0001088034

Usio, Inc.

false

--12-31

FY

2024

true

true

true

true

true

0.01

0.01

10,000,000

10,000,000

0

0

0

0

0.001

0.001

200,000,000

200,000,000

29,902,415

28,671,606

26,609,651

26,332,523

3,292,764

2,339,083

3

10

0

0

0

0

21

21

0.58

0.09

0

59.9

5

November 26, 2024

Louis Hoch

Chairman of the Board of Directors, President, Chief Executive Officer and Chief Operating Officer

136,891

True

false

false

false

00010880342024-01-012024-12-31

iso4217:USD

00010880342024-06-30

xbrli:shares

00010880342025-03-21

thunderdome:item

00010880342024-12-31

00010880342023-12-31

iso4217:USDxbrli:shares

00010880342023-01-012023-12-31

0001088034usio:CommonStockOutstandingMember2022-12-31

0001088034us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001088034us-gaap:TreasuryStockCommonMember2022-12-31

0001088034us-gaap:DeferredCompensationShareBasedPaymentsMember2022-12-31

0001088034us-gaap:RetainedEarningsMember2022-12-31

00010880342022-12-31

0001088034usio:CommonStockOutstandingMember2023-01-012023-12-31

0001088034us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-31

0001088034us-gaap:TreasuryStockCommonMember2023-01-012023-12-31

0001088034us-gaap:DeferredCompensationShareBasedPaymentsMember2023-01-012023-12-31

0001088034us-gaap:RetainedEarningsMember2023-01-012023-12-31

0001088034usio:CommonStockOutstandingMember2023-12-31

0001088034us-gaap:AdditionalPaidInCapitalMember2023-12-31

0001088034us-gaap:TreasuryStockCommonMember2023-12-31

0001088034us-gaap:DeferredCompensationShareBasedPaymentsMember2023-12-31

0001088034us-gaap:RetainedEarningsMember2023-12-31

0001088034usio:CommonStockOutstandingMember2024-01-012024-12-31

0001088034us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-31

0001088034us-gaap:TreasuryStockCommonMember2024-01-012024-12-31

0001088034us-gaap:DeferredCompensationShareBasedPaymentsMember2024-01-012024-12-31

0001088034us-gaap:RetainedEarningsMember2024-01-012024-12-31

0001088034usio:CommonStockOutstandingMember2024-12-31

0001088034us-gaap:AdditionalPaidInCapitalMember2024-12-31

0001088034us-gaap:TreasuryStockCommonMember2024-12-31

0001088034us-gaap:DeferredCompensationShareBasedPaymentsMember2024-12-31

0001088034us-gaap:RetainedEarningsMember2024-12-31

0001088034usio:EmployeeAwardsMember2024-01-012024-12-31

0001088034usio:EmployeeAwardsMember2023-01-012023-12-31

0001088034usio:VendorMember2024-01-012024-12-31

0001088034usio:VendorMember2023-01-012023-12-31

0001088034usio:ACHAndComplementaryServiceRevenueMember2024-01-012024-12-31

0001088034usio:ACHAndComplementaryServiceRevenueMember2023-01-012023-12-31

xbrli:pure

0001088034usio:CreditCardRevenueMember2024-01-012024-12-31

0001088034usio:CreditCardRevenueMember2023-01-012023-12-31

0001088034usio:PrepaidCardServicesRevenueMember2024-01-012024-12-31

0001088034usio:PrepaidCardServicesRevenueMember2023-01-012023-12-31

0001088034usio:OutputSolutionsMember2024-01-012024-12-31

0001088034usio:OutputSolutionsMember2023-01-012023-12-31

0001088034usio:AchAndComplementaryServiceInterestRevenueMember2024-01-012024-12-31

0001088034usio:AchAndComplementaryServiceInterestRevenueMember2023-01-012023-12-31

0001088034usio:PrepaidCardServicesInterestRevenueMember2024-01-012024-12-31

0001088034usio:PrepaidCardServicesInterestRevenueMember2023-01-012023-12-31

0001088034usio:OutputSolutionsInterestMember2024-01-012024-12-31

0001088034usio:OutputSolutionsInterestMember2023-01-012023-12-31

utr:Y

0001088034srt:MinimumMember2024-12-31

0001088034srt:MaximumMember2024-12-31

0001088034us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-31

0001088034us-gaap:RevenueFromContractWithCustomerMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-12-31

0001088034srt:MinimumMember2024-01-012024-12-31

0001088034srt:MaximumMember2024-01-012024-12-31

0001088034usio:First3PercentMatchedMember2024-01-012024-12-31

0001088034usio:Over3PercentMatchedMember2024-01-012024-12-31

0001088034usio:MaximumMatchedMember2024-01-012024-12-31

0001088034us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-31

0001088034us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-31

0001088034us-gaap:EquipmentMember2024-12-31

0001088034us-gaap:EquipmentMember2023-12-31

0001088034us-gaap:FurnitureAndFixturesMember2024-12-31

0001088034us-gaap:FurnitureAndFixturesMember2023-12-31

0001088034us-gaap:LeaseholdImprovementsMember2024-12-31

0001088034us-gaap:LeaseholdImprovementsMember2023-12-31

0001088034usio:AcquisitionOfInformationManagementSolutionsLLCMemberus-gaap:CustomerListsMember2020-12-15

utr:M

0001088034usio:AcquisitionOfInformationManagementSolutionsLLCMemberus-gaap:CustomerListsMember2020-12-16

0001088034usio:AcquisitionOfInformationManagementSolutionsLLCMemberus-gaap:CustomerListsMember2024-12-31

0001088034us-gaap:AllowanceForCreditLossMember2023-12-31

0001088034us-gaap:AllowanceForCreditLossMember2024-01-012024-12-31

0001088034us-gaap:AllowanceForCreditLossMember2024-12-31

0001088034us-gaap:LegalReserveMember2023-12-31

0001088034us-gaap:LegalReserveMember2024-01-012024-12-31

0001088034us-gaap:LegalReserveMember2024-12-31

0001088034us-gaap:AllowanceForCreditLossMember2022-12-31

0001088034us-gaap:AllowanceForCreditLossMember2023-01-012023-12-31

0001088034us-gaap:LegalReserveMember2022-12-31

0001088034us-gaap:LegalReserveMember2023-01-012023-12-31

0001088034us-gaap:TradeAccountsReceivableMember2024-12-31

0001088034us-gaap:TradeAccountsReceivableMember2023-12-31

0001088034us-gaap:TradeAccountsReceivableMember2023-01-01

0001088034us-gaap:RelatedPartyMember2024-12-31

0001088034us-gaap:RelatedPartyMember2023-12-31

0001088034us-gaap:RelatedPartyMember2023-01-01

00010880342023-01-01

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsSorterMember2021-03-20

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsSorterMember2021-03-202021-03-20

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsSorterMember2024-01-012024-12-31

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsFolderAndInserterMember2023-10-01

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsFolderAndInserterMember2023-10-012023-10-01

0001088034usio:DebitArrangementToFinancePurchaseOfOutputSolutionsFolderAndInserterMember2024-01-012024-12-31

