As

filed with the Securities and Exchange Commission on September 16, 2024.

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Sonim

Technologies, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

94-3336783 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

Number) |

4445

Eastgate Mall, Suite 200

San

Diego, CA 92121

Telephone:

(650) 378-8100

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Peter

Liu

Chief

Executive Officer

4445

Eastgate Mall, Suite 200

San

Diego, CA 92121

Telephone:

(650) 378-8100

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

William

N. Haddad, Esq.

Kirill

Y. Nikonov, Esq.

Venable

LLP

151

W. 42nd Street, 49th Floor

New

York, NY 10036

Telephone:

(212) 307-5500

Approximate

date of commencement of proposed sale to the public: From time to time after this registration statement is declared effective, subject

to the terms and conditions of the lock-up agreement described in this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-

accelerated filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

|

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may change. The Selling Stockholder may not sell these securities pursuant to this

registration statement until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus

is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale

is not permitted.

SUBJECT

TO COMPLETION, DATED SEPTEMBER 16, 2024

PROSPECTUS

Sonim

Technologies, Inc.

Up

to 700,000 Shares of Common Stock

Including

up to 350,000 Shares of Common Stock Issuable upon Exercise of Warrants

This

prospectus relates to the resale of up to an aggregate of 700,000 shares of our common stock, par value of $0.001 per share, which

consists of up to (i) 350,000 shares of our common stock (the “April 2024 Shares”) and (ii) 350,000

shares of our common stock issuable upon the exercise of certain common stock purchase warrants (the “Warrants”) with

a term of five (5) years and an exercise price of $11.00 per share (the “Warrant Shares” and, together with the

April 2024 Shares, the “Resale Shares”) by the selling stockholder named in this prospectus and his permitted transferees

(the “Selling Stockholder”). For information about the Selling Stockholder, see the section titled “Selling

Stockholder.”

We

are registering the offer and sale of the Resale Shares originally issued in a private placement pursuant to a registration rights agreement,

which we entered with the Selling Stockholder on April 29, 2024 (the “Registration Rights Agreement”). The Registration

Rights Agreement was contemplated by that certain subscription agreement between us and the Selling Stockholder entered on April 29,

2024 (the “Subscription Agreement”). Pursuant to the Subscription Agreement, we issued and sold the April 2024 Shares

and the Warrants, at a price of $11.00 per share of our common stock and the accompanying Warrant (as adjusted for our 1-for-10

reverse stock split effected on July 17, 2024, and based on an aggregate of 350,000 April 2024 Shares and 350,000 Warrants

originally sold for an aggregate purchase price of $3,850,000). We issued the April 2024 Shares and the Warrants in reliance upon

the exemption from the registration contained in Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities

Act”), and Regulation S promulgated thereunder. The entirety of the Resale Shares is subject to a lock-up agreement (the “Lock-Up

Agreement”) entered contemporaneously with the Subscription Agreement and may not be sold pursuant to this registration statement

before the expiration date of the applicable lockup period, October 26, 2024.

We

are not selling any shares of our common stock and will not receive any of the proceeds from the sale of the Resale Shares by the Selling

Stockholder, pursuant to this prospectus; however, we will receive the exercise price to purchase the Warrant Shares upon any cash exercise

of the Warrants by the Selling Stockholder. For information, see the section titled “Use of Proceeds .”

The

Resale Shares (assuming the exercise of the entirety of the Warrants and disregarding the beneficial ownership limitation of the Selling

Stockholder described in this prospectus) represent approximately 13% of the outstanding shares of our common stock as of August

5, 2024, and approximately 27% of our public float. Given the substantial number of shares of our common stock being registered

for potential resale by the Selling Stockholder pursuant to this prospectus and the prospectus filed as a part of the registration statement

dated December 1, 2023, in connection with a resale of our common stock by certain selling stockholders, the sale of shares of our common

stock, or the perception in the market that holders of a large number of shares intend to sell shares, could increase the volatility

of the market price of our common stock or result in a significant decline in the public trading price of our common stock. These sales,

or the possibility that these sales may occur, also might make it more difficult for us to sell equity securities in the future at a

time and at a price that we deem appropriate. For more information, see the risk factor titled “Sales of our common stock under

resale registration statements or the perception of such sales in the public market or otherwise could cause the market price for our

common stock to decline, even if our business is doing well” on page 23 of our Quarterly Report on Form 10-Q filed

with the SEC on August

9, 2024.

The

Selling Stockholder identified in this prospectus may offer the Resale Shares from time to time through public or private transactions

at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices

determined at the time of sale, or at negotiated prices. The registration of the Resale Shares on behalf of the Selling Stockholder,

however, does not necessarily mean that the Selling Stockholder will offer or sell the Resale Shares under this registration statement

at any time in the near future or at all. We cannot predict when, or in what amounts, the Selling Stockholder may sell any of the Resale

Shares. The timing and amount of any sale of the Resale Shares is within the sole discretion of the Selling Stockholder. We will pay

all expenses of registering the Resale Shares, including legal and accounting fees. All selling and other expenses incurred by the Selling

Stockholder will be borne by the Selling Stockholder. For additional information on the possible methods of sale that may be used by

the Selling Stockholder, see the section titled “Plan of Distribution.”

Investing

in our common stock involves a high degree of risk. You should carefully consider the risk factors beginning on

page 7 of this prospectus and under similar headings in the other documents that are incorporated by reference into this prospectus

before purchasing any of the Resale Shares offered by this prospectus.

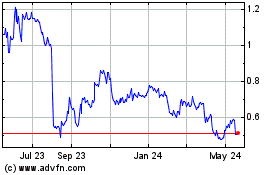

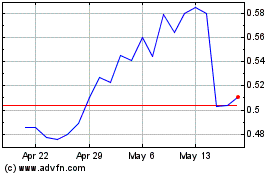

Our

common stock is traded on the Nasdaq Capital Market (“Nasdaq”), under the symbol “SONM.” The last reported

sale price of our common stock on Nasdaq on September 13, 2024, was $2.71 per share.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire

prospectus and any amendments or supplements carefully before you make your investment decision.

