As filed with the Securities and Exchange Commission on October 22, 2024

REGISTRATION NO. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

UP FINTECH HOLDING LIMITED

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

|

|

Cayman Islands |

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification Number) |

1 Raffles Place,

#35-61 One Raffles Place,

Singapore

(048616)

(Address, including zip code, and telephone number of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

Telephone: (302) 738-6680

(Name, address, including zip code, and telephone number of agent for service)

Copies to:

|

|

|

|

Li He, Esq. Davis Polk & Wardwell LLP c/o 10th Floor, The Hong Kong Club Building 3A Chater Road, Central Hong Kong +852 2533-3300 |

|

Approximate date of commencement of proposed sale to the public: from time to time after the effective date of this registration statement

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Securities and Exchange Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

PROSPECTUS

UP Fintech Holding Limited

Class A Ordinary Shares

We may from time to time in one or more offerings offer and sell our Class A ordinary shares, including Class A ordinary shares represented by American depositary shares, or ADSs.

In addition, from time to time, the selling shareholders (if any) named in a prospectus supplement may offer and sell our Class A ordinary shares or ADSs held by them. The selling shareholders (if any) may sell our Class A ordinary shares or ADSs through public or private transactions at prevailing market prices or at privately negotiated prices. We will not receive any proceeds from the sale of our Class A ordinary shares by selling shareholders.

We will provide specific terms of any offering in a supplement to this prospectus. Any prospectus supplement may also add, update, or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement as well as the documents incorporated or deemed to be incorporated by reference in this prospectus before you purchase any of the securities offered hereby.

These securities may be offered and sold in the same offering or in separate offerings; to or through underwriters, dealers, and agents; or directly to purchasers. The names of any underwriters, dealers, or agents involved in the sale of our securities, their compensation and any options to purchase additional securities held by them will be described in the applicable prospectus supplement. For a more complete description of the plan of distribution of these securities, see the section entitled “Plan of Distribution” of this prospectus.

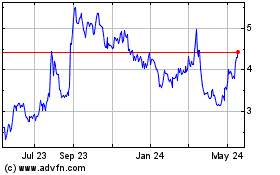

The ADSs are listed on the Nasdaq Global Select Market under the symbol “TIGR.” On October 21, 2024, the last reported sale price of the ADSs on the Nasdaq Global Select Market was US$7.44 per ADS.

Investing in our securities involves a high degree of risk. You should carefully consider the risks described under “Risk Factors” starting on page 5 of this prospectus, included in any prospectus supplement or in the documents incorporated by reference into this prospectus before you invest in our securities.

This prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 22, 2024

table of contents

ABOUT THIS PROSPECTUS

We are a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended, or the Securities Act. This prospectus is part of an automatic shelf registration statement that we filed with the Securities and Exchange Commission, or the SEC. By using an automatic shelf registration statement, we or any selling shareholder may, at any time and from time to time, offer and sell the securities described in this prospectus in one or more offerings. We may also add, update or change information contained in this prospectus by means of a prospectus supplement or by incorporating by reference information that we file or furnish to the SEC. As allowed by the SEC rules, this prospectus and any accompanying prospectus supplement do not contain all of the information included in the registration statement. For further information, we refer you to the registration statement, including its exhibits. Statements contained in this prospectus or any prospectus supplement about the provisions or contents of any agreement or other document are not necessarily complete. If the SEC’s rules and regulations require that an agreement or document be filed as an exhibit to the registration statement, please see that agreement or document for a complete description of these matters.

You should carefully read this document and any applicable prospectus supplement. You should also read the documents we have referred you to under “Where You Can Find More Information About Us” and “Incorporation of Documents by Reference” below for information on our company, the risks we face and our financial statements. The registration statement and exhibits can be read on the SEC’s website as described under “Where You Can Find More Information About Us.”

In this prospectus, unless otherwise indicated or unless the context otherwise requires:

•“ADSs” refers to our American depositary shares, each of which represents fifteen Class A ordinary shares.

•“China” or the “PRC” means the People’s Republic of China, and only in the context of describing PRC laws, regulations and other legal or tax matters in this prospectus, excludes Hong Kong, Macau and Taiwan.

•“Chinese investors” refer to the Chinese speaking population around the globe.

•“conversion rate” means the ratio of (i) the number of trading customers to (ii) the number of customer accounts.

•“customer(s)” or “customer account(s)” means the registered users who have passed the Know-Your- Client (“KYC”) procedures and opened a trading account on our platform (including APP and website).

•“customer(s) with deposits” means the customers who have deposited funds in their accounts on our platform.

•“HK$” or “Hong Kong dollars” means the legal currency of Hong Kong.

•“MAA” refers to the fourth amended and restated memorandum and articles of association of our company, currently effective.

•“NZ$” or “New Zealand dollars” means the legal currency of New Zealand.

•“our VIEs” means Beijing Xiangshang Rongke Technology Development Co., LTD, or Beijing Rongke, formerly known as Ningxia Xiangshang Rongke Technology Development Co., LTD, or Ningxia Rongke and Beijing Xiangshang Yiyi Laohu Technology Group Co., LTD, or Beijing Yiyi; “VIE” or “VIEs” means a variable interest entity or variable interest entities.

•“our WFOEs” means Beijing Bohu Xiangshang Technology Co., Ltd., or Beijing Bohu, formerly known as Ningxia XiangShang Yixin Technology Co., Ltd, or Ningxia Yixin and Beijing Xiangshang Yixin Technology Co., Ltd., or Beijing Yixin; “WFOE” or “WFOEs” means the wholly-foreign owned entity or wholly-foreign owned entities as provided in the relevant PRC laws and regulations.

•“retention rate” means the ratio of (i) the number of trading customers in one period who continue to trade in the next period to (ii) the number of trading customers in the first period.

•“RMB” or “Renminbi” means the legal currency of China.

•“Singapore dollars” means the legal currency of Singapore.

•“trading customer(s)” means the customers who have conducted at least one trading transaction on our platform.

•“trading volume” means the total value of securities traded during a specific period of time.

•“UP Fintech,” “we,” “us,” “our” and “our company” means UP Fintech Holding Limited, our Cayman Islands holding company and its subsidiaries, its consolidated VIEs entity and the subsidiaries of the VIEs.

•“user(s)” or “registered user(s)” means those who have registered on our platform (including APP and website) but not necessarily have opened a trading account.

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference in this prospectus may contain forward-looking statements that reflect our current or then-current expectations and views of future events. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “likely to”, “could”, “potential” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, but are not limited to, statements about:

•our goals and strategies;

• our future business development, including the expansion of existing businesses and development of new businesses;

•our plans for international expansion of our business;

•our expectations and trends regarding our financial condition and results of operations;

•expected changes in our sources and volume of revenues;

•expected changes in our costs or expenditures, including those relating to regulatory compliance, personnel, development and sales of our products and services, arrangements with third parties, acquisitions, cost of funding, and litigation;

•our expectations regarding the demand for and market acceptance of our services;

•expected growth of our customers, including consolidated account customers;

•competition in our industry;

•our expectations regarding the impact of economic factors such as increased interest rates and inflation on our business, financial condition, and results of operations;

•government statutes, policies and regulations relating to our industry and our company, including the Holding Foreign Companies Accountable Act, and Chinese regulations impacting the variable interest entities in our corporate structure;

•whether we will be identified as a “Commission-Identified Issuer”, as defined below, this year or in future years; and

•our relationships with third parties on whom portions of our business depend, including Interactive Brokers.