0001088034us-gaap:RevolvingCreditFacilityMember2024-05-29

0001088034us-gaap:RevolvingCreditFacilityMember2024-05-302024-12-31

0001088034us-gaap:LetterOfCreditMember2024-06-03

0001088034us-gaap:LetterOfCreditMember2024-06-042024-12-31

0001088034usio:OfficeSpaceExecutiveOfficesAndOperationsMembersrt:MaximumMemberusio:SanAntonioTXMember2024-12-31

0001088034usio:OfficeSpaceExecutiveOfficesAndOperationsMemberusio:SanAntonioTXMember2024-01-012024-12-31

0001088034usio:OfficeSpaceExecutiveOfficesAndOperationsMemberusio:SanAntonioTXMember2023-01-012023-12-31

0001088034usio:AmendedOfficeSpaceExecutiveOfficesAndOperationsMemberusio:SanAntonioTXMember2024-12-31

0001088034usio:AmendedOfficeSpaceExecutiveOfficesAndOperationsMembersrt:MinimumMemberusio:SanAntonioTXMember2024-01-012024-12-31

0001088034usio:AmendedOfficeSpaceExecutiveOfficesAndOperationsMembersrt:MaximumMemberusio:SanAntonioTXMember2024-01-012024-12-31

0001088034usio:AmendedOfficeSpaceExecutiveOfficesAndOperationsMemberusio:SanAntonioTXMember2024-01-012024-12-31

0001088034usio:AmendedOfficeSpaceExecutiveOfficesAndOperationsMemberusio:SanAntonioTXMember2023-01-012023-12-31

utr:acre

0001088034usio:AmendmentTwoOfOfficeSpaceExecutiveOfficesAndOperationsMemberusio:SanAntonioTXMember2024-12-31

0001088034usio:AmendmentTwoOfOfficeSpaceExecutiveOfficesAndOperationsMembersrt:MinimumMemberusio:SanAntonioTXMember2024-01-012024-12-31

0001088034usio:AmendmentTwoOfOfficeSpaceExecutiveOfficesAndOperationsMembersrt:MaximumMemberusio:SanAntonioTXMember2024-01-012024-12-31

0001088034usio:AmendmentTwoOfOfficeSpaceExecutiveOfficesAndOperationsMemberusio:SanAntonioTXMember2024-01-012024-12-31

0001088034usio:AmendmentTwoOfOfficeSpaceExecutiveOfficesAndOperationsMemberusio:SanAntonioTXMember2023-01-012023-12-31

0001088034usio:SalesOfficesAndOperationsMemberusio:NashvilleTNMember2024-12-31

0001088034usio:SalesOfficesAndOperationsMemberusio:NashvilleTNMember2024-01-012024-12-31

0001088034usio:SalesOfficesAndOperationsMemberusio:NashvilleTNMember2023-01-012023-12-31

0001088034usio:OutputSolutionsEmployeesAndWarehouseOperationsMemberusio:SanAntonioTXMember2024-09-30

0001088034usio:OutputSolutionsEmployeesAndWarehouseOperationsMemberusio:SanAntonioTXMember2024-12-31

0001088034usio:OutputSolutionsEmployeesAndWarehouseOperationsMembersrt:MinimumMemberusio:SanAntonioTXMember2024-01-012024-12-31

0001088034usio:OutputSolutionsEmployeesAndWarehouseOperationsMembersrt:MaximumMemberusio:SanAntonioTXMember2024-01-012024-12-31

0001088034usio:OutputSolutionsEmployeesAndWarehouseOperationsMemberusio:SanAntonioTXMember2024-01-012024-12-31

0001088034usio:OutputSolutionsEmployeesAndWarehouseOperationsMemberusio:SanAntonioTXMember2023-01-012023-12-31

0001088034usio:LeaseForTechnologyOrganizationMemberusio:AustinTXMember2024-12-31

0001088034usio:LeaseForTechnologyOrganizationMemberusio:AustinTXMember2023-01-31

0001088034usio:LeaseForTechnologyOrganizationMemberusio:AustinTXMember2024-01-012024-12-31

0001088034usio:LeaseForTechnologyOrganizationMemberusio:AustinTXMember2023-01-012023-12-31

0001088034usio:LeaseOfSelectComputerEquipmentMember2024-01-012024-12-31

0001088034usio:LeaseOfSelectComputerEquipmentMember2023-01-012023-12-31

0001088034usio:AngryPugSportswearMember2024-01-012024-12-31

0001088034usio:AngryPugSportswearMember2023-01-012023-12-31

0001088034usio:AngryPugSportswearMemberusio:LouisHochMember2024-01-012024-03-31

0001088034usio:ChairmanPresidentChiefExecutiveOfficerAndChiefOperatingOfficerMember2024-12-292024-12-29

0001088034usio:ChairmanPresidentChiefExecutiveOfficerAndChiefOperatingOfficerMember2024-11-182024-11-18

0001088034us-gaap:RestrictedStockMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:EmployeesAndDirectorsMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:EmployeesAndDirectorsMember2024-06-21

0001088034us-gaap:RestrictedStockMembersrt:ChiefExecutiveOfficerMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockMemberusio:ChiefAccountingOfficerMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockMemberusio:DirectorOneMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockMemberusio:DirectorTwoMember2024-06-212024-06-21

0001088034srt:ChiefOperatingOfficerMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:ChiefAccountingOfficerMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorOneMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorTwoMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:NonEmployeeDirectorsMember2024-06-212024-06-21

00010880342024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorThreeMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorFourMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorFiveMember2024-06-212024-06-21

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorSixMember2024-06-212024-06-21

0001088034srt:ChiefFinancialOfficerMember2024-02-242024-02-24

0001088034usio:ChairmanPresidentChiefExecutiveOfficerAndChiefOperatingOfficerMember2024-02-242024-02-24

0001088034us-gaap:RestrictedStockMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockUnitsRSUMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:EmployeesAndDirectorsMember2023-02-082023-02-08

00010880342023-02-08

0001088034us-gaap:RestrictedStockMembersrt:ChiefExecutiveOfficerMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockMembersrt:ChiefFinancialOfficerMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockMemberusio:DirectorOneMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockMemberusio:DirectorTwoMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockUnitsRSUMembersrt:ChiefExecutiveOfficerMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockUnitsRSUMembersrt:ChiefFinancialOfficerMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorOneMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorTwoMember2023-02-082023-02-08

0001088034us-gaap:RestrictedStockUnitsRSUMember2023-03-162023-03-16

00010880342023-03-16

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorThreeMember2023-03-162023-03-16

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorFourMember2023-03-162023-03-16

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorFiveMember2023-03-162023-03-16

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:DirectorSixMember2023-03-162023-03-16

0001088034srt:ChiefOperatingOfficerMember2023-11-182023-11-18

0001088034usio:ChairmanPresidentChiefExecutiveOfficerAndChiefOperatingOfficerMember2023-11-182023-11-18

00010880342005-01-012005-12-31

00010880342006-01-012006-12-31

00010880342007-01-012007-12-31

00010880342008-01-012008-12-31

00010880342009-01-012009-12-31

00010880342010-01-012010-12-31

00010880342013-01-012013-12-31

00010880342016-01-012016-12-31

00010880342017-01-012017-12-31

00010880342018-01-012018-12-31

00010880342019-01-012019-12-31

00010880342020-01-012020-12-31

00010880342022-01-012022-12-31

0001088034usio:EquityIncentivePlan2025Member2023-12-31

0001088034usio:EquityIncentivePlan2025Member2023-01-012023-12-31

0001088034us-gaap:RestrictedStockMemberusio:EquityIncentivePlan2025Member2024-01-012024-12-31

