false

0001430306

0001430306

2025-02-03

2025-02-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (date of earliest event reported):

February 3, 2025

TONIX PHARMACEUTICALS HOLDING CORP.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-36019 |

|

26-1434750 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

26

Main Street, Chatham,

New Jersey 07928

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area

code: (862) 904-8182

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

TNXP |

The NASDAQ Capital Market |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.02 |

Termination of a Material Definitive Agreement. |

On February 3, 2025, the Loan and Guaranty Agreement (the “Loan Agreement”),

dated as of December 8, 2023, by and among Tonix Pharmaceuticals Holding Corp. (the “Company”), Tonix Pharmaceuticals, Inc.

(“Tonix”), a wholly-owned subsidiary of the Company, Krele LLC, a wholly-owned subsidiary of Tonix, Jenner Institute, LLC,

a wholly-owned subsidiary of Tonix, Tonix R&D Center, LLC, a wholly-owned subsidiary of Tonix (collectively, the “Loan Parties”),

JGB Capital, LP, JGB Partners, LP, JGB (Cayman) Cornish Rock Ltd. (collectively, the “Lenders”), and JGB Collateral LLC, as

administrative agent and collateral agent (the “Agent”) for the Lenders, and each of the other Loan Documents (as defined

in the Loan Agreement) was terminated upon receipt by the Loan Parties of a payoff amount of $9.6 million from the Company. The Loan Agreement

provided for a term loan in the original aggregate principal amount of $11.0 million in accordance with the terms of the Loan Agreement.

The pay-off amount paid by the Company in connection with the termination of the Loan Agreement was pursuant to a pay-off letter (the

“Pay-Off Letter”) with the Lenders and Agent and includes a prepayment fee of $1.0 million in accordance with the terms and

provisions of the Loan Agreement.

The preceding summary of the material terms of the Pay-Off Letter does

not purport to be complete and is qualified in its entirety by reference to the full text of the actual Pay-Off Letter filed as Exhibit

10.01 to this Form 8-K and is incorporated herein by reference.

| Item 2.02 |

Results of Operations and Financial Condition. |

Tonix

Pharmaceuticals Holding Corp. (the “Company”) is disclosing selected preliminary operating results for the year ended December

31, 2024, and certain preliminary financial condition information as of December 31, 2024, as set forth below:

| |

· |

The Company had approximately $98.8 million in cash and cash equivalents as of December 31, 2024, and there were approximately 559,044,486 shares of common stock outstanding as of January 31, 2025. |

| |

· |

The Company’s net cash used in operating activities for the year ended December 31, 2024 was approximately $60.9 million, compared to $102.0 million for the year ended December 31, 2023. |

| |

· |

The Company’s capital expenditures for the year ended December 31, 2024 was approximately $0.1, compared to $29.1 million for the year ended December 31, 2023. |

| |

· |

The Company’s net operating loss for the year ended December 31, 2024 was approximately $126.6 million, which includes non-cash impairment charges of approximately $59.0 million, compared to $116.7 million for the year ended December 31, 2023. |

| |

· |

The Company’s net revenue from the sale of its marketed products for the year ended December 31, 2024 was approximately $10.1million, compared to $7.8 million for the year ended December 31, 2023. |

The Company

believes that its cash resources at December 31, 2024, and the gross proceeds of approximately $30.4 million that it raised from sales

under its at-the-market facility in the first quarter of 2025, will meet its operating and capital expenditure requirements into the first

quarter of 2026.

The above

information is preliminary financial information for the year ended December 31, 2024 and subject to completion. The unaudited, estimated

results for the year ended December 31, 2024 are preliminary and were prepared by the Company’s management, based upon its estimates,

a number of assumptions and currently available information, and are subject to revision based upon, among other things, quarter and year-end

closing procedures and/or adjustments, the completion of the Company’s consolidated financial statements and other operational procedures.

This preliminary financial information is the responsibility of management and has been prepared in good faith on a consistent basis with

prior periods. However, the Company has not completed its financial closing procedures for the year ended December 31, 2024, and its actual

results could be materially different from this preliminary financial information, which preliminary information should not be regarded

as a representation by the Company or its management as to its actual results for the year ended December 31, 2024. In addition, EisnerAmper

LLP, the Company’s independent registered public accounting firm, has not audited, reviewed, compiled, or performed any procedures

with respect to this preliminary financial information and does not express an opinion or any other form of assurance with respect to

this preliminary financial information. During the course of the preparation of the Company’s financial statements and related notes

as of and for the year ended December 31, 2024, the Company may identify items that would require it to make material adjustments to this

preliminary financial information. As a result, prospective investors should exercise caution in relying on this information and should

not draw any inferences from this information. This preliminary financial information should not be viewed as a substitute for full financial

statements prepared in accordance with United States generally accepted accounting principles and reviewed by the Company’s auditors.