We are an “emerging

growth company” as defined in Section 2(a) of the Securities Act and a “smaller reporting company” as defined under

Rule 405 of the Securities Act, and, as such, are subject to certain reduced public company reporting requirements. See “Prospectus

Summary—Implications of Being an Emerging Growth Company and a Smaller Reporting Company”

on page 4 of this prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 under the Securities Act, that we filed with the Securities and Exchange

Commission (the “SEC”), using the “shelf” registration process. Under this shelf registration

process, the Selling Stockholder may offer and sell the shares of our common stock described in this prospectus in one or more

offerings. Any accompanying prospectus supplement or any related free writing prospectus may also add, update, or change information

contained in this prospectus or in any documents incorporated by reference into this prospectus. If the information varies between

this prospectus and the accompanying prospectus supplement, you should rely on the information in the accompanying prospectus

supplement. You should read this prospectus, any accompanying prospectus supplement, and any related free writing prospectus,

together with the information incorporated herein by reference as described under the headings “Where You

Can Find More Information” and “Incorporation by Reference” before

investing in the common stock offered hereby.

You

should rely only on the information contained in or incorporated by reference into this prospectus, any accompanying prospectus supplement,

and any applicable free writing prospectus. Neither we nor the Selling Stockholder have authorized anyone to provide you with different

information. We and the Selling Stockholder take no responsibility for, and can provide no assurance as to the reliability of, any other

information that others may give you. Neither we nor the Selling Stockholder are making an offer of these securities in any jurisdiction

where the offer is not permitted. You should not assume that the information contained in this prospectus, any prospectus supplement,

any applicable free writing prospectus, or the documents incorporated by reference, is accurate as of any date other than the dates of

those documents regardless of the time of delivery of this prospectus or prospectus supplement or any sale of the Resale Shares. Since

the respective dates of this prospectus and the documents incorporated by reference into this prospectus, our business, financial condition,

results of operations, and prospects may have changed.

For

investors outside the United States, neither we nor the Selling Stockholder have done anything that would permit this offering, or possession

or distribution of this prospectus, any prospectus supplement or free writing prospectus, in any jurisdiction where action for that purpose

is required other than in the United States. Persons outside the United States who come into possession of this prospectus, any applicable

prospectus supplement, or free writing prospectus must inform themselves about, and observe any restrictions relating to, the offering

of the Resale Shares and the distribution of this prospectus outside of the United States.

Unless

otherwise stated or the context requires otherwise, when we refer to “Sonim,” “we,” “our,” “us,”

and the “Company” in this prospectus, we mean Sonim Technologies, Inc., and its consolidated subsidiaries. When we refer

to “you,” we mean the potential holders of the applicable series of securities.

All

references to “this prospectus” refer to this prospectus and any applicable prospectus supplement, including the documents

incorporated by reference herein and therein, unless the context otherwise requires.

Solely

for convenience, tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not

intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable

owner will not assert its rights, to these tradenames. We do not intend our use or display of other companies’ trademarks,

trade names, service marks or copyrights to imply a relationship with, or endorsement or sponsorship of us by, such other companies.

All information in this prospectus assumes a 1-for-10 reverse stock split of our common stock, which was effected

on July 17, 2024 (all share and per share amounts in this prospectus have been presented on a retrospective basis to reflect the reverse

stock split).

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference herein contain forward-looking statements that involve substantial risks and uncertainties.

All statements, other than statements of historical facts, included in this prospectus or the documents incorporated herein by reference

regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans, and objectives

of management are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,”

“intend,” “may,” “plan,” “predict,” “project,” “will,” “would,”

“could,” “should,” “potential,” “seek,” “evaluate,” “pursue,”

“continue,” “design,” “impact,” “affect,” “forecast,” “target,”

“outlook,” “initiative,” “objective,” “priorities,” “goal,” or the negative

of such terms and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements

contain these identifying words. Those statements appear in this prospectus, any accompanying prospectus supplement, and the documents

incorporated herein and therein by reference, particularly in the sections titled “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and include statements regarding the intent, belief or

current expectations of our management that are subject to known and unknown risks, uncertainties and assumptions. The forward-looking

statements in this prospectus and the documents incorporated herein by reference may include but are not limited to the statements about:

| |

● |

our

business strategy and objectives; |

| |

|

|

| |

● |

our

future financial performance and results of operations; |

| |

|

|

| |

● |

our

expansion into new market segments and the development of our new segment of products; |

| |

|

|

| |

● |

our

assessment of the market opportunities and our abilities to capitalize on such market opportunities; |

| |

|

|

| |

● |

our

assessments of the impact of various events on our financial condition and results of operations; |

| |

|

|

| |

● |

the

performance of third parties upon which we depend, including manufacturers; |

| |

|

|

| |

● |

the

volatility of capital markets and other macroeconomic factors, including inflationary pressures, banking instability issues, geopolitical

tensions, or the outbreak of hostilities or war; and |

| |

|

|

| |

● |

expectations

regarding the period during which we will qualify as a “smaller reporting company” or “emerging growth company.” |