The forward-looking statements included in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference are subject to risks, uncertainties and assumptions about our company. Our actual results of operations may differ materially from the forward-looking statements as a result of the risk factors disclosed in the documents incorporated by reference in this prospectus or in any accompanying prospectus supplement.

We would like to caution you not to place undue reliance on these forward-looking statements and you should read these statements in conjunction with the risk factors disclosed in the documents incorporated by reference in this prospectus or in any accompanying prospectus supplement for a more complete discussion of the risks of an investment in our securities. The forward-looking statements included in this prospectus or incorporated by reference into this prospectus are made only as of the date of this prospectus or the date of the incorporated document, and we do not undertake any obligation to update the forward-looking statements except as required under applicable law.

CORPORATE INFORMATION

The locations of our principal executive offices are 1 Raffles Place, #35-61 One Raffles Place, Singapore (048616) and 18/F, Grandyvic Building, No. 1 Building, No. 16 Taiyanggong Middle Road, Chaoyang District, Beijing, 100020 PRC and our telephone number at this address is +86-10-56216660. Our registered office in the Cayman Islands is P.O. Box 2547, 23 Lime Tree Bay Avenue, Grand Cayman, KY1-1104, Cayman Islands. Our agent for service of process in the United States is Puglisi & Associates, located at 850 Library Avenue, Suite 204 Newark, Delaware 19711 and the telephone number of our agent is (302) 738-6680.

Investors should contact us for any inquiries through the address and telephone number of our principal executive offices. Our website is itigerup.com. Information contained in, or accessible through, our website is not a part of, and is not incorporated into, this prospectus.

RISK FACTORS

Please see the factors set forth under “Item 3. Key Information—D. Risk Factors” in our annual report on Form 20-F for the year ended December 31, 2023, which is incorporated by reference in this prospectus, and any accompanying prospectus supplement before investing in any securities that may be offered pursuant to this prospectus.

The risks and uncertainties described in this prospectus, any applicable prospectus supplement or other offering materials as well as the documents incorporated by reference herein are not the only ones we face. Additional risks and uncertainties that we do not presently know about or that we currently believe are not material may also adversely affect our business. If any of the risks and uncertainties described in this prospectus, any applicable prospectus supplement or other offering materials as well as the documents incorporated by reference herein actually occur, our business, financial condition and results of operations could be adversely affected in a material way. The occurrence of any of these risks may cause you to lose all or part of your investment in the offered securities.

USE OF PROCEEDS

We intend to use the net proceeds from the sale of the securities we offer as set forth in the applicable prospectus supplement(s). The specific allocations of the proceeds we receive from the sale of our securities will be described in the applicable prospectus supplement(s).

We will not receive any proceeds from the sale of our Class A ordinary shares or ADSs by the selling shareholders (if any).

DESCRIPTION OF SHARE CAPITAL

Organization

We are a Cayman Islands company and our affairs are governed by our fourth amended and restated memorandum and articles of association and the Companies Act, Cap. 22 (Act 3 of 1961, as consolidated and revised) of the Cayman Islands, or the Companies Act, and the common law of the Cayman Islands.

Our MAA provides that we have two classes of ordinary shares, the Class A ordinary shares and Class B ordinary shares. Our authorized share capital is US$50,000 divided into 5,000,000,000 shares of a par value of US$0.00001 each, comprising (i) 4,662,388,278 Class A ordinary shares of a par value of US$0.00001 each and (ii) 337,611,722 Class B ordinary shares of a par value of US$0.00001 each. All incentive shares, including options, regardless of grant dates, will entitle holders to an equivalent number of Class A ordinary shares once the applicable vesting and exercising conditions are met.

The following are summaries of material provisions of our MAA and the Companies Act insofar as they relate to the material terms of our ordinary shares.

Ordinary Shares

Our ordinary shares are divided into Class A ordinary shares and Class B ordinary shares. Holders of our Class A ordinary shares and Class B ordinary shares will have the same rights except for voting and conversion rights. Our ordinary shares are issued in registered form and are issued when registered in our register of members. We shall not issue bearer shares. Our shareholders who are nonresidents of the Cayman Islands may freely hold and vote their shares.

Dividends

The holders of our ordinary shares are entitled to such dividends as may be declared by our board of directors. Our MAA provides that dividends may be declared and paid out of our profits, realized or unrealized, or from any reserve set aside from profits which our board of directors determine is no longer needed. Dividends may also be declared and paid out of share premium account or any other fund or account which can be authorized for this purpose in accordance with the Companies Act. Under the laws of the Cayman Islands, our company may pay a dividend out of either profit or share premium account, provided that in no circumstances may a dividend be paid out of share premium if this would result in our company being unable to pay its debts as they fall due in the ordinary course of business.

Voting Rights

On a show of hands, each shareholder is entitled to one vote for each Class A ordinary share and 20 votes for each Class B ordinary share, or on a poll, each shareholder is entitled to one vote for each Class A ordinary share and 20 votes for each Class B ordinary share, voting together as a single class, on all matters that require a shareholder’s vote. Voting at any shareholders’ meeting is by show of hands unless a poll is demanded. A poll may be demanded by the chairman of such meeting or any shareholder who is present in person or by proxy at the meeting.

An ordinary resolution to be passed at a meeting by the shareholders requires the affirmative vote of a simple majority of the votes attaching to the ordinary shares cast at a meeting, while a special resolution requires the affirmative vote of no less than two-thirds of the votes cast attaching to the outstanding ordinary shares at a meeting. A special resolution will be required for important matters such as a change of name or making changes to our fourth amended and restated memorandum and articles of association.

General Meetings of Shareholders

As a Cayman Islands exempted company, we are not obliged by the Companies Act to call shareholders’ annual general meetings. Our MAA provides that we may (but are not obliged to) in each year hold a general meeting as our annual general meeting in which case we shall specify the meeting as such in the notices calling it, and the annual general meeting shall be held at such time and place as may be determined by our directors.

Shareholders’ general meetings may be convened by the chairman of our board of directors or a majority of our board of directors. Advance notice of at least ten (10) calendar days is required for the convening of our annual general shareholders’ meeting (if any) and any other general meeting of our shareholders. A quorum required for any general meeting of shareholders consists of at least one shareholder present or by proxy, representing not less than one-third of all votes attaching to all of our shares in issue and entitled to vote.

Neither the Companies Act nor our MAA provides shareholders with rights to requisition a general meeting or the right to put any proposal before a general meeting.