0001088034us-gaap:RestrictedStockUnitsRSUMemberusio:EquityIncentivePlan2025Member2024-01-012024-12-31

0001088034usio:StockBuybackProgramMember2024-01-012024-12-31

0001088034usio:StockBuybackProgramMember2023-01-012023-12-31

0001088034us-gaap:RestrictedStockMember2024-01-012024-12-31

0001088034us-gaap:RestrictedStockMember2023-01-012023-12-31

0001088034us-gaap:RestrictedStockMember2023-12-31

0001088034us-gaap:RestrictedStockMember2024-12-31

0001088034usio:The2023EmployeeStockPurchasePlanMember2024-01-012024-12-31

0001088034usio:The2023EmployeeStockPurchasePlanMember2024-12-31

0001088034usio:The2023EmployeeStockPurchasePlanMembersrt:MaximumMember2024-12-31

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMember2020-12-152020-12-15

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMember2020-12-15

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMemberus-gaap:MeasurementInputSharePriceMember2020-12-15

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2020-12-15

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMemberus-gaap:MeasurementInputExpectedTermMember2020-12-15

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMemberus-gaap:MeasurementInputExpectedDividendRateMember2020-12-15

0001088034usio:WarrantsIssuedToAcquireInformationManagementSolutionsLLCMemberus-gaap:MeasurementInputPriceVolatilityMember2020-12-15

0001088034usio:ClaimByKdhmLlcAgainstUsioOutputSolutionsIncMember2021-09-282021-09-28

0001088034usio:CounterclaimByUsioOutputSolutionsIncAgainstKdhmLlcMember2021-09-282021-09-28

0001088034us-gaap:LetterOfCreditMemberusio:UsiosMotionForReconsiderationOfOrderGrantingPlaintiffsSupplementalRule166gMember2024-06-03

0001088034us-gaap:SubsequentEventMember2025-03-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024.

☐ TRANSITION REPORT UNDER SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ________

Commission File No. 000-30152

USIO, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 98-0190072 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| 3611 Paesanos Parkway, Suite 300, San Antonio, TX | 78231 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (210) 249-4100

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name on each exchange on which registered |

| Common stock, par value $0.001 per share | USIO | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| | Emerging Growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

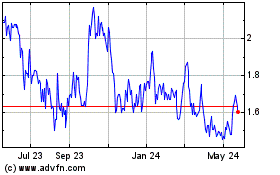

The aggregate market value of the voting stock held by non-affiliates of the registrant on June 30, 2024, was $29,845,563 based on 19,506,904 shares of the registrant’s common stock held by non-affiliates on June 30, 2024 at the closing price of $1.53 per share as reported on the Nasdaq Stock Market. For purposes of this computation, all officers, directors and 10% beneficial owners of the registrant are deemed to be affiliates.

As of March 21, 2025, the number of outstanding shares of the registrant's common stock was 26,514,356.

DOCUMENTS INCORPORATED BY REFERENCE: Items 10, 11, 12, 13 and 14 of Part III will be incorporated by reference information from the registrant’s proxy statement to be filed with the Securities and Exchange Commission in connection with the solicitation of proxies for the registrant’s 2025 Annual Meeting of Stockholders to be held on June 10, 2025

| Usio, Inc. |

| FORM 10-K |

| For the Year Ended December 31, 2024 |

| INDEX |

FACTORS THAT MAY AFFECT FUTURE RESULTS

This Annual Report on Form 10-K and the documents incorporated herein by reference contain certain forward-looking statements as defined under the federal securities laws. Specifically, all statements other than statements of historical facts included in this Annual Report on Form 10-K regarding our financial performance, business strategy and plans and objectives of management for future operations and any other future events are forward-looking statements and based on our beliefs and assumptions. If used in this report, the words "will," "anticipate," "believe," "estimate," "expect," "intend," and words or phrases of similar import are intended to identify forward-looking statements. Such statements reflect our current view with respect to future events and are subject to certain risks, uncertainties, and assumptions, including, but without limitation, those risks and uncertainties contained in the Risk Factors section of this Annual Report on Form 10-K and our other filings made with the SEC. Although we believe that our expectations are reasonable, we can give no assurance that such expectations will prove to be correct. Based upon changing conditions, any one or more of these events described herein as anticipated, believed, estimated, expected or intended may not occur. All prior and subsequent written and oral forward-looking statements attributable to our Company or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement. We do not intend to update any of the forward-looking statements after the date of this Annual Report to conform these statements to actual results or to changes in our expectations, except as required by law.

Factors to consider when evaluating these forward-looking statements include, but are not limited to:

| • |

Loss of key resellers could reduce our revenue growth. |

| • |

If our security applications are breached by cyberattacks or are not adequate to address changing market conditions and customer concerns, we may incur significant losses and be unable to sell our services. |

| • |

Our efforts to expand our product portfolio and market reach, including through acquisitions, may not succeed and may reduce our revenue growth and we may not achieve or maintain profitability. |

| • |

We may need additional financing in the future. We may be unable to obtain additional financing or if we obtain financing it may not be on terms favorable to us. You may lose your entire investment. |

| • |

Unauthorized disclosure of cardholder data, whether through breach of our computer systems or otherwise, could expose us to liability and protracted and costly litigation. |

EXPLANATORY NOTE

This Annual Report includes estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

INTELLECTUAL PROPERTY

We own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect the content of our products and the formulations for such products. Solely for convenience, some of the trademarks, trade names and copyrights referred to in this report are listed without the ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, trade names and copyrights. Please see “Business –Trademarks and Domain Names” for more information.

Other trademarks and trade names in this Annual Report are the property of their respective owners.

SUMMARY OF RISK FACTORS

The following is a summary of the most significant risks and uncertainties that we believe could adversely affect our business, financial condition or results of operations. In addition to the following summary, you should consider the other information set forth in the “Risk Factors” section and the other information contained in this Annual Report.

Risks Related to Our Business

| • |

If our security applications are breached by cyberattacks or are not adequate to address changing market conditions and customer concerns, we may incur significant losses and be unable to sell our services. |

| • |

Unauthorized disclosure of cardholder data, whether through breach of our computer systems or otherwise, could expose us to liability and protracted and costly litigation. |

| • |

If our efforts to protect the security of information about our customers, cardholders and vendors are unsuccessful, we may face additional costly government enforcement actions and private litigation, and our sales and reputation could suffer. |

| • |

If we fail to comply with the applicable requirements of the respective card networks, they could seek to fine us, suspend us or terminate our registrations. |

| • |

Fraud by merchants or others could have an adverse effect on our operating results and financial condition. |

| • |

If we do not adapt to rapid technological change, including as a result of artificial intelligence, our business may fail. |

| • |

Growing use of artificial intelligence has challenges that, if not properly managed could result in harm to our brand, reputation, business or customers, and adversely affect our results of operations. |

| • |

Our efforts to expand our product portfolio and market reach, including through acquisitions, may not succeed and may reduce our revenue growth and we may not achieve or maintain profitability. |

