | 3,859,265 | |

__________________

(1)Does not include additional items of compensation payable to the placement agent which includes a warrant to purchase seven (7%) percent of the aggregate number of shares and Pre-Funded Warrants issued in this offering, with an exercise price equal to no less than 125% of the price per share sold in this offering. We have also agreed to reimburse the placement agent for certain accountable expenses incurred by them. See “Plan of Distribution.” As of May 9, 2024, the aggregate market value of our voting and non-voting common stock held by non-affiliates pursuant to General Instruction I.B.6. of Form S-3 was $25,709,092, which was calculated based upon 8,685,504 shares of our common stock outstanding held by non-affiliates and at a price of $2.96 per share, the closing price of our common stock on March 25, 2024. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell shares pursuant to this prospectus supplement with a value of more than one-third of the aggregate market value of our common stock held by non-affiliates in any 12-month period, so long as the aggregate market value of our common stock held by non-affiliates is less than $75,000,000. We have not sold any securities pursuant to General Instruction I.B.6 of Form S-3 during the prior 12-month calendar period that ends on, and includes, the date of this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

Delivery of the shares of common stock is expected to be made on or about May 14, 2024, subject to the satisfaction of certain conditions.

The date of this prospectus supplement is May 10, 2024

TABLE OF CONTENTS

| | | | | |

| PROSPECTUS SUPPLEMENT | Page No. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is a supplement to the accompanying base prospectus dated May 12, 2022 that is also a part of this document. This prospectus supplement and the accompanying base prospectus are part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”), utilizing a “shelf” registration process. Under the shelf registration process, from time to time, we may sell any of the securities described in the accompanying base prospectus in one or more offerings. In this prospectus supplement, we provide you with specific information about this offering. This prospectus supplement, the accompanying base prospectus and the documents incorporated by reference herein and therein include important information about us, our securities and other information you should know before investing in our securities. This prospectus supplement also adds, updates and changes information contained in the accompanying base prospectus. You should read both this prospectus supplement and the accompanying base prospectus as well as the additional information described in this prospectus supplement under the headings “Where You Can Find Additional Information About Us” and “Incorporation of Certain Documents by Reference” before investing in our securities.

You should rely only on the information contained or incorporated by reference in this prospectus supplement, in the accompanying base prospectus, in any other prospectus supplement and in any free writing prospectus filed by us with the SEC. We and the placement agent have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We and the placement agent are not making an offer to sell our securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying base prospectus and the documents incorporated by reference herein and therein is accurate only as of each of their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates. To the extent that any statement that we make in this prospectus supplement differs from or is inconsistent with statements made in the accompanying base prospectus or any documents incorporated by reference therein, the statements made in this prospectus supplement will be deemed to modify or supersede those made in the accompanying base prospectus and such documents incorporated by reference therein.

We and the placement agent are offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The distribution of this prospectus and the offering of the securities offered hereunder in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of securities and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

Unless otherwise indicated in this prospectus or the context otherwise requires, all references to “we,” “us,” “our,” “the Company” and “Smith Micro” refer to Smith Micro Software, Inc. and its subsidiaries. This prospectus and the information incorporated by reference herein and therein include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus are the property of their respective owners.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement contains forward-looking statements within the meaning of the federal securities laws. We make such forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. You can identify forward-looking statements by the use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “will,” “should,” “may,” “plan,” “assume” and other expressions that predict or indicate future events and trends and that do not relate to historical matters. You should not unduly rely on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements. These statements are not guarantees of future performance and are subject to risks, uncertainties, and assumptions that are difficult to predict. Therefore, our actual results could differ materially from those expressed or implied in any forward-looking statements as a result of various factors. Such factors include, but are not limited to, the following:

•our customer concentration, given that the majority of our sales currently depend on a few large client relationships;

•our ability to establish and maintain strategic relationships with our customers and mobile device manufacturers, their ability to attract customers, and their willingness to promote our products;

•our ability and/or customers’ ability to distribute our mobile software applications to their end users through third party mobile software application stores, which we do not control;

•our dependency upon effective operation with operating systems, devices, networks and standards that we do not control and on our continued relationships with mobile operating system providers, device manufacturers and mobile software application stores on commercially reasonable terms or at all;

•our ability to hire and retain key personnel;

•the possibility of security and privacy breaches in our systems and in the third-party software and/or systems that we use, damaging client relations and inhibiting our ability to grow;

•interruptions or delays in the services we provide from our data center hosting facilities that could harm our business;

•the existence of undetected software defects in our products and our failure to resolve detected defects in a timely manner;

•our ability to remain a going concern;

•our ability to raise additional capital and the risk of such capital not being available to us at commercially reasonable terms or at all;

•our ability to be profitable;

•changes in our operating income due to shifts in our sales mix and variability in our operating expenses;

•our current client concentration within the vertical wireless carrier market, and the potential impact to our business resulting from changes within this vertical market, or failure to penetrate new markets;

•rapid technological evolution and resulting changes in demand for our products from our key customers and their end users;

•intense competition in our industry and the core vertical markets in which we operate, and our ability to successfully compete;

•the risks inherent with international operations;

•the impact of evolving information security and data privacy laws on our business and industry;

•the impact of governmental regulations on our business and industry;

•our ability to protect our intellectual property and our ability to operate our business without infringing on the rights of others;

•the risk of being delisted from Nasdaq if we fail to meet any of its applicable listing requirements;

•our ability to assimilate acquisitions without diverting management attention and impacting current operations;

•failure to realize the expected benefits of prior acquisitions;

•the availability of third-party intellectual property and licenses needed for our operations on commercially reasonable terms, or at all; and

•the difficulty of predicting our quarterly revenues and operating results and the chance of such revenues and results falling below analyst or investor expectations, which could cause the price of our common stock to fall.

These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results to be materially different from the anticipated future results, performance or achievements expressed or implied by any forward-looking statements, including the factors described under the heading “Risk Factors” in this prospectus supplement and the accompanying base prospectus, and the risk factors and cautionary statements described in other documents that we file from time to time with the SEC, specifically under the heading “Item 1A: Risk Factors” and elsewhere in our most recent Annual Report on Form 10-K for the year ended December 31, 2023 that was filed with the SEC on February 26, 2024, and any of our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. You should evaluate all forward-looking statements made in this prospectus supplement and the accompanying prospectus, including the documents we incorporate by reference, in the context of these risks, uncertainties and other factors.

