UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting Material under §240.14a-12 |

Tesla, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ |

Fee paid previously with preliminary materials |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On June 5, 2024, Elon Musk posted the following on X.

On June 6, 2024, Tesla, Inc. (“Tesla”)

updated its website, www.VoteTesla.com. A copy of the updated materials, other than those previously filed, is included below.

How to Vote Video Transcript:

On June 13th, we will hold our Annual Shareholders’

Meeting. Your vote decides the future of Tesla. We made it easy to cast your vote any of three ways: online, by QR code or by phone.

To

vote online, you can either search your inbox for a message from id@proxyvote.com and follow the instructions in the email. Or,

you can locate your sixteen digit control number you received in the postal mail and visit proxyvote.com to cast your vote. Visit votetesla.com

for more information.

To vote by QR code, scan the unique QR code provided on the insert

in the shareholder voting materials you received by mail. Follow the instructions as shown to cast your vote.

To vote by phone, find your unique control number on the insert in

the shareholder voting materials you received by mail. Call the phone number on the insert to cast your vote. Cast your vote in line with

our management recommendations, as shown here.

If you need help voting your shares, or have any questions, please

contact our proxy solicitor, Innisfree M&A Incorporated. Most shareholders must submit their votes no later than 10:59 pm Central

time on June 12th, 2024. Individual brokers may have an earlier deadline to vote.

Your vote is critical to the future growth and success of Tesla, and

the value of your investment.

How to Vote Video Stills:

| 1

1 Tesla Road, Austin TX 78725

P 512 516 8177

VoteTesla.com

June 5, 2024

Dear Fellow Owners of Tesla,

Over the past several weeks, we have seen a lot of speculation and discussion about the important matters we are bringing to you

at next week’s Annual Stockholders’ Meeting. And I know that some of the information that has made its way into the public

discourse about our company has been speculative, lacks context or is just plain wrong. At Tesla, we are accustomed to

the naysayers.

We are entering the final days before the polls close on one of the most important votes in the history of our extraordinary company.

As Board Chair, I want you to hear directly from me on why it is so important that you ratify Elon’s 2018 Performance Award and

vote to move Tesla’s corporate domicile to Texas.

These votes are about fairness, respect and the future of Tesla.

Fairness and respect require that we honor the collective commitment we made to Elon — a commitment that was, and

fundamentally still is, about retaining Elon’s attention and motivating him to focus on achieving astonishing growth for our company.

Elon’s unique contributions have built Tesla from a company that was, in 2018, a loss-making, ambitious company with significant

hurdles and challenges to overcome into what it is today — a company that is literally changing the world by driving so many critical

initiatives that are making our planet more sustainable while at the same time delivering hundreds of billions of dollars of value to all

of you who invested in Tesla’s dream. These contributions should be respected.

When we made our commitment to Elon in 2018 — a commitment that was overwhelmingly approved by approximately 73% of

disinterested stockholders — it had one simple purpose: to keep Elon focused on Tesla and motivated to achieve the Company’s

incomparable ambitions. It’s why we designed the Award to consist of a series of tranches that would vest upon the achievement of

market capitalization and operational milestones. For Elon to realize any benefit of the award, he had to hit milestones that directly

and substantially benefited the Company and our stockholders. And it did exactly what it was designed to do. In 2024, we now have

the benefit of our bargain, with six years’ worth of Elon’s hard work, which has driven exceptional growth in the Company’s size and

profitability and created over $735 billion in value1 for stockholders. Upholding our end of the bargain, then, by ratifying the decision

we all made in 2018, is more important than ever. If Tesla is to retain Elon’s attention and motivate him to continue to devote his

time, energy, ambition and vision to deliver comparable results in the future, we must stand by our deal.