Forward-looking

statements involve risks and uncertainties that could cause actual results to differ materially from those anticipated by these forward-looking

statements. These risks and uncertainties include, but are not limited to, the following:

| |

● |

the

availability of cash on hand and other sources of liquidity to fund our operations and grow our business; |

| |

● |

our

ability to compete effectively depends on multiple factors and we may not be able to continue to develop solutions to address user

needs effectively; |

| |

|

|

| |

● |

a

small number of customers account for a significant portion of our revenue; |

| |

|

|

| |

● |

our

entry into the data device sector could divert our management team’s attention from existing products, cause delays in launching

our new products, or otherwise have a significant adverse impact on our business, operating results, and financial condition; |

| |

|

|

| |

● |

failure

to meet the Nasdaq’s continued listing requirements and other Nasdaq rules could adversely affect the price of our common stock

and make it more difficult for us to sell securities in a future financing or for you to sell our common stock; |

| |

|

|

| |

● |

the

financial and operational projections that we may provide from time to time are subject to inherent risks; |

| |

|

|

| |

● |

our

ability to incorporate emerging technologies into our new consumer products given the lengthy development cycle; |

| |

|

|

| |

● |

our

ability to adapt to shortened customer lead times and tightened inventory controls from our key customers; |

| |

|

|

| |

● |

we

are materially dependent on some customer relationships that are characterized by product award letters and the loss of such relationships

could harm our business and operating results; |

| |

|

|

| |

● |

our

quarterly results may vary significantly from period to period; |

| |

|

|

| |

● |

we

rely primarily on third-party contract manufacturers and partners; |

| |

|

|

| |

● |

if

our products contain defects or errors, we could incur significant unexpected expenses, experience product returns and lost sales,

experience product recalls, suffer damage to our brand and reputation, and be subject to product liability or other claims; |

| |

|

|

| |

● |

we

are required to undergo a lengthy customization and certification process for each wireless carrier customer; |

| |

|

|

| |

● |

we

are dependent on the continued services and performance of a concentrated and limited group of senior management and other key personnel; |

| |

|

|

| |

● |

we

face risks related to the impact of various economic, political, environmental, social, and market events beyond our control that

can impact our business and results of operations; and |

| |

|

|

| |

● |

other

risks and uncertainties other risks described in the section titled “Risk Factors” in our most recent Annual Report on

Form 10-K and documents we have filed with the SEC thereafter. |

Moreover,

we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management

to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of

these risks, uncertainties, and assumptions, the future events and trends discussed in this prospectus, any accompanying prospectus supplement

and the documents incorporated by reference herein may not occur and actual results could differ materially and adversely from those

anticipated or implied in the forward-looking statements.

Because

forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should

not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking

statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements.

You should read this prospectus and the documents that we incorporate by reference herein completely and with the understanding that

our actual future results may be materially different from what we expect. Except as required by applicable law, we undertake no obligation

to update publicly any forward-looking statements for any reason after the date of this prospectus, any prospectus supplement, and the

other documents we have filed with the SEC that are incorporated herein by reference to conform such statements to actual results or

to changes in our expectations.

PROSPECTUS

SUMMARY

This

summary description about us and our business highlights selected information contained elsewhere in this prospectus or incorporated

by reference into this prospectus. It does not contain all the information you should consider before investing in our securities. You

should carefully read the entire prospectus, any applicable prospectus supplement, and any related free writing prospectus, including

the risks of investing in our securities discussed under the heading “Risk Factors” contained in this

prospectus, any applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents

that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into

this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus forms a

part.

Overview

We

are a leading U.S.-based provider of rugged mobile devices and accessories designed for workers physically engaged in their work environments,

often in mission-critical roles. As part of our expansion efforts, we introduced our Connected Solutions division and launched a mobile

hotspot late in the second quarter of 2024. In the second half of 2024, the same mobile hotspot will launch with additional carriers and a second mobile hotspot

will launch in the U.S., Canada and Asia/Pacific. Connected Solutions will primarily consist of devices that connect to the internet including

mobile hotspots, fixed wireless devices and USB dongle devices. In addition to this, we have expanded our rugged phone portfolio by developing

a next-generation rugged smartphone that is designed for enterprise, government, and small to medium businesses and is expected to be

sold through tier-one carriers in North America, beginning in the second half of 2024.

We

are executing the strategy of selling new products into much larger adjacent markets including the connect solutions market, the semi-rugged

phone market, and the consumer durable phone market. During the first half of 2024, we were in a transition period, phasing out

low-margin white-label products and commencing selling new products through our carrier channels. These new products will not only

expand our portfolio of products but will also allow us to diversify our customer base into new markets.

Our

key value proposition in the broader business and consumer market is to incorporate specific elements of our rugged roots into our new

products with added durability without sacrificing attractive design and value pricing. We believe this is an underserved market opportunity

in the small business and prosumer spaces. Our expertise in carrier mobility leads us to a natural extension into data devices, where

we can leverage our technical expertise as well as our streamlined organization to bring better quality, better specs, and low cost to

the marketplace.

Implications

of Being an Emerging Growth Company and a Smaller Reporting Company

We

are an “emerging growth company” under applicable federal securities laws and therefore permitted to comply with certain

reduced public company reporting requirements. We have elected to take advantage of certain of the scaled disclosure available for emerging

growth companies in this prospectus as well as our filings under the Exchange Act of 1934 (the “Exchange Act”) including,

but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act,

reduced disclosure obligations regarding executive compensation and financial statements in our periodic reports and proxy statements,

and exemptions from the requirements of holding a nonbinding advisory vote to approve executive compensation and stockholder approval

of any golden parachute payments not previously approved. We will take advantage of these reporting exemptions until we are no longer

an “emerging growth company.”