The Company currently expects to file its Annual Report

on Form 10-K, including its financial statements for the year ended December 31, 2024, on or about March 31, 2025.

| Item 3.03 |

Material Modification to Rights of Security Holders. |

The Board of Directors of Tonix

Pharmaceuticals Holding Corp., a Nevada corporation (the “Company”), has approved a reverse stock split of the Company’s

issued and outstanding shares of common stock, par value $0.001 per share (the “Common Stock”), at a ratio of 1-for-100

(the “Reverse Stock Split”). The Company anticipates that the Reverse Stock Split will be effective at 12:01 a.m.,

Eastern Time, on February 5, 2025 (the “Effective Date”).

Reason for the Reverse Stock Split

The Company is effecting the Reverse

Stock Split to satisfy the $1.00 minimum bid price requirement (the “Minimum Bid Price Requirement”), as set forth

in Nasdaq Listing Rule 5550(a)(1) (the “Rule”), for continued listing on The NASDAQ Capital Market. As previously disclosed,

on August 9, 2024, the Company received a letter from the staff of the Listing Qualifications Department of The Nasdaq Stock Market

(“Nasdaq”) indicating that for the last 30 consecutive business days, the closing bid price of the Company’s

Common Stock had been below $1.00 per share, the minimum closing bid price required by Nasdaq Listing Rule 5450(a)(1) for continued listing

on the NASDAQ Global Market. To regain compliance with the Rule, the closing bid price of the Company’s Common Stock must be at

least $1.00 per share for a minimum of 10 consecutive business days.

Effects of the Reverse Stock Split

Effective Date; Symbol; CUSIP

Number. The Reverse Stock Split becomes effective with NASDAQ and the Common Stock will begin trading on a split-adjusted basis at

the open of business on the Effective Date. In connection with the Reverse Stock Split, the CUSIP number for the Common Stock will change

to 890260839.

Split Adjustment; Treatment

of Fractional Shares. On the Effective Date, the total number of shares of Common Stock held by each stockholder of the Company will

be converted automatically into the number of shares of Common Stock equal to: (i) the number of issued and outstanding shares of Common

Stock held by each such stockholder immediately prior to the Reverse Stock Split divided by (ii) 100. Any fractional share of Common Stock

that would otherwise result from the Reverse Stock Split will be rounded up to a whole share and, as such, any stockholder who otherwise

would have held a fractional share after giving effect to the Reverse Stock Split will instead hold one whole share of the post-Reverse

Stock Split Common Stock after giving effect to the Reverse Stock Split. As a result, no fractional shares will be issued in connection

with the Reverse Stock Split and no cash or other consideration will be paid in connection with any fractional shares that would otherwise

have resulted from the Reverse Stock Split. The Company intends to treat stockholders holding shares of Common Stock in “street

name” (that is, held through a bank, broker or other nominee) in the same manner as stockholders of record whose shares of Common

Stock are registered in their names. Banks, brokers or other nominees will be instructed to effect the Reverse Stock Split for their beneficial

holders holding shares of our Common Stock in “street name;” however, these banks, brokers or other nominees may apply

their own specific procedures for processing the Reverse Stock Split.

Also on the Effective Date, all

options, warrants and other convertible securities of the Company outstanding immediately prior to the Reverse Stock Split will be adjusted

by dividing the number of shares of Common Stock into which the options, warrants and other convertible securities are exercisable or

convertible by 100 and multiplying the exercise or conversion price thereof by 100, all in accordance with the terms of the plans, agreements

or arrangements governing such options, warrants and other convertible securities and subject to rounding to the nearest whole share.

Such proportional adjustments will also be made to the number of shares and restricted stock units issued and issuable under the Company’s

equity compensation plan.

Certificated and Non-Certificated Shares. Stockholders who hold

their shares in electronic form at brokerage firms do not need to take any action, as the effect of the Reverse Stock Split will automatically

be reflected in their brokerage accounts.

Stockholders holding paper certificates

may (but are not required to) send the certificates to the Company’s transfer agent and registrar, vStock Transfer, LLC (“vStock”),

at the address set forth below. vStock will issue a new stock certificate reflecting the Reverse Stock Split to each requesting stockholder.

VStock can be contacted at (212) 828-8436.

vStock Transfer, LLC

18 Lafayette Place

Woodmere, NY 11598

No Charter Amendment. Under

Nevada law, no amendment to the Company’s Articles of Incorporation is required in connection with the Reverse Stock Split.

Stockholder Approval. Under

the Nevada Revised Statutes (“NRS”) 78.2055, which was amended by the Nevada Legislature in 2023 pursuant to Assembly Bill

No. 126, a publicly traded corporation, as defined in NRS 78.010(1)(e), may decrease the number of issued and outstanding shares of a

class or series without correspondingly decreasing the number of authorized shares of the same class or series if: (a) the board of directors

adopts a resolution setting forth the proposal to decrease the number of issued and outstanding shares of a class or series; and (b) the

proposal is approved by a vote of the stockholders of the affected class or series. The Reverse Stock Split was approved pursuant to NRS

78.2055, as amended, by the Company’s stockholders on October 30, 2024, and accordingly will not have any effect on the number of

authorized shares of Common Stock.