Conversion

Each Class B ordinary share is convertible into one Class A ordinary share by the holder thereof, subject to certain conditions. Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances. Upon any sale of Class B ordinary shares by a holder thereof to any person or entity, such Class B ordinary shares will be automatically and immediately converted into an equal number of Class A ordinary shares.

Transfer of Class A Ordinary Shares

Subject to the restrictions in our MAA as set out below and the provisions above in respect of the transfer of Class B ordinary shares, any of our shareholders may transfer all or any of his or her Class A ordinary shares by an instrument of transfer in the usual or common form or any other form approved by our board of directors.

Our board of directors may, in its absolute discretion, decline to register any transfer of any ordinary share which is not fully paid up or on which we have a lien. Our board of directors may also decline to register any transfer of any ordinary share unless:

•the instrument of transfer is lodged with us, accompanied by the certificate for the ordinary shares to which it relates and such other evidence as our board of directors may reasonably require to show the right of the transferor to make the transfer;

•the instrument of transfer is in respect of only one class of ordinary shares;

•the instrument of transfer is duly and properly stamped, if required;

•in the case of a transfer to joint holders, the number of joint holders to whom the ordinary share is to be transferred does not exceed four; and

•a fee of such maximum sum as Nasdaq may determine to be payable or such lesser sum as our directors may from time to time require is paid to us in respect thereof.

If our directors refuse to register a transfer they shall, within three months after the date on which the instrument of transfer was lodged, send to each of the transferor and the transferee notice of such refusal.

The registration of transfers may, after compliance with any notice required of Nasdaq, be suspended and the register closed at such times and for such periods as our board of directors may from time to time determine, provided, however, that the registration of transfers shall not be suspended nor the register closed for more than 30 days in any year as our board may determine.

Liquidation

On the winding up of our company, if the assets available for distribution amongst our shareholders shall be more than sufficient to repay the whole of the share capital at the commencement of the winding up, the surplus shall be distributed amongst our shareholders in proportion to the amount paid up on the shares held by them at the commencement of the winding up, subject to a deduction from those shares in respect of which there are monies due, of all monies payable to our company for unpaid calls or otherwise. If our assets available for distribution are insufficient to repay all of the paid-up capital, the assets will be distributed so that the losses are borne by our shareholders in proportion to the capital paid up, or which ought to have been paid up, at the commencement of the winding up on the shares held by them.

Calls on Shares and Forfeiture of Shares

Our board of directors may from time to time make calls upon shareholders for any amounts unpaid on their shares in a notice served to such shareholders at least 14 clear days prior to the specified time and place of payment. The shares that have been called upon and remain unpaid are subject to forfeiture.

Redemption, Repurchase and Surrender of Shares

We may issue shares on terms that such shares are subject to redemption, at our option or at the option of the holders of these shares, on such terms and in such manner as may be determined by our board of directors. Our company may also repurchase any of our shares on such terms and in such manner as have been approved by our board of directors or by an ordinary resolution of our shareholders. Under the Companies Act, the redemption or repurchase of any share may be paid out of our company’s profits or out of the proceeds of a new issue of shares made for the purpose of such redemption or repurchase, or out of capital (including share premium account and capital redemption reserve) if our company can, immediately following such payment, pay its debts as they fall due in the ordinary course of business. In addition, under the Companies Act no such share may be redeemed or repurchased (a) unless it is fully paid up, (b) if such redemption or

repurchase would result in there being no shares outstanding or (c) if our company has commenced liquidation. In addition, our company may accept the surrender of any fully paid share for no consideration.

Pre-Emption Rights

There are no pre-emption rights applicable to the issue of new shares under either the Cayman Islands law or our MAA.

Variations of Rights of Shares

If at any time, our share capital is divided into different classes or series of shares, the rights attached to any class or series of shares (unless otherwise provided by the terms of issue of the shares of that class or series), whether or not our company is being wound-up, may be varied with the sanction of a special resolution passed by two-thirds of the votes cast at a separate meeting of the holders of the shares of the class or series. The rights conferred upon the holders of the shares of any class issued shall not, unless otherwise expressly provided by the terms of issue of the shares of that class, be deemed to be varied by the creation or issue of further shares ranking pari passu with such existing class of shares.

Issuance of Additional Shares

Our MAA authorizes our board of directors to issue additional shares from time to time as our board of directors shall determine, to the extent of available authorized but unissued shares.

Our MAA also authorizes our board of directors to establish from time to time one or more series of preference shares and to determine, with respect to any series of preference shares, the terms and rights of that series, including:

•the designation of the series;

•the number of shares of the series;

•the dividend rights, dividends rates, conversion rights, voting rights; and

•the rights and terms of redemption and liquidation preferences.

Our board of directors may issue preference shares without action by our shareholders to the extent authorized but unissued. Issuance of these shares may dilute the voting power of holders of ordinary shares.

Inspection of Books and Records

Holders of our shares will have no general right under Cayman Islands law to inspect or obtain copies of our list of shareholders or our corporate records. However, we will provide our shareholders with annual audited financial statements. See “Where You Can Find More Information.”

Anti-Takeover Provisions

Some provisions of our MAA may discourage, delay or prevent a change of control of our company or management that shareholders may consider favorable, including provisions that:

•authorize our board of directors to issue preference shares in one or more series and to designate the price, rights, preferences, privileges and restrictions of such preference shares without any further vote or action by our shareholders; and

•limit the ability of shareholders to requisition and convene general meetings of shareholders.

However, under Cayman Islands law, our directors may only exercise the rights and powers granted to them under our MAA for a proper purpose and for what they believe in good faith to be in the best interests of our company.

Alteration of Capital

We may from time to time by ordinary resolution:

•increase our capital by such sum, to be divided into shares of such amounts, as the resolution shall prescribe;

•consolidate and divide all or any of our share capital into shares of a larger amount than our existing shares;

•cancel any shares which at the date of the passing of the resolution have not been taken or agreed to be taken by any person, and diminish the amount of its share capital by the amount of the shares so cancelled subject to the provisions of the Companies Act;

•sub-divide our shares or any of them into shares of a smaller amount than is fixed by our amended and restated memorandum and articles of association, subject nevertheless to the Companies Act, and so that the resolution whereby any share is sub-divided may determine that, as between the holders of the shares resulting from such subdivision, one or more of the shares may have any such preferred or other special rights, over, or may have such deferred rights or be subject to any such restrictions as compared with the others as we have power to attach to unissued or new shares; and

•divide shares into several classes and without prejudice to any special rights previously conferred upon the holders of the existing shares, attach to the shares respectively any preferential, deferred, qualified or special rights, privileges, conditions or such restrictions that in the absence of any such determination in general meeting may be determined by our directors.

No alteration may be made of the kind contemplated by the provisions above, or otherwise, to the par value of the Class A Ordinary Shares or the Class B Ordinary Shares unless an identical alteration is made to the par value of the Class B Ordinary Shares or the Class A Ordinary Shares, as the case may be.

We may, by special resolution, subject to any confirmation or consent required by the Companies Act, reduce our share capital or any capital redemption reserve in any manner authorized by law.

