UPDATE: TrustCo Announces First Dividend of 2025; Continues Annualized Payout of $1.44 per share

February 19 2025 - 4:32PM

The Board of Directors of TrustCo Bank Corp NY (TrustCo, Nasdaq:

TRST) on February 18, 2025, declared a quarterly cash dividend of

$0.36 per share, or $1.44 per share on an annualized basis. The

dividend will be payable on April 1, 2025 to shareholders of

record at the close of business on March 7, 2025.

Chairman, President, and Chief Executive Officer

Robert J. McCormick said: “With 2025 now fully under way, many

people, us included, see cause for optimism. Since 1904, TrustCo

has delivered a strong dividend every quarter. This kind of payout,

and the steady corporate performance that supports it, are TrustCo

hallmarks that fuel more than just optimism, but rather lead to the

genuine satisfaction that investors realize from meeting their

financial goals. We are very proud of the team and the effort that

make our reliable dividend - and the positive financial benefits

that come with it - possible.”

About TrustCo Bank Corp NY

TrustCo Bank Corp NY is a $6.2 billion savings

and loan holding company. Through its subsidiary, Trustco Bank,

Trustco operates 136 offices in New York, New Jersey, Vermont,

Massachusetts and Florida. Trustco has a more than 100-year

tradition of providing high-quality services, including a wide

variety of deposit and loan products. In addition, Trustco Bank’s

Financial Services Department offers a full range of investment

services, retirement planning and trust and estate administration

services. Trustco Bank is rated as one of the best performing

savings banks in the country. The common shares of TrustCo are

traded on the NASDAQ Global Select Market under the symbol

TRST. For more information, visit

www.trustcobank.com.

Forward-Looking Statements All statements in

this news release that are not historical are forward-looking

statements within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by words such as

"anticipate," "intend," "plan," "goal," "seek," "believe,"

"project," "estimate," "expect," "strategy," "future," "likely,"

"may," "should," "will" and similar references to future

developments, results or periods. TrustCo wishes to caution readers

not to place undue reliance on any such forward-looking statements,

which speak only as of the date made, and such forward-looking

statements are subject to factors and uncertainties that could

cause actual results to differ materially for TrustCo from the

views, beliefs and projections expressed in such statements.

Examples of these include, but are not limited to: the effects of

ongoing inflationary pressures and changes in monetary and fiscal

policies and laws, including increases in the Federal funds target

rate by, and interest rate policies of, the Federal Reserve Board;

changes in and uncertainty related to benchmark interest rates used

to price loans and deposits; instability in global economic

conditions and geopolitical matters; U.S. government shutdowns,

credit rating downgrades, or failure to increase the debt ceiling;;

the risks and uncertainties under the heading “Risk Factors” in our

most recent annual report on Form 10-K and, if any, in our

subsequent quarterly reports on Form 10-Q or other securities

filings, including our upcoming annual report on Form 10-K for

fiscal 2024; the other financial, operational and legal risks and

uncertainties detailed from time to time in TrustCo’s cautionary

statements contained in its filings with the Securities and

Exchange Commission; and the effect of all of such items on our

operations, liquidity and capital position, and on the financial

condition of our borrowers and other customers. The forward-looking

statements contained in this news release represent TrustCo

management’s judgment as of the date of this news release. TrustCo

disclaims, however, any intent or obligation to update

forward-looking statements, either as a result of future

developments, new information or otherwise, except as may be

required by law.

| Contact: |

Robert M.

Leonard |

| |

Executive Vice President |

| |

(518) 381-3693 |

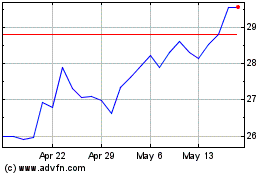

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Jan 2025 to Feb 2025

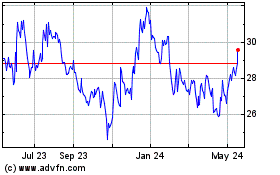

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Feb 2024 to Feb 2025