We

will remain an emerging growth company until the earliest of:

| |

(1) |

the

last day of our fiscal year in which we have total annual gross revenue of $1.235 billion; |

| |

|

|

| |

(2) |

December

31, 2024 (the last day of our fiscal year following the fifth anniversary of the date on which Sonim consummated its initial public

offering); |

| |

|

|

| |

(3) |

the

date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period; or |

| |

|

|

| |

(4) |

the

last day of the fiscal year in which we are deemed to be a “large accelerated filer,” which means the market value of

our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second

fiscal quarter. |

We

are also a “smaller reporting company,” as defined under Rule 405 under the Securities Act of 1933, as amended (the “Securities

Act”). We may take advantage of certain of the scaled disclosures available to smaller reporting companies and will be able

to take advantage of these scaled disclosures for so long as:

| |

(1) |

the

market value of our stock held by non-affiliates is less than $250 million; or |

| |

(2) |

our

annual revenue was less than $100 million during the most recently completed fiscal year and the market value of our stock held by

non-affiliates was less than $700 million. |

Even

after we are no longer an “emerging growth company,” we may remain a “smaller reporting company.” If we are a

smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain disclosure

requirements that are available to smaller reporting companies. For so long as we remain a smaller reporting company, we are permitted

and intend to rely on exemptions from certain disclosure and other requirements that are applicable to other public companies that are

not applicable to a smaller reporting company. For example, as a smaller reporting company, we may choose to present only the two most

recent fiscal years of audited financial statements in our Annual Report on Form 10-K, and, similar to emerging growth companies, smaller

reporting companies have reduced disclosure obligations regarding executive compensation. As a result, the information in this prospectus

supplement, the accompanying base prospectus, or the documents incorporated by reference herein and therein that we provide to our investors

in the future may be different than what investors might receive from other public reporting companies. If investors consider our common

stock less attractive as a result of our election to use the scaled-back disclosure permitted for smaller reporting companies, there

may be a less active trading market for our common stock and our share price may be more volatile.

Corporate

Information

We

were incorporated under the laws of the state of Delaware on August 5, 1999. Our principal executive offices are located at 4445 Eastgate

Mall, Suite 200, San Diego, CA 92121, and our telephone number is (650) 378-8100.

THE

OFFERING

| Common

Stock to be Offered: |

|

An

aggregate of 700,000 shares of our common stock, consisting of up to (i) 350,000 April 2024 Shares issued to the Selling

Stockholder pursuant to the Subscription Agreement and (ii) 350,000 Warrant Shares issuable upon exercise of the Warrants. |

| |

|

|

| Terms

of the Offering: |

|

Subject

to the restrictions pursuant to the Lock-Up Agreement, which generally prohibits any transfer of the Resale Shares before October

29, 2024 (subject to customary limited exceptions), the Selling Stockholder, including his permitted transferees,

donees, pledgees, assignees, or successors-in-interest, may sell, transfer, or otherwise dispose of any or all of the Resale Shares

offered by this prospectus from time to time on Nasdaq or any other stock exchange, market or trading facility on which the shares

are traded or in private transactions. The Resale Shares may be sold at fixed prices, at prevailing market prices, at prices related

to prevailing market prices, at negotiated prices, or at varying prices determined at the time of sale. For more information, see

the section titled “Plan of Distribution” on page 11. |

| |

|

|

| Use

of Proceeds: |

|

We

will not receive any proceeds from the sale of Resale Shares covered by this prospectus. We will receive proceeds in the amount of

$3.85 million, assuming the exercise in full of all of the Warrants for cash. We intend to use any net proceeds from the cash exercise

of the Warrants for general corporate purposes. |

| |

|

|

| Listing

and Symbols: |

|

Our

common stock is listed on Nasdaq under the symbol “SONM.” |

| |

|

|

| Risk

Factors: |

|

Investing

in our securities involves substantial risks. You should read the “Risk Factors” section of

this prospectus and similarly titled sections in the documents incorporated by reference in this prospectus for a discussion of

factors to consider before deciding to purchase our securities. |

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before you decide to invest in our securities, you should carefully consider

the risks discussed under the section entitled “Risk Factors” contained in the applicable prospectus supplement together

with all of the other information contained or incorporated by reference in the prospectus supplement or appearing or incorporated by

reference in this prospectus. You should also consider the risks, uncertainties, and assumptions discussed under “Part I—Item

1A—Risk Factors” of our most recent Annual Report on Form 10-K and in “Part II—Item 1A—Risk Factors”

in our most recent Quarterly Report on Form 10-Q filed subsequent to such Form 10-K that are incorporated herein by reference, as may

be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. The risks and uncertainties

we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem

immaterial may also affect our operations. If any of these risks actually occur, our business, financial condition, results of operations,

or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all

or part of your investment. Please also read carefully the section above titled “Cautionary Note Regarding Forward-Looking Statements”

and the identically titled sections of our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or

Current Reports on Form 8-K.

USE

OF PROCEEDS

We

will not receive any proceeds from the sale of the Resale Shares by the Selling Stockholder.

We

will receive proceeds from the cash exercise of the Warrants, which, if exercised for cash with respect to all of the 350,000

shares of common stock underlying such Warrants at the exercise price per share of $11.00, would result in gross proceeds to us of

$3.85 million. We intend to use any net proceeds from the cash exercise of the Warrants for general corporate purposes. There can be

no assurance that any of the Warrants will be exercised by the Selling Stockholder. Currently, the Warrants cannot be exercised on a

cashless basis, however, there can be no assurance that the terms of the Warrants will not be amended in the future to permit the Warrants

to be exercised on a cashless basis. If the Warrants (as amended to permit the cashless exercise of the Warrants) are exercised in a

cashless exercise, we will not receive any proceeds from the exercise of the Warrants.

The

Selling Stockholder will receive all of the net proceeds from the sale of the Resale Shares under this prospectus. The Selling Stockholder

will pay any underwriting, broker-dealer or agent discounts, concessions and commissions, and expenses incurred by the Selling Stockholder

for accounting, tax, and legal services and any other expenses incurred by the Selling Stockholder in disposing of the Resale Shares,

unless otherwise agreed to by us. We will be responsible for the reasonable and documents fees and expenses of one firm of attorneys

retained by the Selling Stockholder in connection with the sale of the Resale Shares and shall bear all other costs, fees, and expenses

incurred in effecting the registration of the Resale Shares covered by this prospectus.