All forward-looking statements in this prospectus supplement and the accompanying prospectus, including the documents we incorporate by reference, apply only as of the date made and are expressly qualified in their entirety by the cautionary statements included in this prospectus supplement and the accompanying prospectus. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information about us and this offering. Because it is a summary, it does not contain all of the information that you should consider before investing. Before investing in our securities, you should read this entire prospectus supplement and the accompanying prospectus carefully, including the “Risk Factors,” and the financial statements and accompanying notes and other information incorporated by reference in this prospectus supplement and the accompanying prospectus.

Overview

Smith Micro provides software solutions that simplify and enhance the mobile experience to some of the leading wireless service providers around the globe. From enabling the Digital Family Lifestyle™ to providing powerful voice messaging capabilities, we strive to enrich today’s connected lifestyles while creating new opportunities to engage consumers via smartphones and consumer Internet of Things (“IoT”) devices. Our portfolio includes family safety software solutions to support families in the digital age and a wide range of products for creating, sharing, and monetizing rich content, such as visual voice messaging, retail content display optimization and performance analytics on any product set.

We continue to innovate and evolve our business to respond to industry trends and maximize opportunities in growing and evolving markets, such as digital lifestyle services and online safety, “Big Data” analytics, automotive telematics, and the consumer IoT marketplace. The key to our longevity, however, is not simply technological innovation, but our focus on understanding our customers’ needs and delivering value.

Historically we have provided white label Family Safety applications to all three Tier 1 wireless carriers in the United States; however, our Family Safety contract with one of our U.S. Tier 1 customers terminated effective June 30, 2023, with post-termination services ending in November 2023. The revenues associated with that customer contract constituted approximately 36% of our total revenues for 2023. In 2024, we expect no further revenues related to that contract. To address the impact of the contract termination, starting in the first quarter of 2023, we undertook restructuring efforts that resulted in the elimination of approximately 26% of the Company's global workforce. These actions, coupled with other cost reduction measures taken, resulted in a 26% reduction in operating expenses in 2023 as compared to 2022.

Despite that contract termination, we continue to believe that we remain strategically positioned to offer our market-leading family safety platform to most U.S. mobile subscribers. Since our acquisitions of Circle Media Labs, Inc.'s (“Circle”) operator business in 2020 and the Family Safety Mobile Business from Avast plc (“Avast”) in April 2021, we have been focused on migrating those customers from the acquired software platforms to our flagship SafePath® platform, with the first such migration being completed during the first quarter of 2022 at one of our U.S. Tier 1 carrier customers. Another U.S. Tier 1 carrier customer was successfully launched on the SafePath platform during the third quarter of 2023. We believe that with these transitions to the SafePath platform now complete, we have an opportunity to increase the respective subscriber bases, and in turn, grow the revenues associated with the U.S. Tier 1 carriers. Further, we executed a new, multi-year Family Safety agreement with a major Tier 1 carrier in Europe in the fourth quarter of 2023, which is anticipated to launch in 2024, and in March 2024, we signed a new agreement with a U.S.-based mobile operator for deployment of our SafePath Global solution to its subscribers.

Business Segment

We currently have one reportable operating segment: Wireless.

The wireless industry continues to undergo rapid change on all fronts as connected devices, mobile applications, and digital content are consumed by users who want information, high-speed wireless connectivity and entertainment, anytime, anywhere. While most of us think about being “connected” in terms of computers, tablets and smartphones, the consumer IoT market is creating a world where almost anything can be connected to the wireless Internet. Wearable devices such as smartwatches, fitness trackers, pet trackers and GPS locators, as well as smart home devices, are now commonplace, enabling people, pets, and things to be connected to the “Internet of Everything.” These devices have created an entire ecosystem of over-the-top (“OTT”) apps that provide products

over the Internet to bypass traditional distribution methods, while expanding how communication service providers can provide value to mobile consumers.

Although there are numerous business opportunities associated with pervasive connectivity, there are also numerous challenges, including:

•The average age by which most children use smartphones and other connected devices continues to decrease. As such, parents and guardians must be proactive in managing and combating digital lifestyle issues such as excessive screen time, cyberbullying, and online safety;

•As IoT use cases continue to proliferate and scale, management complexity, security and interoperability must be addressed efficiently and correctly;

•Mobile network operators (“MNO”) are being marginalized by messaging applications, and face growing competitive pressure from cable multiple system operators (“MSO”) and others deploying Wi-Fi networks to attract mobile users;

•Enterprises face increasing pressure to mobilize workforces, operations, and customer engagement, but lack the expertise and technologies needed to leverage mobile technology securely and cost-effectively;

•The ubiquity and convenience of e-commerce has created the need for consumer-facing brands to reimagine brick-and-mortar retail experiences; and

•The change in dynamics of work, school and home life has led to an increased use of mobile devices for work, education and entertainment which has given rise to a new set of challenges and issues.

Products

To address these challenges, Smith Micro offers the following solutions:

SafePath® – Comprised of SafePath Family™, SafePath IoT™, SafePath Home™, SafePath Premium™, SafePath Drive™, SafePath OS™ and SafePath Global™, the SafePath product suite provides comprehensive and easy-to-use tools to protect family digital lifestyles and manage connected devices both inside and outside the home. As a carrier-grade, white-label platform, SafePath empowers MNO and cable operators to bring to market full-featured, on-brand family safety solutions that provide in-demand services to mobile subscribers. These solutions include location tracking, parental controls, driver safety functionality, and enhanced AI/machine learning to optimize and customize families' online experience, provide cyberbullying protection, social media intelligence, and public safety notifications for parents or guardians. Delivered to end-users as value-added services, SafePath-based solutions activate new revenue streams for MNOs while helping to increase brand affinity and reduce subscriber churn. In 2024, we plan to deploy and launch (i) SafePath Global™, a new deployment and launch model that will allow MNOs to rapidly deliver SafePath to their users with faster time-to-market, minimal reliance on MNO's resources, and easy customer onboarding, (ii) SafePath OS™, a software-only solution designed to be pre-installed and configured on mobile devices to enable MNOs to offer a kids phone with the features and protections of our SafePath digital family software solution out of the box and (iii) SafePath Premium™, an upgrade to our SafePath Family™ offering that expands the product’s online protection and digital parenting tools.