Exempted Company

We are an exempted company with limited liability under the Companies Act. The Companies Act distinguishes between ordinary resident companies and exempted companies. Any company that is registered in the Cayman Islands but conducts business mainly outside of the Cayman Islands may apply to be registered as an exempted company. The requirements for an exempted company are essentially the same as for an ordinary company except that an exempted company:

•does not have to file an annual return of its shareholders with the Registrar of Companies;

•is not required to open its register of members for inspection;

•does not have to hold an annual general meeting;

•may issue shares with no par value;

•may obtain an undertaking against the imposition of any future taxation (such undertakings are usually given for 20 years in the first instance);

•may register by way of continuation in another jurisdiction and be deregistered in the Cayman Islands;

•may register as a limited duration company; and

•may register as a segregated portfolio company.

“Limited liability” means that the liability of each shareholder is limited to the amount unpaid by the shareholder on the shares of our company (except in exceptional circumstances, such as involving fraud, the establishment of an agency relationship or an illegal or improper purpose or other circumstances in which a court may be prepared to pierce or lift the corporate veil).

Differences in Corporate Law

The Companies Act is derived, to a large extent, from the older Companies Acts of England but does not follow recent English statutory enactments and accordingly there are significant differences between the Companies Act and the current Companies Act of England. In addition, the Companies Act differs from laws applicable to U.S. corporations and their shareholders. Set forth below is a summary of certain significant differences between the provisions of the Companies Act applicable to us and the laws applicable to companies incorporated in the U.S. and their shareholders.

Mergers and Similar Arrangements

The Companies Act permits mergers and consolidations between Cayman Islands companies and between Cayman Islands companies and non-Cayman Islands companies. For these purposes, (i) “merger” means the merging of two or more constituent companies and the vesting of their undertaking, property and liabilities in one of such companies as the surviving company, and (ii) a “consolidation” means the combination of two or more constituent companies into a consolidated company and the vesting of the undertaking, property and liabilities of such companies to the consolidated company. In order to effect such a merger or consolidation, the directors of each constituent company must approve a written plan of merger or consolidation, which must then be authorized by (a) a special resolution of the shareholders of each constituent company, and (b) such other authorization, if any, as may be specified in such constituent company’s articles of association. The plan must be filed with the Registrar of Companies of the Cayman Islands together with a declaration as to the solvency of the consolidated or surviving company, a list of the assets and liabilities of each constituent company and an undertaking that a copy of the certificate of merger or consolidation will be given to the members and creditors of each constituent company and that notification of the merger or consolidation will be published in the Cayman Islands Gazette. Court approval is not required for a merger or consolidation which is effected in compliance with these statutory procedures.

A merger between a Cayman parent company and its Cayman subsidiary or subsidiaries does not require authorization by a resolution of shareholders of that Cayman subsidiary if a copy of the plan of merger is given to every member of that Cayman subsidiary to be merged unless that member agrees otherwise. For this purpose, a company is a “parent” of a subsidiary if it holds issued shares that together represent at least ninety percent (90%) of the votes at a general meeting of the subsidiary.

The consent of each holder of a fixed or floating security interest over a constituent company is required unless this requirement is waived by a court in the Cayman Islands.

Save in certain limited circumstances, a shareholder of a Cayman constituent company who dissents from the merger or consolidation is entitled to payment of the fair value of his shares (which, if not agreed between the parties, will be determined by the Cayman Islands court) upon dissenting to the merger or consolidation, provided that the dissenting shareholder complies strictly with the procedures set out in the Companies Act. The exercise of dissenter rights will preclude the exercise by the dissenting shareholder of any other rights to which he or she might otherwise be entitled by virtue of holding shares, save for the right to seek relief on the grounds that the merger or consolidation is void or unlawful.

Separate from the statutory provisions relating to mergers and consolidations, the Companies Act also contains statutory provisions that facilitate the reconstruction and amalgamation of companies by way of schemes of arrangement, provided that the arrangement is approved by a majority in number of each class of shareholders and creditors with whom the arrangement is to be made, and who must in addition represent seventy-five per cent in value of each such class of shareholders or creditors, as the case may be, that are present and voting either in person or by proxy at a meeting, or meetings, convened for that purpose. The convening of the meetings and subsequently the arrangement must be sanctioned by the Grand Court of the Cayman Islands. While a dissenting shareholder has the right to express to the court the view that the transaction ought not to be approved, the court can be expected to approve the arrangement if it determines that:

•the statutory provisions as to the required majority vote have been met;

•the shareholders have been fairly represented at the meeting in question and the statutory majority are acting bona fide without coercion of the minority to promote interests adverse to those of the class;

•the arrangement is such that may be reasonably approved by an intelligent and honest man of that class acting in respect of his interest; and

•the arrangement is not one that would more properly be sanctioned under some other provision of the Companies Act.

The Companies Act also contains a statutory power of compulsory acquisition which may facilitate the “squeeze out” of dissentient minority shareholder upon a tender offer. When a tender offer is made and accepted by holders of 90.0% of the shares affected within four months, the offeror may, within a two-month period commencing on the expiration of such four-month period, require the holders of the remaining shares to transfer such shares to the offeror on the terms of the offer. An objection can be made to the Grand Court of the Cayman Islands but this is unlikely to succeed in the case of an offer which has been so approved unless there is evidence of fraud, bad faith or collusion.

If an arrangement and reconstruction is thus approved, or if a tender offer is made and accepted, a dissenting shareholder would have no rights comparable to appraisal rights, which would otherwise ordinarily be available to dissenting shareholders of Delaware corporations, providing rights to receive payment in cash for the judicially determined value of the shares.

Shareholders’ Suits

In principle, we will normally be the proper plaintiff to sue for a wrong done to us as a company, and as a general rule a derivative action may not be brought by a minority shareholder. However, based on English authorities, which would in all likelihood be of persuasive authority in the Cayman Islands, the Cayman Islands court can be expected to follow and apply the common law principles (namely the rule in Foss v. Harbottle and the exceptions thereto) so that a non-controlling shareholder may be permitted to commence a class action against or derivative actions in the name of our company to challenge actions where:

•a company acts or proposes to act illegally or ultra vires;

•the act complained of, although not ultra vires, could only be effected duly if authorized by more than a simple majority vote that has not been obtained; and

•those who control our company are perpetrating a “fraud on the minority.”