This is obviously not about the money. We all know Elon is one of the wealthiest people on the planet, and he would remain so even

if Tesla were to renege on the commitment we made in 2018. Elon is not a typical executive, and Tesla is not a typical company. So,

the typical way in which companies compensate key executives is not going to drive results for Tesla. Motivating someone like Elon

requires something different. This is one of the key reasons the Award also requires Elon to hold any shares he receives upon

1 Source: FactSet. Based on change in market value from March 21, 2018 to December 31, 2023. |

| VoteTesla.com 2

exercise of stock options for five years after he exercises the options — which can only serve to incentivize him to continue

delivering value to Tesla and our stockholders.

What we recognized in 2018 and continue to recognize today is that one thing Elon most certainly does not have is unlimited time.

Nor does he face any shortage of ideas and other places he can make an incredible difference in the world. We want those ideas,

that energy and that time to be at Tesla, for the benefit of you, our owners. But that requires reciprocal respect.

We all made a commitment to Elon. Elon honored his commitment and produced tremendous value for our stockholders. Honoring

our commitment to Elon demonstrates that we support his vision for Tesla and recognize his extraordinary accomplishments — this

is what will motivate him to continue to create value for stockholders.

Fairness and respect and concern for the future of Tesla also underlie our decision to ask you to approve moving our company’s

legal home to Texas, marrying our legal home to our operational home. Texas provides stockholders with substantially equivalent

governance rights as Delaware, and is expected to provide more certainty for the innovative, big-ticket decisions that Tesla is known

for. Being incorporated in Texas provides the best platform for Tesla to grow and innovate because we believe that Texas legislators

and courts are in the best position to fairly develop and make decisions about corporate law that applies to Tesla, especially when

our next big bet pays off beyond anyone’s wildest expectations.

Thank you for continued support of Tesla.

Sincerely,

Robyn Denholm

Chairperson of the Board of Directors |

| VoteTesla.com 3

Additional Information and Where to Find It

Tesla, Inc. (“Tesla”) has filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement on Schedule 14A

with respect to its solicitation of proxies for Tesla’s 2024 annual meeting (the “Definitive Proxy Statement”). The Definitive Proxy

Statement contains important information about the matters to be voted on at the 2024 annual meeting. STOCKHOLDERS OF TESLA

ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER

RELEVANT DOCUMENTS THAT TESLA HAS FILED OR WILL FILE WITH THE SEC BECAUSE THEY CONTAIN OR WILL

CONTAIN IMPORTANT INFORMATION ABOUT TESLA AND THE MATTERS TO BE VOTED ON AT THE 2024 ANNUAL MEETING.

Stockholders are able to obtain free copies of these documents and other documents filed with the SEC by Tesla through the website

maintained by the SEC at www.sec.gov. In addition, stockholders are able to obtain free copies of these documents from Tesla by

contacting Tesla’s Investor Relations by e-mail at ir@tesla.com, or by going to Tesla’s Investor Relations page on its website at

ir.tesla.com.

Participants in the Solicitation

The directors and executive officers of Tesla may be deemed to be participants in the solicitation of proxies from the stockholders of

Tesla in connection with 2024 annual meeting. Information regarding the interests of participants in the solicitation of proxies in respect

of the 2024 annual meeting is included in the Definitive Proxy Statement.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995

reflecting Tesla’s current expectations that involve risks and uncertainties. These forward-looking statements include, but are not

limited to, statements concerning its goals, commitments, strategies and mission, its plans and expectations regarding the proposed

redomestication of Tesla from Delaware to Texas (the “Texas Redomestication”) and the ratification of Tesla’s 2018 CEO pay package

(the “Ratification”), expectations regarding the future of litigation in Texas, including the expectations and timing related to the Texas

business court, expectations regarding the continued CEO innovation and incentivization under the Ratification, potential benefits,

implications, risks or costs or tax effects, costs savings or other related implications associated with the Texas Redomestication or

the Ratification, expectations about stockholder intentions, views and reactions, the avoidance of uncertainty regarding CEO

compensation through the Ratification, the ability to avoid future judicial or other criticism through the Ratification, its future financial

position, expected cost or charge reductions, its executive compensation program, expectations regarding demand and acceptance

for its technologies, growth opportunities and trends in the markets in which we operate, prospects and plans and objectives of

management. The words “anticipates,” “believes,” “continues,” “could,” “design,” “drive,” “estimates,” “expects,” “future,” “goals,”