ViewSpot® – Our retail display management platform provides wireless carriers and retailers with a way to bring powerful on-screen, interactive demos to life. These engaging in-store demo experiences deliver consistent, secure, and targeted content that can be centrally managed and updated via ViewSpot Studio. With the feature set provided by the ViewSpot platform, wireless carriers and other smartphone retailers can easily customize and optimize the content loops displayed on demo devices so that it resonates with in-store shoppers. Interactive demos created in ViewSpot can be experienced on Android smart devices. We continue to develop and expand functionality of our ViewSpot solution in order to enhance the utility and usability of ViewSpot as well as giving MNOs greater control and autonomy over their content with ViewSpot Studio improvements.

CommSuite® – The CommSuite premium messaging platform helps mobile service providers deliver a next-generation voicemail experience to mobile subscribers, while monetizing a legacy cost-center. CommSuite Visual

Voicemail (“VVM”) and Premium Visual Voicemail (“PVVM”) quickly and easily allows users to manage voice messages just like email or SMS with reply, forwarding and social sharing options. CommSuite also enables multi-language Voice-to-Text (“VTT”) transcription messaging, which facilitates convenient message consumption for users by reading versus listening. The CommSuite platform is available to both postpaid premium subscribers as well as prepaid subscribers and is installed on millions of Android handsets in the United States.

Marketing and Sales Strategy

Because of our broad product portfolio, deep integration and product development experience and flexible business models we can quickly bring to market innovative solutions that support our customers’ needs, which creates new revenue opportunities and differentiates their products and services from their competitors.

Our marketing and sales strategy is as follows:

Leverage Operator Relationships. We continue to capitalize on our strong relationships with the world’s leading MNOs and MSOs. These customers serve as our primary distribution channel, providing access to hundreds of millions of end-users around the world.

Focus on High-Growth Markets. We continue to focus on providing digital lifestyle solutions, analytics/Big Data solutions, premium messaging services, and visual retail content management solutions.

Expand our Customer Base. In addition to growing our business with current customers, we look to add new MNO and MSO customers worldwide, as well as to expand into new partnerships as we extend the reach of our product platforms within the connected lifestyle ecosystem.

Key Revenue Contributors

In our business, we market and sell our products primarily to large MNOs and MSOs, so there are a limited number of actual and potential customers for our current products, resulting in significant customer concentration. With the launch of SafePath Global, we plan to expand our customer reach more easily to smaller MNOs and MSOs.

As noted above, one of the Company's U.S. Tier 1 carrier customers terminated its family safety contract with Smith Micro, effective June 30, 2023, and elected to continue to receive services under the contract for a transitional period through November 30, 2023. The revenues associated with that customer contract were approximately 36% of our total revenues for 2023. We do not anticipate any further revenue from this contract in 2024.

Customer Service and Technical Support

We provide technical support and customer service through our online knowledge base, email, and live chat. Our operator customers generally provide their own primary customer support functions and rely on us for support to their technical support personnel.

Product Development

The software industry, particularly the wireless market, is characterized by rapid and frequent changes in technology and user needs. We work closely with industry groups and customers, both current and potential, to help us anticipate changes in technology and determine future customer needs. Software functionality depends upon the capabilities of the related hardware. Accordingly, we maintain engineering relationships with various hardware manufacturers, and we develop our software in tandem with their product development. Our engineering relationships with manufacturers, as well as with our major customers, are central to our product development efforts. We remain focused on the development and expansion of our technology, particularly in the wireless space.

Competition

The markets in which we operate are highly competitive and subject to rapid changes in technology. These conditions create new opportunities for Smith Micro, as well as for our competitors, and we expect new competitors

to continue to enter the market. We not only compete with other software vendors for new customer contracts, in an increasingly competitive and fast-moving market we also compete to acquire technology and qualified personnel.

We believe that the principal competitive factors affecting the mobile software market include domain expertise, product features, usability, quality, price, customer service, speed to market and effective sales and marketing efforts. Although we believe that our products currently compete favorably with respect to these factors, there can be no assurance that we can maintain our competitive position against current and potential competitors. We also believe that the market for our software products has been and will continue to be characterized by significant price competition. A material reduction in the price we obtain for our products would negatively affect our profitability.

Many of our existing and potential customers have the resources to develop products internally that would compete directly with our product offerings. As such, these customers may opt to discontinue the purchase of our products in the future. Our future performance is therefore substantially dependent upon the extent to which existing customers elect to purchase software from us rather than designing and developing their own software.

Proprietary Rights and Licenses

We protect our intellectual property through a combination of patents, copyrights, trademarks, trade secrets, intellectual property laws, confidentiality procedures and contractual provisions. We have United States and foreign patents and pending patent applications that relate to various aspects of our products and technology. We have also registered, and applied for the registration of, U.S. and international trademarks, service marks, domain names, and copyrights. We will continue to apply for such protections in the future as we deem necessary to protect our intellectual property. We seek to avoid unauthorized use and disclosure of our proprietary intellectual property by requiring employees and third parties with access to our proprietary information to execute confidentiality agreements with us and by restricting access to our source code.

Our customers license our products and/or access our offerings pursuant to written agreements. Our customer agreements contain restrictions on reverse engineering, duplication, disclosure, and transfer of licensed software, and restrictions on access and use of software as a service (“SaaS”).

Despite our efforts to protect our proprietary technology and our intellectual property rights, unauthorized parties may attempt to copy or obtain and use our technology to develop products and technology with the same functionality as our products and technology. Policing unauthorized use of our technology and intellectual property rights is difficult, and we may not be able to detect unauthorized use of our intellectual property rights or take effective steps to enforce our intellectual property rights.

