Filed pursuant to Rule 424(b)(3)

Registration No. 333-269246

PROSPECTUS SUPPLEMENT NO. 6

(to Prospectus dated April 27, 2023)

(Interactive Strength Inc.)

Up to 1,773,937 shares of common stock

This prospectus supplement supplements the prospectus dated April 27, 2023 (the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-269246). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission on November 14, 2023 (the “Quarterly Report”). Accordingly, we have attached the Quarterly Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the offer and sale from time to time by the selling stockholders named in the Prospectus or their permitted transferees of up to 1,773,937 shares of our common stock, par value $0.0001 per share (the “common stock”). Our registration of the shares covered by the Prospectus does not mean that the selling stockholders will offer or sell any of the shares. The selling stockholders may sell the shares of common stock covered by the Prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may sell the shares in the section entitled “Plan of Distribution” in the Prospectus.

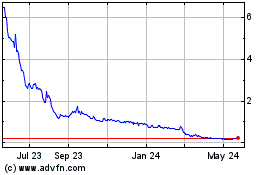

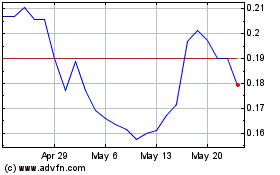

Our shares of common stock are listed on Nasdaq under the symbol “TRNR". On November 21, 2023, the closing price of our shares of common stock was $0.95 per share. We are an “emerging growth company” and a “smaller reporting company” as those terms are defined under the federal securities laws and, as such, have elected to comply with certain reduced public company disclosure and reporting requirements.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

See the section entitled “Risk Factors” beginning on page 15 of the Prospectus and in the documents incorporated by reference in the Prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is November 22, 2023.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ________

Commission File Number: 001-41610

INTERACTIVE STRENGTH INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

Delaware |

82-1432916 |

( State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer

Identification No.) |

1005 Congress Ave, Suite 925 Austin , Texas |

78701 |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (310) 697-8655

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, $0.0001 par value per share |

|

TRNR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

Emerging growth company |

|

☒ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

APPLICABLE ONLY TO CORPORATE ISSUERS:

As of November 10, 2023, the registrant had 14,313,185 shares of common stock, $0.0001 par value per share, outstanding.

TABLE OF CONTENTS

i

Item 1. Financial Statements

INTERACTIVE STRENGTH INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

(In thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

30 |

|

|

$ |

226 |

|

Accounts receivable, net of allowances |

|

|

7 |

|

|

|

— |

|

Inventories, net |

|

|

1,443 |

|

|

|

4,567 |

|

Vendor deposits |

|

|

3,280 |

|

|

|

3,603 |

|

Prepaid expenses and other current assets |

|

|

962 |

|

|

|

1,426 |

|

Total current assets |

|

|

5,722 |

|

|

|

9,822 |

|

Property and equipment, net |

|

|

583 |

|

|

|

1,326 |

|

Right-of-use-assets |

|

|

296 |

|

|

|

110 |

|

Intangible assets, net |

|

|

2,866 |

|

|

|

3,834 |

|

Long-term inventories, net |

|

|

3,121 |

|

|

|

— |

|

Deferred offering costs |

|

|

— |

|

|

|

2,337 |

|

Other assets |

|

|

5,683 |

|

|

|

7,018 |

|

Total Assets |

|

$ |

18,271 |

|

|

$ |

24,447 |

|

Liabilities and stockholders' equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

8,921 |

|

|

$ |

7,743 |

|

Accrued expenses and other current liabilities |

|

|

1,951 |

|

|

|

5,304 |

|

Operating lease liability, current portion |

|

|

53 |

|

|

|

106 |

|

Deferred revenue |

|

|

66 |

|

|

|

29 |

|

Loan payable |

|

|

6,266 |

|

|

|

6,708 |

|

Senior secured notes |

|

|

1,038 |

|

|

|

— |

|

Income tax payable |

|

|

7 |

|

|

|

7 |

|

Convertible note payable |

|

|

— |

|

|

|

4,270 |

|

Total current liabilities |

|

|

18,302 |

|

|

|

24,167 |

|

Operating lease liability, net of current portion |

|

|

243 |

|

|

|

9 |

|

Warrant liabilities |

|

|

— |

|

|

|

3,004 |

|

Total liabilities |

|

$ |

18,545 |

|

|

$ |

27,180 |

|

Commitments and contingencies (Note 13) |

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

|

|

Common stock, par value $0.0001; 900,000,000 and 369,950,000 shares authorized as of September 30, 2023 and December 31, 2022, respectively; 14,178,514 and 2,450,922 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively. |

|

|

7 |

|

|

|

4 |

|

Additional paid-in capital |

|

|

154,942 |

|

|

|

112,436 |

|

Accumulated other comprehensive income |

|

|

286 |

|

|

|

365 |

|

Accumulated deficit |

|

|

(155,509 |

) |

|

|

(115,538 |

) |

Total stockholders' equity (deficit) |

|

|

(274 |

) |

|

|

(2,733 |

) |

Total liabilities and stockholders' equity (deficit) |

|

$ |

18,271 |

|

|

$ |

24,447 |

|

1

INTERACTIVE STRENGTH INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(unaudited)