“intends,” “likely,” “may,” “plans,” “potential,” “seek,” “sets,” “shall,” “spearheads,” “spurring,” “should,” “will,” “would,” and similar

expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying

words. Tesla may not actually achieve the plans, intentions or expectations disclosed in its forward-looking statements and you should

not place undue reliance on Tesla’s forward-looking statements. Actual results or events could differ materially from the plans,

intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks

and uncertainties that could cause Tesla’s actual results to differ materially from those in the forward-looking statements, including,

without limitation, risks related to the Texas Redomestication and the Ratification and the risks set forth in Part I, Item 1A, “Risk

Factors” of the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and that are otherwise described or updated

from time to time in Tesla’s other filings with the SEC. The discussion of such risks is not an indication that any such risks have

occurred at the time of this filing. Tesla disclaims any obligation to update any forward-looking statement contained in this document. |

On June 6, 2024, Tesla posted the following communications.

On June 6, 2024, Tesla sent the following email to Company

employees.

Subject: Vote your TSLA shares today!

Dear colleagues,

As a shareholder, you have an important voice in the future direction

of Tesla. If you haven’t done so, we strongly encourage you to vote your shares as soon as possible – and no later than June 11th.

To cast your vote online, you’ll need

to search for a specific email in your inbox, which may be in your spam folder (same email address that is associated with your

E*TRADE or other brokerage account).

Search for an email received in 2024 using the following keywords:

id@proxyvote.com Tesla

Open the email and follow the instructions.

For information regarding the vote, please visit www.votetesla.com

[votetesla.com].

All the best,

Investor Relations

On June 6, 2024, Robyn Denholm, Chairperson of Tesla’s

Board of Directors, participated in a conversation with Andrew Ross Sorkin on CNBC, Squawk Box. A copy of the transcript for the video

can be found below.

Robyn Denholm CNBC Interview Transcript

Becky Quick: Alright now, let's get over to Andrew, he

joins us with a special guest. Andrew?

Andrew Ross Sorkin: Thank you, Becky.

The Tesla shareholder meeting is one week from today. Mark your calendar. At stake is the big vote on Elon Musk's pay package and to

move the company's legal home from Delaware to Texas. Joining me right now in an exclusive interview is Tesla Board Chair Robyn

Denholm, and we are thrilled to have you.

Robyn Denholm: Thank you for having me.

Sorkin: And you have been working

mightily hard over the past couple of weeks, talking to shareholders from around the country, big institutions and others, and this

is an opportunity to talk to […] retail shareholders about what is going on at Tesla and about this pay package. We've

been debating this pay package virtually every day now for weeks, if not months. I've been very outspoken. I think a lot of people

know my own views about it, but I want to understand your views about it, and not just your views as the lead of the board, but also

personally […] how you think about what is going on right now.

Denholm: Yeah. So I think […]

for me, getting out and talking to shareholders is really important, and today is a great opportunity to actually speak directly to

retail shareholders, who […] form quite a big part of the ownership structure of the company. And so for me, the […]

ratification of the pay package is really about fairness. Fairness to our CEO, if you look at what's happened at the company over

the last six years, tremendous value creation, and he's led that.

Sorkin: Right.

Denholm: Obviously, the Tesla team

has been instrumental in it, but if you sit back, shareholders have benefited tremendously. Over $730 billion of value creation.

Employees […] have benefited tremendously. They're all shareholders in the company, so their stock has […] risen.

Customers have benefited by the tremendous innovation, and the only person who hasn't been paid is actually the leader of the

company, Elon.

