Visteon Corporation (Nasdaq: VC) today announced full-year 2019

results. Sales were $2,945 million, compared with $2,984 million in

2018. The decrease of $39 million is primarily due to lower vehicle

production volumes and the negative impact of currency, customer

pricing and product mix, partially offset by new product launches

and product updates. Net income attributable to Visteon was $70

million or $2.48 per diluted share and net cash provided from

operating activities was $183 million.

New business wins in 2019 were $6.1 billion,

driven by digital clusters, multi-display modules, Android-based

infotainment systems, cockpit domain controllers and battery

management systems.

"Despite lower vehicle production volumes,

Visteon finished the year strong with 7% growth-over-market in the

fourth quarter, driven by our next-generation digital cockpit

solutions," said President and CEO Sachin Lawande. "In 2020, we are

anticipating another challenging year for the automotive industry,

as we expect global vehicle production volumes to further decline

by approximately 3%. However, we expect Visteon sales to continue

to grow above market and increase year-over-year as we lead the

digital cockpit transformation."

Fourth Quarter in Review

Sales were $744 million and $731 million during

the fourth quarters of 2019 and 2018, respectively. The

year-over-year increase is primarily attributable to new product

launches and product updates, partially offset by lower vehicle

production volumes, vehicle launch delays at Ford, the impact of

the strike at GM, customer pricing and the impact of unfavorable

currency. On a regional basis, in the fourth quarter of 2019,

Europe accounted for 32% of sales, China Domestic 20%, China Export

7%, the Americas 25% and Other Asia-Pacific 16%.

Gross margins for the fourth quarters of 2019

and 2018 were $104 million and $96 million, respectively. Adjusted

EBITDA, a non-GAAP measure as defined below, was $85 million for

the fourth quarter of 2019, compared with $74 million in prior

year. Adjusted EBITDA margin was 11.4% for the fourth quarter of

2019, 130 basis points higher than the same period in the prior

year.

For the fourth quarter of 2019, net income

attributable to Visteon was $35 million or $1.24 per diluted share,

compared with $43 million or $1.49 per diluted share for the same

period in 2018. Adjusted net income, a non-GAAP measure as defined

below, was $40 million or $1.42 per diluted share for the fourth

quarter of 2019, compared with $44 million or $1.52 per diluted

share for the same period in 2018.

The company had 28.2 million diluted shares of

common stock outstanding as of Dec. 31, 2019.

Cash and Debt Balances

As of Dec. 31, 2019, Visteon remained in a net

positive cash position with cash of $469 million and debt of $385

million.

For the fourth quarter of 2019, cash from

operations was $65 million and capital expenditures were $33

million. Full-year cash from operations was $183 million and

capital expenditures were $142 million. Total Visteon adjusted free

cash flow, a non-GAAP financial measure as defined below, for the

fourth quarter and the full year was $35 million and $56 million,

respectively.

Full-Year 2020 Outlook

Visteon full-year 2020 guidance projects sales

in the range of $3.0 billion to $3.1 billion, adjusted EBITDA in

the range of $250 million to $270 million, and adjusted free cash

flow in the range of $40 million to $60 million. The full-year

guidance does not include any impact from the coronavirus.

About Visteon

Visteon is a global technology company that

designs, engineers and manufactures innovative cockpit electronics

and connected car solutions for the world’s major vehicle

manufacturers. Visteon is driving the smart, learning, digital

cockpit of the future, to improve safety and the user experience.

Visteon is a global leader in cockpit electronic products including

digital instrument clusters, information displays, infotainment,

head-up displays, telematics, SmartCore™ cockpit domain

controllers, and the DriveCore™ autonomous driving platform.

Visteon also delivers artificial intelligence-based technologies,

connected car, cybersecurity, interior sensing, embedded multimedia

and smartphone connectivity software solutions. Headquartered in

Van Buren Township, Michigan, Visteon has approximately 11,000

employees at more than 40 facilities in 18 countries. Visteon had

sales of approximately $3 billion in 2019. Learn more

at www.visteon.com.

