New Platform Enables Companies to Expand

Participation to Individual Investors in Public Offerings

SoFi Technologies, Inc. (NASDAQ: SOFI), a member-centric,

one-stop shop for digital financial services that helps members

borrow, save, spend, invest and protect their money, and PrimaryBid

Technologies Inc., a leading capital markets fintech firm, today

announced the launch of DSP2.0, an advanced Directed Share Platform

(DSP) that offers a modern and streamlined approach to equity

program management for companies looking to raise capital in the

U.S.

DSPs allow companies to allocate a portion of their share

offerings to specific individuals or groups such as employees or

customers. However, since these solutions often require manual

processing and don’t integrate well with other systems, they’re

expensive and time-intensive to operate and limit investor

participation to a select few.

With a potential rebound for the Initial Public Offering (IPO)

market in 2025, SoFi’s offering brings equity program management,

IPO, and follow-on offering processes into the digital age. It also

gives issuers enhanced flexibility in raising capital by enabling

them to involve non-institutional investor groups at scale.

SoFi’s DSP offers a cohesive investor experience, automations to

minimize manual back-office processing, and expanded integrations

with modern marketing analytics tools.

“For decades, companies have wanted to offer the opportunity to

participate in their IPOs to the employees, partners, customers,

and others who helped them grow,” said Anthony Noto, CEO of SoFi.

“Unfortunately, traditional DSPs often have high account minimum

requirements, carry significant costs to companies, and lack

benefits to underwriters, limiting their appeal. SoFi now offers

companies going public a turnkey, 100% digital way to offer IPO

shares to employees and other people who helped build their

business, and whomever else they want to direct the shares to,

whether it’s to 10 or 10,000 people. People can open an account

from a smartphone in seconds, transfer money seamlessly, and stay

informed throughout the IPO process – with no costs or deposit

requirements. At SoFi, we continue to provide Main Street investors

access to products like alternative investments and IPOs, which

have historically been reserved for high net worth individuals,

helping more of our members get their money right.”

“Companies want intelligent, targeted investor inclusion at IPO

to enfranchise those people who matter to their long-term success,”

said Anand Sambasivan, CEO of PrimaryBid. “Until now, they've

lacked tools to deliver this at scale with meaningful data, a

problem PrimaryBid is solving globally. This solution for the U.S.

market, combining SoFi and PrimaryBid's technologies, ensures

regulatory compliance while removing the administrative burden from

issuers and advisors when running a DSP. SoFi’s DSP2.0 lets

companies shape their offer around strategic needs, not technical

limitations.”

“It's vital to see innovation in the ways companies engage

stakeholders when going public, and the market will welcome new

technologies that modernize the IPO process as policymakers look to

broaden investor participation,” said John Tuttle, former Vice

Chairman for NYSE Group and expert on U.S. capital markets policy.

“These advancements can strengthen our public markets and support

the next generation of great American companies.”

For more information, please contact dsp@sofi.org.

About SoFi Technologies

SoFi (NASDAQ: SOFI) is a member-centric, one-stop shop for

digital financial services on a mission to help people achieve

financial independence to realize their ambitions. The company’s

full suite of financial products and services helps more than 8.8

million SoFi members borrow, save, spend, invest, and protect their

money better by giving them fast access to the tools they need to

get their money right, all in one app. SoFi also equips members

with the resources they need to get ahead – like credentialed

financial planners, exclusive experiences and events, and a

thriving community – on their path to financial independence.

SoFi innovates across three business segments: Lending,

Financial Services – which includes SoFi Checking and Savings, SoFi

Invest, SoFi Credit Card, SoFi Protect, and SoFi Insights – and

Technology Platform, which offers the only end-to-end vertically

integrated financial technology stack. SoFi Bank, N.A., an

affiliate of SoFi, is a nationally chartered bank, regulated by the

OCC and FDIC and SoFi is a bank holding company regulated by the

Federal Reserve. The company is also the naming rights partner of

SoFi Stadium, home of the Los Angeles Chargers and the Los Angeles

Rams. For more information, visit SoFi.com or download our iOS and

Android apps.