Capitalization. The number

of authorized shares of Common Stock was and will remain at 1,000,000,000 following the Reverse Stock Split. As of January 31, 2025 there

were 559,044,486 shares of Common Stock outstanding. As a result of the Reverse Stock Split, there will be approximately 5,590,445 shares

of Common Stock outstanding (subject to adjustment due to the effect of rounding fractional shares into whole shares). The Reverse Stock

Split will not have any effect on number of authorized shares of Common Stock or the stated par value of the Common Stock.

The Reverse Stock Split does not

affect the Company’s authorized preferred stock. There are no outstanding shares of the Company’s preferred stock. After the

Reverse Stock Split, the Company’s authorized preferred Stock of 5,000,000 shares will remain unchanged.

Immediately following the Reverse

Stock Split, each stockholder’s relative ownership interest in the Company and proportional voting power will remain virtually unchanged

except for minor changes and adjustments that will result from rounding fractional shares into whole shares.

The information included in Item 2.02 is incorporated herein

by reference.

On February 3, 2025, the Company issued a press release announcing the

Reverse Stock Split. A copy of the press release is attached hereto as Exhibit 99.01 to this Current Report on Form 8-K and is incorporated

herein by reference.

Forward- Looking Statements

This Current Report on Form 8-K

contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934 and Private Securities Litigation Reform Act, as amended, including those relating to the Reverse Stock Split, the

Company’s product development, clinical trials, clinical and regulatory timelines, market opportunity, competitive position, possible

or assumed future results of operations, business strategies, potential growth opportunities and other statement that are predictive in

nature. These forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry and

markets in which we operate and management’s current beliefs and assumptions.

These statements may be identified

by the use of forward-looking expressions, including, but not limited to, “expect,” “anticipate,” “intend,”

“plan,” “believe,” “estimate,” “potential,” “predict,” “project,”

“should,” “would” and similar expressions and the negatives of those terms. These statements relate to future

events or our financial performance and involve known and unknown risks, uncertainties, and other factors which may cause actual results,

performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the

forward-looking statements. Such factors include those set forth in the Company’s filings with the SEC. Prospective investors are

cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of this press release. The Company

undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

| Item 9.01 |

Financial Statements and Exhibits. |

† Certain portions of this exhibit that are not

material have been redacted pursuant to Item 601(b)(10) of Regulation S-K.

SIGNATURE

Pursuant to the requirement

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

TONIX PHARMACEUTICALS HOLDING CORP. |

| |

|

| Date: February 3, 2025 |

By: |

/s/ Bradley Saenger |

|

| |

Bradley Saenger |

| |

Chief Financial Officer |

Tonix Pharmaceuticals Form 8-K

Exhibit 10.01

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE

IT IS BOTH NOT MATERIAL AND IS PRIVATE OR CONFIDENTIAL. THE OMISSIONS HAVE BEEN INDICATED BY “[***].”

JGB Collateral LLC

246 Post Road East, 2nd

Floor

Westport, CT 06880

February 3, 2025

TONIX PHARMACEUTICALS HOLDING CORP.

26 Main Street

Suite 101

Chatham, NJ 07928

Attention: Seth Lederman, Jessica Morris and Bradley Saenger

Email: Seth.lederman@tonixpharma.com; Jessica.moris@tonixpharma.com and

Bradley.Saenger@tonixpharma.com

Ladies and Gentlemen:

Reference is made to the

LOAN AND GUARANTY AGREEMENT, dated as of December 8, 2023 (as amended, supplemented or otherwise modified from time to time, the

“Loan Agreement”) by and among krele llc, a Delaware limited

liability company, as borrowers representative (“Borrowers Representative”), TONIX R&D CENTER, LLC,

a Delaware limited liability company (“TR&D” and together with Borrowers Representative, the “Borrowers”),

TONIX PHARMACEUTICALS HOLDING CORP., a Nevada corporation, as parent, the entities party thereto as guarantors, the entities party

thereto as lenders from time to time (each, a “Lender” and collectively, the “Lenders”)

and JGB COLLATERAL LLC, as administrative agent and collateral agent. Capitalized terms used herein shall have the respective meanings

given such terms in the Loan Agreement.