Human Capital Resources

As of March 31, 2024, we had a total of 226 employees within the following departments: 148 in engineering and operations, 48 in sales and marketing, and 30 in management and administration. We are not subject to any collective bargaining agreement, and we believe that our relationships with our employees are good. We believe that our strength and competitive advantage is our people. We value the skills, strengths, and perspectives of our diverse team and foster a participatory workplace that enables people to get involved in making decisions. The Company provides various training and development opportunities to foster an environment in which employees are encouraged to be creative thinkers who are driven, focused, and interested and able to advance their knowledge and skills in ever-changing technology.

Recent Developments

Reverse Stock Split

On April 3, 2024, our stockholders and special committee of the Board of Directors approved a 1-for-8 reverse stock split of our outstanding shares of common stock, which became effective as of 11:59 pm Eastern time on April 10, 2024 (the “Reverse Stock Split”). As a result of the Reverse Stock Split, every eight (8) shares of common stock, whether issued and outstanding or held by the Company as treasury stock, were automatically combined into one (1)

issued and outstanding share of common stock. No fractional shares were issued in connection with the Reverse Stock Split. Rather, each fractional share of common stock that would have otherwise been issued as a result of the Reverse Stock Split was rounded up to the nearest whole share of common stock. All equity awards outstanding and common stock reserved for issuance under the Company’s equity incentive plans, employee stock purchase plan and warrants outstanding immediately prior to the Reverse Stock Split were appropriately adjusted by dividing the number of affected shares of common stock by eight (8) and, as applicable, multiplying the exercise price by eight (8), as a result of the Reverse Stock Split.

All share and per share numbers, option numbers, warrant numbers, and other derivative security numbers and exercise prices appearing in this prospectus supplement (but not the base prospectus) have been adjusted to give effect to the Reverse Stock Split in this filing, however, the base prospectus and the Company’s annual, periodic and current reports, and all other information and documents incorporated by reference into this prospectus supplement and the accompanying prospectus that were filed prior to April 11, 2024, do not give effect to the Reverse Stock Split.

Corporate Information

The Company was incorporated in California in November 1983 and reincorporated in Delaware in June 1995. Our principal executive offices are located at 5800 Corporate Drive, Pittsburgh, Pennsylvania 15237 and our telephone number is (412) 837-5300. Our website address is www.smithmicro.com, and we make our filings with the U.S. Securities and Exchange Commission (the “SEC”) available on the Investor Relations page of our website. Our common stock is traded on the Nasdaq Capital Market under the symbol “SMSI.”

THE OFFERING

| | | | | | | | |

Common Stock offered | | 1,065,000 shares of common stock |

| | |

Pre-Funded Warrants | | We are offering Pre-Funded Warrants to purchase up to 845,000 shares of Common Stock to the investors because the investors’ purchase of shares of Common Stock in this offering could otherwise result in the investors, together with its affiliates and certain related parties, beneficially owning more than 9.99% of our outstanding Common Stock immediately following consummation of this offering. Each Pre-Funded Warrant will be exercisable for one share of our Common Stock. The purchase price of each Pre-Funded Warrant is $2.149, which is equal to the price per share at which the shares of Common Stock are being sold, minus $0.001, the exercise price of each Pre-Funded Warrant. The Pre-Funded Warrants will be immediately exercisable at a nominal exercise price of $0.001 per Pre-Funded Warrant Share (as defined herein) and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. There is no established trading market for the Pre-Funded Warrants, and we do not expect a market to develop. We do not intend to apply for a listing for the Pre-Funded Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited. |

| | |

Common Stock offering price | | $2.15 per share of common stock |

| | |

Common stock outstanding immediately after this offering | | 10,666,582 Shares, assuming no exercise of the Warrants issued in the concurrent private placement, Pre-Funded Warrants and otherwise based on the assumptions noted below |

| | |

Concurrent private placement | | Concurrent with this offering of common stock we will be issuing to the investors participating in this offering unregistered warrants. Each share of our common stock is being sold together with a Warrant to purchase one share of our common stock. Each Warrant will have an exercise price of $2.34 per share, will become exercisable following the six month anniversary of the closing of this offering and will expire on the five and one half year anniversary of the Warrant’s issuance date. The Warrants and the Warrant Shares issuable upon the exercise of the Warrants are not being offered pursuant to this prospectus supplement and the base prospectus. The Warrants are being offered pursuant to the exemption provided in Section 4(a)(2) of the Securities Act and Rule 506(b) promulgated thereunder, and will not be listed for trading on any national securities exchange. |

| | |

Use of proceeds | | We estimate that the net proceeds to us from this offering, after deducting the estimated placement agent fees and estimated offering expenses payable by us, will be approximately $3.5 million. We will receive additional proceeds from the Warrants to the extent such Warrants are exercised for cash once exercisable. We intend to use the net proceeds from this for general corporate purposes and working capital purposes. See “Use of Proceeds.” |

| | |

| Risk factors | | Investing in our securities involves significant risks. See “Risk Factors” on page S-11 of this prospectus supplement, on page 3 of the accompanying prospectus and under similar headings in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus for a discussion of the factors you should carefully consider before deciding to invest in our securities. |

| | |

| | | | | | | | |

Nasdaq symbol | | Our shares of common stock are traded on the Nasdaq Capital Market under the symbol “SMSI”. |

| | |

Transfer Agent | | Computershare Trust Company, N.A. |

The number of shares of common stock to be outstanding immediately after this offering is based on 9,601,582 shares of our common stock issued and outstanding as of May 9, 2024, and exclude the following, all as of May 9, 2024:

•9,932 shares of our common stock related to stock options issuable upon exercise, with a weighted-average exercise price of $26.49 per share;

•421,361 shares of our common stock issuable upon the exercise of outstanding warrants with exercise prices ranging from $2.06 to $26.80 per share; and

•up to an aggregate of 99,171 shares of our common stock reserved for future grant or issuance under our 2015 Omnibus Equity Incentive Plan (the “2015 Plan”), and our Employee Stock Purchase Plan (the “ESPP”).

Unless otherwise indicated, all information contained in this prospectus supplement reflects the Reverse Stock Split and assumes no exercise of the Warrants issued in the concurrent private placement, no exercise of the placement agent warrants and no exercise of the outstanding options or warrants described above.