About PrimaryBid

PrimaryBid is a leading fintech firm. We build advanced retail

capital-raising solutions for regulated financial institutions,

enabling smart investor inclusion in public and private offerings

globally. Our SaaS platform facilitates efficient investor access

in IPOs, follow-ons, block sales, and corporate and government

bonds, and transforms retail investor participation into a

systematic and data-driven component of capital raising.

PrimaryBid has facilitated over 350 transactions for companies

ranging from large-cap to SMEs across the UK, EU and U.S. Our

technology ensures compliance while broadening access to regulated

markets, allowing companies to include their most committed

stakeholders in their capital journeys.

A partner to SoFi Technologies, London Stock Exchange Group and

Euronext, PrimaryBid is backed by leading financial institutions

and venture capital firms, including SoftBank, London Stock

Exchange Group, Fidelity, Molten Ventures, OMERS Ventures, Motive

Partners, Outward Ventures and Pentech.

Disclosures:

- Investing in an Initial Public Offering (IPO) involves

substantial risk, including the risk of loss. Further, there are a

variety of risk factors to consider when investing in an IPO,

including but not limited to, unproven management, significant

debt, and lack of operating history. For a comprehensive discussion

of these risks please refer to SoFi Securities’ IPO Risk Disclosure

Statement. This should not be considered a recommendation to

participate in IPOs and investors should carefully read the

offering prospectus to determine whether an offering is consistent

with their investment objectives, risk tolerance, and financial

situation. New offerings generally have high demand and there are a

limited number of shares available for distribution to

participants. Many customers may not be allocated shares and share

allocations may be significantly smaller than the shares requested

in the customer’s initial offer (Indication of Interest). For more

information on the allocation process please visit IPO Allocation.

This information should not be construed as a recommendation to

buy, sell, or hold any security, nor is a recommendation or

endorsement of any investment strategy.

- SoFi Invest refers to the two investment and trading platforms

operated by Social Finance, LLC and its affiliates (described

below). Individual customer accounts may be subject to the terms

applicable to one or more of the platforms below.

- 1) Automated Investing and advisory services are provided by

SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi

Wealth“). Brokerage services are provided to SoFi Wealth LLC by

SoFi Securities LLC.

- 2) Active Investing and brokerage services are provided by SoFi

Securities LLC, Member FINRA(www.finra.org)/SIPC(www.sipc.org).

Clearing and custody of all securities are provided by APEX

Clearing Corporation.

For additional disclosures related to the

SoFi Invest platforms described above, including state licensure of

SoFi Digital Assets, LLC, please visit SoFi.com/legal. Neither the

Investment Advisor Representatives of SoFi Wealth, nor the

Registered Representatives of SoFi Securities are compensated for

the sale of any product or service sold through any SoFi Invest

platform.

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY

LOSE VALUE

- PrimaryBid Technologies Inc (“PrimaryBid”) solely acts as a

communication services provider to broker-dealers in relation to

securities offerings. PrimaryBid is not itself a broker-dealer and

it does not itself effect securities offerings.

SOFI-F

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241002730071/en/

For SoFi: Meghan Brown | pr@sofi.org For PrimaryBid: Mike

Coombes | mike.coombes@primarybid.com

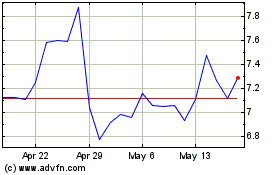

SoFi Technologies (NASDAQ:SOFI)

Historical Stock Chart

From Oct 2024 to Nov 2024

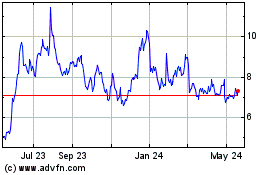

SoFi Technologies (NASDAQ:SOFI)

Historical Stock Chart

From Nov 2023 to Nov 2024