180 Degree Capital Corp. Reports Net Asset Value Per Share (“NAV”) of $4.40 as of September 30, 2024, and Will Host Conference Call to Discuss Results and Q4 2024 Updates on November 15, 2024

November 14 2024 - 3:05PM

180 Degree Capital Corp. (NASDAQ:TURN) (“180 Degree Capital” and

the “Company”), today reported its financial results as of

September 30, 2024, and noted additional developments from the

fourth quarter of 2024. The Company also published a letter to

shareholders that can be viewed at

https://ir.180degreecapital.com/financial-results.

“While the first three quarters of 2024 have

proven challenging for small and microcapitalization stocks on a

relative basis and our holdings on an absolute basis, we believe

that we are at an inflection point in the cycle where interest is

returning to our investment universe, particularly for companies

that are performing,” said Kevin M. Rendino, Chief Executive

Officer of 180 Degree Capital. “We continue to believe there is

significant opportunity going forward for small capitalization

stocks, particularly given the backdrop of their historically low

valuations in general and relative to large capitalization stocks.

I have seen this play out time and time again during my 35+ years

of experience through these types of investment cycles. While it is

always possible this time is different, recent market trends have

similar characteristics to those that, upon reflection, turn out to

be market bottoms heightened by excess pessimism that can be

followed by periods of strong growth.”

“The absence of information breeds uncertainty

and fear, particularly for the stocks in which we invest,”

continued Daniel B. Wolfe, President of 180 Degree Capital.

“Tax-loss selling and low liquidity result in significant

volatility that is often independent from the reality of the state

of these businesses. This is why we, as fundamental investors, get

to know management teams, understand markets, and position

ourselves to take advantage of market dislocations. We are

particularly encouraged by the reports from a number of our largest

holdings during this earnings cycle that we believe position them

for additional growth and stock price appreciation. We look forward

to discussing these updates on our shareholder call and with

investors throughout the quarter.”

The table below summarizes 180’s performance

over periods of time through the end of Q3 20241:

|

|

Quarter |

YTD |

1 Year |

3 Year |

5 Year |

Inception to Date |

|

|

Q3 2024 |

Q4 2023- Q3 2024 |

Q3 2023- Q3 2024 |

Q3 2021- Q3 2024 |

Q3 2019- Q3 2024 |

Q4 2016- Q3 2024 |

|

TURN Public Portfolio Gross Total Return (Excluding SMA Carried

Interest) |

-0.4% |

-6.3% |

0.2% |

-42.4% |

-10.7% |

165.1% |

|

TURN Public Portfolio Gross Total Return (Including SMA Carried

Interest) |

-0.4% |

-6.3% |

0.2% |

-40.9% |

-4.7% |

182.5% |

|

|

|

|

|

|

|

|

|

Change in NAV |

-2.2% |

-12.4% |

-10.4% |

-57.6% |

-51.9% |

-37.3% |

|

|

|

|

|

|

|

|

|

Change in Stock Price |

-11.0% |

-17.7% |

-20.4% |

-53.5% |

-47.4% |

-18.5% |

|

|

|

|

|

|

|

|

|

Russell Microcap Index |

8.3% |

7.4% |

24.7% |

-10.9% |

49.8% |

59.2% |

|

Russell Microcap Growth Index |

8.6% |

6.9% |

23.6% |

-27.2% |

31.5% |

37.4% |

|

Russell Microcap Value Index |

8.2% |

5.2% |

22.8% |

0.1% |

58.1% |

70.5% |

|

Russell 2000 Index |

9.3% |

11.2% |

26.7% |

5.5% |

56.4% |

82.1% |

Mr. Rendino and Mr. Wolfe will host a conference

call tomorrow, Friday, November 15, 2024, at 9am Eastern Time, to

discuss the results from Q3 2024 and developments to date during Q4

2024. The call can be accessed by phone at (609) 746-1082 passcode

415049 or via the web at

https://www.freeconferencecall.com/wall/180degreecapital.

Additionally, slides that will be referred to during the

presentation can be found on 180 Degree Capital’s investor

relations website at

https://ir.180degreecapital.com/ir-calendar.

About 180 Degree Capital

Corp.

180 Degree Capital Corp. is a publicly traded

registered closed-end fund focused on investing in and providing

value-added assistance through constructive activism to what we

believe are substantially undervalued small, publicly traded

companies that have potential for significant turnarounds. Our goal

is that the result of our constructive activism leads to a reversal

in direction for the share price of these investee companies, i.e.,

a 180-degree turn. Detailed information about 180 Degree Capital

and its holdings can be found on its website at

www.180degreecapital.com.

Press Contact:Daniel B. Wolfe180 Degree Capital

Corp.973-746-4500ir@180degreecapital.com

Mo ShafrothRF

Bindermorrison.shafroth@rfbinder.com

Forward-Looking Statements

This press release may contain statements of a

forward-looking nature relating to future events. These

forward-looking statements are subject to the inherent

uncertainties in predicting future results and conditions. These

statements reflect the Company's current beliefs, and a number of

important factors could cause actual results to differ materially

from those expressed in this press release. Please see the

Company's securities filings filed with the Securities and Exchange

Commission for a more detailed discussion of the risks and

uncertainties associated with the Company's business and other

significant factors that could affect the Company's actual results.

Except as otherwise required by Federal securities laws, the

Company undertakes no obligation to update or revise these

forward-looking statements to reflect new events or uncertainties.

The reference and link to the website www.180degreecapital.com has

been provided as a convenience, and the information contained on

such website is not incorporated by reference into this press

release. 180 Degree Capital is not responsible for the contents of

third-party websites.

1. Past performance is not an indication or

guarantee of future performance. Gross unrealized and realized

total returns of 180 Degree Capital's cash and securities of

publicly traded companies are compounded on a quarterly basis, and

intra-quarter cash flows from investments in or proceeds received

from privately held investments are treated as inflows or outflows

of cash available to invest or withdrawn, respectively, for the

purposes of this calculation. 180 Degree Capital is an internally

managed registered closed-end fund that has a portion of its assets

in legacy privately held companies that are fair valued on a

quarterly basis by the Valuation Committee of its Board of

Directors, and 180 Degree Capital does not have an external manager

that is paid fees based on assets and/or returns. Please see 180

Degree Capital's filings with the SEC, including its 2023 Annual

Report on Form N-CSR for information on its expenses and expense

ratios.

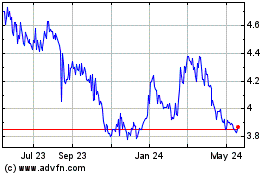

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Dec 2024 to Jan 2025

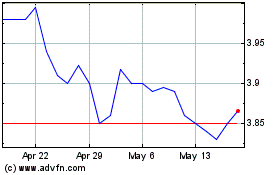

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Jan 2024 to Jan 2025