Conference Call and Presentation

Today, Thursday, Feb. 20, at 9 a.m. ET, the

company will host a conference call for the investment community to

discuss the fourth-quarter and full-year 2019 financial results and

other related items. The conference call is available to the

general public via a live audio webcast.

The dial-in numbers to participate in the call are:

U.S./Canada: 866-411-5196Outside U.S./Canada: 970-297-2404

(Call approximately 10 minutes before the start of the

conference.)

The conference call and live audio webcast,

related presentation materials and other supplemental information

will be accessible in the Investors section of Visteon’s website. A

news release on Visteon’s first-quarter results will be available

in the news section of the website.

A replay of the conference call will be

available through the company’s website or by

dialing 855-859-2056 (toll-free from the U.S. and Canada) or

404-537-3406 (international). The conference ID for the phone

replay is 5473059. The phone replay will be available for one week

following the conference call.

1 Growth-over-market for fourth-quarter 2019 excludes the impact

of currency and acquisitions/divestitures.

Forward-looking Information

This press release contains "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are not guarantees

of future results and conditions but rather are subject to various

factors, risks and uncertainties that could cause our actual

results to differ materially from those expressed in these

forward-looking statements, including, but not limited to: (1)

conditions within the automotive industry, including (i) the

automotive vehicle production volumes and schedules of our

customers, (ii) the financial condition of our customers and the

effects of any restructuring or reorganization plans that may be

undertaken by our customers or suppliers, including work stoppages,

and (iii) possible disruptions in the supply of commodities to us

or our customers due to financial distress, work stoppages, natural

disasters or civil unrest; (2) our ability to satisfy future

capital and liquidity requirements; including our ability to access

the credit and capital markets at the times and in the amounts

needed and on terms acceptable to us; our ability to comply with

financial and other covenants in our credit agreements; and the

continuation of acceptable supplier payment terms; (3) our ability

to satisfy pension and other post-employment benefit obligations;

(4) our ability to access funds generated by foreign subsidiaries

and joint ventures on a timely and cost-effective basis; (5) our

ability to execute on our transformational plans and cost-reduction

initiatives in the amounts and on the timing contemplated; (6)

general economic conditions, including changes in interest rates,

currency exchange rates and fuel prices; (7) the timing and

expenses related to internal restructuring, employee reductions,

acquisitions or dispositions and the effect of pension and other

post-employment benefit obligations; (8) increases in raw material

and energy costs and our ability to offset or recover these costs,

increases in our warranty, product liability and recall costs or

the outcome of legal or regulatory proceedings to which we are or

may become a party; (9) the impact of the coronavirus on our

suppliers, our manufacturing facilities and automotive sales in

China; and (10) those factors identified in our filings with the

SEC (including our Annual Report on Form 10-K for the fiscal year

ended Dec. 31, 2019).

Caution should be taken not to place undue

reliance on our forward-looking statements, which represent our

view only as of the date of this release, and which we assume no

obligation to update. The financial results presented herein are

preliminary and unaudited; final financial results will be included

in the company's Annual Report on Form 10-K for the fiscal year

ended Dec. 31, 2019. New business wins and rewins do not represent

firm orders or firm commitments from customers, but are based on

various assumptions, including the timing and duration of product

launches, vehicle production levels, customer price reductions and

currency exchange rates.

Use of Non-GAAP Financial Information

This press release contains information about

Visteon's financial results which is not presented in accordance

with accounting principles generally accepted in the United States

("GAAP"). Such non-GAAP financial measures are reconciled to their

closest GAAP financial measures attached to this press release. The

provision of these comparable GAAP financial measures for 2019 is

not intended to indicate that Visteon is explicitly or implicitly

providing projections on those GAAP financial measures, and actual

results for such measures are likely to vary from those presented.

The reconciliations include all information reasonably available to

the company at the date of this press release and the adjustments

that management can reasonably predict.

