0001394319false00013943192024-05-142024-05-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 14, 2024 |

Tracon Pharmaceuticals, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36818 |

34-2037594 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4350 La Jolla Village Drive, Suite 800 |

|

San Diego, California |

|

92122 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 550-0780 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

TCON |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 14, 2024, TRACON Pharmaceuticals, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended March 31, 2024. A copy of this press release is furnished as Exhibit 99.1 hereto.

The information provided in this Item 2.02 of this Current Report on Form 8-K, including the exhibits, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

TRACON Pharmaceuticals, Inc. |

|

|

|

|

Date: |

May 14, 2024 |

By: |

/s/ Charles P. Theuer, M.D., Ph.D. |

|

|

|

Charles P. Theuer, M.D., Ph.D.

President and Chief Executive Officer

|

Exhibit 99.1

TRACON Pharmaceuticals Reports First Quarter 2024 Financial Results and

Provides Corporate Update

San Diego, CA – May 14, 2024 – TRACON Pharmaceuticals, Inc. (Nasdaq: TCON), a clinical stage biopharmaceutical company utilizing a cost-efficient, CRO-independent product development platform to advance its pipeline of novel targeted cancer therapeutics and to partner with other life science companies, today announced financial results for the first quarter ended March 31, 2024. The Company will host a conference call and webcast today at 4:30 PM Eastern Time / 1:30 PM Pacific Time.

“With ENVASARC fully enrolled we are focused on leveraging our Product Development Platform to generate non-dilutive capital through either an additional license or by replacing a CRO and executing clinical trials for partners at a lower cost compared to a CRO but still at a premium to our costs using a pay for performance model,” said Charles Theuer, M.D., Ph.D., President and CEO of TRACON. “We look forward to reporting the final response assessment data in all patients from the ENVASARC Phase 2 pivotal trial, which are expected in the third quarter.”

Recent Corporate Highlights

•In April, we announced updated interim safety and efficacy data from the ENVASARC Phase 2 pivotal trial in 73 patients treated with single agent envafolimab. The objective response rate (ORR) was 11% by investigator review and 5.5% by blinded independent central review (BICR), all of which were confirmed responses. Envafolimab monotherapy was generally well tolerated and median duration of response by BICR was greater than six months. The primary endpoint of the study is achievement of an ORR by BICR in nine of 82 patients (11%) treated with envafolimab and median duration of response of greater than six months is a key secondary endpoint.

•In April, the Company announced that the Nasdaq Hearings Panel granted the Company’s request for an extension to demonstrate compliance with all applicable criteria for continued listing on The Nasdaq Capital Market, including the $1.00 bid price and $2.5 million stockholders’ equity requirements, through June 3, 2024, provided the Company execute a reverse stock split and file an S-1, both of which the Company executed in April. The Company continues to consider alternatives to address the $2.5 million stockholders’ equity requirement on or before June 3, 2024.

Expected Upcoming Milestone

•Report the final response assessment data including duration of response in all patients from the ENVASARC Phase 2 pivotal trial, which are expected in the third quarter of 2024.

4350 La Jolla Village Drive Suite 800 San Diego, California 92122 P: 858.550.0780 F: 858.550.0786

URL: www.traconpharma.com

First Quarter 2024 Financial Results

•Cash, cash equivalents and restricted cash were $8.0 million at March 31, 2024, compared to $8.6 million at December 31, 2023, which is expected to fund the Company late into the third quarter of 2024.

•Research and development expenses for the first quarter of 2024 were $1.9 million, compared to $5.0 million for the first quarter of 2023. The decrease was primarily related to completing enrollment of the ENVASARC Phase 2 pivotal trial in 2024.

•General and administrative expenses for the first quarter of 2024 were $1.4 million, compared to $2.3 million for the first quarter of 2023.

•Net loss for the first quarter of 2024 was $3.2 million, compared to $8.5 million for the first quarter of 2023.

Conference Call Details

To access the call by phone, please register using this link and you will be provided with dial-in details.

A live webcast of the conference call will be available online from the Investor/Events and Presentation page of the Company’s website at www.traconpharma.com.

After the live webcast, a replay will remain available on TRACON’s website for 60 days.