Sorkin: So, you know, my view, I believe a contract is

a contract, but there are others who say, and by the way, the court has suggested, that this is just too much money. What do you say to

that?

Denholm: Well, it's not about the

dollars. It's actually about someone who took a huge […] risk from a pay perspective, no compensation would have been awarded

had he not […] hit the milestones. And so for me, that […] risk reward is […] very important in corporate

America. I think it's very important from a […] reaching for the stars, if you like, or Mars in this case. But […] to

me, it's about really setting things up. And Elon embodies that. And so, big, ambitious goals are things that drive innovation. And

I think the […] options underneath this pay package are very well earned.

Sorkin: Let me ask you this, if the pay package is not approved

by shareholders, what do you think would happen?

Denholm: Yeah, well, obviously that's something the board has

spent quite a bit of time deliberating, and when we were assessing all the different options after the January judgment came out,

this is the best option. Ratifying the plan is the best option. Clearly, if it doesn't pass, then there are other alternatives, but none

of them are as good from a shareholder perspective as actually ratifying the plan. People have asked me, well, why didn't you renegotiate?

Well, actually, from a legal perspective, ratification is really taking the same plan and putting it back in front of shareholders with

all the requisite disclosure that the judge asked for.

Sorkin: There are some lawyers who have suggested, even if it

is approved by shareholders again, that a court could strike it down and not, not accept this new ratification, if you will.

Denholm: Well, that is possible. But […], quite frankly,

if you sit back, that's actually quite detrimental from a shareholder primacy perspective, which, at the end of the day, that's another

reason why we're fighting so hard to get this ratified. You know, shareholder votes have been pretty sacrosanct from a Delaware law perspective,

from a corporate America perspective, from a legal system, and over 73% of the unaffiliated […] shareholders voted for this plan

in 2018

Sorkin: So, one of the things that's very interesting about what's happening

now is to ratify, from a technical perspective, it's ratifying the prior plan, as opposed to creating a new plan…

Denholm: That's exactly right.

Sorkin: And one things I think that’s misunderstood, and

maybe you can help explain this, is it would actually cost a lot more from shareholders if, in fact, this was a new contract, prospectively,

in that you wrote down the cost of some of this back in 2018 to the tune of about $2.7 billion, I think.

Denholm: $2.3.

Sorkin: $2.3.

Denholm: Yes.

Sorkin: But, it would cost today, I think closer $25 billion.

Denholm: That’s exactly right, so...

Sorkin: Explain that.

Denholm: So, the actual return for shareholders,

$2.3 billion stock-based comp charge that was taken for the 2018 plan has already happened. The share count […] in the options

is already in the diluted share count. That's already happened. If […] that plan is overturned and we have to put in a new plan,

for example, if it was exactly the same type of plan as the other, it would cost $25 billion worth of stock-based comp.

Sorkin: What do you make of the argument that Elon Musk already

has a huge stake in this company, that he's already incentivized, that he's already motivated, that he's not going to walk away from this

company if he didn't get this package?

Denholm: I think […] I'd turn

that around. What I would say is, put yourself in […] his shoes. You've worked really hard, incredibly hard, over six years

to lead the company through transformative growth. Nobody thought that these […] goals were possible in 2018. I remember

talking to shareholders, and what they would say to me is, Robyn, what are you going to do? What's the board going to do when he

doesn't hit the goals, and he's demotivated? So […] for me, after all of that effort, to then have somebody overturn that

package, or the deal that was struck, how would you feel?

Sorkin: Here's a personal question, when you put that package

together in 2018, did you think he was going to hit those milestones?

Denholm: I […] have tremendous faith in his abilities.

I thought they were extraordinarily ambitious, and […] from my perspective as well, talking to shareholders, the shareholder base

was saying to us, if they hit these plans, if he hits these goals, he's worth every cent of the [...] options underlying the plan.