Follow Visteon:

https://www.linkedin.com/company/visteon/?trk=vsrp_companies_res_photo&trkInfo=VSRPsearchId:522343161373310041683,VSRPtargetId:2865,VSRPcmpt:primaryhttps://twitter.com/visteonhttps://www.facebook.com/VisteonCorporationhttps://www.youtube.com/user/Visteonhttp://www.slideshare.net/VisteonCorporationhttps://www.instagram.com/visteon/https://mp.weixin.qq.com/?lang=en_UShttps://m.weibo.cn/u/6605315328http://i.youku.com/u/UNDgyMjA1NjUxNg==?spm=a2h0k.8191407.0.0

Contacts:

Media:

Amna Kamal734-710-2566akamal@visteon.com

Investors:

Kris Doyle734-710-7893kdoyle@visteon.com

VISTEON CORPORATION AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF

OPERATIONS(Dollars in Millions, Except Per Share Data)

| |

(Unaudited) |

|

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 31 |

|

December 31 |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

|

|

|

|

|

|

|

Sales |

$ |

744 |

|

|

$ |

731 |

|

|

$ |

2,945 |

|

|

$ |

2,984 |

|

| Cost of sales |

(640 |

) |

|

(635 |

) |

|

(2,621 |

) |

|

(2,573 |

) |

| Gross margin |

104 |

|

|

96 |

|

|

324 |

|

|

411 |

|

| Selling, general and

administrative expenses |

(54 |

) |

|

(54 |

) |

|

(221 |

) |

|

(193 |

) |

| Restructuring expense,

net |

(2 |

) |

|

(1 |

) |

|

(4 |

) |

|

(29 |

) |

| Interest expense, net |

(2 |

) |

|

(1 |

) |

|

(9 |

) |

|

(7 |

) |

| Equity in net (loss) income of

non-consolidated affiliates |

(1 |

) |

|

3 |

|

|

6 |

|

|

13 |

|

| Other income, net |

3 |

|

|

4 |

|

|

10 |

|

|

21 |

|

| Income before income

taxes |

48 |

|

|

47 |

|

|

106 |

|

|

216 |

|

| Provision for income

taxes |

(8 |

) |

|

(1 |

) |

|

(24 |

) |

|

(43 |

) |

| Net income from continuing

operations |

40 |

|

|

46 |

|

|

82 |

|

|

173 |

|

| Net (loss) income from

discontinued operations, net of tax |

(1 |

) |

|

(1 |

) |

|

(1 |

) |

|

1 |

|

| Net income |

39 |

|

|

45 |

|

|

81 |

|

|

174 |

|

| Net income attributable to

non-controlling interests |

(4 |

) |

|

(2 |

) |

|

(11 |

) |

|

(10 |

) |

| Net income attributable to

Visteon Corporation |

$ |

35 |

|

|

$ |

43 |

|

|

$ |

70 |

|

|

$ |

164 |

|

| |

|

|

|

|

|

|

|

| Earnings per share data: |

|

|

|

|

|

|

|

| Basic earnings (loss) per

share |

|

|

|

|

|

|

|

|

Continuing operations |

$ |

1.28 |

|

|

$ |

1.53 |

|

|

$ |

2.53 |

|

|

$ |

5.53 |

|

|

Discontinued operations |

(0.04 |

) |

|

(0.03 |

) |

|

(0.04 |

) |

|

0.03 |

|

| Basic earnings per share

attributable to Visteon Corporation |

$ |

1.24 |

|

|

$ |

1.50 |

|

|

$ |

2.49 |

|

|

$ |

5.56 |

|

| |

|

|

|

|

|

|

|

| Diluted earnings (loss) per

share |

|

|

|

|

|

|

|

|

Continuing operations |

$ |

1.28 |

|

|

$ |

1.52 |

|

|

$ |

2.52 |

|

|

$ |

5.49 |

|

|

Discontinued operations |

(0.04 |

) |

|

(0.03 |

) |

|

(0.04 |

) |

|

0.03 |

|

| Diluted earnings per share

attributable to Visteon Corporation |

$ |

1.24 |

|

|

$ |

1.49 |

|

|

$ |

2.48 |

|

|

$ |

5.52 |

|

| |

|

|

|

|

|

|

|

| Average shares outstanding (in

millions) |

|

|

|

|

|

|

|

| Basic |

28.0 |

|

|

28.7 |

|

|

28.1 |

|

|

29.5 |

|

| Diluted |

28.2 |

|

|

28.9 |

|

|

28.2 |

|

|

29.7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

VISTEON CORPORATION AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(Dollars in Millions)