About Envafolimab

Envafolimab (KN035), a single-domain antibody against PD-L1 invented by Alphamab Oncology and licensed by TRACON, is the first approved subcutaneously injected PD-(L)1 inhibitor. Envafolimab was approved by the Chinese NMPA in November 2021 in adult patients with MSI-H/dMMR advanced solid tumors who failed systemic treatment and have no satisfactory alternative treatment options. In December 2019, Alphamab Oncology, 3D Medicines and TRACON entered into a collaboration whereby TRACON has the right to develop and commercialize envafolimab in soft tissue sarcoma in North America. Envafolimab is currently being studied in the ENVASARC Phase 2 pivotal trial in the United States sponsored by TRACON and a Phase 3 pivotal trial in combination with gemcitabine and oxaliplatin in advanced biliary tract cancer patients in China sponsored by TRACON’s corporate partners, Alphamab Oncology and 3D Medicines. TRACON has received orphan drug designation from the U.S. Food and Drug Administration for envafolimab for patients with soft tissue sarcoma and fast track designation from the U.S. Food and Drug Administration for envafolimab (KN035) for patients with locally advanced, unresectable or metastatic undifferentiated pleomorphic sarcoma (UPS) and myxofibrosarcoma (MFS) who have progressed on one or two prior lines of chemotherapy.

About ENVASARC (NCT04480502)

The ENVASARC Phase 2 pivotal trial is a multicenter, open label, randomized, non-comparative, parallel cohort study at 30 top cancer centers in the United States and the United Kingdom that began dosing in December 2020. TRACON enrolled patients in ENVASARC with UPS or MFS who have progressed following one or two lines of prior treatment and have not received an immune checkpoint inhibitor. A total of 82 evaluable patients have received treatment with single agent envafolimab at 600 mg every three weeks. The primary endpoint is objective response rate by central review in nine of 82 patients (11%) with duration of response a key secondary endpoint.

About TRACON

TRACON is a clinical-stage biopharmaceutical company utilizing a cost-efficient, CRO-independent, product development platform to advance its pipeline of novel targeted cancer therapeutics and to partner with other life science companies. The Company’s clinical-stage pipeline includes: Envafolimab, a PD-L1 single-domain antibody given by rapid subcutaneous injection that is being studied in the pivotal ENVASARC trial for sarcoma; YH001, a potential best-in-class CTLA-4 antibody in Phase 1 development; and TRC102, a Phase 2 small molecule drug candidate for the treatment of lung cancer. TRACON is actively seeking additional corporate partnerships through a profit-share or revenue-share partnership, or through franchising TRACON’s product development platform. TRACON believes it can serve as a solution for companies without clinical and commercial capabilities in the United States or who wish to become CRO-independent. To learn more about TRACON and its product pipeline, visit TRACON’s website at www.traconpharma.com.

Forward-Looking Statements

Statements made in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward‐looking statements. Such statements include, but are not limited to, TRACON’s plans to further develop product candidates; TRACON’s ability to regain compliance with Nasdaq continued listing standards and maintain the listing of its securities on a national securities exchange; TRACON’s plans to further license out its platform or replace CROs and generate non-dilutive capital; expectations regarding the timing and scope of clinical trials and availability of clinical data, including the timing and results of accrual and data from TRACON’s ENVASARC Phase 2 pivotal trial; expected development, regulatory and commercial milestones and timing thereof; potential utility of product candidates; TRACON’s cash runway; and TRACON’s business development strategy and goals, including the ability to enter into additional collaborations or licensing arrangements. Risks that could cause actual results to differ from those expressed in these forward‐looking statements include: the risk that TRACON needs substantial additional capital to continue as a going concern and to enroll or complete its ongoing clinical trials as currently planned, if at all; risks associated with clinical development and regulatory approval of novel pharmaceutical product candidates; whether TRACON or others will be able to complete or initiate clinical trials on TRACON’s expected timelines, if at all, including due to risks associated with geopolitical and macroeconomic events; the fact that future preclinical studies and clinical trials, including ENVARSAC, may not be successful or otherwise consistent with results from prior studies; the fact that TRACON has limited control over whether or when third party collaborators complete on-going trials or initiate additional trials of TRACON’s product candidates; the fact that TRACON’s collaboration agreements are subject to early termination; whether TRACON will be able to enter into additional collaboration agreements or licensing arrangements or arrangements whereby TRACON replaces CROs on favorable terms or at all; potential changes in regulatory requirements in the United States and foreign countries; TRACON’s reliance on third parties for the development of its product candidates, including the conduct of its clinical trials and manufacture of its product candidates; whether TRACON will be able to obtain additional financing; whether TRACON will experience unanticipated costs or other events that cause TRACON’s cash runway to not extend late into the third quarter of 2024; whether TRACON will remain listed on Nasdaq; and other risks described in TRACON’s filings with the Securities and Exchange Commission under the heading “Risk Factors”. All forward‐looking statements contained in this press release speak only as of the date on which they were made and are based on management’s assumptions and estimates as of such date. TRACON undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made except as required by law.