Sorkin: To the extent if, again, if this, for some reason, is

not approved, or if a court were to try to prevent this from being approved, what would the next steps be? Is it possible that Elon Musk,

by the way, could ultimately sue Tesla?

Denholm: Well, the good part about the legal system in the US

is anybody can sue anybody. But by the same token, that's not something […] that he has talked to the board about, or anything

like that. It is possible. Is it probable? I don't […] know. But, from a option perspective, in terms of different alternatives,

as I said, putting in a new comp package is an alternative. But none of those alternatives are actually as good as ratifying the plan

for shareholders, because, as we talked about before, there'd be an increase cost, there'd be demotivation at the end of the day, we have

a human at the end of this.

Sorkin: So when you read the ISS recommendation, or the Glass

Lewis recommendation, what do you think? They're recommending against.

Denholm: Yeah, no, I know. I

[…] have read them, and what I would say is the ISS report in actually the substance, they [...] got a lot of it right. What

they got wrong was what ratification is. Because […] their headline was, you know, […] why is the board putting

forward an all or nothing? Well, the reality is, under ratification, it has to be exactly the same plan, and […] we use the

law in Delaware that allows for ratification to actually put it back in front of shareholders, to hopefully reduce any uncertainty,

get this thing passed, and actually then put this chapter behind us. Now, there's no question things will be challenged. We're not

naive as a board, but […] from a legal perspective, from a motivation perspective, from a shareholder perspective, this is

the right path forward.

Sorkin: You know, the Wall Street Journal had an interesting

piece yesterday. They […] were also recommending against, but one of the things they said was that a lot of the shareholder base

may be new. They might not have been the same shareholders who were there in 2018, so they may see this as a […] gift, an opportunity,

effectively. In my mind, I think as you know, there's like a wallet on the ground with money in it, and someone gets to pick it up

all of a sudden. When you talk to shareholders, how much of it is the Ron Baron’s, who came out very vocally on our program just

yesterday, talking about the way he felt in 2018, the way he feels now, is that a different kind of shareholder than somebody who may be

newer?

Denholm: Yeah. I think, firstly,

engagement with shareholders has been great, even the […] challenging ones, the ones who actually push back, […]

that's part of our role, to actually work with shareholders. What I would say is, if […] someone bought into the company

subsequent to the 18 plan being put in place, they knew the plan was there. The disclosure around the plan, the milestones that

needed to be hit, you would have to have been sitting under a rock, not to know that this plan existed. So my view is, anyone buying

into the company, buying shares in the company, knew that this plan existed and what the milestones were for Elon, and actually what

the underlying options were very, very clearly.

Sorkin: One of the questions I hear from shareholders and critics

is that there is the ecosystem that is Elon Musk, and that the Board of Tesla has effectively allowed Elon to pursue too many other paths.

And he talks about AI being one of the great sort of futures of Tesla. And, of course, he’s also created something called xAI, which

is going to be its own business. How do you think about the various component parts of all of the things that he's working on, and how

much, not just time, but mindshare you want him devoting to your shareholders.

Denholm: Yes, I […] think

that is a question I get all the time. So […], from my perspective, the world is better for the ecosystem of Elon. Having

said that, I'm here working for the shareholders of Tesla. I don't work for the shareholders of any of the other companies. And

what we do as a board, is we make sure that those things that are in and around the company from Elon's other companies are actually

fair for Tesla shareholders, that Tesla benefits from anything that happens in and around any of these other companies. The rigor

that we put around related party transactions is very, very steep in terms of how we […] educated the Tesla leaders, in terms

of even notifying that legal and finance team. The compliance aspects of what we do, from an audit committee perspective, is very,

very high.

Sorkin: Do you feel like you can push back on him, personally?

Do you ever say “no Elon, you cannot do that, or I don't want you doing that, or I'm not happy about this?”

Denholm: Absolutely, and the board

does that all the time. I do that all the time. I'm not going to do it in public. I mean, to me […] that is the antithesis of

good governance. What good governance is, is making sure that we're getting the best outcomes for our shareholders, but we're doing

it in a respectful way. I mean Elon’s an amazing asset for the company and the future of the company.