| |

December 31 |

|

December 31 |

| |

2019 |

|

2018 |

| ASSETS |

|

|

|

|

Cash and equivalents |

$ |

466 |

|

|

$ |

463 |

|

| Restricted cash |

3 |

|

|

4 |

|

| Accounts receivable, net |

514 |

|

|

486 |

|

| Inventories, net |

169 |

|

|

184 |

|

| Other current assets |

193 |

|

|

159 |

|

| Total current assets |

1,345 |

|

|

1,296 |

|

| |

|

|

|

| Property and equipment,

net |

436 |

|

|

397 |

|

| Intangible assets, net |

127 |

|

|

129 |

|

| Right-of-use assets |

165 |

|

|

— |

|

| Investments in

non-consolidated affiliates |

48 |

|

|

42 |

|

| Other non-current assets |

150 |

|

|

143 |

|

| Total assets |

$ |

2,271 |

|

|

$ |

2,007 |

|

| |

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

| Short-term debt |

$ |

37 |

|

|

$ |

57 |

|

| Accounts payable |

511 |

|

|

436 |

|

| Accrued employee

liabilities |

73 |

|

|

67 |

|

| Current lease liability |

30 |

|

|

— |

|

| Other current liabilities |

147 |

|

|

161 |

|

| Total current liabilities |

798 |

|

|

721 |

|

| |

|

|

|

| Long-term debt |

348 |

|

|

348 |

|

| Employee benefits |

292 |

|

|

257 |

|

| Non-current lease

liability |

139 |

|

|

— |

|

| Deferred tax liabilities |

27 |

|

|

23 |

|

| Other non-current

liabilities |

72 |

|

|

76 |

|

| |

|

|

|

| Stockholders’ equity |

|

|

|

|

Common stock |

1 |

|

|

1 |

|

|

Additional paid-in capital |

1,342 |

|

|

1,335 |

|

|

Retained earnings |

1,679 |

|

|

1,609 |

|

|

Accumulated other comprehensive loss |

(267 |

) |

|

(216 |

) |

|

Treasury stock |

(2,275 |

) |

|

(2,264 |

) |

| Total Visteon Corporation

stockholders’ equity |

480 |

|

|

465 |

|

| Non-controlling interests |

115 |

|

|

117 |

|

| Total equity |

595 |

|

|

582 |

|

| Total liabilities and

equity |

$ |

2,271 |

|

|

$ |

2,007 |

|

VISTEON CORPORATION AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH FLOWS

1 (Dollars in Millions)

| |

(Unaudited) |

|

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 31 |

|

December 31 |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

OPERATING |

|

|

|

|

|

|

|

|

Net income |

$ |

39 |

|

|

$ |

45 |

|

|

$ |

81 |

|

|

$ |

174 |

|

| Adjustments to reconcile net

income to net cash provided from operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