SELLING

STOCKHOLDER

The

Resale Shares being offered by the Selling Stockholder are comprised of (i) 350,000 April 2024 Shares issued to the Selling Stockholder

pursuant to the Subscription Agreement and (ii) 350,000 Warrant Shares issuable upon exercise of the Warrants. Both the April

2024 Shares and the Warrants were acquired in a private placement and issued and sold pursuant to the Subscription Agreement. Except

for the Subscription Agreement and agreements and transactions contemplated thereby, we have not had any material relationship with the

Selling Stockholder. For additional information regarding the issuance of the Resale Shares, see the section titled “Certain

Relationship with Selling Stockholder” below. We are registering the Resale Shares in order to permit the Selling Stockholder

to offer the shares for resale from time to time.

Under

the terms of the Warrants, the Selling Stockholder may not exercise the Warrants to the extent such exercise would cause the Selling

Stockholder, together with his affiliates and attribution parties, to beneficially own a number of shares of our common stock that would

exceed 9.99%, as applicable, of the then outstanding number of shares of common stock following such exercise, excluding for purposes

of such determination shares of common stock issuable upon exercise of such Warrants that have not been exercised.

The

Selling Stockholder may sell all, some, or none of his shares in this offering. For more information, see the section titled “Plan

of Distribution.”

The

table below lists the Selling Stockholder and provides other information regarding the beneficial ownership of the shares of our common

stock held by the Selling Stockholder. The second column lists the number of shares of common stock beneficially owned by the Selling

Stockholder. The third column lists the shares of our common stock being offered by this prospectus by the Selling Stockholder. The fourth

column assumes the sale of all of the shares offered by the Selling Stockholder registered pursuant to this prospectus and that the Selling

Stockholder does not buy or sell any additional shares of common stock prior to the completion of this offering.

The

number of shares and percentage of beneficial ownership set forth below is based on 4,836,476 shares of our common stock outstanding

as of August 5, 2024. Beneficial ownership is determined under the SEC rules and regulations and generally includes voting or

investment power over securities. We have prepared the table based on information given to us by, or on behalf of, the Selling Stockholder.

Information concerning the Selling Stockholder may change from time to time. We cannot advise you as to whether the Selling Stockholder

will in fact sell any or all of the securities being offered hereunder. In addition, the Selling Stockholder may sell, transfer, or otherwise

dispose of, at any time and from time to time, the securities in transactions exempt from the registration requirements of the Securities

Act after the date of this prospectus. In addition, since the date on which the Selling Stockholder provided this information to us,

such Selling Stockholder may have sold, transferred, or otherwise disposed of all or a portion of the offered securities. The address

of the Selling Stockholder is Unit 1507C, 15/F, Eastcore, 398 Kwun Tong Road, Kwun Tong, Kowloon, Hong Kong, Attn.: Jiang Liu.

| | |

Number of shares of

Common Stock

Beneficially Owned

Prior to Offering | | |

Maximum

Number of

shares of

Common

Stock

to be Sold

Pursuant to

this

Prospectus | | |

Number of shares of

Common Stock

Owned

After Offering | |

| Name of Selling Stockholder | |

Shares | | |

% | | |

| | |

Shares | | |

% | |

| Jiang Liu | |

| 497,943 | (1) | |

| 9.99 | %(1) | |

| 700,000 | (2) | |

| — | | |

| — | |

| (1) |

Includes 147,943 shares

of common stock issuable upon exercise of the Warrants exercisable within 60 days of August 5, 2024. The Selling Stockholder

is subject to a beneficial ownership limitation of 9.99%, which limitation restricts the Selling Stockholder from exercising that portion

of the Warrants that would result in the Selling Stockholder and its affiliates owning, after such exercise a number of shares of common

stock in excess of the applicable beneficial ownership limitation. The amounts and percentages in the table give effect to these beneficial

ownership limitations. |

| (2) |

Figures herein assume the

exercise of all Warrants held by the Selling Stockholder, without giving effect to any beneficial ownership limitations therein. Such

figures represent approximately 13% of the outstanding shares as of August 5, 2024. |

Certain

Relationships with Selling Stockholder

Subscription

Agreement

On

April 29, 2024, we entered into the Subscription Agreement with the Selling Stockholder, providing for the private placement of (i) the

April 2024 Shares and (ii) the Warrants for an aggregate purchase price of $3,850,000 (or $11.00 per share and the accompanying Warrant).

The closing of the private placement occurred contemporaneously with the execution of the Subscription Agreement.

Warrants

The

Warrants have an exercise price of $11.00 per share, are immediately exercisable, will expire on April 29, 2029 (five years from

the date of issuance), and are subject to customary adjustments for certain transactions affecting the Company’s capitalization.

The Warrants may not be exercised if the aggregate number of shares of common stock beneficially owned by the Selling Stockholder would

exceed the specified beneficial ownership limitation provided therein (which is currently 9.99% and may be adjusted upon advance notice)

immediately after exercise thereof.

Lock-Up

Agreement

In

addition, on April 29, 2024, in connection with the entry into the Subscription Agreement, the Company and the Selling Stockholder entered

into the Lock-Up Agreement. Pursuant to the Lock-Up Agreement, the Selling Stockholder agreed not to transfer any securities purchased

under the Subscription Agreement (including the Warrant Shares) until 180 days after the closing of the Subscription Agreement or October

29, 2024, subject to customary limited exceptions.

Registration

Rights Agreement

On

April 29, 2024, in connection with the entry into the Subscription Agreement, the Company entered into the Registration Rights Agreement

with the Selling Stockholder. Pursuant to the Registration Rights Agreement, the Company agreed to prepare and file a registration statement

(the “Initial Registration Statement”) with the SEC by May 30, 2024 for purposes of registering the Resale Shares

(i) issued and sold pursuant to the Subscription Agreement, (ii) issuable upon exercise of the Warrants, (iii) issuable in connection

with any anti-dilution provisions in the Warrants and (iv) any securities issued or then issuable upon any stock split, dividend or other

distribution, recapitalization or similar event with respect to the foregoing. The Company agreed to use commercially reasonable efforts

to cause the Initial Registration Statement to be declared effective by the SEC by October 29, 2024. On

June 2, 2024, the Company entered into an amendment to the Registration Rights Agreement, pursuant to which the Company’s deadline

to file the Initial Registration Statement was extended to September 20, 2024.