(1)

This letter agreement confirms that, as of February 3, 2025, the total outstanding amount due and

owing under the Loan Documents is $8,650,000.00 (the “Payoff Amount”), plus $21,884.50 for the

Collateral Monitoring Charge (the “Monitoring Charge”), plus $92,266.67 for accrued and unpaid interest,

plus $1,000,000.00 for the Prepayment Premium, plus $10,000.00 in legal fees (the “Legal Fees”)

minus an amount held in the JGB Account equal to $192,701.27 which has been withheld by JGB Agent and applied to the foregoing

amounts for the benefit of the Borrowers (collectively, the “Combined Payoff Amount”). The Lenders hereby instruct

the Borrowers to pay or cause to be paid by wire transfer of immediately available funds the balance of the Combined Payoff Amount minus

the amount held in the JGB Account in the following amounts:

JGB (Cayman) Cornish Rock Ltd.

Amount: $2,297,147.98

[***]

ABA: [***]

Account No.: [***]

Account Name: JGB (Cayman) Cornish Rock Ltd.

JGB Partners, LP

Amount: $6,317,156.93

[***]

ABA: [***]

Account No.: [***]

Account Name: JGB Partners, LP

JGB Capital, LP

Amount: $957,144.99

[***]

ABA: [***]

Account No.: [***]

Account Name: JGB Capital, LP

[***]

Amount $10,000

[***]

ABA No.: [***]

Account No.: [***]

Account Name: [***]

Reference: [***]

(2)

Each Lender hereby confirms that payment in full of the Combined Payoff Amount by not later than

4:00 p.m. (New York City time) on February 3, 2025, will not result in any prepayment penalty or other charge to the Borrowers and its

affiliates, which is not already included in the Combined Payoff Amount. If the Combined Payoff Amount is not received by February 10,

2025, this letter agreement shall be deemed to be rescinded and of no further force and effect.

(3)

If the Combined Payoff Amount is received after 4:00 p.m. (New York City time) on February 3, 2025,

a per diem combined interest and Monitoring Charge of $3,546.50 (consisting of $354.65 for JGB Capital LP, $2,340.69 for JGB Partners

LP, and $851.16 for JGB (Cayman) Cornish Rock Ltd.) shall be added to the Combined Payoff Amount for each day until the full amount owed

is received.

(4)

Upon JGB Agent’s and each Lender’s receipt of its portion of the Combined Payoff Amount

and of an executed copy of this letter agreement from the Loan Parties, in each case, by February 10, 2025, (i) JGB Agent and the Lenders

confirm that all indebtedness (including any Indebtedness) of the Borrowers and the other Loan Parties to JGB Agent and the Lenders under

the Loan Agreement or any other Loan Document shall be fully paid and discharged and no further indebtedness or other obligations (including

any Indebtedness) will be owed by the Loan Parties to the Lenders or JGB Agent under the Loan Agreement and the other Loan Documents and

the Lenders and JGB Agent will be deemed to have (A) automatically and irrevocably fully and finally released and discharged the Loan

Parties from all Obligations under the Loan Agreement, the Account Pledge Agreement, the Mortgages and the other Loan Documents and all

guarantees, security documents and other documents delivered pursuant to or in connection with the Loan Agreement, the Account Pledge

Agreement, the Mortgages, the other Loan Documents or otherwise in connection therewith (collectively, the “Documents”),

(B) automatically and irrevocably released and discharged in full every one of the guarantees, hypothecs, security interests and other

liens granted under the Documents as security for the Obligations (the “Security”), (C) automatically and irrevocably

terminated the Security such that the Security shall cease to be of any force or effect whatsoever and (D) automatically and irrevocably

authorize the Loan Parties or their respective designees to proceed with the discharge and termination of all registrations and filings

made in all relevant jurisdictions with respect to the Security, including, without limitation, those (i) registrations set forth in Schedule

A hereto and (ii) those Uniform Commercial Code termination statements attached hereto as Schedule B, and sign and deliver

all such documents as may be required in connection therewith, including the secured party termination notice attached hereto as Schedule

C in respect of the Account Control Agreement; (ii) JGB Agent will promptly record a release of (x) the Deed of Trust, Security Agreement,

Assignment of Leases and Fixture Filing dated December 8, 2023 and recorded with the Frederick County Circuit Court, MD, Liber 16701,

folio 177 on December 14, 2023, in the form attached hereto as Schedule D, and (y) the Mortgage, Security Agreement, Assignment

of Leases and Fixture Filing dated December 8, 2023 and recorded with the Bristol County South Registry of Deeds, MA, Book 14866, page

99 on December 12, 2023, in the form attached hereto as Schedule E; and shall thereafter provide Borrowers with written evidence

of such recordations; (iii) JGB Agent will promptly return to the applicable Loan Parties all possessory collateral and (iv) the Documents

shall automatically and irrevocably be released, terminated and discharged such that the Documents and all underlying Obligations shall

cease to be of any force and effect whatsoever, except for provisions thereof that expressly survive repayment of the Obligations. JGB

Agent and each Lender further covenants and agrees to take such other actions, at the expense of the Loan Parties, as shall be reasonably

requested by the Borrowers to further evidence the total releases, terminations and discharges set forth herein.