Indemnification of Directors and Executive Officers and Limitation of Liability

Cayman Islands law does not limit the extent to which a company’s memorandum and articles of association may provide for indemnification of officers and directors, except to the extent any such provision may be held by the Cayman Islands courts to be contrary to public policy, such as to provide indemnification against fraud or dishonesty or the consequences of committing a crime. Our MAA provides that that we shall indemnify our directors, secretary and other officers for the time being and the liquidator or trustees (if any) for the time being acting in relation to any of the affairs of our company and everyone of them, and everyone of their heirs, executors and administrators, out of the assets and profits of our company from and against all actions, costs, charges, losses, damages and expenses which they or any of them, their or any of their heirs, executors or administrators, shall or may incur or sustain by or by reason of any act done, concurred in or omitted in or about the execution of their duty, or supposed duty, in their respective offices or trusts; and none of them shall be answerable for the acts, receipts, neglects or defaults of the other or others of them or for joining in any receipts for the sake of conformity, or for any bankers or other persons with whom any moneys or effects belonging to our company shall or may be lodged or deposited for safe custody, or for insufficiency or deficiency of any security upon which any moneys of or belonging to our company shall be placed out on or invested, or for any other loss, misfortune or damage which may happen in the execution of their respective offices or trusts, or in relation thereto, provided that this indemnity shall not extend to any matter in respect of any fraud or dishonesty which may attach to any of said persons. This standard of conduct is generally the same as permitted under the Delaware General Corporation Law for a Delaware corporation.

In addition, we have entered into indemnification agreements with our directors and executive officers that provide such persons with additional indemnification beyond that provided in our amended and restated memorandum and articles of association.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers or persons controlling us under the foregoing provisions, we have been informed that in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Directors’ Fiduciary Duties

Under Delaware corporate law, a director of a Delaware corporation has a fiduciary duty to the corporation and its shareholders. This duty has two components: the duty of care and the duty of loyalty. The duty of care requires that a director act in good faith, with the care that an ordinarily prudent person would exercise under similar circumstances. Under this duty, a director must inform himself of, and disclose to shareholders, all material information reasonably available regarding a significant transaction. The duty of loyalty requires that a director acts in a manner he reasonably believes to be in the best interests of the corporation. He must not use his corporate position for personal gain or advantage. This duty prohibits self-dealing by a director and mandates that the best interest of the corporation and its shareholders take precedence over any interest possessed by a director, officer or controlling shareholder and not shared by the shareholders generally. In general, actions of a director are presumed to have been made on an informed basis, in good faith and in the honest belief that the action taken was in the best interests of the corporation. However, this presumption may be rebutted by evidence of a breach of one of the fiduciary duties. Should such evidence be presented concerning a transaction by a director, the director must prove the procedural fairness of the transaction, and that the transaction was of fair value to the corporation.

As a matter of Cayman Islands law, a director of a Cayman Islands company is in the position of a fiduciary with respect to our company and therefore it is considered that he owes the following duties to our company—a duty to act bona fide in the best interests of our company, a duty not to make a profit based on his position as director (unless our company permits him to do so), a duty not to put himself in a position where the interests of our company conflict with his personal interest or his duty to a third party, and a duty to exercise powers for the purpose for which such powers were intended. A director of a Cayman Islands company owes to our company a duty to act with skill and care. It was previously considered that a director need not exhibit in the performance of his duties a greater degree of skill than may

reasonably be expected from a person of his knowledge and experience. However, English and Commonwealth courts have moved towards an objective standard with regard to the required skill and care and these authorities are likely to be followed in the Cayman Islands.

Shareholder Action by Written Consent

Under the Delaware General Corporation Law, a corporation may eliminate the right of shareholders to act by written consent by amendment to its certificate of incorporation. Our MAA follows Delaware General Corporation Law and do not allow our shareholders to approve corporate matters by way of a unanimous written resolution signed by or on behalf of each shareholder.

Shareholder Proposals

Under the Delaware General Corporation Law, a shareholder has the right to put any proposal before the annual meeting of shareholders, provided it complies with the notice provisions in the governing documents. A special meeting may be called by the board of directors or any other person authorized to do so in the governing documents, but shareholders may be precluded from calling special meetings.

Neither Cayman Islands law nor our MAA allows our shareholders to requisition a shareholders’ meeting. As an exempted Cayman Islands company, we are not obliged by law to call shareholders’ annual general meetings.

Cumulative Voting

Under the Delaware General Corporation Law, cumulative voting for elections of directors is not permitted unless the corporation’s certificate of incorporation specifically provides for it. Cumulative voting potentially facilitates the representation of minority shareholders on a board of directors since it permits the minority shareholder to cast all the votes to which the shareholder is entitled on a single director, which increases the shareholder’s voting power with respect to electing such director. There are no prohibitions in relation to cumulative voting under the laws of the Cayman Islands but our MAA does not provide for cumulative voting. As a result, our shareholders are not afforded any less protections or rights on this issue than shareholders of a Delaware corporation.

Removal of Directors

Under the Delaware General Corporation Law, a director of a corporation with a classified board may be removed only for cause with the approval of a majority of the outstanding shares entitled to vote, unless the certificate of incorporation provides otherwise. Under our MAA, directors may be removed with or without cause, by an ordinary resolution of our shareholders.

Transactions with Interested Shareholders

The Delaware General Corporation Law contains a business combination statute applicable to Delaware corporations whereby, unless the corporation has specifically elected not to be governed by such statute by amendment to its certificate of incorporation, it is prohibited from engaging in certain business combinations with an “interested shareholder” for three years following the date that such person becomes an interested shareholder. An interested shareholder generally is a person or a group who or which owns or owned 15% or more of the target’s outstanding voting share within the past three years. This has the effect of limiting the ability of a potential acquirer to make a two-tiered bid for the target in which all shareholders would not be treated equally. The statute does not apply if, among other things, prior to the date on which such shareholder becomes an interested shareholder, the board of directors approves either the business combination or the transaction which resulted in the person becoming an interested shareholder. This encourages any potential acquirer of a Delaware corporation to negotiate the terms of any acquisition transaction with the target’s board of directors.

Cayman Islands law has no comparable statute. As a result, we cannot avail ourselves of the types of protections afforded by the Delaware business combination statute. However, although Cayman Islands law does not regulate transactions between a company and its significant shareholders, it does provide that such transactions must be entered into bona fide in the best interests of our company and not with the effect of constituting a fraud on the minority shareholders.

Dissolution; Winding up

Under the Delaware General Corporation Law, unless the board of directors approves the proposal to dissolve, dissolution must be approved by shareholders holding 100% of the total voting power of the corporation. Only if the dissolution is initiated by the board of directors may it be approved by a simple majority of the corporation’s outstanding shares. Delaware law allows a Delaware corporation to include in its certificate of incorporation a supermajority voting requirement in connection with dissolutions initiated by the board.

Under Cayman Islands law, a company may be wound up by either an order of the courts of the Cayman Islands or by a special resolution of its members or, if our company is unable to pay its debts as they fall due, by an ordinary resolution of its members. The court has authority to order winding up in a number of specified circumstances including where it is, in the opinion of the court, just and equitable

to do so. Under the Companies Act and our MAA, our company may be dissolved, liquidated or wound up by a special resolution of our shareholders.

Variation of Rights of Shares

Under the Delaware General Corporation Law, a corporation may vary the rights of a class of shares with the approval of a majority of the outstanding shares of such class, unless the certificate of incorporation provides otherwise. Under Cayman Islands law and our MAA, if our share capital is divided into more than one class of shares, we may vary the rights attached to any class with the sanction of a special resolution passed at a general meeting of the holders of the shares of that class.