PLAN

OF DISTRIBUTION

Resales

by Selling Stockholder

We

are registering the resale of the Resale Shares on behalf of the Selling Stockholder pursuant to the terms of the Registration Rights

Agreement, which agreement is incorporated herein by reference. The term “Selling Stockholder” also includes persons who

obtain the Resale Shares from the Selling Stockholder as a gift, on foreclosure of a pledge, in a distribution or dividend of assets

by an entity to its equity holders or partners, as an assignee, transferee or other successor-in-interest, or in another private transaction.

Types

of Sale Transactions

The

Selling Stockholder may offer and sell the Resale Shares, from time to time, following the effectiveness of the registration statement

to which this prospectus is a part. The Selling Stockholder will act independently of us in making decisions with respect to the timing,

manner, and size of each sale. The Resale Shares may be sold at:

| |

● |

fixed

prices; |

| |

|

|

| |

● |

prevailing

market prices at the time of sale; |

| |

|

|

| |

● |

prices

related to such prevailing market prices; |

| |

|

|

| |

● |

varying

prices determined at the time of sale; or |

| |

|

|

| |

● |

negotiated

prices. |

The

Selling Stockholder may sell his Resale Shares by one or more of, or a combination of, the following methods to the extent permitted

by applicable rules and regulations or additional obligations of the Selling Stockholder due to our corporate governance documents including

but not limited to our insider transaction policy:

| |

● |

disposition

on any national securities exchange on which our common stock may be listed at the time of the sale; |

| |

|

|

| |

● |

disposition

in the over-the-counter markets; |

| |

|

|

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as

principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions of sale to multiple purchasers or to a single purchaser; |

| |

|

|

| |

● |

short

sales; |

| |

|

|

| |

● |

writing

or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

disposition

in one or more underwritten offerings on a best efforts basis or firm commitment basis; |

| |

● |

broker-dealers

may agree with the Selling Stockholder to sell a specified number of such shares at a stipulated price per share; |

| |

|

|

| |

● |

in

distributions to members, limited partners or stockholders of Selling Stockholder; |

| |

|

|

| |

● |

under

Rule 144, Rule 144A, or Regulation S under the Securities Act, if available, rather than under this prospectus; |

| |

|

|

| |

● |

a

combination of any such methods of sale; or |

| |

|

|

| |

● |

any

other method permitted by applicable law. |

These

transactions may include block transactions or crosses. Crosses are transactions in which the same broker acts as an agent on both sides

of the trade.

The

Selling Stockholder will act independently of us in making decisions with respect to the timing, manner, and size of each resale or other

transfer. We do not know of specific arrangements by the Selling Stockholder for the sale of the Resale Shares. The aggregate proceeds

to the Selling Stockholder from any sale of the Resale Shares will be the purchase price of the Resale Shares less discounts or commissions,

if any. The Selling Stockholder reserves the right to accept and, together with his respective agents from time to time, to reject, in

whole or in part, any proposed purchase of the Resale Shares to be made directly or through agents. We will not receive any of the proceeds

from any such sale.

Broker-dealers

engaged by the Selling Stockholder may arrange for other broker-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the Selling Stockholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a mark-up or

mark-down in compliance with FINRA Rule 2121.

In

connection with the sale of the securities or interests therein, the Selling Stockholder may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they

assume. The Selling Stockholder may also sell securities short and deliver these securities to close out their short positions, or loan

or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Stockholder may also enter into option

or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction). We may

suspend the sale of securities by the Selling Stockholder pursuant to this prospectus for certain periods of time for certain reasons,

including if the prospectus is required to be supplemented or amended to include additional material information, and we may file a post-effective

amendment to the registration statement of which this prospectus is a part to include any material information with respect to the plan

of distribution not previously disclosed in the registration statement or any material change to such information in the registration

statement.

The

Selling Stockholder also may transfer the securities in other circumstances, in which case the transferees, pledgees, or other successors-in-interest

will be the selling beneficial owners for purposes of this prospectus. Upon being notified by a Selling Stockholder that a donee, pledgee,

transferee, other successor-in-interest intends to sell our securities, we will, to the extent required and permitted, promptly file

a supplement to this prospectus to name specifically such person as a Selling Stockholder. The Selling Stockholder may, from time to

time, pledge or grant a security interest in some shares of the securities owned by them and, if a Selling Stockholder defaults in the

performance of its secured obligations, the pledgees or secured parties may offer and sell such shares of the securities, from time to

time, under this prospectus, or under an amendment or supplement to this prospectus amending the list of the Selling Stockholder to include

the pledgee, transferee or other successors in interest as the Selling Stockholder under this prospectus. The Selling Stockholder also

may transfer shares of the securities in other circumstances, in which case the transferees, pledgees, or other successors in interest

will be the selling beneficial owners for purposes of this prospectus.

The

Selling Stockholder and any broker-dealers or agents that participate in the sale of the Resale Shares may be deemed to be “underwriters”

within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions, or profit they earn on any resale

of the shares may be underwriting discounts and commissions under the Securities Act. The Selling Stockholder is subject to the prospectus

delivery requirements of the Securities Act.

We

have agreed to indemnify each seller of Resale Shares, each of its employees, advisors, agents, representatives, partners, officers,

and directors, and each person who controls such seller (within the meaning of the Securities Act), and any agent or investment advisor

thereof against certain liabilities arising under the Securities Act from sales of the Resale Shares. The Selling Stockholder may agree

to indemnify any agent, broker, or dealer that participates in sales of the Resale Shares against liabilities arising under the Securities

Act from sales of the Resale Shares.