RISK FACTORS

Before deciding to invest in our securities, you should consider carefully the following discussion of risks and uncertainties affecting us and our securities, as well as the risks and uncertainties incorporated by reference in this prospectus supplement and the accompanying prospectus from our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the SEC on February 26, 2024, our subsequent periodic reports and the other information contained or incorporated by reference in this prospectus supplement. If any of the events anticipated by these risks and uncertainties occur, our business, financial condition and results of operations could be materially and adversely affected, and the value of our common stock could decline. The risks and uncertainties we discuss in this prospectus supplement and the accompanying prospectus and in the documents incorporated by reference herein and therein are those that we currently believe may materially affect our company. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may materially and adversely affect our business, financial condition and results of operations.

Risks Related To This Offering

Management will have broad discretion in how we use the proceeds from this offering.

Our management will have broad discretion with respect to the use of proceeds of this offering, including for any of the purposes described in the section of this prospectus supplement entitled “Use of Proceeds.” You will be relying on the judgment of our management regarding the application of the proceeds of this offering, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used in ways you would agree with. The results and effectiveness of the use of proceeds are uncertain, and we could spend the proceeds in ways that you do not agree with or that do not improve our results of operations or enhance the value of our common stock. Our failure to apply these funds effectively could harm our business and cause the price of our common stock to decline.

If the price of our common stock fluctuates significantly, your investment could lose value.

Although our common stock is listed on the Nasdaq Capital Market, we cannot assure you that an active public market will continue for our common stock. If an active public market for our common stock does not continue, the trading price and liquidity of our common stock will be materially and adversely affected. If there is a thin trading market or “float” for our stock, the market price for our common stock may fluctuate significantly more than the stock market as a whole. Without a large float, our common stock would be less liquid than the stock of companies with broader public ownership and, as a result, the trading prices of our common stock may be more volatile. In addition, in the absence of an active public trading market, investors may be unable to liquidate their investment in us.

Furthermore, the stock market is subject to significant price and volume fluctuations, and the price of our common stock could fluctuate widely in response to several factors, including:

•our quarterly or annual operating results;

•changes in our earnings estimates;

•investment recommendations by securities analysts following our business or our industry;

•additions or departures of key personnel;

•success of competitors;

•changes in the business, earnings estimates or market perceptions of our competitors;

•our failure to achieve operating results consistent with securities analysts’ projections;

•changes in industry, general market or economic conditions; and

•announcements of legislative or regulatory changes.

Broad market and industry factors may materially harm the market price of our securities irrespective of our operating performance. The stock market in general, and Nasdaq in particular, has experienced price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of the particular companies affected. The trading prices and valuations of these stocks, and of our common stock, may not be predictable.

A loss of investor confidence in the market for our stock or the stocks of other companies which investors perceive to be similar to us could depress our stock price regardless of our business, prospects, financial condition or results of operations. A decline in the market price of our common stock also could adversely affect our ability to issue additional securities and our ability to obtain additional financing in the future.

The stock market has experienced extreme price and volume fluctuations in recent years that have significantly affected the quoted prices of the securities of many companies, including companies in our industry. The changes often appear to occur without regard to specific operating performance. The price of our common stock could fluctuate based upon factors that have little or nothing to do with our company and these fluctuations could materially reduce our stock price.

We do not anticipate paying dividends in the foreseeable future.

We do not currently pay dividends and do not anticipate paying any dividends for the foreseeable future. Any future determination to pay dividends will be made at the discretion of our board of directors, subject to compliance with applicable laws and covenants under any future credit facility, which may restrict or limit our ability to pay dividends. Payment of dividends will depend on our financial condition, operating results, capital requirements, general business conditions and other factors that our board of directors may deem relevant at that time. Unless and until we declare and pay dividends, any return on your investment will only occur if our share price appreciates.

If you purchase our securities in this offering, you may incur immediate and substantial dilution in the book value of your shares of common stock.

You may suffer immediate and substantial dilution in the net tangible book value of the common stock you purchase in this offering. Based on an offering price of $2.15 per share, we estimate our as adjusted net tangible book value per share of common stock after this offering will be $0.88. As a result, purchasers of common stock in this offering will experience an immediate decrease of $1.27 per share in net tangible book value of our common stock. See the section of this prospectus titled “Dilution” for a more detailed description of these factors.

Except as otherwise provided in the Pre-Funded Warrants, holders of Pre-Funded Warrants issued in this offering will have no rights as shareholders of our shares of Common Stock until such holders exercise their Pre-Funded Warrants.

The Pre-Funded Warrants offered in this offering do not confer any rights of Common Stock ownership on their holders, such as voting rights, but rather merely represent the right to acquire a Common Stock at a fixed price. Specifically, a holder of a Pre-Funded Warrant may exercise the right to acquire a Common Stock and pay a nominal exercise price of $0.001 at any time. Upon exercise of the Pre-Funded Warrants, the holders thereof will be entitled to exercise the rights of a holder of shares of Common Stock only as to matters for which the record date occurs after the exercise date.

There is no public market for the Pre-Funded Warrants being offered in this offering.

There is no public trading market for the Pre-Funded Warrants being offered in this offering and we do not expect a market to develop for either. In addition, we do not intend to list the Pre-Funded Warrants on the Nasdaq Capital Market or any other national securities exchange or nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited.

Our Reverse Stock Split may decrease the liquidity of the shares of our common stock.

Effective as of 11:59 pm on April 10, 2024, we effected the Reverse Stock Split on a one-for-eight basis to regain compliance with Nasdaq’s minimum bid price requirement prior to the offering described in this prospectus.

The liquidity of the shares of our common stock may be affected adversely by the Reverse Stock Split given the reduced number of shares that are outstanding following the Reverse Stock Split. In addition, the Reverse Stock Split increased the number of stockholders who own odd lots (less than 100 shares) of our common stock, creating the potential for such stockholders to experience an increase in the cost of selling their shares and greater difficulty effecting such sales.

Following a reverse stock split, the resulting market price of our common stock may not attract new investors, including institutional investors, and may not satisfy the investing requirements of those investors. Consequently, the trading liquidity of our common stock may not improve.