(In thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Fitness product revenue |

|

$ |

206 |

|

|

$ |

144 |

|

|

$ |

502 |

|

|

$ |

402 |

|

Membership revenue |

|

|

38 |

|

|

|

25 |

|

|

|

94 |

|

|

|

53 |

|

Training revenue |

|

|

62 |

|

|

|

32 |

|

|

|

183 |

|

|

|

32 |

|

Total revenue |

|

|

306 |

|

|

|

201 |

|

|

|

779 |

|

|

|

487 |

|

Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of fitness product revenue |

|

|

(360 |

) |

|

|

(764 |

) |

|

|

(1,529 |

) |

|

|

(2,047 |

) |

Cost of membership |

|

|

(960 |

) |

|

|

(1,545 |

) |

|

|

(2,861 |

) |

|

|

(3,537 |

) |

Cost of training |

|

|

(109 |

) |

|

|

(387 |

) |

|

|

(300 |

) |

|

|

(1,077 |

) |

Total cost of revenue |

|

|

(1,429 |

) |

|

|

(2,696 |

) |

|

|

(4,690 |

) |

|

|

(6,661 |

) |

Gross loss |

|

|

(1,123 |

) |

|

|

(2,495 |

) |

|

|

(3,911 |

) |

|

|

(6,174 |

) |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

2,357 |

|

|

|

4,854 |

|

|

|

7,796 |

|

|

|

15,284 |

|

Sales and marketing |

|

|

282 |

|

|

|

1,193 |

|

|

|

1,473 |

|

|

|

5,194 |

|

General and administrative |

|

|

6,313 |

|

|

|

6,131 |

|

|

|

30,043 |

|

|

|

11,774 |

|

Total operating expenses |

|

|

8,952 |

|

|

|

12,178 |

|

|

|

39,312 |

|

|

|

32,252 |

|

Loss from operations |

|

|

(10,075 |

) |

|

|

(14,673 |

) |

|

|

(43,223 |

) |

|

|

(38,426 |

) |

Other income (expense), net: |

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense), net |

|

|

(179 |

) |

|

|

(417 |

) |

|

|

25 |

|

|

|

(740 |

) |

Interest (expense) |

|

|

(154 |

) |

|

|

(187 |

) |

|

|

(1,382 |

) |

|

|

(748 |

) |

Gain upon debt forgiveness |

|

|

— |

|

|

|

523 |

|

|

|

2,595 |

|

|

|

523 |

|

Change in fair value of convertible notes |

|

|

— |

|

|

|

— |

|

|

|

(252 |

) |

|

|

(24 |

) |

Change in fair value of warrants |

|

|

— |

|

|

|

— |

|

|

|

2,266 |

|

|

|

— |

|

Total other income (expense), net |

|

|

(333 |

) |

|

|

(81 |

) |

|

|

3,252 |

|

|

|

(989 |

) |

Loss before provision for income taxes |

|

|

(10,408 |

) |

|

|

(14,754 |

) |

|

|

(39,971 |

) |

|

|

(39,415 |

) |

Income tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net loss attributable to common stockholders |

|

$ |

(10,408 |

) |

|

$ |

(14,754 |

) |

|

$ |

(39,971 |

) |

|

$ |

(39,415 |

) |

Net loss per share - basic and diluted |

|

$ |

(0.73 |

) |

|

$ |

(30.16 |

) |

|

$ |

(3.40 |

) |

|

$ |

(93.10 |

) |

Weighted average common stock outstanding—basic and diluted |

|

|

14,186,222 |

|

|

|

489,132 |

|

|

|

11,750,907 |

|

|

|

423,362 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net loss |

|

$ |

(10,408 |

) |

|

$ |

(14,754 |

) |

|

$ |

(39,971 |

) |

|

$ |

(39,415 |

) |

Other comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation (loss) gain |

|

|

172 |

|

|

|

441 |

|

|

|

(79 |

) |

|

|

931 |

|

Total comprehensive loss |

|

$ |

(10,236 |

) |

|

$ |

(14,313 |

) |

|

$ |

(40,050 |

) |

|

$ |

(38,484 |

) |

2

INTERACTIVE STRENGTH INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF REDEEMABLE CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY (DEFICIT)

(unaudited)

(In thousands, except share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series Seed