| • |

We may need additional financing in the future. We may be unable to obtain additional financing or if we obtain financing it may not be on terms favorable to us. You may lose your entire investment. |

| • |

Business interruptions or systems failures may impair the availability of our websites, applications, products or services, or otherwise harm our business. |

| • |

We rely on our relationship with the Automated Clearing House network, and if the Federal Reserve rules were to change, our business could be adversely affected. |

| • |

Loss of key resellers could reduce our revenue growth. |

| • |

If we lose key personnel or we are unable to attract, recruit, retain and develop qualified employees, our business, financial condition and results of operations may be adversely affected. |

| • |

If our third-party card processing providers or our bank sponsors fail to comply with the applicable requirements of Visa, Mastercard and Discover credit card associations or if our current processors cancel or fail to renew our contracts, we may have to find a new third-party processing provider, which could increase our costs. |

| • |

We may not be able to obtain and maintain sufficient insurance coverage. |

| • |

We have incurred substantial losses in the past and may incur additional losses in the future. |

| • |

We have recorded significant deferred tax assets, and we might never realize their full value, which would result in a charge against our earnings. |

| • |

Our prepaid card revenues from the sale of services to merchants that accept Mastercard cards are dependent upon our continued Mastercard registration and financial institution sponsorship and, in some cases, continued participation in certain payment networks. |

| • |

If our software fails, and we need to repair or replace it, or we become subject to warranty claims, our costs could increase. |

| • |

We will be liable for separation payments in case of change in control, termination without cause, non-renewal of the agreement, death, or disability under the employment agreement with our Chairman, President, Chief Executive Officer, and Chief Operating Officer, Mr. Hoch, which could have an adverse effect on our cash position and on our financial results. |

| • |

We depend on Louis A. Hoch, our Chairman, President, Chief Executive and Chief Operating Officer, and if he ceased to be active in our management, our business may not be successful. |

| • |

Risks associated with reduced levels of consumer spending could adversely affect our revenues and earnings. |

| • |

We are subject to risks and write-offs resulting from fraudulent activities and losses from overdrawn cardholder accounts that could adversely impact our financial performance and results of operations. |

| • |

Our business strategy includes identifying businesses and assets to acquire, and if we cannot integrate acquisitions into our company successfully, we may have limited growth. |

| • |

If we do not manage our credit risks related to our merchant accounts, we may incur significant losses. |

| • |

Market conditions could negatively impact our business, results of operations, cash flows and financial condition. |

Risks Related to Our Industry

| • |

The electronic commerce market is evolving and if it does not grow, we may not be able to sell sufficient services to make our business viable. |

| • |

If we cannot compete successfully in our industry, we could lose market share and our costs could increase. |

Risks Related to Regulation

| • |

Payments and other financial services-related regulations and oversight are material to our business and any failure by us to comply could materially harm our business. |

| • |

As an agent of, and third-party service provider to, our issuing banks, we are subject to indirect regulation and direct audit and examination by the Office of Thrift Supervision, the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, or FRB, and the Federal Deposit Insurance Corporation. |

| • |

We are subject to U.S. laws, regulations, rules, standards, policies, contractual obligations and other legal obligations, particularly those related to privacy, data protection and information security, and our actual or perceived failure to comply with such obligations could harm our business. |

| • |

We are subject to the CARD Act which could subject us to civil and criminal liabilities. |

| • |

Our business is subject to U.S. federal anti-money laundering, or AML laws and regulations, including the Bank Secrecy Act, or BSA. AML laws among other things, require certain financial services providers to develop and implement risk-based anti-money laundering programs, report large cash transactions and suspicious activity and maintain transaction records. |

| • |

We are subject to regulations relating to prepaid card programs which could further increase our compliance costs. |

| • |

The use of Artificial Intelligence could make us subject to evolving regulatory risks |

Risks Related to Our Common Stock

| • |

Our stock price is volatile, and you may not be able to sell your shares at a price higher than what you paid. |

| • |

If security or industry analysts publish reports that are interpreted negatively by the investment community, publish negative research reports about our business, cease coverage of our company or fail to regularly publish reports or us, our share price could decline. |

| • |

Additional stock issuances could result in significant dilution to our stockholders. |

| • |

We may issue additional equity securities, or engage in other transactions that could dilute our book value or affect the priority of our Common Stock, which may adversely affect the market price of our Common Stock. |

| • |

We may issue shares of preferred stock with greater rights than our Common Stock. |

| • |

We have not paid any cash dividends in the past and have no plans to issue cash dividends in the future, which could cause our Common Stock to have a lower value than that of similar companies which do pay cash dividends. |

| • |

Shares eligible for future sale may depress our stock price. |

| • |

Our directors and officers have substantial control over us. |

| • |

We have adopted certain measures that may make it more difficult for a third party to acquire control of our Company. |

____________________________________

Unless the context indicates otherwise, all references in this Annual Report to “Usio,” the “Company,” “we,” “us,” and “our” refer to Usio, Inc. and its subsidiaries.

PART I

ITEM 1. BUSINESS.

General

As a cloud-based, Fintech payment processor, we serve multiple industry verticals with technology that facilitates payment acceptance and funds disbursement in a single, full-stack ecosystem. We provide payment acceptance through multiple payment methods including: payment facilitation, prepaid card and electronic billing products and services to businesses, merchants and consumers. We seek to grow our business both organically through the continued development and enhancement of our products and services and through acquisitions of new products and services. We will continue to look for opportunities (both internally and externally) to enhance our offerings to meet customer demands as they arise.

Since 1998, Usio has entered a number of market verticals within the payments industry in order to satisfy the growing payment needs of consumers and merchants across the United States. Beginning with our Electronic Bill Presentment and Payment, or EBPP, product that launched the Company, we entered into the electronic funds transfer space through the Automated Clearing House, or ACH, network, developing ancillary and complementary products such as PINless debit in 2016, and Remotely Created Checks, or RCC, account validation, and account inquiry in 2019. These supplementary product options offer customers access to faster and more convenient payment options and tools to improve operating efficiencies. Further, our credit card payment offering was expanded in 2017 with the development of Payment Facilitation, or PayFac, that utilizes our unique technology that allows for instant enrollment of merchants and combined our suite of payment options into an integrated platform for merchants and customers to utilize.

Through our innovative Prepaid Debit Card platform, we offer a variety of prepaid card products such as reloadable, incentive, promotional and corporate card programs. Combined with our printing and mailing services, we can satisfy the diverse requirements of customer needs with physical and virtual document creation and distribution, including traditional paper checks. Our Consumer Choice product, developed and introduced in 2022, provides flexible ways to initiate a variety of payment distributions through a multitude of payment methods including physical prepaid and virtual cards, ACH, paper checks, real-time PINless debit and others. This offering allows us a superior opportunity to increase our cross-selling efforts through all of our payment methods.

With the growing need for faster payment methods, we continue to invest in technology that can help us further expand our suite of payment technology. With the rise of Real Time Payments, or RTP, we began expansion into this market vertical in 2023, which serves as an alternative to ACH payments. As well, we continue to enhance our existing product offerings, with improvements in reporting, data management, fraud and risk monitoring, ease of access, and accelerations in client onboarding and implementation times. With our transition to a cloud-based platform, our speed, security, and scalability in payment processing has been further expanded, allowing us to seamlessly grow as the market demands.

