Intevac Stockholders to Receive $4.00 Per Share

in Cash, Plus a Special Dividend of $0.052 Per Share and a Regular

Dividend of $0.05 Per Share

Acquisition Delivers Compelling and Certain

Cash Value

Seagate Technology Holdings plc (Nasdaq: STX) (“Seagate”), a

leading innovator of mass-capacity data storage, and Intevac, Inc.

(Nasdaq: IVAC) (“Intevac”), a supplier of thin-film processing

systems, today announced that Seagate has entered into a definitive

agreement to acquire Intevac in an all-cash transaction for $4.00

per share (the “Transaction”).

In connection with the closing of the Transaction, Intevac will

pay a one-time special dividend of $0.052 per share. The payment of

the special dividend is expected to occur on or about the closing

of the Transaction. Separately, Intevac’s Board of Directors has

declared a regular quarterly dividend of $0.05 per share, which

will be paid on March 13, 2025, to Intevac stockholders of record

as of February 28, 2025. The Transaction and the special dividend

deliver aggregate consideration to Intevac stockholders of $4.052

per share, or $4.102 per share including Intevac’s regular

quarterly dividend. This represents a premium of 45% to Intevac’s

closing price of $2.83 per share on December 11, 2024, one day

prior to Intevac’s announcement that it had renewed its focus on

pursuing strategic options, a premium of approximately 21% to

Intevac’s closing price of $3.38 per share on February 12, 2025 and

an aggregate value of approximately $119 million including both

dividends.

As a result of the Transaction, Intevac will no longer hold its

earnings call, which was previously scheduled for February 25,

2025.

Transaction Details

The definitive agreement provides for Seagate to launch an

all-cash tender offer for all of Intevac’s outstanding shares for

$4.00 per share in cash, to be commenced as promptly as reasonably

practicable. The consummation of the tender offer is subject to a

minimum tender condition of at least one share more than 50% of

Intevac’s issued and outstanding shares, as well as other customary

closing conditions. Following successful completion of the tender

offer, the definitive agreement provides for Seagate to acquire all

remaining shares not tendered in the offer through a second step

merger at the same $4.00 per share all-cash price as the tender

offer. The special dividend of $0.052 per share and the regular

quarterly dividend of $0.05 per share are in addition to the $4.00

cash consideration in the Transaction.

Intevac’s Board of Directors unanimously approved the

Transaction and recommends that all stockholders tender their

shares in the offer. In addition to the approval by Intevac’s Board

of Directors, two of Intevac’s largest stockholders, Palogic Value

Fund, L.P. and Bleichroeder LP, who together represent

approximately 22% of Intevac’s outstanding shares, have entered

into customary agreements to support the Transaction.

The Transaction is expected to close in late March or early

April 2025, subject to the satisfaction of customary closing

conditions. Seagate expects the Transaction to be accretive to the

company’s non-GAAP earnings per share (“EPS”) over the long-term

and have minimal impact to non-GAAP EPS over the short-term.

Advisors

Houlihan Lokey is serving as financial advisor to Intevac, and

Wilson Sonsini Goodrich & Rosati, Professional Corporation is

serving as legal advisor to Intevac.

Wachtell, Lipton, Rosen & Katz is serving as legal advisor

to Seagate.

About Seagate

Seagate Technology is a leading innovator of mass-capacity data

storage. We create breakthrough technology so you can confidently

store your data and easily unlock its value. Founded over 45 years

ago, Seagate has shipped over four billion terabytes of data

capacity and offers a full portfolio of storage devices, systems,

and services from edge to cloud. To learn more about how Seagate

leads storage innovation, visit www.seagate.com and our blog, or

follow us on X, Facebook, LinkedIn, and YouTube.

About Intevac, Inc.

Founded in 1991, we are a leading provider of thin-film process

technology and manufacturing platforms for high-volume

manufacturing environments. With over 30 years of leadership in

designing, developing, and manufacturing high-productivity,

thin-film processing systems, we deploy our materials science

expertise primarily to the hard disk drive (HDD) industry. Our

industry-leading 200 Lean® platform is our flagship system,

supporting HDD disk media production, including the industry’s most

advanced, leading-edge, heat-assisted magnetic recording (HAMR)

media. The majority of Intevac’s HDD business for the last several

years has been focused on enabling the upgrades of the installed

base of worldwide media capacity in close partnership with our HDD

customers, thus enabling their technology roadmaps. For more

information call 408-986-9888 or visit the Company's website at

www.Intevac.com.

Additional Information and Where to Find It

In connection with the proposed acquisition (the “Transaction”)

of Intevac, Inc. (“Intevac”) by Seagate Technology Holdings plc

(“Seagate”), Irvine Acquisition Holdings, Inc. (“Bidder”) will

commence a tender offer for all of the outstanding shares of

Intevac. The tender offer has not yet commenced. This communication

is for informational purposes only and is neither an offer to

purchase nor a solicitation of an offer to sell shares of Intevac.