(5)

The Borrowers hereby confirm that, upon JGB Agent’s and each Lender’s receipt of its

portion of the Combined Payoff Amount and of an executed copy of this letter agreement from the Loan Parties, any obligations of the Lenders

to make loans or otherwise provide extensions of credit under the Loan Documents are terminated and the Lenders do not have any further

obligation to make loans or other financial accommodations to the Borrowers.

(6)

The Loan Parties acknowledge that the amounts referred to in Section 1 above are enforceable

obligations of the Loan Parties, due and owing pursuant to the provisions of the Loan Documents and this letter agreement and confirms

their agreement to the terms and provisions of this letter agreement by returning to JGB Agent and the Lenders a signed counterpart of

this letter agreement. This letter agreement may be executed in several counterparts (and by each party on a separate counterpart), each

of which when so executed and delivered shall be an original, but all of which together shall constitute one agreement. Upon the execution

and delivery of this letter agreement by the Loan Parties, JGB Agent and the Lenders, this letter agreement shall take effect as a binding

agreement.

(7)

EACH LOAN PARTY HEREBY ACKNOWLEDGES THAT AS OF THE DATE HEREOF IT HAS NO DEFENSE, COUNTERCLAIM,

OFFSET, CROSS-COMPLAINT, CLAIM OR DEMAND OF ANY KIND OR NATURE WHATSOEVER, IN EACH CASE RELATED TO THE LOAN DOCUMENTS, THAT CAN BE

ASSERTED TO REDUCE OR ELIMINATE ALL OR ANY PART OF ITS LIABILITY TO REPAY THE OBLIGATIONS OR TO SEEK AFFIRMATIVE RELIEF OR DAMAGES OF

ANY KIND OR NATURE FROM EACH LENDER, AND THEIR RESPECTIVE AFFILIATES, PARTICIPANTS, OR ANY OF THEIR RESPECTIVE DIRECTORS, OFFICERS, AGENTS,

EMPLOYEES, OR ATTORNEYS (COLLECTIVELY, “THE LENDER GROUP”). EACH LOAN PARTY HEREBY VOLUNTARILY AND KNOWINGLY RELEASES

AND FOREVER DISCHARGES THE LENDERS AND EACH MEMBER OF THE LENDER GROUP FROM ALL POSSIBLE CLAIMS, DEMANDS, ACTIONS, CAUSES OF ACTION, DAMAGES,

COSTS, EXPENSES, AND LIABILITIES WHATSOEVER, KNOWN OR UNKNOWN, ANTICIPATED OR UNANTICIPATED, SUSPECTED OR UNSUSPECTED, FIXED, CONTINGENT,

OR CONDITIONAL, AT LAW OR IN EQUITY, THAT SUCH LOAN PARTY MAY NOW OR HEREAFTER HAVE AGAINST THE LENDERS OR ANY MEMBER OF THE LENDER GROUP,

IF ANY, AND IRRESPECTIVE OF WHETHER ANY SUCH CLAIMS ARISE OUT OF CONTRACT, TORT, VIOLATION OF LAW OR REGULATIONS, OR OTHERWISE, AND IN

EACH CASE ARISING FROM THE LIABILITIES UNDER THE LOAN DOCUMENTS, THE EXERCISE OF ANY RIGHTS AND REMEDIES UNDER THE LOAN DOCUMENTS (OTHER

THAN THIS LETTER AGREEMENT), AND NEGOTIATION FOR AND EXECUTION OF THIS LETTER AGREEMENT. EACH LOAN PARTY HEREBY COVENANTS AND AGREES NEVER

TO INSTITUTE ANY ACTION OR SUIT AT LAW OR IN EQUITY, NOR INSTITUTE, PROSECUTE, OR IN ANY WAY AID IN THE INSTITUTION OR PROSECUTION OF

ANY CLAIM, ACTION OR CAUSE OF ACTION, RIGHTS TO RECOVER DEBTS OR DEMANDS OF ANY NATURE AGAINST THE LENDERS OR ANY MEMBER OF THE LENDER

GROUP ARISING OUT OF OR RELATED TO ANY OF SUCH PERSON’S ACTIONS, OMISSIONS, STATEMENTS, REQUESTS OR DEMANDS IN ADMINISTERING, ENFORCING,

MONITORING, COLLECTING OR ATTEMPTING TO COLLECT THE OBLIGATIONS OF EACH LOAN PARTY TO THE LENDERS UNDER THE LOAN DOCUMENTS, WHICH OBLIGATIONS

WERE EVIDENCED BY THE LOAN DOCUMENTS.

(8)

THIS LETTER AGREEMENT SHALL BE GOVERNED BY AND CONSTRUCTED AND INTERPRETED IN ACCORDANCE WITH

THE GOVERNING LAW SET FORTH IN THE LOAN AGREEMENT.