TRACON Pharmaceuticals, Inc.

Unaudited Condensed Consolidated Statements of Operations

(in thousands, except share and per share data)

|

|

|

|

Three Months Ended

March 31, |

|

2024 |

2023 |

Revenue |

$100 |

$— |

Operating expenses: |

|

|

Research and development |

1,878 |

4,969 |

General and administrative |

1,434 |

2,344 |

Total operating expenses |

3,312 |

7,313 |

Loss from operations |

(3,212) |

(7,313) |

Total other income (expense) |

44 |

(1,191) |

Net loss |

$(3,168) |

$(8,504) |

Loss per share, basic and diluted |

$(1.33) |

$(6.76) |

Weighted‑average common shares outstanding, basic and diluted |

2,389,519 |

1,258,096 |

|

TRACON Pharmaceuticals, Inc.

Unaudited Condensed Consolidated Balance Sheets

(in thousands)

|

|

|

|

|

March 31, |

|

December 31, |

|

2024 |

|

2023 |

Assets |

|

|

|

Current assets: |

|

|

|

Cash and cash equivalents |

$7,891 |

|

$8,564 |

Prepaid and other assets |

511 |

|

526 |

Total current assets |

8,402 |

|

9,090 |

Property and equipment, net |

33 |

|

37 |

Restricted Cash |

73 |

|

73 |

Other assets |

847 |

|

905 |

Total assets |

$9,355 |

|

$10,105 |

Liabilities and Stockholders’ Deficit |

|

|

|

Current liabilities: |

|

|

|

Accounts payable and accrued expenses |

$10,036 |

|

$9,755 |

Accrued compensation and related expenses |

414 |

|

427 |

Total current liabilities |

10,450 |

|

10,182 |

Other long-term liabilities |

667 |

|

732 |

Commitments and contingencies |

|

|

|

Stockholders’ deficit: |

|

|

|

Common stock |

3 |

|

2 |

Additional paid‑in capital |

241,902 |

|

239,688 |

Accumulated deficit |

(243,667) |

|

(240,499) |

Total stockholders’ deficit |

(1,762) |

|

(809) |

Total liabilities and stockholders’ deficit |

$9,355 |

|

$10,105 |

|

|

Company Contact: |

Investor Contact: |

Charles Theuer |

Brian Ritchie |

Chief Executive Officer |

LifeSci Advisors LLC |

(858) 550-0780 |

(212) 915-2578 |

ctheuer@traconpharma.com |

britchie@lifesciadvisors.com |

v3.24.1.1.u2

Document And Entity Information

|

May 14, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 14, 2024

|

| Entity Registrant Name |

Tracon Pharmaceuticals, Inc.

|

| Entity Central Index Key |

0001394319

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-36818

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

34-2037594

|

| Entity Address, Address Line One |

4350 La Jolla Village Drive, Suite 800

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92122

|

| City Area Code |

(858)

|

| Local Phone Number |

550-0780

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

TCON

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

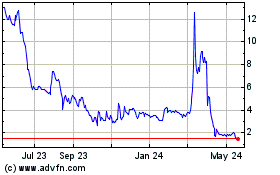

TRACON Pharmaceuticals (NASDAQ:TCON)

Historical Stock Chart

From Oct 2024 to Nov 2024

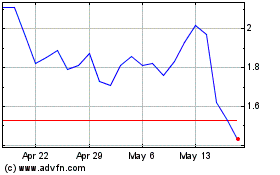

TRACON Pharmaceuticals (NASDAQ:TCON)

Historical Stock Chart

From Nov 2023 to Nov 2024