Amendment of Governing Documents

Under the Delaware General Corporation Law, a corporation’s governing documents may be amended with the approval of a majority of the outstanding shares entitled to vote, unless the certificate of incorporation provides otherwise. Under the Companies Act and our MAA, our memorandum and articles of association may only be amended by a special resolution of our shareholders.

Rights of Non-resident or Foreign Shareholders

There are no limitations imposed by our amended and restated memorandum and articles of association on the rights of non-resident or foreign shareholders to hold or exercise voting rights on our shares. In addition, there are no provisions in our amended and restated memorandum and articles of association governing the ownership threshold above which shareholder ownership must be disclosed.

History of Securities Issuances

The following is a summary of the issuances of our securities in the past three years.

Ordinary Shares

On June 10, 2021, the Company completed a follow-on public offering, issued 112,125,000 Class A ordinary shares for a total consideration of US$175.4 million after deducting the underwriting discounts and commissions and offering expenses.

In March, August and December 2021, 22,500,000, 45,000,000 and 48,000,000 Class B ordinary shares were converted into Class A ordinary shares, respectively.

In March 2022, 124,500,000 Class B ordinary shares were converted into Class A ordinary shares.

As of December 31, 2023, the Company had 2,252,892,845 Class A ordinary shares and 97,611,722 Class B ordinary shares issued and outstanding, respectively.

Convertible Notes

In February 2021, we entered into convertible note purchase agreements with a group of investors led by an affiliate of Xiaomi Corporation in an aggregate principal amount of US$65 million through a private placement to these investors. The convertible notes will mature in 2026 unless previously converted.

In April 2021, we entered into convertible note purchase agreements with a group of investors in an aggregate principal amount of US$90 million through a private placement to these investors. The convertible notes will mature in 2026 unless previously converted.

Grants of Options and Restricted Share Units under our 2018 Share Incentive Plan and 2019 Performance Incentive Plan

We have granted options to purchase our Class A ordinary shares to certain of our directors, executive officers, employees and other eligible awardees of our 2018 Share Incentive Plan and 2019 Performance Incentive Plan as described in Item 6. B “Compensation—2018 Share Incentive Plan” and “—2019 Performance Incentive Plan” in our annual report on Form 20-F for the year ended December 31, 2023, which is incorporated in this prospectus by reference.

DESCRIPTION OF AMERICAN DEPOSITARY SHARES

American Depositary Shares

Deutsche Bank Trust Company Americas, as depositary, issues and delivers the ADSs. Each ADS represents 15 Class A ordinary shares, deposited with Deutsche Bank AG, Hong Kong Branch, as custodian for the depositary. Each ADS also represents ownership of any other securities, cash or other property which may be held by the depositary. The depositary’s corporate trust office at which the ADSs will be administered is located at 1 Columbus Circle, New York, New York 10019, USA. The principal executive office of the depositary is located at 1 Columbus Circle, New York, New York 10019, USA.

The Direct Registration System, or DRS, is a system administered by The Depository Trust Company, or DTC, pursuant to which the depositary may register the ownership of uncertificated ADSs, which ownership shall be evidenced by periodic statements issued by the depositary to the ADS holders entitled thereto.

We will not treat ADS holders as our shareholders and accordingly, you, as an ADS holder, will not have shareholder rights. Cayman Islands law governs shareholder rights. The depositary will be the holder of the Class A ordinary shares underlying your ADSs. As a holder of ADSs, you will have ADS holder rights. A deposit agreement among us, the depositary and you, as an ADS holder, and the beneficial owners of ADSs sets out ADS holder rights as well as the rights and obligations of the depositary. The laws of the State of New York govern the deposit agreement and the ADSs, see — “Jurisdiction and Arbitration.”

The following is a summary of the material provisions of the deposit agreement. For more complete information, you should read the entire deposit agreement and the form of American Depositary Receipt. For directions on how to obtain copies of those documents, see —“Where You Can Find More Information About Us.”

Holding the ADSs

How will you hold your ADSs?

You may hold ADSs either (1) directly (a) by having an American Depositary Receipt, or ADR, which is a certificate evidencing a specific number of ADSs, registered in your name, or (b) by holding ADSs in DRS, or (2) indirectly through your broker or other financial institution. If you hold ADSs directly, you are an ADS holder. This description assumes you hold your ADSs directly. ADSs will be issued through DRS, unless you specifically request certificated ADRs. If you hold the ADSs indirectly, you must rely on the procedures of your broker or other financial institution to assert the rights of ADS holders described in this section. You should consult with your broker or financial institution to find out what those procedures are.

Dividends and Other Distributions

How will you receive dividends and other distributions on the shares?

The depositary has agreed to pay to you the cash dividends or other distributions it or the custodian receives on Class A ordinary shares or other deposited securities, after deducting its fees and expenses. You will receive these distributions in proportion to the number of Class A ordinary shares your ADSs represent as of the record date (which will be as close as practicable to the record date for our Class A ordinary shares) set by the depositary with respect to the ADSs.

•Cash. The depositary will convert or cause to be converted any cash dividend or other cash distribution we pay on the Class A ordinary shares or any net proceeds from the sale of any Class A ordinary shares, rights, securities or other entitlements under the terms of the deposit agreement into U.S. dollars if it can do so on a practicable basis, and can transfer the U.S. dollars to the United States and will distribute promptly the amount thus received. If the depositary shall determine in its judgment that such conversions or transfers are not practical or lawful or if any government approval or license is needed and cannot be obtained at a reasonable cost within a reasonable period or otherwise sought, the deposit agreement allows the depositary to distribute the foreign currency only to those ADS holders to whom it is possible to do so. It will hold or cause the custodian to hold the foreign currency it cannot convert for the account of the ADS holders who have not been paid and such funds will be held for the respective accounts of the ADS holders. It will not invest the foreign currency and it will not be liable for any interest for the respective accounts of the ADS holders.

Before making a distribution, any taxes or other governmental charges, together with fees and expenses of the depositary, that must be paid, will be deducted. See “—Taxation.” It will distribute only whole U.S. dollars and cents and will round down fractional cents to the nearest whole cent. If the exchange rates fluctuate during a time when the depositary cannot convert the foreign currency, you may lose some or all of the value of the distribution.

•Shares. For any Class A ordinary shares we distribute as a dividend or free distribution, either (1) the depositary will distribute additional ADSs representing such Class A ordinary shares or (2) existing ADSs as of the applicable record date will represent rights and interests in the additional Class A ordinary shares distributed, to the extent reasonably practicable and permissible under law, in either case, net of applicable fees, charges and expenses incurred by the depositary and taxes and/or other governmental charges. The depositary will only distribute whole ADSs. It will try to sell Class A ordinary shares which would require it to deliver a fractional ADS and distribute the net proceeds in the same way as it does with cash. The depositary may sell a portion of the distributed Class A ordinary shares sufficient to pay its fees and expenses, and any taxes and governmental charges, in connection with that distribution.