26 |

|

|

24 |

|

|

100 |

|

|

91 |

|

|

Non-cash stock-based compensation |

3 |

|

|

4 |

|

|

17 |

|

|

8 |

|

|

Transaction (gains) |

— |

|

|

— |

|

|

— |

|

|

(8 |

) |

|

Equity in net income of non-consolidated affiliates, net of

dividends remitted |

1 |

|

|

(3 |

) |

|

(6 |

) |

|

(13 |

) |

|

Other non-cash items |

3 |

|

|

1 |

|

|

8 |

|

|

3 |

|

| Changes in assets and

liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

(50 |

) |

|

(38 |

) |

|

(33 |

) |

|

44 |

|

|

Inventories |

26 |

|

|

39 |

|

|

13 |

|

|

1 |

|

|

Accounts payable |

24 |

|

|

(2 |

) |

|

73 |

|

|

(19 |

) |

|

Other assets and other liabilities |

(7 |

) |

|

27 |

|

|

(70 |

) |

|

(77 |

) |

| Net cash provided from

operating activities |

65 |

|

|

97 |

|

|

183 |

|

|

204 |

|

|

INVESTING |

|

|

|

|

|

|

|

| Capital expenditures,

including intangibles |

(33 |

) |

|

(31 |

) |

|

(142 |

) |

|

(127 |

) |

| Loans to non-consolidated

affiliate, net of repayments |

— |

|

|

— |

|

|

11 |

|

|

— |

|

| Acquisition of businesses, net

of cash acquired |

— |

|

|

— |

|

|

— |

|

|

16 |

|

| Other, net |

1 |

|

|

— |

|

|

3 |

|

|

13 |

|

| Net cash used by investing

activities |

(32 |

) |

|

(31 |

) |

|

(128 |

) |

|

(98 |

) |

|

FINANCING |

|

|

|

|

|

|

|

| Repurchase of common

stock |

— |

|

|

(50 |

) |

|

(20 |

) |

|

(300 |

) |

| Short-term debt, net |

(11 |

) |

|

25 |

|

|

(19 |

) |

|

12 |

|

| Dividends paid to

non-controlling interests |

(2 |

) |

|

(16 |

) |

|

(9 |

) |

|

(28 |

) |

| Distribution payments |

— |

|

|

— |

|

|

— |

|

|

(14 |

) |

| Stock based compensation tax

withholding payments |

— |

|

|

— |

|

|

— |

|

|

(7 |

) |

| Other |

(1 |

) |

|

— |

|

|

(1 |

) |

|

2 |

|

| Net cash used by financing

activities |

(14 |

) |

|

(41 |

) |

|

(49 |

) |

|

(335 |

) |

| Effect of exchange rate

changes on cash and equivalents |

4 |

|

|

— |

|

|

(4 |

) |

|

(13 |

) |

| Net increase (decrease) in

cash and equivalents |

23 |

|

|

25 |

|

|

2 |

|

|

(242 |

) |

| Cash and equivalents at

beginning of period |

446 |

|

|

442 |

|

|

467 |

|

|

709 |

|

| Cash and equivalents at end of

period |

$ |

469 |

|

|

$ |

467 |

|

|

$ |

469 |

|

|

$ |

467 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 The Company has combined cash flows from discontinued

operations with cash flows from continuing operations within the

operating, investing and financing categories.

VISTEON CORPORATION AND

SUBSIDIARIESRECONCILIATION OF NON-GAAP FINANCIAL

MEASURES(Unaudited, Dollars in Millions)

Adjusted EBITDA: Adjusted

EBITDA is presented as a supplemental measure of the Company's

performance that management believes is useful to investors because

the excluded items may vary significantly in timing or amounts

and/or may obscure trends useful in evaluating and comparing the

Company's operating activities across reporting periods. The

Company defines Adjusted EBITDA as net income attributable to the

Company adjusted to eliminate the impact of depreciation and

amortization, restructuring expense, net interest expense, loss on

divestiture, equity in net income of non-consolidated affiliates,

gain on non-consolidated affiliate transactions, provision for

income taxes, discontinued operations, net income attributable to

non-controlling interests, non-cash stock-based compensation

expense, and other gains and losses not reflective of the Company's

ongoing operations. Because not all companies use identical

calculations, this presentation of Adjusted EBITDA may not be

comparable to similarly titled measures of other companies.