Payment Acceptance. We provide integrated electronic payment processing services to merchants and businesses, including credit, and debit card-based processing services and electronic funds transfer via the ACH network. The ACH network is a nationwide electronic funds transfer system that is regulated by the Federal Reserve and the National Automatic Clearing House Association, or NACHA, the electronic payments association, and provides for the clearing of electronic payments between participating financial institutions. Our ACH processing services enable merchants or businesses to both disburse and collect funds electronically using e-checks instead of traditional paper checks. An e-check is an electronic debit to a bank checking account that is initiated at the point-of-sale, on the Internet, over the telephone, or via a bill payment sent through the mail via a physical check. E-checks are processed using the ACH network. We are one of nine companies that hold the prestigious NACHA certification for Third-Party Senders and were the second company to receive the certification and are the most tenured to hold the certification.

Our payment acceptance services are delivered in a variety of forms and situations. For example, our capabilities allow merchants to convert a paper check to an e-check or receive card authorization at the point-of-sale, allow our merchants’ respective customer service representatives to take e-check or card payments from their consumers by telephone, and enable their consumers to make e-check or card payments directly through the use of a website or by calling an interactive voice response telephone system.

Similarly, our PINless debit product allows merchants to debit and credit accounts in real-time.

Card-Based Services. Our card-based processing services enable merchants to process both traditional card-present, tap-and-pay, or "swipe" transactions, as well as card-not-present transactions. A traditional card-present transaction occurs whenever a card holder physically presents a credit or debit card to a merchant at the point-of-sale. A card-not-present transaction occurs whenever the customer does not physically present a payment card at the point-of-sale and may occur over the Internet, mail, or telephone. A tap-and-pay transaction occurs whenever a consumer taps their phone on a physical terminal utilizing third party wallet services like Apple Pay®, Samsung Pay™ and Google Pay™.

Payment Facilitation. Following the completion of the Singular Payments acquisition in 2017, we launched our payment facilitation, or PayFac, platform called "PayFac-in-a-Box" in late 2018 targeting partnership opportunities with app and software developers in bill-centric verticals, such as legal, healthcare, property management, utilities and insurance. The PayFac-in-a-Box platform 'integration layer' offers a simple integration experience for technology companies who are looking to monetize payments within an existing base of downstream clients. The added value of offering our integration partners access to real-time merchant enrollment, credit card, debit card, ACH and prepaid card issuance capabilities through a single vendor partner relationship in face-to-face, mobile and virtual payment acceptance environments provides a true single channel commerce experience through an application programming interface, or API.

Prepaid and Incentive Card Services. Through our December 2014 acquisition of the assets of Akimbo Financial, Inc., we added a highly talented technical staff of industry subject matter experts and an innovative cardholder service platform including cardholder web and mobile applications and launched what is now our UsioCard business. As a result of this acquisition, through our subsidiary, FiCentive, Inc., we offer customizable prepaid cards which companies use for expense management, incentives, refunds, claims and disbursements, as well as unique forms of compensation such as per diem payments, government disbursements, and similar payments. This comprehensive money disbursement platform allows businesses to pay their contractors, employees, or other recipients by choosing among a prepaid debit Mastercard, real-time deposit to a checking account, traditional ACH, direct deposit or paper check. These cardholder web and mobile applications have been fully integrated into FiCentive’s prepaid card core processor, and now support all program types and brands offered by FiCentive and its clients.

As part of our Prepaid card-based processing services, we develop and manage a variety of Mastercard-branded prepaid card program types, including consumer reloadable, consumer gift, incentive, promotional, general and government disbursement and corporate expense cards. We also offer prepaid cards to consumers for use as a tool to stay on budget, manage allowances and share money with family and friends. Our UsioCard platform supports Apple Pay®, Samsung Pay™ and Google Pay™.

In our over 25+year history, we have created a loyal customer base that relies on us for our convenient, secure, innovative and adaptive services and technology, and we have built long-standing and valuable relationships with premier banking institutions such as Fifth Third Bank, Sunrise Bank, TransPecos and others.

Electronic and Paper Billing. On December 15, 2020, we entered into the business of electronic bill presentment, document composition, document decomposition and printing and mailing services serving hundreds of customers representing a wide range of industry verticals, including utilities and financial institutions, through the acquisition of substantially all of the assets of Information Management Solutions, LLC, or IMS. This product offering provides an outsourced solution for document design, print, and electronic delivery to potential customers and entities looking to reduce postage costs and increase efficiencies. This acquisition increased our ability to grow new revenue streams and allowed us to reenter the electronic bill presentment and payment revenue stream. The success of this business line depends on our ability to realize the anticipated growth opportunities; we cannot provide any assurance that we will be able to realize these opportunities. Since the acquisition of substantially all of the assets of IMS, we have invested in new equipment to enhance the capacity and speed of the business unit, such as a new inserter and folder, on October 1, 2023, that was implemented over the course of 2024. Further, in December 2024, we partnered with an outsourced presorting company, that we believe will help lower costs of postage and labor, while increasing the speed of our mail delivery services.

Industry Background and Trends

In the United States, the use of non-paper-based forms of payment, such as credit and debit cards, has risen steadily over the past several years. According to the triennial 2022 Federal Reserve Payments Study, or FRPS, as updated through July 27, 2023, with supplementary reporting on Cards and Alternative Payments in 2021 and 2022 released in November 2024, the estimated number of non-cash payments continue to increase at accelerated rates. The FRPS reflects the effects of the COVID-19 pandemic which resulted in an increase of non-paper payments by 24% from 2019 through the end of 2020, and subsequent growth and recovery.

The growth of electronic commerce has made the acceptance of card-based and other electronic forms of payment a necessity for businesses, both large and small, in order to remain competitive.

| • |

The value of core noncash payments in the United States grew 9.5% per year since 2018, faster than in any previous FRPS measurement period since 2000. |

| • |

The number of core non-cash payments, comprising debit card, credit card, ACH, and check payments, reached 204.5 billion in 2021, an increase of 30.7 billion from 2018. The value of these payments totaled $128.51 trillion in 2021, an increase of $31.47 trillion from 2018, more than twice the rate of increase in the previous three-year period (2015 to 2018). |

| • |

ACH payments exhibited accelerating growth, increasing 8.3% per year by number and 12.7% per year by value from 2018 to 2021, and accounted for more than 90% of the rise in non-cash payments. |

| • |

In 2021 ACH transfers grew to $91.85 trillion, representing 72% of core non-cash payments value. |

| • |

For calendar year 2022, general-purpose (GP) card payments reached 153.3 billion transactions and $9.76 trillion in value. |

| • |

From 2021 to 2022, GP card payments grew 6.0% by number and 10.5% by value, effectively continuing the growth trajectory from 2018 to 2021, where they grew 6.5% and 10.3% by year, respectively. |

| • |

In 2022, remote payments represented 36.2% of the total number of card payments, down slightly versus the 37.7% of total card payments at the end of 2020. This decline representing the recovery from the COVID-19 pandemic. |

| • |

Chip authenticated payments accounted for 87.5% of in-person GP card payments in 2022, compared to 75.2% in 2020, while 29.1% used chip and PIN, and 19.7% were contactless. |

| • |

From 2015 to 2018, total card payments - the sum of credit card, non-prepaid debit card and prepaid debit card payments - increased 25.9 billion to reach 157 billion payments by number and increased $2.35 trillion to reach $9.43 trillion by value in 2018. |

| • |

In 2022, private-label (PL) card payments, including PL credit cards, PL prepaid cards, and electronic benefits transfer (EBT) cards, totaled 12.8 billion transactions and $0.64 trillion in value, down 2.1% and 18.1% respectively from 2021. |

| • |

Within card payments, prepaid debit card payments had the highest growth rate in 2021 over 2018, by value, at 20.6%, compared with 13.7% per year for non-prepaid debit card payments and 7% for credit card payments. |

| • |

Mobile wallet payments continued to exhibit strong growth, reaching 14.4 billion transactions in 2022, up from 2.9 billion in 2018. |

Figure 1 (below) illustrates the overall growth in key non-cash metrics since the Federal Reserve Payments Study was first reported for the year 2000 and reflects the acceleration of growth in recent years.