0 - 10 |

|

Convertible Preferred Stock Series A |

|

Series A-1 |

|

Series A-2 |

|

|

|

Common Stock |

|

Class A Common Stock |

|

Class B Common Stock |

|

Additional Paid-In Capital |

|

Accumulated Other Comprehensive (Income) Loss |

|

Accumulated Deficit |

|

Total Stockholders' Equity (Deficit) |

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

|

|

|

|

|

|

|

|

Balances at December 31, 2021 |

|

42,999 |

|

$ |

7,594 |

|

|

86,703 |

|

$ |

19,535 |

|

|

10,208 |

|

$ |

2,604 |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

181,362 |

|

$ |

3 |

|

|

31,703 |

|

$ |

— |

|

$ |

37,806 |

|

$ |

(159 |

) |

$ |

(57,313 |

) |

$ |

(19,663 |

) |

Issuance of Class A common stock |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

267,384 |

|

|

3 |

|

|

— |

|

|

— |

|

|

2,060 |

|

|

— |

|

|

— |

|

|

2,063 |

|

Issuance of Series A-2 preferred stock upon conversion of convertible notes |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

124,313 |

|

|

5,926 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Issuance of Series A-2 preferred stock, net of issuance costs of $66 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

631,292 |

|

|

30,028 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Issuance of Class B common stock upon exercise of stock options |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

501 |

|

|

— |

|

|

8 |

|

|

— |

|

|

— |

|

|

8 |

|

Stock-based compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

97 |

|

|

— |

|

|

— |

|

|

97 |

|

Foreign currency translation gain |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

167 |

|

|

— |

|

|

167 |

|

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(12,691 |

) |

|

(12,691 |

) |

Balances at March 31, 2022 |

|

42,999 |

|

$ |

7,594 |

|

|

86,703 |

|

$ |

19,535 |

|

|

10,208 |

|

$ |

2,604 |

|

|

755,605 |

|

$ |

35,954 |

|

|

— |

|

$ |

— |

|

|

448,746 |

|

$ |

6 |

|

|

32,204 |

|

$ |

— |

|

$ |

39,971 |

|

$ |

8 |

|

$ |

(70,004 |

) |

$ |

(30,019 |

) |

Issuance of Series A-2 preferred stock, net of issuance costs of $27 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(27 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Issuance of Class B common stock upon exercise of stock options |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2 |

|

|

— |

|

|

— |

|

|

2 |

|

Stock-based compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

100 |

|

|

— |

|

|

— |

|

|

100 |

|

Foreign currency translation gain |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

323 |

|

|

— |

|

|

323 |

|

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(11,970 |

) |

|

(11,970 |

) |

Balances at June 30, 2022 |

|

42,999 |

|

|

7,594 |

|

|

86,703 |

|

|

19,535 |

|

|

10,208 |

|

|

2,604 |

|

|

755,605 |

|

|

35,927 |

|

|

— |

|

|

— |

|

|

448,746 |

|

|

6 |

|

|

32,204 |

|

|

— |

|

|

40,073 |

|

|

331 |

|

|

(81,974 |

) |

|

(41,564 |

) |

Issuance of Class A common stock |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

8 |

|

|

(3 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(3 |

) |

Issuance of Series A-2 preferred stock, net of issuance costs of $4 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

|

|

(4 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Issuance of Class B common stock upon exercise of stock options |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

57 |

|

|

— |

|

|

3 |

|

|

— |

|

|

— |

|

|

3 |

|

Stock-based compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

3,754 |

|

|

— |

|

|

— |

|

|

3,754 |

|

Foreign currency translation gain |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

441 |

|

|

— |

|

|

441 |

|

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(14,754 |

) |

|

(14,754 |

) |

Balances at September 30, 2022 |

|

42,999 |

|

|

7,594 |

|

|

86,703 |

|

|

19,535 |

|

|

10,208 |

|

|

2,604 |

|

|

755,606 |

|

|

35,923 |

|

|

— |

|

|

— |

|

|

448,754 |

|

|

3 |

|

|

32,261 |

|

|

— |

|

|

43,830 |

|

|

772 |

|

|

(96,728 |

) |

|

(52,122 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series Seed

0 - 10 |

|

Convertible Preferred Stock Series A |

|

Series A-1 |

|

Series A-2 |

|

|

|

Common Stock |

|

Class A Common Stock |

|

Class B Common Stock |

|

Additional Paid-In Capital |

|

Accumulated Other Comprehensive (Income) Loss |

|

Accumulated Deficit |

|

Total Stockholders' Equity (Deficit) |

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

|

|

|

|

|

|

|

|

Balances at December 31, 2022 |

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

2,416,698 |

|

|

4 |

|

|

34,224 |

|

$ |

— |

|

|

112,436 |

|

|

365 |

|

|

(115,538 |

) |

|

(2,733 |

) |

Issuance of Common stock |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

8,676,924 |

|

|

3 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

4,449 |

|

|

— |

|

|

— |

|

|

4,452 |

|

Issuance of Common stock upon conversion of Class A Common Stock |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,416,698 |

|

|

4 |

|

|

(2,416,698 |

) |

|

(4 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Issuance of Class B common stock upon exercise of stock options |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