| |

Three Months Ended |

|

Twelve Months Ended |

Estimated |

| |

December 31 |

|

December 31 |

Full Year |

| Visteon: |

2019 |

|

2018 |

|

2019 |

|

2018 |

2020 |

|

Net income attributable to Visteon |

$ |

35 |

|

$ |

43 |

|

|

$ |

70 |

|

|

$ |

164 |

|

$48 - $63 |

|

Depreciation and amortization |

26 |

|

24 |

|

|

100 |

|

|

91 |

|

110 |

|

Restructuring expense, net |

2 |

|

1 |

|

|

4 |

|

|

29 |

|

30 - 25 |

|

Interest expense, net |

2 |

|

1 |

|

|

9 |

|

|

7 |

|

10 |

|

Equity in net loss (income) of non-consolidated affiliates |

1 |

|

(3 |

) |

|

(6 |

) |

|

(13 |

) |

(8) |

|

Provision for income taxes |

8 |

|

1 |

|

|

24 |

|

|

43 |

|

30 - 40 |

|

Net loss (income) from discontinued operations, net of tax |

1 |

|

1 |

|

|

1 |

|

|

(1 |

) |

— |

|

Net income attributable to non-controlling interests |

4 |

|

2 |

|

|

11 |

|

|

10 |

|

10 |

|

Non-cash, stock-based compensation expense |

3 |

|

4 |

|

|

17 |

|

|

8 |

|

20 |

|

Other |

3 |

|

— |

|

|

4 |

|

|

(8 |

) |

— |

| Adjusted EBITDA |

$ |

85 |

|

$ |

74 |

|

|

$ |

234 |

|

|

$ |

330 |

|

$250 - $270 |

Adjusted EBITDA is not a recognized term under

U.S. GAAP and does not purport to be a substitute for net income as

an indicator of operating performance or cash flows from operating

activities as a measure of liquidity. Adjusted EBITDA has

limitations as an analytical tool and is not intended to be a

measure of cash flow available for management's discretionary use,

as it does not consider certain cash requirements such as interest

payments, tax payments and debt service requirements. In addition,

the Company uses Adjusted EBITDA (i) as a factor in incentive

compensation decisions, (ii) to evaluate the effectiveness of the

Company's business strategies, and (iii) because the Company's

credit agreements use similar measures for compliance with certain

covenants.

Free Cash Flow and Adjusted Free Cash

Flow: Free cash flow and Adjusted free cash flow are

presented as supplemental measures of the Company's liquidity that

management believes are useful to investors in analyzing the

Company's ability to service and repay its debt. The Company

defines Free cash flow as cash flow provided from operating

activities less capital expenditures, including intangibles. The

Company defines Adjusted free cash flow as cash flow provided from

operating activities less capital expenditures, including

intangibles as further adjusted for restructuring related payments.

Free cash flow and Adjusted free cash flow include amounts

associated with discontinued operations. Because not all companies

use identical calculations, this presentation of Free cash flow and

Adjusted free cash flow may not be comparable to other similarly

titled measures of other companies

| |

Three Months Ended |

|

Twelve Months Ended |

|

Estimated |

| |

December 31 |

|

December 31 |

|

Full Year |

| Total

Visteon: |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

2020 |

|

Cash provided from operating activities |

$ |

65 |

|

|

$ |

97 |

|

|

$ |

183 |

|

|

$ |

204 |

|

|

$150 - $175 |

| Capital expenditures |

(33 |

) |

|

(31 |

) |

|

(142 |

) |

|

(127 |

) |

|

(145 - 140) |

| Free cash flow |

$ |

32 |

|

|

$ |

66 |

|

|

$ |

41 |

|

|

$ |

77 |

|

|

$5 - $35 |

| Restructuring related

payments |

3 |

|

|

6 |

|

|

15 |

|

|

30 |

|

|

35 - 25 |

| Adjusted free cash flow |

$ |

35 |

|

|

$ |

72 |

|

|

$ |

56 |

|

|

$ |

107 |

|

|

$40 - $60 |

Free cash flow and Adjusted free cash flow are

not recognized terms under U.S. GAAP and do not purport to be a

substitute for cash flows from operating activities as a measure of

liquidity. Free cash flow and Adjusted free cash flow have

limitations as analytical tools as they do not reflect cash used to

service debt and do not reflect funds available for investment or

other discretionary uses. In addition, the Company uses Free cash

flow and Adjusted free cash flow (i) as factors in incentive

compensation decisions and (ii) for planning and forecasting future

periods.