Figure 2 (below) illustrates the overall growth in key cash metrics since the Federal Reserve Payments Study was first reported for the year 2000 and reflects the acceleration of growth in recent years.

Note: All estimates are on a triennial basis, except that card payments were estimated for every year since 2015. Credit card payments include general-purpose and private-label versions. Prepaid debit card payments include general-purpose, private-label, and electronic benefits transfer, or EBT, versions. Estimates for prepaid debit card payments are not available for 2000 or 2003. The points mark years for which data were collected and estimates were produced. Lines connecting the points are linear interpolations.

Source: 2022 Federal Reserve Payments Study & 2023 annual Supplement.

We believe that the electronic payment processing industry will continue to benefit from the following trends:

Favorable Demographics

As consumers age, we expect that they will continue to use the payment technology to which they have grown accustomed. More consumers are beginning to use card-based and other electronic payment methods for purchases at an earlier age. These consumers have witnessed the wide adoption of card products, technology innovations such as mobile phone payment applications, widespread adoption of the internet and a significant increase in card not present transactions and on-line shopping during COVID-19, that subsequently remained at levels higher than pre 2020. As younger consumers comprise an increasing percentage of the population and as they enter the work force, we expect purchases using electronic payment methods will become a larger percentage of total consumer spending. We believe the increasing usage of smart phones as an instrument of payment will also create further opportunities for us in the future. We also believe that contact-less payments such as Apple Pay®, Samsung Pay™ and Google Pay™ will increase payment processing opportunities for us.

Increased Electronic Payment Acceptance by Small Businesses

Small businesses are a vital component of the U.S. economy and are expected to contribute to the increased use of electronic payment methods. The lower costs associated with electronic payment methods are making these services more affordable to a larger segment of the small business market. In addition, we believe these businesses are experiencing increased pressure to accept electronic payment methods in order to remain competitive and to meet consumer expectations. As a result, many of these small businesses are seeking to provide customers with the ability to pay for merchandise and services using electronic payment methods, including those in industries that have historically accepted cash and checks as the only forms of payment for their merchandise and services.

Growth in Online Transactions

Market researchers expect continued growth in card-not-present transactions due to the steady growth of the internet and electronic commerce. According to the U.S. Census Bureau, estimated retail e-commerce sales for 2024 were estimated at $1,192.6 billion, an increase of approximately 8.1% from 2023, and e-commerce sales in 2024 accounted for 16.1% of total sales, compared to 15.3% in 2023.

Products and Services

Our suite of payment solutions is driven by a sophisticated infrastructure that merges our own technology with strategic alliances, offering secure, scalable, and resilient payment processing services. Leveraging the latest in cloud computing and cybersecurity, including Microsoft Azure's robust security features, we ensure the protection of data transmissions and transactions. Our adoption of Azure's hub-spoke architecture and other cutting-edge technologies supports enhanced performance and security, facilitating seamless integrations with third-party processors and offering tailored payment services to meet the specific requirements of our clients.

The platform supports secure data exchanges using state-of-the-art encryption standards and secure communication protocols, using the latest technology in best-practices encryption to safeguard electronic transactions across the internet. With comprehensive data warehousing, we offer efficient storage, retrieval, and data analysis, ensuring all sensitive information is encrypted and securely managed.

Payment Acceptance. Our service offerings encompass a broad spectrum of ACH transaction processing, including innovative solutions such as Represented Check and Check Conversion for electronic payment facilitation. Clients have the flexibility to initiate transactions via our online portal or leverage our expertise for transaction processing on their behalf via a robust API set.

We extend merchant services across major card networks (VISA, Mastercard, American Express, Discover), supported by online and physical terminal access. Our proprietary platform merges ACH and card processing capabilities, enabling businesses to handle both e-checks and card payments efficiently. Simultaneously, we offer a variety of supplementary service products for the payment acceptance space, such as PINless debit, and RTP which offer faster means of fund disbursement to address the growing desire of near instant fund transfers.

The expansion of our platform and the transition to cloud-based infrastructure underscore our commitment to speed, security, and scalability in payment processing. Our direct Fed ACH system integration, facilitated by our NACHA certification, exemplifies our efforts to optimize processing efficiency, reduce costs, and enhance merchant services.

Prepaid and Incentive Card Services. Our Prepaid and Incentive Card Issuance Services are anchored by our sophisticated processing platform, which supports an array of card program types in partnership with prominent banks and offers highly customizable digital solutions. A key feature of our innovative service offerings is the integration of an external authorization engine that provides real-time transaction authorization through a unique dual-funding mechanism, enhancing transactional flexibility and user experience by allowing for the application of real-time value loads by the program managers. This engine, coupled with our comprehensive support for popular mobile wallets via Mastercard’s Digital Enablement Services, underscores our commitment to leveraging cutting-edge technology to deliver seamless and enriched payment experiences. Our platform's rapid custom solution deployment capability further cements our position as a leader in the market, demonstrating our dedication to innovation and operational agility in meeting the advanced payment solution needs of our clients.

Electronic Billing. Following the acquisition of substantially all of the assets of IMS, we've enhanced and expanded our services to include electronic bill presentment and comprehensive document management solutions, catering to a wide array of industries. Our state-of-the-art digital printing capabilities, combined with our status as a seamless mailer with USPS, enable us to meet high-volume demands efficiently, ensuring we remain at the forefront of printing and mailing services. Output Solutions provides printing and mailing services to utilities, healthcare providers, credit unions, banks, governmental agencies, and manufacturing and other customers that have high volume billing and printing needs. Since the acquisition of substantially all of the assets of IMS, we have invested in new equipment to enhance the capacity and speed of the business unit, such as a new inserter and folder, on October 1, 2023, that was implemented over the course of 2024. Further, in December 2024, we partnered with an outsourced presorting company, that we believe will help lower costs of postage and labor, while increasing the speed of our mail delivery services.