It is also not a substitute for the tender offer materials that

Bidder will file with the U.S. Securities and Exchange Commission

(the “SEC”) upon commencement of the tender offer. At the time that

the tender offer is commenced, Bidder will file tender offer

materials on Schedule TO with the SEC, and Intevac will file a

Solicitation/Recommendation Statement on Schedule 14D-9 with the

SEC with respect to the tender offer. Under certain circumstances

described in the definitive Transaction documents, Seagate may

determine instead to terminate or withdraw the offer and effect the

Transaction through a merger only, in which case the relevant

documents to be filed with the SEC will include a proxy statement

for the solicitation of votes of Intevac stockholders to approve

the merger. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO

PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER

OFFER DOCUMENTS), THE SOLICITATION/RECOMMENDATION STATEMENT ON

SCHEDULE 14D-9, AND, IF APPLICABLE, THE PROXY STATEMENT AND ANY

OTHER RELEVANT DOCUMENTS FILED BY SEAGATE, INTEVAC, OR BIDDER WILL

CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND

CONSIDERED BY INTEVAC’S STOCKHOLDERS BEFORE ANY DECISION IS MADE

WITH RESPECT TO THE TENDER OFFER, OR IF APPLICABLE, VOTING ON THE

TRANSACTION. A free copy of these materials will be available to

Intevac’s stockholders by visiting Intevac’s website

(https://ir.intevac.com). In addition, these materials (and all

other documents filed by Seagate, Intevac, and Bidder with the SEC)

will be available at no charge on the SEC’s website (www.sec.gov)

upon filing with the SEC.

If the tender offer is terminated and the Transaction is to be

effected by merger only, in which case, the approval of Intevac

stockholders must be obtained, Seagate, Intevac and their

respective directors and executive officers may be deemed to be

participants in any such solicitation of proxies from Intevac’s

stockholders in connection with the Transaction. Information

regarding Seagate’s directors and executive officers is available

in its most recent proxy statement that was filed with the SEC (and

is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/1137789/000113778924000085/stx-20240903.htm).

Information regarding Intevac’s directors and executive officers is

available in its most recent proxy statement that was filed with

the SEC (and is available at

https://www.sec.gov/Archives/edgar/data/1001902/000119312524091334/d719495ddef14a.htm).

Other information regarding potential participants in any such

proxy solicitation will be contained in any proxy statement filed

in connection with the Transaction.

Forward-Looking Statements

Certain statements contained in this communication may be

characterized as forward-looking under the Private Securities

Litigation Reform Act of 1995. These statements involve a number of

risks, uncertainties and other factors that could cause actual

results to differ materially.

Statements in this communication regarding Intevac and Seagate

that are forward-looking may include statements regarding: (i) the

Transaction; (ii) the anticipated occurrence, manner and timing of

the proposed tender offer, (iii) the expected timing of the closing

of the Transaction; (iv) considerations taken into account in

approving and entering into the Transaction; (v) the anticipated

benefits to, or impact of, the Transaction on Intevac’s and

Seagate’s respective businesses; and (vi) expectations for Intevac

and Seagate following the closing of the Transaction. There can be

no assurance that the Transaction will be consummated.

Actual events or results may differ materially from these

forward-looking statements. Words such as “anticipate,” “expect,”

“intend,” “plan,” “propose,” “provide,” “believe,” “seek,”

“estimate,” variations of such words, and similar expressions are

intended to identify such forward-looking statements, although not

all forward-looking statements contain these identifying words.

Risks and uncertainties that could cause actual results to differ

materially from those indicated in the forward-looking statements,

in addition to those identified above, include: (i) the possibility

that the conditions to the closing of the Transaction are not

satisfied or waived; (ii) uncertainties as to how many of Intevac’s

stockholders will tender their stock; (iii) the possibility that

competing offers will be made; (iv) the occurrence of any event,

change or other circumstance that could give rise to a right to

terminate the Transaction; (v) possible disruption related to the

Transaction to Intevac’s and Seagate’s current plans, operations

and business relationships, including through the loss of customers

and employees; (vi) the amount of the costs, fees, expenses and

other charges incurred by Intevac and Seagate related to the

Transaction; (vii) the risk that Intevac’s or Seagate’s stock price

may fluctuate during the pendency of the Transaction; (viii) the

diversion of Intevac’s or Seagate’s respective management’s time

and attention from ongoing business operations and opportunities;

(ix) the response of competitors and other market participants to

the Transaction; (x) potential litigation relating to the

Transaction; (xi) uncertainty as to timing of completion of the

Transaction and the ability of each party to consummate the

Transaction; and (xii) and the impact of global macroeconomic

conditions and supply chain challenges on Intevac’s or Seagate’s

respective businesses.

A more complete description of these and other material risks

can be found in the periodic reports that Intevac and Seagate have

filed and will file with the SEC, including their Quarterly Reports

on Form 10-Q for the quarterly period ended December 27, 2024 and

September 28, 2024 for Seagate and Intevac respectively, and their

Annual Reports on Forms 10-K for the fiscal year ended June 28,

2024 and December 30, 2023 for Seagate and Intevac respectively, as

well as the Schedule TO and related tender offer documents to be

filed by Seagate and its acquisition subsidiary, Bidder, the

Schedule 14D-9 to be filed by Intevac, and, if applicable, the

proxy statement referenced above. All forward-looking statements in

this communication are based on information available to Intevac

and Seagate as of the date of this communication, and, except as

required by law, neither Intevac nor Seagate assume any obligation

to update the forward-looking statements provided to reflect events

that occur or circumstances that exist after the date on which they

were made.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213031336/en/

For Intevac: Cameron McAulay Chief Financial Officer, Intevac

(408) 986-9888

David Hanover or Jack Perkins KCSA Strategic Communications

Intevac@kcsa.com (212) 896-1220

For Seagate: Shanye Hudson (510) 661-1600

shanye.hudson@seagate.com

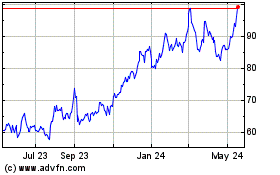

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Jan 2025 to Feb 2025

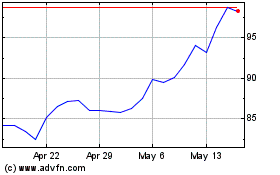

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Feb 2024 to Feb 2025