646,433 |

|

|

— |

|

|

14 |

|

|

— |

|

|

— |

|

|

14 |

|

Issuance of Common stock upon conversion of Class B Common Stock |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

680,657 |

|

|

— |

|

|

— |

|

|

— |

|

|

(680,657 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Stock-based compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

15,057 |

|

|

— |

|

|

— |

|

|

15,057 |

|

Net exercise of options |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

323 |

|

|

— |

|

|

— |

|

|

323 |

|

Foreign currency translation loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(115 |

) |

|

— |

|

|

(115 |

) |

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(15,961 |

) |

|

(15,961 |

) |

Balances at March 31, 2023 |

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

11,774,279 |

|

$ |

7 |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

$ |

132,279 |

|

$ |

250 |

|

$ |

(131,499 |

) |

$ |

1,037 |

|

Initial public offering, net of issuance cost of $1.2 million |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,500,000 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

10,820 |

|

|

— |

|

|

— |

|

|

10,820 |

|

Initial public offering costs |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(4,607 |

) |

|

— |

|

|

— |

|

|

(4,607 |

) |

Issuance of Common stock upon conversion of convertible notes |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

565,144 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

4,521 |

|

|

— |

|

|

— |

|

|

4,521 |

|

Exercise of stock warrants |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

339,091 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,468 |

|

|

— |

|

|

— |

|

|

2,468 |

|

Stock-based compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

4,510 |

|

|

— |

|

|

— |

|

|

4,510 |

|

Foreign currency translation loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(136 |

) |

|

— |

|

|

(136 |

) |

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(13,602 |

) |

|

(13,602 |

) |

Balances at June 30, 2023 |

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

14,178,514 |

|

$ |

7 |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

$ |

149,991 |

|

$ |

114 |

|

$ |

(145,101 |

) |

$ |

5,011 |

|

Stock-based compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

4,951 |

|

|

— |

|

|

— |

|

|

4,951 |

|

Foreign currency translation loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

172 |

|

|

— |

|

|

172 |

|

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(10,408 |

) |

|

(10,408 |

) |

Balances at September 30, 2023 |

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

14,178,514 |

|

$ |

7 |

|

|

— |

|

$ |

— |

|

|

— |

|

$ |

— |

|

$ |

154,942 |

|

$ |

286 |

|

$ |

(155,509 |

) |

$ |

(274 |

) |

3

INTERACTIVE STRENGTH INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

Cash Flows From Operating Activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(39,971 |

) |

|

$ |

(39,415 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Foreign currency |

|

|

64 |

|

|

|

821 |

|

Depreciation |

|

|

743 |

|

|

|

932 |

|

Amortization |

|

|

4,188 |

|

|

|

3,735 |

|

Non-cash lease expense |

|

|

66 |

|

|

|

— |

|

Inventory valuation loss |

|

|

261 |

|

|

|

1,106 |

|

Stock-based compensation |

|

|

23,773 |

|

|

|

3,951 |

|

Gain upon debt forgiveness |

|

|

(2,595 |

) |

|

|

(523 |

) |

Interest expense |

|

|

77 |

|

|

|

746 |

|

Amortization of debt discount |

|

|

1,305 |

|

|

|

— |

|

Change in fair value of convertible notes |

|

|

252 |

|

|

|

24 |

|

Warrants issued to service providers |

|

|

442 |

|

|

|

— |

|

Change in fair value of warrants |

|

|

(2,266 |

) |

|

|

— |

|

Changes in operating assets and liabilities |

|

|

|

|

|

|

Accounts receivable |

|

|

(7 |

) |

|

|

— |

|

Inventories |

|

|

(442 |

) |

|

|

(2,806 |

) |

Prepaid expenses and other current assets |

|

|

464 |

|

|

|

(721 |

) |

Vendor deposits |

|

|

323 |

|

|

|

316 |

|

Deferred offering costs |

|

|

— |

|

|

|

(1,123 |

) |

Long-term inventories |

|

|

— |

|

|

|

(313 |

) |

Other assets |

|

|

(10 |

) |

|

|

(1 |

) |

Accounts payable |

|

|

585 |

|

|

|

1,642 |

|

Accrued expenses and other current liabilities |

|

|

(780 |

) |

|

|

2,141 |

|

Deferred revenue |

|

|

37 |

|

|

|

(4 |

) |

Operating lease liabilities |

|

|

(70 |

) |

|

|

— |

|

Net cash used in operating activities |

|

|

(13,561 |

) |

|

|

(29,492 |

) |

Cash Flows From Investing Activities: |

|

|

|

|

|

|

Purchase of property and equipment |

|

|

— |

|

|

|

(501 |

) |

Acquisition of internal use software |

|

|

(349 |

) |

|

|

(2,744 |

) |

Acquisition of software and content |

|

|

(797 |

) |

|

|

(4,958 |

) |

Net cash used in investing activities |

|

|

(1,146 |

) |

|

|

(8,203 |

) |

Cash Flows From Financing Activities: |

|

|

|

|

|

|

Proceeds from issuance of related party loans |

|

|

465 |

|

|

|

14 |

|

Payments of related party loans |

|

|

(483 |

) |

|

|

(1,178 |

) |

Proceeds from issuance of common stock upon initial public offering, net of offering costs |