Relationships with Sponsors and Processors

We have agreements with several processors that provide us, on a non-exclusive basis, with transaction processing and transmittal, transaction authorization and data capture, and access to various reporting tools. In order to provide payment processing services for ACH transactions, we must maintain a relationship with an Originating Depository Financial Institution, or ODFI, in the ACH network because we are not a bank and therefore, we are not eligible to be an ODFI. For the ODFI portion of our ACH business, we have entered into agreements with the North American Banking Company, or NABC, Metropolitan Commercial Bank and TransPecos Banks. We are financially liable for all fees, fines, chargebacks, and losses related to our ACH processing merchant customers. We may also require cash deposits and other types of collateral from certain merchants to mitigate any such risk. Similarly, in order to provide payment-processing services for Visa, Mastercard and Discover transactions, we must be sponsored by a financial institution that is a principal member of the respective Visa, Mastercard and Discover card associations. Central Bank of St. Louis and Fifth Third Bank have, respectively, sponsored us under the designations Third Party Processor, or TPP, and Independent Sales Organization, or ISO, with the Visa card association, and under the designations Third Party Servicer, or TPS, and Merchant Service Provider, or MSP, with the Mastercard card association. We also have an agreement with TriSource Solutions, LLC and an agreement with Global Payments, Inc. through which their member banks, Central Bank of St. Louis and Fifth Third Bank, sponsor us for membership in the Visa, Mastercard, American Express, and Discover card associations and settle card transactions for our merchants. These agreements may be terminated by the processor if we materially breach the agreements and we do not cure the breach within 30 days, or if we enter bankruptcy or file for bankruptcy. We also maintain a bank sponsorship agreement with Sunrise Banks, N.A. for our prepaid card programs. We are liable for any card-associated losses for cards that we issue that might incur a negative balance and we are liable for card association fines, fees and chargebacks.

Under our processing agreements with TriSource Solutions and Global Payments, Inc., we are financially liable for all fees, fines, chargebacks and losses related to our card processing merchant customers. If, due to insolvency or bankruptcy of our merchant customers, or for another reason, we are unable to collect from our merchant customers amounts that have been refunded to the cardholders because the cardholders properly initiated a charge-back transaction to reverse the credit card charges, we must bear the credit risk for the full amount of the card holder transaction. We utilize a number of systems and procedures to evaluate and manage merchant risk, such as obtaining approval of prospective merchants from our processor and sponsor bank, setting transaction limits and monitoring account activity. We may also require cash deposits and other types of collateral from certain merchants to mitigate any such risk. We maintain a reserve for losses resulting from card processing and related chargebacks. We estimate our potential loss for chargebacks by performing a historical analysis of our charge-back loss experience with similar merchants and considering other factors that could affect that experience in the future, such as the types of card transactions processed and nature of the merchant relationship with their consumers.

We are currently sponsored by Evolve Bank & Trust and TransPecos Bank in order to access certain regional debit networks. Through these sponsorships, we created a new service in late 2016 to provide both the issuance of real time credits and debits to a debit card holder via a regional network without using a PIN. Regional networks are not affiliated with major credit card associations and operate independently. Through our sponsorships with Evolve Bank & Trust, and TransPecos Bank, we are financially liable for all fees, fines, chargebacks and losses related to our PINless debit card processing for our merchant customers. We may also require cash deposits and other types of collateral from certain merchants to mitigate any such risk. The banking sponsor and each of the regional debit networks have the ability to terminate our access or anyone of our merchant’s access to process payments without notice. If either case occurs, our revenue could be negatively affected. In January 2018, our previous sponsor, Pueblo Bank and Trust, terminated their relationship with our gateway provider and as a result we stopped processing PINless debit transactions for a short period of time. We secured a relationship with Evolve Bank & Trust and resumed processing PINless debit transactions and subsequently secured a sponsoring relationship with TransPecos bank in 2023.

We maintain an allowance for estimated losses resulting from the inability or failure of our merchant customers to make required payments for fees charged by us. Amounts due from customers may be deemed uncollectible because of merchant disputes, fraud, insolvency or bankruptcy. We determine the allowance based on an account-by-account review, taking into consideration such factors as the age of the outstanding receivable, historical pattern of collections and financial condition of the customer. We closely monitor extensions of credit and if the financial condition of our customers were to deteriorate, resulting in an impairment of their ability to make contractual payments, additional allowances may be required.

Sales and Marketing

We sell and market our ACH products and services primarily through non-exclusive resellers that act as an external sales force, with minimal direct investment in sales infrastructure and management, as well as direct contact by our sales personnel. Our direct sales efforts are coordinated by two sales executives and supported by other employees who function in sales capacities. Our primary market focus is on companies generating high volumes of electronic payment transactions. We tailor our sales efforts to reach this market by pre-qualifying prospective sales leads through direct contact or market research. Our sales personnel typically initiate contact with prospective customers that we identify as meeting our targeted customer profile.

We also market and sell our prepaid card program directly to government entities, corporations and to consumers through the Internet. We have recently undertaken a major initiative to package and cross-sell of our platform of payment options across our portfolio of merchants. As a part of this major initiative, we will continue to analyze our sales and marketing efforts to optimize productivity, increase sales force effectiveness, broaden our reach through reseller initiatives and advantageous alliances and effectively optimize sales and marketing expenses while meeting our revenue and profit objectives.

We also offer additional services relating to electronic bill presentment, document composition, document decomposition and printing and mailing services serving hundreds of customers representing a wide range of industry verticals, including utilities and financial institutions. This service, which we began with the acquisition of substantially all of the assets of IMS in December 2020, allows us to cross-sell existing service offerings to our customers.

Since December 2024, we have pursued the “One Usio” strategy in order to increase the integration of all of our various product offerings so that we approach the market as a unified force with a portfolio of capabilities that can meet our customer’s various electronic payment and associated needs. This strategy is designed to sell multiple, complementary Usio products to an increasing number of clients who benefit from the synergies and efficiencies that arise from consolidating their relationship.

Elements of this strategy include:

| • |

unified onboarding process that allows every client boarded to have access to all of our various payment methods; |

| • |

consolidated sales and customer support teams that can better cross-sell and integrate clients across all of our services; |

| • |

improved reporting and customer management with the development of a new customer management platform that encompasses all of our business lines; |

| • |

enhanced security and fraud protection through the development of new fraud detection tools, and a unified risk and compliance team; |

Customers

Our customers are consumers, merchants, and businesses that use our Automated Clearing House and/or card-based processing services in order to provide their consumers with the ability to pay for goods and services without having to use cash or a paper check. These merchant customers operate in a variety of predominately retail industries and are under contract with us to exclusively use the services that we provide to them. Recent areas of customer focus have included system integrators, law firms, churches, charitable organizations, medical and dental clinics, doctor's offices, property management and homeowner associations, hospitality firms and municipalities. Most of our merchant customers have signed long-term contracts, generally with three-year terms, that provide for volume-based transaction fees. Our merchant accounts increased 20% to 7,549 customers at December 31, 2024 from 6,281 customers at December 31, 2023. Our customers are geographically dispersed throughout the United States.

No customer accounted for more than 10% of revenues in 2024 or 2023.