(9)

Delivery of a signature page of this letter agreement by electronic means including by email delivery

of a “.pdf” format data file shall be as effective as delivery of an original executed counterpart of this letter agreement.

(10) This letter agreement

is the entire agreement between the parties with respect to the subject matter of this letter agreement. There are no other agreements

or understandings, written or oral, express or implied. JGB Agent, the Lenders and the Loan Parties agree, at the expense of the Loan

Parties, to execute such other documents as the other may reasonably request in order to accomplish the matters referred to in this letter

agreement.

[signature pages follow]

| |

Very truly yours, |

|

| |

|

|

| |

jgb collateral llc |

|

| |

|

|

|

| |

By: |

/s/ Brett Cohen |

|

| |

Name: |

Brett Cohen |

|

| |

Title: |

President |

|

| |

|

|

|

| |

|

|

|

| |

JGB CAPITAL, LP |

|

| |

|

|

|

| |

By: |

/s/ Brett Cohen |

|

| |

Name: |

Brett Cohen |

|

| |

Title: |

President |

|

| |

|

|

|

| |

|

|

|

| |

JGB PARTNERS, LP |

|

| |

|

|

|

| |

By: |

/s/ Brett Cohen |

|

| |

Name: |

Brett Cohen |

|

| |

Title: |

President |

|

| |

|

|

|

| |

|

|

|

| |

JGB (Cayman) cornish rock Ltd. |

|

| |

|

|

|

| |

By: |

/s/ Brett Cohen |

|

| |

Name: |

Brett Cohen |

|

| |

Title: |

President |

|

[JGB- Tonix- Payoff Letter Signature Page]

Accepted and Agreed to by the undersigned

as of the date first set forth above:

| |

BORROWERS: |

|

| |

|

|

| |

|

|

| |

KRELE LLC |

|

| |

|

|

|

| |

By: |

/s/ Seth Lederman |

|

| |

Name: |

Seth Lederman |

|

| |

Title: |

Manager |

|

| |

|

|

|

| |

|

|

|

| |

TONIX R&D CENTER, LLC |

|

| |

|

|

|

| |

By: |

/s/ Seth Lederman |

|

| |

Name: |

Seth Lederman |

|

| |

Title: |

CEO |

|

[JGB- Tonix- Payoff Letter Signature Page]

| |

GUARANTORS: |

|

| |

|

|

| |

|

|

| |

TONIX PHARMACEUTICALS HOLDING CORP. |

|

| |

|

|

|

| |

By: |

/s/ Seth Lederman |

|

| |

Name: |

Seth Lederman |

|

| |

Title: |

CEO |

|

| |

|

|

|

| |

|

|

|

| |

TONIX PHARMACEUTICALS, INC. |

|

| |

|

|

|

| |

By: |

/s/ Seth Lederman |

|

| |

Name: |

Seth Lederman |

|

| |

Title: |

CEO |

|

| |

|

|

|

| |

|

|

|

| |

JENNER INSTITUTE, LLC |

|

| |

|

|

|

| |

By: |

/s/ Seth Lederman |

|

| |

Name: |

Seth Lederman |

|

| |

Title: |

CEO |

|

[JGB- Tonix- Payoff Letter Signature Page]

SCHEDULE A

SECURITY REGISTRATIONS

[***]

SCHEDULE B

UNIFORM COMMERCIAL CODE FINANCING STATEMENT TERMINATIONS

[***]

SCHEDULE C

SECURED PARTY TERMINATION NOTICE

[***]

SCHEDULE D

MARYLAND DEED OF TRUST RELEASE

[***]

SCHEDULE E

MASSACHUSETTS MORTGAGE RELEASE

[***]

Tonix Pharmaceuticals Form 8-K

Exhibit 99.1

Tonix Pharmaceuticals Announces 1-for-100 Reverse

Stock Split

CHATHAM, N.J., February 3, 2025 (GLOBE NEWSWIRE) --

Tonix Pharmaceuticals Holding Corp. (Nasdaq: TNXP) (Tonix or the Company), a fully-integrated biopharmaceutical company with marketed

products and a pipeline of development candidates, today announced that it will effect a 1-for-100 reverse stock split of its outstanding

common stock. The reverse stock split will be effective for trading purposes as of the commencement of trading on February 5, 2025.

The reverse stock split is intended to increase the

per share trading price of Tonix’s common stock to satisfy the $1.00 minimum bid price requirement for continued listing on The

NASDAQ Capital Market (Rule 5550(a)(1)). Tonix’s common stock will continue to trade on the NASDAQ Capital Market under the symbol

“TNXP” and under a new CUSIP number, 890260839. As a result of the reverse stock split, every one hundred pre-split shares

of common stock outstanding will become one share of common stock. The reverse split will also apply to common stock issuable upon the

exercise of Tonix’s outstanding warrants and stock options. The reverse stock split will not proportionately reduce the number of

shares of authorized common stock, as permitted under Nevada law, as shareholder approval for the reverse stock split was obtained on

October 30, 2024.