|

|

10,820 |

|

|

|

— |

|

Payments of offering costs |

|

|

(1,453 |

) |

|

|

— |

|

Proceeds from senior secured notes |

|

|

3,030 |

|

|

|

— |

|

Payments of senior secured notes |

|

|

(2,000 |

) |

|

|

— |

|

Proceeds from issuance of Preferred Stock - Series A, net of issuance costs |

|

|

— |

|

|

|

29,997 |

|

Proceeds from issuance of convertible notes |

|

|

— |

|

|

|

5,902 |

|

Proceeds from the issuance of common stock A |

|

|

4,247 |

|

|

|

2,060 |

|

Proceeds from the exercise of common stock options |

|

|

30 |

|

|

|

6 |

|

Repayment Bounce Back Loan |

|

|

— |

|

|

|

(69 |

) |

Net cash provided by financing activities |

|

|

14,656 |

|

|

|

36,732 |

|

Effect of exchange rate on cash |

|

|

(145 |

) |

|

|

(74 |

) |

Net Change In Cash and Cash Equivalents |

|

|

(196 |

) |

|

|

(1,037 |

) |

Cash and restricted cash at beginning of year |

|

|

226 |

|

|

|

1,697 |

|

Cash and restricted cash at end of year |

|

$ |

30 |

|

|

$ |

660 |

|

Supplemental Disclosure Of Cash Flow Information: |

|

|

|

|

|

|

Property & equipment in AP |

|

|

18 |

|

|

|

175 |

|

Inventories in AP and accrued |

|

|

815 |

|

|

|

783 |

|

Issuance of Series A preferred stock in connection with convertible notes payable |

|

|

— |

|

|

|

5,926 |

|

Offering costs in AP and accrued |

|

|

3,155 |

|

|

|

— |

|

Exercise of stock warrants |

|

|

2,468 |

|

|

|

— |

|

Right-of-use assets obtained in exchange for new operating lease liabilities |

|

|

313 |

|

|

|

— |

|

Conversion of convertible notes into common stock |

|

|

4,521 |

|

|

|

— |

|

Decrease in right-of-use asset and operating lease liabilities due to lease termination |

|

|

61 |

|

|

|

— |

|

Issuance of Common Stock from Rights Offering |

|

|

202 |

|

|

|

— |

|

Net exercise of options |

|

|

323 |

|

|

|

— |

|

Stock-based compensation capitalized in software |

|

|

745 |

|

|

|

— |

|

4

INTERACTIVE STRENGTH INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1.Description of Business and Basis of Presentation

Description and Organization

Interactive Strength Inc., together with its consolidated subsidiaries doing business as “Forme” (“Forme” or the “Company”), is an interactive home fitness platform that offers an immersive smart home gym with a life-size touchscreen mirror and accessories. Our Members are defined as any individual who has a Forme account through a paid connected fitness membership. The Company’s interactive home fitness platform is known as the Studio, for which the Company continues to develop new accessories and add-ons to further customize a Member’s experience (“Connected Fitness Products”). Through the Studio, Members can stream immersive, instructor-led boutique classes anytime, anywhere. The Company enables Members to get the most out of their wellness journey from their home.

Initial Public Offering

In May 2023, the Company closed its initial public offering ("IPO") in which we issued and sold 1.5 million shares of common stock at a public offering price of $8.00 per share and excluding shares sold in the IPO by certain of our existing stockholders. Total proceeds, after deducting underwriting commissions of $1.2 million and other offering expenses of $4.6 million, was $6.2 million.

Basis of Presentation and Consolidation

The accompanying condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and applicable rules and regulations of the U.S. Securities and Exchange Commission (“SEC”). The condensed consolidated financial statements include the accounts of Interactive Strength Inc. and its subsidiaries in which the Company has a controlling financial interest. All intercompany balances and transactions have been eliminated.

In the opinion of management, the accompanying unaudited interim condensed consolidated financial statements reflect all normal recurring adjustments necessary to present fairly the financial position, results of operations, cash flows, and the changes in equity for the interim period.

Liquidity and Going Concern

Since its inception, the Company has sustained recurring losses and has relied on funding from private investors and other third-parties (collectively “outside capital”) to execute the Company’s growth strategy. As a result, the Company incurred a net loss of $40.0 million during the nine months ended September 30, 2023 and had an accumulated deficit of $155.5 million as of September 30, 2023. The Company’s long-term success is dependent upon its ability to successfully develop, market, and deliver its revenue-generating products and services in a profitable manner. While management believes the Company can be successful in executing its growth strategy, no assurance can be provided it will be able to do so in a timely or profitable manner. As a result, the Company anticipates it will continue to rely on outside capital to fund the Company’s operations for the foreseeable future.