Competition

The payment processing industry is highly competitive. Many small and large companies compete with us in providing payment processing services and related services to a wide range of merchants. There are a number of large transaction processors, including Fiserv, Inc., Elavon Inc., WorldPay, Stripe and Block, Inc. (formerly known as Square), that serve a broad market spectrum from large to small merchants and provide banking, automatic teller machine, and other payment-related services and systems in addition to card-based payment processing. There are also a large number of smaller transaction processors that provide various services to small and medium- sized merchants. Many of our competitors have substantially greater capital resources than us and operate as subsidiaries of financial or bank holding companies, which may allow them on a consolidated basis to own and conduct depository and other banking activities that we do not have the regulatory authority to own or conduct. We believe that the principal competitive factors in our market include:

| • |

reliability of service; |

| • |

ability to evaluate, undertake and manage risk; |

| • |

ability to offer customized technology solutions; |

| • |

speed in implementing payment processes; |

| • |

price and other financial terms; and |

| • |

multi-channel payment capability. |

We believe that our specific focus on providing integrated payment processing solutions to merchants, in addition to our keen understanding of the needs and risks associated with providing payment processing services electronically, gives us a competitive advantage over other competitors, which have a narrower market perspective, and over competitors of a similar or smaller size that may lack our experience and expertise in the electronic payments industry. We believe this allows us to satisfy the market demands for risk management, and service reliability. Furthermore, we believe we present a competitive distinction through our internal technology to provide a single integrated payment warehouse that consolidates, processes, tracks and reports all payments regardless of payment source or channel. This integrated payments approach helps offer superior quality in service, alongside industry leading implementation times, and platform reliability. We also believe our customized technology solutions and high level of service provide a competitive advantage, particularly for smaller businesses that do not have large internal technology capabilities or the ability to comply with payment security regulations, saving our customers time and money, while offering a broad range of diverse payment options.

Due to our proprietary systems and our ability to create and establish corporate-branded card programs in shorter time frames than our competitors, our prepaid card offerings are competitive with those of much larger companies. We also believe that our ten plus years of prepaid industry experience in processing and managing prepaid card programs is a competitive advantage over many of our competitors. We believe our connectivity and the ability to process via the contact-less networks of Apple Pay®, Samsung Pay™ and Google Pay™ are also competitive advantages. We also believe that the Akimbo mobile application technology and advanced card holder websites provide a competitive advantage in securing both consumers and business clients that have a need for a card program for their customer base. Finally, we believe we hold a significant competitive advantage over potential entrants into the prepaid industry as a result of the significant barrier in obtaining bank sponsorships for prepaid card program management and an even higher barrier for performing prepaid card processing.

Trademarks and Domain Names

We own federally registered trademarks on the marks “Usio,” “Payment Data Systems, Inc.,” “Akimbo,” “FiCentive Innovations in Prepaid Card Solutions,” “Don’t change your bank, just your card” and “ZBILL” and their respective designs.

Some of our material websites are www.usio.com, www.payfacinabox.com, www.ficentive.com, www.akimbocard.com, and www.usiooutput.com. The inclusion of these website addresses in this Annual Report do not include or incorporate by reference the information on or accessible through these websites, and the information contained on or accessible through these websites should not be considered as part of this Annual Report on Form 10-K.

We rely on a combination of copyright, trademark and trade secret laws, employee and third-party nondisclosure agreements, and other intellectual property protection methods to protect our services and related products.

Government Regulation

Our industry is highly regulated. Any new, or changes made to, U.S. federal, state and local laws, regulations, card network rules or other industry standards affecting our business may require significant development efforts or have an unfavorable impact to our financial results. Failure to comply with these laws and regulations may result in the suspension or revocation of licenses or registrations, the limitation, suspension or termination of services and/or the imposition of civil and criminal penalties, including fines. Certain of our services are also subject to rules set by various payment networks, such as Visa and Mastercard.

The Dodd-Frank Act

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the "Dodd-Frank Act") effected and required significant changes to United States financial regulations, include regulations addressing fees charged or received by issuers for processing debit transactions and the transaction routing options available to merchants. The Dodd-Frank Act also established the Consumer Financial Protection Bureau (“CFPB”) to regulate consumer financial services, including many services offered by our customers. The CFPB is responsible for enforcing and writing rules regarding consumer access to disclosures, fees and statements, error resolution, limited liability and overdrafts when using prepaid cards.

CARD Act

As an agent of, and third-party service provider to, our issuing banks, we are subject to indirect regulation and direct audit and examination by the Office of Thrift Supervision, the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, or FRB, and the Federal Deposit Insurance Corporation.

The Credit Card Accountability, Responsibility, and Disclosure Act of 2009 (“CARD Act”) imposes requirements relating to disclosures, fees and expiration dates that are generally applicable to gift certificates, store gift cards and general-use prepaid cards. We believe that our general purpose re-loadable prepaid cards, and the maintenance fees charged on our general purpose re-loadable cards, are exempt from the requirements under this rule, as they fall within an express exclusion for cards which are re-loadable and not marketed or labeled as a gift card or gift certificate. However, this exclusion is not available if the issuer, the retailer selling the card to a consumer or the program manager, promotes, even if occasionally, the use of the card as a gift card or gift certificate. As a result, we provide retailers with instructions and policies regarding the display and promotion of our general purpose re-loadable cards. However, it is possible that despite our instructions and policies to the contrary, a retailer engaged in offering our general purpose re-loadable cards to consumers could take an action with respect to one or more of the cards that would cause each similar card to be viewed as being marketed or labeled as a gift card, such as by placing our general purpose re-loadable cards on a display which prominently features the availability of gift cards and does not separate or otherwise distinguish our general purpose re-loadable cards from the gift cards. In such event, it is possible that such general purpose re-loadable cards would lose their eligibility for such exemption to the CARD Act and its requirements, and therefore we could be deemed to be in violation of the CARD Act and the rule, which could result in the imposition of fines, the suspension of our ability to offer our general purpose re-loadable cards, civil liability, criminal liability, and the inability of our issuing banks to apply certain fees to our general purpose re-loadable cards, each of which would likely have a material adverse impact on our revenues.

Any gift cards we issue will be governed by the CARD Act and other various regulations. Any violations with our gift card issuance could result in the imposition of fines, the suspension of our ability to offer our gift cards, civil liability, criminal liability, and the inability of our issuing banks to apply certain fees to our gift cards, each of which would likely have a material adverse impact on our revenues.

Data Privacy Laws

Our billers, financial institutions, partners and their consumers, store personal and business information, financial information and other sensitive information on our platform. In addition, we receive, store, handle, transmit, use and otherwise process personal and business information and other data from and about actual and prospective billers, financial institutions and partners, as well as our employees and service providers. As a result, we and our handling of data are subject to a variety of laws, rules and regulations relating to privacy, data protection and information security, including regulation by various governmental authorities, such as the U.S. Federal Trade Commission, or FTC, and various state, local and foreign agencies. Our data handling and processing activities are also subject to contractual obligations and industry standard requirements. The legislative and regulatory landscapes for privacy, data protection and information security continue to evolve in jurisdictions worldwide, with an increasing focus on privacy and data protection issues with the potential to affect our business.

In the United States, various laws and regulations apply to the security, collection, processing, storage, use, disclosure and other processing of certain types of data, In addition, many states in which we operate have enacted laws that protect the privacy and security of sensitive and personal data, such as the California Consumer Privacy Act, or CCPA, as amended by the California Privacy Rights Act, or CPRA, in California. Certain other state laws impose similar privacy obligations, such as in New York, Nevada, Virginia, Colorado, Connecticut and Utah to name a few. In addition, all 50 states have data breach laws including obligations to provide notification of security breaches of computer databases that contain personal information to affected individuals, state officers and others.