Tonix’s transfer agent, VStock Transfer LLC,

which is also acting as the exchange agent for the reverse split, will provide instructions to shareholders regarding the process for

exchanging share certificates. Any fractional shares of common stock resulting from the reverse stock split will be rounded up to the

nearest whole post-split share and no shareholders will receive cash in lieu of fractional shares.

Tonix Pharmaceuticals Holding Corp.*

Tonix is a fully-integrated biopharmaceutical company

focused on transforming therapies for pain management and vaccines for public health challenges. Tonix’s development portfolio is

focused on central nervous system (CNS) disorders. Tonix’s priority is to advance TNX-102 SL, a product candidate for the management

of fibromyalgia, for which an NDA was submitted based on two statistically significant Phase 3 studies for the management of fibromyalgia

and for which a PDUFA (Prescription Drug User Fee act) goal date of August 15, 2025 has been assigned for a decision on marketing authorization.

The FDA has previously granted Fast Track designation to TNX-102 SL for the management of fibromyalgia. TNX-102 SL is also being developed

to treat acute stress reaction and acute stress disorder under a Physician-Initiated IND at the University of North Carolina in the OASIS

study funded by the U.S. Department of Defense (DoD). Tonix’s CNS portfolio includes TNX-1300 (cocaine esterase), a biologic in

Phase 2 development designed to treat cocaine intoxication that has FDA Breakthrough Therapy designation, and its development is supported

by a grant from the National Institute on Drug Abuse. Tonix’s immunology development portfolio consists of biologics

to address organ transplant rejection, autoimmunity and cancer, including TNX-1500, which is an Fc-modified humanized monoclonal antibody

targeting CD40-ligand (CD40L or CD154) being developed for the prevention of allograft rejection and for the treatment of autoimmune diseases.

Tonix also has product candidates in development in infectious disease, including a vaccine for mpox, TNX-801. In July 2024, Tonix announced

a contract with the U.S. DoD’s Defense Threat Reduction Agency (DTRA) for up to $34 million over five years to develop TNX-4200,

small molecule broad-spectrum antiviral agents targeting CD45 for the prevention or treatment of infections to improve the medical readiness

of military personnel in biological threat environments. Tonix owns and operates a state-of-the art infectious disease research facility

in Frederick, Md. Tonix Medicines, our commercial subsidiary, markets Zembrace® SymTouch® (sumatriptan injection) 3 mg and Tosymra®

(sumatriptan nasal spray) 10 mg for the treatment of acute migraine with or without aura in adults.

| * | Tonix’s product development candidates are investigational new drugs or biologics; their efficacy

and safety have not been established and have not been approved for any indication. |

Zembrace SymTouch and Tosymra are registered trademarks

of Tonix Medicines. All other marks are property of their respective owners.

This press release and further information about Tonix

can be found at www.tonixpharma.com.

Forward Looking Statements

Certain statements in this press release are forward-looking

within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of forward-looking

words such as “anticipate,” “believe,” “forecast,” “estimate,” “expect,” and

“intend,” among others. These forward-looking statements are based on Tonix's current expectations and actual results could

differ materially. There are a number of factors that could cause actual events to differ materially from those indicated by such forward-looking

statements. These factors include, but are not limited to, risks related to the failure to obtain FDA clearances or approvals and noncompliance

with FDA regulations; risks related to the failure to successfully market any of our products; risks related to the timing and progress

of clinical development of our product candidates; our need for additional financing; uncertainties of patent protection and litigation;

uncertainties of government or third party payor reimbursement; limited research and development efforts and dependence upon third parties;

and substantial competition. As with any pharmaceutical under development, there are significant risks in the development, regulatory

approval and commercialization of new products. Tonix does not undertake an obligation to update or revise any forward-looking statement.

Investors should read the risk factors set forth in the Annual Report on Form 10-K for the year ended December 31, 2023, as filed with

the Securities and Exchange Commission (the “SEC”) on April 1, 2024, and periodic reports filed with the SEC on or after the

date thereof. All of Tonix's forward-looking statements are expressly qualified by all such risk factors and other cautionary statements.

The information set forth herein speaks only as of the date thereof.

Investor Contacts

Jessica Morris

Tonix Pharmaceuticals

investor.relations@tonixpharma.com

(862) 799-8599

Peter Vozzo

ICR Healthcare

peter.vozzo@icrhealthcare.com

(443) 213-0505

Media Contact

Ray Jordan

Putnam Insights

ray@putnaminsights.com

(949) 245-5432

Indication and Usage

Zembrace® SymTouch® (sumatriptan succinate)

injection (Zembrace) and Tosymra® (sumatriptan) nasal spray are prescription medicines used to treat acute migraine headaches

with or without aura in adults who have been diagnosed with migraine.