Although we believe that a higher market price of our common stock may help generate greater or broader investor interest, there can be no assurance that a reverse stock split, including the Reverse Stock Split, will result in a share price that will attract new investors, including institutional investors. In addition, there can be no assurance that the market price of our common stock will satisfy the investing requirements of those investors. As a result, the trading liquidity of our common stock may not necessarily improve.

If securities or industry analysts do not publish research or reports, or if they publish negative, adverse, or misleading research or reports, regarding us, our business or our market, our common stock price and trading volume could decline.

The trading market for our common stock is influenced by the research and reports that securities or industry analysts publish about us, our business, or our market. We do not currently have a significant number of firms providing research coverage on the Company, and may never obtain significant research coverage by securities or industry analysts. If no or few securities or industry analysts provide coverage of us, our common stock price could be negatively impacted. In the event we obtain significant securities or industry analyst coverage and such coverage is negative, or adverse or misleading regarding us, our business model, our intellectual property, our stock performance or our market, or if our operating results fail to meet the expectations of analysts, our common stock price would likely decline. If one or more of these analysts cease coverage of us or fail to publish reports on us regularly, we could lose visibility in the financial markets, which in turn could cause our common stock price or trading volume to decline.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our securities.

In 2020, the SEC implemented Regulation Best Interest requiring that “A broker, dealer, or a natural person who is an associated person of a broker or dealer, when making a recommendation of any securities transaction or investment strategy involving securities (including account recommendations) to a retail customer, shall act in the best interest of the retail customer at the time the recommendation is made, without placing the financial or other interest of the broker, dealer, or natural person who is an associated person of a broker or dealer making the recommendation ahead of the interest of the retail customer.” This is a significantly higher standard for broker-dealers to recommend securities to retail customers than before under prior FINRA suitability rules. FINRA suitability rules do still apply to institutional investors and require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending securities to their customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information, and, for retail customers, determine that the investment is in the customer’s “best interest,” and meet other SEC requirements. Both SEC Regulation Best Interest and FINRA’s suitability requirements may make it more difficult for broker-dealers to recommend that their customers buy speculative, low-priced securities. They may affect investing in our common stock, which may have the effect of reducing the level of trading activity in our securities. As a result, fewer broker-dealers may be willing to make a market in common stock, reducing a stockholder’s ability to resell shares of our common stock.

Our charter documents, Delaware law, and our commercial contracts may contain provisions that may discourage an acquisition of us by others and may prevent attempts by our stockholders to replace or remove our current management.

Provisions in our charter documents, as well as provisions of the Delaware General Corporation Law (“DGCL”), could have an impact on the trading price of our common stock by making it more difficult for a third party to acquire us at a price favorable to our shareholders. For example, our charter documents include provisions: classifying our board of directors such that only approximately one-third of the directors are elected each year; prohibiting the use of cumulative voting for the election of directors; authorizing the issuance of “blank check” preferred stock, the terms of which may be established and shares of which may be issued by our board of directors without stockholder approval to defend against a takeover attempt; and establishing advance notice requirements for nominations for election to our Board of Directors or for proposing matters that can be acted upon at stockholder meetings.

In addition, these provisions may frustrate or prevent any attempts by our stockholders to replace or remove our board of directors or current management. We are subject to Section 203 of the DGCL, which generally prohibits a Delaware corporation from engaging in any of a broad range of business combinations with an interested stockholder for a period of three years following the date on which the stockholder became an interested stockholder, unless such transactions are approved by our board of directors. This provision could have the effect of delaying or preventing a change of control, whether or not it is desired by or beneficial to our stockholders, which could also affect the price that some investors are willing to pay for our common stock.

Finally, commercial contracts that we enter into with our vendors and customers in the course of our business operations may contain provisions with respect to changes in control that could provide for termination rights or otherwise have a negative impact on our business or results of operations if a stockholder were to acquire a significant percentage of our outstanding stock.

The issuance of additional stock in connection with acquisitions or otherwise will dilute all other stockholdings.

We are not restricted from issuing additional shares of our common stock, or from issuing securities that are convertible into or exchangeable for, or that represent the right to receive, common stock. As of May 9, 2024, we had an aggregate of 100.0 million shares of common stock authorized and of that approximately 89.7 million shares that are not issued, outstanding or reserved for issuance (for purposes of warrant exercise or under the Company’s current 2015 Plan). We may issue all of these shares without any action or approval by our stockholders. We may expand our business through complementary or strategic business combinations or acquisitions of other companies and assets, and we may issue shares of common stock in connection with those transactions. The market price of our common stock could decline as a result of our issuance of a large number of shares of common stock, particularly if the per share consideration we receive for the stock we issue is less than the per share book value of our common stock or if we are not expected to be able to generate earnings with the proceeds of the issuance that are as great as the earnings per share we are generating before we issue the additional shares. In addition, any shares issued in connection with these activities, the exercise of warrants or stock options or otherwise would dilute the percentage ownership held by our investors. We cannot predict the size of future issuances or the effect, if any, that they may have on the market price of our common stock.

We have a history of losses, may not be able to achieve profitability going forward, and may not be able to raise additional capital necessary to continue as a going concern.

We have experienced losses since 2021 and, at December 31, 2023 and 2022, had an accumulated deficit of approximately $305.9 million and $281.6 million, respectively. We may incur additional losses in the future.

As of March 31, 2024, we had cash and cash equivalents of $6.2 million. There are no assurances that we will be able to raise additional capital or on terms favorable to us. Our recurring losses from operations and projected future cash flow requirements raise substantial doubt about our ability to continue as a going concern without sufficient capital resources and we have included explanatory information in the notes to our financial statements for the year ended December 31, 2023, with respect to this uncertainty, and the report of our independent registered public accounting firm dated February 26, 2024 with respect to our audited financial statements for the year ended

December 31, 2023 included an emphasis of matter for this as well. Our consolidated financial statements do not include any adjustments that might result from the outcome of this going concern uncertainty and have been prepared under the assumption that we will continue to operate as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

Our ability to continue as a going concern is dependent on our available cash, how well we manage that cash, and our operating requirements. If we are unable to raise additional capital when needed, we could be forced to curtail operations or take other actions such as, implementing additional restructuring and cost reductions, disposing of one or more product lines and/or, selling or licensing intellectual property. If we are unable to continue as a going concern, we may be forced to liquidate our assets, which would have an adverse impact on our business and developmental activities. In such a scenario, the values we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our financial statements.