As of the date the accompanying condensed consolidated financial statements were issued (the “issuance date”), the Company’s available liquidity was not sufficient to fund the Company’s operations over the next twelve months or meet its obligations as they become due, absent the Company’s ability to secure additional outside capital. While management plans to take action to address the Company’s liquidity needs, such as cost mitigation initiatives to reduce unnecessary costs, securing additional outside capital, and/or pursuing other strategic arrangements, no assurance can be provided that management’s actions will be sufficient to fund the Company’s operations over the next twelve months or meet its obligations as they become due.

As of September 30, 2023, the Company had $1.0 million of senior secured notes outstanding with THLWY, LLC (see Note 10).

In addition, as of September 30, 2023, the Company had loans outstanding from certain related parties (See Note 19) with an aggregate principal and interest amount owed of approximately $6.3 million. All of these loans matured prior to September 30, 2023, but their repayment has been temporarily waived. However, absent additional outside capital, the Company will be unable to repay these loans upon their maturity and, as such, the aggregate amounts owed have been classified as current debt in the accompanying condensed consolidated balance sheet as of September 30, 2023.

In the event that one or more of management’s planned actions are not sufficient to fund the Company’s operations over the next twelve months or meet its obligations as they become due, management will be required to seek other strategic alternatives, which may include, among others, a significant curtailment in the Company’s operations, a sale of certain of the Company’s assets, a sale of the entire Company to strategic or financial investors, and/or allowing the Company to become insolvent by filing for bankruptcy. These uncertainties raise substantial doubt about the Company’s ability to continue as a going concern.

5

The accompanying condensed consolidated financial statements have been prepared on the basis that the Company will continue to operate as a going concern, which contemplates that the Company will be able to realize assets and settle liabilities and commitments in the normal course of business for the foreseeable future. Accordingly, the accompanying condensed consolidated financial statements do not include any adjustments that may result from the outcome of these uncertainties.

2.Summary of Significant Accounting Policies

Unaudited Interim Financial Information

The accompanying unaudited interim condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, or GAAP, for interim financial reporting and as required by Regulation S-X, Rule 10-01. The unaudited interim condensed consolidated financial statements have been prepared on the same basis as the audited consolidated annual financial statements for the years ended December 31, 2022 and 2021 and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary for a fair statement of the Company’s condensed consolidated balance sheet as of September 30, 2023, the condensed consolidated statements of operations and comprehensive (loss) for the three and nine months ended September 30, 2023 and 2022, the condensed consolidated statement of redeemable convertible preferred stock and stockholders' equity (deficit) as of September 30, 2023 and condensed consolidated statements of cash flows for the nine months ended September 30, 2023 and 2022. The financial data and other information disclosed in these notes related to the nine months ended September 30, 2023 and 2022 are unaudited. The results for the nine months ended September 30, 2023, are not necessarily indicative of results to be expected for the year ending December 31, 2023, any other interim periods, or any future year or period.

Use of Estimates

The preparation of the condensed consolidated financial statements in conformity with U.S. GAAP requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue, expenses, and related disclosures. On an ongoing basis, the Company evaluates its estimates, including, among others, those related to revenue related reserves, the realizability of inventory, fair value measurements, useful lives of long lived assets, including property and equipment and finite lived intangible assets, product warranty, stock-based compensation expense, valuation of the debt component of convertible notes, warrant liabilities, and commitments and contingencies. The Company bases its estimates on historical experience and on various other assumptions that are believed to be reasonable. Actual results may differ from these estimates.

Segment Information

Operating segments are defined as components of an enterprise for which separate and discrete information is available for evaluation by the chief operating decision-maker (“CODM”) in deciding how to allocate resources and assess performance. The Company has one operating segment, the development and sale of its at-home fitness technology platform. The Company’s chief operating decision maker, its chief executive officer, manages the Company’s operations on a consolidated basis for the purpose of allocating resources. As the Company has one reportable segment, all required segment financial information is presented in the consolidated financial statements. The Company currently operates in the United States, the United Kingdom, and Taiwan. As of September 30, 2023 and 2022, substantially all of the Company’s long-lived assets are held in the United States.

Cash

Cash consists of cash on deposit in banks.

Deferred Offering Costs

The Company complies with the requirements of ASC 340-10-S99-1 and SEC Staff Accounting Bulletin Topic 5A “Expenses of Offering”. Offering costs consist principally of professional and registration fees incurred through the balance sheet date that are related to the IPO. As of September 30, 2023, the Company incurred offering costs amounting to $4.6 million through the IPO and subsequently classified the costs to additional paid in capital.

