false

0001494891

0001494891

2025-02-11

2025-02-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 11, 2025

SENSUS HEALTHCARE, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-37714 |

|

27-1647271 |

| (State of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

|

|

|

851 Broken Sound

Pkwy., NW # 215, Boca Raton, Florida |

|

33487 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area code:

(561) 922-5808

_________________________________________________

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

SRTS |

|

Nasdaq Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SENSUS HEALTHCARE, INC.

FORM 8-K

CURRENT REPORT

On February

11, 2025, Sensus Healthcare, Inc. (the “Company”) announced the resumption of its common stock repurchase program, the authorization

of which was previously reported in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on

August 11, 2023.

| Item 9.01 | Financial Statements and Exhibits |

Exhibits. The press release referred to

in Item 8.01 is being filed as an exhibit to this Current Report on Form 8-K and is incorporated by reference herein.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

SENSUS HEALTHCARE, INC. |

| |

|

| Date: February 11, 2025 |

By: |

/s/ Javier Rampolla |

| |

|

Javier Rampolla |

| |

|

Chief Financial Officer |

EXHIBIT INDEX

Exhibit 99.1

Sensus Healthcare Buys Back Shares

BOCA RATON, Fla. (February 11, 2025) –

Sensus Healthcare, Inc. (Nasdaq: SRTS), a medical device company specializing in highly effective, non-invasive, minimally-invasive

and cost-effective treatments for oncological and non-oncological skin conditions, announces that the company has resumed purchasing shares

of its common stock in open-market transactions under a $3.0 million share repurchase program approved by its Board of Directors and announced

in August 2023.

“We are implementing this program now as

we view the repurchase of our common stock as a compelling opportunity at current prices,” said Joe Sardano, Chairman and CEO of

Sensus Healthcare. “We remain confident in our growth prospects and believe that returning capital to shareholders while maintaining

the flexibility to invest in our strategic initiatives best positions us to enhance value for all stakeholders. We completed a similar

$3 million repurchase program in 2022.”

Today’s announcement marks the resumption

of purchases under a Board-approved program that was announced in August 2023, providing for the purchase up to $3.0 million of the company’s

common stock from time to time. Prior to the resumption of the program, 9,427 shares had been previously repurchased under the program.

The timing and amount of share repurchases under this program are determined by Sensus Healthcare’s management at its discretion

based upon its ongoing assessments of the capital needs of the business, the market price of Sensus’ common stock and general market

conditions. Share repurchases under this program may be made through a variety of methods, including open-market purchases, block trades,

exchange transactions or any combination thereof. The program does not obligate Sensus to acquire any particular amount of its common

stock, and the share repurchase program may be suspended or discontinued at any time at the company’s discretion.

About Sensus Healthcare

Sensus

Healthcare, Inc. is a global pioneer in the development and delivery of non-invasive treatments for skin cancer and keloids. Leveraging

its cutting-edge superficial radiotherapy (SRT and IG-SRT) technology, the company provides healthcare providers with a highly effective,

patient-centric treatment platform. With a dedication to driving innovation in radiation oncology, Sensus Healthcare offers solutions

that are safe, precise, and adaptable to a variety of clinical settings. For more information, please visit www.sensushealthcare.com.

Forward-Looking Statements

This press release includes statements that are,

or may be deemed, ''forward-looking statements.'' In some cases, these statements can be identified by the use of forward-looking terminology

such as "believes," "estimates," "anticipates," "expects," "plans," "intends,"

"may," "could," "might," "will," "should," “approximately,” "potential"

or negative or other variations of those terms or comparable terminology, although not all forward-looking statements contain these words.

Forward-looking statements involve risks and uncertainties

because they relate to events, developments, and circumstances relating to Sensus, our industry, and/or general economic or other conditions

that may or may not occur in the future or may occur on longer or shorter timelines or to a greater or lesser degree than anticipated.

In addition, even if future events, developments, and circumstances are consistent with the forward-looking statements contained in this

press release, they may not be predictive of results or developments in future periods. Although we believe that we have a reasonable

basis for each forward-looking statement contained in this press release, forward-looking statements are not guarantees of future performance,

and our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ

materially from the forward-looking statements contained in this press release, as a result of the following factors, among others: the

possibility that inflationary pressures continue to impact our sales; the level and availability of government and/or third party payor

reimbursement for clinical procedures using our products, and the willingness of healthcare providers to purchase our products if the

level of reimbursement declines; concentration of our customers in the U.S. and China, including the concentration of sales to one particular

customer in the U.S.; the development by others of new products, treatments, or technologies that render our technology partially or wholly

obsolete; the regulatory requirements applicable to us and our competitors; our ability to efficiently manage our manufacturing processes

and costs; the risks arising from doing business in China and other foreign countries; legislation, regulation, or other governmental

action that affects our products, taxes, international trade regulation, or other aspects of our business; the performance of the Company’s

information technology systems and its ability to maintain data security; our ability to obtain and maintain the intellectual property

needed to adequately protect our products, and our ability to avoid infringing or otherwise violating the intellectual property rights

of third parties; and other risks described from time to time in our filings with the Securities and Exchange Commission, including our

Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q.

Any forward-looking statements that we make in

this press release speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events

or circumstances after the date of this press release, except as may be required by applicable law. You should read carefully our "Introductory

Note Regarding Forward-Looking Information" and the factors described in the "Risk Factors" section of our periodic reports

filed with the Securities and Exchange Commission to better understand the risks and uncertainties inherent in our business.

Contact:

Alliance Advisors IR

Tirth T. Patel

tpatel@allianceadvisors.com

212-201-6614

# # #

v3.25.0.1

Cover

|

Feb. 11, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 11, 2025

|

| Entity File Number |

001-37714

|

| Entity Registrant Name |

SENSUS HEALTHCARE, INC.

|

| Entity Central Index Key |

0001494891

|

| Entity Tax Identification Number |

27-1647271

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

851 Broken Sound

Pkwy.

|

| Entity Address, Address Line Two |

NW # 215

|

| Entity Address, City or Town |

Boca Raton

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33487

|

| City Area Code |

(561)

|

| Local Phone Number |

922-5808

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

SRTS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

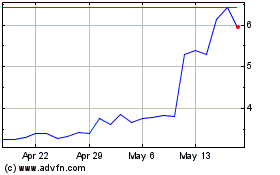

Sensus Healthcare (NASDAQ:SRTS)

Historical Stock Chart

From Jan 2025 to Feb 2025

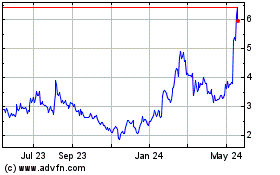

Sensus Healthcare (NASDAQ:SRTS)

Historical Stock Chart

From Feb 2024 to Feb 2025