Sorkin: But people have asked about the independence of the

board relative to Elon, and given how big a presence he is and how important he is to the company, just how much leverage, if you will,

he has, versus the board.

Denholm: No. What the reality is

that backward and forward between the board and a […] CEO is part of being a board, but part of understanding how to do that

well with anybody, let alone someone as, you know, important as Elon, is to understand his motivations, to work with him on

different things, to […] challenge, but also to lean into different areas of his…

Sorkin: He’s talked, and I think it's really in the context

of AI, and I think it's important to contextualize this, of wanting to have 25% voting control of the company, at least he threw out that

idea at one point, because of the future of AI, and what he thinks of the dangers of AI. If this package is ratified, I believe he gets

closer to 20%, and he’s sort of made these references on the call to, you know, if there's buybacks and things maybe get closer

to 25. Has he ever come to you and said, I need to have voting control?

Denholm: No. So, what […] that tweet was about, and what

that conversation, which is he's […] tried to clarify, is actually around the governance of AI.

Sorkin: Right.

Denholm: AI is an incredibly important technology for Tesla,

but also for the world. And so […] for me, it's about, and who better in in the world than Elon to actually understand the pitfalls

as well as the opportunities that AI creates. And I think the other thing is, AI is two letters that we use all the time, but it's actually

a whole broad range of different technologies. I call it a horizontal set of technologies. It applies to healthcare. Tesla's not going

to go into healthcare anytime soon. It applies to other parts of the economy.

Sorkin: Real quick, Texas.

Denholm: Yes.

Sorkin: Trying to move out of […] trying to move to Texas.

Oh, you know what actually, can we just do? We're going to take a quick pause for half a second, because we actually just have some breaking

news. ECB is coming out with their numbers, and we'll come back to you in just half a second, Joe I’m just going to send it back

to you

[…]

Sorkin: Thanks, Joe. And we were

talking with Robyn Denholm here, of course, the Chair of Tesla. And you appreciated this […] news, we were both sort of

watching intently.

Denholm: Huge. Yes.

Sorkin: It is huge news. But getting back to where we were,

we were really in the middle of a question about moving to Texas, and there's a question mark I think among investors, about : A, the

decision to why you want to do that, and B, how that affects this […] very case.

Denholm: So firstly, on the case, it doesn't affect the case

at all. We've been very clear, this case, the compensation case, the Tornetta case, actually is being tried in […] Delaware, and

it will continue in Delaware, because it's actually not finalized yet. So, but in terms of the move to Texas, we obviously moved our headquarters,

our business headquarters, to Texas in 2021. The epicenter of Tesla today is Texas from a business perspective. You know, the board has

looked at a move to […] the legal […] to marry the legal and the business headquarters, and we formed a special committee

and went through a gold standard process in terms of governance in order to decide where we should be located in terms of other states

in the US. But for […] Tesla, Texas is the future. We're not running away from Delaware from a legal perspective, but the legal

system and what is happening in Delaware from a legal certainty point of view, with a lot of cases being overturned and […] judgments

actually not keeping the shareholder primacy front and center, is actually concerning to us as a board.

Sorkin: Different question about incentives, longer term for

Elon, which is, he's obviously enormously wealthy. How are you going to incentivize him in the future? I know we're really only 6 years

into what is a 10 year plan, and there's still […] 5 years of vesting, that have to take place. And I'm not sure shareholders always

appreciate that piece either.

Denholm: Yeah. So, when we constructed the 2018 plan with outside

help and […] also understanding the motivations, obviously big audacious goals are what drive Elon in terms of motivation. But

we wanted to put this in for the long term. So, it is a 10-year plan. Even after he exercises the shares, he must hold them for another

5 years, and that hasn't even started yet, so he has not exercised one share under this […] program. So, we have a lot of runway

under this existing plan, which is why we want it ratified.

