180 Degree Capital Corp. Notes Average Discount of Net Asset Value per Share to Stock Price for Eleventh Month of Initial Measurement Period of Its Discount Management Program

December 02 2024 - 8:00AM

180 Degree Capital Corp. (“180 Degree Capital”) (NASDAQ: TURN),

noted today that the average discount between its estimated daily

net asset value per share (“NAV”) and its daily closing stock price

during November 2024 and year-to-date through the end of November

2024, were approximately 21% and 20%, respectively.1 This discount

was approximately 26% on November 29, 2024, the last day of trading

of the month.

As previously disclosed in a press release on

November 13, 2023, 180 Degree Capital’s Board of Directors (the

“Board”) has set two measurement periods of 1) January 1, 2024 to

December 31, 2024, and 2) January 1, 2025 to June 30, 2025, in

which it will evaluate the average discount between TURN’s

estimated daily NAV and its closing stock price pursuant to a

Discount Management Program. Should TURN’s common stock trade at an

average daily discount to NAV of more than 12% during either of

these measurement periods, the Board will consider all available

options at the end of each measurement period including, but not

limited to, a significant expansion of 180 Degree Capital’s current

stock buyback program of up to $5 million, cash distributions

reflecting a return of capital to shareholders, a tender offer, or

other strategic options.

“While it has certainly taken longer than we

anticipated or desired, November 2024 provides an example of the

type of performance that we continue to believe is possible in

future periods,” said Kevin M. Rendino, Chief Executive Officer of

180 Degree Capital. “For the month of November, our NAV increased

by approximately 26%. Our investment thesis in Brightcove, Inc.

(BCOV), ultimately proved correct with its announced sale to

Bending Spoons for approximately $233 million, or $4.45 per share.

The cost basis of our position immediately prior to this

announcement was approximately $2.55 per share. As we noted in our

release discussing the transaction, BCOV is a perfect example of

the companies we seek to invest in. We believe we have additional

companies with similar profiles in our portfolio and are actively

working with them through our constructive activism to lead to what

we believe could be significant value-unlocking events.”

“In addition to the BCOV announcement, our

strong performance in November 2024, was aided by our active

portfolio management throughout the month,” added Daniel B. Wolfe,

President of 180 Degree Capital. “We increased certain positions on

weakness following earnings announcements that proceeded to

increase in value from their lows. We also took advantage of the

sudden increase in value of Quantum Corporation (QMCO) to monetize

our position in that company. In November, QMCO advanced from a low

closing price per share of $2.96 to a high closing price per share

of $21.77. We sold the entirety of our approximately 223,000 shares

of QMCO into this rally. We believe the rally was

driven by posts on Reddit and the market’s near-term obsession with

owning quantum computing-related companies. While QMCO is not

technically a quantum computing company, we believe it likely

benefited from having “quantum” in its name. Yes, that is crazy to

us, but such naïve and incorrect associations are becoming all too

common in the public markets.”

Mr. Rendino concluded, “As 180 Degree Capital’s

Board continues to evaluate all potential options regarding our

Discount Management Program, it is important to remember that 180

Degree Capital itself is in a position of strength to drive value

creation for its shareholders. I cannot say it enough, the 12.7%

ownership position of management and the Board of 180 Degree

Capital, built largely through open market purchases, should make

it abundantly clear that there is alignment of interests with

regard to taking steps to increase 180 Degree Capital’s stock price

and create value for all shareholders. Our gross total return on

our public portfolio holdings of approximately +212% since 180

Degree Capital’s inception in 2017 through November 30, 2024, was

approximately 2.7x the approximately +79% total return of the

Russell Microcap Index. We believe this performance kept 180 Degree

Capital’s predecessor company from potential insolvency given that

the decline in our NAV over the same period of approximately 31%

was largely due to declines in the value of the legacy private

portfolio. Our public market performance has been the primary

source of value creation since 2017. While the increase in NAV for

November 2024 of approximately 26% is not an indication of future

returns, it demonstrates what we continue to believe is possible

from a concentrated portfolio of what we believe to be undervalued

companies. BCOV was a core position. We have additional core

positions that we currently believe have similar or larger upside

to their current valuations. We will continue to focus on creating

value for all of 180 Degree Capital’s shareholders, and we look

forward to discussing these efforts in more detail as we are able

to do so.”

About 180 Degree Capital

Corp.

180 Degree Capital Corp. is a publicly traded

registered closed-end fund focused on investing in and providing

value-added assistance through constructive activism to what we

believe are substantially undervalued small, publicly traded

companies that have potential for significant turnarounds. Our goal

is that the result of our constructive activism leads to a reversal

in direction for the share price of these investee companies, i.e.,

a 180-degree turn. Detailed information about 180 and its holdings

can be found on its website at www.180degreecapital.com.

Press Contact:Daniel B. WolfeRobert E. Bigelow180 Degree Capital

Corp.973-746-4500ir@180degreecapital.com

Forward-Looking Statements

This press release may contain statements of a

forward-looking nature relating to future events. These

forward-looking statements are subject to the inherent

uncertainties in predicting future results and conditions. These

statements reflect the Company's current beliefs, and a number of

important factors could cause actual results to differ materially

from those expressed in this press release. Please see the

Company's securities filings filed with the Securities and Exchange

Commission for a more detailed discussion of the risks and

uncertainties associated with the Company's business and other

significant factors that could affect the Company's actual results.

Except as otherwise required by Federal securities laws, the

Company undertakes no obligation to update or revise these

forward-looking statements to reflect new events or uncertainties.

Any discussion of past performance is not an indication of future

results. Investing in financial markets involves a substantial

degree of risk. Investors must be able to withstand a total loss of

their investment. The information herein is believed to be reliable

and has been obtained from sources believed to be reliable, but no

representation or warranty is made, expressed or implied, with

respect to the fairness, correctness, accuracy, reasonableness or

completeness of the information and opinions. The

reference and link to the website www.180degreecapital.com has been

provided as a convenience, and the information contained on such

website is not incorporated by reference into this press release.

180 is not responsible for the contents of third-party

websites.

1. Daily estimated NAVs used for the discount

calculation outside of quarter-end dates are determined as

prescribed in 180’s Valuation Procedures for Level 3 assets.

Non-investment-related assets and liabilities used to determine

estimated daily NAV are those reported as of the end of the prior

quarter.

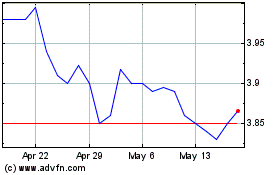

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Dec 2024 to Jan 2025

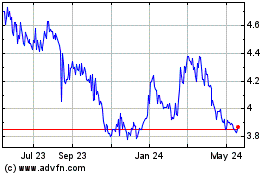

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Jan 2024 to Jan 2025