UP Fintech Announces Closing of Follow-on Public Offering of American Depositary Shares

October 24 2024 - 3:00PM

UP Fintech Holding Limited (Nasdaq: TIGR) (“UP Fintech” or the

“Company”), a leading online brokerage firm focusing on global

investors, today announced the closing of its public offering of

15,000,000 American Depositary Shares (“ADSs”), each representing

15 Class A ordinary shares of the Company, at a public offering

price of US$6.25 per ADS. The underwriters have an option to

purchase up to an aggregate of 2,250,000 additional ADSs from the

Company at the public offering price, less underwriting discounts

and commissions, exercisable within 20 days from the date of the

prospectus supplement.

The Company expects to use the net proceeds from

the ADS offering for strengthening the Company’s capital base and

furthering the Company’s business development initiatives.

Deutsche Bank AG, Hong Kong Branch, China

International Capital Corporation Hong Kong Securities Limited and

US Tiger Securities, Inc. acted as the joint bookrunners for the

ADS offering.

The ADS offering has been made pursuant to an

automatic shelf registration statement on Form F-3 filed with the

United States Securities and Exchange Commission (the “SEC”) and is

available on the SEC’s website at http://www.sec.gov. The ADS

offering has been made only by means of a prospectus supplement and

an accompanying prospectus included in the Form F-3. The Form F-3

and the prospectus supplement are available on the SEC’s website at

http://www.sec.gov. The final prospectus supplement has been filed

with the SEC and is available on the SEC’s website at:

http://www.sec.gov. Copies of the final prospectus supplement and

the accompanying prospectus may be obtained by contacting Deutsche

Bank AG, Hong Kong Branch, Level 60, International Commerce Centre,

1 Austin Road West, Kowloon, Hong Kong; China International Capital

Corporation Hong Kong Securities Limited 29/F, One International

Finance Centre, 1 Harbour View Street, Central, Hong Kong; or, US

Tiger Securities, Inc., 437 Madison Avenue, 27th Floor, New York,

NY 10022, United States of America.

This announcement shall not constitute an offer to

sell, or a solicitation of an offer to buy, the securities

described herein, nor shall there be any offer, solicitation or

sale of these securities in any state or jurisdiction in which such

an offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About UP Fintech Holding

Limited

UP Fintech Holding Limited is a leading online

brokerage firm focusing on global investors. The Company’s

proprietary mobile and online trading platform enables investors to

trade in equities and other financial instruments on multiple

exchanges around the world. The Company offers innovative products

and services as well as a superior user experience to customers

through its “mobile first” strategy, which enables it to better

serve and retain current customers as well as attract new ones. The

Company offers customers comprehensive brokerage and value-added

services, including trade order placement and execution, margin

financing, IPO subscription, ESOP management, investor education,

community discussion and customer support. The Company’s

proprietary infrastructure and advanced technology are able to

support trades across multiple currencies, multiple markets,

multiple products, multiple execution venues and multiple

clearinghouses.

For more information on the Company, please visit:

https://ir.itigerup.com.

Safe Harbor Statement

This announcement contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by

terminology such as “may,” “might,” “aim,” “likely to,” “will,”

“expects,” “anticipates,” “future,” “intends,” “plans,” “believes,”

“estimates” and similar statements or expressions. Among other

statements, the business outlook and quotations from management in

this announcement, the Company’s strategic and operational plans

and expectations regarding growth and expansion of its business

lines, and the Company’s plans for future financing of its business

contain forward-looking statements. The Company may also make

written or oral forward-looking statements in its periodic reports

to the U.S. Securities and Exchange Commission (“SEC”) on Forms

20−F and 6−K, in its annual report to shareholders, in press

releases and other written materials and in oral statements made by

its officers, directors or employees to third parties, including

the earnings conference call. Statements that are not historical

facts, including statements about the Company’s beliefs and

expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: the Company’s ability to effectively

implement its growth strategies; trends and competition in global

financial markets; changes in the Company’s revenues and certain

cost or expense accounting policies; and governmental policies and

regulations affecting the Company’s industry and general economic

conditions in China, Singapore and other countries. Further

information regarding these and other risks is included in the

Company’s filings with the SEC, including the Company’s annual

report on Form 20-F filed with the SEC on April 22, 2024. All

information provided in this press release and in the attachments

is as of the date of this press release, and the Company undertakes

no obligation to update any forward-looking statement, except as

required under applicable law. Further information regarding these

and other risks is included in the Company’s filings with the

SEC.

For investor and media inquiries please

contact:

Investor Relations Contact UP

Fintech Holding Limited Email: ir@itiger.com

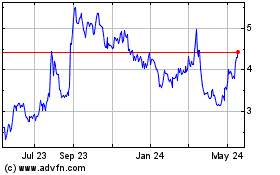

UP Fintech (NASDAQ:TIGR)

Historical Stock Chart

From Nov 2024 to Dec 2024

UP Fintech (NASDAQ:TIGR)

Historical Stock Chart

From Dec 2023 to Dec 2024