Sorkin: I wanted to go back just for, to the ecosystem question

for one second, if you’d indulge me. Which is a report by CNBC, actually, earlier this week about NVIDIA chips. And I thought maybe

you could help us with this.

Robyn: Yes.

Sorkin: Because the report suggested, effectively that, and

this goes to sort of the related party transactions piece, that given the […] Elon ecosystem, that Elon was moving chips that were

originally scheduled to go to Tesla, to go to his other business, xAI, and how a Tesla shareholder is supposed to think about that, if,

in fact, it's true.

Denholm: Yeah, so it’s not true. So from a […]

Tesla perspective, you saw on the q1 earnings call that we actually lowered our CapEx guide for […] the fiscal year of 24’.

So, we have built out significant compute with GPU capability, already. We have a second phase. We're actually building a new data center

in […] Texas as we speak. It won't come online until August. We had originally a purchase order for the whole year. We pushed some

of that out into next year. So, what happened to those chips on the NVIDIA side, that they were not Tesla's chips, they were NVIDIA's

chips. We moved out our purchase order to later in the year to line up with the data center build.

Sorkin: Is there a good, we were talking earlier also about

pushing back meaning what that relationship's like. I’m curious if there’s a good example of something where Elon wanted to

do something and you said no. And one of the reasons I raised the question is, shareholders have said to me, they said, look, you know,

there's a great example, the SEC put in place, this idea […] that Elon’s tweets were supposed to be monitored, and then they

appeared to not be monitored. And so, people want to understand what the dynamic really is like.

Denholm: No, there's […] plenty of areas, from a board

perspective, that we have a constructive dialog, a […] great debate, you know. And sometimes, things move the way the board had

originally come out with […] and sometimes they move back towards Elon. It is a […] positive, constructive dialogue.

Sorkin: Sounds like there was a debate over buybacks at one

time.

Denholm: Oh, there was a, yes, there was a very significant

debate over buyback.

Sorkin: And where do you think that stands right now?

Denholm: Well, we didn't have a buyback at that point in time.

We always evaluate it. But from […] the board's perspective, we do the right thing from a shareholder […], for all shareholders,

and so having that debate is part of being an effective board.

Sorkin: Let me ask you another question, which is, Elon is very

public about debating folks on X and the like and has increasingly made comments that are considered political. There's a big debate going

on in this country, obviously, around our politics, but also around EVs. And in some cases, there's a view that EVs, you know, are more

popular in blue states rather than red states, and […] sort of how the politics are emerging. What do you tell him about speaking

publicly about politics?

Denholm: Yeah, so everyone is entitled to their own view. Obviously,

when you hold great sway, and you've got a huge following, you do need to be careful with what you're talking about. But by the same token,

it's the interpretation as opposed to his views. He's entitled to his views. Everybody is. I don't happen to put mine on Twitter, but

I have views myself. But, so […], from our perspective, we monitor, I […]

Sorkin: Do you monitor his tweets?

Denholm: Absolutely. So […]

Sorkin: How does that work?

Denholm: It's very interesting, actually, the range and breadth

of tweeting that happens. But, […] definitely if things that he talks about that are not associated with Tesla, but are associated

with politics or anything else, and we as a board aren't comfortable with the […] point of view, or they've been misinterpreted,

or whatever, we will lean into that conversation. Again, not in public, because, quite frankly, that's not helpful to anybody, but […]

we will have conversations, or I will […] I’ll pick up the phone, you know. The […] rest of the board will as well.

That is part of our role.

Sorkin: Final question. Can Tesla exist without Elon Musk?

Denholm: It can exist, […] but from my perspective, the

[…] right thing for Tesla at this time is for Elon to continue to be at the helm, and this, this ratification of the comp plan

is exactly about that.

Sorkin: Robyn Denholm, thank you for joining us this morning.

Denholm: Thank you.