•Elective Distributions in Cash or Shares. If we offer holders of our Class A ordinary shares the option to receive dividends in either cash or shares, the depositary, after consultation with us and having received timely notice as described in the deposit agreement of such elective distribution by us, has discretion to determine to what extent such elective distribution will be made available to you as a holder of the ADSs. We must timely first instruct the depositary to make such elective distribution available to you and furnish it with satisfactory evidence that it is legal to do so. The depositary could decide it is not legal or reasonably practicable to make such elective distribution available to you. In such case, the depositary shall, on the basis of the same determination as is made in respect of the Class A ordinary shares for which no election is made, distribute either cash in the same way as it does in a cash distribution, or additional ADSs representing Class A ordinary shares in the same way as it does in a share distribution. The depositary is not obligated to make available to you a method to receive the elective dividend in shares rather than in ADSs. There can be no assurance that you will be given the opportunity to receive elective distributions on the same terms and conditions as the holders of Class A ordinary shares.

•Rights to Purchase Additional Shares. If we offer holders of our Class A ordinary shares any rights to subscribe for additional shares, the depositary shall having received timely notice as described in the deposit agreement of such distribution by us, consult with us, and we must determine whether it is lawful and reasonably practicable to make these rights available to you. We must first instruct the depositary to make such rights available to you and furnish the depositary with satisfactory evidence that it is legal to do so. If the depositary decides it is not legal or reasonably practicable to make the rights available but that it is lawful and reasonably practicable to sell the rights, the depositary will endeavor to sell the rights and in a riskless principal capacity or otherwise, at such place and upon such terms (including public or private sale) as it may deem proper distribute the net proceeds in the same way as it does with cash. The depositary will allow rights that are not distributed or sold to lapse. In that case, you will receive no value for them.

If the depositary makes rights available to you, it will establish procedures to distribute such rights and enable you to exercise the rights upon your payment of applicable fees, charges and expenses incurred by the depositary and taxes and/or other governmental charges. The depositary shall not be obliged to make available to you a method to exercise such rights to subscribe for Class A ordinary shares (rather than ADSs).

U.S. securities laws may restrict transfers and cancellation of the ADSs represented by shares purchased upon exercise of rights. For example, you may not be able to trade these ADSs freely in the United States. In this case, the depositary may deliver restricted depositary shares that have the same terms as the ADSs described in this section except for changes needed to put the necessary restrictions in place.

There can be no assurance that you will be given the opportunity to exercise rights on the same terms and conditions as the holders of Class A ordinary shares or be able to exercise such rights.

•Other Distributions. Subject to receipt of timely notice, as described in the deposit agreement, from us with the request to make any such distribution available to you, and provided the depositary has determined such distribution is lawful and reasonably practicable and feasible and in accordance with the terms of the deposit agreement, the depositary will distribute to you anything else we distribute on deposited securities by any means it may deem practicable, upon your payment of applicable fees, charges and expenses incurred by the depositary and taxes and/or other governmental charges. If any of the conditions above are not met, the depositary will endeavor to sell, or cause to be sold, what we distributed and distribute the net proceeds in the same way as it does with cash; or, if it is unable to sell such property, the depositary may dispose of such property in any way it deems reasonably practicable under the circumstances for nominal or no consideration, such that you may have no rights to or arising from such property.

The depositary is not responsible if it decides that it is unlawful or impractical to make a distribution available to any ADS holders. We have no obligation to register ADSs, shares, rights or other securities under the Securities Act. We also have no obligation to take any other action to permit the distribution of ADSs, shares, rights or anything else to ADS holders. This means that you may not receive the distributions we make on our shares or any value for them if we and/or the depositary determines that it is illegal or not practicable for us or the depositary to make them available to you.

Deposit, Withdrawal and Cancellation

How are ADSs issued?

The depositary will deliver ADSs if you or your broker deposit Class A ordinary shares or evidence of rights to receive Class A ordinary shares with the custodian. Upon payment of its fees and expenses and of any taxes or charges, such as stamp taxes or stock transfer taxes or fees, the depositary will register the appropriate number of ADSs in the names you request and will deliver the ADSs to or upon the order of the person or persons entitled thereto.

How do ADS holders cancel an American Depositary Share?

You may turn in your ADSs at the depositary’s corporate trust office or by providing appropriate instructions to your broker. Upon payment of its fees and expenses and of any taxes or charges, such as stamp taxes or stock transfer taxes or fees, the depositary will deliver the Class A ordinary shares and any other deposited securities underlying the ADSs to you or a person you designate at the office of the custodian. Or, at your request, risk and expense, the depositary will deliver the deposited securities at its corporate trust office, to the extent permitted by law.

How do ADS holders interchange between Certificated ADSs and Uncertificated ADSs?

You may surrender your ADR to the depositary for the purpose of exchanging your ADR for uncertificated ADSs. The depositary will cancel that ADR and will send you a statement confirming that you are the owner of uncertificated ADSs. Alternatively, upon receipt by the depositary of a proper instruction from a holder of uncertificated ADSs requesting the exchange of uncertificated ADSs for certificated ADSs, the depositary will execute and deliver to you an ADR evidencing those ADSs.

Voting Rights

How do you vote?

You may instruct the depositary to vote the Class A ordinary shares or other deposited securities underlying your ADSs at any meeting at which you are entitled to vote pursuant to any applicable law, the provisions of our memorandum and articles of association, and the provisions of or governing the deposited securities. Otherwise, you could exercise your right to vote directly if you withdraw the Class A ordinary shares. However, you may not know about the meeting sufficiently enough in advance to withdraw the Class A ordinary shares.

If we ask for your instructions and upon timely notice from us by regular, ordinary mail delivery, or by electronic transmission, as described in the deposit agreement, the depositary will notify you of the upcoming meeting at which you are entitled to vote pursuant to any applicable law, the provisions of our fourth amended and restated memorandum and articles of association, and the provisions of or governing the deposited securities, and arrange to deliver our voting materials to you. The materials will include or reproduce (a) such notice of meeting or solicitation of consents or proxies; (b) a statement that the ADS holders at the close of business on the ADS record date will be entitled, subject to any applicable law, the provisions of our fourth amended and restated memorandum and articles of association, and the provisions of or governing the deposited securities, to instruct the depositary as to the exercise of the voting rights, if any, pertaining to the Class A ordinary shares or other deposited securities represented by such holder’s ADSs; and (c) a brief statement as to the manner in which such instructions may be given to the depositary or deemed given in accordance with the second to last sentence of this paragraph if no instruction is received by the depositary to give a discretionary proxy to a person designated by us. Voting instructions may be given only in respect of a number of ADSs representing an integral number of Class A ordinary shares or other deposited securities. For instructions to be valid, the depositary must receive them in writing on or before the date specified. The depositary will try, as far as practical, subject to applicable law and the provisions of our memorandum and articles of association, to vote or to have its agents vote the Class A ordinary shares or other deposited securities (in person or by proxy) as you instruct. The depositary will only vote or attempt to vote as you instruct. If we timely requested the depositary to solicit your instructions but no instructions are received by the depositary from an owner with respect to any of the deposited securities represented by the ADSs of that owner on or before the date established by the depositary for such purpose, the depositary shall deem that owner to have instructed the depositary to give a discretionary proxy to a person designated by us with respect to such deposited securities, and the depositary shall give a discretionary proxy to a person designated by us to vote such deposited securities. However, no such instruction shall be deemed given and no such discretionary proxy shall be given with respect to any matter if we inform the depositary we do not wish such proxy given, substantial opposition exists or the matter materially and adversely affects the rights of holders of the ordinary shares.