Adjusted Net Income and Adjusted

Earnings Per Share: Adjusted net income and Adjusted

earnings per share are presented as supplemental measures that

management believes are useful to investors in analyzing the

Company's profitability, providing comparability between periods by

excluding certain items that may not be indicative of recurring

business operating results. The Company believes management and

investors benefit from referring to these supplemental measures in

assessing company performance and when planning, forecasting and

analyzing future periods. The Company defines Adjusted net income

as net income attributable to Visteon adjusted to eliminate the

impact of restructuring expense, loss on divestiture, gain on

non-consolidated affiliate transactions, discontinued operations,

other gains and losses not reflective of the Company's ongoing

operations and related tax effects. The Company defines Adjusted

earnings per share as Adjusted net income divided by diluted

shares. Because not all companies use identical calculations, this

presentation of Adjusted net income and Adjusted earnings per share

may not be comparable to other similarly titled measures of other

companies.

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 31, 2020 |

|

December 31, 2020 |

| Net

income attributable to Visteon: |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net income |

$ |

36 |

|

|

$ |

44 |

|

|

$ |

71 |

|

|

$ |

163 |

| Discontinued

operations |

|

(1 |

) |

|

|

(1 |

) |

|

|

(1 |

) |

|

|

1 |

| Net income

attributable to Visteon |

$ |

35 |

|

|

$ |

43 |

|

|

$ |

70 |

|

|

$ |

164 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Twelve Months Ended |

| |

December 31 |

|

December 31 |

| Diluted earnings per

share: |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net income attributable to Visteon |

$ |

35 |

|

|

$ |

43 |

|

|

$ |

70 |

|

|

$ |

164 |

|

| Average shares outstanding,

diluted (in millions) |

28.2 |

|

|

28.9 |

|

|

28.2 |

|

|

29.7 |

|

| Diluted earnings per

share |

$ |

1.24 |

|

|

$ |

1.49 |

|

|

$ |

2.48 |

|

|

$ |

5.52 |

|

| |

|

|

|

|

|

|

|

| Adjusted earnings per

share: |

|

|

|

|

|

|

|

| Net income attributable to

Visteon |

$ |

35 |

|

|

$ |

43 |

|

|

$ |

70 |

|

|

$ |

164 |

|

| Restructuring, net |

2 |

|

|

1 |

|

|

4 |

|

|

29 |

|

| Other |

2 |

|

|

(1 |

) |

|

3 |

|

|

(10 |

) |

| Income (loss) from

discontinued operations, net of tax |

1 |

|

|

1 |

|

|

1 |

|

|

(1 |

) |

| Adjusted net income |

$ |

40 |

|

|

$ |

44 |

|

|

$ |

78 |

|

|

$ |

182 |

|

| Average shares outstanding,

diluted (in millions) |

28.2 |

|

|

28.9 |

|

|

28.2 |

|

|

29.7 |

|

| Adjusted earnings per

share |

$ |

1.42 |

|

|

$ |

1.52 |

|

|

$ |

2.77 |

|

|

$ |

6.13 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income and Adjusted earnings per

share are not recognized terms under U.S. GAAP and do not purport

to be a substitute for profitability. Adjusted net income and

Adjusted earnings per share have limitations as analytical tools as

they do not consider certain restructuring and transaction-related

payments and/or expenses. In addition, the Company uses Adjusted

net income and Adjusted earnings per share for internal planning

and forecasting purposes.

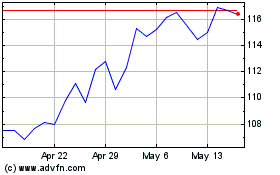

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024