Property and Equipment

Property and equipment purchased by the Company are stated at cost less accumulated depreciation. Major updates and improvements are capitalized, while charges for repairs and maintenance which do not improve or extend the lives of the respective asset, are expensed as incurred. The Company capitalizes the cost of pre-production tooling which it owns under a supply arrangement. Pre-production tooling, including the related engineering costs the Company will not own or will not use in producing products under long-term supply arrangements, are expensed as incurred.

6

Depreciation and amortization is computed on a straight-line basis over the following estimated useful lives:

|

|

|

|

|

|

Pre-production tooling |

|

2 – 5 years |

Machinery and equipment |

|

2 – 10 years |

Furniture and fixtures |

|

3 – 5 years |

Leasehold improvements |

|

Lesser of lease term or estimated useful life |

Inventories, net

Inventories, which are comprised of finished goods, are stated at the lower of cost or net realizable value, with cost determined using actual costs. The Company maintains inventory in a third-party warehouse. Reserves are established to reduce the cost of inventories to their estimated net realizable value and are reflected in cost of revenues in the consolidated statement of operations. The Company assessed the obsolescence reserve by evaluating factors such as inventory levels, historical sales, and the remaining life of its products. Inventory losses are written-off against the reserve. Inventory not expected to be sold in the next twelve months is classified as long-term in the accompanying condensed, consolidated balance sheets.

Vendor Deposits

Vendor deposits represent prepayments made to the third-party manufacturers of the Company’s inventory. In general, the Company’s manufacturers require that the Company pay a portion of the costs for a manufacturing purchase order in advance, with the remaining cost being invoiced upon delivery of the products. Prior to receipt of the goods, any costs associated with the prepayments made by the Company are reflected as vendor deposits on the Company’s consolidated balance sheet.

Capitalized Studio Content

Capitalized Studio content costs include certain expenditures to develop video and live content for the Company’s customers. The Company capitalizes production costs for recorded content in accordance with ASC 926-20, Entertainment-Films - Other Assets - Film Costs. The Company recognizes capitalized content, net of accumulated amortization, within other non-current assets in the consolidated balance sheets and recognizes the related amortization expense as a component of cost of revenue in the consolidated statements of operations and comprehensive (loss). Costs which qualify for capitalization include production costs, development costs, direct costs, labor costs, and production overhead. Expenditures for capitalized content are included within operating activities in the consolidated statements of cash flows. Based on certain factors, including historical and estimated user viewing patterns, the Company amortizes individual titles within the Studio content library on a straight-line basis over a three-year useful life. The Company reviews factors impacting the amortization of the capitalized Studio content on an ongoing basis. Estimates related to these factors require considerable management judgment.

The Company considered certain factors in determining the useful life of the content, including expected periods over which the content will be made available through the platform and related viewership, the lack of “obsolescence” of such content over such period given the nature of its videos (i.e., exercise classes which are not significantly impacted by changes in markets or customer preferences, and/or for which the content is expected to significantly change or evolve over time), and the expected significant growth of its subscriber base which will contribute to substantial increases in viewership over time given the recent launch of its product and membership offerings. Based on these factors, the Company has determined that a three-year (3-year) amortization period is reasonable for the content. The Company will continue to review factors impacting the amortization of the capitalized content on an ongoing basis.

The Company’s business model is membership based as opposed to generating revenues at a specific title level. Therefore, all content assets are monetized as part of a single asset group. The content is assessed at the group level when an event or change in circumstances indicates a change in the expected usefulness of the content or that fair value may be less than unamortized cost. Unamortized costs are assessed for impairment regardless of whether the produced content is completed. To date, the Company has recognized one impairment with regards to the carrying value of its content portfolio. If circumstances in the future suggest that an impairment may exist, these aggregated content assets will be stated at the lower of unamortized cost or fair value. In addition, unamortized costs for assets that have been, or are expected to be, abandoned are written off. The unamortized cost of content is approximately $2.9 million and $4.4 million as of September 30, 2023 and December 31, 2022, respectively.

7

Identifiable Intangible Assets

The Company capitalizes certain eligible software development costs incurred in connection with its internal use software in accordance with ASC 350-40, Internal-use Software and ASC 985, Software. These capitalized costs also relate to the Company’s Studio software that is accessed by its customers on a membership basis as well as certain costs associated with its information systems. Capitalized software costs are amortized over the estimated useful life is three years. Capitalization begins once the application development stage begins, management has authorized and committed to funding the project, it is probable the project will be completed, and the software will be used to perform the function intended. Internal and external costs, if direct and incremental, are capitalized until the software is substantially complete and ready for its intended use. The Company expenses all costs incurred that relate to planning and post-implementation phases of development. Intangible assets are assessed for impairment when events or circumstances indicate the existence of a possible impairment, and none were identified in the quarter ended September 30, 2023.

During the nine months ended September 30, 2023 and the year ended December 31, 2022, the Company capitalized $0.5 million and $2.7 million, respectively, of internal use software.