USE OF PROCEEDS

We expect that the net proceeds to us from this offering will be approximately $3.5 million, but excluding the proceeds, if any, received from the exercise of Warrants issued in the concurrent private placement. We expect to use the net proceeds of the common stock offered by us in this offering for general corporate purposes and working capital. We may temporarily invest the net proceeds in short-term, interest-bearing instruments or other investment-grade securities. We have not determined the amount of net proceeds to be used specifically for such purposes. As a result, management will retain broad discretion over the allocation of net proceeds.

DIVIDEND POLICY

We currently intend to retain any future earnings and do not anticipate paying cash dividends in the foreseeable future. Any future determination to pay cash dividends will be at the discretion of our board of directors and will depend upon our financial condition, operating results, capital requirements, any contractual restrictions and such other factors as our board of directors may deem appropriate.

DILUTION

If you purchase shares of our common stock in this offering, your ownership interest will be immediately diluted to the extent of the difference between the offering price per share and the net tangible book value per share of our common stock immediately after this offering. Net tangible book value per share is total tangible assets less total liabilities divided by the number of shares of common stock outstanding as of March 31, 2024.

Our historical net tangible book value as of March 31, 2024, was approximately $6.7 million, or $0.70 per share, based on 9,601,504 shares of our common stock outstanding as of that date.

After giving effect to the sale of 1.9 million shares of common stock (including the 845,000 Pre-Funded Warrant Shares) by us and after deducting the estimated fees and estimated offering expenses payable by us, our as adjusted net tangible book value as of March 31, 2024, would have been $10.7 million, or $0.88 per share. This represents an immediate increase in net tangible book value of $0.18 per share to existing stockholders and immediate dilution of $1.27 per share to the investors in this offering, as illustrated by the following table (which assumes no exercise of the Warrants in connection with the concurrent private placement):

| | | | | | | | | | | |

Offering price per share | | | $2.15 |

Net tangible book value per share as of March 31, 2024 | $0.70 | | |

Pro forma increase in net tangible book value per share attributable to investors participating in this offering | $0.18 | | |

As adjusted net tangible book value per share after giving effect to this offering | | | $0.88 |

Dilution per share to the investors participating in this offering | | | $1.27 |

The number of shares of common stock to be outstanding immediately after this offering is based on 9,601,504 shares of our common stock issued and outstanding as of March 31, 2024, and excludes the following, all as of March 31, 2024:

•9,984 shares of our common stock related to stock options issuable upon exercise, with a weighted-average exercise price of $26.43 per share;

•421,361 shares of our common stock issuable upon the exercise of outstanding warrants with exercise prices ranging from $2.06 to $26.80 per share; and

•up to an aggregate of 99,171 shares of our common stock reserved for future grant or issuance under our 2015 Plan.

Unless otherwise indicated, all information contained in this prospectus supplement reflects the Reverse Stock Split and assumes no exercise of the Warrants, no exercise of the placement agent warrants and no exercise of the outstanding options or warrants described above.

To the extent the Warrants issued in the concurrent offering are exercised or any options or warrants are exercised, new options, restricted stock awards, restricted stock units or performance stock units are issued under our equity incentive plans, shares are purchased pursuant to our employee stock purchase plan, or we otherwise issue additional shares of common stock in the future, there will be further dilution to new investors. In addition, we may choose to raise additional capital due to market conditions or strategic considerations, even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or debt securities, the issuance of these securities could result in further dilution to our stockholders.

DESCRIPTION OF SECURITIES WE ARE OFFERING

The securities we are offering consist of shares of our common stock.

Common Stock

The material terms and provisions of our common stock and each other class of our securities which qualifies or limits our common stock are described in the section entitled “Capital Stock” beginning on page 4 of the accompanying prospectus and the Description of Securities included as Exhibit 4.1 to our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission on February 26, 2024. Pre-Funded Warrant

The following summary of certain terms and provisions of the Pre-Funded Warrants that are being offered hereby is not complete and is subject to, and qualified in its entirety by, the provisions of the Pre-Funded Warrant, the form of which will be filed as an exhibit to a Current Report on Form 8-K. Prospective investors should carefully review the terms and provisions of the securities purchase agreement and the form of Pre-Funded Warrant for a complete description of the terms and conditions of the Pre-Funded Warrants.

Each Pre-Funded Warrant will be sold in this offering at a purchase price equal to $2.149 (equal to the purchase price per share of common stock, minus $0.001). Because the purchaser’s purchase of shares of common stock in this offering could otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 9.99% of our outstanding common stock immediately following consummation of this offering, we are offering to the purchaser pre-funded warrants to purchase up to 845,000 shares of common stock (the “Pre-Funded Warrants”) in lieu of shares of common stock pursuant to this prospectus supplement and accompanying prospectus. Each Pre-Funded Warrant will be exercisable for one share of our common stock

Duration, Exercise Price and Form

The Pre-Funded Warrants will have an exercise price of $0.001 per share. The Pre-Funded Warrants are exercisable immediately upon issuance, and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. The exercise price is subject to appropriate adjustment in the event of stock dividends, stock splits, reorganizations, or similar events affecting our common stock and the exercise price.

Exercisability

The Pre-Funded Warrants will be exercisable, at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice and, at any time a registration statement registering the issuance of the shares of common stock underlying the Pre-Funded Warrants under the Securities Act is effective and available for the issuance of such shares, or an exemption from registration under the Securities Act is available for the issuance of such shares, by payment in full in immediately available funds for the number of shares of common stock purchased upon such exercise. Generally, a holder will not have the right to exercise any portion of the Pre-Funded Warrant if the holder (together with its affiliates) would beneficially own in excess of 4.99% (or 9.99% upon the request of the holder) of the number of shares of common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Pre-Funded Warrants. However, any holder may increase or decrease such percentage, provided that any increase will not be effective until the 61st day after such election.

Cashless Exercise

The Pre-Funded Warrants may also be exercised, in whole or in part, by means of a cashless exercise, in which case the holder would receive upon such exercise the net number of shares of common stock determined according to the formula set forth in the Pre-Funded Warrant.