Zembrace and Tosymra are not used to prevent migraines. It is not known

if Zembrace or Tosymra are safe and effective in children under 18 years of age.

Important Safety Information

Zembrace and Tosymra can cause serious side effects, including heart

attack and other heart problems, which may lead to death. Stop use and get emergency help if you have any signs of a heart attack:

| · | discomfort in the center of your chest that lasts for more

than a few minutes or goes away and comes back |

| · | severe tightness, pain, pressure, or heaviness in your chest,

throat, neck, or jaw |

| · | pain or discomfort in your arms, back, neck, jaw or stomach |

| · | shortness of breath with or without chest discomfort |

| · | breaking out in a cold sweat |

Zembrace and Tosymra are not for people with risk factors for heart disease

(high blood pressure or cholesterol, smoking, overweight, diabetes, family history of heart disease) unless a heart exam shows no problem.

Do not use Zembrace or Tosymra if you have:

| · | history of heart problems |

| · | narrowing of blood vessels to your legs, arms, stomach,

or kidney (peripheral vascular disease) |

| · | uncontrolled high blood pressure |

| · | hemiplegic or basilar migraines. If you are not sure if

you have these, ask your provider. |

| · | had a stroke, transient ischemic attacks (TIAs), or problems

with blood circulation |

| · | taken any of the following medicines in the last 24 hours:

almotriptan, eletriptan, frovatriptan, naratriptan, rizatriptan, ergotamines, or dihydroergotamine. Ask your provider for a list of these

medicines if you are not sure. |

| · | are taking certain antidepressants, known as monoamine oxidase

(MAO)-A inhibitors or it has been 2 weeks or less since you stopped taking a MAO-A inhibitor. Ask your provider for a list of these medicines

if you are not sure. |

| · | an allergy to sumatriptan or any of the components of Zembrace

or Tosymra |

Tell your provider about all of your medical conditions and medicines you

take, including vitamins and supplements.

Zembrace and Tosymra can cause dizziness, weakness, or drowsiness. If so,

do not drive a car, use machinery, or do anything where you need to be alert.

Zembrace and Tosymra may cause serious side effects including:

| · | changes in color or sensation in your fingers and toes |

| · | sudden or severe stomach pain, stomach pain after meals,

weight loss, nausea or vomiting, constipation or diarrhea, bloody diarrhea, fever |

| · | cramping and pain in your legs or hips; feeling of heaviness

or tightness in your leg muscles; burning or aching pain in your feet or toes while resting; numbness, tingling, or weakness in your legs;

cold feeling or color changes in one or both legs or feet |

| · | increased blood pressure including a sudden severe increase

even if you have no history of high blood pressure |

| · | medication overuse headaches from using migraine medicine

for 10 or more days each month. If your headaches get worse, call your provider. |

| · | serotonin syndrome, a rare but serious problem that can

happen in people using Zembrace or Tosymra, especially when used with anti-depressant medicines called SSRIs or SNRIs. Call your provider

right away if you have: mental changes such as seeing things that are not there (hallucinations), agitation, or coma; fast heartbeat;

changes in blood pressure; high body temperature; tight muscles; or trouble walking. |

| · | hives (itchy bumps); swelling of your tongue, mouth, or

throat |

| · | seizures even in people who have never had seizures before |

The most common side effects of Zembrace and Tosymra include: pain and

redness at injection site (Zembrance only); tingling or numbness in your fingers or toes; dizziness; warm, hot, burning feeling to your

face (flushing); discomfort or stiffness in your neck; feeling weak, drowsy, or tired; application site (nasal) reactions (Tosymra only)

and throat irritation (Tosymra only).

Tell your provider if you have any side effect that bothers you or does

not go away. These are not all the possible side effects of Zembrace and Tosymra. For more information, ask your provider.

This is the most important information to know about Zembrace and Tosymra

but is not comprehensive. For more information, talk to your provider and read the Patient Information and Instructions for Use. You can

also visit https://www.tonixpharma.com or call 1-888-869-7633.

You are encouraged to report adverse effects of prescription drugs to

the FDA. Visit www.fda.gov/medwatch or call 1-800-FDA-1088.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

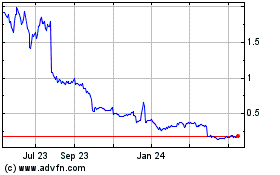

Tonix Pharmaceuticals (NASDAQ:TNXP)

Historical Stock Chart

From Jan 2025 to Feb 2025

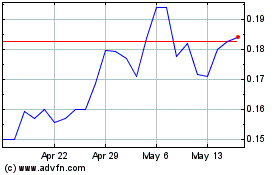

Tonix Pharmaceuticals (NASDAQ:TNXP)

Historical Stock Chart

From Feb 2024 to Feb 2025