Sorkin: Really appreciate it, and thank you for your patience

with the news and everything else. So, thank you.

Denholm: Thank you.

Sorkin: We will be following your progress…

Additional Information and Where to Find It

Tesla has filed with the Securities and Exchange

Commission (the “SEC”) a definitive proxy statement on Schedule 14A with respect

to its solicitation of proxies for Tesla’s 2024 annual meeting (the “Definitive Proxy Statement”). The

Definitive Proxy Statement contains important information about the matters to be voted on at the 2024 annual meeting. STOCKHOLDERS OF

TESLA ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT TESLA

HAS FILED OR WILL FILE WITH THE SEC BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT TESLA AND THE MATTERS TO BE VOTED

ON AT THE 2024 ANNUAL MEETING. Stockholders are able to obtain free copies of these documents and other documents filed with the SEC by

Tesla through the website maintained by the SEC at www.sec.gov. In addition, stockholders are able to obtain free copies of these documents

from Tesla by contacting Tesla’s Investor Relations by e-mail at ir@tesla.com, or by going to Tesla’s Investor Relations page on

its website at ir.tesla.com.

Participants in the Solicitation

The directors and executive officers of Tesla

may be deemed to be participants in the solicitation of proxies from the stockholders of Tesla in connection with 2024 annual meeting.

Information regarding the interests of participants in the solicitation of proxies in respect of the 2024 annual meeting is included in

the Definitive Proxy Statement.

Forward-Looking Statements

This communication contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995 reflecting Tesla’s current expectations that involve

risks and uncertainties. These forward-looking statements include, but are not limited to, statements concerning its goals, commitments,

strategies and mission, its plans and expectations regarding the proposed redomestication of Tesla from Delaware to Texas (the “Texas

Redomestication”) and the ratification of Tesla’s 2018 CEO pay package (the “Ratification”), expectations

regarding the future of litigation in Texas, including the expectations and timing related to the Texas business court, expectations regarding

the continued CEO innovation and incentivization under the Ratification, potential benefits, implications, risks or costs or tax effects,

costs savings or other related implications associated with the Texas Redomestication or the Ratification, expectations about stockholder

intentions, views and reactions, the avoidance of uncertainty regarding CEO compensation through the Ratification, the ability to avoid

future judicial or other criticism through the Ratification, its future financial position, expected cost or charge reductions, its executive

compensation program, expectations regarding demand and acceptance for its technologies, growth opportunities and trends in the markets

in which we operate, prospects and plans and objectives of management. The words “anticipates,” “believes,” “continues,”

“could,” “design,” “drive,” “estimates,” “expects,” “future,”

“goals,” “intends,” “likely,” “may,” “plans,” “potential,” “seek,”

“sets,” “shall,” “spearheads,” “spurring,” “should,” “will,” “would,”

and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these

identifying words. Tesla may not actually achieve the plans, intentions or expectations disclosed in its forward-looking statements and

you should not place undue reliance on Tesla’s forward-looking statements. Actual results or events could differ materially from

the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve

risks and uncertainties that could cause Tesla’s actual results to differ materially from those in the forward-looking statements,

including, without limitation, risks related to the Texas Redomestication and the Ratification and the risks set forth in Part I, Item

1A, “Risk Factors” of the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and that are otherwise

described or updated from time to time in Tesla’s other filings with the SEC. The discussion of such risks is not an indication

that any such risks have occurred at the time of this filing. Tesla disclaims any obligation to update any forward-looking statement contained

in this document.

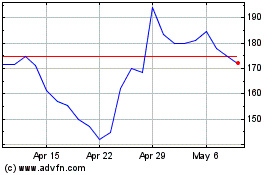

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From May 2024 to Jun 2024

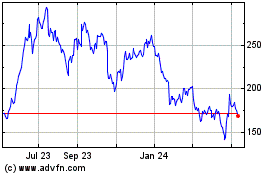

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Jun 2023 to Jun 2024