Tenaya Therapeutics Announces Pricing of Public Offering

March 03 2025 - 10:19PM

Tenaya Therapeutics, Inc. (Nasdaq: TNYA), a clinical-stage

biotechnology company with a mission to discover, develop and

deliver potentially curative therapies that address the underlying

causes of heart disease, today announced the pricing of its

underwritten public offering of 75,000,000 total units for gross

proceeds of approximately $52.5 million prior to deducting

underwriting discounts and commissions and offering expenses.

Tenaya intends to use the net proceeds from the

offering to fund the ongoing and planned development of its

clinical and early-stage product candidates, particularly TN-201

and TN-401, and for working capital and other general corporate

purposes.

The offering is comprised of 75,000,000 units,

priced at a public offering price of $0.70 per unit, with each unit

consisting of one share of common stock, a warrant to purchase one

share of common stock (which equates to 100% warrant coverage) at

an exercise price of $0.80 per share, which will be immediately

exercisable and will expire five years from the date of issuance (a

Series A Warrant) and a warrant to purchase one-half of a share of

common stock (which equates to 50% warrant coverage) at an exercise

price of $0.70 per share, which will be immediately exercisable and

expire on June 30, 2026 (a Series B Warrant). The securities

comprising the units are immediately separable and will be issued

separately.

All of the securities are to be sold by Tenaya.

The offering is expected to close on or about March 5, 2025,

subject to satisfaction of customary closing conditions.

Leerink Partners and Piper Sandler are acting as

joint book-running managers for the offering.

The securities are being offered by Tenaya

pursuant to a Registration Statement on Form S-3, which was

previously filed and declared effective by the SEC, and Tenaya has

filed a preliminary prospectus supplement and accompanying

prospectus relating to and describing the terms of the offering

with the SEC. A final prospectus supplement and accompanying

prospectus relating to the offering will also be filed with the

SEC. These documents can be accessed for free through the SEC’s

website at www.sec.gov.

When available, copies of the final prospectus supplement and

the accompanying prospectus relating to this offering may also be

obtained from: Leerink Partners LLC, Attention: Syndicate

Department, 53 State Street, 40th Floor, Boston, MA 02109, by

telephone at 1 (800) 808-7525, ext. 6105, or by email at

syndicate@leerink.com; or Piper Sandler & Co., 800 Nicollet

Mall, J12S03, Minneapolis, MN 55402, Attention: Prospectus

Department, by telephone at (800) 747-3924, or by email at

prospectus@psc.com.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy, nor will there be any

sale of these securities in any state or other jurisdiction in

which such offer, solicitation, or sale would be unlawful before

registration or qualification under the securities laws of that

state or jurisdiction.

About Tenaya Therapeutics

Tenaya Therapeutics is a clinical-stage biotechnology company

committed to a bold mission: to discover, develop and deliver

potentially curative therapies that address the underlying drivers

of heart disease. Tenaya employs a suite of integrated internal

capabilities, including modality agnostic target validation, capsid

engineering and manufacturing, to generate a portfolio of genetic

medicines aimed at the treatment of both rare genetic disorders and

more prevalent heart conditions. Tenaya’s pipeline includes TN-201,

a gene therapy for MYBPC3-associated hypertrophic cardiomyopathy

(HCM), TN-401, a gene therapy for PKP2-associated arrhythmogenic

right ventricular cardiomyopathy (ARVC), TN-301, a small molecule

HDAC6 inhibitor intended for heart failure with preserved ejection

fraction (HFpEF), and multiple early-stage programs in preclinical

development.

Forward-Looking StatementsThis press release

contains forward-looking statements as that term is defined in

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. Such

statements include, but are not limited to, statements relating to

the offering, including the size and terms of the offering, the

securities being offered, the timing of the closing of the

offering, the expected gross proceeds and the use of proceeds.

These forward-looking statements are neither promises nor

guarantees and are subject to a variety of risks and uncertainties,

including but not limited to: whether or not Tenaya will be able to

raise capital through the sale of securities or consummate the

offering; the final terms of the offering on the anticipated terms

or at all, including the satisfaction of customary closing

conditions; the anticipated use of the proceeds of the offering

which could change as a result of market conditions or for other

reasons; general economic and market conditions as well as

geopolitical developments; and other risks. For further information

regarding the foregoing and additional risks that could cause

actual results to differ from those expressed in these

forward-looking statements, as well as risks relating to the

business of Tenaya in general, see Tenaya’s recent Quarterly Report

on Form 10-Q filed on November 6, 2024, the prospectus supplement

related to the proposed public offering we plan to file and

subsequent filings with the Securities and Exchange Commission.

These forward-looking statements are made as of the date of this

press release, and Tenaya assumes no obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

Contact

Michelle Corral

Vice President, Investor Relations and Corporate Communications

Tenaya Therapeutics

IR@tenayathera.com

Investors

Anne-Marie Fields

Precision AQ (formerly Stern Investor Relations)

annemarie.fields@precisionaq.com

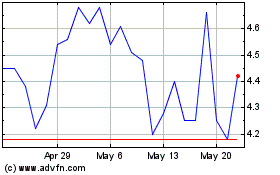

Tenaya Therapeutics (NASDAQ:TNYA)

Historical Stock Chart

From Feb 2025 to Mar 2025

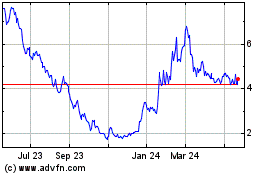

Tenaya Therapeutics (NASDAQ:TNYA)

Historical Stock Chart

From Mar 2024 to Mar 2025