We cannot assure you that you will receive the voting materials in time to ensure that you can instruct the depositary to vote the Class A ordinary shares underlying your ADSs. In addition, there can be no assurance that ADS holders and beneficial owners generally, or any holder or beneficial owner in particular, will be given the opportunity to vote or cause the custodian to vote on the same terms and conditions as the holders of our Class A ordinary shares.

The depositary and its agents are not responsible for failing to carry out voting instructions or for the manner of carrying out voting instructions. This means that you may not be able to exercise your right to vote and you may have no recourse if the Class A ordinary shares underlying your ADSs are not voted as you requested.

In order to give you a reasonable opportunity to instruct the depositary as to the exercise of voting rights relating to deposited securities, if we request the depositary to act, we will give the depositary notice of any such meeting and details concerning the matters to be voted at least 30 business days in advance of the meeting date.

Compliance with Regulations

Information Requests

Each ADS holder and beneficial owner shall (a) provide such information as we or the depositary may request pursuant to law, including, without limitation, relevant Cayman Islands law, any applicable law of the United States of America, our fourth amended and restated memorandum and articles of association, any resolutions of our board of directors adopted pursuant to such memorandum and articles of association, the requirements of any markets or exchanges upon which the Class A ordinary shares, ADSs or ADRs are listed or traded, or to any requirements of any electronic book-entry system by which the ADSs or ADRs may be transferred, regarding the capacity in which they own or owned ADRs, the identity of any other persons then or previously interested in such ADRs and the nature of such interest, and any other applicable matters, and (b) be bound by and subject to applicable provisions of the laws of the Cayman Islands, our fourth amended and restated memorandum and articles of association, and the requirements of any markets or exchanges upon which the ADSs, ADRs or Class A ordinary shares are listed or traded, or pursuant to any requirements of any electronic book-entry system by which the ADSs, ADRs or Class A ordinary shares may be transferred, to the same extent as if such ADS holder or beneficial owner held Class A ordinary shares directly, in each case irrespective of whether or not they are ADS holders or beneficial owners at the time such request is made.

Disclosure of Interests

Each ADS holder and beneficial owner shall comply with our requests pursuant to Cayman Islands law, the rules and requirements of the Nasdaq Global Select Market and any other stock exchange on which the Class A ordinary shares are, or will be, registered, traded or listed or our fourth amended and restated memorandum and articles of association, which requests are made to provide information, inter alia, as to the capacity in which such ADS holder or beneficial owner owns ADS and regarding the identity of any other person interested in such ADS and the nature of such interest and various other matters, whether or not they are ADS holders or beneficial owners at the time of such requests.

Fees and Expenses

As an ADS holder, you will be required to pay the following service fees to the depositary bank and certain taxes and governmental charges (in addition to any applicable fees, expenses, taxes and other governmental charges payable on the deposited securities represented by any of your ADSs):

|

|

Service |

Fees |

•To any person to which ADSs are issued or to any person to which a distribution is made in respect of ADS distributions pursuant to share dividends or other free distributions of shares, bonus distributions, share splits or other distributions (except where converted to cash) |

Up to US$0.05 per ADS issued |

•Cancellation of ADSs, including the case of termination of the deposit agreement |

Up to US$0.05 per ADS cancelled |

•Distribution of cash dividends |

Up to US$0.05 per ADS held |

•Distribution of cash entitlements (other than cash dividends) and/or cash proceeds from the sale of rights, securities and other entitlements |

Up to US$0.05 per ADS held |

•Distribution of ADSs pursuant to exercise of rights. |

Up to US$0.05 per ADS held |

•Distribution of securities other than ADSs or rights to purchase additional ADSs |

Up to US$0.05 per ADS held |

|

|

|

Up to US$0.05 per ADS held on the applicable record date(s) established by the depositary bank |

As an ADS holder, you will also be responsible to pay certain fees and expenses incurred by the depositary bank and certain taxes and governmental charges (in addition to any applicable fees, expenses, taxes and other governmental charges payable on the deposited securities represented by any of your ADSs) such as:

•Fees for the transfer and registration of Class A ordinary shares charged by the registrar and transfer agent for the Class A ordinary shares in the Cayman Islands (i.e., upon deposit and withdrawal of Class A ordinary shares).

•Expenses incurred for converting foreign currency into U.S. dollars.

•Expenses for cable, telex and fax transmissions and for delivery of securities.

•Taxes and duties upon the transfer of securities, including any applicable stamp duties, any stock transfer charges or withholding taxes (i.e., when Class A ordinary shares are deposited or withdrawn from deposit).

•Fees and expenses incurred in connection with the delivery or servicing of Class A ordinary shares on deposit.

•Fees and expenses incurred in connection with complying with exchange control regulations and other regulatory requirements applicable to Class A ordinary shares, deposited securities, ADSs and ADRs.

•Any applicable fees and penalties thereon.

The depositary fees payable upon the issuance and cancellation of ADSs are typically paid to the depositary bank by the brokers (on behalf of their clients) receiving the newly issued ADSs from the depositary bank and by the brokers (on behalf of their clients) delivering the ADSs to the depositary bank for cancellation. The brokers in turn charge these fees to their clients. Depositary fees payable in connection with distributions of cash or securities to ADS holders and the depositary services fee are charged by the depositary bank to the holders of record of ADSs as of the applicable ADS record date.

The depositary fees payable for cash distributions are generally deducted from the cash being distributed or by selling a portion of distributable property to pay the fees. In the case of distributions other than cash (i.e., share dividends, rights), the depositary bank charges the applicable fee to the ADS record date holders concurrent with the distribution. In the case of ADSs registered in the name of the investor (whether certificated or uncertificated in direct registration), the depositary bank sends invoices to the applicable record date ADS holders. In the case of ADSs held in brokerage and custodian accounts (via DTC), the depositary bank generally collects its fees through the systems provided by DTC (whose nominee is the registered holder of the ADSs held in DTC) from the brokers and custodians holding ADSs in their DTC accounts. The brokers and custodians who hold their clients’ ADSs in DTC accounts in turn charge their clients’ accounts the amount of the fees paid to the depositary banks.

In the event of refusal to pay the depositary fees, the depositary bank may, under the terms of the deposit agreement, refuse the requested service until payment is received or may set off the amount of the depositary fees from any distribution to be made to the ADS holder.

The depositary may make payments to us or reimburse us for certain costs and expenses, by making available a portion of the ADS fees collected in respect of the ADR program or otherwise, upon such terms and conditions as we and the depositary bank agree from time to time.

Payment of Taxes