Amortization is computed on a straight-line basis over the following estimated useful lives:

|

|

|

Internal-use software |

|

3 years |

Music Royalty Fees

The Company recognizes music royalty fees as these fees are incurred in accordance with the terms of the relevant license agreement with the music rights holder. The incurrence of such royalties is primarily driven by the number of paid subscribers each month and it is classified as cost of membership and training within the Company’s statement of operations. The Company’s license agreements with music rights holders generally include provisions for advance royalties as well as minimum guarantees. When a minimum guarantee is paid in advance, the guarantee is recorded as a prepaid asset and amortized over the shorter of the period consumed or the term of the agreement. As of September 30, 2023 and December 31, 2022 there were no music guarantee-related prepaids, respectively.

Fair Value Measurements

Fair value is the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Subsequent changes in fair value of these financial assets and liabilities are recognized in earnings when they occur. When determining the fair value measurements for assets and liabilities which are required to be recorded at fair value, the Company considers the principal or most advantageous market in which the Company would transact and the market-based risk measurement or assumptions that market participants would use in pricing the assets or liabilities, such as inherent risk, transfer restrictions, and credit risk.

The Company applies the following fair value hierarchy, which prioritizes the inputs used to measure fair value into three levels and bases the categorization within the hierarchy upon the lowest level of input that is available and significant to the fair value measurement:

•Level 1 inputs are based on quoted prices in active markets for identical assets or liabilities.

•Level 2 inputs are based on observable inputs other than Level 1 prices, such as quoted prices for similar assets or liabilities, quoted prices in markets with insufficient volume or infrequent transactions (less active markets), or model-derived valuations in which all significant inputs are observable or can be derived principally from or corroborated by observable market data for substantially the full term of the assets or liabilities.

•Level 3 inputs are based on unobservable inputs to the valuation methodology that are significant to the measurement of fair value of assets or liabilities, and typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability.

The Company’s material financial instruments consist primarily of cash and cash equivalents, accounts payable, accrued expenses, convertible notes, and warrants. The carrying amounts of current financial instruments, which include cash, accounts receivable, accounts payable and accrued expenses, approximate their fair values due to the short-term nature of these instruments.

8

Impairment of Long-Lived Assets

The Company evaluates long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset (or asset group) to the future undiscounted cash flows expected to be generated by the assets (or asset group). If such assets are considered to be impaired, the impairment to be recognized is measured as the amount by which the carrying amount of the assets exceeds their fair value.

Convertible Notes

As permitted under ASC Topic 825, Financial Instruments, the Company has elected the fair value option to account for its convertible notes. In accordance with ASC Topic 825, the Company records these convertible notes at fair value with changes in fair value recorded as a component of other income (expense), net in the condensed consolidated statement of operations and comprehensive loss. As a result of applying the fair value option, direct costs and fees related to the convertible notes were expensed as incurred and were not deferred. The Company concluded that it was appropriate to apply the fair value option as they are liabilities that are not, in whole or in part, classified as a component of members’ deficit. In addition, the convertible notes meet other applicable criteria for electing fair value option under ASC Topic 825.

In May 2023, upon closing of the Company's IPO, the convertible notes were converted into an aggregate of 565,144 shares of common stock.

Warrants

The Company records its warrants as a liability as allowed in the exceptions for derivative accounting under ASC Topic 815, Derivatives and Hedging. Accordingly, as the Company has elected the fair value option to account for its convertible notes as permitted under ASC Topic 825, the Company also records the warrants issued in association with the convertible notes at fair value, with changes in fair value recorded as a component of other expense, net in the condensed consolidated statement of operations and comprehensive loss. The Company concluded that it was appropriate to apply the fair value option as the warrants are liabilities that are not, in whole or in part, classified as a component of members’ deficit.

In November 2022, the Company issued a warrant to an unrelated third party in consideration for the Company’s hiring of certain employees from the third party (the “acqui-hire transaction”) that is exercisable for a number of shares of common stock that is determined by dividing $225,000 by (x) the price per share of the next equity financing with total proceeds of at least $10.0 million or (y) the initial public offering price per share of a future initial public offering, whichever event occurs first, for an exercise price of $0.0001 per share, in whole or in part. The warrant may also be net exercised upon election. The warrant vests associated with the services of certain employees and as such contains a substantive future requisite service condition. In May 2023, upon closing of the Company's IPO, the warrants were exercised and converted into an aggregate of 28,124 shares of common stock.

In March 2023, we issued warrants to unrelated third-party service providers in consideration for certain marketing communications services, which warrants are exercisable for a total number of shares of our common stock that is determined by dividing $400,000 by (x) the price per share of our next bona fide equity financing with total proceeds of at least $10,000,000 or (y) the initial public offering price per share in our initial public offering, whichever event occurs first, for an exercise price of $0.0001 per share, in whole or in part. The warrants may also be net exercised upon election. The warrant vests associated with the services of certain employees and as such contains a substantive future requisite service condition. In May 2023, upon closing of the Company's IPO, the warrants were exercised and converted into an aggregate of 49,996 shares of common stock.