We

have agreed to pay certain expenses incurred in connection with the registration and sale of the Resale Shares covered by this prospectus,

including, among other things, all registration and filing fees (including SEC, Nasdaq, and state blue sky registration and filing fees),

printing expenses, and the fees and disbursements of our outside counsel and independent accountants, but excluding underwriting discounts

and commissions.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the shares of our common stock may

not simultaneously engage in market-making activities with respect to the common stock for the applicable restricted period, as defined

in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholder will be subject to applicable provisions

of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales

of the common stock by the Selling Stockholder or any other person. We will make copies of this prospectus available to the Selling Stockholder

and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including

by compliance with Rule 172 under the Securities Act). Once sold under the registration statement of which this prospectus forms a part,

the shares of our common stock will be freely tradable in the hands of persons other than our affiliates.

LEGAL

MATTERS

The

validity of the issuance of the common stock offered hereby will be passed upon for us by Venable LLP, New York, New York. Any underwriters

or agents will be advised about other issues relating to the offering by counsel to be named in the applicable prospectus supplement.

EXPERTS

The

consolidated financial statements of Sonim Technologies, Inc. incorporated in this registration statement on Form S-3 by reference from

Sonim Technologies, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2023, have been audited by Moss Adams

LLP, an independent registered public accounting firm, as stated in their report, which is incorporated herein by reference. Such consolidated

financial statements are incorporated by reference in reliance upon the report of such firm given their authority as experts in accounting

and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

This

prospectus forms part of a registration statement on Form S-3 filed with the SEC under the Securities Act. This prospectus does not contain

all of the information set forth in the registration statement and the exhibits to the registration statement or the documents incorporated

by reference herein and therein. For further information with respect to us and the securities offered under this prospectus, we refer

you to the registration statement and the exhibits and schedules filed as a part of the registration statement and the documents incorporated

by reference herein and therein. You should read the actual documents for a more complete description of the relevant matters.

We

file annual, quarterly, and current reports, proxy statements, and other information with the SEC. Our SEC filings are available to the

public over the Internet at the SEC’s website at http://www.sec.gov. We also maintain a website at https://ir.sonimtech.com. Through

our website, we make available, free of charge, annual, quarterly, and current reports, proxy statements, and other information as soon

as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The information contained on, or that may

be accessed through, our website is not part of, and is not incorporated into this prospectus.

INCORPORATION

BY REFERENCE

The

SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can

disclose important information to you by referring you to those publicly available documents. The information incorporated by reference

is considered to be part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we

filed with the SEC prior to the date of this prospectus, while information that we file later with the SEC will automatically update

and supersede the information in this prospectus. This means that you must look at all of the SEC filings that we incorporate by reference

to determine if any of the statements in this prospectus or in any document previously incorporated by reference have been modified or

superseded.

We

incorporate by reference into this prospectus and the registration statement of which this prospectus is a part the information or documents

listed below that we have filed under the Exchange Act:

| |

● |

our

Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 27, 2024, as amended by Amendment No. 1 to our

Annual Report on Form 10-K/A for the year ended December 31, 2023, filed with the SEC on April 26, 2024; |

| |

|

|

| |

● |

our

Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, filed with the SEC on May

14, 2024, and June 30, 2024, filed with the SEC on August

9, 2024;

|

| |

|

|

| |

● |

our

Current Reports on Form 8-K filed with the SEC on March

14, 2024, April

29, 2024, May

3, 2024, as amended by our Current Report on Form 8-K/A filed with the SEC on June

3, 2024; June

4, 2024; June

14, 2024; June

21, 2024; July

16, 2024; July

18, 2024; August

5, 2024; and August

7, 2024; and |

| |

|

|

| |

● |

the

description of our common stock contained in our registration statement on Form

8-A filed with the SEC on May 9, 2019, as updated by Exhibit

4.4 of our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the SEC on March 27, 2020,

and as subsequently amended or updated. |

We

also incorporate by reference into this prospectus all documents (other than current reports furnished under Item 2.02 or Item 7.01 of

Form 8-K and exhibits furnished on such form that are related to such items) that are filed by us with the SEC pursuant to Sections 13(a),

13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus but prior to the termination of the offering. In addition, all

reports and other documents filed by us pursuant to the Exchange Act after the date of the initial registration statement and prior to

effectiveness of the registration statement shall be deemed to be incorporated by reference into this prospectus. All such documents

are deemed to be part of this prospectus from the date of the filing of such reports and documents.

Notwithstanding

the foregoing, we are not incorporating any document or information deemed to have been furnished and not filed in accordance with SEC

rules. No additional information is deemed to be part of or incorporated by reference into this prospectus.

You

may obtain any of the documents incorporated by reference in this prospectus from the SEC through the SEC’s website at the address

provided above. You may also request and we will provide, free of charge, a copy of any document incorporated by reference in this prospectus

(excluding exhibits to such document unless an exhibit is specifically incorporated by reference in the document) by visiting our internet

website at https://ir.sonimtech.com or by writing or calling us at the following address and telephone number:

Sonim

Technologies, Inc.

4445

Eastgate Mall, Suite 200

San

Diego, CA 92121

Telephone:

(650) 378-8100

Attn.:

Chief Financial Officer

You

should rely only on the information contained in, or incorporated by reference into, this prospectus, in any accompanying prospectus

supplement, or in any free writing prospectus filed by us with the SEC. We have not authorized anyone to provide you with different or

additional information. We are not offering to sell or soliciting any offer to buy any securities in any jurisdiction where the offer

or sale is not permitted. You should not assume that the information in this prospectus or in any document incorporated by reference

is accurate as of any date other than the date on the front cover of the applicable document.

700,000

Shares of Common Stock

PROSPECTUS

, 2024

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution.

The

following table sets forth all expenses that we may incur in connection with the securities being registered hereby. All amounts shown

are estimates except for the SEC registration fee.