Fundamental Transactions

In the event of a fundamental transaction, as described in the Pre-Funded Warrants and generally including any reorganization, recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding common stock, or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding common stock, the holders of the Pre-Funded Warrants will be entitled to receive upon exercise of the Pre-Funded Warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the Pre-Funded Warrants immediately prior to such fundamental transaction.

Transferability

A Pre-Funded Warrant may be transferred at the option of the holder upon surrender of the Pre-Funded Warrants to us together with the appropriate instruments of transfer.

Fractional Shares

No fractional shares of common stock will be issued upon the exercise of the Pre-Funded Warrants. Rather, the number of shares of common stock to be issued will, at our election, either be rounded down to the nearest whole number or we will pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the exercise price.

Trading Market

There is no established trading market for the Pre-Funded Warrants, and we do not expect a market to develop. We do not intend to apply for a listing of the Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited. The common stock issuable upon exercise of the Pre-Funded Warrants is currently listed on the Nasdaq Capital Market.

Rights as a Stockholder

Except as otherwise provided in the Pre-Funded Warrants or by virtue of such holder’s ownership of our shares of common stock, the holder of a Pre-Funded Warrant does not have the rights or privileges of a holder of our common stock, including any voting rights, until the holder exercises the Pre-Funded Warrant.

Amendment and Waiver

The Pre-Funded Warrants may be modified or amended, or the provisions thereof waived with the written consent of the Company and the respective holder.

CONCURRENT PRIVATE PLACEMENT

Warrants

The following summary of certain terms and provisions of the Warrants that are being offered pursuant to a securities purchase agreement between the investors and the Company is not complete and is subject to, and qualified in its entirety by, the provisions of the Warrant, the form of which will be filed as an exhibit to our Current Report on Form 8-K. Prospective investors should carefully review the terms and provisions of the securities purchase agreement and the form of the Warrant for a complete description of the terms and conditions of the Warrants.

The Warrants and the Warrant Shares issuable upon the exercise of the Warrants are not being registered under the Securities Act, nor are they being offered pursuant to this prospectus supplement and accompanying prospectus. The Warrants and Warrant Shares are being offered pursuant to the exemption provided in Section 4(a)(2) of the Securities Act and Rule 506(b) promulgated thereunder.

Accordingly, the investors in the concurrent private placement may exercise the Warrants and sell the Warrant Shares issuable upon the exercise of such security only pursuant to an effective registration statement under the Securities Act covering the resale of those shares, an exemption under Rule 144 under the Securities Act or another applicable exemption under the Securities Act or, if and only if there is no effective registration statement registering the resale of the Warrant Shares, or no current prospectus available for such shares, the investors may exercise the Warrants by means of a “cashless exercise.”

Except as otherwise provided in the Warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of the Warrants do not have the rights or privileges of holders of our common stock, including any voting rights, until they exercise their Warrants, as applicable.

The Warrants are not and will not be listed for trading on any national securities exchange. As part of the concurrent private placement, we have agreed to register for resale the Warrant Shares issuable upon exercise of the Warrants sold in the concurrent private placement.

Duration, Exercise Price and Form

Each Warrant will have an exercise price equal to $2.34 per share, will become exercisable following the six-month anniversary of issuance and will expire five and one-half years from the date of issuance. The exercise price and number of shares of common stock issuable upon exercise is subject to appropriate adjustment in the event of stock dividends, stock splits, reorganizations or similar events affecting our common stock and the exercise price. The Warrants will be issued separately from the common stock and may be transferred separately immediately thereafter.

Exercisability

The Warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as discussed below). Generally, a holder (together with its affiliates) may not exercise any portion of such holder’s Warrants to the extent that the holder would own more

than 4.99% of the outstanding common stock (or at the election of a holder prior to the date of issuance, 9.99%) immediately after exercise, except that upon at least 61 days’ prior notice from the holder to us, the holder may increase the amount of ownership of outstanding stock after exercising the holder’s warrants up to 9.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the common warrants.

Fundamental Transactions

In the event of a fundamental transaction, as described in the Warrants and generally including any reorganization, recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding common stock, or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding common stock, the holders of the Warrants will be entitled to receive upon exercise of the common warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the Warrants immediately prior to such fundamental transaction. In addition, in certain circumstances, upon a fundamental transaction, the holder of a Warrant will have the right to require us to repurchase its Warrants at the Black-Scholes value; provided, however, that, if the fundamental transaction is not within our control, including not approved by our Board, then the holder will only be entitled to receive the same type or form of consideration (and in the same proportion), at the Black-Scholes value of the unexercised portion of the Warrant that is being offered and paid to the holders of our common stock in connection with the fundamental transaction.

Transferability

Subject to applicable laws, a Warrant may be transferred at the option of the holder upon surrender of the Warrants to us together with the appropriate instruments of transfer.

Fractional Shares

No fractional shares of common stock will be issued upon the exercise of the Warrants. Rather, the number of shares of common stock to be issued will, at our election, either be rounded down to the nearest whole number or we will pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the exercise price.

Trading Market

There is no established trading market for the Warrants, and we do not expect a market to develop. We do not intend to apply for a listing of the Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Warrants will be limited. The common stock issuable upon exercise of the Warrants is currently listed on the Nasdaq Capital Market.

Rights as a Stockholder

Except as otherwise provided in the Warrants or by virtue of such holder’s ownership of our shares of common stock, the holder of a Warrant does not have the rights or privileges of a holder of our common stock, including any voting rights, until the holder exercises the Warrant.

Waivers and Amendments

The Warrants may be modified or amended, or the provisions thereof waived with the written consent of the Company and the respective holder.

PLAN OF DISTRIBUTION

We have entered into a securities purchase agreement with certain institutional and accredited investors pursuant to which we have agreed to issue and sell directly to such investors, and such investors have agreed to purchase directly from us, an aggregate of 1,910,000 shares of common stock and Pre-Funded Warrants. The securities purchase agreement is included as an exhibit to a Current Report on Form 8-K that we will file with the SEC and that is incorporated by reference into the registration statement of which this prospectus supplement forms a part.