We

will bear all costs, expenses, and fees in connection with the registration of the securities. The Selling Stockholder, however, will

bear all brokers and underwriting commissions and discounts, if any, attributable to the sale of his securities.

| SEC registration fee | |

$ | 249 | |

| Legal fees and expenses | |

$ | 50,000 | |

| Accounting fees and expenses | |

$ | 30,000 | |

| Printing and miscellaneous fees and expenses | |

$ | 500 | |

| | |

| | |

| Total | |

$ | 80,749 | |

Item 15.

Indemnification of Officers and Directors.

Section

145 of Title 8 of the Delaware General Corporation Law (the “DGCL”) empowers a corporation, within certain limitations,

to indemnify any person against expenses (including attorneys’ fees), judgments, fines, and amounts paid in settlement and reasonably

incurred by such person in connection with any suit or proceeding to which such person is a party by reason of the fact that such person

is or was a director, officer, employee, or agent of the corporation or is or was serving at the request of the corporation as a director,

officer, employee, or agent of another corporation, partnership, joint venture, trust, or other enterprise, as long as such person acted

in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the corporation. With

respect to any criminal proceedings, such person must have had no reasonable cause to believe that his or her conduct was unlawful.

In

the case of a proceeding by or in the right of the corporation to procure a judgment in its favor (e.g., a stockholder derivative

suit), a corporation may indemnify an officer, director, employee, or agent if such person acted in good faith and in a manner such person

reasonably believed to be in or not opposed to the best interests of the corporation; provided, however, that no person adjudged to be

liable to the corporation may be indemnified unless, and only to the extent that, the Delaware Court of Chancery or the court in which

such action or suit was brought determines upon application that, despite the adjudication of liability, in view of all the circumstances

of the case, such person is fairly and reasonably entitled to indemnity for such expenses which such court deems proper. A director,

officer, employee, or agent who is successful, on the merits or otherwise, in defense of any proceeding subject to the DGCL’s indemnification

provisions must be indemnified by the corporation for reasonable expenses incurred therein, including attorneys’ fees.

Section

102(b)(7) of the DGCL provides that a corporation’s certificate of incorporation may contain a provision eliminating or limiting

the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director,

provided that such provision shall not eliminate or limit the liability of a director (i) for any breach of the director’s duty

of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct

or a knowing violation of law, (iii) under Section 174 of the DGCL, or (iv) for any transaction from which the director derived an improper

personal benefit.

As

permitted by the DGCL, our amended and restated certificate of incorporation allows for indemnification of our directors, officers, employees,

and other agents to the maximum extent permitted by the DGCL. Our amended and restated bylaws also provide for the indemnification of

our directors and executive officers to the maximum extent permitted by the DGCL.

We

have entered into indemnification agreements with our directors and officers, whereby we have agreed to indemnify our directors and officers

to the fullest extent permitted by law, including indemnification against expenses and liabilities incurred in legal proceedings to which

the director or officer was, or is threatened to be made, a party by reason of the fact that such director or officer is or was a director,

officer, employee, or agent of Sonim, provided that such director or officer acted in good faith and in a manner that the director or

officer reasonably believed to be in, or not opposed to, the best interest of Sonim.

We

maintain insurance policies that indemnify our directors and officers against various liabilities arising under the Exchange Act, that

might be incurred by any director or officer in his or her capacity as such.

The

foregoing summaries are subject to the complete text of the DGCL and our amended and restated certificate of incorporation and amended

and restated bylaws and are qualified in their entirety by reference thereto.

Item 16.

Exhibits.

Item 17.

Undertakings.

The

undersigned registrant hereby undertakes:

| |

(1) |

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| |

(i) |

to include any prospectus required by Section 10(a)(3) of the Securities Act; |

| |

|

|

| |

(ii) |

to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in the volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and |

| |

|

|

| |

(iii) |

to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; |

provided,

however, that paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or

Section 15(d) of the Exchange Act that are incorporated by reference in this registration statement, or is contained in a form of prospectus

filed pursuant to Rule 424(b) that is part of the registration statement.

| |

(2) |

That,

for the purposes of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at the time shall be

deemed to be the initial bona fide offering thereof. |

| |

|

|

| |

(3) |

To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

| |

|

|

| |

(4) |

That,

for the purpose of determining liability under the Securities Act to any purchaser, each prospectus filed pursuant to Rule 424(b)

as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than

prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date

it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is

part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement

or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first

use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration

statement or made in any such document immediately prior to such date of first use. |

| |

|

|

| |

(5) |

That,

for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant

to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report

pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. |

| |

|

|

| |

(6) |

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the

SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event

that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid

by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in

the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the

final adjudication of such issue. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Scottsdale, State of Arizona, on September 16, 2024.

| |

SONIM

TECHNOLOGIES, INC. |

| |

|

|

| |

By: |

/s/

Clayton Crolius |

| |

Name: |

Clayton

Crolius |

| |

Title: |

Chief

Financial Officer |

| |

|

(Principal

Financial and Accounting Officer) |

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below severally constitutes and appoints Peter Liu and Clayton

Crolius, and each of them, and as his or her attorneys-in-fact, each with the power of substitution and resubstitution, for him or her

in any and all capacities, to sign any amendments to this registration statement on Form S-3 or other applicable form and to file the

same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said

attorneys-in-fact and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to

be done in order to effectuate the same as fully, to all intents and purposes, as they or he or she might or could do in person, hereby

ratifying and confirming all that each of said attorney-in-fact, or their substitute or substitutes, may lawfully do or cause to be done

by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities

and on the date indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Hao Liu |

|

Chief

Executive Officer and Director |

|

September

16, 2024 |

| Hao

(Peter) Liu |

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Clayton Crolius |

|

Chief

Financial Officer |

|

September

16, 2024 |

| Clayton

Crolius |

|

(Principal

Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/

James Cassano |

|

Director |

|

September

16, 2024 |

| James

Cassano |

|

|

|

|

| |

|

|

|

|

| /s/

Mike Mulica |

|

Chairman

of the Board and Director |

|

September

16, 2024 |

| Mike